TIDMBSIF

RNS Number : 9113N

Bluefield Solar Income Fund Limited

28 September 2023

28 September 2023

Bluefield Solar Income Fund Limited

('Bluefield Solar' or the 'Company')

Annual Report and Financial Statements for the Year Ended 30

June 2023

Bluefield Solar (LON:BSIF), the London listed income fund

focused on acquiring and managing renewable energy and storage

assets predominantly in the UK , is pleased to announce its Annual

Results for the Year Ended 30 June 2023.

The Annual Report has been submitted to the National Storage

Mechanism and will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Highlights

As at 30 June 2023 / 30 June 2022

Net Asset Value (NAV) Dividend Target per Share

GBP854.2m GBP858.4m 8.40pps 8.16pps

NAV per share Actual Dividend Declared

139.70p 140.39p 8.60pps 8.20pps

Underlying Earnings(1) Total Shareholder Return in

(pre amortisation of debt) year(2)

GBP108.4m GBP66.8m -2.03% 14.55%

Underlying Earnings per share(1) Total Return in year(3)

(pre amortisation of debt) 5.45% 28.16%

17.72p 12.04p

Total return to Shareholders

since IPO

89.79% 92.45%

Underlying Earnings per share(1)

(post amortisation of debt)

14.74p 9.54p

Environmental, Social and Governance (ESG)

ESG KPIs

Ø Over 836,231 MWh of renewable energy generated. 624,000

MWh

Ø Over 173,000 tonnes of CO2e savings achieved. 120,000

Ø Equivalent of 280,000 homes powered with renewable energy.

215,000

ESG Highlights

Ø Enhanced ESG governance through policy adoption, quantitative

reporting against a comprehensive set of ESG commitments and

KPIs, and enhanced supply chain practices.

Ø 25 educational workshops delivered to local schools (2022:

0) and GBP253,000 paid to community benefit funds (2022: GBP154,000)

Ø 30 Biodiversity Net Gain (BNG) assessments conducted

across the operational portfolio (2022: 0)

Construction and Development Pipeline

-- 93 MW under construction

-- 595 MW approved

-- 364 MW in planning

-- 377 MW potential capacity

1.43 GW

(956 MW Solar, 473 MW battery)

1. Underlying earnings is an alternative performance measure

employed by the Company to provide insight to the Shareholders by

linking the underlying financial performance of the operational

projects to the dividends declared and paid by the Company. It is

defined in the Alternative Performance Measure appendix.

2. Total Shareholder Return is based on share price movement and

dividends paid in the year. It is defined in the Alternative

Performance Measure appendix.

3. Total Return is based on the NAV movement and dividends paid

in the year. It is defined in the Alternative Performance Measure

appendix.

Results Summary:

For the year For the year

ended ended

30 June 2023 30 June 2022

Total operating income GBP49,069,809 GBP176,141,970

Total comprehensive income before GBP46,793,621 GBP174,572,832

tax

Total underlying earnings (pre GBP108,367,331 GBP66,750,110

amortisation of debt) (1)

Earnings per share (per below) 7.65p 34.91p

Underlying EPS available for distribution(2) 18.13p 11.92p

Total declared dividends per share

for year 8.60p 8.20p

Earnings per share carried forward

(See below) 9.53p 3.39p

NAV per share 139.70p 140.39p

Share price at 30 June 120.00p 131.00p

Total return(3) 5.45% 28.16%

Total Shareholder Return(4) (2.03)% 14.55%

Total Shareholder Return since

inception(5) 89.79% 92.45%

Dividends per share paid since

inception 69.79p 61.45p

1. Underlying earnings is an alternative performance measure

employed by the Company to provide insight to the Shareholders by

linking the underlying financial performance of the operational

projects to the dividends declared and paid by the Company. It is

defined in the Alternative Performance Measure appendix.

2. Underlying EPS is calculated using underlying earnings

available for distribution divided by the average number of

shares.

3. Total return is based on NAV per share movement and dividends

paid in the year.

4. Total Shareholder Return is based on share price movement and

dividends paid in the year .

5. Total Shareholder Return since inception is based on share

price movement and dividends paid since the IPO.

John Scott, Chair of Bluefield Solar, said:

" We are delighted to report on a further period of strong

financial performance in this, the Company's tenth year of

operations. Over that decade, we have experienced significant

changes in the emergence of renewables as an asset class and as a

proportion of UK generation against a variety of backdrops in the

investment environment. Solar and wind have grown from 8.5% to

28.8% of indigenous generation in this time. In this latest period

of strong performance irradiation was above expectations, wind

revenues outperformed our forecasts, we sold our electricity at

record prices, our regulated revenues increased with inflation and

our 129 solar PV plants performed well. Accordingly, we were able

to increase total declared dividends for the period to 8.60pps

(2022/23 8.20pps), ahead of our original target of 8.40pps.

My strong belief is that Bluefield Solar has a major role to

play in the future of Britain's rapidly changing electricity mix

and your Board looks with confidence at the challenges and

opportunities that lie ahead. "

Analyst presentation

A remote call for analysts will be hosted by James Armstrong and

Neil Wood of Bluefield Partners LLP at 09:30am today, 28 September

2023. For details, please contact Buchanan on

BSIF@buchanan.uk.com.

A copy of the presentation is available via the Company's

website and an audio webcast of the presentation will also be made

available at 09:30am today.

https://bluefieldsif.com/

For further information:

Bluefield Partners LLP (Company Investment Tel: +44 (0) 20 7078 0020

Adviser) www.bluefieldllp.com

James Armstrong / Neil Wood / Giovanni

Terranova

Numis Securities Limited (Company Broker) Tel: +44 (0) 20 7260 1000

Tod Davis / David Benda / Matt Goss www.numis.com

Ocorian Administration (Guernsey) Limited Tel: +44 (0) 1481 742 742

(Company Secretary & Administrator) www.ocorian.com

Patrick Ogier

Media enquiries: Tel: +44 (0) 20 7466 5000

Buchanan (PR Adviser) www.buchanan.uk.com

Henry Harrison-Topham / Henry Wilson BSIF@buchanan.uk.com

Notes to Editors

About Bluefield Solar

Bluefield Solar is a London listed income fund focused on

acquiring and managing renewable energy and storage projects in the

UK, to provide long term, growing dividends for its shareholders

whilst furthering the decarbonisation of the energy system. Not

less than 75% of the Company's gross assets will be invested into

UK solar assets. The Company can also invest up to 25% of its gross

assets into other technologies, such as wind and storage. The

majority of the Company's revenue streams are regulated and

non-correlated to short term UK energy market fluctuations.

Bluefield Solar owns and operates a 812MWp UK portfolio, comprised

of 754MWp of solar and 58MWp of onshore wind.

Further information can be viewed at www.bluefieldsif.com

About Bluefield Partners

Bluefield Partners LLP was established in 2009 and is an

investment adviser to companies and funds investing in renewable

energy infrastructure. It has a proven record in the selection,

acquisition and supervision of large-scale energy assets in the UK

and Europe. The team has been involved in over GBP6.5 billion

renewable funds and/or transactions in both the UK and Europe,

including over GBP1 billion in the UK since December 2011.

Bluefield Partners LLP has led the acquisitions of, and

currently advises on, over 100 UK based solar PV assets that are

agriculturally, commercially or industrially situated. Based in its

London office, it is supported by a dedicated and experienced team

of investment, legal and portfolio executives. Bluefield Partners

LLP was appointed Investment Adviser to Bluefield Solar in June

2013.

Corporate Summary

Investment objective

The investment objective of the Company is to provide

Shareholders with an attractive return, principally in the form of

regular income distributions, by being invested primarily in solar

energy assets located in the UK. The Company also invests a

minority of its capital into other renewables assets including wind

and energy storage.

Structure

The Company is a non-cellular company limited by shares

incorporated in Guernsey under the Law on 29 May 2013. The

Company's registration number is 56708, and it is regulated by the

GFSC as a registered closed-ended collective investment scheme and

as a Green Fund after successful application under the Guernsey

Green Fund Rules to the GFSC on 16 April 2019 . The Company's

Ordinary Shares were admitted to the Premium Segment of the

Official List and to trading on the Main Market of the LSE

following its IPO on 12 July 2013. The issued capital during the

year comprises the Company's Ordinary Shares denominated in

Sterling.

The Company makes its investments via its wholly owned

subsidiary Bluefield Renewables 1 Limited (BR1) and has the ability

to use long term and short term debt at the holding company level,

as well as having long term, non-recourse debt at the SPV

level.

Investment Adviser

The Investment Adviser to the Company during the period was

Bluefield Partners LLP which is authorised and regulated by the UK

FCA under the number 507508. In May 2015 Bluefield Services Limited

(BSL), a company with the same ownership as the Investment Adviser,

commenced providing asset management services to the investment

SPVs held within BSIF's portfolio. In August 2017 Bluefield

Operations Limited (BOL), a company with the same ownership as the

Investment Adviser, commenced providing operation and maintenance

services to the Company and provides services to c.80% of the

investment portfolio held by the Company as at year end.

In December 2020 Bluefield Renewable Developments Limited (BRD),

a company with the same ownership as the Investment Adviser,

commenced providing BSIF with new build development opportunities

in addition to arrangements in place with the Company's other

development partners.

Chair's Statement

Introduction

The Company was founded in the summer of 2013 and the Period

under review therefore covers our tenth year of operations; our

first decade has seen remarkable changes in electricity markets and

how they are supplied, notably the emergence of renewables as a

significant contributor to Britain's electricity mix, aided by the

dramatic reduction in capital costs, particularly for solar panels.

Ten years ago, solar and wind power contributed only 8.5% to

indigenous electricity generation; by 2022, that number had grown

to 28.8%.

By most measures, the 2022/23 year was a period of considerable

success for your Company. Irradiation levels were above

expectations, wind revenues outperformed our forecasts (despite low

wind speeds), we sold our electricity at record prices, our

regulated revenues increased with inflation and our 129 solar PV

plants performed well. Progress was made on a number of fronts, but

the main disappointment for your Board is the softening of the

Company's share price (down 8.4% for the year under review),

despite growing profits, a raised dividend, excellent operating

ratios and a robust Net Asset Value (NAV).

The Period was not without its challenges, the problems deriving

in significant part from the rapidly changing UK political

landscape, with the chaotic Johnson regime giving way to the

short-lived Truss administration, whose "mini Budget" was

sufficiently badly received by financial markets for the Premier's

defenestration to follow in short order. None of these events can

be seen as conducive to enhancing Britain's reputation for

financial prudence and stability.

The fallout which has affected Bluefield relates not to our

operations - demand for green electricity continues to grow, and

together with others in our sector we play our part in meeting

this. The main issue we face is that our access to equity markets

is hampered by the discount to NAV at which our shares currently

trade, making it difficult to raise the fresh equity which would in

other circumstances be the cornerstone of the investment programme

which is required if we are to increase our participation in the

UK's quest to decarbonise the economy. In short, we are capital

constrained at a time when renewable electricity is in urgent need

of capital investment, and there are attractive opportunities in

our pipeline.

Highlights of the year

The main features of the year under review are:

-- BSIF generated 836GWh of electricity (2021/22: 688GWh), an increase of 22%;

-- Our installed capacity grew to 754.3MW of solar and 58.3MW of

wind power (2021/22: 707.9MW and 58.3MW, respectively);

-- The Company completed the purchase of a 46.4MW operational

solar portfolio for GBP56.0 million, all accredited under the ROC

regime with approximately 60% of contracted and regulated revenues,

expiring in 2035;

-- Ensuring a focus on increasing future renewable generation

and supporting the UK's transition to Net Zero, 93MW of new build

solar entered construction and c.62MW of solar Contracts for

Difference were secured through the fourth Allocation Round;

-- Momentum on the Company's development pipeline continued

apace, with planning consents being secured on some 350MW of solar

projects and 19MW of battery projects, while the wider pipeline

grew to approximately 950MW of solar and 470MW of battery

storage;

-- The Net Asset Value per share fell marginally to 139.7pps (30

June 2022: 140.39pps), reflecting higher interest and discount

rates, which offset the sharply increased electricity prices that

we have been able to capture through our successful power sales

strategy;

-- BSIF's shares moved to a wider discount to NAV, the closing

price on 30 June 2023 being 14% below the Directors' Valuation (30

June 2022: 7% discount);

-- Total declared dividends for the Period increased to 8.60pps

(2022/23: 8.20pps), ahead of our original target of 8.40pps;

-- The Company successfully re-financed its GBP110 million

three-year term loan with NatWest during the year, increasing the

facility to GBP130 million and extending maturity to December 2039.

Hedging on GBP110 million has been put in place for the tenor of

the loan, at an effective all-in cost of c.2.7%;

-- The Company also increased its GBP100 million revolving

credit facility (RCF) by GBP110 million, with an uncommitted

accordion feature allowing for a further increase of up to GBP30

million;

-- The term of the facility has been extended to May 2025 with

the lender group being diversified further with the introduction of

Lloyds Bank plc, alongside existing lenders RBS International and

Santander UK;

-- Post period end one project received planning permission for

70MW of solar and 40MW of battery storage, and BSIF achieved

allocations of CfDs on all 4 projects submitted to AR5.

At the time of writing, the Group's total outstanding debt

stands at c.GBP597.4 million and its leverage level stands at c.41%

of GAV (June 2022: 35% of GAV).

Underlying Earnings and Dividends

The Underlying Earnings for the Period, before amortisation of

long-term debt, were GBP108.4 million, or 17.72pps, and underlying

earnings available for distribution, post debt repayments of

GBP18.3m (3.00pps), were GBP90.1m (14.74pps). Thus, the Company has

earned comfortably in excess of its dividend target of 8.40pps for

the year to 30 June 2023, thanks to higher power prices and the

strong operational performance of its portfolio.

This has enabled the Board to declare an increased fourth

interim dividend of 2.30pps, bringing the total dividend for the

Period to 8.60pps (30 June 2022: 8.20pps); the yield on our shares

- based on a share price of 118.20pps on 26 September - is 7.3%.

The Company remains the LSE listed solar investment company

sector's highest dividend payer on a pence per share basis.

Notwithstanding its strong dividend cover, the Company's

established policy is to increase distributions on a progressive

basis, and it has set a target dividend for the 2023/24 financial

year of not less than 8.80pps. Retained earnings are being deployed

by the Company to finance further projects emerging from its strong

development pipeline.

Valuation and Discount Rate

Secondary market demand for renewable electricity projects, at

all stages of their lifecycle, remains strong; power prices and

inflation have surged, largely cancelling out the impact of higher

interest rates and operating costs. The Investment Adviser is

currently seeing solar portfolios priced in a range of GBP1.20m/MW

- GBP1.45m/MW, which is very similar to previous years (typically

GBP1.20m/MW - GBP1.40m/MW). Higher interest rates have caused the

Board to increase the discount rate for the 30 June 2023 Directors'

Valuation to 8.0% (June 2022: 6.75%). By valuing the Company's

operational portfolio at an enterprise value of GBP1,195m

(c.GBP1.35m/MW for the solar assets vs. GBP1.38m/MW in June 2022),

the Directors' Valuation as at 30 June 2023 is in line with recent

market transactions and is consistent with the Company's valuation

approach of 'willing buyer/willing seller'.

Inflation

In the past 12 months UK inflation has continued at a high

level, notwithstanding a string of interest rate increases that

have taken the current Base Rate up to 5.25%, from 0.1% less than

two years ago. The UK 5 year gilt rate, which was below 1% for some

3 years prior to January 2022, now stands at approximately 4.5%.

Current UK inflation, on an RPI basis, is close to 9%, with CPI at

6.8%. Interest rates may have further to rise, but for the moment

at least inflation has fallen from its peak, suggesting that the

medicine prescribed by the Bank of England is working, albeit later

in the day than many of us might have wished.

BSIF is a net beneficiary of inflation, since our regulated

income (principally from ROCs) is index-linked, boosting our

regulated revenues faster than the increase in our operating costs.

Our prudent approach to debt, where we have (predominantly) fixed

rate and amortising long term loans, means that the capital

structure has been largely shielded from the rises in interest

rates. The flipside of this, however, is that as gilt yields adjust

upwards in the face of inflation, bond prices go down; in tandem

with others in our sector, the price of your Company's shares has

likewise fallen, as investors seek a concomitant increase in yield

from BSIF to preserve the risk premium between our shares and

Government bonds. We therefore find ourselves in the invidious

position of posting excellent operating results and having built a

robust capital structure well suited to this environment, yet

watching our share price fall to a significant discount to NAV.

Power Prices

Increasing electricity demand and fuel supply concerns following

the onset of Russia's war against Ukraine saw UK electricity prices

in the autumn of 2022 at record levels, with day-ahead power prices

touching c.GBP180/MWh in December 2022. They stabilised in the

first half of 2023, but power prices remain significantly higher

than those seen prior to the March 2022 invasion.

The Company's PPA strategy of fixing power prices for between

one and three years has allowed it to agree power contracts through

the months of rising prices, insulating the portfolio from short

term volatility, and enabling it to create pricing certainty for up

to 36 months ahead. The average weighted prices for these contracts

were GBP190.1/MWh for June 2022, GBP303/MWh for January 2023 and

GBP230/MWh for June 2023.

Environmental, Social and Governance ("ESG")

I am delighted to present the Company's significantly expanded

ESG report and I applaud the commitment shown by the Investment

Adviser in ensuring that the Company implements best practice

policies in this important and rapidly evolving area.

In addition to the Period being the Company's first year for

implementing and monitoring its ESG performance against its KPIs,

it was also the first time BSIF reported against the Level 2

requirements of the EU's Sustainable Finance Disclosure Regulation

("SFDR"). The Company also produced its first Principal Adverse

Impact ("PAI") report.

The Energy Crisis and the Levy

The fuel supply crisis precipitated by the Ukraine war resulted

in energy prices reaching unsustainably high levels and prompted

the UK Government to intervene by introducing caps on domestic

electricity prices to alleviate the widespread hardship being

experienced. In late 2022 the Government introduced the Electricity

Generator Levy (the "Levy"), to operate from January 2023 until

March 2028; the Levy is a 45% charge on revenues from the sales of

electricity in excess of GBP75 per MWh for generators who have

in-scope annual generation in excess of 50GWh. The Government has

also stated that it recognises the need to reform electricity

market arrangements to deliver the pace and scale of change

required to meet its target of decarbonisation of the electricity

system by 2035 and continues to assess its options following a

first round of consultations in 2022. We are active participants in

this debate.

The Board

John Rennocks, having stepped down as Chair at the November 2022

AGM, retired from the Board in February. Much has already been said

about John's contribution to the creation and development of BSIF

so I will simply repeat the deep gratitude we feel to John for what

was achieved during his tenure.

Paul Le Page, another Director who has served from the start and

who has throughout chaired our Audit and Risk Committee with

remarkable skill and diligence, will retire from the Board on 30

September 2023. On behalf of the Board, I thank Paul most sincerely

for what he has done for BSIF in his decade of service. Libby

Burne, whose principal career has been with PwC and who joined the

BSIF Board in 2021, will succeed Paul as Audit and Risk Committee

Chair.

Last October, we welcomed Michael Gibbons to the Board, and he

has assumed the role of Senior Independent Director. Michael has

many years of experience of electricity and other energy markets,

which is already proving to be invaluable to our business.

The AGM and Continuation Vote

The Company's Annual General Meeting will take place at 10am on

28 November 2023 at Floor 2, Trafalgar Court, Les Banques, St Peter

Port, Guernsey. Shareholders who are unable to be present in person

are encouraged to submit questions in advance of the meeting.

Resolution 13 is a continuation vote, seeking the support of

Shareholders for the Company to remain in business for a further

five years. Your Board believes that it has met or exceeded all of

the objectives of its original and subsequent prospectuses,

producing sector-leading returns for investors, while assisting

with the decarbonisation of the economy. The Board is confident

that BSIF is well placed to continue investing in renewable

electricity and thereby delivering value for Shareholders; it is

therefore unanimous in recommending that Shareholders support this

Resolution.

Conclusion

Our business is a relatively straightforward one - we convert

daylight and wind energy into electric power for sale to the

wholesale markets and, in the case of those plants which were

constructed at a time when incentives were required to compensate

for the high cost of equipment, we receive subsidies, typically for

20 years from the date of plant commissioning. In the Period, we

generated 836GWh of electricity which, if used to power electric

cars, would replace over 200 million litres of petrol. Another

measure of our output and our contribution to de-carbonising the

economy is that it represents sufficient electricity to meet the

annual needs of 288,000 homes, or a city the size of Leeds. All of

our generation took place in the UK, with 84% coming from solar PV

and 16% from onshore wind. In 2022/23, we received GBP107 million

from the sale of electricity, GBP77 million from government

subsidies (principally ROCs) and GBP5 million from other sources

which are set out in more detail in the Investment Adviser's

report. We believe that scale is important, and it is our intention

to continue to grow the Company through acquisition and the

construction of new assets, while pursuing our established policy

of paying progressively higher dividends.

Our Investment Adviser, Bluefield Partners, is to be

congratulated for what has been achieved in our first decade. We

raised an initial GBP128 million in July 2013 and today your

Company has an enterprise value of GBP1.2 billion, having in the

past 10 years distributed over GBP270 million in dividends. There

are several important contributors to this result, including

Bluefield Partners' strong record in constructing or purchasing the

plants we now own, and the record of both Bluefield Services and

Bluefield Operations in running these facilities at

industry-leading levels of performance. Particularly in the context

of the past year, I would also identify the forward power sales

strategy implemented by the Investment Adviser as one of the

significant successes of the Company, providing a high degree of

visibility of our income for up to 30 months ahead.

If the world is to reduce its dependence on fossil fuels, we

will need more electricity and much of this must come from

renewable sources; there is, for example, little point in making us

abandon the internal combustion engine in favour of electric cars

if the energy for the latter has to come from a fossil fuelled

power plant. In the UK the additional power is likely to involve

substantially more solar and wind generation, sources which remain

the lowest cost generators, while providing indigenous, clean and

secure supplies of energy. My strong belief is that BSIF has a

major role to play in the future of Britain's rapidly changing

electricity mix and your Board looks with confidence at the

challenges and opportunities which lie ahead.

John Scott

Chair

27 September 2023

The Company's Investment Portfolio

[chart]

Analysis of the Company's Investment Portfolio

[chart]

Report of the Investment Adviser

Introduction from the Managing Partner of the Investment

Adviser

The Period to 30 June 2023 has been the most successful period

in BSIF's decade long history, with the Company delivering record

earnings, record dividend cover, its highest dividend whilst

maintaining parity with its highest recorded NAV. Conversely, it

has also been the first time the share price has been at a

significant discount to NAV.

There is a certain irony to this as the financial shocks to the

system that have precipitated the falls - sharp rises in gilt and

interest rates - have only heightened the Company's five core

strengths, summarised below (and outlined in detail within the

Investment Advisers report):

1. Capital Structure: since its 2013 IPO the Company has focused

on a simple and deliberate strategy of ensuring, outside of the

Company's Revolving Credit Facility, all debt within the structure

is secured at portfolio level with fixed interest rates on fully

amortising terms. This is a prudent use of debt in any environment,

but with a current average cost of debt of c.3.5% on all the

Company's long term borrowings being c.GBP430m as at 30 June 2023,

it looks particularly prescient in today's higher interest rate

environment.

2. Power Sales Strategy: Bluefield Solar focuses on fixing Power

Price Agreements contracts at the short end of the power curve

(6-30 months), through competitive tender processes, enabling it to

maximise value for shareholders from the most liquid part of the

power market. This strategy has not only underpinned the

sector-leading dividends paid since inception, but crucially has

enabled the Company to secure highly attractive power contracts

when power prices reached record highs during the period to June

2023. The result has been record full year earnings and a c.2x

covered dividend (net of debt amortisation and the EGL). This is

creating retained earnings that can be invested into new

opportunities, not least the proprietary pipeline.

3. Active Management: Active Management is a much misused term

in investment. In the context of Bluefield Solar's portfolio it

means a dedicated workforce of 115 (and growing) within Bluefield

Partners and Services, split across specialist teams covering

primary investment, secondary investment, ESG, development,

engineering, construction management, monitoring and reporting,

debt compliance, technical asset management, operation and

maintenance and commercial with 74 different core responsibilities.

These specialist units have been established in the past decade to

deliver an aligned, dedicated and diversely skilled workforce to an

increasingly complex business.

4. Proprietary Pipeline: Bluefield Solar's ability to control

the pipeline has been a major contributor to its success over the

past ten years. Fusing deep rooted relationships across the UK

renewables market with the support of its specialist technical

teams, Bluefield has been able to establish the DNA of the business

around developing the primary pipeline. No better highlight of this

is the 1GW solar and storage proprietary pipeline the Investment

Adviser has built up exclusively for Bluefield Solar. These

transactions, alongside secondary opportunities that are being

evaluated, provide Bluefield Solar with the platform for a further

period of significant growth.

5. Capital Discipline: Adherence to investment principles is

paramount and so despite the fast paced growth of the solar market

in the past decade, uniquely for Bluefield Solar there have still

been periods where the Company elected to cease acquisitions, based

on our view that nothing we saw would provide Shareholder value. To

emphasise this, between 2016 to 2020 BSIF did not go to the market

for an equity raise. This capital discipline has benefitted

Shareholders and has contributed to BSIF's outperformance. This

discipline will continue, as it has been a key pillar in enabling

the Company to achieve exceptional growth - not least during and

after the Covid 19 pandemic.

The solace we take from the current situation is that these

strengths, applied since the Company was founded, cannot be easily

replicated, and will continue to benefit the Shareholders for many

years to come.

We have visibility over earnings that will support the ongoing

progression of our dividend and retained earnings that can deliver

reinvestment into our accretive pipeline, whilst always focusing on

the capital discipline Bluefield Solar is known for. And, thus, as

the Chair has said in his statement, we look forward to the future

with great confidence and with the expectation of a rerating of the

shares in the short term.

James Armstrong

Managing Partner, Bluefield Partners LLP

1. About Bluefield Partners LLP ('Bluefield')

Bluefield was established in 2009 and is an investment adviser

to companies and funds investing in renewable energy

infrastructure. Our team has a proven record in the selection,

acquisition and supervision of large scale energy and

infrastructure assets in the UK and Europe. The Bluefield team has

been involved in over GBP6.5 billion renewable funds and/or

transactions in both the UK and Europe, including over GBP1.4

billion in the UK since December 2011.

Bluefield was appointed Investment Adviser to the Company in

June 2013. Based in its London office, Bluefield's partners are

supported by a dedicated and highly experienced team of investment,

legal and portfolio executives. As Investment Adviser, Bluefield

takes responsibility for selection, origination and execution of

investment opportunities for the Company, having executed over 150

individual SPV acquisitions on behalf of BSIF and European

vehicles.

2. Portfolio: Acquisitions, Performance and Value

Enhancement

Portfolio Overview

As at 30 June 2023, the Company held an operational solar

portfolio of 129 PV plants (consisting of 87 large scale sites, 39

micro sites and 3 roof top sites), 6 wind farms and 109 small scale

UK onshore wind turbines with a total capacity of 812.6MW (30 June

2022: 766.2MW).

During the period to 30 June 2023, the combined solar and wind

portfolio generated an aggregated total of 836.2GWh (30 June 2022:

687.5GWh), representing a Generation Yield of 1,029MWh/MW.

Investment Approach and Acquisitions in the Period

The Company has taken a disciplined approach to the deployment

of capital since listing, deploying capital only when there are

projects of suitable quality at attractive returns to complement

the existing portfolio. Rigorous adherence to restrained capital

deployment inevitably means there can be periods where acquisition

activity falls, even when sector activity appears in contrast, but

this controlled approach is beneficial in driving long term,

sustainable growth for Shareholders, as evidenced by Bluefield

Solar's record of sector leading returns since listing over a

decade ago.

[chart]

In December 2022 the Company completed the acquisition of a

46.4MW operational solar portfolio from Fengate Asset Management.

At the time of the transaction, the enterprise value of the

portfolio was GBP56.0 million, which included the economic benefit

of all cashflows from May 2022. The portfolio contained GBP27.3

million of long-term amortising debt provided by Macquarie Bank

Limited.

The portfolio consists of two ground mounted solar photovoltaic

('PV') plants, a 39.3MW plant (Ravensthorpe) located in Scunthorpe,

Lincolnshire and a 7.1MW facility (Roanhead) located in

Barrow-in-Furness, Cumbria. Both solar sites are accredited under

the Renewable Obligation Certificate ('ROC') regime with a tariff

of 1.4 ROCs.

In May 2023, the Company completed the purchase of three

recently consented ready to build PV projects, totalling 97MW from

its development partners Lightrock Power and Bluefield Renewable

Developments, for a total of GBP3.9m. The projects, which are

located in Devon, East Sussex and Shropshire, have grid connection

dates between 2024 and 2026.

Portfolio Performance and Optimisation

Solar PV Performance

In the 12-months to 30 June 2023, irradiation levels were 6.0%

higher than the Company's forecasts and 3.1% higher than FY

2021/22, whilst generation, being 702.4GWh, was marginally lower

than expectations.

During the year, the solar portfolio achieved a Net PR of 76.16%

(FY 2021/22: 79.38%) against a forecast of 80.63%, due to

availability issues driven primarily by supply chain challenges and

capital improvement works. Consequently, generation yield was

959.88MWh per MW of installed capacity, marginally lower than

recorded in the previous year.

Table 1. Summary of Solar Fleet Performance for 2022/23:

Delta Delta 22/23

FY FY to FY to

2022/23 2022/23 Forecast 2021/22 21/22 Actual

Actual(4) Forecast (% change) Actual (% change)

========================== =========== ========== ============ ========= ==============

Portfolio Total

Installed

Capacity (MW) 754.2 - - 642.9 +17.3%

========================== =========== ========== ============ ========= ==============

Weighted Average

Irradiation (Hrs)(1,

2) 1,260.7 1,189.9 +6.0% 1,222.7 +3.1%

========================== =========== ========== ============ ========= ==============

Total Generation

(MWh) 702,428 703,664 -0.2% 624,651 +12.5%

========================== =========== ========== ============ ========= ==============

Generation Yield

(MWh/MW) 959.9 959.9 0.0% 971.6 -1.2%

========================== =========== ========== ============ ========= ==============

Average Total

Unit Price (GBP/MWh)(3) GBP223.7 GBP187.1 +19.5% GBP132.4 +68.9%

========================== =========== ========== ============ ========= ==============

Notes to Table 1.

1. Periods of irradiation where irradiance exceeds the minimum

level required for generation to occur (50W/m(2) )

2. Excluding grid outages and significant periods of constraint

or curtailment that were outside the Company's control (for

example, DNO-led outages and curtailments)

3. Average Total Unit Price includes all income associated with

the sale of power, all subsidy payments, liquidated damages and

insurance claims amounts. ROC recycle revenue is included assuming

a 10% recycle rate for both Actual and Forecast Revenue

4. Includes 46.4MW of solar assets acquired in December 2022,

not included in the published 2022/23 interim results

[chart]

Total Revenue for the period was GBP157.2m, 19% higher than

forecast and 121% higher than the previous FY. PPA agreements which

commenced during the Period were the principal reason for increased

revenue, as the average power price rose from GBP57/MWh in the

previous FY to GBP141/MWh, a 147% increase.

Operational costs for the Period (incorporating all fixed,

contracted costs such as lease payments, O&M fees etc.)

totalled c.GBP23m, including expenditure associated with the

optimisation & enhancement projects (see below).

Solar PV Optimisation & Enhancement Activity

A core focus of the Investment Adviser's activities is

protecting, optimising, and enhancing the value of the Company's

operational portfolio. Principally, this is done through in-depth

performance monitoring and carefully tailored preventative

maintenance programmes, ensuring that capital spend across the

Company's portfolio (expected to be GBP4m to GBP5m annually over

the next decade) is completed during months of low irradiation

(typically October to February).

A rolling capital investment programme is essential for

optimising the long-term operational performance of the portfolio.

The Investment Adviser has identified that one of the key causes of

lower-than-expected availability is a long lead time for spare

parts for major High Voltage ('HV') components, notably central

inverters, due to industry demand from construction projects and

other operators' repowering works.

Two significant string-inverter repowering projects and the

replacement of 3 transformers at Hall Farm were completed during

the Period to improve both current and future performance of the

assets. Further inverter repowering and optimisation projects are

planned for FY 23/24.

As at 30 June 2023, 494.6 MW (30 June 2022: 401 MW) of the PV

portfolio have leases that allow for terms beyond 30 years (being

66% of the solar PV portfolio), of which 338.2 MW (100% of

applications successful) benefit from planning terms in excess of

30 years, with the Investment Adviser continuing to pursue lease

extensions on the remaining assets in the portfolio.

Onshore Wind Performance

As at 30 June 2023, the Company held an operational onshore wind

portfolio of 135 installations , comprising 109 small scale

turbines (55-250kW) and 26 turbines (850kW-2.3MW), with an

aggregated capacity 58.4MW.

During the reporting period, the portfolio generated 133.8 GWh,

-16.2% below forecasts. This was largely due to reduced wind

resource, combined with lower than forecasted availability during

H1. Availability improved considerably during H2 following the

replacement of the O&M provider for Delabole Wind Farm in

December 2022. Significant liquidated damages were further

recovered from the previous O&M provider for the

underperformance at Delabole.

The average onsite wind speeds recorded were similar to FY

2021/22, which was a period of historically low wind resource.

Table 2. Aggregated Wind Portfolio Performance, FY 2022/23

Delta 22/23

to

FY 2022/23 FY 2022/23 Delta to Forecast FY 2021/22 21/22 Actual

Actual Forecast (% change) Actual (% change)

================= ========== ========== ================= ========== =============

Portfolio

Total Installed

Capacity (MW) 58.4 - - 30.0 +94.5%

================= ========== ========== ================= ========== =============

Total Generation

(MWh) 133,804.0 159,586.3 -16.2% 62,795.6 +113.1%

================= ========== ========== ================= ========== =============

Generation

Yield (MWh/MW) 2,292.7 2,734.5 -16.2% 2,092.5 +9.6%

================= ========== ========== ================= ========== =============

Average Total

Unit Price

(GBP/MWh)(1,2) 208.3 204.2 +2.0% 216.7 -3.9%

================= ========== ========== ================= ========== =============

Notes to Table 2.

1. Actual & Forecast Average Total Power Price exclude ROC Recycle

estimates

2. Average Total Power Price includes LDs, Insurance & Mutualisation

Rebate

The portfolio achieved a Generation Yield of 2,293 MWh per MW of

installed capacity, equivalent to a 9.6% increase from FY 2021/22,

largely due to the improved plant availability. Despite lower than

forecast generation, the portfolio provided total revenues of

GBP27.9 m, with an average revenue per MWh of GBP208.3, 2% above

forecast.

Onshore Wind Optimisation & Enhancement Activity

In Northern Ireland, 17 of the 29 small-scale turbines have been

identified for repowering with replacement EWT 250kW turbines. This

will increase efficiency and output, whilst maintaining their

respective NIRO accreditation status.

As at 30 June 2023, seven turbines have been repowered and

returned to operation, with a further nine having received planning

approval for repowering, with a new 25-year term. A further two

projects have received a turbine delivery, with repowering planned

for FY 2023 /24 . Planning applications for the remaining projects

have been submitted to the relevant Local Planning Authorities.

General Portfolio

OFGEM Audits

As part of the industry-wide audits of FiT and RO-accredited

generating assets, the Investment Adviser and Asset Manager have

been working closely with the regulator on certain assets that have

been selected, at random, for audit. All OFGEM audits completed to

date have been classified as 'satisfactory', with the respective

assets' accreditation being fully compliant.

Health & Safety Activities

The Investment Adviser continues to ensure H&S awareness,

policies, processes and procedures remain at the forefront of every

activity around the portfolio. H&S policies and logs are

reviewed at least annually. All main contractors (including asset

management and O&M providers) are audited annually by a

qualified third-party specialist consultant, with new retained

contractors (associated with operational projects acquired by BSIF,

for example) audited immediately following acquisition.

Cyber Security

The Investment Adviser arranged penetration testing of 48.2% of

the solar PV portfolio (of those plants above 2MW) by a specialist

external consultant, as part of a periodic cyber security review.

Whilst the security across the portfolio was satisfactory, the

Investment Adviser has arranged for all the recommendations to

further enhance cyber security to be undertaken, including both

hardware and software upgrades, with works to commence shortly. The

remainder of the PV portfolio and all wind farms will undergo

similar penetration testing in FY 2023/24.

3. Power Purchase Agreements

The Company actively monitors power market conditions, ensuring

that contract renewals are spread evenly through any 12-month

period with competitive tender processes on both fixed and floating

price options run for each PPA renewal in the 3 months prior to the

commencement of a new fixing period.

Flexibility within the Company's capital structure enables PPA

counterparties to be selected on a competitive basis and not

influenced by lenders requiring long term contracts with one

offtaker.

This means the programme of achieving value and diversification

from contracting with multiple counterparties (which in turn

reduces offtaker risk) is executed for the benefit of shareholders

and not the lenders.

By rolling PPA fixes during the year and targeting the most

liquid area of the power market (one to three years) the Company

was able to complete a number of fixes during periods when

wholesale power prices were at their peak.

Evidence of this is reflected in the BSIF average seasonal

weighted power price, which for the 12 months ending 30 June 2023

increased by 147% from the 12 months ending 30 June 2022, rising

from GBP57/MWh to GBP141/MWh. The rise in the BSIF average seasonal

weighted power price is a result of the 156.2MW fixed secured

during the reporting period from January 2023, at an average fixed

price of GBP118.9/MWh, combined with favourable pricing from

contracts struck in the period preceding the end of December

2022.

As at 30 June 2023, the average term of the fixed-price PPAs

across the portfolio is 26.2 months (FY 2021/22: 25.8 months) and

the Company has a price confidence level of 92% to December 2023

and 86% to June 2024 (including subsidy revenues), representing the

% of the BSIF portfolio that already has a fixed price in place and

thus no exposure to power market uncertainty. Looking ahead, the

strategy has also secured power fixes and thus revenue certainty,

at levels that are materially in excess of the latest forecaster

expectations.

Chart 1. PPA Fixed Power Prices (Average Vs Average for Fixes

completed during Reporting Period)

1 July 1 Jan 1 July 1 Jan

Price as at: 23 24 24 25

158.9 173.5 149.2 160.8

(716MW) (678MW)

BSIF Portfolio Weighted Average (473MW) (437MW)

Contract Price (GBP/MWh)

--------- --------- --------- ---------

Blended Average of forecasters

nominal terms power prices per

30 June 2023 valuation (GBP/MWh) 109 117 117 104

--------- --------- --------- ---------

Footnote: MW stated in the BSIF Portfolio Weighted Average

Contract price refers to the total amount of the portfolio fixed

for that period.

The result is the Investment Adviser believes its PPA policy is

the best strategy for Shareholders, who are looking for stable

revenues and forecastable, sustainable dividends with high

visibility of revenues on a rolling multiyear basis. It is this

approach that has delivered almost a decade of sector leading

dividend cover (covered by current earnings and post debt

amortisation).

4. Power Market Summary

Since December 2022, power markets have begun to stabilise after

record highs were seen in August and December 2022, due to Russia's

continuing war against Ukraine exacerbating concerns surrounding

gas supplies to Europe ahead of Winter 2023.

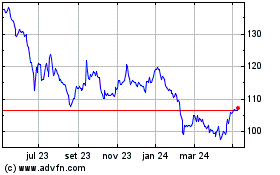

Chart 2. UK Natural Gas & Wholesale Power Prices (1 July

2020 - June 2023)

[chart]

Source data: Bloomberg

Gas prices fell from their recent historic highs, as supply

increased as more liquefaction facilities become available, with

power prices predominantly following gas markets. This is

demonstrated in Chart 2, with day-ahead baseload power prices

falling from highs of GBP180/MWh in mid-December 2022 to lows of

GBP86/MWh at the end of June 2023.

In relation to medium-term market expectations, the gas market

is expected to rebalance by the mid-2020s, with prices set to fall

back to levels seen prior to COVID. As a result, the baseload

wholesale power prices are forecast to fall by 23% on average from

2023 to 2030, driven by lower gas prices.

Over the Company's ten year history, building a proprietary

pipeline and then funding the construction of new projects has been

at the heart of its success. Entering earlier in the value chain

brings some additional risk but if managed appropriately, we

believe it also allows us to control the quality of projects far

better, which ultimately brings enhanced risk-adjusted returns to

Shareholders.

5. Proprietary Pipeline

Over the past four years, the Company has continued to implement

its new build strategy across the solar value chain to ensure that

Bluefield Solar continues to build its market share amongst UK

solar power producers. We have signed co-development agreements to

fund new sites. We have also expanded our strategy to battery

storage, which will enable the diversification of the BSIF's

revenues and allow us to monetise the expected increases in

volatility of power prices in the future.

This focus on development activities has enabled the Company to

build up a significant pipeline of assets which can be built over

the next five years. As our projects progress, we are working with

selected construction contractors to ensure that projects are

designed and built to a high specification for long term

performance.

We are pleased to report that the new build strategy has

delivered well on its objectives thus far: the development pipeline

now stands at over 1.4 GW and the first development to be funded,

Yelvertoft, - is progressing well through construction. This 49MW

project is set to be connected to the grid towards the end of 2023

and it has entered into a Contract for Difference ("CfD") for its

output.

The following sections provide a more detailed update on both

our construction and development programmes.

Construction Programme

As at the end of the period, BSIF had solar assets with a

capacity of 412MW and battery storage assets with 183MW capacity

that are fully consented and are in pre-construction. The projects

have connection dates between 2023 and 2028.

Of these the first projects to enter the construction phase are

Yelvertoft Solar Farm, a 49MW solar PV park in Northamptonshire and

Mauxhall Farm Energy Park, a c.44MW solar PV project in North East

Lincolnshire. Yelvertoft signed a fixed price EPC contract with

Bouygues in September 2022 and is targeting operation in Q4 2023,

while Mauxhall Farm signed a fixed price EPC contract with EQUANS

in March 2023 and is expected to be operational in Q2 2024.

Mauxhall Farm is planned to be a co-located project and

construction of a 25MW battery energy storage scheme is expected to

commence shortly after the solar plant has been commissioned.

As the EPC agreements require contractors to provide full

procurement activity and to supply all materials, the Investment

Adviser completes a full assessment of each contractor's

procurement and supply chain management processes to ensure

compliance with the Company's ESG policies and standards.

Projects with CfDs

In July 2022, the Investment Adviser successfully secured CfDs

on 62.4MW of ready to build PV plants (Yelvertoft, Romsey extension

and Oulton extension). By securing a CfD contract, the plants will

benefit from index-linked (to CPI) revenues over a 15-year duration

at the AR4 solar PV strike price of GBP45.99/MWh (in 2012

equivalent prices) or c.GBP64/MWh (in 2023 equivalent prices). The

contracts commence from 31 March 2025 and the strike prices will be

adjusted appropriately for CPI.

Post period BSIF achieved allocations of CfDs on all 4 projects

submitted to AR5.

Development Programme

The Investment Adviser has been pursuing its development

strategy since 2019 to enable BSIF to continue to be a key player

in the UK renewable energy market. Since this time, a portfolio of

approximately 950MW of solar and over 470MW of batteries has been

built up across 28 projects. BSIF has a 5% investment limit in

pre-construction development stage activities, while less than 1%

is currently committed.

Currently, no value is attributed to projects without planning

consent. Once developments receive planning consent, however, and

move from the development stage to pre-construction, the Investment

Adviser believes it is appropriate to reflect this change in the

Company valuation. At this point in their lifecycle, the projects

will have received all the necessary planning consents, land rights

and valid grid connection offers and so have discernible value

beyond the direct costs of development.

The current pipeline status and valuation is summarised in the

graphic below.

Current pipeline status and valuation

[chart]

6. Analysis of underlying earnings

The total generation and revenue earned in the Period by the

Company's portfolio, split by subsidy regime, is outlined

below:

Subsidy Regime Generation (MWh) PPA Revenue (GBPm) Regulated Revenue (GBPm)

FiT 66,874 6.0 12.1

----------------- ------------------- -------------------------

4.0 ROC 12,773 1.6 3.0

----------------- ------------------- -------------------------

2.0 ROC 23,524 1.6 2.9

----------------- ------------------- -------------------------

1.6 ROC 116,884 14.9 11.3

----------------- ------------------- -------------------------

1.4 ROC 296,183 39.2 25.1

----------------- ------------------- -------------------------

1.3 ROC 71,800 9.8 5.7

----------------- ------------------- -------------------------

1.2 ROC 140,384 21.6 11.2

----------------- ------------------- -------------------------

1.0 ROC 32,838 3.6 1.9

----------------- ------------------- -------------------------

0.9 ROC 74,972 9.1 3.8

----------------- ------------------- -------------------------

Total 836,232 107.4 77.0

----------------- ------------------- -------------------------

The Company includes ROC recycle assumptions within its long

term forecasts and applies a market based approach on recognition

within any current financial period, including prudent estimates

within its accounts where there is clear evidence that participants

are attaching value to ROC recycle for the current accounting

period.

The key drivers behind the changes in Underlying Earnings

between FY 2022/23 and FY 2021/22 are the combined effects of the

acquisitions within the Period and higher PPA pricing.

Underlying Portfolio Earnings

Full year Full year Full year Full year

to to to to

30 June 30 June 30 June 30 June

23 22 21 20

(GBPm) (GBPm) (GBPm) (GBPm)

Portfolio Revenue 184.4 111.4 73.1 65.9

---------- ---------- ---------- ----------

Liquidated damages

and Other Revenue* 5.4 1.6 2.0 3.8

---------- ---------- ---------- ----------

Net Earnings from Acquisitions

in the period 0.0 0.0 5.1 0.0

---------- ---------- ---------- ----------

Portfolio Income 189.8 113.0 80.2 69.7

---------- ---------- ---------- ----------

Portfolio Costs -36.3 -27.8 -17.6 -14.1

---------- ---------- ---------- ----------

Project Finance Interest

Costs -13.6 -4.7 -1.8 -0.6

---------- ---------- ---------- ----------

Total Portfolio Income

Earned 139.9 80.5 60.8 55.0

---------- ---------- ---------- ----------

Group Operating Costs(#)

** -25.4 -8.3 -7.5 -5.8

---------- ---------- ---------- ----------

Group Debt Costs -6.1 -5.4 -4.7 -4.6

---------- ---------- ---------- ----------

Underlying Earnings 108.4 66.8 48.6 44.6

---------- ---------- ---------- ----------

Group Debt Repayments -18.3 -13.8 -9.3 -9.2

---------- ---------- ---------- ----------

Underlying Earnings

available for distribution 90.1 53.0 39.3 35.3

---------- ---------- ---------- ----------

Full year Full year Full year Full year

to to to to

30 June 30 June 30 June 30 June

23 22 21 20

(GBPm) (GBPm) (GBPm) (GBPm)

---------- ---------- ---------- ----------

Brought forward reserves 20.9 13.4 8.4 2.3

---------- ---------- ---------- ----------

Total funds available

for distribution -1 111.0 66.4 47.7 37.6

-------------------------------- ---------- ---------- ---------- ----------

Target distribution*** 51.4 45.2 34.3 29.3

-------------------------------- ---------- ---------- ---------- ----------

Actual Distribution

-2 52.6 45.5 34.3 29.3

---------- ---------- ---------- ----------

Underlying Earnings

carried forward

(1-2) 58.4 20.9 13.4 8.4

---------- ---------- ---------- ----------

* Other Revenue includes ROC mutualisation, ROC recycle late

payment CP20, insurance proceeds, O&M settlement agreements and

rebates received.

#Includes the Company, BR1 and BSIFIL (the UK HoldCos) and any

tax charges within the UK HoldCos.

**Excludes one-off transaction costs and the release of up-front

fees related to the Company's debt facilities

***Target distribution is based on funds required for total

target dividend for each financial period.

The table below presents the underlying earnings on a 'per

share' basis.

Full year Full year Full year Full year

to to to to

30 June 23 30 June 22 30 June 30 June

21 20

(GBPm) (GBPm) (GBPm) (GBPm)

Actual Distribution 52.6 45.5 34.3 29.3

------------ ------------ --------------- ------------

Total funds available

for distribution

(including reserves) 111.0 66.4 47.7 37.6

------------ ------------ --------------- ------------

Average Number of

shares in year* 611,452,217 554,042,715 429,266,617 370,499,622

------------ ------------ --------------- ------------

Target Dividend

(pps) 8.40 8.16 8.00 7.90

------------ ------------ --------------- ------------

Total funds available

for distribution

(pps) 18.13 12.22 11.19 10.13

------------ ------------ --------------- ------------

Total Dividend Declared

& Paid (pps) 8.60 8.20 8.00 7.90

------------ ------------ --------------- ------------

Reserves carried

forward

(pps) ** 9.53 3.39 2.67 2.23

------------ ------------ --------------- ------------

* Average number of shares is calculated based on shares in

issue at the time each dividend was declared.

** Reserves carried forward are based on the shares in issue at

the point of Annual Accounts publication (being c.611m shares for

30 June 2022 and c.496m shares for 30 June 2021).

7. NAV and Valuation of the Portfolio

The Investment Adviser is responsible for advising the Board in

determining the Directors' Valuation and, when required, carrying

out the fair market valuation of the Company's investments.

Valuations are carried out on a quarterly basis at 30 September,

31 December, 31 March and 30 June each year, with the Company

committed to conducting independent reviews as and when the Board

believes it benefits Shareholders.

As the portfolio comprises only non-market traded investments,

the Investment Adviser has adopted valuation guidelines based upon

the IPEV Valuation Guidelines published by the BVCA (the British

Venture Capital Association). The application of these guidelines

is considered consistent with the requirements of compliance with

IFRS 9 and IFRS 13.

Following consultation with the Investment Adviser, the

Directors' Valuation adopted for the portfolio as at 30 June 2023

was GBP1,018.4m (30 June 2022, GBP939.9m).

The table below shows a breakdown of the Directors' valuations

over the last three financial years:

Valuation Component (GBPm) June 2023 June 2022 June 2021

DCF Enterprise Value of Portfolio (EV) 1,195.2 1,180.6 770.1

---------- ---------- ----------

Consented Solar and Battery Storage Development rights 67.5 13.8 1.8

---------- ---------- ----------

Deduction of Project Co debt -430.8 -390.3 -119.8

---------- ---------- ----------

Project Net Current Assets 186.5 135.8 42.4

---------- ---------- ----------

Directors' Valuation 1,018.4 939.9 694.5

---------- ---------- ----------

Portfolio Size (MW) 812.6 766.2 613.0

---------- ---------- ----------

Discounting Methodology

The Directors' Valuation is based on the discounting of

post-tax, projected cash flows of each investment, based on the

Company's current capital structure, with the result then

benchmarked against comparable market multiples, if relevant. The

discount rate applied on the project cash flows is the weighted

average discount rate. In addition, the Board continues to adopt

the approach under the 'willing buyer/willing seller' methodology,

that the valuation of the Company's portfolio be appropriately

benchmarked to pricing against comparable portfolio

transactions.

Key factors behind the valuation

There have been a number of key factors that have been

considered in the Investment Adviser's recommendation to the

Directors' Valuation (and which are quantified in the NAV movement

chart below):

(i) The RPI inflation forecast for 2023 has been increased to 7%

(5.5% in December 2022 and 3.4% in June 2022), reflecting

expectations that UK inflation will remain higher for longer. As

evidence builds that inflation will fall during H2 2023, a rate of

3.5% has been applied for 2024 (2024 inflation forecast previously

used: 4.0% in December 2022 and 3% in June 22);

(ii) The portfolio discount rate has been increased to 8.00%

(7.25% in December 2022 and 6.75% June 2022). This is a result of

increases over the period in both the Bank of England base rate

(rising to 5.0% as at 30 June 2023 , from 3.5% as at 31 December

2022) and 15 year gilt yields (c. 4.8% as at 30 June 2023, from c.

3.9% as at 31 December 2022);

(iii) Inclusion of the latest forecasters' curves as at 30 June

2023, and the corresponding impact of the Electricity Generator

Levy ("the Levy") - a 45% tax on the extraordinary returns made by

electricity generators, announced late in 2022, following sharp

increases in electricity prices. The Levy will be in place from 1

January 2023 until 31 March 2028 and is applied to returns from

sale of electricity in excess of a benchmark price of GBP75 per

MWh, indexed to CPI from April 2024;

(iv) The value attributed to BSIF's development and construction

portfolio has risen during the Period, reflecting sites receiving

planning permission and further progress and investment into

construction projects;

(v) Working capital has grown in the period to Jun 23 reflecting

higher power prices being captured from the Company's successful

PPA strategy.

By reflecting the core factors above within the Directors'

Valuation for 30 June 2023, the EV of the operational portfolio is

GBP 1,195.2 m (June 2022: GBP1,180.6m) with the effective price for

the solar component of GBP1.35m/MW (June 2022: GBP1.38m/MW). These

metrics sit within the pricing range of precedent market

transactions and the 'willing buyer-willing seller' methodology

upon which the Directors' Valuation is based.

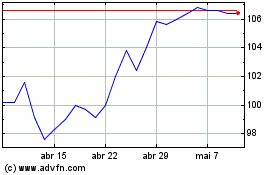

Power Prices

A blended forecast of three leading consultants is used within

the latest Directors' Valuation [1] , as shown in the graph below.

This is based on forecasts released in the quarter to end June

2023. For illustration purposes, the graph below also includes the

blended curve used in the Company's accounts for the year ended 30

June 2023.

The curves used in the 30 June 2023 Directors' Valuation reflect

the following key updates:

1. Short-term European fuel prices - gas and coal - have fallen

amid lower gas demand, higher gas storage levels and robust LNG

deliveries, with a similar trend reflected in the wholesale power

price curve;

2. Higher renewable generation capacity deployment levels in the

medium term (with ambitions for up to c.50GW offshore wind by 2030)

as the UK strives to meet its net zero targets and fully

decarbonise its power system by 2035; and

3. Annual demand for power in Great Britain, driven principally

by electrification of heat and transport, is expected to rise from

292TWh in 2023 to 438TWh by 2035.

[chart]

The main contributors to the increase in the Directors'

Valuation from 30 June 2022 to 30 June 2023 were an increase in

power price forecast curves provided by the Company's three

independent advisers, a new acquisition, change in development

portfolio valuation (8.6pps) and updated near-term inflation

assumptions.

Directors' Valuation movement (GBPmillion) As % of

valuation

------------------------------- ------- ------------------ -----------

30 June 2022 Valuation 939.9

------------------------------- ------- ------------------ -----------

New investments acquired 59.4 6.3%

Development uplift 52.8 5.6%

Cash receipts from portfolio (52.6) (5.6%)

Power curve updates (incl.

PPAs) 76.6 8.1%

Inflation updates 17.1 1.8%

Discount rate change (44.9) (4.8%)

Levy tax impact (39.8) (4.2%)

Balance of portfolio return 9.9 1.1%

-------------------------------

30 June 2023 Valuation 1,018.4 8.3%

------------------------------- ------- ------------------ -----------

There have been no material changes to assumptions regarding the

future performance or cost optimisation of the portfolio when

compared to the Directors' Valuation of 30 June 2022.

On the basis of these key assumptions, the Board believes there

remains further scope for NAV enhancement from the potential

extensions of asset life for further projects in the portfolio, as

well as cost optimisation on long term O&M fees.

The assumptions set out in this section remain subject to

continuous review by the Investment Adviser and the Board.

Reconciliation of Directors' Valuation to Balance sheet

Balance at Year End

Category 30 June 2023 30 June 2022 30 June 2021

(GBPm) (GBPm) (GBPm)

---------------------------- ---------------------------- ----------------------------

Directors'

Valuation 1,018.4 939.9 694.5

---------------------------- ---------------------------- ----------------------------

Portfolio

Holding Company

Working Capital (12.5) (13.6) 26.4

---------------------------- ---------------------------- ----------------------------

Portfolio

Holding Company

Debt (153.0) (70.0) (250.6)

---------------------------- ---------------------------- ----------------------------

Financial Assets

at Fair Value

per Balance

sheet 852.9 856.3 470.3

---------------------------- ---------------------------- ----------------------------

Gross Asset

Value 1,438.0 1,316.7 840.7

---------------------------- ---------------------------- ----------------------------

Gearing (% GAV*) 41% 35% 44%

---------------------------- ---------------------------- ----------------------------

* GAV is the Financial Assets, as at 30 June 2023, at Fair Value

of GBP852.9m plus RCF of GBP153.0m and 3(rd) party portfolio debt

of GBP430.8m (giving total debt of GBP583.8m).

Directors' Valuation sensitivities

Valuation sensitivities are set out in tabular form in Note 8 of

the financial statements. The following diagram reviews the

sensitivity of the EV of the portfolio to the key underlying

assumptions within the discounted cash flow valuation.

[chart]

8. Financing

Debt Strategy

Since its IPO the Company has focused on a simple and defensive

approach to debt. This means having debt agreements that have,

primarily, fixed interest rates and are amortising. Debt split into

(1) long-term asset-level debt, and (2) revolving credit facility

at fund-level for short-term funding. Debt in the portfolio is

generally not subject to stringent lender requirements on PPAs,

allowing BSIF to take advantage of more competitive PPA

pricing.

The Company's weighted average cost of long-term debt is 3.5%

and is largely locked-in via fixed interest rates. Whilst BSIF has

some index-linked debt, it also has significant levels of RPI

linked revenues, leaving the Company a net beneficiary of

inflation.

The fund's revolving credit facility (RCF) is the only

floating-rate debt instrument in the portfolio and represents 26%

of the total debt balance. 80% of asset-level debt has a fixed

interest rate. 20% of principal for long-term debt is

inflation-linked.

Revolving Credit Facility

On 22 June 2023, the Company agreed a GBP110 million increase to

its existing committed GBP100 million revolving credit facility

('RCF'), bringing the total committed amount to GBP210 million. The

facility also has an uncommitted accordion feature allowing it to

be increased by up to a further GBP30 million. As part of the

increase, the Company has sought to broaden the lender group

through the introduction of Lloyds Bank Plc, alongside the existing

lenders RBS International and Santander UK. The term of the

facility has been extended to May 2025 and the facility's margin

remains unchanged at 1.9%.

As at 30 June 2023 the Company's subsidiary RP1 had drawn

GBP153m from its RCF.

External Debt

Excluding the Company's RCF, total outstanding loans to

third-party lenders as at 30 June 2023 total GBP431m, with each

loan secured against a portfolio of assets and fully amortising

within the life of the respective asset's subsidies. The average

interest cost, excluding the Company's RCF, across the external

debt facilities in the table below is 3.54%.

Debt Principal Maturity % of Interest All-in Interest

Outstanding Fixed (1) Rate

(GBPm)

Syndicate - Fund

RCF 153 May-25 0% 8.00%

=========================== ============ ======== ============= ===============

Bayern LB - Project

Finance 8 Sep-29 100% 5.50%

=========================== ============ ======== ============= ===============

Syndicate - Project

Finance 72 Dec-33 100% 3.50%

=========================== ============ ======== ============= ===============

Aviva (fixed)

Project Finance 88 Sep-34 100% 2.88%

=========================== ============ ======== ============= ===============

Aviva (index-linked)

Project Finance 67 Sep-34 100% 3.70%

=========================== ============ ======== ============= ===============

Macquarie (fixed)

Project Finance 7 Mar-35 100% 4.60%

=========================== ============ ======== ============= ===============

Macquarie (indexed-linked)

Project Finance 20 Mar-35 100% 4.70%

=========================== ============ ======== ============= ===============

Gravis (index-linked)

Project Finance 38 Jun-35 100% 6.48%

=========================== ============ ======== ============= ===============

NatWest - Project

Finance 130 Dec-39 85% 2.70%

=========================== ============ ======== ============= ===============

Total/Wtd Avg 584 70% 4.71%

=========================== ============ ======== ============= ===============

Total/Wtd Avg

excl. RCF 431 95% 3.54%

=========================== ============ ======== ============= ===============

Note: Index-linked debt treated as fixed for the purposes of

this table as proportion fixed represents interest rate risk

only

NatWest 3-year term loan maturity and refinancing

On 2 May 2023, the Company announced the re-financing of its

GBP110 million three-year term loan with NatWest.

The original loan, 75% hedged with a swap at circa 0.35% over a

notional 18-year period, had a maturity of September 2023 and has

been increased to GBP130 million and extended in maturity to

December 2039.

Hedging has been put in place for the tenor of the loan on

GBP110 million, at an effective all-in cost of c.2.7% (being margin

and swap rate).

The financing is secured against the UK-based portfolio of 31

operational PV plants with a total installed capacity of 139MW and

benefitting from attractive subsidies; 29 of the assets are

accredited under the ROC regime with tariffs ranging from 1.2 - 2.0

ROCs, while two are accredited under the FiT scheme.

The additional debt of GBP20 million is being used to provide

financing for the construction of Yelvertoft, the Company's 49MW

CfD-backed solar PV project in Northamptonshire. Once construction

is complete, expected in Q4 2023, the Company will review whether

to enter hedging arrangements on this tranche.

GAV Leverage

The Group's total outstanding debt, as at 30 June 2023, was

c.GBP584 million and its leverage stands at c.41% of GAV (35% as at

30 June 2022) within the 35% - 45% preferred range the Directors

have previously outlined as desirable for the Company.

9. Market Developments

UK renewable generation capacity and deployment

Latest Government data shows that UK solar photovoltaic (PV)

capacity stands at around 15GW, across c.1.3 million installations.

Of this amount, around 7.3GW (c.48% of the total solar capacity in

the UK) and 5.1GW (34%) is accredited under the RO and FiT schemes,

respectively, and c.2.4GW (16%) is unaccredited. Onshore and

offshore wind installed capacity stands at around 15.2GW and

13.9GW, respectively. The UK has 2.8GW of operational battery

storage capacity, according to data from energy association

RenewableUK.

The UK's total renewable generation capacity is projected to

continue to grow over the coming years as the Government strives to

meet its net zero targets and meet power demand from the

electrification of the domestic heat, transport and industrial

sectors. Deployment is expected to be supported by policies such as

the CfD scheme, which is described in more detail in the next

section of this report.

In March 2023, the UK Government stated its ambition to increase