TIDMLWDB

RNS Number : 4834H

Law Debenture Corp PLC

28 July 2023

The Law Debenture Corporation p.l.c. today published its results

for the half-year ended 30 June 2023

Solid overall performance in difficult market conditions

Group Highlights:

-- Net asset value (NAV) total return with debt and Independent

Professional Services (IPS) business at fair value (FV) for H1 2023

delivered a modest outperformance of 4.0% compared to our

benchmark, the FTSE All-Share Index, at 2.6%. With debt at par the

return was 2.2%.

-- IPS profit before tax up by 8.5% and valuation up 4.4% to

GBP210m (compared to 30 December 2022).

-- Since the publication of The Law Debenture Corporation

p.l.c.'s (Law Debenture) Annual Report in February 2023, Law

Debenture has issued 2 million new ordinary shares at a premium to

NAV (to existing and new investors) with net proceeds of GBP16.6m

to support ongoing investment.

-- Continued low ongoing charges of 0.48%, compared to the UK

Equity Income industry average of 1.07%.

Winner of Investment Week's UK Equity Income Investment Trust of

the Year for 2022 (second year running); winner in UK Equity -

Active category at the AJ Bell Fund and Investment Awards 2022 and

winner for Best Investment Trust for Income at the 2022 Shares

Awards.

Dividend Highlights:

-- Declared a first interim dividend of 7.625 pence per ordinary

share, paid in July 2023, representing an increase of 5.17% over

the prior year's first interim dividend.

-- It is the Board's intention for each of the first three

interim dividends for 2023 to be equivalent to a quarter of Law

Debenture's total 2022 dividend of 30.5 pence per ordinary share.

Performance and growth of the IPS business continues to support the

Board's intention to maintain or increase the total dividend in

2023.

-- Dividend yield of 3.8% based on our closing share price of

812 pence on 26 July 2023 (with a relatively strong reserves

position).

Overall Highlights:

-- Modest outperformance (with debt and IPS at FV) in first half of 2023.

-- Long-term outperformance of the benchmark over three, five and ten years.

-- Strong long-term record with share price total return over 10

years of 129.3% (FTSE All-Share: 78%).

-- Total dividend income from the portfolio of GBP19.3m (June 2022: GBP18.4m).

YTD 1 year 3 years 5 years 10 years

% % % % %

NAV total return (with debt at par)[1] (*) 2.2 6.0 43.0 28.4 121.9

NAV total return (with debt at fair value)(1*) 4.0 11.1 60.9 38.9 136.4

FTSE Actuaries All-Share Index

Total Return[2] 2.6 7.9 33.2 16.5 78.0

Share price total return(2) (*) 1.5 5.0 67.4 59.2 129.3

Change in Retail Price Index[3] 4.1 10.4 28.2 33.3 50.3

IPS Highlights:

-- Wholly-owned independent provider of professional services.

Accounts for 21% of H1 2023 NAV but has funded approximately 34% of

dividends in the last 10 years.[4]

-- IPS enters its sixth consecutive year of consistent growth

with net revenues of GBP24.1m (June 2022: GBP21.7m) up 11.2% with

profit before tax up by 8.5% (compared to 30 June 2022).

Longer Term Record:

-- 134 years of history with a long-term track record of value creation for shareholders.

-- GBP10,000 invested in Law Debenture ten years ago would be

worth GBP22,930 as at 30 June 2023[5].

-- Over 44 years of increasing or maintaining dividends to shareholders.

Robert Hingley, Chairman, said:

"Law Debenture aims to provide a steadily increasing income for

our shareholders whilst achieving long-term capital growth in real

terms. The market backdrop has been difficult, with elevated levels

of inflation proving more persistent than many economic

commentators may have hoped and, within the investment trust

sector, a marked widening of discounts. Against this background, we

are pleased that IPS has shown continued growth and that, overall,

we have modestly outperformed our benchmark. We are confident that

the combination of a high-quality equity portfolio and growth in

our IPS business will continue to deliver attractive long-term

returns for our shareholders.

Denis Jackson, Chief Executive Officer, commented:

"Against a backdrop of continued macroeconomic uncertainty with

high global inflation and interest rates, Law Debenture has

delivered a solid performance in the first half of 2023. Our

portfolio managers select investments based on an assessment of

their long-term value and believe an undervalued UK stock market

continues to offer investors the opportunity to own resilient,

cash-generative and well-managed businesses at attractive valuation

multiples. We believe the strong, predictable income from the IPS

business offers our portfolio managers greater flexibility in their

investment selection, helping set Law Debenture apart from other UK

equity income trusts. Though the near-term economic outlook is not

without its challenges, we feel our ongoing investment in IPS

leaves it well positioned for medium-term growth in-line with our

mid to high single percentage target."

Past performance is not a guide to future performance. The value

of an investment and any income from it is not guaranteed and may

go down as well as up and investors may not get back the amount

invested.

THE LAW DEBENTURE CORPORATION P.L.C. AND ITS SUBSIDIARIES

HALF YEARLY REPORT FOR THE SIX MONTHS TO 30 JUNE 2023

(UNAUDITED)

Financial summary

Six months Six months Twelve months

30 June 30 June 2022 31 December

2023 2022

GBP000 GBP000 GBP000

------------------------------------ ----------- -------------- --------------

Net Asset Value - with debt

and IPS at fair value* 1,009,140 917,365 972,566

Total Net Assets per the statement

of financial position 812,578 787,932 799,067

------------------------------------ ----------- -------------- --------------

Pence Pence Pence

NAV per share at fair value(1,2,*) 775.92 726.74 761.69

Revenue return per share:

Investment portfolio 13.29 13.66 24.06

Independent professional services 4.80(3) 4.55(3) 10.38

Group revenue return per share 18.09 18.21 34.44

Capital (loss)/return per share (5.26) (100.61) (103.17)

Dividends per share(4) 7.625 7.25 30.50

Share price 767 760 771

------------------------------------ ----------- -------------- --------------

% % %

Ongoing charges(5*) 0.48 0.48 0.49

Net gearing(*) 13 11 12

Premium/(discount)(*) (1.15) 4.58 1.22

------------------------------------ ----------- -------------- --------------

(1) Please see below for calculation of NAV.

(2) NAV is calculated in accordance with the AIC methodology,

based on performance data held by Law Debenture including the fair

value of the IPS business and long-term borrowings.

(3) Revenue per share is calculated using the weighted average

shares in issue as at 30 June 2023.

(4) The second interim dividend is not due to be announced until

September 2023 and has not been factored in the calculation

presented. The Board have indicated their intention to pay three

interim dividends of 7.625p in respect of 2023, each representing a

quarter of the total 2022 dividend declared of 30.5p. The final

dividend will be declared in February 2024.

(5) Ongoing charges are calculated based on AIC guidance, using

the administrative costs of the investment trust and include the

Janus Henderson investment management fee, charged at an annual

rate of 0.30% of the NAV of the investment portfolio. There is no

performance related element to the fee.

* Items marked "*" are alternative performance measures ('APM')

and calculated using the published daily NAV. For a description of

these measures, see page 152 of the annual report and financial

statements for the year ended 31 December 2022.

Half yearly management report

Introduction

I am pleased to report that The Law Debenture Corporation p.l.c.

('Law Debenture') has delivered another solid performance during a

time of significant global economic uncertainty. Elevated interest

rates and persistent inflation have resulted in ongoing market

volatility. Despite these headwinds, the combination of our

well-diversified portfolio and another good performance from our

Independent Professional Services ('IPS') business has enabled Law

Debenture to marginally outperform our benchmark, the FTSE

Actuaries All-Share Index. This delivered a 2.6% total return,

whereas Law Debenture's Net Asset Value ('NAV'), with debt and IPS

at fair value, delivered a return of 4.0%. With debt at par, our

NAV delivered a return of 2.2%.

Our Investment Managers continue to build on their successful

long-term record of outperformance against our benchmark, the FTSE

Actuaries All Share Index, and drivers of their performance are

covered in detail in their report. Our IPS business is now well

into its sixth year of consistent mid-to-high single-digit growth,

with net revenue up 11.2% and profit before tax up 8.5%.

Our IPS business accounts for 21% of Law Debenture's NAV but has

funded approximately 34% of dividends over the past decade. As a

result, our Investment Managers have increased flexibility in

selecting what they feel are strong business models and attractive

valuation opportunities, which we believe will continue to position

the equity portfolio for future longer-term growth.

Dividend

We are pleased to continue building on our 44-year record of

maintaining or increasing dividends. We recently declared a first

interim dividend of 7.625 pence per ordinary share, representing an

increase of 5.2% over the prior year's first interim dividend. This

highlights the benefits of IPS's income streams, as well as Law

Debenture's substantial revenue reserves. This dividend was paid on

6 July 2023 to shareholders on the register at close of business on

2 June 2023. Based on the closing share price on 26 July 2023 of

812 pence, the dividend yield per Law Debenture share is 3.8%(1) .

Over the last 10 years, we have increased the dividend by 114%(2)

in aggregate, which compares favourably with our sector peers.

Since the publication of our Annual Report at the end of

February 2023, we have issued 2 million new ordinary shares to

existing and new investors, raising a total of GBP16.6 million. It

is the Board's current intention to recommend that the total

dividend in relation to 2023 is to maintain or increase the total

2022 dividend of 30.5 pence per ordinary share. Our shareholders

will be asked to vote on the final dividend at our AGM in 2024.

(1) Based on the total dividend paid in relation to 2022 of

30.5p per share.

(2) Based on the period 2012 to 2022.

Independent Professional Services

DIVISION Net revenue(1) Net revenue(1) Growth

30 June 2023 30 June 2022 2021/2022

GBP000 GBP000 %

-------------------- --------------- --------------- ----------

Pensions 8,597 6,973 23.3

Corporate Trust 5,818 5,185 12.2

Corporate Services 9,693 9,515 1.9

-------------------- --------------- --------------- ----------

Total 24,108 21,673 11.2

-------------------- --------------- --------------- ----------

(1) Revenue shown is net of cost of sales.

Corporate Trust

Despite a challenging economic backdrop, we are pleased to

report net revenue growth of 12.2% in the first half of 2023.

Primary issuance in debt capital markets ebbs and flows and

market conditions can change rapidly. Our long-standing

relationships with many of our clients and referral partners make

us well placed to participate when a more buoyant issuance

environment returns.

The strength of our Corporate Trust business lies in its

diversified revenue streams, some elements of countercyclicality

and, in the current environment at least, a healthy proportion of

fee income with linkage to inflation.

In 2019, we made the decision to increase the investment in our

escrow product. This product allows two (or more) parties the

ability to transfer an asset, typically cash, to us as a trusted

independent third-party, pending the satisfaction of certain

conditions that need to be met prior to the entitlement to such

assets being determined. Our increasing success in this market is

based on our ability to move fast and use our expertise to consider

bespoke transactions. Our book of business is growing steadily and

has considerable range including Corporate M&A, Litigation,

Real Estate and Sporting Events. Pensions is also an increasingly

active market for escrow services, which we are well-placed to

serve. For example, we completed a Reservoir Trust in the first

half of 2023 that resolved trapped surplus considerations between

the sponsor and participants in a major UK Pension Scheme.

Post-issue work, when a bond issuer runs into financial

difficulty, can lead to countercyclical incremental revenues for

this business. It is inevitable but unfortunate that, as businesses

adapt to the elevated interest rate environment, we are beginning

to see increasing signs of stress, which is likely to impact our

pool of issuers over time. Office for National Statistics' data

shows that corporate bankruptcies are currently on the rise. (3)

When bonds default, the workflow, risk and revenue profiles of our

role can materially change. A key duty of the bond trustee is to be

the legal creditor of the issuer on behalf of the bondholders. Our

role in such default situations requires material incremental work

that, given a favourable outcome, can lead to significant

additional income for us. That said, defaults often take years to

play out and the results are uncertain.

Many of the debt capital markets transactions that sit on our

books, built up over many decades, have contractual

inflation-linked fee increases for our services. The longer that

inflation remains at elevated levels (40-year highs for UK RPI were

recorded toward the end of last year (4) ) the more these

inflation-linked increases feed through to our book of

business.

We are now in our 134 (th) year of the provision of Corporate

Trust services to our clients. We are pleased to have grown our

business in the first half of 2023 despite challenging primary

market conditions. The diversification of our revenue streams, and

our ability to innovate, underpin our confidence that this business

will continue to produce good returns over the longer-term.

(3) Commentary - Monthly Insolvency Statistics April 2023 -

GOV.UK (www.gov.uk).

(4) Inflation and price indices - Office for National Statistics

(ons.gov.uk).

Pensions

The first half of 2023 has illustrated the importance of

effective pension scheme trusteeship and governance in turbulent

times. We have seen the continuation of activity driven from the

"gilts crisis" in Q3/Q4 2022 with many schemes recognising the need

to review their funding and investment strategies. In particular,

we are seeing an increased interest in journey planning and buy-in

strategies, as well as corporate sponsors working with trustees to

consider the viability of running pension schemes with a surplus on

a long-term basis.

Increasing regulatory obligations require more attention and

manpower than ever from the trustees and in-house teams. The common

denominator is the need for more expertise and relevant experience

from professional trustees and governance executives to help manage

schemes properly and effectively. We believe that the market need

for independent professional pension support continues to grow.

The Pensions business had a busy first half-year supporting

their existing clients as well as winning new business, with net

revenues up 23.3% for H1 at GBP8.6m. This positions us well to

build on our record of growth within this business, having

delivered compound revenue growth in the five-year period 2018 to

2022 of 10.7%.

Notable wins for the Trustee business have been Arvin Meritor,

Lafarge UK Pension Plan, and SLB. Ireland continues to grow its

book of business, having added Irish Life MasterTrust to its

portfolio of clients, among others. The Manchester Pensions team is

also growing and has firmly put Law Debenture on the map for

potential opportunities coming from the local offices of large law

firms and consultancies. In February, we were proud and grateful to

have been awarded "Independent Trustee Firm of the Year" at the

2023 Pensions Age awards. It was an honour to be recognised for the

work we do for our clients, especially following an eventful year

like 2022.

Our outsourced pensions governance business, Pegasus, has

expanded its team and continues to win new business including in

the corporate sole trustee space, in house support, scheme

secretarial services, project management, trustee effectiveness

review work and single code implementation.

We continue to hire and invest in the right people who can

deliver the high-quality service our Pensions team is known for in

the market. We believe that the diversity of expertise, experience

and background of our Pensions team has enabled us to provide a

first-class service to our clients and evolve our offering to meet

their requirements.

Corporate Services

Our Corporate Services business reported net revenue growth of

1.9%.

Corporate Secretarial Services ('CSS')

In our 2022 year-end update, we mentioned the capacity

constraints that we were experiencing. However, healthy demand for

our products and services remains very much in place. Satisfying

that demand with excellent people, efficient operational workflows,

and enhanced technology takes some time to deliver. Our journey to

hire and develop the right people, skills, technology, and

operational infrastructure continued in H1 2023 and will be the

focus for this business for the remainder of the year, under Trish

Houston's leadership.

At the last year end, we had raised our headcount by almost 40%

since the January 2021 acquisition of CSS. We added to our

headcount by a further 12% in this business in H1 2023, despite

fierce competition for candidates. We continue to make progress in

filling the skills and experience gaps that we have identified and

have expanded our staff training initiatives. Just after the year

end, we completed the implementation of a digital matter management

system that significantly enhances control, delivers efficiencies

and builds scale in the Global Entity Management segment of this

business. We are increasingly recording more accurate and useful

management information and are progressively able to make

better-informed decisions regarding effective resource

allocation.

The growing need for these types of outsourced governance

solutions is well established and underpinned by a steady stream of

regulatory initiatives. Put simply, the provision of high-quality

supply needs to catch up with demand. Over time, we are confident

that we will see good returns from this investment.

Service of Process

This remains our business which has the fewest recurring

revenues and is most dependent on global macro-economic factors.

Major economies, such as the UK and US, allow overseas businesses

to sign legal documents subject to their laws, provided that they

have either a registered address or appointed agent for service of

process in the governing law jurisdiction. We act as the agent for

service of process to thousands of clients from all over the world

each year. The greater the amount of global economic activity and

capital markets new issuance, the greater the demand for our

product. Given the difficult conditions in primary capital markets,

downward revisions to global economic growth, and a number of major

economies being at or close to entering recession, Service of

Process revenues were unsurprisingly depressed in the first half of

2023.

Our knowledge of this market reassures us that we will be well

placed as primary markets activity in capital markets improves and

global economic expansion returns. However, we have no special

insight as to when this might happen. In the meantime, we have

continued to improve our technology platform and remain very much

present in the minds of our referral partner networks.

Structured Finance

This niche business provides accounting and administrative

services to special purpose vehicles ('SPVs'). Typical buyers of

our services are asset managers, hedge funds and challenger banks.

They use SPV structures to warehouse and provide long-term funding

for real assets. Examples include credit card receivables,

mortgages, real estate and aircraft leases.

Although a small business for us, we saw record levels of

enquiry, new business wins and revenue in the first half of the

year. This is particularly pleasing given the difficult operating

conditions for many financial markets' participants. The increase

in our Paying Agency work (often driven by corporate disposals) was

encouraging in H1 2023 and we will work hard to continue to build

momentum in this substantial market.

In a busy industry where excellent delivery is a differentiator,

we will continue to focus on providing high-quality bespoke

products to our expanding group of clients.

Safecall

The first half of 2023 was another robust period for this

business as we continue to increase our market share in this

growing market.

Significant investment in account management and business

development resource was made, with new business wins hitting an

all-time high. Reports received on behalf of our clients also

reached record levels and barely a week goes by without a major

news story involving a whistleblower. Increased public awareness of

the product and regulatory impetus further reinforce our confidence

in the long-term growth prospects for our business in this

market.

Examples of the breadth of new business signed in the first half

of 2023 includes Evelyn Partners, TBC Bank, Herbert Smith

Freehills, a number of sporting organisations and several Fire

Services across the UK.

It is also important that we continue to innovate through

investment in our product offering. As a result, our revenue

streams are increasingly diversified. Sales of our training modules

are growing, as are appointments to undertake investigations, where

our unique expertise adds significant value for clients.

From a technology perspective, we delivered a new management

information module for our clients in H1 2023 and will develop more

advancements for clients in the latter half of the year. In

addition, we are investing in a new investigation training module

for our clients together with a new website, to improve user

experience for both prospective and existing clients.

Central overview

We have been steadily investing to ensure that our

infrastructure provides an appropriate, scalable, control

environment which is critical for us to deliver sustainable

long-term growth. In the first part of 2023, we have selectively

added expertise to fill skills gaps identified in HR, Finance and

IT.

Technology advances continue to quicken and, in order to compete

effectively and deliver as our clients demand, we must be nimble.

Accordingly, we have started a programme to refresh our IT

operating model adopted in 2019 that served us well during the many

challenges of Covid.

Environmental, Social and Governance ('ESG')

2022 was a significant year in Law Debenture's ESG development

and this was detailed in the 2022 Annual Report (pages 50-57).

Since then, we have continued our progress in the areas where we

can make a real impact.

We were ranked 1st in the Financial Services category and 2nd

overall amongst the FTSE 250 in the FTSE Women Leaders Review for

the second consecutive year. This Review is the third and successor

phase to the Hampton-Alexander and Davies Reviews. It is an

independent, voluntary and business-led initiative supported by the

UK Government, aimed at increasing the representation of women in

leadership roles.

In March 2023 we were shortlisted in the Trailblazer Exco and

Direct Reports' category for FTSE 250 businesses for the inaugural

Institute of Directors and INSEAD Alumni Balance in Business

Awards. Other shortlisted companies included a number of our

clients and market leading organisations such as Diageo plc, HSBC

Bank plc, Lloyds Banking Group plc, Marks and Spencer plc, Tate

& Lyle plc and Tesco plc.

We continue to give consideration to ESG factors across both the

investment portfolio and the IPS business and will share a more

detailed review in the 2023 Annual Report.

Outlook

We believe that the combination of IPS with the investment

portfolio is a unique and well-diversified model and I am

cautiously optimistic about the Group's progress in the second half

of 2023 and beyond, in spite of the ongoing macroeconomic

uncertainties. I believe that IPS' investment in talent and

technology leaves it well positioned to continue to win new

business, increase market share and deliver medium-term growth in

line with our mid-to-high single percentage target.

Our Investment Managers continue to invest in what they feel are

a differentiated selection of high-quality businesses with

competitive advantage and good long-term growth prospects. We are

confident that their disciplined approach of buying at attractive

entry point valuations will continue to deliver over the

longer-term for our shareholders. The Board supports their view

that the UK stock market continues to offer investors the

opportunity to own resilient, cash-generative and well-managed

business models that are well positioned to produce attractive

longer-term returns.

Denis Jackson

Chief Executive

27 July 2023

Investment managers' report

Overview

The period began positively with the return of some investor

confidence in equity markets. However, this proved short-lived when

the Silicon Valley Bank collapsed. There was concern at the time

that this collapse might lead to contagion globally. Thankfully,

this did not prove to be the case as the banking system does not

carry the same degree of leverage as in the past. The narrative in

the market moved on, but risk aversion in the market remains. The

global inflation level has not fallen as quickly as some had hoped.

This is particularly the case with the UK, resulting in continued

upward movement in its interest rates. The outcome has been that

the gilt market has adjusted downwards, leaving yields at a level

that is even higher than last autumn. This background of rising

rates has undermined investor confidence in equities, particularly

in UK-orientated small companies. AIM-listed companies in

particular, have experienced share price weakness, falling, in some

cases, to what appear to be extraordinarily low valuations.

Year to date, the FTSE Actuaries All-Share Index has seen some

marginal growth of 2.6% in total return. This compares to Law

Debenture's NAV (with debt and IPS at fair value) which saw total

return growth of 4%. This marginal out-performance of the benchmark

is predominantly driven by movements in the fair value of the debt

and growth in the valuation of the IPS business.

Activity

The share price weakness in UK listed businesses is creating

attractive long-term investment opportunities. Therefore, over the

six-month period, we have been a net buyer of GBP31.6 million UK

shares. This has been in a diverse number of companies; for

instance, the holding in Marshalls, the building materials company,

has been added to, as has Marks and Spencer where there are early

signs of trading improving. In the smaller companies' sphere, the

holding in the alternative energy company, Ceres Power, has been

increased, as has the exposure to Hipgnosis, the owner of a

catalogue of recorded music. In the technology space, we increased

the holding in Oxford Nanopore, the gene sequencing business, and

Surface Transforms, the ceramic brake maker. The exposure to

renewable energy was further expanded by purchases of Air Products

and Chemicals and Johnson Matthey. These companies are mainly

servicing very different end-markets, but they have in common the

potential to be substantially bigger businesses in the future,

without the current valuation reflecting this.

When increasing gearing, it is important to remain vigilant to

companies held that are not performing as hoped. During the period,

the holding in Direct Line was reduced after a disappointing

underwriting result. Unilever and Haleon were sold as their

valuations appear relatively high due to investors believing them

to be safe havens. On a recovery in equity market sentiment, the

risk appetite of investors might increase, which should benefit the

Portfolio.

Contributors

Amongst the five biggest positive contributors are two aerospace

stocks, namely Rolls Royce and Senior. The aviation industry is

recovering from the severe setback of Covid effects on air travel.

The number of miles flown globally has recovered and the aerospace

industry is an area of excellence in the UK. Another recovery stock

which has seen share price appreciation is Marks and Spencer,

thanks to an improved operating performance as a result of bold

management action, particularly in relation to its store footprint

and work to reposition their offering in clothing. One of the

largest contributors in the period was Flutter Entertainment, which

operates Betfair and Paddy Power in the UK. Flutter Entertainment

has also seen very strong growth in gaming in the US with the

opening up of the gambling market in some States, which contributed

to the rise in its share price.

Detractors

The largest detractor in the period was Direct Line. The

insurance company has had very disappointing underwriting results.

They failed to pick up some of the underlying trends in claims

experience. We reduced the holding and await management action to

address the problems.

Top five absolute contributors

The following five stocks produced the largest absolute

contribution to performance in the first half of 2023:

Share price

Stock movement (%) Contribution (GBPm)

----------------------- -------------- --------------------

Flutter Entertainment 40.0 7.0

Rolls Royce 77.1 6.8

Marks & Spencer 60.5 5.2

HSBC 20.6 4.6

Senior 39.9 4.3

Source: Performance data held by Law Debenture based on market

prices.

Top five absolute detractors

The following five stocks produced the largest negative impact

on portfolio valuation in the first half of 2023:

Share price

Stock movement (%) Contribution (GBPm)

----------------------- -------------- --------------------

Direct Line Insurance (35.7) (5.1)

Anglo American (30.9) (4.5)

i3 Energy (43.5) (3.3)

Rio Tinto (14.0) (3.1)

AFC Energy (58.6) (2.3)

Source: Performance data held by Law Debenture based on market

prices.

The next three largest detractors, Anglo American, i3 Energy and

Rio Tinto, are all commodity producers. The concerns over economic

activity have led to a fall in the price of, for instance, oil and

copper. These are cyclical shares, and we would expect them to

recover over time.

Income from the Investment Portfolio

Dividend payments from the underlying Portfolio are growing with

ordinary dividend income for H1 2023 up 4.9% at GBP19.3m (H1 2022:

GBP18.4m). This has exceeded our expectations, but last year the

Portfolio did benefit from GBP3.4m of special dividends, which has

not been repeated in 2023.

A large contributor to Law Debenture's overall income remains

the IPS business, which facilitates us holding low- or

zero-yielding stocks, not typically seen in an income fund.

ESG

We continue to interact and engage with companies, both at the

board and executive levels, on ESG factors. We believe that this

approach provides the most accurate insights into the progress

companies are making against their ESG objectives, such as

environmental footprint.

During the first half, we have challenged several company

management teams about all aspects of sustainability. Where

appropriate, we took action as a result of those engagements, which

included exiting positions where it seemed there was very little

progress against sustainability goals.

Outlook

The chart regarding UK Market PE vs World on page 11 of the half

year report illustrates how undemanding UK companies' valuations

have become. The investment focus remains on companies that will be

able to adapt to the circumstances they find themselves in. They

will do this by providing good quality products and services. At

the moment, however, investors are predominantly focused on

macro-economic concerns, the main one of which is the persistence

of inflation and the level interest rates may reach within the UK.

It is through periods of uncertainty like this that we can refresh

the Portfolio and position it so that it will benefit when a degree

of confidence returns.

James Henderson and Laura Foll

Investment Managers

27 July 2023

Sector distribution of portfolio by value

30 June 2023 31 December 2022

-------------------- ------------- -----------------

Oil and gas 10.9% 10.9%

Basic materials 6.7% 8.7%

Industrials 23.1% 21.7%

Consumer goods 7.4% 7.7%

Health care 7.7% 8.1%

Consumer services 10.3% 9.0%

Telecommunications 2.1% 2.0%

Utilities 3.2% 3.2%

Financials 26.6% 27.4%

Technology 2.0% 1.3%

Geographical distribution of portfolio by value

30 June 2023 31 December

2022

---------------- ------------- ------------

United Kingdom 83.8% 83.2%

North America 5.5% 5.1%

Europe 9.6% 10.6%

Japan 1.1% 1.1%

Fifteen largest holdings: investment rationale

as at 30 June 2023

Approx Valuation Appreciation/ Valuation

Rank % of Market Dec 2022 Purchases Sales (Depreciation) June 2023

2023 Company Location portfolio Cap. GBP000 GBP000 GBP000 GBP000 GBP000

----- ---------------- --------- ---------- ----------- ---------- ---------- ------- --------------- ----------

1 Shell UK 3.18 GBP109bn 29,075 - - 206 29,281

2 HSBC UK 2.93 GBP128.2bn 22,360 - - 4,601 26,961

3 BP UK 2.84 GBP86.5bn 27,069 - - (943) 26,126

Flutter

4 Entertainment UK 2.67 GBP11.3bn 17,492 - - 6,990 24,482

5 GlaxoSmithKline UK 2.1 GBP69.6bn 19,983 - - (679) 19,304

6 Barclays UK 2.05 GBP16.1bn 19,498 - - (632) 18,866

7 Rolls Royce UK 2.05 GBP69.8bn 8,797 3,223 - 6,786 18,806

8 Rio Tinto UK 2.04 GBP46.7bn 21,742 - - (3,048) 18,694

9 NatWest UK 1.7 GBP22.5bn 17,238 - - (1,592) 15,646

10 Marks & Spencer UK 1.68 GBP3.7bn 8,631 1,558 - 5,219 15,408

11 Senior UK 1.63 GBP0.8bn 10,682 - - 4,265 14,947

12 Sanofi France 1.57 GBP103.3bn 12,815 746 - 822 14,383

13 National Grid UK 1.48 GBP28.1bn 13,058 - - 557 13,615

14 Tesco UK 1.43 GBP16.7bn 11,888 - - 1,284 13,172

Lloyds Banking

15 Group UK 1.42 GBP33.0bn 13,623 - - (546) 13,077

Calculation of net asset value (NAV) per share

Valuation of our IPS business

Accounting standards require us to consolidate the income, costs

and taxation of our IPS business into the Group income statement

below. The assets and liabilities of the business are also

consolidated into the Group column of the statement of financial

position below. A segmental analysis is also provided below, which

shows a detailed breakdown of the split between the investment

portfolio, IPS business and Group charges.

Consolidating the value of the IPS business in this way fails to

recognise the value created for shareholders by the IPS business.

To address this, since December 2015, the NAV performance we have

published for the Group has included a fair value for the

standalone IPS business.

The current fair value of the IPS business is calculated based

on historical earnings before interest, taxation, depreciation and

amortisation ('EBITDA') for the second half of 2022, and the EBITDA

for the half year to 30 June 2023, with an appropriate multiple

applied.

The calculation of the IPS valuation and methodology used to

derive it are included in the previous annual report at Note 3 on

page 135. In determining a calculation basis for the fair valuation

of the IPS business, the Directors have taken external professional

advice from PwC LLP. The multiple applied in valuing IPS is from

comparable companies sourced from market data, with appropriate

adjustments to reflect the difference between the comparable

companies and IPS in respect of size, liquidity, margin and growth.

A range of multiples is then provided by PwC from which the Board

selects an appropriate multiple to apply. The make-up of our IPS

business is unique meaning we do not have a like for like

comparator group to benchmark ourselves against. We believe our

core comparators remain as Sanne Group, Intertrust, Link

Administration Holdings and JTC. However, each of these companies

have specific factors which limit their usability for a market

multiples-based valuation approach.

Sanne and Intertrust have been acquired and are no longer

listed. Link's valuation has been impacted by transactional

influences and updates to the ongoing Woodford scandal. JTC

continues to be a highly acquisitive group.

These company-specific factors restrict their usability when

monitoring market movements, but the transaction multiples

themselves do provide benchmark data points for consideration.

However, given these limitations, PwC have also considered the

wider, less comparable companies listed below, but only to broadly

assess market movements in the relevant and complementary service

sectors. The table below shows a summary of performance of our

comparators:

Revenue

Revenue CAGR FY19 EBITDA

LTM* LTM EV/EBITDA - margin

Company (GBPm) 30 June 2023 LTM 2023 LTM

------------------------------ -------- -------------- ----------- --------

Law Deb IPS 50 10.5x 12% 38%

SEI Investments Company 1,519 12.3x 5% 22%

SS&C Technologies Holdings,

Inc. 4,325 10.5x 4% 32%

EQT Holdings Limited 67 14.0x 7% 34%

Perpetual Limited 428 11.1x 11% 19%

JTC PLC 200 18.0x 27% 24%

Link Administration Holdings

Limited 662 5.3x -4% 13%

Begbies Traynor Group plc 116 8.7x 18% 19%

Christie Group plc 69 4.7x -3% 9%

*LTM refers to the trailing 12 months 'results' which are

publicly available. Source: Capital IQ.

The multiple selected for the current period is 10.5x, which is

broadly in line with the mean multiple of the comparator group. The

multiple selected is consistent with that used at both the half

year and year end of 2022.

It is hoped that our initiatives to inject growth into the IPS

business will result in a corresponding increase in valuation over

time. As stated above, management is aiming to achieve mid to high

single digit growth in 2023. The valuation of the IPS business has

increased by GBP120m/133% since the first valuation of the business

as at 31 December 2015.

Valuation guidelines require the fair value of the IPS business

be established on a stand-alone basis. The valuation does not

therefore reflect the value of Group tax relief from the investment

portfolio to the IPS business.

In order to assist investors, the Company restated its

historical NAV in 2015 to include the fair value of the IPS

business for the last ten years. This information is provided in

the annual report within the 10 year record.

Long-term borrowing

The methodology of fair valuing all long-term borrowings is to

benchmark the Group debt against A rated UK corporate bond

yields.

Calculation of NAV per share

The table below shows how the NAV at fair value is calculated.

The value of assets already included within the NAV per the Group

statement of financial position that relates to IPS is removed

(GBP57.3m) and substituted with the calculation of the fair value

and surplus net assets of the business (GBP153.4m). The fair value

of the IPS business has increased by 4.4% due to a combination of

higher surplus net assets being available and a higher EBITDA. An

adjustment of GBP43.1m is then made to show the Group's debt at

fair value, rather than the book cost that is included in the NAV

per the Group statement of financial position. This calculation

shows NAV fair value for the Group as at 30 June 2023 of

GBP1,009.1m or 775.92 pence per share:

30 June 2023 31 December 2022

Pence Pence per

GBP000 per share GBP000 share

------------------------------------ ---------- ----------- --------- ----------

Net asset value (NAV) per Group

statement of financial position 812,578 624.78 799,067 625.81

Fair valuation of IPS: EBITDA at

a multiple of 10.5x (31 December

2022: 10.5x) 178,017 136.88 174,174 136.41

IPS net assets attributable to

IPS valuation 32,627 25.09 27,566 21.59

Fair value of IPS business 210,644 161.97 201,740 158.00

Removal of IPS net assets included

in Group net assets (57,263) (44.03) (53,364) (41.79)

Fair value uplift for IPS business 153,381 117.94 148,376 116.20

Debt fair value adjustment 43,181 33.20 25,123 19.68

NAV at fair value 1,009,140 775.92 972,566 761.69

------------------------------------ ---------- ----------- --------- ----------

GBP000 % GBP000 %

NAV attributable to IPS 210,644 21 201,740 21

------------------------------------ ---------- ----------- --------- ----------

See commentary for the breakdown of the assets already included

in the NAV per the financial statements.

The Financial Statements NAV at fair value calculated above

differs to the published NAV at fair value for 30 June 2023 (half

year NAV released by RNS on 3 July 2023). As such, please see below

for a reconciliation:

Reconciliation of published NAV to results Pence

NAV: GBP000 per share

-------------------------------------------------- ---------- -----------

Published NAV cum income with debt at fair value 1,010,790 777.19

Reconciliation of shareholders' funds to net

assets:

Published NAV (819,233) (629.90)

Results NAV 812,578 624.78

Revised IPS valuation uplift:

Published NAV (valuation per 31 December 2022) (148,376) (114.08)

Results NAV 153,381 117.93

-------------------------------------------------- ---------- -----------

Total NAV at fair value per results 1,009,140 775.92

-------------------------------------------------- ---------- -----------

Group income statement

for the six months ended 30 June 2023 (unaudited)

30 June 2023 30 June 2022

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

UK dividends 16,005 - 16,005 15,921 - 15,921

UK special dividends - - - - 3,442 3,442

Overseas dividends 3,291 - 3,291 2,487 - 2,487

Overseas special dividends - - - - - -

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Total dividend income 19,296 - 19,296 18,408 3,442 21,850

Interest income 440 - 440 14 - 14

Independent professional services fees (+) 27,174 - 27,174 25,691 - 25,691

Other income 393 - 393 216 - 216

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Total income 47,303 - 47,303 44,329 3,442 47,771

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Net gain/(loss) on investments held

at fair value through profit or loss - (3,285) (3,285) - (124,238) (124,238)

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Total income and capital gains/(losses) 47,303 (3,285) 44,018 44,329 (120,796) (76,467)

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Cost of sales (3,141) - (3,141) (4,061) - (4,061)

Administrative expenses (19,391) (1,045) (20,436) (16,288) (996) (17,284)

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Operating profit/(loss) 24,771 (4,330) 20,441 23,980 (121,792) (97,812)

Finance costs

Interest payable (818) (2,454) (3,272) (818) (2,454) (3,272)

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Profit/(loss) before taxation 23,953 (6,784) 17,169 23,162 (124,246) (101,084)

Taxation (625) - (625) (669) - (669)

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Profit/(loss) for the period 23,328 (6,784) 16,544 22,493 (124,246) (101,753)

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

Return per ordinary share (pence) 18.09 (5.26) 12.83 18.21 (100.61) (82.40)

Diluted return per ordinary share (pence) 18.08 (5.26) 12.82 18.21 (100.58) (82.37)

-------------------------------------------- --------- -------- --------- --------- ---------- ----------

+ IPS fees are presented gross. Please refer to Note 6 below for

a reconciliation to the net revenue.

Group statement of comprehensive income

for the six months ended 30 June 2023 (unaudited)

30 June 2023 30 June 2022

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------------------------- -------- -------- ------- -------- ---------- ----------

Profit/(loss) for the period 23,328 (6,784) 16,544 22,493 (124,246) (101,753)

------------------------------------------------------- -------- -------- ------- -------- ---------- ----------

Foreign exchange gain/(loss) on translation of foreign

operations - (168) (168) - (112) (112)

------------------------------------------------------- -------- -------- ------- -------- ---------- ----------

Total comprehensive income/(loss) for the period 23,328 (6,952) 16,376 22,493 (124,358) (101,865)

------------------------------------------------------- -------- -------- ------- -------- ---------- ----------

Group statement of financial position

as at 30 June 2023 (unaudited)

Unaudited Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

Non-current assets GBP000 GBP000 GBP000

------------------------------------------------------- ------------- ------------- -----------------

Goodwill 19,010 18,973 19,036

Property, plant and equipment 1,838 1,901 1,796

Right-of-use asset 4,584 5,253 5,040

Other intangible assets 2,971 3,177 3,417

Investments held at fair value through profit or loss 918,221 853,231 891,005

Retirement benefit asset 7,973 7,085 7,400

Total non-current assets 954,597 889,620 927,694

------------------------------------------------------- ------------- ------------- -----------------

Current assets

Trade and other receivables 18,363 24,213 19,697

Contract assets 9,576 8,720 7,182

Cash and cash equivalents 33,520 71,979 49,559

------------------------------------------------------- ------------- ------------- -----------------

Total current assets 61,459 104,912 76,438

------------------------------------------------------- ------------- ------------- -----------------

Total assets 1,016,056 994,532 1,004,132

------------------------------------------------------- ------------- ------------- -----------------

Current liabilities

Trade and other payables 18,865 19,854 19,815

Lease liability 964 356 991

Corporation tax payable 1,718 1,387 1,256

Other taxation including social security 2,376 2,561 2,892

Contract liabilities 6,139 7,504 5,223

------------------------------------------------------- ------------- ------------- -----------------

Total current liabilities 30,062 31,662 30,177

------------------------------------------------------- ------------- ------------- -----------------

Non-current liabilities and deferred income

------------------------------------------------------- ------------- ------------- -----------------

Long-term borrowings 163,931 164,267 163,909

Contract liabilities 3,151 3,463 3,976

Deferred tax liability* 1,344 1,060 1,344

Lease liability 4,990 6,148 5,659

Total non-current liabilities 173,416 174,938 174,888

------------------------------------------------------- ------------- ------------- -----------------

Total net assets 812,578 787,932 799,067

------------------------------------------------------- ------------- ------------- -----------------

Equity

Called up share capital 6,530 6,371 6,407

Share premium 102,812 72,042 83,022

Own shares (4,180) (3,128) (3,128)

Capital redemption 8 8 8

Translation reserve 2,687 2,544 2,855

Capital reserves 655,463 665,177 662,512

Retained earnings 49,258 44,918 47,391

------------------------------------------------------- ------------- ------------- -----------------

Total equity 812,578 787,932 799,067

------------------------------------------------------- ------------- ------------- -----------------

Total equity pence per share(+) 624.78 624.20 625.81

------------------------------------------------------- ------------- ------------- -----------------

* The deferred tax liability has been re-classified as

non-current to align with the disclosure requirements outlined in

IAS 1.56.

(+) Please see above for calculation of total equity pence per

share.

Group statement of cash flows

for the six months ended 30 June 2023 (unaudited)

Unaudited Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

GBP000 GBP000 GBP000

--------------------------------------------------------------------- ------------- ------------- -----------------

Cash flows from operating activities (before dividends received and

taxation paid) 3,603 (2,052) 2,249

--------------------------------------------------------------------- ------------- ------------- -----------------

Cash dividends received 17,958 15,921 37,498

--------------------------------------------------------------------- ------------- ------------- -----------------

Taxation paid - - (700)

--------------------------------------------------------------------- ------------- ------------- -----------------

Cash generated from operating activities 21,561 13,869 39,047

--------------------------------------------------------------------- ------------- ------------- -----------------

Investing activities

Acquisition of property, plant and equipment (191) (79) (151)

Acquisition of right of use assets - - (428)

Expenditure on intangible assets - (60) (639)

Purchase of investments (less cost of acquisition) (51,631) (77,296) (170,653)

Sale of investments 21,130 92,327 145,892

--------------------------------------------------------------------- ------------- ------------- -----------------

Cash flow from investing activities (30,692) 14,892 (25,979)

--------------------------------------------------------------------- ------------- ------------- -----------------

Financing activities

Interest paid (3,272) (3,272) (6,544)

Dividends paid (21,236) (19,530) (37,167)

Payment of lease liability (629) (239) (505)

Proceeds of increase in share capital 19,913 30,403 41,419

Purchase of own shares (1,052) 87 87

--------------------------------------------------------------------- ------------- ------------- -----------------

Net cash flow from financing activities (6,276) 7,449 (2,710)

--------------------------------------------------------------------- ------------- ------------- -----------------

Net increase/(decrease) in cash and cash equivalents (15,407) 36,210 10,358

--------------------------------------------------------------------- ------------- ------------- -----------------

Cash and cash equivalents at beginning of period 49,559 35,880 35,880

Foreign exchange gains/(losses) on cash and cash equivalents (632) (111) 3,321

--------------------------------------------------------------------- ------------- ------------- -----------------

Cash and cash equivalents at end of period 33,520 71,979 49,559

--------------------------------------------------------------------- ------------- ------------- -----------------

Group statement of changes in equity

as at 30 June 2023 (unaudited)

Share Share Capital Translation Capital Retained

capital premium Own shares redemption reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ---------

Balance at 1

January 2023 6,407 83,022 (3,128) 8 2,855 662,512 47,391 799,067

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ---------

Profit/(loss)

for the

period - - - - - (6,784) 23,328 16,544

Foreign

exchange - - - - (168) (265) (225) (658)

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ---------

Total

comprehensive

profit/(loss)

for the

period - - - - (168) (7,049) 23,103 15,886

Issue of

shares 123 19,790 (1,052) - - - - 18,861

Dividend

relating to

2022 - - - - - - (11,276) (11,276)

Dividend

relating to

2023 - - - - - - (9,960) (9,960)

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ---------

Total equity

at 30 June

2023 6,530 102,812 (4,180) 8 2,687 655,463 49,258 812,578

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ----------- ---------

Independent Professional

Investment Portfolio Services Total

---------------------------------- ------------------------------- ----------------------------------

30 30 31 30 June 30 June 31 30 30 31

June June 2022 Dec 2022 2023 2022 Dec June June 2022 Dec 2022

2023 2022 2023

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ---------- ---------- ---------- --------- --------- --------- ---------- ---------- ----------

Revenue

Dividend income 19,296 18,408 34,464 - - - 19,296 18,408 34,464

IPS revenue

Corporate

Trust - - - 6,800 6,614 13,292 6,800 6,614 13,292

Corporate

Services - - - 11,744 12,094 25,792 11,744 12,094 25,792

Pensions - - - 8,630 6,983 14,368 8,630 6,983 14,368

Segment income 19,296 18,408 34,464 27,174 25,691 53,452 46,470 44,099 87,916

Other income 393 216 847 - - - 393 216 847

Cost of sales (75) (43) (125) (3,066) (4,018) (8,283) (3,141) (4,061) (8,408)

Administration

costs (1,856) (898) (3,522) (17,535) (15,390) (30,810) (19,391) (16,288) (34,332)

Return before

interest and

tax 17,758 17,683 31,664 6,573 6,283 14,359 24,331 23,966 46,023

Interest

payable (net) (624) (804) (1,432) 246 - 62 (378) (804) (1,370)

Return,

including

profit on

ordinary

activities

before

taxation 17,134 16,879 30,232 6,819 6,283 14,421 23,953 23,162 44,653

Taxation - - - (625) (669) (1,392) (625) (669) (1,392)

Return,

including

profit

attributable

to

shareholders 17,134 16,879 30,232 6,194 5,614 13,029 23,328 22,493 43,261

Return per

ordinary share

(pence) 13.29 13.66 24.06 4.80 4.55 10.38 18.09 18.21 34.44

Assets 931,689 910,116 922,080 84,367 84,416 84,640 1,016,056 994,532 1,006,720

Liabilities (176,373) (166,604) (176,377) (27,105) (39,996) (31,276) (203,478) (206,600) (207,653)

Total net

assets 755,315 743,512 745,703 57,263 44,420 53,364 812,578 787,932 799,067

Group segmental analysis

Please see below for a breakdown of net revenue by

department.

The capital element of the income statement is wholly

attributable to the investment portfolio.

Principal risks and uncertainties

The principal Group risks include investment performance and

market risk, cyber and technology risk and IPS concentration risk.

ESG considerations are our emerging risk.

These top risks are explained along with mitigating actions in

the Risk Management section of the Annual Report for the year ended

31 December 2022. In the view of the Board these risks and

uncertainties are as applicable to the remaining six months of the

financial year as they were to the period under review. As part of

ongoing risk management to identify new risks and developments, the

Board continues to review and assess risks, uncertainties and

impacts during the course of the year.

Related party transactions

There have been no related party transactions during the period

which have materially affected the financial position or

performance of the Group. During the period, transactions between

the Corporation and its subsidiaries have been eliminated on

consolidation. Details of related party transactions are given in

the notes to the annual accounts for the year ended 31 December

2022.

Directors' responsibility statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements have been prepared

in accordance with IAS 34 Interim Financial Reporting as

adopted by the UK and gives a true and fair view of the

assets, liabilities, financial position and profit of the

Group as required by DTR 4.2.4R;

-- the half yearly report includes a fair review of the information

required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that

have occurred during the first six months of the current

financial year and their impact on the condensed set

of financial statements; and a description of the principal

risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken

place in the first six months of the current financial

year and that have materially affected the financial

position or performance of the entity during that period.

On behalf of the Board

Robert Hingley

Chairman

27 July 2023

Past performance is not a guide to future performance. The value

of an investment and any income from it is not guaranteed and may

go down as well as up and investors may not get back the amount

invested.

Notes to the condensed consolidated financial statements

Basis of preparation

1.

The condensed set of financial statements included in this

half yearly financial report has been prepared in accordance

with International Accounting Standards (IASs) in conformity

with the requirements of the Companies Act 2006 and in accordance

with International Financial Reporting Standards (IFRS) as

adopted and endorsed by the UK.

The financial resources available are expected to meet the

needs of the Group for the foreseeable future. The financial

statements have therefore been prepared on a going concern

basis.

The Group's accounting policies during the period are the

same as in its 2022 annual financial statements, except for

those that relate to new standards effective for the first

time for periods beginning on (or after) 1 January 2023,

and will be adopted in the 2023 annual financial statements.

Presentation of financial information

2.

The financial information presented herein does not amount

to full statutory accounts within the meaning of section

435 of the Companies Act 2006 and has neither been audited

nor reviewed pursuant to guidance issued by the Auditing

Practices Board. The annual report and financial statements

for 2022 have been filed with the Registrar of Companies.

The independent auditor's report on the annual report and

financial statements for 2022 was unqualified, did not include

a reference to any matters to which the auditor drew attention

by way of emphasis without qualifying the report, and did

not contain a statement under section 498(2) or (3) of the

Companies Act 2006.

Calculations of NAV and earnings per share

3.

The calculations of NAV and earnings per share are based

on:

NAV: shares at end of the period 130,057,740 (30 June 2022:

126,230,289; 31 December 2022: 127,685,028) being the total

number of shares on issue less shares acquired by the ESOT

in the open market.

Income: average shares during the period 128,924,615 (30

June 2022: 123,497,103; 31 December 2022: 125,628,620) being

the weighted average number of shares on issue after adjusting

for shares held by the ESOT.

Listed investments

4.

Listed investments are all traded on active markets and as

defined by IFRS 13 are Level 1 financial instruments. As

such they are valued at unadjusted quoted bid prices. Unlisted

investments are Level 3 financial instruments. They are valued

by the Directors using unobservable inputs including the

underlying net assets of the instruments.

5. Note to the statement of cash flows

The presentation of the cash flow statement has been updated in

line with that in the 2022 annual report. As such, this note

accompanies the statement of cash flows above.

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

------------------------------------------ ---------- ---------- -------------

Operating profit/(loss) before

interest and taxation 20,441 (97,812) (78,411)

Adjust for non-cash flow items:

------------------------------------------ ---------- ---------- -------------

Losses/(gains) on investments 3,285 124,238 126,234

Movement in amortised cost of borrowings 22 - (336)

Depreciation of property, plant

and equipment 149 152 328

Depreciation of right-of-use assets 456 349 931

Amortisation of intangible assets 379 679 675

Decrease/(increase) in receivables (1,060) (5,856) 198

(Decrease)/increase in payables (950) (8,183) (9,604)

(Decrease)/increase in deferred

income 91 - (475)

(Decrease)/increase in other taxation

payable (679) 811 (1,123)

Normal pension contributions in

excess of cost (573) (509) 1,330

Dividends receivable (17,958) (15,921) (37,498)

------------------------------------------ ---------- ---------- -------------

Cash flows from operating activities

(before dividends received and

taxation paid) 3,603 (2,052) 2,249

------------------------------------------ ---------- ---------- -------------

6. Breakdown of net revenue per department

The table below illustrates a breakdown of net revenue per

department:

Gross Revenue Cost of sales Net Revenue

---------------------------- ---------------------------- ----------------------------

30 June 30 June 31 Dec. 30 June 30 June 31 Dec. 30 June 30 June 31 Dec.

2023 2022 2022 2023 2022 2022 2023 2022 2022

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Pensions 8,630 6,983 14,368 (33) (10) (25) 8,597 6,973 14,343

Corporate

Trust 6,800 6,614 13,292 (982) (1,429) (2,672) 5,818 5,185 10,620

Corporate

Services 11,744 12,094 25,792 (2,051) (2,579) (5,586) 9,693 9,515 20,206

----------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Total IPS

income 27,174 25,691 53,452 (3,066) (4,018) (8,283) 24,108 21,673 45,169

----------- -------- -------- -------- -------- -------- -------- -------- -------- --------

7. Investments

A full list of investments is included on the website each month.

8. Half yearly report 2023

The 2023 half yearly report will be available on the website in early

August via the following link:

https://www.lawdebenture.com/investment-trust/shareholder-information/annual-reports-and-half-yearly-reports

Registered office:

8th Floor, 100 Bishopsgate, London, EC2N 4AG Telephone: 020 7606

5451

(Registered in England - No. 00030397)

LEI number - 2138006E39QX7XV6PP21

[1] NAV is calculated in accordance with the Association of

Investment Companies (AIC) methodology, based on performance data

held by Law Debenture including the fair value of the IPS business

and long-term borrowings.

[2] Source: Refinitiv.

[3] Source: Office for National Statistics.

[4] Calculated for the 10 years ended 31 December 2022.

[5] Calculated on a total return basis assuming dividend

re-investment between 30 June 2013 and 30 June 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFETDSIDFIV

(END) Dow Jones Newswires

July 28, 2023 02:00 ET (06:00 GMT)

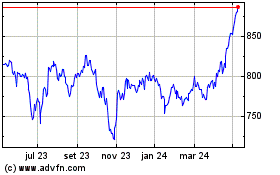

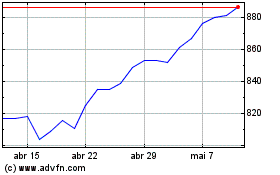

Law Debenture (LSE:LWDB)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Law Debenture (LSE:LWDB)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024