TIDMJFJ

RNS Number : 7920V

JPMorgan Japanese Inv. Trust PLC

06 December 2023

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN JAPANESE INVESTMENT TRUST PLC

FINAL RESULTS FOR THE YEARED 30TH SEPTEMBER 2023

Legal Entity Identifier: 549300JZW3TSSO464R15

Information disclosed in accordance with DTR 4.2.2

CHAIRMAN'S STATEMENT

Investment Performance

Japanese equities market has had a good year with local currency

returns for the year to 30 September up some 29.3%; the weakening

Yen meant though that in sterling terms the market return was only

14.7%.

In the year to 30th September 2023, the Company's total return

on net assets (in sterling terms), with debt calculated at fair

value, was 8.0% in net asset value (NAV) terms, an underperformance

of some 6.7% relative to the benchmark. The share price total

return, with dividends reinvested, was 6.4%, because of a modest

widening in the discount to NAV at which the Company's shares trade

over the year. NAV and share price performance for the prior year

and the 3, 5 and 10 year annualised performance is shown on page 6

of the Annual Report and Financial Statements.

After the earlier periods of underperformance, this year's

numbers are indeed disappointing. As reported in the half year

report, the Company's performance over the first six months of the

2023 financial year was in line with its benchmark, the Tokyo Stock

Exchange (TOPIX) Index. However, relative performance over the full

year has not been so positive; returns kept up with the market for

most of the second half but we had a very challenging end to our

financial year meaning we lagged the market in the second half of

the year and so for the full year. By way of illustration, c 4.6%

of the year's NAV underperformance of 6.7% came in September, the

final month of our financial year.

The Portfolio Managers set out in more detail in their report on

the following pages the main reason for the underperformance during

the year, namely the market's rotation into low quality, value and

cyclical stocks at the expense of the quality and growth stocks

favoured by the Company's strategy. They also set out the

investment rationale behind recent portfolio activity and the

outlook in more detail.

There is, however, cause for optimism; the TOPIX increase of

14.7% in sterling terms was supported by several positive

developments, including a surge in economic activity following the

post-pandemic reopening of the Japanese economy, widespread wage

increases and an acceleration in corporate governance reforms,

which are lifting shareholder returns. And after decades of

seemingly intractable deflation, unlike other central banks the

Bank of Japan is likely to welcome the recent modest rise in

inflation and therefore take a very cautious approach to monetary

tightening. One other encouraging aspect of the rise in Japanese

stock prices is that it has been fuelled in part by foreign

buying.

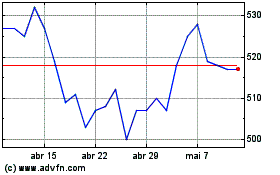

Since the end of the financial year, the Company's net asset

value has increased by 2.6% as at 1st December 2023, compared to a

benchmark increase of 0.2%, while the share price increased by

3.4%.

Analyst Ratings

As I commented in the half year report, the Company's

Morningstar Analyst rating has been maintained at the highest

level, Gold, recognising the strength of the Company's Investment

Manager and their investment process. The Company also continues to

maintain the highest Morningstar sustainability rating of five

globes.

Morningstar assesses and publishes data on some 900 Japanese

equity funds and share classes under its 'Japan Large-Cap equity'

classification. Your Manager is one of the only three active

Japanese Equity Managers with a Gold Morningstar Analyst rating

within this category. You can find further details of the

Morningstar research and rating at www.morningstar.co.uk

Board Investment Review

The Board recognises the Company's underperformance vs its

benchmark over the medium term which primarily results from poor

performance at the end of 2021 and in the first quarter of 2022, as

well as the poor numbers in September 2023 referred to above. The

Board is also conscious of the very unusual investment environment

our Manager has faced since the start of Covid in early 2020 and

that your Company has performed reasonably vs growth indices and

peers with a similar growth style of investing.

The Board has continued to spend a significant amount of time

with the Company's Portfolio Managers and other members of the

JPMorgan Asset Management (JPMAM) investment team to discuss and

understand the factors behind the Company's performance. These

conversations focused on the price at which the Portfolio Managers

are willing to buy/sell the stocks they like, the valuation

analysis described on page 20 of the Annual Report and Financial

Statements, and the impact of the corporate governance changes

(described in the Investment Manager's report) on the Company's

portfolio vs the wider index. The Board supported the Portfolio

Managers' plans to increase their focus on valuation (you can read

about some of the resulting changes made to the Portfolio in the

Investment Managers' report), and recognised that the corporate

governance changes may well continue to represent a headwind for

the Company's performance vs. the benchmark and those peers with a

value style of investing.

Following these detailed discussions with JPMAM, the Board

remains fully supportive of the strategy the Company offers UK

investors, our Portfolio Managers and their investment process.

Gearing

The Board believes that gearing can benefit performance. The

Board sets the overall strategic gearing policy and guidelines and

reviews them at each Board meeting. The Portfolio Managers then

manage the gearing within the agreed limits of 5% net cash to 20%

geared in normal market conditions. As at 30th September 2023,

gearing was equivalent to 13.7% (2022: 11.7%) of net assets.

The Scotiabank loan facility expired on 2nd December 2022.

During the second half of the financial year, the Company took out

a Yen10 billion revolving credit facility with Industrial and

Commercial Bank of China Limited, London Branch, which is in

addition to the existing Yen5 billion credit facility with Mizuho

Bank Limited and the Company's long-term fixed rate debt. Further

details on page 84 of the Annual Report and Financial

Statements.

Revenues and Dividends

Income received during the year ended 30th September 2023 again

rose year-on-year, with earnings per share for the full year of

7.46p (2022: 7.48p). This reflected a continued recovery in the

level of dividends paid and the strong balance sheets of portfolio

companies.

The Board's dividend policy is to pay out the majority of

revenue available each year. The Board therefore proposes, subject

to shareholders' approval at the Annual General Meeting to be held

on 11th January 2024, to pay a final dividend of 6.5p per share

(2022: 6.2p) on 5th February 2024 to shareholders on the register

at the close of business on 22nd December 2023 (ex-dividend date

21st December 2023). This increase represents an increase of 4.8%

in the dividend (2022: 17%).

We hope to be able to continue to increase the dividend in

future years.

Discount Management and Share repurchases

The Board monitors the discount to NAV at which the Company's

shares trade. It believes that for the Company's shares to trade

close to NAV over the long term, the focus must remain on

consistent, strong investment performance over the key one, three,

five and ten-year timeframes, combined with effective marketing and

promotion of the Company.

The Board recognises that a widening of, and volatility in, the

Company's discount is seen by some investors as a disadvantage of

investments trusts. The Board has restated its commitment to seek a

stable discount or premium over the long run, commensurate with

investors' appetite for Japanese equities and the Company's various

attractions, not least the quality of the investment team, the

investment process and the resultant strong long-term performance.

To this end, during the past financial year, a total of 3,870,000

shares (2.40% of shares in issue) were repurchased (2022: 2,278,345

shares).

As at 30th September 2023, the discount was 8.8%, compared to

the level of 7.3% where it closed the previous year. Over the past

financial year, the discount ranged from 1.2% to 11.3% and the

average discount was 7.4%. This compares with the previous

financial year, when the discount ranged from 10.6% to a premium of

2.7% and the average discount was 5.7%.

Since the end of the current review period, the Board has

repurchased a further 1,740,000 shares and the discount stood at

8.1% as at 1st December 2023.

Shares are only repurchased at a discount to the prevailing net

asset value, which increases the Company's net asset value per

share on remaining shares. Shares may either be cancelled or held

in Treasury for possible re-issue at a premium to net asset

value.

Stewardship

Effective investment stewardship can materially contribute to

the construction of stronger portfolios over the long term, and

therefore enhance returns. The Company's Investment Manager has a

well-established, active approach to investment stewardship, both

to understand how companies consider issues related to

Environmental, Social and Governance ('ESG') factors (see the ESG

Report on pages 24 to 28 in the Annual Report and Financial

Statements), and to seek to influence their behaviour and encourage

best practices. The portfolio managers, research analysts and

investment stewardship specialists engage regularly with investee

companies and the Company exercises its voice as a long-term

investor through proxy voting. The Board supports the Investment

Manager's approach to investment stewardship and its commitment to

its stewardship responsibilities.

Task Force on Climate-related Financial Disclosures

As a regulatory requirement, JPMorgan Asset Management (JPMAM)

published its first UK Task Force on Climate-related Financial

Disclosures ('TCFD') Report for the Company in respect of the year

ended 31st December 2022 on 30th June 2023. The report discloses

estimates of the Company's portfolio climate-related risks and

opportunities according to the Financial Conduct Authority (FCA)

Environmental, Social and Governance (ESG) Sourcebook and the Task

Force on Climate-related Disclosures (TCFD). The report is

available on the Company's website under the ESG documents

section:

https://am.jpmorgan.com/content/dam/jpm-am-aem/emea/regional/en/regulatory/esg-

information/jpm-japanese-investment-trust-plc-fund-tcfd-report-uk-per.pdf

The Board is aware that best practice reporting under TCFD is

still evolving with respect to metrics and input data quality, as

well as the interpretation and implications of the outputs

produced, and will continue to monitor developments as they

occur.

Board Composition and Appointment

The Board has given considerable thought to its succession

planning. As mentioned previously, having served as a Director for

nine years, I will retire from the Board and Stephen Cohen, our

current Audit Chair, will replace me as Chairman at the forthcoming

Annual General Meeting. Sally Duckworth, who was appointed to the

Board in October 2022, will assume the role of the Company's Audit

Chair.

As illustrated on page 58 of the Annual Report and Financial

Statements, Stephen Cohen and George Olcott would in the normal

course step down together from the Board after nine years in

January 2025. The Board has decided, not least because of the

challenging investment environment, to avoid losing two Directors

in the same year and so has agreed that Stephen Cohen will serve as

Chairman for three years meaning he will have been on the Board for

ten years when he retires. Sally Macdonald, our Senior Independent

Director, will confirm that this has the support of

shareholders.

Given these plans, the Company engaged an independent search

consultancy to find a suitably qualified Director to join the

Board. After a thorough selection process, Lord Jonathan Kestenbaum

was appointed as a non-executive Director with effect from 1st

October 2023. Lord Kestenbaum has over two decades of private and

public markets investing experience across asset classes. He is a

non-executive Director of Windmill Hill Asset Management, and an

adviser to a range of interests associated with the Rothschild

family. Until 2022, he was the Chief Operating Officer at RIT

Capital Partners, the publicly quoted investment trust. He was born

and spent his early childhood in Japan and has therefore taken an

active interest in the country, its companies and markets

throughout his professional career.

The Board supports annual re-election for all Directors, as

recommended by the AIC Code of Corporate Governance. In compliance

with this, all Directors, excluding myself, will stand for

re-appointment at the forthcoming AGM.

Board Diversity

The Board is conscious of the increased focus on diversity and

recognises the value and importance of diversity in the boardroom.

The recommendations of the FTSE Women Leaders Review, which form

part of the Listing Rules, set targets for FTSE 350 companies to

have 40% female representation, up from 33%. The recommendations

also stipulate that a woman occupies the role of either Chair or

Senior Independent Director. I am pleased to report that the

Company complies with these guidelines - the Board currently has

over 40% female representation and, on my retirement, this will

increase to 50% - and in the absence of any unforeseen

circumstances, it will continue to remain compliant.

More information showing the gender and ethnic composition of

the Board is shown in a table on page 57 of the Annual Report and

Financial Statements.

Annual General Meeting and Shareholder Contact

The Company's Annual General Meeting (AGM) will be held on

Thursday, 11th January 2024 at 12.30 p.m. at 60 Victoria

Embankment, London EC4Y 0JP.

We are delighted that this year we will once again be able to

invite shareholders to join us in person for the Company's AGM, to

hear from the Portfolio Managers. Their presentation will be

followed by a question-and-answer session. Shareholders wishing to

follow the AGM proceedings but choosing not to attend in person,

will be able to view proceedings live and ask questions (but not

vote) through conferencing software. Details on how to register,

together with access details, will be available shortly on the

Company's website at www.jpmjapanese.co.uk, or by contacting the

Company Secretary at invtrusts.cosec@jpmorgan.com.

My fellow Board members, representatives of JPMorgan and I look

forward to the opportunity to meet and speak with shareholders

after the formalities of the meeting have been concluded.

Shareholders who are unable to attend the AGM are strongly

encouraged to submit their proxy votes in advance of the meeting,

so they are registered and recorded at the AGM. Proxy votes can be

lodged in advance of the AGM either by post or electronically,

detailed instructions are included in the Notes to the Notice of

Annual General Meeting on pages 101 to 104 of the Annual Report and

Financial Statements.

If there are any changes to these arrangements for the AGM, the

Company will update shareholders via the Company's website, and, if

appropriate, through an announcement on the London Stock

Exchange.

Stay Informed

The Company delivers email updates with regular news and views,

as well as the latest performance. If you have not already signed

up to receive these communications and you wish to do so, you can

opt in via

https://web.gim.jpmorgan.com/emea_investment_trust_subscription/welcome?targetFund=JFJ

or by scanning the QR code in the Annual Report and Financial

Statements.

Outlook

The Board is encouraged by the improvements in the Japanese

economy and equity market sentiment over the past year, and shares

the Portfolio Managers' optimism about the country's longer-term

prospects. We are particularly gratified that corporate governance

reforms appear to be gathering momentum, as this has the potential

to significantly enhance shareholder returns across the entire

market. The Board remains confident in the Portfolio Managers'

focus on quality and growth, and their research-driven,

unconstrained approach to stock selection.

I have very much enjoyed my time on the Company's Board as a

Director, Chair of the Audit Committee and most recently as

Chairman and so, as I step down, I would like to thank

shareholders, Board colleagues, our Portfolio Managers Nicholas

Weindling and Miyako Urabe, and of course everyone else at JPMAM

and across all our other service providers for their support over

the last nine years. I know that under the Company's new Chairman,

Stephen Cohen, and my other Board colleagues, the Company will

continue to be very well served.

Finally, as usual, on behalf of the Board, can I thank you, our

shareholders, for your continued strong support.

Christopher Samuel

Chairman 5th December 2023

INVESTMENT MANAGERS' REPORT

Performance

Over the twelve months to 30th September 2023, the Company

returned +8.0% on a net asset basis (in GBP), compared to its

benchmark, the TOPIX index, which returned +14.7%. Over the three

years to end September 2023, the Company recorded an annualised

decline of 8.0%, versus the average benchmark return of +4.4% pa.

However, long term absolute and relative performance remains

positive; over the ten years to September 2023, the Company

returned +7.6% on an annualised basis, ahead of the benchmark

return of +7.5%.

We use an unconstrained investment approach which seeks the very

best ideas, with excellent growth prospects. This means the

portfolio has a bias towards quality and growth companies, which

inevitably leads to poor performance at times, as it has done over

the last three years. This performance is disappointing to us.

However, we stress that it is the result of the same focus,

particularly on quality and growth, that has helped us achieve much

stronger performance over the longer-term.

Compared to the US market, the Japanese market has been

particularly unusual over the last year, as it has been very driven

by lower quality value stocks. The chart on page 12 of the Annual

Report and Financial Statements illustrates the recent

outperformance of poorer quality stocks, relative to previous

periods, while showing how the highest quality companies we favour

have lagged.

There are several reasons for this:

(a) Monetary policy divergence between Japan and the US has

caused the yen to weaken, boosting the profits of some low-quality

export cyclicals;

(b) Expectations of a gradual tightening in Japanese monetary

policy have improved the outlook for financial companies, another

cyclical sector characterised by intense competition and

commoditised product offerings; and

(c) A perception, incorrect in our view, that the recent and

ongoing improvements in corporate governance will only help

companies trading on a price/book valuation of less than 1. On the

contrary, in our assessment, the Tokyo Stock Exchange wants all

companies to improve their corporate valuations. As we note

elsewhere in our report, the most important consideration in our

investment process is how companies compound earnings over the

longer term. However, the Company's holdings, which are mostly

rated as Premium and Quality, are positioned to benefit from these

reforms and many have already begun the process of restructuring

and returning cash to shareholders.

Performance attribution

Year ended 30th September 2023

% %

---------------------------------------------- ------ -----

Contributions to total returns

---------------------------------------------- ------ -----

Benchmark return 14.7

---------------------------------------------- ------ -----

Stock selection -10.7

---------------------------------------------- ------ -----

Currency 0.0

---------------------------------------------- ------ -----

Gearing/Cash 3.9

---------------------------------------------- ------ -----

Investment Manager contribution -6.8

---------------------------------------------- ------ -----

Portfolio return(A) 7.9

---------------------------------------------- ------ -----

Management fee and other expenses -0.7

---------------------------------------------- ------ -----

Share Buy-Back 0.2

---------------------------------------------- ------ -----

Other effects -0.5

---------------------------------------------- ------ -----

Return on net assets - Debt at par value(A) 7.4

---------------------------------------------- ------ -----

Impact of fair value of debt 0.6

---------------------------------------------- ------ -----

Return on net assets - Debt at fair value(A) 8.0

---------------------------------------------- ------ -----

Return to shareholders(A) 6.4

---------------------------------------------- ------ -----

Source: JPMAM and Morningstar. All figures are on a total return

basis.

Performance attribution analyses how the Company achieved its

recorded performance relative to its benchmark.

(A) Alternative Performance Measure ('APM').

A glossary of terms and APMs is provided on pages 105 and 106 of

the Annual Report and Financial Statements.

Economic and market background

The reforms underway in Japan's corporate sector are not the

only positive recent development in the Japanese market. The

economy has been on an improving trend since the government lifted

its strict border controls in October 2022 and removed the last

pandemic related restrictions earlier this year. Since then,

tourist numbers have risen very sharply. This activity is

benefiting a broad array of tourism and hospitality businesses.

There are also signs of a very welcome shift in Japan's labour

market. The country has labour shortages in many fields due to its

aging population. Yet historically, companies have been resistant

to raising wages to attract and retain workers, and Japanese wages

barely increased for 30 years.

However, this is beginning to change. Recent wage increases have

been significant and broad-based. For example, NTT, a telecoms

company, has raised starting salaries by 14%, and JGC, which

designs, constructs and maintains industrial facilities, has

increased its base salary by 10%.

Although Japanese inflation remains relatively low in absolute

terms and relative to other countries, it is noteworthy that

inflation is the highest for decades at around 3%. The Bank of

Japan (BoJ) response has been muted so far and it continues to

pursue a negative interest rate policy although there have been

some recent tweaks to yield curve control. It is possible that we

see further shifts in policy and this may, in turn, have

implications for the Japanese yen which has been weak against major

currencies over the last year.

After a long period during which Japanese equities have been

unloved and under-owned by global investors, Japan's improving

fundamentals have begun to attract attention. The stock market has

reached multi-decade highs and outperformed global markets over the

year ended 30th September 2023 - the MSCI ACWI and the S&P 500

both rose by c 11.0% over the period in GBP terms, compared to the

TOPIX index's 14.7% rise. One of the most welcome aspects of this

market rebound is that it has been driven in part by foreign

investors.

Portfolio themes

Investment Trust Portfolio Themes

The portfolio is constructed entirely on a stock-by-stock basis

as we seek out the best, most attractive companies. Nonetheless,

certain themes underpin our investment decisions. These companies

are also well-placed to take advantage of shifts in the corporate

governance landscape as, although they are outstanding businesses

poised to compound earnings growth for many years, they often have

sub-optimal capital allocation policies.

Japan remains well behind most other advanced economies in areas

such as online shopping and cloud computing leaving plenty of scope

for such trends to continue developing over coming years. For

example, the penetration of e-commerce within the Japanese retail

market is just over 10% and remains much lower than in China, the

UK, South Korea or the US. Portfolio holdings such as Zozo, Japan's

number one online apparel retailer, and Monotaro, a top-ranked

business-to-business (B2B) e-commerce company, are well placed to

benefit. Meanwhile, many companies still use inefficient internally

developed software systems which will need to change as employees

retire. OBIC, which is a leading provider of software for small and

mid-sized companies, has operating margins over 60%. It also has a

significant and growing net cash position as well as a portfolio of

shareholdings, which are depressing its return on equity. We are

engaging with the company on these topics to generate

improvement.

Deglobalisation is another trend gathering momentum. The

pandemic, and subsequent events such as widespread supply chain

shortages, the conflict in Ukraine and simmering US/China

geo-political tensions, have increased companies' desire to move

production nearer to end customers. With wage inflation now an

issue in the US and other markets, businesses establishing new

production plants and warehouses have a stronger incentive to

incorporate factory automation into these facilities wherever

feasible. Japan is fortunate to be home to some of the world's

leading automation companies, of which the Company holds several,

including Keyence and SMC. Both of these long-held Premium rated

companies not only have dominant shares and high profitability but

also significant potential for improved shareholder returns. For

example, since the son of the founder took the helm at SMC, we have

already seen a step up in shareholder returns and an important

change in auditor. However, with over Yen600 billion in net cash

and shareholdings in over twenty companies there is still much more

the company can do.

Japan is a country with few natural resources and there is a

clear need to shift its energy mix away from a heavy reliance on

imported fossil fuels. Our portfolio includes shares in Japan's

leading solar energy REIT (Canadian Solar Infrastructure) and in

several companies that help reduce energy usage, such as Daikin,

which produces energy-efficient air conditioners. JGC, which

constructs liquid natural gas (LNG) production plants, has a net

cash position equivalent to 60% of its market capitalisation. It

announced a significant share buyback programme earlier in the year

but can clearly do far more to improve its capital efficiency.

Meanwhile, Hitachi, which is the global leader in cables used for

transmitting renewable energy, has made huge strides in corporate

governance reducing the number of listed subsidiaries from nine to

zero. With a resolute focus on free cash flow, we expect more

emphasis on shareholder return from now on.

Japan is home to many global leading consumer brands such as

Fast Retailing (operator of the Uniqlo clothing brand) and computer

games companies such as Sony and Nintendo. Once again, we can find

companies that combine long-term structural growth with significant

potential from improved governance. Nintendo, which owns some of

the world's strongest intellectual property, with characters such

as Super Mario and Pokemon, has roughly a quarter of its market cap

in net cash and could do much more in terms of shareholder returns.

Meanwhile, Shimano, which has over 75% market share in gears for

bicycles and will therefore benefit from a long-term trend of more

people cycling, also has close to a quarter of its market cap in

net cash. We are engaging with the company to improve its capital

efficiency.

One feature of the Japanese market is the relatively low level

of sell side analyst coverage. One relatively recent purchase in

the medical technology field is Osaka Soda which has the global

number one position in an ingredient for anti-obesity drugs and is

covered by just one analyst from a large investment bank. We expect

profits to grow rapidly due to the uptake of these drugs but also

think there will be a significant shift in shareholder returns as

the company already has a strong net cash balance sheet.

There are many companies in Japan that are well positioned to

compound earnings growth over many years often regardless of the

economic cycle. We can own these companies which, as illustrated

above, are also very well placed to benefit from the corporate

governance changes that we see. There is no need to sacrifice

business quality to find such opportunities. Indeed, the companies

which have the businesses with the best long-term outlooks are

often the same as those with the strongest but most inefficient

balance sheets.

Portfolio Characteristics

Over the last two years, the characteristics of the portfolio

have changed due to movements in share prices and companies that we

have bought and sold such as our purchase of Tokyo Marine, Nippon

Telegraph & Telephone, Hitachi and ITOCHU.

This can be seen both in the types of companies invested,

comparing the themes as at 30th September 2023 with those from 30th

September 2021, and also in the portfolio metrics:

30th September 2023 30th September 2021

JFJ Index JFJ Index

-------------------------------- --------------- ------ --------------- ------

Forward Price to Earning Ratio

(12 months forward) 20x 14x 36x 15x

-------------------------------- --------------- ------ --------------- ------

Return on Equity* 12.4% 9% 13.5% 8.7%

-------------------------------- --------------- ------ --------------- ------

Operating Margin 20% 13% 22% 12%

-------------------------------- --------------- ------ --------------- ------

Active Share 92 93

-------------------------------- --------------- ------ --------------- ------

Gearing 13.9% 12.7%

(12-month (12-month

average 12.7%) average 14.0%)

-------------------------------- --------------- ------ --------------- ------

Turnover (annualised) 22% 19%

-------------------------------- --------------- ------ --------------- ------

*Return on Equity is a financial ratio which shows how much net

income a company generates per dollar of invested capital. It helps

investors understand how efficiently a firm uses its money to

generate profit. The numbers shown above is a weighted average

number for the companies included in the Company's portfolio and

the companies included in TOPIX.

Significant contributors and detractors to performance

Top Contributors

The largest contributors to returns over the 12-month review

period included ASICS, which manufactures and distributes sporting

goods and equipment. The company is Quality rated. The company is

continuing to deliver strong results thanks to its decision to

refocus on its core product, running shoes, following a difficult

period between 2016 and 2020 when it attempted to compete with Nike

and Adidas in casual trainers (sneakers). ITOCHU, a trading

conglomerate operating in a variety of sectors including textiles,

fashion and machinery, also boosted returns. It is rated Standard.

Companies in the wholesale trade sector performed well both because

of enhanced shareholder returns, and because Warren Buffett

announced stakes in the five major companies within the sector.

Financial stocks performed well in general, and Tokio Marine, a

Quality rated insurance company, has been enhancing its returns to

shareholders, which has benefited the share price. Capcom, a

Quality rated gaming and multi-media company, continued to post

consistent results from its key game software franchises, including

Monster Hunter and Resident Evil. Hitachi, an industrial

conglomerate focused on digital systems, green energy, metals,

construction and automotives, has dramatically changed its business

portfolio over the last few years and now owns several businesses

which are global leaders in their sectors. Results remain strong.

The company is Standard rated.

Top Detractors

The major detractors from performance over the period included

Monotaro, Japan's top B2B e-commerce company. It is rated Premium.

The company's share price fell due to a slowing sales growth. We

retain our view that the business has a long growth runway, but we

reduced the position over the year. Our decision not to hold the

Standard rated Mitsubishi UFJ Financial Group also detracted from

returns. As mentioned above, banks and other financial names

performed well on expectations that monetary policy will eventually

be tightened, a move that would boost earnings after a long period

of negative interest rates. Nihon M&A Center is Japan's leading

provider of mergers and acquisitions related services. It has been

dogged by concerns about increased competition from new entrants to

the sector. We downgraded the stock's strategic classification to

Quality accordingly and have since closed the position. The shares

of Premium rated Nomura Research Institute, a consultancy that

advises companies in their digital strategy, de-rated despite the

company's favourable long-term outlook and its good execution. We

see no change in the investment case and continue to hold the

stock. Benefit One, a Premium rated name, specialises in providing

fringe benefits for employees. During the pandemic the company's

earnings, and share price, rose sharply as it organised

vaccinations for its clients' employees, but the share price has

since declined as earnings return to pre-pandemic levels.

Portfolio Activity - New Purchases

The ongoing improvements in corporate governance have put many

more companies on the path towards becoming the kind of quality

businesses that fit our investment criteria. This is a very

exciting development for us, as it means we are seeing many more

investment opportunities. One such example is the conglomerate =,

which has dramatically reduced its business portfolio, so that it

now only holds several world-leading businesses, and no listed

subsidiaries, down from nine previously. We have also opened a

position in Secom, Japan's largest provider of security

systems.

Secom has substantial net cash which has been depressing

returns. However, the company recently announced its first price

increase in over 20 years and two buybacks, its first for almost 15

years. This led us to upgrade Secom's strategic classification and

purchase the shares in anticipation of significantly enhanced

shareholder returns. We also added the standard rated T&D

Holdings, a leading life insurance provider, for the same

reason.

Other new names include Seven & I Holdings. This standard

rated company is the largest operator of convenience stores in

Japan, under the 7/11 brand. Domestically, the company operates in

a three-player oligopoly characterised by high profitability and

strong free cash flow. The company is also the market leader in the

US's much more fragmented market, where there is an opportunity for

it to gain market share. Additionally, the company has started to

restructure its non-core businesses in Japan - a process that we

hope will continue. Japan Material is a provider of infrastructure

services to semiconductor factories. The company is a major

beneficiary of the deglobalisation trend intended to shorten,

diversify and secure supply chains by relocating semiconductor

manufacturing inside Japan. We also opened a position in Unicharm,

a leading manufacturer of consumer goods such as adult diapers,

feminine hygiene products and pet care items.

Portfolio Activity - Largest Disposals

These purchases above were funded by the outright sale of

several holdings whose investment cases had deteriorated, including

Nihon M&A Center (see above). We disposed of our positions in

Nippon Prologis REIT, a Standard rated company, on concerns of

increasing supply in the warehousing industry, and in JSR, a

Quality rated specialist chemicals producer operating in the

plastics, digital solutions and life sciences industries. Having

aggressively restructured to focus on chemicals used in the

production of semiconductors, JSR is about to be acquired by the

government-led Japan Investment Corporation. With limited upside

potential following the bid, we opted to sell. The bulk of the

value in Digital Garage, an IT services company focusing on payment

platforms, derives from its 20% stake in Kakaku.com, an

internet-based provider of product and service reviews. However,

Kakaku has been struggling to grow, so we sold this Standard rated

name. Misumi, which focuses on factory automation, tools and

components, is facing increasing competition, particularly from its

Chinese rival, Yiheda, which prompted a downgrade in its strategic

classification to Quality. We subsequently closed the position. We

also sold CyberAgent, an internet advertiser, as the path to

profitability for its digital television service became

increasingly unclear, and we sold Oriental Land, the operator of

Tokyo Disneyland, and M3, an online information service for

doctors, on valuation grounds.

The net effect of these purchases and sales is that the

portfolio trades on a significantly lower multiple than over the

last three years, at under 20x earnings versus over 30x at the

peak. Meanwhile, its quality and growth characteristics are

unchanged, with the portfolio generating an ROE almost 38% higher

than the market.

Outlook

Recent developments in the Japanese economy and corporate sector

have reinforced our optimism about the market's medium to long term

prospects. Economic activity is strengthening and encouraging wage

trends will be supported by the structurally tight labour market.

Wage growth should help end Japan's long period of damaging and

seemingly intractable deflation and have a positive impact on

consumption and the overall economy. The BoJ will welcome these

developments, so, unlike in other major markets, investors need not

be overly concerned about aggressive monetary tightening. As

discussed above, Japan is also undergoing a major technological

transformation as businesses and government increase their efforts

to digitise and automate their operations. This will lay the base

for significant growth and productivity gains over the medium term

and provide a supportive environment for the dynamic, quality

businesses in which we invest.

In addition, while we continue to face some headwinds, and we

cannot say how long these will last, the spread between value and

growth has narrowed and is no longer at extreme levels.

However, for us, the improvements in corporate governance are

the most important reason to be excited about the outlook for

Japanese equities. This trend is looking increasingly structural in

nature, and we are seeing signs that the trend is accelerating. If

we are correct, there is potential for the whole market, including

the Company's portfolio holdings, to move to a higher

valuation.

The value of the local currency is another key consideration for

foreign investors, and there is cause for some optimism on this

front too. The Economist's Big Mac Index suggests it is 43%

undervalued and the table below provides further illustrations of

disparities between prices in the UK and Japan. Although we do not

know when the yen's weakness will unwind, any reversal should be

beneficial for GBP-denominated investors.

The Japanese market offers many exciting investment

opportunities for those prepared to seek them out. The market is

deep, broad and liquid, with over 3,000 listed stocks. Yet it is

under-researched by buy and sell side analysts - over 50% of the

stocks have no sell-side coverage, versus the US market where 50%

of companies are scrutinised by 20 or more sell-side analysts. In

addition, most sell-side analysts who do cover Japan focus on the

short term. For example, only two sell-side analysts publish 5-year

forecasts for Toyota. This is a great environment for

well-resourced, locally based teams such as JPMorgan's to identify

interesting companies that are overlooked by other managers.

And although the stock market has reached multi-decade highs,

valuations are still compelling when compared to other markets. The

Japanese market is still trading at 14x earnings (on a forward PE

basis) and at 1.4x book value (trailing PB) - valuations which

still appear to reflect past perceptions of the market, rather than

the opportunities that lie ahead.

For all these reasons, we believe our optimism about the

Japanese market is well-founded, and we are confident about the

long-term prospects of our portfolio holdings. But we are not

complacent. We will continue our search for companies capable of

thriving regardless of the near-term macroeconomic environment.

Most importantly, we remain convinced that our investment approach

will ensure the Company continues to deliver outright gains and

outperformance for shareholders over the long term.

We thank you for your ongoing support.

Nicholas Weindling

Miyako Urabe

Investment Managers 5th December 2023

PRINCIPAL AND EMERGING RISKS

The Directors confirm that they have carried out a robust

assessment of the principal risks facing the Company, including

those that would threaten its business model, future performance,

solvency or liquidity. With the assistance of JPMF, the Audit

Committee has drawn up a risk matrix, which identifies the key

risks to the Company. These are reviewed and noted by the Board.

The risks identified and the broad categories in which they fall,

and the ways in which they are managed or mitigated are summarised

below. The AIC Code of Corporate Governance requires the Audit

Committee to put in place procedures to identify emerging risks.

Emerging risks, which are not deemed to represent an immediate

threat, are considered by Audit Committee as they come into view

and are incorporated into the existing review of the Company's risk

register. However, since emerging risks are likely to be more

dynamic in nature, they are considered on a more frequent basis,

through the remit of Board when the Audit Committee does not meet.

The key principal and emerging risks identified are summarised

below.

Movement in

risk

status in year

to

Principal Description Mitigating activities 30th September

risk 2023

-------------------------------- -------------------------------------- ---------------

Investment Management and Performance

Underperformance Poor implementation The Board manages these risks é

of the investment by monitoring the Investment

strategy, for example Managers diversification

as to thematic exposure, of investments and through

sector allocation, its investment restrictions

stock selection, undue and guidelines, which are

concentration of holdings, monitored and reported on

factor risk exposure by the Manager. The Investment

or the degree of total Manager provides the Directors

portfolio risk, may with timely and accurate

lead to underperformance management information, including

against the Company's performance data and attribution

benchmark index and analyses, revenue estimates,

peer companies. liquidity reports and shareholder

A widening of the analyses. The Board monitors

discount could result the implementation and results

in loss of value for of the investment process

shareholders. with the Investment Managers,

at least one of whom attends

all appropriate Board meetings,

and reviews data which show

measures of the Company's

risk profile. The Investment

Managers employ the Company's

gearing tactically, within

a strategic range set by

the Board. The Board holds

a separate meeting devoted

to strategy each year.

The Board monitors the level

of both the absolute and

sector relative premium/discount

at which the shares trade.

The Board reviews both sales

and marketing activity and

sector relative performance,

which it believes are the

primary drivers of the relative

discount level. In addition,

the Company has authority

to buy back its existing

shares to enhance the NAV

per share for remaining shareholders

when deemed appropriate.

-------------------------------- -------------------------------------- ---------------

Market and Market risk arises The Board believes that shareholders é

Economic from uncertainty about expect that the Company will

Risk the future prices and should be fairly fully

of the Company's investments, invested in Japanese equities

which might result at all times. The Board therefore

from political, economic, would normally only seek

fiscal, monetary, to mitigate market risk through

regulatory or climate guidelines on gearing given

change, including to the Investment Manager.

the impact from energy The Board receives regular

shocks, recessions reports from the Investment

or wars. It represents Manager's strategists and

the potential loss Investment Managers regarding

the Company might market outlook and gives

suffer through holding the Investment Mangers discretion

investments in the regarding acceptable levels

face of negative market of gearing and/or cash. Currently

movements. The Board the Company's gearing policy

considers thematic is to operate within a range

and factor risks, of 5% net cash to 20% geared.

stock selection and The majority of the Company's

levels of gearing assets, liabilities and income

on a regular basis are denominated in yen rather

and has set investment than in the Company's functional

restrictions and guidelines currency of sterling (in

which are monitored which it reports). As a result,

and reported on by movements in the yen:sterling

the Manager. exchange rate may affect

A part of this risk the sterling value of those

is Currency risk which items and therefore impact

arises from currency on reported results and/or

volatility and/or financial position and there

significant currency is an inherent risk from

movements, principally these exchange rate movements.

in the yen:sterling It is the Company's policy

rate. not to undertake foreign

currency hedging. Further

details about the foreign

currency risk may be found

in note 21 on page 89 in

the Annual Report and Financial

Statements.

-------------------------------- -------------------------------------- ---------------

Loss of Investment A sudden departure The Board seeks assurance è

Team or Investment of an Investment Manager that the Manager takes steps

Manager or several members to reduce the risk arising

of the investment from such an event by ensuring

management team could appropriate succession planning

result in a short and the adoption of a team

term deterioration based approach, as well as

in investment performance. special efforts to retain

key personnel. The Board

engages with the senior management

of the Manager in order to

mitigate this risk.

-------------------------------- -------------------------------------- ---------------

Operational Risks

Outsourcing Disruption to, or Details of how the Board è

failure of, the Manager's monitors the services provided

accounting, dealing by JPM and its associates

or payments systems and the key elements designed

or the Depositary to provide effective risk

or Custodian's records management and internal control

may prevent accurate are included within the Risk

reporting and monitoring Management and Internal Controls

of the Company's financial section of the Corporate

position or a misappropriation Governance Statement on pages

of assets. 56 to 62 of the Annual Report

and Financial Statements.

The Manager has a comprehensive

business continuity plan

which facilitates continued

operation of the business

in the event of a service

disruption.

-------------------------------- -------------------------------------- ---------------

Cyber Crime The threat of cyber-attack, The Company benefits directly è

in all guises, is and/or indirectly from all

regarded as at least elements of JPMorgan's Cyber

as important as more Security programme. The information

traditional physical technology controls around

threats to business physical security of JPMorgan's

continuity and security. data centres, security of

its networks and security

of its trading applications,

are tested by independent

auditors and reported every

six months against the AAF

Standard.

-------------------------------- -------------------------------------- ---------------

Corporate Governance

Statutory The Company must also The Board relies on the services è

and Regulatory comply with the provisions of its Company Secretary,

Compliance of the Companies Act the Manager and its professional

2006 and, since its advisers to ensure compliance

shares are listed with the Companies Act 2006,

on the London Stock the UKLA Listing Rules, DTRs,

Exchange, the UKLA MAR and AIFMD. Details of

Listing Rules and the Company's compliance

Disclosure Guidance with Corporate Governance

and Transparency Rules best practice, are set out

('DTRs'). A breach in the Corporate Governance

of the Companies Act Statement on pages 56 to

could result in the 62 of the Annual Report and

Company and/or the Financial Statements.

Directors being fined The Section 1158 qualification

or the subject of criteria are continually

criminal proceedings. monitored by the Manager

Breach of the UKLA and the results reported

Listing Rules or DTRs to the Board each month.

could result in the

Company's shares being

suspended from listing

which in turn would

breach Section 1158.

In order to qualify

as an investment trust,

the Company must comply

with Section 1158

of the Corporation

Tax Act 2010 ('Section

1158'). Were the Company

to breach Section

1158, it may lose

investment trust status

and, as a consequence,

gains within the Company's

portfolio would be

subject to Capital

Gains Tax.

-------------------------------- -------------------------------------- ---------------

Environmental

Climate Change Climate change has The Board receives ESG reports é

become one of the from the Manager on the portfolio

most critical issues and the way ESG considerations

confronting companies are integrated into the investment

and their investors. decision-making, so as to

Climate change can mitigate risk at the level

have a significant of stock selection and portfolio

impact on the business construction. As extreme

models, sustainability weather events become more

and even viability common, the Manager is increasingly

of individual companies, focussed on assessing the

whole sectors and impact on investee companies.

even asset classes. In addition, the resilience

and Business Continuity Plans

('BCP') will come under more

focus.

The Board has considered

the risk of climate risk

on the investment portfolio

of the Company and it is

built in the market prices.

-------------------------------- -------------------------------------- ---------------

Movement in

risk

status in year

to

Emerging Description Mitigating activities 30th September

risk 2023

-------------------------------- -------------------------------------- ---------------

Specific to Japan

Natural Disasters Although natural disasters The Manager reports on Business é

anywhere in the world Continuity Plans ('BCPs')

could impact individual and other mitigation plans

companies, the Board in place for itself and other

believes the largest key service providers. BCPs

such impact could plans are regularly tested

arise from an earthquake and applied, including split

causing general economic teams, relocations and limiting

damage to Japan and access to/meetings with third

to the operations parties. The Manager discusses

of specific companies BCPs with investee companies.

in the portfolio.

The Japanese government

believes there is

a 70% probability

of an earthquake,

registering a magnitude

seven on the Richter

Scale, hitting Tokyo

over the next 30 years.

-------------------------------- -------------------------------------- ---------------

Global

Social Dislocation Social dislocation/civil The Manager's market strategists é

& Conflict unrest/war around are available for the Board

the world may threaten and can discuss market trends.

global economic growth External consultants and

and, consequently, experts can be accessed by

companies in the portfolio. the Board. The Board can,

with shareholder approval,

look to amend the investment

policy and objectives of

the Company to gain exposure

to or mitigate the risks

arising from geopolitical

instability although this

is limited if it is truly

global.

-------------------------------- -------------------------------------- ---------------

Artificial While AI might be The Board will work with è

Intelligence a great opportunity the Manager to monitor developments

(AI) and force for good, concerning AI as its use

there may also be evolves and consider how

an increasing risk it might threaten the Company's

to business and society activities, which may, for

more widely. AI has example, include a heightened

become a powerful threat to cybersecurity.

tool with the potential The Board will work closely

to disrupt and even with the Manager in identifying

to harm. The use of these threats and, in addition,

AI could be a significant monitor the strategies of

disrupter to business our service providers. Furthermore,

processes and whole the Company's investment

companies leading process includes consideration

to added uncertainty of technological advancement

in corporate valuations. and the resultant potential

to disrupt both individual

companies and the wider markets.

-------------------------------- -------------------------------------- ---------------

TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES.

Details of the management contract are set out in the Directors'

Report on page 49 of the Annual Report and Financial Statements.

The management fee payable to the Manager for the year was

GBP4,498,000 (2022: GBP5,124,000) of which GBPnil (2022: GBPnil)

was outstanding at the year end.

Included in administration expenses in note 6 on page 82 are

safe custody fees amounting to GBP104,000 (2022: GBP74,000) payable

to JPMorgan Chase Bank, N.A., of which GBP36,000 (2022: GBPnil) was

outstanding at the year end.

The Manager may carry out some of its dealing transactions

through group subsidiaries. These transactions are carried out at

arm's length. The commission payable to JPMorgan Securities for the

year was GBP2,000 (2022: GBP2,000) of which GBPnil (2022: GBPnil)

was outstanding at the year end.

Handling charges on dealing transactions amounting to GBP2,000

(2022: GBP5,000) were payable to JPMorgan Chase Bank N.A. during

the year of which GBP1,000 (2022: GBP2,000) was outstanding at the

year end.

At the year end, total cash of GBP2,141,000 (2022:

GBP27,974,000) was held with JPMorgan Chase. A net amount of

interest of GBP2,000 (2022: GBPnil) was receivable by the Company

during the year from JPMorgan Chase of which GBPnil (2022: GBPnil)

was outstanding at the year end.

Stock lending income amounting to GBP524,000 (2022: GBP682,000)

was receivable by the Company during the year. JPMAM commissions in

respect of such transactions amounted to GBP58,000 (2022:

GBP76,000).

Full details of Directors' remuneration and shareholdings can be

found on pages 54 and 55 and in note 6 on page 82 of the Annual

Report and Financial Statements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report

& Financial Statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law, the Directors

have elected to prepare the Annual Report & Financial

Statements in accordance with United Kingdom generally accepted

accounting practice (United Kingdom Accounting Standards) including

FRS 102 'The Financial Reporting Standards applicable in the UK and

Republic of Ireland' and applicable laws. Under company law, the

Directors must not approve the Annual Report & Financial

Statements unless they are satisfied that, taken as a whole, Annual

Report & Financial Statements are fair, balanced and

understandable, provide the information necessary for shareholders

to assess the Company's position and performance, business model

and strategy and that they give a true and fair view of the state

of affairs of the Company and of the total return or loss of the

Company for that period. In order to provide these confirmations,

and in preparing these Annual Report & Financial Statements,

the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on a going concern basis

unless it is inappropriate to presume that the Company will

continue in business;

and the Directors confirm that they have done so.

The Directors are responsible for keeping proper accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and to enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The accounts are published on the www.jpmjapanese.co.uk website,

which is maintained by the Company's Manager. The maintenance and

integrity of the website maintained by the Manager is, so far as it

relates to the Company, the responsibility of the Manager. The work

carried out by the Auditors does not involve consideration of the

maintenance and integrity of this website and, accordingly, the

Auditors accept no responsibility for any changes that have

occurred to the accounts since they were initially presented on the

website. The accounts are prepared in accordance with UK

legislation, which may differ from legislation in other

jurisdictions.

Under applicable law and regulations the Directors are also

responsible for preparing a Directors' Report, Strategic Report,

Statement of Corporate Governance and Directors' Remuneration

Report that comply with that law and those regulations.

Each of the Directors, whose names and functions are listed on

pages 47 and 48 of the Annual Report and Financial Statements,

confirms that, to the best of their knowledge:

-- the financial statements, which have been prepared in

accordance with United Kingdom Accounting Standards, and applicable

law), (United Kingdom Generally Accepted Accounting Practice) give

a true and fair view of the assets, liabilities, financial position

and net return or loss of the Company; and

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company, together with a description of the principal risks and

uncertainties that the Company faces.

The Board confirms that it is satisfied that the Annual Report

and Financial Statements taken as a whole are fair, balanced and

understandable and provide the information necessary for

shareholders to assess the Company's position and performance,

business model and strategy and that they give a true and fair view

of the state of affairs of the Company and of the total return or

loss of the Company for that period.

For and on behalf of the Board

Christopher Samuel

Chairman

5th December 2023

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30th September 2023

2023 2022

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- --------- -------- --------- ---------- -----------

Gains/(losses) on investments

held at fair value

through profit or loss - 33,592 33,592 - (418,203) (418,203)

Net foreign currency gains(1) - 12,918 12,918 - 8,328 8,328

Income from investments 14,180 135 14,315 14,016 - 14,016

Other interest receivable

and similar income 526 - 526 682 - 682

------------------------------- --------- --------- -------- --------- ---------- -----------

Gross return/(loss) 14,706 46,645 61,351 14,698 (409,875) (395,177)

Management fee (450) (4,048) (4,498) (512) (4,612) (5,124)

Other administrative expenses (1,276) - (1,276) (959) - (959)

------------------------------- --------- --------- -------- --------- ---------- -----------

Net return/(loss) before

finance costs and taxation 12,980 42,597 55,577 13,227 (414,487) (401,260)

Finance costs (134) (1,202) (1,336) (141) (1,272) (1,413)

------------------------------- --------- --------- -------- --------- ---------- -----------

Net return/(loss) before

taxation 12,846 41,395 54,241 13,086 (415,759) (402,673)

Taxation (1,418) - (1,418) (1,400) - (1,400)

------------------------------- --------- --------- -------- --------- ---------- -----------

Net return/(loss) after

taxation 11,428 41,395 52,823 11,686 (415,759) (404,073)

------------------------------- --------- --------- -------- --------- ---------- -----------

Return/(loss) per share 7.46p 27.03p 34.49p 7.48p (266.28)p (258.80)p

(1) Foreign currency gains are due to Yen denominated loan notes and bank loans.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

in the year.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance issued

by the Association of Investment Companies.

Net return/(loss) after taxation represents the profit or loss

for the year and also total comprehensive income/(expense).

STATEMENT OF CHANGES IN EQUITY

Called Capital

up

share redemption Other Capital Revenue

capital reserve(1) reserve(1) reserve(1) reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- ----------- ----------- ----------- ----------- -----------

At 30th September 2021 40,312 8,650 166,791 923,650 15,141 1,154,544

Repurchase of shares into

Treasury - - - (11,802) - (11,802)

Net (loss)/return - - - (415,759) 11,686 (404,073)

Dividend paid in the year

(note 2) - - - - (8,295) (8,295)

--------------------------- -------- ----------- ----------- ----------- ----------- -----------

At 30th September 2022 40,312 8,650 166,791 496,089 18,532 730,374

Repurchase of shares into

Treasury - - - (18,180) - (18,180)

Net return - - - 41,395 11,428 52,823

Dividend paid in the year

(note 2) - - - - (9,546) (9,546)

--------------------------- -------- ----------- ----------- ----------- ----------- -----------

At 30th September 2023 40,312 8,650 166,791 519,304 20,414 755,471

--------------------------- -------- ----------- ----------- ----------- ----------- -----------

(1) See footnote to note 16 on page 86 of the Annual Report & Financial Statements.

STATEMENT OF FINANCIAL POSITION

At 30th September 2023

2023 2022

GBP'000 GBP'000

------------------------------------------------------- --------- ----------

Fixed assets

Investments held at fair value through profit or loss 859,289 815,789

------------------------------------------------------- --------- ----------

Current assets

Debtors 12,967 7,161

Cash and cash equivalents 2,141 27,974

------------------------------------------------------- --------- ----------

15,108 35,135

Current liabilities

Creditors: amounts falling due within one year (47,867) (9,619)

------------------------------------------------------- --------- ----------

Net current (liabilities)/assets (32,759) 25,516

------------------------------------------------------- --------- ----------

Total assets less current liabilities 826,530 841,305

Creditors: amounts falling due after more than one

year (71,059) (110,931)

------------------------------------------------------- --------- ----------

Net assets 755,471 730,374

------------------------------------------------------- --------- ----------

Capital and reserves

Called up share capital 40,312 40,312

Capital redemption reserve 8,650 8,650

Other reserve 166,791 166,791

Capital reserves 519,304 496,089

Revenue reserve 20,414 18,532

------------------------------------------------------- --------- ----------

Total shareholders' funds 755,471 730,374

------------------------------------------------------- --------- ----------

Net asset value per share 500.9p 472.1p

Included in the investments held at fair valuation through

profit or loss are investments of GBP77,851,000 (2022:

GBP167,908,000) that are on loan under securities lending

arrangements.

STATEMENT OF CASH FLOWS

For the year ended 30th September 2023

2023 2022(1)

GBP'000 GBP'000

------------------------------------------------------ ----------- -----------

Cash flows from operating activities

Net profit/(loss) before finance costs and taxation 55,577 (401,260)

Adjustment for:

Net (gains)/losses on investments held at fair value

through profit or loss (33,592) 418,203

Net foreign currency gains (12,918) (8,328)

Dividend income (14,315) (14,016)

Interest income (2) -

Realised loss on foreign exchange transactions (695) (1,215)

Increase in accrued income and other debtors - (19)

Increase/(decrease) in accrued expenses 77 (29)

------------------------------------------------------ ----------- -----------

Net cash outflow from operations before dividends

and interest (5,868) (6,664)

------------------------------------------------------ ----------- -----------

Dividends received 12,885 10,967

Interest received 2 -

------------------------------------------------------ ----------- -----------

Net cash inflow from operating activities 7,019 4,303

------------------------------------------------------ ----------- -----------

Purchases of investments (190,000) (176,268)

Sales of investments 183,372 242,438

------------------------------------------------------ ----------- -----------

Net cash (outflow)/inflow from investing activities (6,628) 66,170

------------------------------------------------------ ----------- -----------

Dividends paid (9,546) (8,295)

Repurchase of shares into Treasury (18,180) (11,820)

Repayment of bank loan (9,225) (60,364)

Drawdown of bank loan 12,014 30,979

Interest paid (1,287) (1,390)

------------------------------------------------------ ----------- -----------

Net cash outflow from financing activities (26,224) (50,890)

------------------------------------------------------ ----------- -----------

(Decrease)/increase in cash and cash equivalents (25,833) 19,583

------------------------------------------------------ ----------- -----------

Cash and cash equivalents at start of year 27,974 8,299

Exchange movements - 92

------------------------------------------------------ ----------- -----------

Cash and cash equivalents at end of year 2,141 27,974

------------------------------------------------------ ----------- -----------

Cash and cash equivalents consist of:

Cash and short term deposits 2,141 27,974

------------------------------------------------------ ----------- -----------

Total 2,141 27,974

------------------------------------------------------ ----------- -----------

(1) The presentation of the Cash Flow Statement, as permitted

under FRS 102, has been changed so as to present the reconciliation

of 'net return/(loss) before finance costs and taxation' to 'net

cash inflow from operating activities' on the face of the Cash Flow

Statement. Previously, this was shown by way of note. Interest paid

has also been reclassified to financing activities, previously

shown under operating activities, as this relates to the loans

drawn down.

Analysis of change in net debt

As at Other As at

30th September non-cash 30th September

2022 Cash flows movements 2023

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------------- ----------- ---------- ---------------

Cash and cash equivalents:

Cash and cash equivalents 27,974 (25,833) - 2,141

---------------------------- --------------- ----------- ---------- ---------------

27,974 (25,833) - 2,141

Borrowings

Debt due within one year (40,228) (2,789) 4,584 (38,433)

Debt due after one year (79,986) - 8,927 (71,059)

---------------------------- --------------- ----------- ---------- ---------------

(120,214) (2,789) 13,511 (109,492)

---------------------------- --------------- ----------- ---------- ---------------

Net debt (92,240) (28,622) 13,511 (107,351)

---------------------------- --------------- ----------- ---------- ---------------

NOTES TO THE FINANCIAL STATEMENTS

For the year ended 30th September 2023

1. Accounting policies

(a) Basis of accounting

The financial statements are prepared under the historical cost

convention, modified to include fixed asset investments at fair

value, in accordance with the Companies Act 2006, United Kingdom

Generally Accepted Accounting Practice ('UK GAAP'), including FRS

102 'The Financial Reporting Standard applicable in the UK and

Republic of Ireland' and with the Statement of Recommended Practice

'Financial Statements of Investment Trust Companies and Venture

Capital Trusts' (the 'SORP') issued by the Association of

Investment Companies in July 2022.

All of the Company's operations are of a continuing nature.

The financial statements have been prepared on a going concern

basis. The Directors have a reasonable expectation that the Company

has adequate resources to continue in operational existence up to

31st January 2025 which is at least 12 months from the date of

approval of these Financial Statements. In making their assessment

the Directors have reviewed income and expense projections,

reviewed the liquidity of the investment portfolio and considered

the Company's ability to meet liabilities as they fall due. In

forming this opinion, the directors have considered direct and

indirect impact of the ongoing conflict between Ukraine and Russia

and more recently between Israel and Palestine on the going concern

and viability of the Company. In making their assessment, the

Directors have reviewed income and expense projections and the

liquidity of the investment portfolio, and considered the

mitigation measures which key service providers, including the

Manager, have in place to maintain operational resilience in light

of disruption from pandemics. The disclosures on long term

viability and going concern on pages 45 and 63 of the Directors'

Report form part of these financial statements.

In preparing these financial statements the Directors have

considered the impact of climate change risk as a principal and as

an emerging risk as set out on page 41 of the Annual Report and

Financial Statements and have concluded that there was no further

impact of climate change to be taken into account as the

investments are valued based on market pricing, which incorporates

market participants view of climate risk.

The policies applied in these financial statements are

consistent with those applied in the preceding year.

2. Dividends

(a) Dividends paid and proposed

2023 2022

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Dividends paid

2022 final dividend paid of 6.2p (2021: 5.3p) per

share 9,546 8,295

---------------------------------------------------- -------- --------

Dividend proposed

2023 final dividend proposed of 6.5 p (2022: 6.2p)

per share 9,804 9,546

---------------------------------------------------- -------- --------

All dividends paid and proposed in the year are and will be

funded from the revenue reserve.

The dividend proposed in respect of the year ended 30th

September 2023 is subject to shareholder approval at the

forthcoming Annual General Meeting. In accordance with the

accounting policy of the Company, this dividend will be reflected