TIDMBGUK

RNS Number : 9816H

Baillie Gifford UK Growth Trust PLC

30 November 2022

RNS Announcement

Baillie Gifford UK Growth Trust plc

Legal entity identifier: 549300XX386SYWX8XW22

For the six months to 31 October 2022

Over the six month period to 31 October 2022, the Company's net

asset value per share total return was negative 10.9% compared to a

negative 5.8% for the FTSE All-Share Index total return. The share

price total return for the same period was negative 11.9%.

3/4 Two new positions were initiated in the period: IT

infrastructure provider Softcat; and, the digitisation specialist

Kainos. One position was sold: online food ordering and delivery

company Just Eat Takeaway.com.

3/4 The net revenue return per share was 2.22p compared to 2.28p

in the corresponding period last year. As highlighted previously,

no interim dividend will be declared as all dividends are paid as a

single final dividend.

3/4 Over the period a total of 2,100,000 shares were bought back

for treasury. Following the purchase of a further 300,000 shares

since the period end, as at 28 November 2022 the Company has

9,821,700 shares held in treasury accounting for 6.5% of the

Company's current shares in issue. (*)

3/4 Notwithstanding the near term economic challenges, the Board

and portfolio managers believe that there is an interesting and

growing disconnect between top-down perceptions of the UK market

and the long-term opportunities for growth investors.

* This percentage calculation excludes treasury shares from the

denominator.

Total return information is sourced from Baillie

Gifford/Refinitiv. See disclaimer at the end of this announcement.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Baillie Gifford UK Growth Trust plc invests to achieve capital

growth predominantly from investment in UK equities with the aim of

providing a total return in excess of the FTSE All-Share Index.

The Company is managed by Baillie Gifford & Co, an Edinburgh

based fund management group with around GBP227 billion under

management and advice as at 29 November 2022.

Baillie Gifford UK Growth is a listed UK company. The value of

its shares and any income from them can fall as well as rise and

investors may not get back the amount invested. The Company is

listed on the London Stock Exchange and is not authorised or

regulated by the Financial Conduct Authority. You can find up to

date performance information about Baillie Gifford UK Growth at

bgukgrowthtrust.com (++) .

Past performance is not a guide to future performance. See

disclaimer at end of this announcement.

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

29 November 2022

For further information please contact:

Anzelm Cydzik, Baillie Gifford & Co

Tel: 0131 275 2000

Jonathan Atkins, Four Communications

Tel: 0203 920 0555 or 07872 495396

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of Financial Statements has been prepared

in accordance with FRS 104 'Interim Financial Reporting';

b) the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months,

their impact on the Financial Statements and a description of the

principal risks and uncertainties for the remaining six months of

the year); and

c) the Interim Financial Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related party transactions and changes

therein).

By order of the Board

Carolan Dobson

Chairman

29 November 2022

Interim Management Report

Performance

Over the six months to 31 October 2022, the Company's net asset

value ('NAV') total return per share declined by 10.9% which

compares to a 5.8% decrease in the FTSE All-Share Index, total

return, over the same period. The share price total return over the

six months declined by 11.9% as the shares moved from a discount of

11.8% to the NAV per share to a discount of 13.0%. Our short term

performance continued to disappoint, with the headwinds against our

pronounced growth style, that we discussed in the Annual Report,

continuing to persist. The paradox is that in operational terms the

portfolio in general is continuing to perform satisfactorily and

therefore portfolio activity was relatively low.

The main detractors from performance in the period included the

kitchen company Howden Joinery, car platform AutoTrader and clean

air solution provider Volution. In all three cases, despite strong

trading, the market is worried about the impact of an economic

downturn in the short term although all of these businesses have

compelling growth opportunities over the longer term and strong

balance sheets to weather any near term turbulence. Our exposure to

fast growing unlisted technology businesses through Molten Ventures

was another notable detractor as markets correctly assumed that the

fall in valuations in the quoted market would have an impact on the

carrying value of Molten's investments; although the pessimism

baked into its share price, when compared to its most recent

written down valuation of its assets, seems excessive to us.

Finally, not owning the major oil stocks in the period was again

the other notable detractor to our relative performance.

In terms of positives, we benefitted from a couple of businesses

that agreed to be taken over; namely the home emergency service

business HomeServe and the information, data and events business

Euromoney Institutional Investor. In both cases we were actually

supportive of management's growth strategy and although both bids

were at significant premiums to the pre bid share price, we would

have been happy to have remained owners of both businesses.

However, it was clear that the boards of both were determined to

accept the bids and we reluctantly decided to accept both offers.

The other notable positive in the period was Wise, the foreign

exchange platform that offers a more compelling and cheaper

proposition to consumers and small businesses than using banks.

Like many growth businesses, its shares had been pummelled but our

old adage that share prices will reflect fundamentals was partially

borne out, with the shares recovering strongly following a very

encouraging trading statement where growth was much stronger than

expected; this bodes wells for the future.

'A week is a long time in politics' and other market musings

Perhaps one of the main reasons why it's difficult to be a

long-term investor is that when events keep coming thick and fast

there is natural human tendency to want to make sense of them (or

be asked to comment on them). This six month period is no

exception. Although it seems a long time ago now, it was only at

the beginning of the period that Boris Johnson dramatically lost

the confidence of his MPs and resigned as leader of the

Conservative Party, triggering a leadership election that resulted

in Liz Truss being appointed as Prime Minister. This ceremonial

handing over of power was poignantly the last official act of our

late Queen Elizabeth. Her passing, after an incredible seventy

years on the throne, led to understandable mourning by many people

in the UK and beyond. Yet, with barely a pause, we witnessed yet

more astonishing events with the implosion of the Truss Government

after a disastrously received 'mini' budget which ultimately led to

her resignation as Prime Minister after just 49 days. The

subsequent appointment of Rishi Sunak as our first British Asian

Prime Minister, and the youngest for over a century and a half, was

a moment of tremendous symbolism, yet few would envy his task of

trying to restore calm to the market and to attempt to sort out the

finances of the Government in the midst of a difficult economic

backdrop with a fractious governing party on to its fifth prime

minister since the Brexit referendum.

What interested us in this tumultuous period was less the hurly

burly of politics and more the attempt by some commentators to sum

up the changes seen in this country over the long reign of our late

Monarch. In particular, in this 'instant analysis' there was a

fundamental misunderstanding of progress in our view. Of course,

today we have many pressing social and economic challenges and it's

also true that Britain's relative standing in the world has

declined in part because of self-inflicted mistakes over the

decades. However, what this gloomy, near term focussed analysis

forgets is the astonishing progress and general increase in

prosperity over the last seventy years. Frankly, much of this

progress would amaze previous generations so it begs the question

of why this misunderstanding? The answer is deceptively simple:

behaviourally, after the novelty wears off, we take most instances

of progress, such as a new product, for granted, but quietly and

gradually these all incrementally add up over time to something

quite dramatic. This is exactly the same when it comes to investing

in companies over the long term. However, as mentioned at the start

of this commentary, most people don't think like that and would

rather we comment on Sterling, interest rates, inflation, domestic

and world politics etc. This isn't daft, as they are big questions

and, as a former colleague said once, "we all have bosses". Why

wouldn't you want to know if you thought we might have the answer?

But we don't.

Instead, we'd rather have the honesty and humility in

communicating with fellow shareholders to acknowledge that

forecasting macro-economic events is a skill we simply don't

possess. Moreover, it is a skill that is anathema to our bottom-up

style of researching and investing in companies that we believe

have superior growth prospects. Of course, we're not blind to the

tougher near-term environment but we're also alert to understanding

what the opportunities might be for the many businesses that have

superior business models and competitive positions. As we've seen

many times before, these companies usually come out of tough times

with enhanced competitive positions.

Portfolio Update

In terms of portfolio activity, we made some modest changes in

the period. The thinking is straightforward. It has clearly been a

very tough market for growth stocks, and we have been monitoring a

number where the share price has been beaten up but the operational

performance is, in fact, ahead of expectations. We, therefore,

added to existing holdings in Wise (foreign exchange transfers) and

Experian (credit checking) as both stocks have been unfairly

derated given their strong fundamentals, and, as noted earlier, it

was pleasing that, subsequent to our purchase, Wise reported much

better than expected trading.

We also decided to take new holdings in Softcat and Kainos - two

businesses which we know well but where valuation has been a

stumbling block. Both are beneficiaries of what we think is a very

compelling long-term structural trend, namely growth in corporate

IT investment. The Covid-19 pandemic has only reinforced the

imperative for companies of all shapes and sizes to invest in their

IT estate and develop capabilities in areas such as data management

and analytics, cyber security and the cloud in order to remain

competitive. Softcat is a value-added reseller, mainly serving SMEs

in the UK. We think it possesses a differentiated corporate culture

which has enabled it to outperform the underlying market

consistently and meaningfully. Kainos is a Northern Irish company

which leads digitisation projects for the government (but

increasingly corporates as well) and is also one of only a handful

of Workday software implementation partners globally. Workday is a

US enterprise software company which has successfully disrupted the

on-premise HR and financial software market with its cloud-based

offering. We think Kainos will continue to benefit from the global

roll out of Workday's product suite.

These purchases have been funded by reductions in our holdings

in the information business RELX and the distributor Bunzl. Both

have held up much better in share price terms than many holdings,

but their growth profiles are more sedate, so we decided to

reallocate capital to our new holdings. We also decided to sell

Just Eat Takeaway.com. Although we reduced our holding when it

completed the now disastrous US acquisition, it was a mistake not

to sell out completely. Our worry is that fierce competition by

incumbents and other parties encouraging competition, such as

Amazon, will result in businesses never able to exploit network

benefits. We have also utilised some borrowings to fund some of

purchases and equity gearing stood at 3% as at 31 October 2022.

Outlook

We're currently working hard at developing a pipeline of new

investment ideas that might be mispriced in the current

environment. We are not market timers or forecasters, but the

evidence of a growing opportunity set of potential investments

shows there is an interesting and growing disconnect between

top-down perceptions of the UK market and what we are starting to

see in terms of long-term opportunities for growth investors,

notwithstanding the near term economic challenges. In plain English

and with apologies to Charles Dickens: it was the worst of times,

it was the best of times.

Iain McCombie & Milena Mileva

Baillie Gifford & Co

29 November 2022

Valuing Private Companies

We aim to hold our private company investments at `fair value'

i.e., the price that would be paid in an open-market transaction.

Valuations are adjusted both during regular valuation cycles and on

an ad hoc basis in response to `trigger events'. Our valuation

process ensures that private companies are valued in both a fair

and timely manner.

The valuation process is overseen by a valuations committee at

Baillie Gifford which takes advice from an independent third party

(S&P Global). The portfolio managers feed into the process, but

the valuations committee owns the process and the portfolio

managers only receive final valuation notifications once they have

been applied.

We revalue the private holdings on a three-month rolling cycle,

with one-third of the holdings reassessed each month. The prices

are also reviewed twice per year by the Company's Board and are

subject to the scrutiny of external auditors in the annual audit

process.

Beyond the regular cycle, the valuations committee also monitors

the portfolio for certain `trigger events'. These may include:

changes in fundamentals; a takeover approach; an intention to carry

out an Initial Public Offering (IPO); or significant changes to the

valuation of comparable public companies.

The valuations committee also monitors relevant market indices

on a weekly basis and updates valuations in a manner consistent

with our external valuer's (S&P Global) most recent valuation

report where appropriate. When market volatility is particularly

pronounced the team undertake these checks daily. Any ad hoc change

to the fair valuation of any holding is implemented swiftly and

reflected in the next published NAV. There is no delay.

As at 31 October 2022, the valuation for Wayve was based on the

recent purchase price adjusted for market movements in comparable

companies.

List of Investments at 31 October 2022

Value % of total

Name Business GBP'000 assets

======================== =============================================== ======== ==========

Basic Materials

Rio Tinto Metals and mining company 6,856 2.5

Speciality high-performance chemicals

Victrex manufacturer 3,835 1.4

Bodycote Heat treatment and materials testing 3,422 1.2

======== ==========

14,113 5.1

======== ==========

Consumer Discretionary

Games Workshop Toy manufacturer and retailer 9,519 3.5

Manufacturer and distributor of kitchens

Howden Joinery to trade customers 7,393 2.7

Burberry Luxury goods retailer 7,252 2.6

Professional publications and information

RELX provider 6,758 2.5

4imprint Direct marketer of promotional merchandise 6,039 2.2

Technology platform for the global fashion

Farfetch industry 3,138 1.1

Boohoo.com Online fashion retailer 1,213 0.4

Naked Wines Online wine retailer 383 0.1

======== ==========

41,695 15.1

======== ==========

Consumer Staples

Diageo International drinks company 10,231 3.7

======== ==========

10,231 3.7

======== ==========

Financials

St. James's Place UK wealth manager 11,419 4.1

Legal & General Insurance and investment management company 7,554 2.7

Prudential International life insurer 6,176 2.2

Lancashire Holdings General insurance 6,006 2.2

AJ Bell Investment platform 5,675 2.1

Provider of retirement income products

Just Group and services 4,542 1.7

Hiscox Property and casualty insurance 4,353 1.6

Hargreaves Lansdown UK retail investment platform 4,082 1.6

HomeServe Domestic insurance 3,792 1.4

Provides platform services to financial

IntegraFin clients 3,654 1.3

Molten Ventures Technology focused venture capital firm 3,423 1.2

IG Group Spread betting website 3,419 1.2

======== ==========

64,095 23.3

======== ==========

Healthcare

Online platform selling antibodies to life

Abcam science researchers 11,469 4.2

Genus World leading animal genetics company 8,158 2.9

Oxford Nanopore Novel DNA sequencing technology 813 0.3

Exscientia Biotech company 803 0.3

Creo Medical Designer and manufacturer of medical equipment 205 0.1

======== ==========

21,448 7.8

======== ==========

Industrials

Experian Global provider of credit data and analytics 11,234 4.1

Ashtead Construction equipment rental company 10,950 4.0

Volution Group Supplier of ventilation products 9,906 3.6

Wise Online platform to send and receive money 9,064 3.3

Renishaw World leading metrology company 8,357 3.0

Bunzl Distributor of consumable products 7,327 2.6

Inchcape Car wholesaler and retailer 7,289 2.6

Halma Specialist engineer 6,777 2.5

Provider of professional services focusing

FDM Group on information technology 4,916 1.8

PageGroup Recruitment consultancy 4,609 1.7

Euromoney Institutional

Investor Specialist publisher 4,589 1.7

======== ==========

85,018 30.9

======== ==========

Real Estate

Rightmove UK's leading online property portal 7,994 2.9

Helical Property developer 5,988 2.2

======== ==========

13,982 5.1

======== ==========

Technology

Advertising portal for second hand cars

Auto Trader Group in the UK 11,252 4.1

First Derivatives IT consultant and software developer 3,431 1.2

Kainos Group IT services and implementer 2,397 0.9

IT reseller and infrastructure solutions

Softcat provider 1,723 0.6

Wayve Technologies

Ltd

Series B Pref. (U) Developer of full autonomous driving systems 1,055 0.4

======== ==========

19,858 7.2

======== ==========

Total Equities 270,440 98.2

========================================================================= ======== ==========

Net Liquid Assets 4,993 1.8

========================================================================= ======== ==========

Total Assets 275,433 100.0

========================================================================= ======== ==========

(U) Denotes unlisted (private company) investment.

Stocks highlighted in bold are the 20 largest holdings.

Income Statement (unaudited)

For the six months

ended 31 October For the six months For the year ended

2022 ended 31 October 2021 30 April 2022 (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

(Losses)/gains on

investments - (35,463) (35,463) - 7,350 7,350 - (63,036) (63,036)

Currency gains - - - - 18 18 - 40 40

Income from investments and

interest receivable 3,912 - 3,912 4,047 - 4,047 7,787 - 7,787

Investment management fee

(note 3) (209) (489) (698) (280) (653) (933) (519) (1,211) (1,730)

Other administrative

expenses (265) - (265) (248) - (248) (498) - (498)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return before finance

costs and taxation 3,438 (35,952) (32,514) 3,519 6,715 10,234 6,770 (64,207) (57,437)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Finance costs of borrowings (50) (118) (168) (18) (42) (60) (33) (76) (109)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return on ordinary

activities

before taxation 3,388 (36,070) (32,682) 3,501 6,673 10,174 6,737 (64,283) (57,546)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Tax on ordinary activities - - - - - - - - -

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return on ordinary

activities

after taxation 3,388 (36,070) (32,682) 3,501 6,673 10,174 6,737 (64,283) (57,546)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return per ordinary

share

(note 4) 2.22p (23.66p) (21.44p) 2.28p 4.35p 6.63p 4.39p (41.89p) (37.50p)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Note:

Dividends paid and payable

per share (note 5) - - 3.91p

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

The total column of this statement is the profit and loss

account of the Company. The supplementary revenue and capital

columns are prepared under guidance published by the Association of

Investment Companies.

All revenue and capital items in the above statements derive

from continuing operations.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

statement.

The accompanying notes below are an integral part of the

Financial Statements.

Balance Sheet (unaudited)

At 30 April

At 31 October 2022

2022 (audited)

GBP'000 GBP'000

======================================= ================= ===========

Fixed assets

Investments held at fair value through

profit or loss (note 6) 270,440 306,585

======================================= ================= ===========

Current assets

Debtors 236 1,824

Cash and cash equivalents 5,329 1,491

======================================= ================= ===========

5,565 3,315

======================================= ================= ===========

Creditors

Amounts falling due within one year:

Bank loan (note 7) (14,450) (6,450)

Other creditors (572) (517)

======================================= ================= ===========

(15,022) (6,967)

======================================= ================= ===========

Net current liabilities (9,457) (3,652)

======================================= ================= ===========

Net assets 260,983 302,933

======================================= ================= ===========

Capital and reserves

Share capital 40,229 40,229

Share premium account 11,664 11,664

Capital redemption reserve 19,759 19,759

Warrant exercise reserve 417 417

Share purchase reserve 57,116 60,433

Capital reserve 119,433 155,503

Revenue reserve 12,365 14,928

======================================= ================= ===========

Shareholders' funds 260,983 302,933

======================================= ================= ===========

Net asset value per ordinary share

* 172.4p 197.4p

======================================= ================= ===========

Ordinary shares in issue (note 8) 151,395,484 153,495,484

======================================= ================= ===========

* See Glossary of Terms and Alternative Performance Measures

below.

The accompanying notes below are an integral part of the

Financial Statements.

Statement of Changes in Equity (unaudited)

For the six months ended 31 October 2022

Share capital Share Capital Warrant Share Capital Revenue Shareholders'

GBP'000 premium redemption exercise purchase Reserve* reserve funds

account reserve reserve reserve GBP'000 GBP'000 GBP'000

GBP'000 GBP'000 GBP'000 GBP'000

================ ============= ========= ============ ========== ========== ========== ========= =============

Shareholders'

funds at 1 May

2022 40,229 11,664 19,759 417 60,433 155,503 14,928 302,933

Net return on

ordinary

activities

after taxation - - - - - (36,070) 3,388 (32,682)

Ordinary shares

bought back

into treasury - - - - (3,317) - - (3,317)

Dividends paid

(note 5) - - - - - - (5,951) (5,951)

================ ============= ========= ============ ========== ========== ========== ========= =============

Shareholders'

funds at 31

October

2022 40,229 11,664 19,759 417 57,116 119,433 12,365 260,983

================ ============= ========= ============ ========== ========== ========== ========= =============

For the six months ended 31 October 2021

Share capital Share Capital Warrant Share Capital Revenue Shareholders'

GBP'000 premium redemption exercise purchase Reserve* reserve funds

account reserve reserve reserve GBP'000 GBP'000 GBP'000

GBP'000 GBP'000 GBP'000 GBP'000

================ ============= ========= ============ ========== ========== ========== ========= =============

Shareholders'

funds at 1 May

2021 40,229 11,328 19,759 417 60,433 218,981 11,906 363,053

Ordinary shares

sold from

treasury - 336 - - - 805 - 1,141

Net return on

ordinary

activities

after taxation - - - - - 6,673 3,501 10,174

Dividends paid

(note 5) - - - - - - (3,715) (3,715)

================ ============= ========= ============ ========== ========== ========== ========= =============

Shareholders'

funds at 31

October

2021 40,229 11,664 19,759 417 60,433 226,459 11,692 370,653

================ ============= ========= ============ ========== ========== ========== ========= =============

* The Capital Reserve balance at 31 October 2022 includes

investment holding losses of GBP38,250,000 (31 October 2021 - gains

of GBP64,943,000).

The accompanying notes below are an integral part of the

Financial Statements.

Condensed Cashflow Statement (unaudited)

Six months Six months

to 31 October to 31 October

2022 2021

GBP'000 GBP'000

------------------------------------------- -------------- --------------

Cash flows from operating activities

Net return on ordinary activities before

taxation (32,682) 10,174

Net losses/(gains) on investments 35,463 (7,350)

Currency gains - (18)

Finance costs of borrowings 168 60

Changes in debtors and creditors 1,501 1,147

=========================================== ============== ==============

Cash from operations * 4,450 4,013

Interest paid (100) (64)

=========================================== ============== ==============

Net cash inflow from operating activities 4,350 3,949

=========================================== ============== ==============

Cash flows from investing activities

Acquisitions of investments (13,289) (12,577)

Disposals of investments 13,970 16,907

=========================================== ============== ==============

Net cash inflow from investing activities 681 4,330

=========================================== ============== ==============

Cash flows from financing activities

Bank loan drawn down 8,000 2,450

Bank loan repaid - (2,450)

Equity dividends paid (5,951) (3,715)

Ordinary shares sold from treasury - 1,141

Ordinary shares bought back into treasury

and stamp duty thereon (3,242) -

=========================================== ============== ==============

Net cash outflow from financing activities (1,193) (2,574)

=========================================== ============== ==============

Increase in cash and cash equivalents 3,838 5,705

Exchange movements - 18

Cash and cash equivalents at start of

period 1,491 1,872

=========================================== ============== ==============

Cash and cash equivalents at end of period 5,329 7,595

=========================================== ============== ==============

* Cash from operations includes dividends received of

GBP5,470,000 (2021 - GBP5,218,000).

Cash and cash equivalents represent cash at bank and short term

money market deposits repayable on demand.

The accompanying notes below are an integral part of the

Financial Statements.

Notes to the Condensed Financial Statements (unaudited)

1. The condensed Financial Statements for the six months to 31

October 2022 comprise the statements set out above together with

the related notes below. They have been prepared in accordance with

FRS 104 'Interim Financial Reporting' and the AIC's Statement of

Recommended Practice issued in November 2014 and updated in July

2022 with consequential amendments and have not been audited or

reviewed by the Auditor pursuant to the Auditing Practices Board

Guidance 'Review of Interim Financial Information'. The Financial

Statements for the six months to 31 October 2022 have been prepared

on the basis of the same accounting policies as set out in the

Company's Annual Report and Financial Statements at 30 April

2022.

Going Concern

Having considered the nature of the Company's principal risks

and uncertainties, as set out below, together with its current

position, investment objective and policy, its assets and

liabilities and projected income and expenditure, together with the

Company's dividend policy, it is the Directors' opinion that the

Company has adequate resources to continue in operational existence

for the foreseeable future. The Board has, in particular,

considered the ongoing impact of market volatility since the

Covid-19 pandemic and over recent months due to macroeconomic and

geopolitical concerns, including the Russia-Ukraine conflict, but

does not believe the Company's going concern status is affected.

The Company's assets, the majority of which are investments in

quoted securities which are readily realisable, exceed its

liabilities significantly and could be sold to repay borrowings if

required. All borrowing facilities require the prior approval of

the Board. Gearing levels and compliance with borrowing covenants

are reviewed by the Board on a regular basis. In accordance with

the Company's Articles of Association, shareholders have a right to

vote on the continuation of the Company every five years, the next

vote being in 2024. Accordingly, the Directors consider it

appropriate to adopt the going concern basis of accounting in

preparing these Financial Statements and confirm that they are not

aware of any material uncertainties which may affect the Company's

ability to continue to do so over a period of at least twelve

months from the date of approval of

these Financial Statements.

2. The financial information contained within this Interim

Financial Report does not constitute statutory accounts as defined

in sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 30 April 2022 has been extracted

from the statutory accounts which have been filed with the

Registrar of Companies. The Auditor's Report on those accounts was

not qualified, did not include a reference to any matters to which

the Auditor drew attention by way of emphasis without qualifying

their report, and did not contain a statement under sections 498(2)

or (3) of the Companies Act 2006.

3. Baillie Gifford & Co Limited, a wholly owned subsidiary

of Baillie Gifford & Co, has been appointed by the Company as

its Alternative Investment Fund Manager (AIFM) and Company

Secretary. The investment management function has been delegated to

Baillie Gifford & Co. The management agreement can be

terminated on six months' notice. The annual fee is 0.5% of net

asset value, calculated and payable quarterly.

4.

Six months Six months

to 31 October to 31 October

2022 2021

GBP'000 GBP'000

====================================== ===================== =====================

Net return per ordinary share

Revenue return on ordinary activities

after taxation 3,388 3,501

Capital return on ordinary activities

after taxation (36,070) 6,673

====================================== ===================== =====================

Total net return (32,682) 10,174

====================================== ===================== =====================

Weighted average number of ordinary

shares in issue 152,402,008 153,420,349

====================================== ===================== =====================

Net return per ordinary share is based on the above totals of

revenue and capital and the weighted average number of ordinary

shares in issue during each period. There are no dilutive or

potentially dilutive shares in issue.

5.

Six months Six months

to 31 October to 31 October

2022 2021

GBP'000 GBP'000

==================================== ===================== =====================

Dividends

Amounts recognised as distributions

in the period:

Previous year's final dividend

of 3.91p (2021 - 2.42p),

paid 16 September 2022 5,951 3,715

==================================== ===================== =====================

6. Fair Value Hierarchy

The fair value hierarchy used to analyse the basis on which the

fair values of financial instruments held at fair value through the

profit or loss account are measured is described below. Fair value

measurements are categorised on the basis of the lowest level input

that is significant to the fair value measurement.

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

Level 1 Level 2 Level 3 Total

As at 31 October 2022 GBP'000 GBP'000 GBP'000 GBP'000

====================== =============== =============== =============== ===============

Listed equities 269,385 - - 269,385

Unlisted preference

shares * - - 1,055 1,055

====================== =============== =============== =============== ===============

Total financial asset

investments 269,385 - 1,055 270,440

====================== =============== =============== =============== ===============

Level 1 Level 2 Level 3 Total

As at 30 April 2022 GBP'000 GBP'000 GBP'000 GBP'000

====================== =============== =============== =============== ===============

Listed equities 305,193 - - 305,193

Unlisted preference

shares * - - 1,392 1,392

====================== =============== =============== =============== ===============

Total financial asset

investments 305,193 - 1,392 306,585

====================== =============== =============== =============== ===============

* The unlisted preference shares investment represents a holding

in Wayve Technologies Limited.

The fair value of listed investments is either bid price or last

traded price depending on the convention of the exchange on which

the investment is listed. Listed investments are categorised as

Level 1 if they are valued using unadjusted quoted prices for

identical instruments in an active market and as Level 2 if they do

not meet all these criteria but are, nonetheless, valued using

market data. Unlisted investments are valued at fair value by the

Directors following a detailed review and appropriate challenge of

the valuations proposed by the Managers. The Managers' unlisted

investment policy applies methodologies consistent with the

International Private Equity and Venture Capital Valuation

Guidelines ('IPEV').

These methodologies can be categorised as follows: (a) market

approach (multiples, industry valuation benchmarks and available

market prices); (b) income approach (discounted cash flows); and

(c) replacement cost approach (net assets). The Company's holding

in an unlisted investment is categorised as Level 3 as unobservable

data is a significant input to its fair value measurement.

7. At 31 October 2022 the Company had borrowings of

GBP14,450,000 (30 April 2022 - GBP6,450,000). This was drawn down

under the one year GBP30 million unsecured revolving credit loan

facility with The Royal Bank of Scotland International Limited

which expires in July 2023.

8. At 31 October 2022, the Company had the authority to buy back

22,226,628 ordinary shares and to allot or sell from treasury

15,299,548 ordinary shares without application of pre-emption

rights in accordance with the authorities granted at the AGM in

September 2022. During the six months to 31 October 2022, no shares

were sold from treasury (year to 30 April 2022 - 475,000 ordinary

shares were sold from treasury at a premium to net asset value,

with a nominal value of GBP119,000 raising net proceeds of

GBP1,141,000). During the six months to 31 October 2022, 2,100,000

ordinary shares with a nominal value of GBP525,000 were bought back

at a total cost of GBP3,317,000 and held in treasury (year to 30

April 2022 - no shares were bought back).

9. During the period, transaction costs on equity purchases

amounted to GBP58,000 (31 October 2021 - GBP23,000) and on equity

sales GBP6,000 (31 October 2021 - GBP2,000).

10. Related Party Transactions

There have been no transactions with related parties during the

first six months of the current financial year that have materially

affected the financial position or the performance of the Company

during that period and there have been no changes in the related

party transactions described in the last Annual Report and

Financial Statements that could have had such an effect on the

Company during that period.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Glossary of Terms and Alternative Performance Measures (APM)

Total Assets

Total assets less current liabilities, before deduction of all

borrowings.

Net Asset Value

Net Asset Value (NAV) is the value of total assets less

liabilities (including borrowings). The NAV per share is calculated

by dividing this amount by the number of ordinary shares in issue

(excluding treasury shares).

Net Liquid Assets

Net liquid assets comprise current assets less current

liabilities, excluding borrowings.

Discount/Premium (APM)

As stockmarkets and share prices vary, an investment trust's

share price is rarely the same as its NAV. When the share price is

lower than the NAV per share it is said to be trading at a

discount. The size of the discount is calculated by subtracting the

share price from the NAV per share and is usually expressed as a

percentage of the NAV per share. If the share price is higher than

the NAV per share, it is said to be trading at a premium.

31 October 30 April

2022 2022

====================== ================= ===============

Closing NAV per share 172.4p 197.4p

Closing share price 150.0p 174.2p

====================== ================= ===============

Discount (13.0%) (11.8%)

====================== ================= ===============

Total Return (APM)

The total return is the return to shareholders after reinvesting

the net dividend on the date that the share price goes

ex-dividend.

31 October 31 October 30 April 30 April

2022 NAV 2022 2022 NAV 2022

Share Share

price price

============================ ========== ============== ============== ================ ===============

Closing NAV per share/share

price (a) 172.4p 150.0p 197.4p 174.2p

Dividend adjustment

factor * (b) 1.0203 1.0233 1.0096 1.0098

Adjusted closing NAV (c = a

per share/share price x b) 175.9p 153.5p 199.3p 175.9p

Opening NAV per share/share

price (d) 197.4p 174.2p 237.3p 244.0p

============================ ========== ============== ============== ================ ===============

(c ÷

Total return d) -1 (10.9%) (11.9) (16.0%) (27.9%)

============================ ========== ============== ============== ================ ===============

* The dividend adjustment factor is calculated on the assumption

that the dividends of 3.91p (2021 - 2.42p) paid by the Company

during the year were reinvested into shares of the Company at the

cum income NAV per share/share price, as appropriate, at the

ex-dividend date.

Ongoing Charges (APM)

The total expenses (excluding borrowing costs) incurred by the

Company as a percentage of the average net asset value. The ongoing

charges have been

calculated on the basis prescribed by the Association of

Investment Companies.

Turnover (APM)

Annual turnover is a measure of portfolio change or trading

activity in a portfolio. Turnover is calculated as the minimum of

purchases and sales in a month,

divided by the average market value of the portfolio, summed to

get rolling 12 month turnover data.

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other

public company, an investment trust can borrow money to invest in

additional investments for its portfolio. The effect of the

borrowing on the shareholders' assets is called 'gearing'. If the

Company's assets grow, the shareholders' assets grow

proportionately more because the debt remains the same. But if the

value of the Company's assets falls, the situation is reversed.

Gearing can therefore enhance performance in rising markets but can

adversely impact performance in falling markets.

Equity gearing is the Company's borrowings adjusted for cash and

cash equivalents expressed as a percentage of shareholders'

funds.

31 October 30 April

2022 2022

================================ ===================== =====================

Borrowings GBP14,450,000 GBP6,450,000

Less: cash and cash equivalents (GBP5,329,000) (GBP1,491,000)

Adjusted borrowings GBP9,121,000 GBP4,959,000

Shareholders' funds GBP260,983,000 GBP302,933,000

================================ ===================== =====================

Equity gearing 3% 2%

================================ ===================== =====================

Potential gearing is the Company's borrowings expressed as a

percentage of shareholders' funds.

31 October 30 April

2022 2022

==================== ===================== =====================

Borrowings GBP14,450,000 GBP6,450,000

==================== ===================== =====================

Shareholders' funds GBP260,983,000 GBP302,993,000

==================== ===================== =====================

Potential gearing 6% 2%

==================== ===================== =====================

Leverage (APM)

For the purposes of the Alternative Investment Fund Managers

(AIFM) Regulations, leverage is any method which increases the

Company's exposure, including the borrowing of cash and the use of

derivatives. It is expressed as a ratio between the Company's

exposure and its net asset value and can be calculated on a gross

and a commitment method. Under the gross method, exposure

represents the sum of the Company's positions after the deduction

of sterling cash balances, without taking into account any hedging

and netting arrangements. Under the commitment method, exposure is

calculated without the deduction of sterling cash balances and

after certain hedging and netting positions are offset against each

other.

Active Share (APM)

Active share, a measure of how actively a portfolio is managed,

is the percentage of the portfolio that differs from its

comparative index. It is calculated by deducting from 100 the

percentage of the portfolio that overlaps with the comparative

index. An active share of 100 indicates no overlap with the index

and an active share of zero indicates a portfolio that tracks the

index.

Unlisted (Private) Company

An unlisted (private) company means a company whose shares are

not available to the general public for trading and not listed on a

stock exchange.

Principal Risks and Uncertainties

The principal risks facing the Company are financial risk,

investment strategy risk, climate and governance risk, discount

risk, regulatory risk, custody and depositary risk, operational

risk, cyber security risk, leverage risk, political risk and

emerging risks. An explanation of these risks and how they are

managed is set out on pages 7 to 9 of the Company's Annual Report

and Financial Statements for the year to 30 April 2022 which is

available on the Company's website: bgukgrowthtrust.com . The

principal risks and uncertainties have not changed since the date

of that report.

Third Party Data Provider Disclaimer

No third party data provider ('Provider') makes any warranty,

express or implied, as to the accuracy, completeness or timeliness

of the data contained herewith nor as to the results to be obtained

by recipients of the data. No Provider shall in any way be liable

to any recipient of the data for any inaccuracies, errors or

omissions in the index data included in this document, regardless

of cause, or for any damages (whether direct or indirect) resulting

therefrom.

No Provider has any obligation to update, modify or amend the

data or to otherwise notify a recipient thereof in the event that

any matter stated herein changes or subsequently becomes

inaccurate.

Without limiting the foregoing, no Provider shall have any

liability whatsoever to you, whether in contract (including under

an indemnity), in tort (including negligence), under a warranty,

under statute or otherwise, in respect of any loss or damage

suffered by you as a result of or in connection with any opinions,

recommendations, forecasts, judgements, or any other conclusions,

or any course of action determined, by you or any third party,

whether or not based on the content, information or materials

contained herein.

FTSE Index Data

London Stock Exchange Group plc and its group undertakings

(collectively, the 'LSE Group'). (c) LSE Group 2022. FTSE Russell

is a trading name of certain of the LSE Group companies. 'FTSE(R)'

'Russell(R)', FTSE Russell (R), is/are a trade mark(s) of the

relevant LSE Group companies and is/are used by any other LSE Group

company under license. All rights in the FTSE Russell indexes or

data vest in the relevant LSE Group company which owns the index or

the data. Neither LSE Group nor its licensors accept any liability

for any errors or omissions in the indexes or data and no party may

rely on any indexes or data contained in this communication.

No further distribution of data from the LSE Group is permitted

without the relevant LSE Group company's express written consent.

The LSE Group does not promote, sponsor or endorse the content of

this communication.

Sustainable Finance Disclosure Regulation ('SFDR')

The EU Sustainable Finance Disclosure Regulation ('SFDR') does

not have a direct impact in the UK due to Brexit, however, it

applies to third-country products marketed in the EU. As Baillie

Gifford UK Growth Trust plc is marketed in the EU by the AIFM, BG

& Co Limited, via the National Private Placement Regime (NPPR)

the following disclosures have been provided to comply with the

high-level requirements of SFDR.

The AIFM has adopted Baillie Gifford & Co's Governance and

Sustainable Principles and Guidelines as its policy on integration

of sustainability risks in investment decisions.

Baillie Gifford & Co's approach to investment is based on

identifying and holding high quality growth businesses that enjoy

sustainable competitive advantages in their marketplace. To do this

it looks beyond current financial performance, undertaking

proprietary research to build an in-depth knowledge of an

individual company and a view on its long-term prospects. This

includes the consideration of sustainability factors

(environmental, social and/or governance matters) which it believes

will positively or negatively influence the financial returns of an

investment.

More detail on the Managers' approach to sustainability can be

found in the Governance and Sustainability Principles and

Guidelines document, available publicly on the Baillie Gifford

website (bailliegifford.com).

Taxonomy Regulation

The Taxonomy Regulation establishes an EU-wide framework of

criteria for environmentally sustainable economic activities in

respect of six environmental objectives. It builds on the

disclosure requirements under SFDR by introducing additional

disclosure obligations in respect of Alternative Investment Funds

that invest in an economic activity that contributes to an

environmental objective. The Company does not commit to make

sustainable investments as defined under SFDR. As such, the

underlying investments do not take into account the EU criteria for

environmentally sustainable economic activities.

- ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGWCGUPPGQB

(END) Dow Jones Newswires

November 30, 2022 02:00 ET (07:00 GMT)

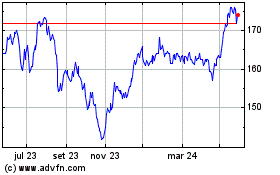

Baillie Gifford Uk Growth (LSE:BGUK)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

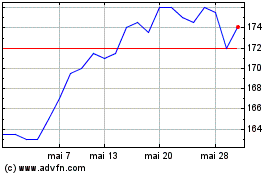

Baillie Gifford Uk Growth (LSE:BGUK)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024