TIDMJZCP

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end investment company incorporated with limited liability under the

laws of Guernsey with registered number 48761)

INTERIM RESULTS FOR THE SIX-MONTH PERIODED

31 AUGUST 2023

LEI: 549300TZCK08Q16HHU44

(Classified Regulated Information, under DTR 6 Annex 1 section 1.2)

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014 WHICH FORMS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

9 November 2023

JZ Capital Partners Limited, the London listed fund that has investments in US

and European micro-cap companies and US real estate, announces its interim

results for the period ended 31 August 2023.

Financial and Operational Highlights

· NAV per share of $4.04 (FYE 28/02/23: $4.06).

· NAV of $312.7 million (FYE 28/02/22: $314.5 million).

· Total realisation and distribution proceeds of $9.9 million.

· The US micro-cap portfolio has overall performed well, delivering a net

increase of 7 cents per share, while the European portfolio remained flat for

the six-month period and continues to be challenged by the economic headwinds in

Europe and war in Ukraine. However, both portfolios are working towards several

realisations.

· The Company has two remaining properties with equity value: Esperante, an

office building in West Palm Beach, Florida, and 247 Bedford Avenue, a retail

building with Apple as the primary tenant, in Williamsburg, Brooklyn.

Investment Policy and Liquidity

· The Company remains focused on the implementation of its New Investment

Policy. This policy focuses on realising the maximum value from the Company's

investment portfolio and, after repaying its debt obligations, returning capital

to shareholders.

· Since the Company adopted its New Investment Policy in August 2020, the

Company has achieved realisations in excess of $395 million and repaid

approximately $225 million of debt.

· The Company's outstanding debt is limited to its $45 million Senior Credit

Facility due 26 January 2027.

· Although no significant realisations have been achieved in the period under

review, the Board anticipates potential near-term realisations that would enable

the Company to repay its Senior Credit Facility and, subject to retaining

sufficient funds to cover existing obligations and support certain existing

investments to maximise their value, to plan to commence to make distributions

to shareholders.

David Macfarlane, Chairman of JZCP, said: "Our view of the outlook for the

Company remains substantially unchanged to that reported at year-end. The

Company is committed to delivering on the New Investment Policy and is well

-positioned to weather potential financial pressures from an economic downturn

or period of volatility in financial markets.

The stability of the Company's balance sheet should allow the Investment Adviser

the time needed to maximise the value of the portfolio and implement the policy

in an orderly manner. The Board continues to expect that in due course a

significant amount of capital will be returned to shareholders."

Market Abuse Regulation:

The information contained within this announcement is inside information as

stipulated under MAR. Upon the publication of this announcement, this inside

information is now considered to be in the public domain. The person responsible

for arranging the release of this announcement on behalf of the Company is David

Macfarlane, Chairman.

For further information:

Kit Dunford +44 (0)7717 417 038

FTI Consulting

David Zalaznick +1 212 485 9410

Jordan/Zalaznick Advisers, Inc.

Matt Smart +44 (0) 1481 745 228

Northern Trust International Fund

Administration Services (Guernsey) Limited

About JZ Capital Partners

JZCP has investments in US and European micro-cap companies, as well as real

estate properties in the US.

JZCP's Investment Adviser is Jordan/Zalaznick Advisers, Inc. ("JZAI") which was

founded by David Zalaznick and Jay Jordan in 1986. JZAI has investment

professionals in New York, Chicago, London and Madrid.

In August 2020, the Company's shareholders approved changes to the Company's

investment policy. Under the new policy, the Company will make no further

investments except in respect of which it has existing obligations and to

continue to selectively supporting the existing portfolio. The intention is to

realise the maximum value of the Company's investments and, after repayment of

all debt, to return capital to shareholders.

JZCP is a Guernsey domiciled closed-ended investment company authorised by the

Guernsey Financial Services Commission. JZCP's shares trade on the Specialist

Fund Segment of the London Stock Exchange.

For more information please visit www.jzcp.com.

The Directors present the results for the Company for the six-month period ended

31 August 2023. The NAV per share of the Company has declined from $4.06 as at

28 February 2023 to $4.04 as at 31 August 2023.

This decline results mainly from a modest excess of finance and administrative

costs over net write-ups of some investments during the period.

Investment Policy and Liquidity

The financial position of the Company is stable and strong as at 31 August 2023;

cash and treasuries were approximately $103.7 million while the Company's

outstanding debt is limited to its $45 million senior credit facility (the

"Senior Credit Facility") due 26 January 2027 (which may be repaid early without

penalty at any time).

The Board and the Investment Adviser remain focused on the implementation of the

new investment policy (the "New Investment Policy") to realise maximum value

from the Company's investments and, after the repayment of all debt, to return

capital to shareholders. Under the New Investment Policy, the Company will limit

further investment to where it has existing obligations or selectively to

support the existing portfolio.

As we said upon the publication of the results for the year-end, although the

Investment Adviser had achieved several significant realisations in the

portfolio over the previous two years, the Board believed that in the current

climate, it might be difficult to maintain that pace. So in the period under

review it has proved to be the case, no significant new realisations having been

achieved. However, the Board anticipates potential near-term realisations that

would enable the Company to repay its Senior Credit Facility and, subject to

retaining sufficient funds to cover existing obligations and support certain

existing investments to maximise their value, to plan to commence to make

distributions to shareholders.

US and European Micro-cap Portfolios

While our US micro-cap portfolio has overall performed well, with several

material realisations in the US portfolio over the past 18 months, our European

portfolio continues to be challenged by the economic headwinds in Europe and

wars in Ukraine and the Middle East. We continue to work towards several

realisations in both portfolios.

Real Estate Portfolio

The Company has two remaining properties with equity value: Esperante, an office

building in West Palm Beach, Florida, and 247 Bedford Avenue, a retail building

with Apple as the primary tenant, in Williamsburg, Brooklyn.

Outlook

Our view of the outlook for the Company remains substantially unchanged to that

reported at year-end. The Company is committed to delivering on the New

Investment Policy and is well-positioned to weather potential financial

pressures from an economic downturn or period of volatility in the financial

markets. The stability of the Company's balance sheet should allow the

Investment Adviser the time needed to maximise the value of the portfolio and

implement the New Investment Policy in an orderly manner. The Board continues to

expect that in due course a significant amount of capital will be returned to

shareholders.

David Macfarlane

Chairman

8 November 2023

Investment Adviser's Report

Dear Fellow Shareholders,

JZCP is in a strong financial position, having achieved several successful

realizations over the past eighteen months. The proceeds from the realizations

were used to repay the ZDPs, CULS and Subordinated Notes, leaving the Company

with a healthy cash balance. We need a significant amount of cash to support our

existing portfolio - as all our investments are illiquid assets, it is crucial

to have a strong cash position, especially after the Senior Credit Facility is

repaid. As we have further realizations, we will prioritize repaying remaining

debt and returning capital to shareholders.

While our remaining US micro-cap portfolio showed a gain for the past six

months, our European portfolio continues to be challenged by high interest rates

and a gathering recession in Europe. Notwithstanding these challenges, we are

pursuing several significant realizations in our European portfolio which, if

consummated, will return capital to JZCP.

The Company's two remaining real estate assets that have equity value are 247

Bedford Avenue in Brooklyn, New York (where Apple is the principal tenant), and

the Esperante office building in West Palm Beach, Florida.

As of 31 August 2023, our US micro-cap portfolio consisted of 12 businesses,

which includes three `verticals' and five co-investments, across nine

industries. Our European micro-cap portfolio consisted of 17 companies across

six industries and seven countries.

Net Asset Value ("NAV")

JZCP's NAV per share decreased 2 cents, or approximately 0.5%, during the six

-month period.

NAV per Ordinary share as of 28 February 2023 $4.06

Change in NAV due to capital gains and accrued income

+ US micro-cap 0.07

+ European micro-cap -

- Real estate (0.02)

- Other investments (0.03)

+ Income from treasuries 0.03

Other decreases in NAV

+ Net foreign exchange effect 0.02

- Finance costs (0.04)

- Expenses and taxation (0.05)

NAV per Ordinary share as of 31 August 2023 $4.04

The US micro-cap portfolio continued to perform well during the six-month

period, delivering a net increase of 7 cents per share. This was primarily due

to net accrued income of 2 cents and write-ups at ISS (4 cents) and co

-investment Deflecto (3 cents). Offsetting these increases was a decrease at US

micro-cap portfolio company Avante (2 cents).

Our European portfolio was flat for the six-month period.

Our real estate portfolio experienced a net write-down of 2 cents per share.

Returns

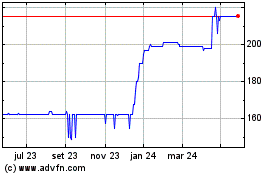

The chart below summarises cumulative total shareholder returns and total NAV

returns for the most recent six-month, one-year, three-year and five-year

periods.

31.8.2023 28.2.2023 31.8.20221

31.8.2020 31.8.2018

Share price £1.63 £1.58 £1.71 £0.89

£4.44

(in GBP)

NAV per share $4.04 $4.06 $4.45 $4.60

$9.82

(in USD)

NAV to market 49.0% 53.0% 55.3% 74.1%

41.2%

price

discount

6 month 1 year 3 year

5 year

return return return

return

Total 3.2% -5.0% 82.6%

-63.4%

Shareholders'

return (GBP)

Total NAV -0.5% -9.2% -12.2%

-58.9%

return per

share (USD)

1 The NAV per share at 31 August 2022, after a prior period adjustment was

restated from $4.71 per share to $4.45 per share and the respective total NAV

return per share for the 12-month period ended 31 August 2023 from -14.2% to

-9.2%.

Portfolio Summary

Our portfolio is well-diversified by asset type and geography, with 29 US and

European micro-cap investments across eleven industries. The European portfolio

itself is well-diversified geographically across Spain, Italy, Portugal,

Luxembourg, Scandinavia and the UK.

Below is a summary of JZCP's assets and liabilities at 31 August 2023 as

compared to 28 February 2023. An explanation of the changes in the portfolio

follows:

31.8.2023 28.2.2023

US$'000 US$'000

US micro-cap portfolio 125,881 127,811

European micro-cap portfolio 73,472 71,966

Real estate portfolio 29,865 31,156

Other investments 24,403 25,683

Total Private Investments 253,621 256,616

Treasury bills 58,540 90,600

Cash 45,193 11,059

Total cash and cash equivalents 103,733 101,659

Other assets 24 168

Total Assets 357,378 358,443

Senior Credit Facility 43,539 43,181

Other liabilities 1,179 764

Total Liabilities 44,718 43,945

Total Net Assets 312,660 314,498

US microcap portfolio

As you know from previous reports, our US portfolio is grouped into industry

`verticals' and co-investments. As of December 4, 2020, certain of our verticals

and co-investments are now grouped under JZHL Secondary Fund, LP ("JZHL" or the

"Secondary Fund"). JZCP has a continuing interest in the Secondary Fund through

a Special LP Interest, which entitles JZCP to certain distributions from the

Secondary Fund.

Our `verticals' strategy focuses on consolidating businesses under industry

executives who can add value via organic growth and cross company synergies. Our

co-investments strategy has allowed for greater diversification of our portfolio

by investing in larger companies alongside well-known private equity groups.

The US micro-cap portfolio continued to perform well during the six-month

period, delivering a net increase of 7 cents per share. This was primarily due

to net accrued income of 2 cents and write-ups at ISS (4 cents) and co

-investment Deflecto (3 cents). Offsetting these increases was a decrease at US

micro-cap portfolio company Avante (2 cents).

European microcap portfolio

Our European portfolio remained flat for the six-month period ended 31 August

2023. As stated in the Investment Adviser's Report as of 28 February 2023, our

European portfolio continues to be challenged by the ongoing economic

difficulties in Europe. We expect further write downs in the European portfolio

if the current trend continues.

JZCP invests in the European micro-cap sector through its approximately 18.8%

ownership of JZI Fund III, L.P. As of 28 February 2023, Fund III held 13

investments: five in Spain, two in Scandinavia, two in Italy, two in the UK and

one each in Portugal and Luxembourg. JZCP held direct loans to a further two

companies in Spain: Docout and Toro Finance.

Real estate portfolio

The Company's two remaining real estate assets that have equity value are 247

Bedford Avenue in Brooklyn, New York (where Apple is the principal tenant), and

the Esperante office building in West Palm Beach, Florida.

The real estate portfolio experienced a net write-down of 2 cents per share,

largely due to small balance sheet changes at the two properties from the year

-end. Consistent with prior years, the Company will be engaging an appraisal

firm to value the two properties again at the year-end. Discussions with

appraisers indicate there would be no significant change in property values

between 31 December 2022 and 31 August 2023.

Other investments

Our asset management business in the US, Spruceview Capital Partners, has

continued to grow since we last reported to you. Spruceview addresses the

growing demand from corporate pensions, endowments, family offices and

foundations for fiduciary management services through an Outsourced Chief

Investment Officer ("OCIO") model as well as customized products/solutions per

asset class.

During the period, Spruceview undertook the development of its fifth private

markets fund, which is focused on growth buyout co-investments in the U.S. The

fund is expected to begin receiving commitments in the fourth quarter of 2023.

We expect Spruceview assets under management to continue to grow with increasing

indications of investor interest.

Spruceview also maintained a pipeline of potential client opportunities and

continued to provide investment management oversight to the pension funds of the

Mexican and Canadian subsidiaries of an international packaged foods company, as

well as portfolios for family office clients, and a growing series of private

market funds.

As previously reported, Richard Sabo, former Chief Investment Officer of Global

Pension and Retirement Plans at JPMorgan and a member of that firm's executive

committee, is leading a team of 23 investment, business and product development,

legal and operations professionals.

Outlook

Our priority now is to realize current investments and finish building the

portfolio that is not yet ready for sale. Our goal is to repay the Company's

remaining debt and then return capital to shareholders.

Thank you for your continued support.

Yours faithfully,

Jordan/Zalaznick Advisers, Inc.

8 November 2023

Board of Directors

David Macfarlane (Chairman)1

Mr Macfarlane was appointed to the Board of JZCP in 2008 as Chairman and a non

-executive Director. Until 2002, he was a Senior Corporate Partner at Ashurst.

He was a non-executive director of the Platinum Investment Trust Plc from 2002

until January 2007.

James Jordan

Mr Jordan is a private investor who was appointed to the Board of JZCP in 2008.

He is a director of the First Eagle family of mutual funds. Until 30 June 2005,

he was the managing director of Arnhold and S. Bleichroeder Advisers, LLC, a

privately owned investment bank and asset management firm; and until 25 July

2013, he was a non-executive director of Leucadia National Corporation.

Sharon Parr2

Ms Parr was appointed to the Board of JZCP in June 2018. She has over 35 years

in the finance industry and spent a significant portion of her professional

career with Deloitte and Touche in a number of different countries. After a

number of years in the audit department, on relocating to Guernsey in 1999 she

transferred into their fiduciary and fund management business and, after

completing a management buyout and subsequently selling to Barclays Wealth in

2007, she ultimately retired from her role there as Global Head of Wealth

Structuring in 2011. Ms Parr holds a number of Non-Executive Directorships

across the financial services sector including in other listed funds. Ms Parr is

a Fellow of the Institute of Chartered Accountants in England and Wales and a

member of the Society of Trust and Estate Practitioners, and is a resident of

Guernsey.

Ashley Paxton

Mr Paxton was appointed to the Board in August 2020. He has more than 25 years

of funds and financial services industry experience, with a demonstrable track

record in advising closed-ended London listed boards and their audit committees

on IPOs, capital market transactions, audit and other corporate governance

matters. He was previously C.I. Head of Advisory for KPMG in the Channel

Islands, a position he held from 2008 through to his retirement from the firm in

2019. He is a Fellow of the Institute of Chartered Accountants in England and

Wales and a resident of Guernsey. Amongst other appointments he is Chairman of

the Youth Commission for Guernsey & Alderney, a locally based charity whose

vision is that all children and young people in the Guernsey Bailiwick are

ambitious to reach their full potential.

1Chairman of the nominations committee of which all Directors are members.

2Chairman of the audit committee of which all Directors are members.

Report of the Directors

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Interim Report and Financial

Statements comprising the Half- yearly Interim Report (the "Interim Report") and

the Unaudited Condensed Interim Financial Statements (the "Interim Financial

Statements") in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

· the Interim Financial Statements have been prepared in accordance with IAS

34, "Interim Financial Reporting" as adopted in the European Union and give a

true and fair view of the assets, liabilities, financial position and profit or

loss of the Company; and

· the Chairman's Statement and Investment Adviser's Report include a fair

review of the information required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules of the United Kingdom's Financial Conduct Authority, being an indication

of important events that have occurred during the first six months of the

financial year and their impact on the Interim Financial Statements; and a

description of the principal risks and uncertainties for the remaining six

months of the year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules of the United Kingdom's Financial Conduct Authority, being related party

transactions that have taken place in the first six months of the financial year

and that have materially affected the financial position or the performance of

the entity during that period; and any changes in the related party transactions

described in the 2023 Annual Report and Financial Statements that could do so.

Principal Risks and Uncertainties

The Company's Board believes the principal risks and uncertainties that relate

to an investment in JZCP are as follows:

Portfolio Liquidity

The Company invests predominantly in unquoted companies and real estate.

Therefore, this potential illiquidity means there can be no assurance

investments will be realised at their latest valuation or on the timing of such

realisations. The Board considers this illiquidity when planning to meet its

future obligations, whether committed investments or the repayment of the Senior

Credit Facility. On a quarterly basis, the Board reviews a working capital model

produced by the Investment Adviser which highlights the Company's projected

liquidity and financial commitments.

Investment Performance and Impact on NAV

The Company is reliant on the Investment Adviser to support the Company's

investment portfolio by executing suitable investment decisions. The Investment

Adviser provides the Board with an explanation of all investment decisions and

also provides quarterly investment reports and valuation proposals of investee

companies. The Board reviews investment performance quarterly and investment

decisions are checked to ensure they are consistent with the agreed investment

strategy.

Operational and Personnel

Although the Company has no direct employees, the Company considers what

dependence there is on key individuals within the Investment Adviser and service

providers that are key to the Company meeting its

operational and control requirements.

Share Price Trading at Discount to NAV

JZCP's share price is subject to market sentiment and will also reflect any

periods of illiquidity when it may be difficult for shareholders to realise

shares without having a negative impact on share price. The Directors review the

share price in relation to Net Asset Value on a regular basis and determine

whether to take any action to manage the discount. The Directors, with the

support of the Investment Adviser, work with brokers to maintain interest in the

Company's shares through market contact and research reports.

Macroeconomic Risks and Impact on NAV

The Company's performance, and underlying NAV, is influenced by economic factors

that affect the demand for products or services supplied by investee companies

and the valuation of Real Estate interests held. Economic factors will also

influence the Company's ability to invest and realise investments and the level

of realised returns. Approximately 24% (28 February 2023: 21%) of the Company's

investments are denominated in non-US dollar currencies, primarily the euro and

also sterling. Fluctuations to these exchange rates will affect the NAV of the

Company.

Uncertainties in today's world that influence economic factors include:

(i) War in Ukraine and resulting energy crisis

The Board strongly condemns the actions of the Russian government and the

devastating events that have unfolded since Russia's unprovoked invasion of

Ukraine.

JZCP's investments are predominantly focused in the U.S. and Western Europe, and

as such, the portfolio has no direct exposure to the affected regions. However,

certain portfolio companies have exposure to the volatility in energy costs

resulting from the conflict. The Board continue to receive reports from the

Investment Adviser on the impact of these increased costs. The Board is not

aware that the Company has any Russian investors.

(ii) Conflict in the Middle East

The Board does not consider the Israel-Hamas conflict will directly impact its

investment portfolio. However, the Board notes an escalation of the conflict in

the Middle East could further increase volatility in energy cost and financial

markets.

(iii) Climate Change

JZCP does not have a sustainability-driven investment strategy, nor is its

intention to do so, but the Board believes that considering the principle of

being environmentally responsible is important in realising the maximum value of

the Company's investments.

JZCP only invests where it has existing obligations or to continue selectively

to support the existing portfolio. JZAI where possible plans to use its

influence as an investor to ensure investee businesses and funds have a cautious

and responsible approach to environmental management of their business

operations. JZCP invests across a wide range of businesses but has limited

exposure to those that create high levels of emissions.

The Board considers the impact of climate change on the firm's business strategy

and risk profile and, where appropriate will make timely climate change related

disclosures. Regular updates, given by the Investment Adviser on portfolio

companies and properties will include potential risk factors pertaining to

climate change and how/if these risks are to be mitigated. The Board receives a

report from the Investment Adviser categorising the Company's investments

according to their level of exposure to climate-related risks. These climate

-related risks can be categorised as either physical (impact of extreme weather,

rising sea levels) or transitional (impact of the transition to a lower-carbon

economy).

The Board also has regard to the impact of the Company's own operations on the

environment and other stakeholders. There are expectations that portfolio

companies operate in a manner that contributes to sustainability by considering

the social, environmental, and economic impacts of doing business. The Board

requests the Investment Adviser report on any circumstances where expected

standards are not met.

The Board has assessed the impact of climate change and has judged that the

Company's immediate exposure to the associated risks are low and therefore there

is no material impact on the fair value of investments and the financial

performance reported in these Interim Financial Statements.

The Board considers the impact of climate change on the firm's business strategy

and risk profile and, where appropriate will make timely climate change related

disclosures. Regular updates, given by the Investment Adviser on portfolio

companies and properties will include potential risk factors pertaining to

climate change and how/if these risks are to be mitigated.

The Board considers the principal risks and uncertainties above are broadly

consistent with those reported at the prior year end, but wish to note the

following:

· The effect of the uncertainty, primarily as a result of the war in Ukraine

on market conditions means that there are challenges to completing corporate

transactions within the European micro-cap portfolio and planned realisations

may take longer than initially anticipated. The potential escalation of the

conflict in the Middle East could further increase volatility in financial

markets.

· The World Health Organization has now declared that COVID-19 no longer

represents a "global health emergency". The Board no longer considers COVID-19 a

principal risk.

Going Concern

A fundamental principle of the preparation of financial statements in accordance

with IFRS is the judgement that an entity will continue in existence as a going

concern for a period of at least 12 months from signing of the Interim Financial

Statements, which contemplates continuity of operations and the realisation of

assets and settlement of liabilities occurring in the ordinary course of

business.

In reaching its conclusion, the Board has considered the risks that could impact

the Company's liquidity over the period from 8 November 2023 to 30 November 2024

(the "Going Concern Period"). There were no events or conditions identified

beyond this period which may cast significant doubt on the company's ability to

continue as a going concern.

Going Concern Assessment

In June 2023, the Company reported on its much-improved liquidity following a

period of material realisations and the subsequent repayment of the Company's

Subordinated Notes and ZDP shares.

During the six-month period ended 31 August 2023, the Company received

approximately $9.9 million from realisations and distributions and had cash

outflows relating to follow-on investments, expenses and finance costs of $10.1

million. Therefore, there has been no material change to the Company's liquidity

position since 28 February 2023 of approximately $100 million, comprising cash

of $45 million (28 February 2023: $11 million) and treasuries of $58 million (28

February 2023: $91 million). There has been no material change in liquidity

subsequent to 31 August 2023. The Company's remaining material debt obligation

is its $45 million Senior Credit Facility (28 February 2023: $45 million) which

matures in January 2027. The Company continues to comply with the covenants

attached to the Senior Credit Facility and the Board expect full compliance

throughout the going concern period.

As reported in the Chairman's Statement and the Investment Advisors report, the

Company anticipates potential near-term realisations that would enable the

Company to repay its Senior Credit Facility.

The Board takes account of the levels of realisation proceeds historically

generated by the Company's micro-cap portfolios, the level of funding

obligations the Company could be called on through capital calls on existing

investments, as well as the accuracy of previous forecasts to assess the

predicted accuracy of forecasts presented. The Company continues to work on the

realisation of various investments within a timeframe that will enable the

Company to maximise the value of its investment portfolio. Due to the Company's

strong liquidity, the timeframe to realise investments is not determined by the

need to repay debt and the Company is able to mitigate any downturn in the wider

economy which might influence the ability to exit investments.

Going Concern Conclusion

After careful consideration and based on the reasons outlined above, the Board

have not identified any material uncertainties which may cast significant doubt

on the Company's ability to continue as a going concern for the duration of the

going concern period. As such the Board is satisfied that it is appropriate to

adopt the going concern basis in preparing the Interim Financial Statements and

they have a reasonable expectation that the Company will continue in existence

as a going concern for the period to 30 November 2024.

Approved by the Board of Directors and agreed on behalf of the Board on 8

November 2023.

David MacfarlaneSharon Parr

Investment Portfolio

Percentage

of

Portfolio

31

August

2023

Cost1 Value

US$'000 US$'000

%

US Micro-cap portfolio

US Micro-cap Fund

JZHL Secondary Fund L.P.2

JZHL Secondary Fund L.P.

JZCP's investment in the JZHL Secondary Fund is

further detailed on Summary of JZCP's Investments.

Total JZHL Secondary Fund L.P. valuation

25.8

34,876 80,548

US Micro-cap (Vertical)

Industrial Services Solutions3

INDUSTRIAL SERVICES SOLUTIONS ("ISS")

Provider of aftermarket maintenance, repair, and

field services for critical process equipment

throughout the US

Total Industrial Services Solutions valuation

7.2

21,139 22,348

US Micro-cap (Co-investments)

DEFLECTO

4.7

Deflecto designs, manufactures and sells innovative 12,174 14,777

plastic products to multiple industry segments

ORIZON

1.2

Manufacturer of high precision machine parts and 3,899 3,840

tools for aerospace and defence industries

Total US Micro-cap (Co-investments)

5.9

16,073 18,617

US Micro-cap (Other)

AVANTE HEALTH SOLUTIONS

1.1

Provider of new and professionally refurbished 8,750 3,368

healthcare equipment

NATIONWIDE

0.3

STUDIOS 26,324 1,000

Processor of digital photos for pre-schoolers

Total US Micro-cap (Other)

1.4

35,074 4,368

Total US Micro-cap portfolio 107,16

40.3

2 125,881

European Micro-cap portfolio

EUROMICROCAP FUND 2010, L.P.

825

Invested in European Micro-cap

- -

entities

JZI FUND III, L.P.

63,854 70,120 22.4

JZCP's investment in JZI Fund III is further detailed on Summary of JZCP's

investment.

Total European Micro-cap

64,679 70,120 22.4

Debt Investments

DOCOUT4

2,777 1,833 0.6

Provider of digitalisation, document processing and storage services

TORO FINANCE

21,619 1,519 0.5

Provides short term receivables finance to the suppliers of major Spanish

companies

XACOM4

2,055

Supplier of telecom products and technologies

- -

Debt Investments (loans to European micro-cap companies)

26,451 3,352 1.1

Total European Micro-cap portfolio

91,130 73,472 23.5

Real Estate portfolio

247 BEDFORD AVENUE

17,717 6,298 2.0

Prime retail asset in northern Brooklyn, NY

ESPERANTE

14,983 23,567 7.6

An iconic building on the downtown, West Palm Beach skyline

Total Real Estate portfolio

32,700 29,865 9.6

Other investments

BSM ENGENHARIA

6,115 50

Brazilian-based provider of supply chain logistics, infrastructure services

-

and equipment rental

JZ

750 0.2

INTERNATIONAL -

Fund of European LBO investments

SPRUCEVIEW CAPITAL

34,255 23,603 7.6

Asset management company focusing primarily on managing endowments and

pension funds

Total Other investments

40,370 24,403 7.8

Listed investments

U.S. Treasury Bills - Maturity 21 September 2023

23,691 23,930 7.7

U.S. Treasury Bills - Maturity 16 November 2023

34,537 34,610 11.1

Total Listed investments

58,228 58,540 18.8

Total - portfolio

329,590 312,161 100.0

1 Original book cost incurred by JZCP adjusted for subsequent transactions.

Other than JZHL Secondary Fund (see foot note 2), the book cost represents cash

outflows and excludes PIK investments.

2Notional cost of the Company's interest in JZHL Secondary Fund is calculated in

accordance with IFRS, and represents the fair value of the Company's LP interest

on recognition adjusted for subsequent distributions.

3Co-investment with Fund A, a Related Party (Note 18).

4 Classified as loan at amortised cost.

Summary of JZCP's investments in JZHL Secondary Fund

JZHL Valuation1

As at

31.8.2023

$'000s

US Micro-cap investments

ACW FLEX PACK, LLC 4,483

Provider of a variety of custom flexible packaging solutions

to converters and end-users

FLOW CONTROL, LLC 17

Manufacturer and distributor of high-performance, mission

-critical flow handling products and components utilized to

connect processing line equipment

SAFETY SOLUTIONS HOLDINGS 3,305

Provider of safety focused solutions for the industrial,

environmental and life science related markets

FELIX STORCH 48,000

Supplier of specialty, professional, commercial, and medical

refrigerators and freezers, and cooking appliances

PEACEABLE STREET CAPITAL 13,703

Specialty finance platform focused on commercial real estate

TIERPOINT 11,112

Provider of cloud computing and colocation data centre

services

80,620

Hurdle amount due to Secondary Investors (72)

JZCP's interest in JZHL Secondary Fund 80,548

1JZCP's valuation being the 37.5% Special L.P. interest in the underlying

investment in JZHL Secondary Fund.

Summary of JZCP's investments in JZI Fund III

JZCP Cost (EURO)1 JZCP Value (EURO)1 JZCP Value

(USD)

Country As at As at As at

31.8.2023 31.8.2023 31.8.2023

?'000s ?'000s $'000s

ALIANZAS EN ACEROS Spain 4,468 3,472 3,768

Steel service

center

BLUESITES Portugal 1,372 4,802 5,212

Build-up in cell

tower land leases

COLLINGWOOD UK 3,015 2,513 2,727

Niche UK motor

insurer

ERSI Lux 8,482 1,675 1,818

Reinforced steel

modules

FACTOR ENERGIA Spain 3,989 9,263 10,053

Electricity

supplier

FINCONTINUO Italy 4,859 426 462

Niche consumer

lender

GUANCHE Spain 7,486 10,571 11,474

Build-up of petrol

stations

KARIUM UK 4,879 9,731 10,562

Personal care

consumer brands

LUXIDA Spain 3,315 4,969 5,393

Build-up in

electricity

distribution

MY LER Finland 4,321 192 209

Niche consumer

lender

S.A.C Denmark 3,392 9,000 9,768

Operational van

leasing

TREEE Italy 6,141 4,313 4,681

e-waste recycling

UFASA Spain 6,318 8,122 8,816

Niche consumer

lender

Other net (4,823)

Liabilities

Total valuation 70,120

1Represents JZCP's 18.75% of Fund III's investment portfolio.

Independent Review Report to JZ Capital Partners Limited

Conclusion

We have been engaged by the Company to review the condensed set of financial

statements in the half-yearly financial report for the six months ended 31

August 2023 which comprises the Statement of Comprehensive Income (Unaudited),

Statement of Financial Position (Unaudited), Statement of Changes in Equity

(Unaudited), Statement of Cash Flows (Unaudited) and related Notes 1 to 23. We

have read the other information contained in the half-yearly financial report

and considered whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of financial

statements.

Based on our review, nothing has come to our attention that causes us to believe

that the condensed set of financial statements in the half-yearly financial

report for the six months ended 31 August 2023 are not prepared, in all material

respects, in accordance with International Accounting Standard 34 "Interim

Financial Reporting", as adopted by the European Union ("IAS 34"), and the

Disclosure Guidance and Transparency Rules of the United Kingdom's Financial

Conduct Authority.

Basis for conclusion

We conducted our review in accordance with International Standard on Review

Engagements 2410 (UK) "Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" (ISRE) issued by the Financial Reporting

Council. A review of interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting matters, and

applying analytical and other review procedures. A review is substantially less

in scope than an audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain assurance that we

would become aware of all significant matters that might be identified in an

audit. Accordingly, we do not express an audit opinion.

As disclosed in Note 2, the annual financial statements of the Company are

prepared in accordance with IFRS as adopted by the European Union. The condensed

set of financial statements included in this half-yearly financial report have

been prepared in accordance with IAS 34 "Interim Financial Reporting" as adopted

by the European Union.

Conclusion relating to going concern

Based on our review procedures, which are less extensive than those performed in

an audit as described in the Basis for Conclusion section of this report,

nothing has come to our attention to suggest that management have

inappropriately adopted the going concern basis of accounting or that management

have identified material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in accordance with

the ISRE, however future events or conditions may cause the entity to cease to

continue as a going concern.

Responsibilities of the Directors

The Directors are responsible for preparing the half-yearly financial report in

accordance with Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

In preparing the half-yearly financial report, the directors are responsible for

assessing the company's ability to continue as a going concern, disclosing, as

applicable, matters related to going concern and using the going concern basis

of accounting unless the directors either intend to liquidate the company or to

cease operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial information

In reviewing the half-yearly report, we are responsible for expressing to the

Company a conclusion on the condensed set of financial statements in the half

-yearly financial report. Our conclusion, including our Conclusions relating to

Going Concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of this report.

Use of our report

This report is made solely to the company in accordance with guidance contained

in International Standard on Review Engagements 2410 (UK) "Review of Interim

Financial Information Performed by the Independent Auditor of the Entity" issued

by the Financial Reporting Council. To the fullest extent permitted by law, we

do not accept or assume responsibility to anyone other than the company, for our

work, for this report, or for the conclusions we have formed.

Ernst & Young LLP

Guernsey, Channel Islands

8 November 2023

Notes

1. The Interim Report and Financial Statements are published on websites

maintained by the Investment Adviser.

2. The maintenance and integrity of these websites are the responsibility of

the Investment Adviser; the work carried out by the Auditors does not involve

consideration of these matters and, accordingly, the Auditor accepts no

responsibility for any changes that may have occurred to the Condensed Interim

Financial Statements since they were initially presented on the website.

3. Legislation in Guernsey governing the preparation and dissemination of

Condensed Interim Financial Statements may differ from legislation in other

jurisdictions.

Statement of Comprehensive Income (Unaudited)

For the Period from 1 March 2023 to 31 August 2023

Six Month

Six Month Period Ended

Period Ended 31 August 2022

31 August 2023 (Restated)

Note US$'000 US$'000

Income,

investment and

other gains

Net profit on 6 1,630 24,911

investments at

fair

value through

profit or loss

Investment income 8 3,967 7,920

Bank and deposit

interest 42 85

Net foreign 109 8,693

currency exchange

gains

Realisations from 21 999

investments held -

in escrow

accounts

5,748 42,608

Expenses and

losses

Expected credit 7

losses (259) (229)

Investment 10 (2,696) (3,872)

Adviser's base

fee

Administrative (1,280) (1,331)

expenses

Directors'

remuneration (145) (145)

(4,380) (5,577)

Operating profit 1,368 37,031

Finance costs 9 (3,206) (4,806)

Other income 398

-

(Loss)/profit (1,838) 32,623

before taxation

Taxation 22

- -

(Loss)/profit for (1,838) 32,623

the period

Weighted average 20 77,477,214 77,477,214

number of

Ordinary shares

in issue during

the period

Basic and diluted 20 (2.37)c 42.10c

(loss)/earnings

per Ordinary

share

The (loss)/profit for the period all derive from continuing operations.

The accompanying notes form an integral part of the Interim Financial

Statements.

Prior period balances have been restated to present an investment which has been

reclassified to fair value through profit or loss from amortised cost as at 31

August 2022 and 1 March 2022, leading to the loan being remeasured on these

dates (see Note 2 to the Financial Statements).

Statement of Financial Position (Unaudited)

As at 31 August 2023

31 August 28 February

2023 2023

Note US$'000 US$'000

Assets

Investments at fair value 11 310,328 343,521

through profit or loss

Loans at amortised cost 11 1,833 3,695

Other receivables 24 168

Cash at bank 45,193 11,059

Total assets 357,378 358,443

Liabilities

Senior Credit Facility 12 43,539 43,181

Other payables 15 829 764

Investment Adviser's base 10 350 -

fee

Total liabilities 44,718 43,945

Equity

Share capital 216,650 216,650

Other reserve 353,528 353,528

Retained deficit (257,518) (255,680)

Total equity 312,660 314,498

Total liabilities and 357,378 358,443

equity

Number of Ordinary shares 16 77,477,214 77,477,214

in issue at period/year

end

Net asset value per $4.04 $4.06

Ordinary share

These Interim Financial Statements were approved by the Board of Directors and

authorised on 8 November 2023. They were signed on its behalf by:

David MacfarlaneSharon Parr

ChairmanDirector

The accompanying notes form an integral part of the Interim Financial

Statements.

Statement of Changes in Equity (Unaudited)

For the Period from 1 March 2023 to 31 August 2023

Share Other Retained

Capital Reserve Deficit Total

US$'000 US$'000 US$'000 US$'000

Balance

as at 216,650

1 March 353,528 314,498

2023 (255,680)

Loss (1,838)

for the

period - -

(1,838)

Balance

at 31 (257,518)

August 216,650 353,528 312,660

2023

Restated comparative for the period from 1 March 2022 to 31 August 2022

Share Other Retained

Capital Reserve Deficit Total

Note US$'000 US$'000 US$'000 US$'000

Balance as 216,650 353,528 (237,91

332,264

at 1

March 2022 4

)

Restatement

(20,412)

to 2 - - (20,412)

correct

historical

error1

Balance as 216,650 353,528 (258,32

311,852

at 1

March 2022 6

(restated) )

Profit for

32,623

the - - 32,623

period

(restated)

Balance at

31 August 216,650 353,528

344,475

2022

(restated)

(225,70

3

)

1Prior period balances have been restated to present an investment which has

been reclassified to fair value through profit or loss from amortised cost as at

31 August 2022 and 1 March 2022, leading to the loan being remeasured on these

dates (see Note 2 to the Financial Statements).

The accompanying notes form an integral part of the Interim Financial

Statements.

Statement of Cash Flows (Unaudited)

For the Period from 1 March 2023 to 31 August 2023

Six Month Six Month

Period Ended Period Ended

31 August 2023 31 August 2022

Note US$'000 US$'000

Cash flows

from operating

activities

Cash inflows

Realisation of investments 11 9,880 105,024

Maturity of treasury bills 11 215,850

3,395

Bank interest received

42 85

Escrow receipts received 21

- 999

Income distributions received

from investments - 372

Cash outflows

Direct investments and 11 (3,659)

capital calls (4,945)

Purchase of Treasury Bills 11 (181,566) (123,132)

and UK Gilts

Investment Adviser's base fee 10 (2,281)

paid (3,691)

Other operating expenses paid (1,281)

(2,048)

Net cash inflow/(outflow) 36,985

before financing activities (23,941)

Financing

activities

Finance costs paid:

· Senior Credit Facility 12 (2,848)

(1,834)

· Subordinated Notes 14

- (945)

Net cash outflow from (2,848)

financing activities (2,779)

Increase/(decrease) in cash 34,137

at bank (26,720)

Reconciliation

of net cash

flow to

movements in

cash at bank

US$'000 US$'000

Cash and cash equivalents at 11,059 43,656

1 March

Increase/(decrease) in cash 34,137

at bank (26,720)

Foreign exchange movements on

cash at bank (3) (983)

Cash and cash equivalents at 45,193 15,953

period end

The accompanying notes form an integral part of the Interim Financial

Statements.

Notes to the Interim Financial Statements (Unaudited)

1. General Information

JZ Capital Partners Limited ("JZCP" or the "Company") is a Guernsey domiciled

closed-ended investment company which was incorporated in Guernsey on 14 April

2008 under the Companies (Guernsey) Law, 1994. The Company is now subject to the

Companies (Guernsey) Law, 2008. The Company is classified as an authorised fund

under the Protection of Investors (Bailiwick of Guernsey) Law 2020. As at 31

August 2023, the Company's capital consisted of Ordinary shares which are traded

on the London Stock Exchange's Specialist Fund Segment ("SFS").

The Company's new investment policy, adopted in August 2020, is for the Company

to make no further investments outside of its existing obligations or to the

extent that investment may be made to support selected existing portfolio

investments. The intention is to realise the maximum value of the Company's

investments and, after repayment of all debt, to return capital to shareholders.

The Company's previous Investment Policy was to target predominantly private

investments and back management teams to deliver on attractive investment

propositions. In executing this strategy, the Company took a long term view. The

Company looked to invest directly in its target investments and was able to

invest globally but with a particular focus on opportunities in the United

States and Europe.

The Company is currently mainly focused on supporting its investments in the

following areas:

(a) small or micro-cap buyouts in the form of debt and equity and preferred

stock in both the US and Europe; and

(b) real estate interests.

The Company has no direct employees. For its services, the Investment Adviser

receives a management fee as described in Note 10. The Company has no ownership

interest in the Investment Adviser. During the period under review, the Company

was administered by Northern Trust International Fund Administration Services

(Guernsey) Limited.

2. Basis of Accounting and Significant Accounting Policies

Statement of compliance

The Unaudited Condensed Interim Financial Statements (the "Interim Financial

Statements") of the Company for the period 1 March 2023 to 31 August 2023 have

been prepared in accordance with IAS 34, "Interim Financial Reporting" as

adopted in the European Union, together with applicable legal and regulatory

requirements of the Companies (Guernsey) Law, 2008 and the Disclosure Guidance

and Transparency Rules of the United Kingdom's Financial Conduct Authority. The

Interim Financial Statements do not include all the information and disclosure

required in the Annual Audited Financial Statements and should be read in

conjunction with the Annual Report and Financial Statements for the year ended

28 February 2023.

Basis of preparation

The Interim Financial Statements have been prepared under the historical cost

basis, except for financial assets and financial liabilities held at fair value

through profit or loss ("FVTPL"). The principal accounting policies adopted in

the preparation of these Interim Financial Statements are consistent with the

accounting policies stated in Note 2 of the Annual Financial Statements for the

year ended 28 February 2023. The preparation of these Interim Financial

Statements is in conformity with IAS 34, "Interim Financial Reporting" as

adopted in the European Union, and requires the Company to make estimates and

assumptions that affect the reported amounts of assets and liabilities at the

date of the Interim Financial Statements and the reported amounts of revenues

and expenses during the reporting period.

The Unaudited Condensed Interim Financial Statements (the "Interim Financial

Statements") are presented in US$'000 except where otherwise indicated.

New standards, interpretations and amendments adopted by the Company

There has been no early adoption, by the Company, of any other standard,

interpretation or amendment that has been issued but is not yet effective.

Several amendments apply for the first time in 2023, but do not have material

impact on the Company's interim financial position or on the presentation of the

Company's statements.

Changes in accounting policy and disclosure

The accounting policies adopted in the preparation of these Interim Financial

Statements have been consistently applied during the period, unless otherwise

stated.

Climate Change

The Board has assessed the impact of climate change and has judged that the

Company's immediate exposure to the associated risks are low and therefore there

is no material impact on the fair value of investments and the financial

performance reported in these Interim Financial Statements.

Restatement to correct historical error in classification and associated

measurement of asset

In reporting the Company's results for the year ended 28 February 2023, a

restatement was made to correct a historical error in classification and

associated measurement of an investment. These Interim Financial Statements have

also been restated to reflect the correction of the same historical error

(detailed below), which has impacted the prior period's statement of

comprehensive income and statement of changes in equity. This restatement has

not impacted the Company's previously reported statement of financial position

as at 28 February 2023.

An investment in a direct loan to a European micro-cap company has been

reclassified to fair value through profit or loss from amortised cost as at 31

August 2022 and 1 March 2022 to reflect its contractual terms, leading to the

loan being remeasured on these dates. The reclassification is required as the

contractual terms of the loan do not give rise, on specified dates, to cash

flows that are solely payments of principal and interest on the principal amount

of the loan outstanding and are therefore not consistent with an amortised cost

classification. The affected financial statement line items for the prior

periods have been restated, as follows:

Impact on the statement of changes in equity

Reclassification Reclassification

and 1.3.2022 and

31.8.2022

1.3.20221 remeasurement (restated) 31.8.20221 remeasurement2

(restated)

US$ '000 US$ '000 US$ '000 US$ '000 US$ '000

US$ '000

Retained (237,914) (20,412) (258,326) (205,116) (20,587)

(225,703)

deficit

1The retained deficit as recorded in the prior year financial statements before

restatement.

2Assumes the reclassification and remeasurement occurred on 31 August 2022

rather than 1 March 2022. The effect of the remeasurement for the six month

period ended 31 August 2022 is a reduction in profits of $0.175 million (see

below), being the decrease in value at this date being $20.587 million less the

decrease in value recognised at 1 March 2022 of $20.412 million.

NAV per share as at 31.8.2022 of $4.71 per share has been restated to $4.45.

Impact on statement of comprehensive income

31.8.2022

US$ '000

Investment (687)

income

Net foreign 2,585

currency

exchange

gains

Net gain on (2,760)

investments

at fair

value

through

profit or

loss

Expected 687

credit

losses

Net impact (175)

on profit

for the

period

Impact on

basic and

diluted

earnings

(Cents per

Ordinary

share)

31.8.2022

Basic and 42.33c

diluted

earnings

per

Ordinary

share

(cents per

share)

Impact from (0.23)c

correction

Basic and 42.10c

diluted

earnings

per

Ordinary

share

(restated)

3. Estimates and Judgements

The estimates and judgements made by the Board of Directors are consistent with

those made in the Audited Financial Statements for the year ended 28 February

2023.

Directors' assessment of going concern

A fundamental principle of the preparation of financial statements in accordance

with IFRS is the judgement that an entity will continue in existence as a going

concern for a period of at least 12 months from signing of the Interim Financial

Statements, which contemplates continuity of operations and the realisation of

assets and settlement of liabilities occurring in the ordinary course of

business.

In reaching its conclusion, the Board has considered the risks that could impact

the Company's liquidity over the period from 8 November 2023 to 30 November 2024

(the "Going Concern Period"). There were no events or conditions identified

beyond this period which may cast significant doubt on the company's ability to

continue as a going concern.

In June 2023, the Company reported on its much-improved liquidity following a

period of material realisations and the subsequent repayment of the Company's

Subordinated Notes and ZDP shares.

During the six-month period ended 31 August 2023, the Company received

approximately $9.9 million from realisations and distributions and had cash

outflows relating to follow-on investments, expenses and finance costs of

$10.1million. Therefore, there has been no material change to the Company's

liquidity position since 28 February 2023 of approximately $100 million,

comprising cash of $45 million (28 February 2023: $11 million) and treasuries of

$58 million (28 February 2023: $91 million). There has been no material change

in liquidity subsequent to 31 August 2023.

The Company's remaining material debt obligation is its $45 million Senior

Credit Facility (28 February 2023: $45 million) which matures in January 2027.

The Company continues to comply with the covenants attached to the Senior Credit

Facility and the Board expect full compliance throughout the going concern

period.

As reported in the Chairman's Statement and the Investment Advisors report, the

Company anticipates potential near-term realisations that would enable the

Company to repay its Senior Credit Facility.

The Board takes account of the levels of realisation proceeds historically

generated by the Company's micro-cap portfolios, the level of funding

obligations the Company could be called on through capital calls on existing

investments, as well as the accuracy of previous forecasts to assess the

predicted accuracy of forecasts presented. The Company continues to work on the

realisation of various investments within a timeframe that will enable the

Company to maximise the value of its investment portfolio. Due to the Company's

strong liquidity, the timeframe to realise investments is not determined by the

need to repay debt and the Company is able to mitigate any downturn in the wider

economy which might influence the ability to exit investments.

Going concern conclusion

After careful consideration and based on the reasons outlined above, the Board

have not identified any material uncertainties which may cast significant doubt

on the Company's ability to continue as a going concern for the duration of the

going concern period. As such the Board is satisfied that it is appropriate to

adopt the going concern basis in preparing the interim financial statements and

they have a reasonable expectation that the Company will continue in existence

as a going concern for the period to 30 November 2024.

4. Segment Information

The Investment Manager is responsible for allocating resources available to the

Company in accordance with the overall business strategies as set out in the

Investment Guidelines of the Company. The Company is organised into the

following segments:

· Portfolio of US Micro-cap investments

· Portfolio of European Micro-cap investments

· Portfolio of Real Estate investments

· Portfolio of Other Investments - (not falling into above categories)

Investments in treasury bills are not considered as part of the investment

strategy and are therefore excluded from this segmental analysis.

The investment objective of each segment is to achieve consistent medium-term

returns from the investments in each segment while safeguarding capital by

investing in a diversified portfolio.

US European Real

Other

Micro-cap Micro-cap Estate

Investments Total

US$ '000 US$ '000 US$ '000 US$

'000 US$ '000

Interest 1,484 259

1,743

revenue - -

Dividend

revenue - - - -

-

Total 1,484 259

1,743

segmental - -

revenue

Net 3,415 1,586 (1,291)

(2,080) 1,630

gain/(loss)

on

investments

at FVTPL

Expected (259)

(259)

credit - - -

losses

Realisations

from - - - -

-

investments

held in

Escrow

Investment (959) (548) (234)

(192) (1,933)

Adviser's

base fee

Total 3,940 1,038 (1,525)

(2,272) 1,181

segmental

operating

profit/(lo

ss)

For the period from 1 March 2022 to 31 August 2022 (restated1)

US European Real

Other

Micro-cap Micro-cap Estate

Investments Total

US$ '000 US$ '000 US$ '000 US$

'000 US$ '000

Interest 7,081 229

revenue - -

7,310

Dividend 372

revenue - - -

372

Total 7,453 229

segmental - -

7,682

revenue

Net 41,604 (12,748) (522)

(504)

gain/(loss)

27,830

on

investments

at FVTPL

Expected (229)

credit - - -

(229)

losses

Realisations 999

from - - -

999

investments

held in

Escrow

Other income 398

- - -

398

Investment (2,237) (776) (179)

(178)

Adviser's

(3,370)

base fee

Total 47,819 (13,126) (701)

(682) 33,310

segmental

operating

profit/(lo

ss)

Certain income and expenditure are not considered part of the performance of an

individual segment. This includes net foreign exchange gains, interest on cash,

finance costs, management fees, custodian and administration fees, directors'

fees and other general expenses. The segmental allocation is consistent with

that of the previous year end.

The following table provides a reconciliation between total segmental operating

profit and operating (loss)/profit:

31.8.2022

31.8.2023 (restated1)

US$ '000 US$ '000

Total 1,181 33,310

segmental

operating

profit

Net foreign 109

exchange 8,693

gain/(loss)

Bank and 42

deposit 85

interest

Other 2,224

interest 238

Expenses not (1,425) (1,476)

attributable

to segments

Fees payable (763)

to (502)

investment

adviser

based on non

-segmental

assets

Finance (3,206)

costs (4,806)

Net loss on

non - (2,919)

-segmental

investments

at FVTPL

(Loss)/profit (1,838) 32,623

for the

period

1See Note 2

The following table provides a reconciliation between total segmental revenue

and Company revenue:

31.8.2022

31.8.2023 (restated1)

US$ '000 US$ '000

Total 1,743 7,682

segmental

revenue

Non

-segmental

revenue

Bank and 42 85

deposit

interest

Other 2,224 238

interest

Total 4,009 8,005

revenue

1See Note 2

Segmental Net Assets

At 31 August 2023

US European Real Other

Micro-cap Micro-cap Estate

Investments Total

US$ '000 US$ '000 US$ '000 US$

'000 US$ '000

Segmental

assets

Investments 125,881 29,865

24,403

at FVTPL 71,639

251,788

Loans at

amortised - 1,833 - -

1,833

cost

Total 125,881 29,865

24,403

segmental 73,472

253,621

assets

Segmental

liabilities

Payables (123)

(24)

and accrued (72) (29)

(248)

expenses

Total (123)

(24)

segmental (72) (29)

(248)

liabilities

Total 125,758 29,836

24,379

segmental 73,400

253,373

net

assets

At 28 February

US European Real

Other

Micro-cap Micro-cap Estate

Investments Total

US$ '000 US$ '000 US$ '000

US$ '000 US$ '000

Segmental

assets

Investments 127,811 68,271 31,156

25,683 252,921

at FVTPL

Loans at 3,695

3,695

amortised - - -

cost

Prepaid 29 12

47

expenses 3 3

Total 127,840 71,978 31,159

25,686 256,663

segmental

assets

Segmental

liabilities

Total

segmental - - - -

-

liabilities

Total 127,840 71,978 31,159

25,686 256,663

segmental

net

assets

The following table provides a reconciliation between total segmental assets and

total assets and total segmental liabilities and total liabilities:

31.8.2023 28.2.2023

US$ '000 US$ '000

Total 253,621 256,663

segmental

assets

Non

segmental

assets

Cash at 45,193 11,059

bank

Treasury 58,540 90,600

bills

Other 121

receivables 24

Total 357,378 358,443

assets

Total (248)

segmental -

liabilities

Non

segmental

liabilities

Senior (43,539) (43,181)

Credit

Facility

Other (764)

payables (931)

Total (44,718) (43,945)

liabilities

Total net 312,660 314,498

assets

Other receivables (other than the Investment Adviser fee prepayment) are not

considered to be part of individual segment assets. Certain liabilities are not

considered to be part of the net assets of an individual segment. These include

custodian and administration fees payable, directors' fees payable and other

payables and accrued expenses.

5. Fair Value of Financial Instruments

The Company classifies fair value measurements of its financial instruments at

FVTPL using a fair value hierarchy that reflects the significance of the inputs

used in making the measurements. The financial instruments valued at FVTPL are

analysed in a fair value hierarchy based on the following levels:

Level 1

Quoted prices (unadjusted) in active markets for identical assets or

liabilities.

Level 2

Those involving inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (that is, as prices) or

indirectly (that is, derived from prices). For example, investments which are

valued based on quotes from brokers (intermediary market participants) are

generally indicative of Level 2 when the quotes are executable and do not

contain any waiver notices indicating that they are not necessarily tradeable.

Another example would be when assets/liabilities with quoted prices, that would

normally meet the criteria of Level 1, do not meet the definition of being

traded on an active market.

Level 3

Those involving inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs). Investments in JZCP's

portfolio valued using unobservable inputs such as multiples, capitalisation

rates, discount rates fall within Level 3.

Differentiating between Level 2 and Level 3 fair value measurements i.e.,

assessing whether inputs are observable and whether the unobservable inputs are

significant, may require judgement and a careful analysis of the inputs used to

measure fair value including consideration of factors specific to the asset or

liability.

The following table shows financial instruments recognised at fair value,

analysed by the hierarchy level that the fair value is based on:

Financial

assets at

31 August

2023

Level 1 Level 2 Level 3

Total

US$ '000 US$ '000 US$ '000

US$

'000

US micro 125,881

125,881

-cap - -

European 71,639

71,639

micro-cap - -

Real estate 29,865

29,865

- -

Other 24,403

24,403

investments - -

Treasury 58,540

58,540

bills - -

58,540 251,788

310,328

-

Financial

assets at

28 February

2023

Level 1 Level 2 Level 3

Total

US$ '000 US$ '000 US$ '000

US$

'000

US micro 127,811

127,811

-cap - -

European 68,271

68,271

micro-cap - -

Real estate 31,156

31,156

- -

Other 25,683

25,683

investments - -

Treasury 90,600

90,600

bills - -

90,600 252,921

343,521

-

Valuation techniques

In valuing investments in accordance with IFRS, the Board follows the principles

as detailed in the IPEVCA guidelines.

When fair values of listed equity and debt securities at the reporting date are

based on quoted market prices or binding dealer price quotations (bid prices for

long positions), without any deduction for transaction costs, the instruments

are included within Level 1 of the hierarchy.

Investments for which there are no active markets are valued according to one of

the following methods:

Real estate

JZCP owns its real estate investments through a wholly-owned subsidiary, which

in turn owns interests in real estate properties. The net asset value of the

subsidiary is used for the measurement of fair value. The underlying fair value

of JZCP's Real Estate holdings, however, is represented by the properties

themselves. The Company's Investment Adviser and Board review the fair value

methods and measurement of the underlying properties on a quarterly basis. Where

available, the Company will use third party appraisals on the subject property,

to assist the fair value measurement of the underlying property. Third-party

appraisals are prepared in accordance with the Appraisal and Valuation Standards

(6th edition) issued by the Royal Institution of Chartered Surveyors. Fair value

techniques used in the underlying valuations are:

- Use of comparable market values per square foot of properties in recent

transactions in the vicinity in which the property is located, and in similar

condition, of the relevant property, multiplied by the property's square

footage.

- Income capitalisation approach using the property's net operating income and a

capitalization rate.

For each of the techniques third party debt is deducted to arrive at fair value.

The valuations obtained in relation to the real estate portfolio are dated 31

December 2022. Subsequent discussions with appraisers indicate there would be no

significant change in property values between 31 December 2022 and 31 August

2023. Due to the inherent uncertainties of real estate valuation, the values

reflected in the financial statements may differ significantly from the values

that would be determined by negotiation between parties in a sales transaction

and those differences could be material.

Unquoted preferred shares, unquoted equities and equity related securities

Unquoted equities and equity related securities investments are classified in

the Statement of Financial Position as Investments at fair value through profit

or loss. These investments are typically valued by reference to their enterprise

value, which is generally calculated by applying an appropriate multiple to the

last twelve months' earnings before interest, tax, depreciation and amortisation

("EBITDA"). In determining the multiple, the Board consider inter alia, where

practical, the multiples used in recent transactions in comparable unquoted

companies, previous valuation multiples used and where appropriate, multiples of

comparable publicly traded companies. In accordance with IPEVCA guidelines, a

marketability discount is applied which reflects the discount that in the

opinion of the Board, market participants would apply in a transaction in the

investment in question. The increase of the fair value of the aggregate

investment is reflected through the unquoted equity component of the investment

and a decrease in the fair value is reflected across all financial instruments

invested in an underlying company.

In respect of unquoted preferred shares the Company values these investments at

fair value by reference to the attributable enterprise value as the exit

strategy in respect to these investments would be a one tranche disposal

together with the equity component. The fair value of the investment is

determined by reference to the attributable enterprise value reduced by senior

debt and marketability discount.

Micro-cap loans

Investments in micro-cap debt are valued at fair value by reference to the

attributable enterprise value when the Company also holds an equity position in

the investee company.

When the Company invests in micro-cap loans and does not hold an equity position

in the underlying investee company these loans are valued at amortised cost in

accordance with IFRS 9 (Note 2). The carrying value at amortised cost is

considered to approximate to fair value.

Other Investments

Other investments at year end, comprise of mainly the Company's investment in

the asset management business -Spruceview Capital Partners ("Spruceview").