Ironveld PLC Update on DMS Magnetite Joint Venture (0312L)

01 Setembro 2023 - 3:00AM

UK Regulatory

TIDMIRON

RNS Number : 0312L

Ironveld PLC

01 September 2023

Ironveld Plc

("Ironveld" or the "Company")

Update on DMS Magnetite Joint Venture

Ironveld, the AIM quoted mining development company, is pleased

to confirm that its subsidiary, Ironveld Mining (Pty) Limited

("Ironveld Mining"), and its Joint Venture ("JV") partner, Pace SA

Pty Limited ("Pace"), have agreed with a subsidiary of JSE-listed

Sable Exploration and Mining Limited ("SEAM", ticker code SXM)

certain amendments to the funding and operational structure of the

DMS Magnetite operation currently being established at Ironveld's

mining area. The new structure retains Ironveld's ability to supply

ore into the JV and benefit from a share of positive cashflows

without having to fund the initial capital expenditure.

The JV between Ironveld and Pace, IPace Pty Limited ("IPace"),

shall continue to be responsible for erecting, operating, and

maintaining the plant alongside all marketing of the final product

and Ironveld Mining will continue to supply ore on a 'cost plus'

basis to IPace.

The parties have now agreed that SEAM, via a subsidiary company

Sable Platinum Holdings (Pty) Limited ("SPH"), will advance all

necessary funding of approximately ZAR 15 million (approximately

GBP650,000) for the establishment of an initial quick start 10,000

tonnes per month ("tpm") capacity plant. There will also be an

option to fund future expansions in capacity, depending on the

success of the venture.

Once SPH's capital loan has been repaid out of 70% profits, it

will retain a 50% interest and IPace will own 50% of the venture

and remain entitled to 50% of all profits.

SEAM and Pace have both introduced significant offtake customers

to IPace, and forecasted tonnage volumes are now approximately

double the level envisaged in early 2023 when Ironveld Mining and

Pace established the JV. The amendments to percentage interests

between the parties will have a negligible effect on the positive

cashflows likely to accrue to Ironveld.

This revised structure maintains the benefits for Ironveld

Mining in being able to mine and sell additional ore, including

'fines' that would otherwise not be suitable for the Group's

Rustenburg smelter. The reduced upfront capital requirement for a

smaller and more efficient plant, which minimises unused capacity

versus the original plant design, means that, based on anticipated

sales, the period before such capital is repaid is also reduced,

thereby bringing forward the point where positive cashflows are

likely to arise for IPace.

Ground works and civil works at the site are progressing well,

with the expectation of the plant to be installed in around four

weeks, and first sales to follow approximately four to six weeks

after that.

Martin Eales, Chief Executive Officer, said : "Ironveld and Pace

welcome SEAM as a funding partner for the DMS Magnetite Joint

Venture. The DMS Magnetite project is beneficial for Ironveld

Mining in terms of reducing overall average mining costs and should

in time contribute positive cashflow, without us having to divert

funding from our core smelting activities in order to establish the

venture."

James Allan, Chief Executive Officer of SEAM, said: "Sable is

really pleased to be partnering with IPace in this exciting project

that we believe will generate good cashflow for all the parties and

provide a base for further developments."

For further information, please contact:

Ironveld plc c/o BlytheRay

Martin Eales, Chief Executive Officer +44 20 7138 3204

finnCap (Nomad and Broker)

Christopher Raggett / Charlie Beeson / George

Dollemore +44 20 7220 0500

Turner Pope (Joint Broker)

Andrew Thacker / James Pope +44 20 3657 0050

BlytheRay

Tim Blythe / Megan Ray +44 20 7138 3204

NOTES TO EDITORS

Ironveld (IRON.LN) is the owner of Mining Rights over

approximately 28 kilometres of outcropping Bushveld magnetite with

a SAMREC compliant ore resource of some 56 million tons of ore

grading 1,12% V2O5, 68,6% Fe2O3 and 14,7% TiO2.

In 2022 Ironveld agreed to acquire and refurbish a smelter

facility in Rustenburg, South Africa, in which it can process its

magnetite ore into the marketable products of high purity iron,

titanium slag and vanadium slag. This transaction became

unconditional in March 2023.

Ironveld is an AIM traded company. For further information on

Ironveld please refer to www.ironveld.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAPPFDLADEFA

(END) Dow Jones Newswires

September 01, 2023 02:00 ET (06:00 GMT)

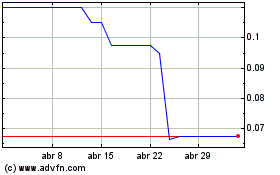

Ironveld (LSE:IRON)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ironveld (LSE:IRON)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024