TIDMGCL TIDMTTM

RNS Number : 5554E

Geiger Counter Ltd

30 June 2023

30 June 2023

GEIGER COUNTER LIMITED

(THE "COMPANY")

RELEASE OF INTERIM REPORT AND FINANCIAL STATEMENTS

The Directors announce the release of the Interim Report and

Financial Statements for the period ended 31 March 2023, which are

included as an attachment to this announcement.

http://www.rns-pdf.londonstockexchange.com/rns/5554E_1-2023-6-30.pdf

CHAIRMAN'S STATEMENT - FOR THE YEAR ENDED 31 MARCH 2023

Having risen sharply in late 2021 and early 2022 on the back of

climate related government policies that recognised the significant

benefits of nuclear power in order to meet carbon emission goals,

the uranium sector has been more muted over the last 12 months as

high inflation and the resultant higher interest rates have weighed

on investor risk appetites. Uranium equities have not been immune

from the wider market background and despite positive news coming

from the sector in the form of supportive government policies

towards uranium, equities involved in the sector have fallen. The

investment managers report on pages 7 to 8 sets out the investment

position more fully.

The Company's net asset value fell from 47.46p at the start of

the financial year in October 2022 to 41.27p as at 31 March 2023

which is a fall of 13.0% for the six month period. The share price

fell from 46.0p to 36.0p over the same period which represents a

larger decline of 21.7% as the discount to net asset value widened

from 3.1% at the start of the period to 12.9% as at the end of

March 2023.

Share Capital

At the end of April 2023, the second Annual Subscription Right

event took place and I am sorry to report that the net asset value

at that time was substantially below the exercise price of 51.52p

and therefore no new shares were issued. The third Subscription

Right price will be 37.74p per share with the expected date being

30 April 2024.

Outlook

Your Board and the Investment Managers remain confident over the

long-term outlook for uranium. Pro-nuclear government policies have

seen nuclear power being included in most "green" policy frameworks

encouraging wider use. The US has made available zero emission

credits and nuclear deployment incentives to uranium companies and

China is accelerating its new nuclear building programme. In Japan,

higher prices for fossil fuels have increased support to restart

the nation's nuclear fleet. and momentum is gathering pace in this

regard after completion of more stringent reactor upgrades.

Expected demand for uranium is higher than the available supply and

with such structural impetus, we believe the outlook for nuclear

energy is bright.

At the time of writing the Company's net asset value stands at

43.03p and the ordinary share price is 38.00p with the ordinary

shares trading at a discount of 13.2%.

Ian Reeves CBE

Chairman

June 2023

INVESTMENT ADVISER'S REPORT - FOR THE YEAR ENDED 31 MARCH

2023

The six-month period under review has been disappointing for the

Fund, as positive news in the uranium sector has not translated

into gains in the price of equities involved in developing and

producing uranium. The net asset value has declined by 13% over the

six months to 31st March 2023. The positive news we refer to is the

increasing number of longer-term contracts that have been signed to

deliver U3O8 to reactors worldwide. We have also seen China

planning to accelerate its new reactor programme and both France

and Japan commit to extend the life of their nuclear fleet and add

capacity. At the end of 2022 the US signed several long-term

contracts with several US based uranium companies to supply the

newly formed US strategic reserves. Despite this improving

background the largest stocks held within the Fund are all showing

a negative return over the six months - prices started 2023 on an

upwards path but uranium equities were caught up in the poor

broader market sentiment in February and March following weakness

in the US banking sector.

Shift in opinion underpins nuclear power's structural

recovery

Nuclear energy has seen a shift in attitudes to embrace it. The

introduction of pro-nuclear government policies alongside this,

underpins an incredibly appealing outlook for the nuclear sector's

structural recovery, which is still only in its early stages.

Furthermore, with related equities caught-up in broader

recessionary sentiment it appears an opportune time to invest.

Nuclear power has now been included in most "green" policy

frameworks encouraging wider use. In the US, currently the largest

nuclear power market, zero emission credits and nuclear deployment

incentives are now available to utilities under the Inflation

Reduction Act, aimed at reducing US emissions by 40% within this

decade. This builds on the Civil Nuclear Credit Program and

legislation to fund a strategic fuel inventory. Similarly, nuclear

power has been included in the EU taxonomy to improve its green

credentials. Meanwhile in Japan, recent surveys show popular

support to restart the nation's nuclear fleet and momentum is

gathering pace in this regard after completion of more stringent

reactor upgrades.

Demand outstripping supply

Crucially, acknowledgment of the ability of reactors to operate

safely for significantly longer than initially expected has allowed

planned reactor decommissioning to be deferred. Typically adding

around 20 years to the operating life, such extensions have

instantly boosted fuel demand expectations. More significantly new

reactors require around 3 times this quantity of fuel for an

initial charge and with 59 reactors currently under construction

and a further 100 planned, underlying uranium demand is expected to

rise by over 50Mlbs (>3% pa) by the end of the decade. Ambitious

roll-out plans in developing nations will sustain momentum beyond

this timeframe. Commissioning around 8 reactors a year, China is on

course to supplant the US as the largest nuclear fuel consumer

before 2030, while longer-term plans to build another 150 new

domestic reactors by 2035 will see construction accelerate.

Standardisation of small modular reactor designs, to reduce upfront

reactor build costs, is increasingly appealing and should also

accelerate industry growth.

On the supply side, output from the restart of previously

mothballed mines has already been absorbed by the market and

further greenfield supply will be required to satisfy the widening

deficit. As highlighted by Athabasca producer Cameco and developer

Nexgen, at least 2-3 more Cigar Lake or Arrow sized and

geologically scarce deposits will be required to meet end-of-decade

demand. There is mounting pressure to address the future deficit. A

further step up in price from current levels will be needed to

incentivise this.

In addition, there is a need to insure against supply disruption

given highly concentrated fuel production. Notwithstanding

potential shocks resulting from operational issues, such as the

2007 Cigar Lake mine flood, the recent energy crisis highlighted an

over-reliance on Russia and Kazakh origin fuel by established

markets. Akin to OPEC, Kazakhstan and Russia each control over 40%

of global uranium mining and enrichment respectively.

While there are no formal sanctions against using fuel sourced

from these regions, governments and utilities are increasingly

aware of their need to diversify supply. US legislation to

establish a strategic reserve is a prime case in point and no

wonder given that nuclear power will represent 20-25% of these

nation's electricity. This matches the situation in Japan.

Alleviating bottlenecks may spur activity

Consideration also needs to be given to other factors that could

spur activity. Notably, downstream bottlenecks in the fuel cycle,

particularly conversion, in which uranium is converted from a solid

"yellowcake" form into a gaseous "hexafluoride" state, are now

being addressed. The ramp-up of facilities in France and the US are

crucial to increase capacity of this conversion process step, a

necessary precursor to enrichment and then fabrication. Further

capacity expansion will be required beyond this. The scheduled

return of 20% of France's nuclear capacity, after a further round

of safety system checks is completed later this year, is an

additional positive driver of the need to create capacity in the

fuel cycle.

Outlook

In summary, we believe the improving demand backdrop and limited

development of new uranium supply continues to support the sector

outlook, as illustrated by revised government policies to encourage

a greater contribution from nuclear power in the energy mix.

For further information, please contact:

Craig Cleland - CQS (UK) LLP - 020 7201 5368

Jane De Barros-Sousa - R&H Fund Services (Jersey) Limited -

01534 825 259

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCWPUWGQUPWUBU

(END) Dow Jones Newswires

June 30, 2023 05:30 ET (09:30 GMT)

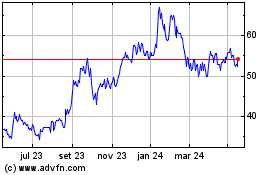

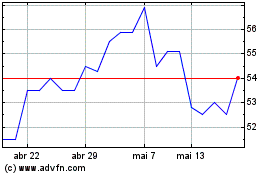

Geiger Counter (LSE:GCL)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Geiger Counter (LSE:GCL)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024