TIDMASIT

Aberforth Split Level Income Trust plc

Audited Annual Results for the year to 30 June 2023

The following is an extract from the Company's Annual Report and Financial

Statements for the year to 30 June 2023. The Annual Report is expected to be

posted to shareholders by 7 August 2023. Members of the public may obtain

copies from Aberforth Partners LLP, 14 Melville Street, Edinburgh EH3 7NS or

from its website: www.aberforth.co.uk. A copy will also shortly be available for

inspection at the National Storage Mechanism at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

FINANCIAL HIGHLIGHTS (SUMMARY)

Performance (Total Return) Year

to

30

June

2023

------

------

Total Assets +9.7%

Ordinary Share NAV +12.2

%

Ordinary Share Price +20.0

%

ZDP Share NAV +3.6%

ZDP Share Price +3.0%

Refer to Note 2, Alternative Performance Measures, and

Glossary.

Dividends Declared

Second Interim Dividend per Ordinary Share 3.30p

Together with the first interim dividend of 1.70p, the

total underlying dividend for the year to 30 June 2023 is

5.00p per Ordinary Share. This is an increase of 16%

compared to last year's underlying dividend of 4.30p,

which represents the total dividend of 4.55p less the

special dividend of 0.25p per Ordinary Share.

The second interim dividend has an ex-dividend date of 10

August 2023, record date of 11 August 2023 and pay date of

31 August 2023.

INVESTMENT OBJECTIVE

The investment objective of Aberforth Split Level Income Trust plc (ASLIT) is to

provide Ordinary Shareholders with a high level of income, with the potential

for income and capital growth, and to provide Zero Dividend Preference (ZDP)

Shareholders with a pre-determined final capital entitlement of 127.25p on the

planned winding-up date of 1 July 2024.

CHAIRMAN'S STATEMENT

Introduction

This is the sixth annual report of Aberforth Split Level Income Trust (the

Company), which covers the financial year to 30 June 2023.

Many of the significant challenges highlighted in my recent reports remain

firmly in focus. Elevated geopolitical tensions, persistently high inflation,

especially in the UK, and rising interest rates continue to influence the

direction of stockmarkets. With consumer budgets and profit margins under

pressure, recession is a realistic threat either in this or next year.

The financial year started well as the initial shock of Russia's invasion of

Ukraine and the impact on energy prices eased. M&A activity also contributed to

positive returns, but the UK's well documented Budget debacle in September 2022

led to weak share prices, higher bond yields and sterling approaching parity

with the US dollar. Calm was restored towards ASLIT's half year with the change

of Prime Minister and Chancellor. Share prices responded well to this

development and further impetus was provided by the emergence of more benign

inflation data in the US. However, enthusiasm about the prospects of lower

interest rates in the US was interrupted by the rapid demise of Silicon Valley

Bank and Credit Suisse, which provoked a sharp reappraisal of risk in March.

Swift regulatory action reassured the markets that these bankruptcies were

isolated cases and enabled stockmarkets to shift their focus back to subsiding

rates of inflation. The exception was the UK, where stubbornly persistent

inflation is requiring the Bank of England to continue to raise interest rates

and, by extension, the risk of recession.

Given this `wall of worry' it was pleasing to see positive index returns for UK

equities during the period, albeit marginal ones for mid and small cap

companies, who underperformed their large cap brethren. However, UK indices

remain deeply unpopular from a global perspective, which is reflected in lower

returns generated during the year compared to most international peers.

Performance

I appreciate that it doesn't really feel like it but in fact, over the financial

year as a whole, UK equities generated positive returns. The Numis Smaller

Companies Index (excluding Investment Companies) ("the Index" or "NSCI (XIC)"),

which defines ASLIT's investment opportunity base, generated a positive total

return of 4.4% over the twelve months to 30 June 2023. Larger companies in the

UK, in the form of the FTSE All-Share Index, recorded a total return of 7.9%.

It is pleasing to report that ASLIT's total assets total return, which measures

its ungeared portfolio performance, was up 9.7% during the year. When geared by

the Zero Dividend Preference (ZDP) Shares, the net asset value total return of

the Ordinary Shares was 12.2%. This reflects the return attributable to equity

Shareholders of 8.87p per Ordinary Share together with the effect of the

reinvestment of previously declared dividends. The Ordinary Share price total

return of 20.0% was helped by a narrowing of the share price's discount to net

asset value from 12.1% to 6.7%.

As the capital value of the portfolio has increased, the projected cumulative

cover of the ZDP shares increased to 3.2 times at 30 June 2023 from 3.0 times

twelve months earlier.

Turning to the longer-term perspective from ASLIT's inception in 2017 to 30 June

2023, the cumulative total assets total return and net asset value total return

are 5.8% and 1.8% respectively. These modest returns are clearly not what the

Board envisaged when ASLIT launched but in its short life, ASLIT has had to

battle with the fraught aftermath of the EU referendum, the pandemic and the war

in Ukraine, as well as the macro-economic headwinds of the past year. Any one of

these events would have been challenging enough for a company with ASLIT's

geared structure, let alone all four. Detail about the effect of these

challenges on ASLIT's valuation opportunity is provided in the Managers' Report.

Earnings and Dividends

The twists and turns of share prices over the year to 30 June 2023 contrast with

the steady progress of ASLIT's revenue stream. The upward trend from the

pandemic lows has continued, which reflects positively on how well investee

companies' boards stewarded capital during what was a very challenging period.

ASLIT's dividend experience in the twelve months was enhanced by the receipt of

seven special dividends.

ASLIT's revenue return per Ordinary Share was 5.35p in the year to 30 June 2023,

which is 11% higher than the 4.81p earned in the year to 30 June 2022. Special

dividends from investee companies represent 0.42p per Ordinary Share of the

5.35p of revenue generated for this financial year.

The Board is pleased to declare a second interim dividend of 3.30p per Ordinary

Share for the year to 30 June 2023, which represents an increase of 18% compared

to the 2.79p in respect of the previous year. Together with the first interim

dividend of 1.70p paid on 8 March 2023, the total underlying ordinary dividend

with respect to the year to 30 June 2023 is 5.00p per Ordinary Share. This is an

increase of 16% compared to last year's ordinary underlying dividend of 4.30p,

which represents the total dividend of 4.55p less the special dividend of 0.25p

per Ordinary Share.

After accounting for the second interim dividend, retained revenue reserves were

1.32p per Ordinary Share at 30 June 2023. There are two reasons for the Board's

decision to increase revenue reserves. First, notwithstanding the resilience of

the investee companies, an economic downturn could affect the dividend

performance of the portfolio. Second, prudent portfolio and liquidity management

activities in the run-up to the end of ASLIT's planned life might affect

dividend receipts. Retained revenue reserves give the Board scope to offset such

factors and sustain dividends paid by ASLIT. Any revenue reserves not utilised

will be distributed to Ordinary Shareholders before or at the end of ASLIT's

planned life next year.

The second interim dividend of 3.30p per Ordinary Share will be paid on 31

August 2023 to Ordinary Shareholders on the register on 11 August 2023. The ex

-dividend date is 10 August 2023. The Company operates a Dividend Reinvestment

Plan. Details of the plan, including the Form of Election, are available from

Aberforth Partners LLP or on the website, www.aberforth.co.uk.

Stewardship

As part of its stewardship responsibilities, the Board regularly reviews the

Managers' approach to environmental, social and governance issues. Pages 13 to

15, of the Annual Report, describe the Board's and Managers' oversight and

activities in the year to 30 June 2023. The Board endorses the Managers'

stewardship policy, which is set out in their submission as a signatory to the

UK Stewardship Code. This, together with examples relating to voting and

engagement with investee companies, can be found in the "About Aberforth"

section of the Managers' website.

Annual General Meeting ("AGM")

The AGM will be held at 14 Melville Street, Edinburgh EH3 7NS at 11.00 a.m. on

30 October 2023 and details of the resolutions to be considered by Shareholders

are set out in the Notice of the Meeting on page 62 of the Annual Report.

Shareholders are encouraged to submit their votes by proxy in advance of the

meeting. An update on performance and the portfolio will be available on the

Managers' website following the meeting.

Conclusion

The Board is conscious that ASLIT's capital performance over its life so far has

not matched expectations at the time of launch. However, despite the various top

-down challenges along the way, the investee companies have made underlying

progress, as may be gauged from the growth in ASLIT's dividend over the six

years. The upshot of muted capital returns and resilient profits is that the

portfolio's valuations today appear even more attractive than was the case at

inception. The consequent opportunity is addressed in detail in the Managers'

Report and influences the Board's thinking as it contemplates the end of ASLIT's

planned life.

That planned life ends on 1 July 2024, on which date or in the three months

prior, the Board is obliged by the Company's Articles to convene a general

meeting to propose that the Company be wound up. The spectre of recession and

the general apathy towards UK assets mean that the upside in ASLIT's portfolio

is unlikely to be fully realised by 1 July 2024. Therefore, before then, the

Board intends to examine means whereby holders of both classes of Share will be

given the opportunity to continue their investment in some form, alongside the

option to realise their investment in cash.

The Board is working with the Managers and at this stage nothing has yet been

decided or, indeed, ruled out. We shall seek specialist advice in due course and

shall also take account of feedback received from Shareholders when developing

proposals, which we would expect to finalise during the second calendar quarter

of 2024.

My fellow directors and I would welcome the views of Shareholders about these or

any other matters pertinent to the Company, to which end my email address is

noted below.

Angus Gordon Lennox

Chairman

27 July 2023

Angus.GordonLennox@aberforth.co.uk

Managers' Report

Introduction

Equity returns over the twelve months to 30 June 2023 were positive. The FTSE

All-Share index, which is representative of large UK companies, recorded a total

return of +7.9%. The gain from smaller companies was more modest. The total

return of the NSCI (XIC), which is ASLIT's investment universe, was +4.4%.

ASLIT's total asset total return, which is a measure of the portfolio's ungeared

performance, was +9.7%. This backdrop of rising share prices benefited both

classes of shareholder: the Ordinary Shares' net asset value total return was

+12.2%, while the final cumulative cover of the ZDP Shares rose from 3.0x to

3.2x.

The positive returns from equity markets around the world in the twelve months

to 30 June 2023 contrast with the falling share prices that characterised

ASLIT's previous financial year. Several factors contributed to the improved

mood. The initial shock of Russia's war in Ukraine has subsided, while some of

the worst fears about energy supplies and prices have so far proved misplaced.

The reopening of China's economy, following strict pandemic lockdowns, should

contribute to global economic activity and promises to ease pressure on supply

chains. Related to these points, inflationary forces appear to be abating: in

most major economies, the rate of change in consumer prices is declining, though

it remains elevated in comparison with the period before the pandemic.

The response to inflation has been the large and rapid increases in interest

rates over the past 18 months. These have complicated economic activity and

asset valuations. They have also precipitated financial accidents, such as the

UK's brief LDI crisis in the autumn followed by the spring's regional bank

failures in the US. The markets' calculation is that subsiding inflation will

soon allow the Federal Reserve to signal that the all-important US Fed Funds

rate has peaked. In stockmarket terms, the main beneficiaries so far of this

expectation of falling interest rates have been the large technology companies

in the US: their valuations thrived in the low inflation and low interest rate

environment preceding the pandemic and they are perceived as being best placed

to exploit the emerging fascination with artificial intelligence.

The likelihood of the UK's monetary policy following suit seems more distant.

Consumer price inflation is proving more persistent, forcing the Bank of England

to raise interest rates to 5% and bringing recession closer as higher mortgage

rates bite. Reawakened memories of a British problem with inflation have

contributed to a pervasive and thorough pessimism about the UK's prospects.

Domestic politics of recent years have not helped. A succession of prime

ministers has struggled with the additional challenges that the country's

departure from the EU has presented to economic activity. Ideology has too often

won out over pragmatism, culminating only nine months ago in Liz Truss's

extraordinary and short-lived premiership.

These concerns have affected investment in the UK. Open-ended equity funds have

experienced persistent outflows for several years and institutional asset

allocation decisions appear influenced more by what has been rather than what

will be. Valuations attributed to UK assets languish. Against the dollar and

euro, sterling remains 15% or so below its levels before the EU referendum. Gilt

yields are on a wide premium to government bond yields in the US and Europe. And

UK stockmarket valuations are towards their lowest in over 30 years when

compared with global equity market averages.

Equity valuations are examined in greater detail later in this report, but the

important point is that they contrast sharply with the recent performance of the

underlying businesses. The majority of small UK quoted companies and of the

portfolio's holdings increased profits and dividends over the past year,

notwithstanding the slew of macro-economic challenges. Cost inflation was passed

on successfully, which confounds a recurring concern that small companies lack

pricing power. Balance sheets were strengthened and are as strong as they have

been in Aberforth's 32 years history. This underlying progress and resilience

have persisted through the first part of 2023.

Performance and portfolio analysis

The following paragraphs describe the main influences on ASLIT's performance

over the twelve months to 30 June 2023, as well as some of the significant

characteristics of the portfolio.

Style

The Managers' value investment style has often been a significant influence on

ASLIT's returns, and that was again the case in the twelve months to 30 June

2023. Over this period, the value cohort of the NSCI (XIC) significantly out

-performed the index's growth stocks, according to data from the London Business

School. Continuing the trend since the pandemic recovery started, investment

style was therefore beneficial to ASLIT's returns. It is notable that most of

this benefit came in the earlier part of the twelve month period. Over recent

months, the glamour of artificial intelligence has contributed to a strong

rebound in the share prices of the American technology leviathans, which has

been to the advantage of the growth style.

Size

The NSCI (XIC) is formed from companies in the bottom ten per cent by value of

the entire UK stockmarket. This meant that the largest company in the index on

its 1 January 2023 rebalancing had a market capitalisation of £1.6bn and that

the index has a significant overlap with the FTSE 250. ASLIT's portfolio has a

relatively low exposure to companies in this overlap. It has relatively high

exposure to the NSCI (XIC)'s smaller constituents. This reflects these "smaller

small" companies' much more attractive valuations, which are set out later in

this report. Over the twelve months to 30 June 2023, the portfolio's size

positioning was modestly unhelpful to investment performance, as can be gauged

by the fact that the FTSE 250 out-performed the FTSE SmallCap by 3%.

Balance sheets

The table below shows the balance sheet profile of the portfolio and of the

Tracked Universe at 30 June 2023, which is the subset of the NSCI (XIC) that the

Managers follow closely and which represents 98% by value of the total index.

Weight in Net cash Net debt/EBITDA < 2x Net debt/EBITDA > 2x Others*

companies

with:

Portfolio 47% 42% 5% 5%

2023

Tracked 34% 36% 23% 8%

Universe

2023

*Includes

loss-makers

and lenders

The portfolio's balance sheet profile compares well with that of the index,

having a relatively high exposure to companies with net cash and a relatively

low exposure to those with higher leverage. This profile has emerged from the

Managers' bottom-up stock selection - the stockmarket is not giving small

companies credit in their valuations for balance sheet strength.

The other important point to make about small companies' balance sheets is that

they have not been so strong since around 2014. Companies had entered the 2009

recession with too much leverage and spent the next five years repairing their

balance sheets. Today, in contrast, companies would be entering a slowdown or

recession with healthy balance sheets. Clearly, there are exceptions, but the

broad-based balance sheet resilience is an under-appreciated feature of small

companies at present.

Income

ASLIT's aim to generate income growth from its portfolio was impeded by the

pandemic, which forced many small companies to pass their dividends and

necessitated a cut in ASLIT's dividend two years ago. However, since the

pandemic recovery started, smaller companies have displayed their resilience and

their commitment to their shareholders by promptly resuming dividend payments.

The rebound has been surprisingly and pleasingly quick, which has allowed

ASLIT's revenue return attributable to Equity Shareholders in the twelve months

to 30 June 2023 to exceed its pre-pandemic level.

The table below illustrates the dividend performance of the portfolio over the

past year. It splits the 63 holdings into five categories, which are determined

by each company's most recent dividend action.

Nil Payer Cutter Unchanged Payer Increased Payer New / Returner

4 8 8 40 3

The majority of the holdings increased their most recent dividends. A further

boost to the income performance comes from the New / Returners category. Its

constituents are companies that are paying dividends for the first time or that

have resumed payments, having paid nothing through the pandemic. It is

anticipated that three of the current Nil Payers will move into the New /

Returner category over the next twelve months. ASLIT's income also benefited

from seven special dividends announced by investee companies in the year to 30

June 2023.

The average historical yield of the portfolio's holdings at 30 June 2023 was

5.2%, while the average dividend cover was 2.4x. An economic downturn would

threaten dividend forecasts, but its impact should be mitigated by the

portfolio's high dividend cover and strong balance sheets.

Corporate Activity

There was a flurry of M&A activity in the first part of 2022, but this petered

out as interest rates and the cost of corporate debt rose through the second

half of the year. Entering 2023, the Managers believed that the volatility of

debt markets would continue to discourage takeovers. In the event, however, six

new bids were announced for constituents of the NSCI (XIC) in the six months to

30 June 2023, with ASLIT owning two of them. The average EV/EBITA of the six at

their deal prices was 16.2x, while the average premium to the pre-announcement

share prices was 67%.

More surprising than the rebound in M&A has been the nature of the bidders: in

five of the six deals, the buyers have been private equity firms. The surprise

reflects the fact that debt is the lifeblood of private equity and debt markets

have not yet settled down amid on-going tightening of monetary policy. However,

it would appear that the very low valuations of small UK quoted companies mean

that private equity does not need debt at the outset to make their M&A models

work. This is a stark illustration of the opportunity currently embedded in the

valuations of small UK quoted companies.

ASLIT may benefit from further takeover premiums for its holdings as long as

stockmarket valuations remain at their present low levels. However, in these

circumstances, it remains important to guard against opportunism on the part of

the buyers. Large takeover premiums may still not bring valuations to

appropriate levels and the Managers are prepared to vote against deals where

this is the case. The best M&A experiences are often those in which boards of

directors consult shareholders well in advance. Such consultation reduces the

risk of embarrassment, should shareholders find proposed terms unacceptable, and

can lead to better outcomes, which may be that the company in question retains

its independence. The Managers make it clear to the boards of the investee

companies that they should be consulted in such situations and that they are

willing to be insiders for extended periods.

Active share

Active share is a measure of how different a portfolio is from an index. The

ratio is calculated as half of the sum of the absolute differences between each

stock's weighting in the index and its weighting in the portfolio. The higher a

portfolio's active share, the higher its chance of performing differently from

the index, for better or worse. The Managers target an active share ratio of at

least 70%. At 30 June 2023, it stood at 78%.

Portfolio turnover

Portfolio turnover is defined as the lower of purchases and sales divided by

average portfolio value. Over the twelve months to 30 June 2023, turnover was

18%. This relatively subdued rate of turnover is due to the low stockmarket

valuations of the portfolio's holdings - discounts to the Managers' target

prices have not generally narrowed, so the opportunity for "value roll" within

the portfolio has been limited. "Value roll" is the term that the Managers use

to describe the recycling of capital from companies with less upside to target

prices into those with greater upside.

Some of the turnover in the period reflected investment in companies that

entered the NSCI (XIC) on 1 January 2023. As described in the last Interim

Report, this was the largest ever rebalancing of the index. The 29 companies

that were injected into the index offered the Managers additional opportunity:

the portfolio owned three of these so-called "fallen angels" at 30 June 2023.

Valuations

The table below sets out the forward valuations of the portfolio, the Tracked

Universe and certain subdivisions of the Tracked Universe. The metric displayed

is enterprise value to earnings before interest, tax and amortisation

(EV/EBITA), which the Managers use most often in valuing companies. The

forecasts underlying the ratios are the Managers'. The bullet points following

the table summarise its main messages.

EV/EBITA 2022 2023 2024

ASLIT 6.7x 7.6x 6.0x

Tracked Universe (234 stocks) 9.4x 9.6x 8.7x

- 40 growth stocks 14.5x 13.6x 13.7x

- 194 other stocks 8.7x 9.0x 7.9x

- 78 stocks > £600m market cap 11.0x 10.8x 10.2x

- 156 stocks < £600m market cap 7.4x 7.9x 6.6x

· The average EV/EBITA multiples of the portfolio are much lower than those of

the Tracked Universe. This has been a consistent feature over ASLIT's history

and is consistent with the Managers' value investment style.

· The portfolio's 7.6x EV/EBITA ratio for 2023 is considerably lower than the

average multiple of 16.2x at which this year's M&A deals in the NSCI (XIC) have

been struck.

· The profit forecasts underlying the EV/EBITA multiples for 2023 and 2024 are

subject to uncertainty about the timing and intensity of an economic downturn.

It can be inferred from the progression of the multiple across the three years

that the Managers presently expect a slowdown in 2023, followed by a recovery in

2024.

· The growth stocks within the Tracked Universe are on much higher multiples

than both the portfolio and the rest of the Tracked Universe.

· The "smaller small" companies within the index - here illustrated by those

with market capitalisations less than

£600m - are on vast valuation discounts to their larger peers. The Managers

identify no reason for this beyond a

general concern about liquidity and so the portfolio has a relatively high

exposure to these "smaller small" companies.

The table below set out some of the main characteristics of ASLIT's diversified

portfolio of smaller companies. The point above about exposure to "smaller

small" companies is reinforced in the weighted average market capitalisation

row.

Portfolio characteristics 30 June 2023 30 June 2022

ASLIT NSCI (XIC) ASLIT NSCI (XIC)

Number of companies 63 339 66 323

Weighted average market capitalisation £630m £945m £622m £795m

Price earnings (PE) ratio (historical) 8.0x 10.8x 8.3x 9.8x

Dividend yield (historical) 5.2% 3.5% 4.5% 3.1%

Dividend cover 2.4x 2.6x 2.7x 3.3x

Alongside the 5.2% dividend yield, the portfolio's most notable feature of the

table is average historical price earnings ratio (PE). It has fallen from 8.3x

to 8.0x over the twelve months to 30 June 2023. Given ASLIT's positive total

assets total return in this period, it can be inferred that the reduction in the

PE was due to growth in the earnings per share of the portfolio's holdings. An

advantage of historical valuation measures, particularly when a recession looms,

is that they are not susceptible to forecast uncertainties. To give a longer

term perspective than ASLIT's six years, the chart below plots the historical PE

ratio for the Managers' longest standing portfolio, which shares many of ASLIT's

holdings.

[image]

The messages from the chart are that PE ratios are unusually low at present and

that they fall so low when recession threatens: the earlier low-points in the

chart were the early 1990s recession, the global financial crisis and the

pandemic. It is therefore possible that much of the risk of an economic downturn

is already embedded within share prices. Taking this argument further, small

company profits typically fall by around 30% in a recession. A repeat of this

would take the historical PE ratio of ASLIT's portfolio of 8.0x to a forward

ratio of 11.4x. This multiple of what can be thought of as trough profits would

still be below the long term average PE multiple shown in the chart of 12.1x.

An influence on the portfolio's low valuation at present is its exposure to UK

equities. These are out of favour with global investors for reasons previously

set out in this report. Data from Panmure Gordon help quantify the scale of this

disenchantment. The PE of the UK stockmarket is presently 27% lower than the PE

of global equities, which is much more than the average discount of 15% over

Aberforth's 32 year history. Comparing ASLIT's portfolio directly with global

equities, the current PE discount is 46%, whereas the 32 year average for

Aberforth's longest standing portfolio has been 24%. The valuation elastic is

therefore extremely stretched at present, with ASLIT on a triple discount by

virtue of its value investment style, its exposure to small companies and its

Britishness. This appears incongruous given the resilience of the portfolio's

investee companies and the fact 42% of their revenues on average are generated

outside the UK. An easing of the tension in valuations, as one or more of these

relationships returns towards the normal levels of the past 32 years, should

bode well for ASLIT's returns.

Outlook

Stockmarkets' immediate obsession is US interest rates - each data release is

scrutinised exhaustively for a hint of what the Federal Reserve might do next.

The positive start to 2023 for equities indicates an expectation that US

interest rates are close to their peak. However, there are important caveats.

The speed and extent of the interest rate increases threaten further accidents -

the financial world has grown used to more than a decade of almost costless

money. Moreover, it is not clear that inflation will return conveniently and

reliably to its pre-pandemic levels - the rate of increase will subside, but

underlying inflationary pressures from labour markets and from forces such as de

-globalisation linger.

While equity investors are presently enthused by the outlook for US monetary

policy, they remain nervous about prospects for UK politics and economics over

the next couple of years. On the political front, there will be a UK General

Election within the next eighteen months. This will come at a time when the

influence of the more extreme elements of both main political parties appears to

be waning. However, a change of government looks likely, which brings

incremental risk.

Meanwhile, the UK economy is blighted by more persistent inflation than are its

peers. This threatens a more aggressive monetary response by the Bank of England

and potentially a more severe downturn in economic activity. Recessions are

unpleasant. They increase hardship faced by households and businesses. They

reduce incomes and profits. But they are also inevitable and even necessary in

order to address the effects of past policy mistakes and of unforeseeable

developments such as the pandemic.

The near term risks are undeniable. But so is the attractiveness of the

valuations attributed to the portfolio's holdings by the stockmarket.

Importantly, the stress-testing of today's valuations described above suggests

that much of the risk of a recession may already be embedded in share prices.

Ironically, therefore, there is less uncertainty about the medium and long term

outlook for returns from the companies in ASLIT's portfolio. History is rather

convincing: when valuations have reached today's levels in the past, total

returns over the next five years have been strong.

Conclusion

Herein lies the frustration for ASLIT. By virtue of its closed end structure and

its gearing, it is well suited to take advantage of today's valuations, but it

has just one year of its planned life left. It is not clear that the qualities

of ASLIT's portfolio - its strong balance sheets, resilient income profile and

very low valuations - will be recognised widely by investors within this time

frame. Further takeover activity will help close value gaps, but more time is

likely to be necessary to benefit fully from the opportunity in today's

valuations. Therefore, the Managers are working with the Board to offer

Shareholders the option, no later than 1 July 2024, either to realise their

investment in cash or to continue their exposure to the Managers' investment

approach in some form.

Aberforth Partners LLP

Managers

27 July 2023

FINANCIAL HIGHLIGHTS

TOTAL RETURN PERFORMANCE

Ordinary ZDP

Share Share

Total NAV2 Share NAV4 Share

Assets1 Price3 Price5

Year to 30 9.7% 12.2% 20.0% 3.6% 3.0%

June 2023

Annualised 14.8% 20.0% 22.1% 3.6% 4.1%

3 years

5 years 0.1% -0.9% -0.7% 3.6% 2.3%

Since 0.9% 0.3% -0.5% 3.5% 3.0%

inception14

Cumulative 51.1% 72.9% 82.2% 11.2% 12.7%

3 years

5 years 0.3% -4.2% -3.6% 19.3% 12.2%

Since 5.8% 1.8% -2.9% 22.8% 19.5%

inception14

The total

return per

Ordinary

Share2 for

the year to

30 June

2023 was

8.87p

(2022:

(18.98)p).

ORDINARY SHARE

Net Share Discount / Revenue Ordinary Special Ongoing

Gearing7

Asset Price (Premium) Return per Dividends per Dividends

Charges6

Value Share Share

per per Share

Share

----- ----- ---------- ----------- ------------ --------- -------

- --------

----- ----- -- --- ----

----

-

30 77.2p 72.0p 6.7% 5.35p 5.00p - 1.3%

39.8%

June

2023

30 73.0p 64.2p 12.1% 4.81p 4.30p 0.25p 1.2%

40.6%

June

2022

30 95.7p 87.2p 8.8% 2.90p 3.05p - 1.2%

29.9%

June

2021

At inception14 an Ordinary Share had a NAV of 100p and a gearing7 level of 25%.

ZERO DIVID PREFERENCE SHARE (ZDP SHARE)

Net Asset Share Discount / Return Projected Final Redemption

Value per Price (Premium) Cumulative Yield9

Share per Cover8

Share

------------ ------ ---------- ------ ------------ ----------

----- -- ---- --

30 122.8p 119.5p 2.7% 4.3p 3.2x 6.4%

June

2023

30 118.6p 116.0p 2.2% 4.1p 3.0x 4.7%

June

2022

30 114.5p 114.0p 0.4% 4.0p 3.6x 3.7%

June

2021

At inception14 a ZDP Share had a NAV of 100p, a Projected Final Cumulative

Cover8 of 3.4x, and a Redemption Yield9 of 3.5%.

HURDLE RATES10

Ordinary ZDP Shares

Shares

Annualised Hurdle Rates to return

Annualised

Hurdle

Rates to

return

100p Share Zero 127.25p Zero Value

Price Value

At ---------- ------ ------ ------------ ------------

-- ------ ------

30 June 28.4% 1.3% -68.6% -68.6% -99.7%

2023

30 June 16.2% -0.7% -42.6% -42.6% -94.8%

2022

Inception14 1.5% n/a -17.0% -17.0% -57.2%

REDEMPTION YIELDS & TERMINAL NAVs (ORDINARY SHARES)

As at 30 June 2023

Annualised

Ordinary

Share

Redemption

Yields11

Dividend

Growth

(per

annum)

Capital -20.0% -10.0% +0.0% +10.0% +20.0% Terminal

Growth (per NAV12

annum)

------ ----- ------ ------ ------ --------

------ ----- ------ ------ ------ ----

--

-20.0% -23.8% -22.6% -21.3% -19.9% -18.4% 50.0p

-10.0% -9.0% -7.7% -6.4% -4.9% -3.3% 60.3p

+0.0% 5.8% 7.1% 8.6% 10.1% 11.7% 70.7p

+10.0% 20.5% 22.0% 23.5% 25.1% 26.8% 81.0p

+20.0% 35.3% 36.8% 38.4% 40.0% 41.8% 91.3p

The valuation statistics in the tables above are projected, illustrative and do

not represent profit forecasts. There is no guarantee these returns will be

achieved.

1-14 Refer to Note 2, Alternative Performance Measurement, and Glossary.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors who were in office at the date of approving the financial

statements confirm to the best of their knowledge that:

(a) the financial statements, which have been prepared in accordance with

applicable accounting standards, give a true and fair view of the assets,

liabilities, financial position and profit/loss of the Company;

(b) the Strategic Report includes a fair review of the development and

performance of the business and financial position of the Company, together with

a description of the principal risks and uncertainties that it faces; and

(c) the Annual Report and Financial Statements, taken as a whole, is fair,

balanced and understandable and provides the information necessary for

Shareholders to assess the Company's performance, business model and strategy.

On behalf of the Board

Angus Gordon Lennox

Chairman

27 July 2023

PRINCIPAL RISKS AND RISK MANAGEMENT

The Board carefully considers the risks faced by the Company and seeks to manage

these risks through continual review, evaluation, mitigating controls and action

as necessary. A risk matrix for the Company is maintained. It groups risks into

the following categories: portfolio management; investor relations; regulatory

and legal; and financial reporting. Further information regarding the Board's

governance oversight of risk, its review process and the context for risks can

be found in the Corporate Governance Report (page 30 of the Annual Report). The

Audit Committee Report (pages 31 to 33 of the Annual Report) details matters

considered and actions taken on internal controls and risks during the year. The

Company outsources all the main operational activities to recognised, well

-established firms and the Board receives internal control reports from these

firms, where available, to review the effectiveness of their control frameworks.

Emerging risks are those that could have a future impact on the Company. The

Board regularly reviews them and, during the year, it considered the effects of

economic and political developments within the risk category of market risk. The

Board regularly monitors how the Managers integrate such risks into the

investment decision making.

Principal risks are those risks derived from the matrix that have the highest

risk ratings based on likelihood and impact. They tend to be relatively

consistent from year to year given the nature of the Company and its business.

Monitoring by the Board did not give rise to any changes during the year to the

risk ratings applied to each of the principal risks. On a forward looking basis,

the principal risks faced by the Company, together with the approach taken by

the Board towards them, are summarised below.

To indicate the extent to which the principal risks change during the year and

the level of monitoring required, each principal risk has been categorised as

either dynamic risk, requiring detailed monitoring as it can change regularly,

or stable risk.

(i) Investment policy/performance risk (a portfolio management risk) - The

Company's investment policy and strategy expose the portfolio to share price

movements. The performance of the investment portfolio will be influenced by

stock selection, liquidity and market risk (see Market risk below and Note 19 of

the Annual Report for further details). Investment in small companies is

generally perceived to carry more risk than investment in large companies. While

this is reasonable when comparing individual companies, it is much less so when

comparing the risks inherent in diversified portfolios of small and large

companies. The Board's aim is to achieve the investment objective by ensuring

the investment portfolio is managed in accordance with the policy and strategy.

The Board has outsourced portfolio management to experienced investment managers

with a clearly defined investment philosophy and investment process. The Board

receives regular and detailed reports on investment performance including

detailed portfolio and risk profile analysis. Senior representatives of

Aberforth Partners attend each Board meeting. This remains a dynamic risk, with

detailed consideration during the year. The Managers' Report contains

information on portfolio investment performance and risk.

(ii) Market risk (a portfolio management risk) - Investment performance is

affected by a number of market risk factors, which cause uncertainty about

future price movements of investments. The Board delegates consideration of

market risk to the Managers to be carried out as part of the investment process.

The Managers regularly assess the exposure to market risk when making investment

decisions and the Board monitors the results via the Managers' reporting. The

Board and Managers closely monitor economic and political developments. This

remained a dynamic risk during the year, in which the Managers reported on

market risks including inflation and supply-chain pressures and other

geopolitical issues referred to in the Managers' Report.

(iii) Structural conflicts of interest (an investor relations risk) - The

different rights and expectations of the holders of Ordinary Shares and the

holders of ZDP Shares may give rise to conflicts of interest between them. While

the Company's investment objective and policy seek to strike a balance between

the interests of both classes of Shareholder, there can be no guarantee that

such a balance will be achieved and maintained during the life of the Company.

The Board acts in a manner that it considers fair, reasonable and equitable to

both classes of Shareholder. This is a stable risk.

(iv) Significant fall in investment income (a portfolio management risk)- A

significant fall in investment income could lead to the inability to provide a

high level of income and income growth. The Board receives regular and detailed

reports from the Managers on income performance together with income forecasts.

The Board and Managers monitor investment income and it is considered a dynamic

risk.

(v) Loss of key investment personnel (a portfolio management risk) - The Board

believes that a risk exists in the loss of key investment personnel at the

Managers. The Board recognises that the collegiate approach employed by the

Managers mitigates this risk. Board members are in regular contact with the

partners and staff of the Managers and monitor personnel changes. This is a

stable risk.

(vi) Regulatory risk (a regulatory and legal risk) - Breach of regulatory rules

could lead to suspension of the Company's share price listings, financial

penalties or a qualified audit report. Breach of Section 1158 of the Corporation

Tax Act 2010 could lead to the Company losing investment trust status and, as a

consequence, any capital gains would then be subject to capital gains tax. The

Board reviews regular reports from the Secretaries to monitor compliance with

regulations. This is a stable risk.

The Income Statement, Reconciliation of Movements in Shareholders' Funds,

Balance Sheet and Cash Flow Statement are set out below.

INCOME STATEMENT

Year to 30 June 2023

(audited)

Year to Year to

30 June 30 June 2022

2023

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Net gains / (losses) - 10,052 10,052 - (41,748) (41,748)

on investments

Investment income 10,985 20 11,005 10,024 - 10,024

Other income 14 - 14 - - -

Investment management (443) (1,034) (1,477) (521) (1,216) (1,737)

fee

Portfolio transaction - (313) (313) - (329) (329)

costs

Other expenses (357) - (357) (335) - (335)

------- ------- ------- -------- -------- --------

- - -

Net return before 10,199 8,725 18,924 9,168 (43,293) (34,125)

finance costs and tax

Finance costs:

Appropriation to ZDP - (2,024) (2,024) - (1,956) (1,956)

Shares

Interest expense and (3) (7) (10) (3) (6) (9)

overdraft fee

------- ------- ------- -------- -------- --------

- - -

Return on ordinary 10,196 6,694 16,890 9,165 (45,255) (36,090)

activities before tax

Tax on ordinary (24) - (24) (22) - (22)

activities

------- ------- ------- -------- -------- --------

- - -

Return attributable 10,172 6,694 16,866 9,143 (45,255) (36,112)

to Equity

Shareholders

====== ====== ======= ====== ======= =======

Returns per Ordinary 5.35p 3.52p 8.87p 4.81p (23.79)p (18.98)p

Share

The Board declared on 27 July 2023 a second interim dividend of 3.30p per

Ordinary Share. The Board also declared on 26 January 2023 a first interim

dividend of 1.70p per Ordinary Share.

The total column of this statement is the profit and loss account of the

Company. All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued in the

period. A Statement of Comprehensive Income is not required as all gains and

losses of the Company have been reflected in the above statement.

RECONCILIATION OF MOVEMENTS IN SHAREHOLDERS' FUNDS

Year to 30 June 2023

(audited)

Share Special Capital Revenue

capital reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000

Balance as at 30 1,902 187,035 (57,620) 7,635 138,952

June 2022

Return on ordinary - - 6,694 10,172 16,866

activities after

tax

Equity dividends - - - (9,018) (9,018)

paid

-------- -------- -------- -------- --------

Balance as at 30 1,902 187,035 (50,926) 8,789 146,800

June 2023

====== ====== ====== ====== ======

Year to 30 June

2022

Share Special Capital Revenue

capital reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000

Balance as at 30 1,902 187,035 (12,365) 5,417 181,989

June 2021

Return on ordinary - - (45,255) 9,143 (36,112)

activities after

tax

Equity dividends - - - (6,925) (6,925)

paid

-------- -------- -------- -------- --------

Balance as at 30 1,902 187,035 (57,620) 7,635 138,952

June 2022

====== ====== ====== ====== ======

BALANCE SHEET

As at 30 June 2023

(audited)

30 June 2023 30 June 2022

£'000 £'000

Fixed assets

Investments at fair value 202,150 193,062

through profit or loss

---------- ----------

Current assets

Debtors 782 755

Cash at bank 2,949 1,590

---------- ----------

3,731 2,345

Creditors (amounts falling (664) (62)

due within one year)

---------- ----------

Net current assets 3,067 2,283

---------- ----------

Total Assets less Current 205,217 195,345

Liabilities

Creditors (amounts falling

due after more than one

year)

ZDP Shares (58,417) (56,393)

---------- ----------

TOTAL NET ASSETS 146,800 138,952

======= =======

Capital and Reserves: Equity

Interests

Share capital:

Ordinary Shares 1,902 1,902

Reserves:

Special reserve 187,035 187,035

Capital reserve (50,926) (57,620)

Revenue reserve 8,789 7,635

---------- ----------

TOTAL SHAREHOLDERS' FUNDS 146,800 138,952

======= =======

Net Asset Value per Ordinary 77.16p 73.04p

Share

Net Asset Value per ZDP 122.82p 118.57p

Share

CASH FLOW STATEMENT

For the year to 30 June 2023

(audited)

Year to Year to

30 June 2023 30 June 2022

£'000 £'000

Operating activities

Net revenue before finance costs and tax 10,199 9,168

Receipt of special dividend taken to capital 20 -

Tax (withheld) from income (24) (20)

Investment management fee charged to capital (1,034) (1,216)

(Increase) in debtors (27) (421)

(Decrease)/increase in creditors (7) 9

-------- --------

Cash inflow from operating activities 9,127 7,520

===== =====

Investing activities

Purchases of investments excluding transaction costs (36,395) (41,203)

Sales of investments excluding transaction costs 37,655 41,007

-------- --------

Cash inflow/(outflow) from investing activities 1,260 (196)

===== =====

Financing activities

Equity dividends paid (9,018) (6,925)

Interest and fees paid (10) (9)

-------- --------

Cash outflow from financing activities (9,028) (6,934)

===== =====

Change in cash during the period 1,359 390

===== =====

Cash at the start of the period 1,590 1,200

Cash at the end of the period 2,949 1,590

====== ======

SUMMARY NOTES TO THE FINANCIAL STATEMENTS

1. SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been presented under Financial Reporting Standard

102 (FRS 102) and the AIC's Statement of Recommended Practice "Financial

Statements of Investment Trust Companies and Venture Capital Trusts" (SORP).

The financial statements have been prepared on a going concern basis under the

historical cost convention, modified to include the revaluation of the Company's

investments as described below. The Directors' assessment of the basis of going

concern is described on page 24 of the Annual Report. In particular the

Directors considered the implications of the proximity to the planned winding-up

date of 1 July 2024 and that Shareholders will have a vote on proposals relating

to the Company's planned life, on or within the three months prior to 1 July

2024. The Directors may be released from the obligation to call a general

meeting to wind up the Company if a special resolution has been passed to that

effect not later than 1 July 2024. The Directors also considered the investment

outlook, the objectives of both classes of Shareholder, potential sources of

funding to finance the repayment of the entitlement due to the ZDP Shareholders

and other future cash flows of the Company. The nature of any proposals that may

be presented by the Directors relating to the Company's planned life on which

the Shareholders will be required to vote and the outcome of the vote on any

such proposals represent a material uncertainty in the context of assessing the

prospects of the Company beyond 1 July 2024. This may cast significant doubt on

the ability of the Company to continue preparing its financial statements on a

going concern basis to the extent that they include, and Shareholders vote for,

a winding-up of the Company. If at some point in the future the Directors

conclude it is not appropriate to prepare the financial statements on a going

concern basis then adjustments would be required to reclassify all assets as

current, and a provision for further liabilities, including liquidation costs,

would be made. Consideration would also be given to valuing the portfolio on a

discounted bid basis to reflect the cost of liquidating the portfolio in a

shorter time frame.

The functional and presentation currency is pounds sterling, which is the

currency of the environment in which the Company operates. The Board confirms

that no significant accounting judgements or estimates have been applied to the

financial statements and therefore there is not a significant risk of causing a

material adjustment to the carrying amounts of assets and liabilities within the

next financial year. Given the nature of the Company, the Board does not

consider climate change material to the presentation of the financial

statements.

2. ALTERNATIVE PERFORMANCE MEASURES

Alternative Performance Measures (APMs) are measures that are not defined under

the requirements of FRS 102 and are unaudited. The Company believes that APMs,

referred to within "Financial Highlights", provide Shareholders with important

information on the Company and are appropriate for an investment trust company.

These APMs are also a component of reporting to the Board. A glossary including

APMs can be found below and in the 2023 Annual Report.

3. INVESTMENT MANAGEMENT FEE

The Managers, Aberforth Partners LLP, receive an annual management fee, payable

quarterly in advance, equal to 0.75% of the Company's Total Assets. The

management fee is allocated 70% to capital reserves and 30% to revenue reserves.

4. DIVIDS PAID

Amounts recognised as Year to Year to

distributions to equity

holders: 30 June 2023 30 June 2022

£'000 £'000

In respect of the year to 30

June 2021:

Second interim dividend of - 4,052

2.13p (paid on 27 August

2021)

In respect of the year to 30 - 2,873

June 2022

First interim dividend of

1.51p (paid on 8 March

2022)

Second interim dividend of 5,308 -

2.79p (paid on 26 August

2022)

Special dividend of 0.25p 475 -

(paid on 26 August 2022)

3,235 -

In respect of the year to 30

June 2023:

First interim dividend of

1.70p (paid on 8 March

2023)

------------ ------------

Total 9,018 6,925

------------ ------------

The second interim dividend for the year ended 30 June 2023 of 3.30p (2022:

2.79p) per Ordinary Share is payable on 31 August 2023 and has not been

recognised in the financial statements as at 30 June 2023. Deducting the second

interim dividend from the Company's revenue reserves at 30 June 2023 leaves

revenue reserves equivalent to 1.32p per Ordinary Share.

5. RETURNS PER

SHARE

Year to

Year to

30 June

30 June 2022

2023

Ordinary Shares

Net return for the year £16,866,000

£(36,112,000)

Weighted average Ordinary Shares in issue during the year 190,250,000

190,250,000

Return per Ordinary 8.87p

(18.98)p

Share

ZDP Shares

Appropriation to ZDP Shares for the year £2,024,000

£1,956,000

Weighted average ZDP Shares in issue during the year 47,562,500

47,562,500

Return per ZDP Share 4.26p

4.11p

There are no dilutive or potentially dilutive shares in issue.

6. INVESTMENTS HELD AT FAIR VALUE THROUGH PROFIT OR LOSS

Year to Year to

30 June 2023 30 June 2022

£'000 £'000

Investments at fair value through profit or loss

Opening fair value 193,062 235,448

Opening fair value adjustment 38,832 (9,102)

------------ ------------

Opening book cost 231,894 226,346

Purchases at cost 36,734 40,342

Sale proceeds (37,698) (40,980)

Realised gains on sales 3,543 6,186

------------ ------------

Closing book cost 234,473 231,894

Closing fair value adjustment (32,323) (38,832)

------------ ------------

Closing fair value 202,150 193,062

------------ ------------

All investments are in ordinary shares listed on the London Stock Exchange.

Year to Year to

30 June 2023 30 June 2022

£'000 £'000

Gains/(losses) on investments:

Net realised gains on sales 3,543 6,186

Movement in fair value adjustment 6,509 (47,934)

------------ ------------

Net gains/(losses) on investments 10,052 (41,748)

------------ ------------

In accordance with FRS 102, fair value measurements have been classified using

the fair value hierarchy:

Level 1 - using unadjusted quoted prices for identical instruments in an active

market;

Level 2 - using inputs, other than quoted prices included within Level 1, that

are directly or indirectly observable (based on market data); and

Level 3 - using inputs that are unobservable (for which market data is

unavailable).

All investments are held at fair value through profit or loss, have been

classified as Level 1 and are traded on a recognised stock exchange.

7. NET ASSET VALUE ("NAV") PER SHARE

The Net Assets and the Net Asset Value per share attributable to the Ordinary

Shares and ZDP Shares are as follows.

30 June 2023 30 June 2022

Ordinary ZDP Total Ordinary ZDP

Total

Shares Shares Shares Shares

Net assets £146,800,000 £58,417,000 £205,217,000 £138,952,000 £56,393,000

£195,345,000

attributable

Number of 190,250,000 47,562,500 237,812,500 190,250,000 47,562,500

237,812,500

Shares at

the

reporting

date

------------ ----------- ------------ ------------ -----------

------------

- -

NAV per 77.16p 122.82p 86.29p 73.04p 118.57p

82.14p

Share (a)

Dividend 1.319066 - 1.226413 1.242432 -

1.174303

reinvestment

factor13 (b)

------------ ----------- ------------ ------------ -----------

------------

- -

NAV per 101.78p 122.82p 105.83p 90.75p 118.57p

96.46p

Share on a

total return

basis

at the end

of the

period (c) =

(a) x

(b)

------------ ----------- ------------ ------------ -----------

------------

- -

NAV per 90.75p 118.57p 96.46p 114.43p 114.46p

113.40p

Share on a

total return

basis

at the start

of the

period (d)

------------ ----------- ------------ ------------ -----------

------------

- -

Total Return 12.2% 3.6% 9.7% -20.7% 3.6%

-14.9%

performance

(c) / (d) -

1

------------ ----------- ------------ ------------ -----------

------------

- -

13 Refer to Glossary

8. SHARE CAPITAL

Shares £'000

As at 30 June 2023

Ordinary Shares of 1p each 190,250,000 1,902

ZDP Shares of 1p each 47,562,500 476

------------ ------------

Total issued and allotted 237,812,500 2,378

------------ ------------

There have been no changes in the issued share capital since the launch of the

Company on 3 July 2017.

9. ZERO DIVIDEND PREFERENCE SHARES

Year ended: 30 June 30 June

2023 2022

£'000 £'000

Opening Balance 56,393 54,437

Issue costs amortised during the period 48 46

Capital growth of ZDP Shares 1,976 1,910

------------ ------------

Closing Balance 58,417 56,393

------------ ------------

10. RELATED PARTY TRANSACTIONS

The Directors have been identified as related parties and their fees and

interests have been disclosed in the Directors' Remuneration Report contained in

the Annual Report. During the year no Director or entity controlled by a

Director was interested in any contract or other matter requiring disclosure

under section 412 of the Companies Act 2006.

11. FURTHER INFORMATION

The foregoing do not constitute statutory accounts (as defined in section 434(3)

of the Companies Act 2006) of the Company. The statutory accounts for the year

ended 30 June 2022, which contained an unqualified Report of the Auditors, have

been lodged with the Registrar of Companies and did not contain a statement

required under section 498(2) or (3) of the Companies Act 2006.

Certain statements in this announcement are forward looking statements. By

their nature, forward looking statements involve a number of risks,

uncertainties or assumptions that could cause actual results or events to differ

materially from those expressed or implied by those statements. Forward looking

statements regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the future.

Accordingly, undue reliance should not be placed on forward looking statements.

The Annual Report is expected to be posted to shareholders by 7 August 2023.

Members of the public may obtain copies from Aberforth Partners LLP, 14 Melville

Street, Edinburgh EH3 7NS or from its website: www.aberforth.co.uk.

GLOSSARY:

1 Total Assets Total Return - the theoretical return of the combined funds of

the Ordinary Shareholders and ZDP Shareholders assuming that dividends paid to

Ordinary Shareholders were reinvested at the NAV per Ordinary Share at the close

of business on the day the Ordinary Shares were quoted ex dividend.

2 Ordinary Share NAV Total Return - the theoretical return on the NAV per

Ordinary Share assuming that dividends paid to Ordinary Shareholders were

reinvested at the NAV per Ordinary Share at the close of business on the day the

Ordinary Shares were quoted ex dividend.

3 Ordinary Share Price Total Return - the theoretical return to an Ordinary

Shareholder, on a closing market price basis, assuming that all dividends

received were reinvested, without transaction costs, into the Ordinary Shares at

the close of business on the day the shares were quoted ex dividend.

4 ZDP Share NAV Total Return - represents the return on the entitlement of a ZDP

Share. The ZDP Share NAV as at 30 June 2023 was 122.82p (30 June 2022: 118.57p).

5 ZDP Share Price Total Return - the theoretical return to a ZDP Shareholder, on

a closing market price basis.

6 Ongoing Charges - represents the percentage per annum of investment management

fees and other operating expenses to the average published Ordinary

Shareholders' NAV over the period.

7 Gearing - calculated by dividing the asset value attributable to the ZDP

Shares by the asset value attributable to the Ordinary Shares.

8 Projected Final Cumulative Cover - the ratio of the total assets of the

Company as at the calculation date, to the sum of the assets required to pay the

final capital entitlement of 127.25p per ZDP Share on the planned winding-up

date, the future estimated management fees charged to capital, and estimated

winding-up costs.

9 Redemption Yield (ZDP Share) - the annualised rate at which the total

discounted value of the planned future payment of capital equates to its share

price at the date of calculation.

10 Hurdle Rate - the rate of capital growth per annum in the Company's

investment portfolio to return a stated amount per Share at the planned winding

-up date.

11 Redemption Yield (Ordinary Share) - the annualised rate at which projected

future income and capital cash flows (based on assumed future capital and

dividend growth rates) is discounted to produce an amount equal to the share

price at the date of calculation.

12 Terminal NAV (Ordinary Share)- the projected NAV per Ordinary Share at the

planned winding-up date at a stated rate of capital growth in the Company's

investment portfolio after taking into account the final capital entitlement of

the ZDP Shares, future estimated costs charged to capital and estimated winding

-up costs.

13 Dividend reinvestment factor - is calculated on the assumption that dividends

paid by the Company were reinvested into Ordinary Shares of the Company at the

NAV per Ordinary Share or the share price, as appropriate, on the day the

Ordinary Shares were quoted ex dividend.

14 Inception Date - 30 June 2017.

CONTACT:

Euan Macdonald / Christopher Watt - Aberforth Partners LLP - 0131 220 0733

Aberforth Partners LLP

Managers and Secretaries

28 July 2023

ANNOUNCEMENT ENDS

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

July 28, 2023 05:11 ET (09:11 GMT)

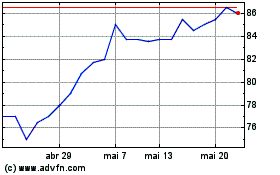

Aberforth Split Level In... (LSE:ASIT)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Aberforth Split Level In... (LSE:ASIT)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024