Aussie Tumbles To New 2-month Low Against Yen

02 Outubro 2009 - 5:36AM

RTTF2

The Australian dollar extended its previous sessions' losing

streak versus its major opponents on Friday morning in New York as

traders flee from riskier-currencies following the report showed

that the US economy lost more jobs in September than economists had

predicted.

The domestic currency also tumbled after the Australian stock

market suffered its biggest percentage fall in more than 3 months

today. The benchmark S&P/ASX 200 index closed at 4,601, down 99

points or 2.11% and the broader All Ordinaries index fell 96 points

or 2.04% to 4,606.

On the economic front, TD Securities said today that an index

measuring inflation in Australia was up 1.3% on year in September,

marking the slowest rate of increase in seven years. This marked

the fifth straight month that inflation has come in below the

Reserve Bank of Australia's target range of 2%-3%.

The Australian dollar slumped to a 17-day low of 0.8572 against

the US dollar by 8:30 am ET, down around 3.3 percent from

yesterday's fresh 13-month high of 0.8861. The next downside target

for the aussie-buck pair is likely to be seen near the 0.855 level.

At Thursday's close, the pair was worth 0.87.

In the U.S., job losses in September were sharply higher than

economists had expected, driving the unemployment rate to its

highest level in 26 years and pushing the number of people out of

work above 15 million, the U.S. Labor Department revealed

today.

Non-farm payrolls dropped 263,000 in September. Economists had

expected a decline of 170,000 jobs. August's results were revised

to show a decline of 201,000 jobs.

The unemployment rate for September came in at 9.8% compared to

9.7% in the previous month.

The Australian dollar dropped more than 4 percent to 76.35

against the Japanese yen from yesterday's weekly high of 79.58 to

reach its lowest level since July 22nd. The next downside target

for the aussie-yen pair is seen around the 75.7 level.

Japan's jobless rate edged down in August, after hitting a

record high in July, an official report showed today, raising hopes

that sustained recovery in the world's second largest economy may

be well on track. Moreover, consumer spending also increased in

August, after falling in July.

Data released by the Ministry of Internal Affairs and

Communications showed Friday that the jobless rate decreased to

5.5% in August, on a seasonally adjusted basis, from a record high

of 5.7% in July. Moreover, the rate came in below economists'

expectations for 5.8%.

Elsewhere, the Bank of Japan said today the monetary base rose

4.5% year-on-year in September to 92.39 trillion yen, following a

6.1% rise in August. Seasonally adjusted, the monetary base was

down 11.9% in September.

Extending its 2-day losing streak, the Australian currency

declined to a 4-day low of 1.2065 against the New Zealand dollar

around 8:30 am ET. This may be compared to yesterday's close of

1.218. If the aussie drops further, likely support is seen around

the 1.204 level.

The Australian dollar that surged to a 14-month high of 1.6519

against the European currency on Thursday pared more than 2.4

percent to reach a 4-day low of 1.6931 by 8:30 am ET Friday. The

euro-aussie pair, which closed yesterday's deals at 1.6729, is

presently worth 1.6886 with 1.70 seen as the next target level.

The Eurostat said today in a report that Eurozone industrial

producer price index or PPI dropped 7.5% year-on-year in August,

compared with a 8.4% fall in the previous month. The July month

figure was revised from 8.5% decline reported initially. Economists

expected a decline of 7.6%.

Month-on-month, producer prices increased 0.4% in August, after

falling 0.7% in July , revised from 0.8% drop estimated initially.

Economists were looking for a decline of 0.4%.

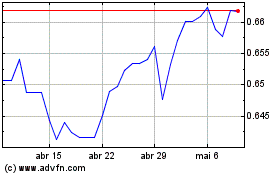

AUD vs US Dollar (FX:AUDUSD)

Gráfico Histórico de Câmbio

De Jul 2024 até Ago 2024

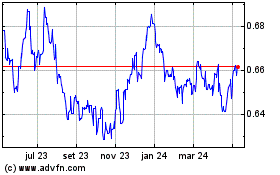

AUD vs US Dollar (FX:AUDUSD)

Gráfico Histórico de Câmbio

De Ago 2023 até Ago 2024