KLÉPIERRE: 2023 NET CURRENT CASH FLOW AT €2.48 PER SHARE AND 2024

EBITDA TO GROW BY AT LEAST 4%

PRESS RELEASE2023 NET CURRENT CASH FLOW AT €2.48

PER SHARE AND 2024 EBITDA TO GROW BY AT LEAST 4%

Paris — February 14, 2024

Klépierre, the European leader in shopping

malls, delivered another strong performance over 2023(1):

- Net current cash

flow up 10.7%(2) vs. 2022 to €2.48(3) per share, beating the

initial guidance by 5.5%

- EBITDA(4) up 9.6% versus 2022

- Like-for-like(5) net rental income

up 8.8% year on year, outpacing indexation by 300 bps

- Solid operating metrics:

- Strong increase in retailer sales,

up 6% like-for-like(6) compared to 2022

- Financial occupancy rate at 96.0%,

up 20 bps year-on-year

- 4.4% positive reversion on renewals

and re-lettings

- Stable OCR at 12.8%

- Higher proposed cash distribution

to shareholders of €1.80(7) per share

- Like-for-like portfolio valuation

stable over six months, paving the way to a bottom out

- €169 million(8) in disposals closed

or secured, 20% above appraised values

- EPRA NTA per share stable over six

months at €30.10

- Net debt down €130 million over one

year to €7,349 million

- Net debt to EBITDA at 7.4x, LTV of

38.0% and ICR at 8.4x

- €1.8 billion in new financing

- Guidance: EBITDA growth of at least

4% expected in 2024, along with net current cash flow per share for

full-year 2024 of €2.45–2.50

- IFRS consolidated net income:

€174.3 million

Jean-Marc Jestin, Chairman of the Executive

Board, said, “Klépierre embarked on a strong growth journey in 2022

that accelerated in 2023, delivering an outstanding performance

with the pace of growth increasing from top to bottom line. Our

portfolio valuations have been stabilizing, while our

sector-leading balance sheet leaves us room for maneuver. These

results are a testimony of our leadership position in the

continental European mall industry and we are fully confident in

our capacity to pursue our growth next year. In a changing retail

landscape, our portfolio of top-quality malls will continue to

provide the most desirable stores to leading omnichannel retailers

and further gain market shares. Thanks to the same operating

levers, we plan to deliver at least 4% EBITDA growth in 2024 and

generate a net current cash flow per share of €2.45-€2.50.”

KEY

FINANCIALS(9)

|

|

12/31/2022 |

12/31/2023 |

Like-for-like change(10) |

| In millions of

euros, total share |

|

|

|

| Total

revenues |

1,430.7 |

1,501.0 |

|

| Net Rental

Income (NRI) |

926.6 |

1,005.0 |

+8.8% |

|

EBITDA |

841.1 |

921.4 |

|

|

In euros, Group share |

|

|

|

|

Net current cash flow per share |

2.24 |

2.48 |

|

| |

|

|

|

|

|

12/31/2022 |

12/31/2023 |

|

|

In millions of euros, total share |

|

|

|

| Portfolio

valuation (including transfer taxes) |

19,832 |

19,331 |

|

| Net debt |

7,479 |

7,349 |

|

| Loan-to-Value

(LTV) |

37.7% |

38.0% |

|

| Net debt to

EBITDA |

7.9x |

7.4x |

|

|

In euros, Group share |

|

|

|

|

EPRA Net Tangible Assets (NTA) per share |

30.90 |

30.10 |

|

STRONG GROWTH MOMENTUM

In 2023, Group net rental income reached €1,005

million, up 8.8% on a like-for-like basis(10), outpacing the 5.8%

indexation by 300 basis points. This record growth was fueled by

the combination of a 110 basis-point increase in the collection

rate (to 97.5%), the delivery of a 21% like-for-like increase in

additional revenues (turnover rents, car park revenues and mall

income) and a disciplined management of property charges which

translated into a wider operating margin.

On a like-for-like basis, total retailer sales

at Klépierre malls rose 6%(11) in 2023 compared to 2022. All

countries contributed to the growth and exceeded 2022 levels.

Segment wise, this upward trajectory was mainly fueled by food

& beverage, while leisure and entertainment also posted

double-digit growth. Sports and health & beauty were on the

same outperforming trend.

This performance, coupled with the Group’s asset

management and development actions to adapt its offering to an

evolving retail environment, has been driving solid leasing tension

for its assets identified as key destinations for expanding

banners. In 2023, this translated into a 22% increase in volume of

leases signed to 1,658, including 1,317 renewals and re-lettings,

generating a 4.4% positive reversion.

Meanwhile, Klépierre’s operating fundamentals

remained very solid with an occupancy rate of 96.0%,

up 20 basis points over the year and an occupancy cost

ratio of 12.8% as of December 31, 2023. The average remaining

duration of leases stood at 5.1 years (versus 5.0 years in 2022),

reflecting the Group’s strategy of favoring long-term leases

providing high visibility on rents.

GROWING EARNINGS AND

DISTRIBUTION

In 2023, net current cash flow amounted to

€811.6 million (total share), or €2.48(12) per share (Group share),

a record 10.7%(13) increase over one year. With more than €1.6

billion in disposals since 2021, this strong performance

demonstrates Klépierre’s capacity to continue to grow the net

current cash flow significantly while selling assets.

The Supervisory Board will recommend that the

shareholders, at the Annual General Meeting to be held on

May 3, 2024, approve the payment of a cash distribution

in respect of fiscal year 2023 of €1.80 per share to be

paid in two installments: (i) a cash distribution of €0.90 per

share from Klépierre’s tax exempt activities (SIIC) on March 26,

2024; and (ii) the balance of €0.90 per share (comprising a €0.7983

per share “SIIC” dividend; and €0.1017 per share distribution of

share premiums qualifying as an equity repayment(14)), to be paid

on July 11, 2024.

STABILIZING PORTFOLIO

VALUE

Including transfer taxes, the like-for-like(15)

value of the portfolio remained stable over six months, at

€19,331 million on a total share basis (down 0.2%).

As of December 31, 2023, the appraisers’ main

assumptions were the following:

- Discount rate at

7.8% and exit rate at 6.1%; and

-

Compound annual growth rate of 2.8% for the next 10 years.

This stabilization in valuation of the portfolio

should pave the way for values bottoming out.

As of December 31, 2023, the average EPRA

NIY(16) for the portfolio stood at 5.9%. EPRA NTA per share

amounted to €30.10 as of December 31, 2023, stable over six

months.

INVESTING IN HIGH-RETURN

OPPORTUNITIES

With conservative credit metrics and strong cash

flow generation, Klépierre is pursuing an accretive capital

rotation policy, reinvesting the proceeds from disposals of

non-core assets or land banks into retail development projects

(extensions and refurbishment) and targeted acquisitions. As such,

in 2023, Klépierre disposed or signed promissory agreements for

€169 million (excluding transfer taxes), 20% above appraised values

for a blended EPRA Net Initial Yield of 5.5%.Meanwhile, the Group

continued to invest in extensions of its dominant malls

crystallizing strong leasing tension. As of today, before launching

any new projects, Klépierre ensures that the expected yield on cost

is at least 8%. In November 2023, the 16,200 sq.m. extension of

Grand Place (Grenoble, France) was delivered, while the Maremagnum

rooftop (Barcelona, Spain) will be finalized in the first half of

2024. In early 2024, Klépierre engaged a new development project

with the extension of Odysseum (Montpellier, France).Lastly,

Klépierre’s leverage enables it to consider opportunities and

complete targeted acquisitions as demonstrated by the acquisition

of O’Parinor, a 100,000 sq.m. super-regional shopping mall in the

Paris region. Klépierre will own 25% of the property and act as an

asset, property and leasing manager. This investment is expected to

generate a strong double digit levered annual cash return from year

one. The transaction is expected to close in the first half of

2024.

SECTOR-LEADING LEVERAGE AND AMPLE ACCESS TO

FINANCING

Klépierre continued to have good access to debt

capital markets, raising more than €1.0 billion with an average

maturity of 6.7 years. Furthermore, the Group signed or renewed

€725 million of revolving credit facilities. At the end of 2023,

Klépierre’s liquidity position(17) stood at €3.0 billion.

The Group’s strong cash flow generation led to a

€130 million decrease in consolidated net debt to

€7,349 million as of December 31, 2023. This translated into

sector-leading credit and cost-of-debt metrics including net debt

to EBITDA at 7.4x, a Loan-to-Value (LTV) ratio at 38.0% and an

interest coverage ratio (ICR) of 8.4x, leaving the Group room for

maneuver. Thanks to an active hedging policy, the average cost of

debt stood at 1.5% at the end of the year with an average maturity

of the Group’s debt of 6.3 years. As of December 31,

2023, the hedging rate(18) stood at 98% for 2024 and 84% for

2025.

Since May 2023, Fitch has assigned an A− rating

with a stable outlook to Klépierre’s senior unsecured debt (F1

short-term rating). Standard & Poor’s currently assigns

Klépierre a long-term BBB+ rating (A2 short-term rating) with a

stable outlook (affirmed on June 9, 2023).

ACT4GOODTM:

CONSOLIDATING OUR LEADING POSITION IN ESG

In early 2024, Klépierre was once again included

in the CDP’s “A List” of the most advanced companies fighting

climate change at global level. The list comprises only 346

companies out of a total sample of 21,000.

The Group is rewarded with the highest

certifications by several non-financial rating agencies, including

GRESB (Europe’s leading listed real estate company) and MSCI (“AA”)

while its low-carbon commitments have been approved as the most

ambitious 1.5°C-aligned targets by the Science-Based Target

initiative (SBTi). The Group is also member of the Euronext CAC 40

ESG stock market index and CAC SBT 1.5.

These accolades are a testament to Klépierre’s

both ambitious ESG plan (Act4Good™) and non-financial performance

of 2022. In 2023, Klépierre consolidated its position as leader in

sustainable development, with solid achievements, including a 48%

reduction in the energy consumption of its portfolio since 2013,

and a decrease of 22% in the total greenhouse gas emissions (Scopes

1 & 2, market-based approach) of its portfolio on a

like-for-like basis, pointing to 3.4 kgCO2e/sq.m.

Mid-term, Klépierre is well on track to achieve

a net-zero carbon portfolio by 2030 with an average energy

intensity of 70 kWh/sq.m., the most demanding targets in the

sector.

OUTLOOK

The guidance is built under the assumption of

low GDP growth in continental Europe in 2024, with a labor market

remaining supportive and the inflation environment easing.

In 2024, Klépierre expects to generate at least

a 4% increase in EBITDA(19) supported by:

- Retailer sales at least stable

compared to 2023;

- Positive

indexation;

- Higher additional

revenues (turnover rents, car park revenues, mall income); and

- Contribution of

extensions of existing assets.

Factoring in the new secured cost of debt for

2024 (€0.11 per share increase), Klépierre expects to generate net

current cash flow per share of €2.45–€2.50 in 2024.

This guidance does not include the impact of any

disposals or acquisitions in 2024.

NET CURRENT CASH

FLOW(a)

|

|

12/31/2022 |

12/31/2023 |

|

In millions of euros, total share |

|

|

| Gross rental

income |

1,095.3 |

1,164.8 |

| Rental and

building expenses |

(168.7) |

(159.9) |

|

Net rental income |

926.6 |

1,005.0 |

|

Management, administrative, related income and other income |

77.6 |

74.6 |

| Payroll

expenses and other general expenses |

(163.1) |

(158.1) |

|

EBITDA(b) |

841.1 |

921.4 |

|

Cost of net debt |

(113.4) |

(131.9) |

|

Cash flow before share in equity method investees and taxes |

727.7 |

789.5 |

|

Share in equity method investees |

53.4 |

56.7 |

|

Current tax expenses |

(38.7) |

(34.7) |

|

NET CURRENT CASH FLOW (total share) |

742.4 |

811.6 |

| Average number

of shares(c) |

|

|

|

In millions of euros, Group share |

|

|

|

NET CURRENT CASH FLOW (group share) |

641.9 |

709.0 |

| |

|

|

|

In euros, per share |

|

|

|

NET CURRENT CASH FLOW |

2.24 |

2.48 |

(a) The data used to calculate the net current

cash flow are obtained by deducting from IFRS aggregates certain

non-cash and/or non-recurring effects, mainly related to positive

non-recurring income linked to the 2020 and 2021 account

receivables, changes in the fair value of buildings (net of

deferred taxes) of equity-accounted companies, and certain

provisions and depreciations. (b) EBITDA stands for “earnings

before interest, taxes, depreciation and amortization” and is a

measure of the Group’s operating performance.

2023 FULL-YEAR EARNINGS WEBCAST — PRESENTATION

AND CONFERENCE CALL

Klépierre’s Executive

Board will be presenting the 2023 full-year earnings on

Thursday February 15, 2024 at 9:00 a.m.

CET (8.00 a.m. London time) during a conference

call. Please visit Klépierre’s website

www.klepierre.com to listen to the webcast, or

click here.A replay will also be available after the event.

|

AGENDA |

|

|

May 3, 2024 |

Annual General Meeting |

|

May 3, 2024 |

First quarter 2024 trading update (before market opening) |

|

INVESTOR RELATIONS CONTACTS |

MEDIA CONTACTS |

|

|

Paul Logerot, Group Head of IR and Financial

Communication +33 (0)7 50 66 05 63 —

paul.logerot@klepierre.comHugo Martins, IR Manager

+33 (0)7 72 11 63 24 — hugo.martins@klepierre.comTanguy

Phelippeau, IR Manager +33 (0)7 72 09 29 57

—tanguy.phelippeau@klepierre.com |

Hélène Salmon, Group Head of Communication +33

(0)1 40 67 55 16 –

helene.salmon@klepierre.com Wandrille

Clermontel, Taddeo +33 (0)6 33 05 48 50 –

teamklepierre@taddeo.fr |

|

ABOUT KLÉPIERRE

Klépierre is the European leader in shopping

malls, combining property development and asset management skills.

The Company’s portfolio is valued at €19.3 billion at December

31, 2023, and comprises large shopping centers in more than 10

countries in Continental Europe which together host hundreds of

millions of visitors per year. Klépierre holds a controlling stake

in Steen & Strøm (56.1%), Scandinavia’s number one shopping

center owner and manager. Klépierre is a French REIT (SIIC) listed

on Euronext Paris and is included in the CAC Next 20 and EPRA Euro

Zone Indexes. It is also included in ethical indexes, such as

Euronext CAC 40 ESG, Euronext CAC SBT 1.5, MSCI Europe ESG Leaders,

FTSE4Good, Euronext Vigeo Europe 120, and features in CDP’s

“A-list”. These distinctions underscore the Group’s commitment to a

proactive sustainable development policy and its global leadership

in the fight against climate change. For more information, please

visit the newsroom on our website: www.klepierre.com

This press release and its appendices together

with the earnings presentation slideshoware available in the

“Publications section” of Klépierre’s Finance page:

www.klepierre.com/en/finance/publications

(1) The Supervisory Board met on February 13, 2024, to

examine the full-year financial statements, as approved by the

Executive Board on February 13, 2024. The consolidated

financial statements have been subject to audit procedures. The

Statutory Auditors’ report is to be issued shortly with the

Universal Registration Document.

(2) Excluding the positive non-recurring income

statement impact related to the 2020 and 2021 account receivables

(€0.30) and the cash flow generated by disposed assets (€0.08), net

current cash flow per share reached €2.24 in 2022.(3) Excluding the

positive non-recurring income statement impact related to the 2020

and 2021 account receivables.(4) EBITDA stands for “earnings before

interest, taxes, depreciation and amortization” and is a measure of

the Group’s operating performance.(5) Like-for-like data exclude

the contribution of new spaces (acquisitions, greenfield projects

and extensions), spaces being restructured, disposals completed

since January 2022.(6) Change is on a same-store basis, excluding

the impact of disposals and acquisitions, and excluding Turkey.(7)

Amount to be approved by the shareholders present or represented at

the Annual General Meeting to be held on May 3, 2024.(8) Total

share, excluding transfer taxes.

(9) The data used to calculate the net current cash flow are

obtained by deducting from IFRS aggregates certain non-cash and/or

non-recurring effects, mainly related to positive non-recurring

income linked to the 2020 and 2021 account receivables, changes in

the fair value of buildings (net of deferred taxes) of

equity-accounted companies, and certain provisions and

depreciations.

(10) Like-for-like data exclude the contribution

of new spaces (acquisitions, greenfield projects and extensions),

spaces being restructured and disposals completed since January

2022.(11) Change is on a same-store basis, excluding the impact of

disposals and acquisitions, and excluding Turkey.

(12) Excluding the positive non-recurring income statement

impact related to the 2020 and 2021 account receivables.

(13) Excluding the positive non-recurring income

statement impact related to the 2020 and 2021 account receivables

(€0.30) and the cash flow generated by disposed assets (€0.08), net

current cash flow per share reached €2.24 in 2022.(14) Within the

meaning of Article 112-1 of the French Tax Code (Code général des

impôts).(15 ) Like-for-like change. For Scandinavia and Turkey,

change is indicated on a constant currency basis. Central European

assets are valued in euros.(16) Group share for the total portfolio

appraised. EPRA Net Initial Yield is calculated as annualized

rental income based on cash passing rents, less non-recoverable

property operating expenses, divided by the market value of the

property (including transfer taxes).

(17) The liquidity position represents the total financial

resources available to a company. This indicator is therefore equal

to the sum of cash at hand at the end of the period (€0.4 billion),

committed and unused revolving credit facilities (€2.3 billion, net

of commercial paper) and other credit facilities (€0.3

billion).

(18) Calculated as the ratio of fixed-rate debt (after hedging)

to net debt expressed as a percentage.

(19) EBITDA stands for “earnings before

interest, taxes, depreciation and amortization” and is a measure of

the Group’s operating performance.

- PR_KLEPIERRE_2023_FY_EARNINGS

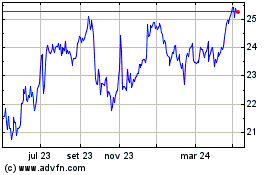

Klepierre (EU:LI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

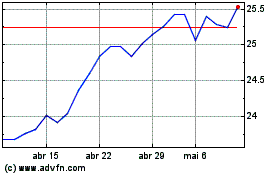

Klepierre (EU:LI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024