TIDMIRON

RNS Number : 3261R

Ironveld PLC

26 October 2023

Ironveld Plc

("Ironveld" or the "Company")

Fundraising at a premium and Board change

Ironveld plc ("Ironveld" or the "Company"), the AIM quoted

mining development company, is pleased to confirm that its largest

shareholder, Tracarta Limited ("Tracarta") (in which current

Non-Executive Director Dr John Wardle has a beneficial interest),

has agreed to cornerstone a fundraising at a premium to the current

share price (the "Subscription" or "Fundraising"), to assist with

the ongoing working capital requirements of the business.

Highlights

-- Cash subscription by Tracarta of GBP450,000 for 162,000,000

new Ordinary Shares in the Company ("Tracarta's Subscription") at a

price per share of 0.278p (the "Subscription Price"), representing

a premium of 23.5 per cent. to the closing mid-price of 0.225p on

25 October 2023;

-- In addition, Turner Pope, acting as the Company's Broker, has

procured orders for a further GBP550,000 from existing shareholders

on the same terms;

-- Conditional upon shareholder approval, all subscribers will

also be issued with warrants to subscribe for new Ordinary Shares

at a price of 0.29p; and

-- Following Tracarta's Subscription , Dr John Wardle will

assume the role of Executive Chairman of the Company, with Giles

Clarke remaining as a Non-Executive Director.

Outgoing Chairman, Giles Clarke, commented: "I have worked with

John Wardle over many years and know him to be a man with a

successful track record in the natural resources space. His

executive experience from senior positions at the likes of Amerisur

Resources and Emerald Energy hold him in good stead and I am

delighted that he has agreed to become Executive Chairman of the

Company, which is consistent with Tracarta's position as the

Company's largest investor. I will continue to provide the Company

with my ongoing support as a Non-Executive Director as the Company

continues in its transformational phase of development."

Incoming Chairman, John Wardle commented: "I thank Giles for his

contribution in advancing the Company to its current stage of

development and I look forward to working more directly with the

Ironveld team. Our objective is to drive the further development of

the Company in the short term and demonstrate the inherent value of

our assets."

Details of the Fundraising use of proceeds

Since the Company's Operations Update on 18 September 2023, the

operations at the Rustenburg smelter have consumed a greater amount

of cash resources than originally planned, in particular the impact

of critical repairs and optimisation costing approximately

GBP250,000 to rectify which, combined with a material interruption

to planned production during October, has created a requirement for

additional working capital.

Whilst the Directors' loan facilities announced in September

still have undrawn headroom, the Board considers that it is prudent

to maintain a larger working capital buffer in order to provide

maximum flexibility in maintaining operations and believes that the

Fundraising at a substantial premium to the existing market price

of the shares represents an attractive option.

The Ipace DMS Magnetite joint venture is progressing as planned

and first product will be shipped and sold in November 2023.

Tracarta's investment is based on the available authorised

headroom available to the Company, being approximately 162,000,000

new Ordinary Shares. Given this strong demonstration of support by

the Company's largest investor, Turner Pope has been able to

procure subscribers for a further GBP550,000 for a further

198,000,000 new Ordinary Shares (together with Tracarta's

Subscription, the "Subscription Shares").

The Subscription Price per share is 0.278p, representing a

premium of 23.5 per cent. To the closing mid-market price of 0.225p

on 25 October 2023.

Board Change

The Board has agreed that, following Tracarta's Subscription, Dr

John Wardle will assume the role of Executive Chairman of the

Company, whilst Giles Clarke will remain as a Non-Executive

Director.

Related Party Opinion

Tracarta has agreed to subscribe for 162,000,000 Shares for a

total of GBP450,000 in cash.

The resultant holding of the relevant Director is included in

the table below:

Director Existing Per cent. Subscription Revised Holding Percentage

Holding Shares of Enlarged

Issued Share

Capital**

J Wardle* 407,428,567 11.40 162,000,000 569,428,567 14.47

* J Wardle's interest in all Ordinary Shares above is through

his beneficial interest in Tracarta.

** Assuming the issue of all new Ordinary Shares pursuant to the

Fundraising

John Wardle has a beneficial interest in Tracarta and, as such,

the Subscription constitutes a related party transaction pursuant

to Rule 13 of the AIM Rules for Companies. The Company's

independent Directors (being Giles Clarke, Nick Harrison, Peter

Cox, Martin Eales and Malebo Ratlhagane) consider, having consulted

with the Company's nominated adviser, Cavendish, that the terms of

Tracarta's Subscription are fair and reasonable insofar as the

Company's shareholders are concerned.

Details of the Fundraising

In total, 360,000,000 new Ordinary Shares are proposed to be

allotted and issued pursuant to the Fundraising, at a Subscription

Price of 0.278 pence per new Ordinary Share to raise gross proceeds

of GBP 1,000,000. The Tranche 2 Subscription Shares (as detailed

below), have been conditionally placed by Turner Pope, acting as

agent and broker of the Company.

The Company currently has limited shareholder authority to issue

new Ordinary Shares for cash on a non-pre-emptive basis.

Accordingly, the Fundraising is being conducted in two tranches as

set out below:

1. Tranche 1 Subscription

A total of GBP450,000, representing the issue and allotment of

162,000,000 new Ordinary Shares (the "Tranche 1 Subscription

Shares") at the Subscription Price (the "Tranche 1 Subscription"),

has been raised using the Company's existing share allotment

authorities which were granted at the Company's general meeting

held on 13 March 2023 . Application has been made for the Tranche 1

Subscription Shares to be admitted to trading on AIM and it is

expected that their admission to AIM will take place on or around

31 October 2023 ("First Admission"). The issue of the Tranche 1

Subscription Shares is conditional, inter alia, on First Admission.

The issue of the Tranche 1 Subscription Shares is not conditional

on the Tranche 2 Subscription completing.

2. Tranche 2 Subscription

The balance of the Fundraising, being approximately GBP550,000

and representing the issue and allotment of 198,000,000 new

Ordinary Shares (the "Tranche 2 Subscription Shares") at the

Subscription Price (the "Tranche 2 Subscription") is conditional

upon, inter alia, the passing of resolutions to be put to

shareholders of the Company at a general meeting of the Company to

be held on 13 November 2023 (the "Resolutions") to provide the

relevant authorities to the Directors to issue and allot further

new Ordinary Shares on a non-pre-emptive basis, whereby such

authorities will be utilised by the Directors to enable completion

of the Tranche 2 Subscription (amongst other things, as detailed

below).

Conditional on the passing of the Resolutions, application will

be made for the Tranche 2 Subscription Shares to be admitted to

trading on AIM and it is expected that their admission to AIM will

take place on or around 14 November 2023 ("Second Admission").

In addition to the passing of the Resolutions, the Tranche 2

Subscription is conditional, inter alia, on Second Admission.

The Tranche 1 Subscription Shares and Tranche 2 Subscription

Shares will, when issued, be credited as fully paid and will rank

pari passu in all respects with the existing Ordinary Shares of the

Company, including the right to receive all dividends or other

distributions made, paid, or declared in respect of such shares

after the date of issue of the relevant Subscription Shares.

Warrants

The Company is proposing to issue subscribers to the Fundraising

with warrants to subscribe for new Ordinary Shares on the basis of

one (1) warrant for every one (1) Subscription Share (the "Investor

Warrants"). The Investor Warrants are exercisable at 0.29 pence for

a period of three years from the date of their grant, on Second

Admission.

The grant of the Investor Warrants is conditional on the passing

of the Resolutions to be put to shareholders of the Company at the

General Meeting to provide the relevant authorities to the

Directors to issue and allot further new Ordinary Shares on a

non-pre-emptive basis. None of the Investor Warrants will be

admitted to trading on AIM or any other stock exchange.

Direct Funding Discussions

The Company confirms that the direct funding discussions as

detailed in the announcement dated 18 September 2023 are still

ongoing. The Company will provide a further update when

appropriate.

Total voting rights

Following First Admission, the Company's total issued share

capital will consist of 3,736,996,887 Ordinary Shares, with one

voting right per share. The Company does not hold any shares in

treasury. Therefore, the total number of Ordinary Shares and voting

rights in the Company will be 3,736,996,887 from First Admission.

This figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company pursuant to the FCA's

Disclosure Guidance and Transparency Rules.

Notice of General Meeting

The Company will publish a Circular to convene the General

Meeting to propose the Resolutions to enable completion of the

Fundraising, and the grant of the Investor Warrants.

The General Meeting will be held at 10.00 a.m. on 13 November

2023. The circular containing the notice of general meeting will be

published and sent to shareholders in the coming days and will be

available on the Company's website, www.ironveld.com. Shareholders

are strongly urged to vote by proxy in accordance with the

instructions that will be set out in the notice of general

meeting.

For further information, please contact:

Ironveld plc c/o BlytheRay

Martin Eales, Chief Executive Officer +44 20 7138 3204

Cavendish (Nomad and Broker)

Derrick Lee / Charlie Beeson / George Dollemore +44 20 7220 0500

Turner Pope (Joint Broker)

Andrew Thacker / James Pope +44 20 3657 0050

BlytheRay

Tim Blythe / Megan Ray +44 20 7138 3204

NOTES TO EDITORS

Ironveld (IRON.LN) is the owner of Mining Rights over

approximately 28 kilometres of outcropping Bushveld magnetite with

a SAMREC compliant ore resource of some 56 million tons of ore

grading 1.12% V2O5, 68.6% Fe2O3 and 14.7% TiO2.

In 2022 Ironveld agreed to acquire and refurbish a smelter

facility in Rustenburg, South Africa, in which it can process its

magnetite ore into the marketable products of high purity iron,

titanium slag and vanadium slag. This transaction became

unconditional in March 2023.

Ironveld is an AIM traded company. For further information on

Ironveld please refer to www.ironveld.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFEFEFIEDSEFS

(END) Dow Jones Newswires

October 26, 2023 02:00 ET (06:00 GMT)

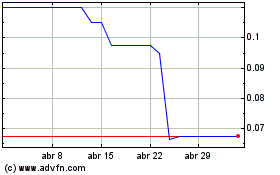

Ironveld (LSE:IRON)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ironveld (LSE:IRON)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024