TIDMHDT

RNS Number : 3220X

Holders Technology PLC

19 December 2023

19 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION.

Holders Technology plc

("Holders Technology", the "Group" or the "Company")

Update on Tender Offer - Acceptance Condition satisfied and

Tender Offer declared wholly unconditional

Holders Technology (AIM:HDT) announces that, further to the

announcement of the Tender Offer on 29 November 2023, valid

applications have now been received in excess of 289,367 Ordinary

Shares, representing approximately 6.85 per cent. of the issued

ordinary share capital of the Company. As a result, the Acceptance

Condition has been satisfied as the Concert Party will, upon these

shares being cancelled pursuant to the terms of the Tender Offer,

hold more than 50 per cent. of the voting rights of the Company

following completion of the Tender Offer.

All of the remaining conditions under the Tender Offer have been

satisfied and therefore the Company is pleased to announce that the

Tender Offer has become unconditional in all respects.

The Ordinary Shares tendered pursuant to the Tender Offer will

be purchased and cancelled on 22 December 2023. Shareholders can

expect to receive the proceeds from the sale of the Ordinary Shares

they have tendered, at 43p per Ordinary Share, by 5 January

2024.

The Tender Offer will remain open for acceptances for a further

14 calendar days from the date of this announcement, to enable

Shareholders who have not yet tendered their Ordinary Shares in the

Tender Offer to do so if they wish. In order to do so, Shareholders

must lodge their completed Tender Forms with the Company's

receiving agent, Neville Registrars Limited, or submit their

instructions via CREST, prior to 1.00 p.m. on 2 January 2024. The

Board urges Shareholders who have not yet tendered their Ordinary

Shares under the Tender Offer to carefully read the Circular

published on 29 November 2023, which provides information about the

background to, and reasons for, the Tender Offer.

In accordance with the Takeover Code, the Company will remain in

an "Offer Period" for the purposes of the Takeover Code until 1.00

p.m. on 20 December 2023.

The Board urges Shareholders who have not yet tendered their

Ordinary Shares under the Tender Offer to consider carefully

paragraph 3.2 of Part 1 of the Circular which states as

follows:

"Following the De-Listing, the only formal market mechanism

enabling the Shareholders to trade Ordinary Shares will be the

intended Matched Bargain Facility, details of which are set out in

paragraph 5.1 of Part 1 of the Circular; while the Ordinary Shares

will remain freely transferrable, it is possible that the liquidity

and marketability of the Ordinary Shares will, in the future, be

more constrained than at present and the value of such shares may

be adversely affected as a consequence; in the absence of a formal

market and quote, it may be more difficult for Shareholders to

determine the market value of their investment in the Company at

any given time."

In addition, the Board advises Shareholders who have not yet

tendered their Ordinary Shares in the Tender Offer to consider

carefully the content of paragraph 19 of Part 1 of the Circular,

part of which is set out below:

"Accordingly, any Shareholder who does not accept the Tender

Offer may find it difficult to sell their Ordinary Shares after the

Tender Offer closes and the De-Listing takes effect,

notwithstanding that the Company intends to make arrangements for

the Matched Bargain Facility to be put in place. Shareholders will

also not receive regular information from the Company, and will not

benefit from regulatory compliance with governance procedures

(other than under the Companies Act) and will not enjoy the

protections afforded by the AIM Rules. Furthermore, there is no

guarantee that the Company or any other purchaser would be willing

to buy Ordinary Shares after the Tender Offer has closed.

In the opinion of the Independent Directors, Shareholders should

carefully consider their own individual circumstances in deciding

whether or not to accept the Tender Offer. In the absence of any

immediate prospect to sell their Ordinary Shares once the Tender

Offer closes and the De-Listing has occurred, Shareholders should

balance their desire for a cash realisation now or in the immediate

foreseeable future, against the prospect of remaining a shareholder

in a private company, with a reduced level of disclosure and

corporate governance protections that this affords them.

The Independent Directors, who have been so advised by SP Angel

as to the financial terms of the Tender Offer, consider the terms

of the Tender Offer to be fair and reasonable. In providing advice

to the Independent Directors, SP Angel has taken into account the

commercial assessments of the Independent Directors. Shareholders

who anticipate greater value in the Ordinary Shares in the future

whilst recognising and being willing to accept the prospect of

remaining invested in an unlisted company controlled by the Concert

Party, may decide not to accept the Tender Offer.

Notwithstanding the Independent Directors' recommendation above,

Shareholders should only make a decision as to whether to tender

all or any of their Ordinary Shares based on, among other things,

their view of the Company's prospects and their own individual

circumstances, including their tax position and are recommended to

seek advice from their duly authorised independent advisers.

If Shareholders are in any doubt about the action that they wish

to take in respect of the Tender Offer, they should consult an

independent financial adviser without delay."

For further information, contact:

Holders Technology plc 01896 758781

Rudi Weinreich, Executive Chairman

Victoria Blaisdell, Group Managing Director

Mehul Shah, Group Finance Director

Website www.holderstechnology.com

SP Angel Corporate Finance LLP (Financial Adviser, 020 3470

Nominated Adviser and Broker) 0470

Matthew Johnson/Harry Davies-Ball, Corporate Finance

Abigail Wayne, Corporate Broking

Important Notices

S.P. Angel Corporate Finance LLP ("SP Angel"), which is

authorised and regulated by the FCA, is acting as nominated adviser

and broker to the Company for the purposes of the AIM Rules.

Persons receiving this announcement should note that SP Angel is

acting exclusively for the Company and no one else and will not be

responsible to anyone, other than the Company, for providing the

protections afforded to customers of SP Angel or for advising any

other person on the transactions and arrangements described in this

announcement. SP Angel makes no representation or warranty, express

or implied, as to the contents of this announcement and SP Angel

does not accept any liability whatsoever for the accuracy of or

opinions contained (or for the omission of any material

information) in this announcement and shall not be responsible for

the contents of this announcement. Nothing in this paragraph shall

serve to exclude or limit any responsibilities which SP Angel may

have under FSMA or the regulatory regime established

thereunder.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or solicitation of any offer

to purchase, otherwise acquire, subscribe for, sell or otherwise

dispose of any securities or the solicitation of any vote or

approval in any jurisdiction. Any offer (if made) will be made

solely by certain documentation which will contain the full terms

and conditions of any offer (if made), including details of how

such offer may be accepted. This announcement has been prepared in

accordance with English law and the Code and information disclosed

may not be the same as that which would have been prepared in

accordance with laws outside the United Kingdom. The release,

distribution or publication of this announcement in jurisdictions

outside the United Kingdom may be restricted by the laws of the

relevant jurisdictions and therefore persons into whose possession

this announcement comes should inform themselves about, and

observe, any such restrictions. Any failure to comply with the

restrictions may constitute a violation of the securities laws of

any such jurisdiction.

Forward-looking statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates", "targets", "aims", "continues", "expects",

"intends", "hopes", "may", "will", "would", "could" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that

are not facts. They appear in a number of places throughout this

announcement and include statements regarding the Directors'

intentions, beliefs or current expectations concerning, amongst

other things, the Group's results of operations, financial

condition, liquidity, prospects, growth and strategies. By their

nature, forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances. A number of

factors could cause actual results and developments to differ

materially from those expressed or implied by the forward-looking

statements, including, without limitation: ability to find

appropriate investments in which to invest and to realise

investments held by the Group; conditions in the public markets;

the market position of the Group; the earnings, financial position,

cash flows and return on capital of the Group; the anticipated

investments and capital expenditures of the Group; changing

business or other market conditions; and general economic

conditions.

Forward-looking statements contained in this announcement based

on past trends or activities should not be taken as a

representation that such trends or activities will continue in the

future. Subject to any requirement under the AIM Rules, Prospectus

Rules, the Disclosure and Transparency Rules or other applicable

legislation or regulation, the Company does not undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Investors should not place undue reliance on forward-looking

statements, which speak only as of the date of this

announcement.

No Profit Forecast

No statement in this announcement or incorporated by reference

into this announcement is intended to constitute a profit forecast

or profit estimate for any period, nor should any statement be

interpreted to mean that earnings or earnings per share will

necessarily be greater or less than those for the preceding

financial periods of the Company.

Notice for US Shareholders

The Tender Offer relates to securities in a non-US company which

is registered in the UK and is subject to the disclosure

requirements, rules and practices applicable to companies listed in

the UK, which differ from those of the United States in certain

material respects. This announcement has been prepared in

accordance with UK style and practice for the purpose of complying

with English law and the AIM Rules, and US Shareholders should read

this entire announcement and the Circular, including Part 2. The

financial information relating to the Company, which is available

for review on the Company's website, has not been prepared in

accordance with generally accepted accounting principles in the

United States and thus may not be comparable to financial

information relating to US companies.

The Tender Offer is not subject to the disclosure and other

procedural requirements of Regulation 14D under the US Exchange

Act. The Tender Offer will be extended into the United States in

accordance with the requirements of Regulation 14E under the US

Exchange Act to the extent applicable. Certain provisions of

Regulation 14E under the US Exchange Act are not applicable to the

Tender Offer by virtue of Rule 14d-1(c) under the US Exchange Act.

US Shareholders should note that the Ordinary Shares are not listed

on a US securities exchange and the Company is not subject to the

periodic reporting requirements of the US Exchange Act and is not

required to, and does not, file any reports with the US Securities

and Exchange Commission thereunder.

It may be difficult for US Shareholders to enforce certain

rights and claims arising in connection with the Tender Offer under

US federal securities laws since the Company is located outside the

United States and all of its officers and directors reside outside

the US. It may not be possible to sue a non-US company or its

officers or directors in a non-US court for violations of US

securities laws. It also may not be possible to compel a non-US

company or its affiliates to subject themselves to a US court's

judgment.

The receipt of cash pursuant to the Tender Offer by a

Shareholder who is a US person may be a taxable transaction for US

federal income tax purposes and under applicable US state and

local, as well as foreign and other, tax laws. Each Shareholder is

urged to consult his, her or its independent professional adviser

immediately regarding the tax consequences of tendering any

Ordinary Shares in the Tender Offer.

To the extent permitted by applicable law and in accordance with

normal UK practice, the Company, SP Angel or any of their

respective affiliates, may make certain purchases of, or

arrangements to purchase, Ordinary Shares outside the United States

during the period in which the Tender Offer remains open for

participation, including sales and purchases of Ordinary Shares

effected by SP Angel acting as market maker in the Ordinary Shares.

These purchases, or other arrangements, may occur either in the

open market at prevailing prices or in private transactions at

negotiated prices. In order to be excepted from the requirements of

Rule 14e-5 under the US Exchange Act by virtue of Rule 14e-5(b)(10)

thereunder, such purchases, or arrangements to purchase, must

comply with applicable English law and regulation, including the

AIM Rules, and the relevant provisions of the US Exchange Act. Any

information about such purchases will be disclosed as required in

the UK and the United States and, if required, will be reported via

a Regulatory Information Service and will be available on the

London Stock Exchange website at www.londonstockexchange.com.

While the Tender Offer is being made available to Shareholders

in the United States, the right to tender Ordinary Shares is not

being made available in any jurisdiction in the United States in

which the making of the Tender Offer or the right to tender such

Ordinary Shares would not be in compliance with the laws of such

jurisdiction.

This announcement has not been approved, disapproved or

otherwise recommended by the US Securities and Exchange Commission

or any US state securities commission and such authorities have not

confirmed the accuracy or determined the adequacy of this

announcement. Any representation to the contrary is a criminal

offence in the United States

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables or forms may vary

slightly and figures shown as totals in certain tables or forms may

not be an arithmetic aggregation of the figures that precede

them.

Disclosure Requirements of the Takeover Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th Business Day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th Business Day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror, save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the Business

Day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on Website

A copy of this announcement will be made available, subject to

certain restrictions relating to persons resident in restricted

jurisdictions, on the Company's website at

www.holderstechnology.com by no later than 12 noon (London time) on

20 December 2023. The content of the website referred to in this

announcement is not incorporated into and does not form part of

this announcement.

Defined Terms

Defined terms in this announcement have the same meaning as in

the Circular (unless otherwise specified).

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPTLBBTMTTBBPJ

(END) Dow Jones Newswires

December 19, 2023 06:29 ET (11:29 GMT)

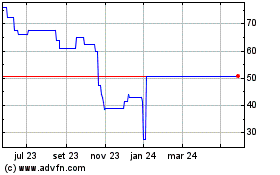

Holders Technology (LSE:HDT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

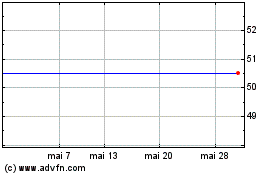

Holders Technology (LSE:HDT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024