TIDMNESF

RNS Number : 6003W

NextEnergy Solar Fund Limited

10 November 2014

NOT FOR PUBLICATION, RELEASE, OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN, OR INTO THE UNITED STATES, CANADA, AUSTRALIA,

JAPAN, SOUTH AFRICA OR ANY JURISDICTION IN WHICH THE SAME WOULD BE

UNLAWFUL OR TO U.S. PERSONS (WITHIN THE MEANING OF REGULATION S

UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED).

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS. THIS

ANNOUNCEMENT DOES NOT CONSTITUTE OR FORM PART OF, AND SHOULD NOT BE

CONSTRUED AS, ANY OFFER FOR SALE OR SUBSCRIPTION OF, OR

SOLICITATION OF ANY OFFER TO BUY OR SUBSCRIBE FOR, ANY SHARES IN

NEXTENERGY SOLAR FUND LIMITED IN ANY JURISDICTION, INCLUDING THE

UNITED STATES, NOR SHALL IT, OR ANY PART OF IT, OR THE FACT OF ITS

DISTRIBUTION, FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY CONTRACT OR INVESTMENT DECISION WHATSOEVER, IN ANY

JURISDICTION. THIS ANNOUNCEMENT DOES NOT CONSTITUTE A

RECOMMENDATION REGARDING ANY SECURITIES.

ANY INVESTMENT DECISION MUST BE MADE EXCLUSIVELY ON THE BASIS OF

THE PROSPECTUS EXPECTED TO BE PUBLISHED BY THE COMPANY (AND ANY

SUPPLEMENT THERETO).

10 November 2014

NextEnergy Solar Fund Limited ("NESF")

Placing Programme Up-date

Further to its announcement on 5 November 2014 regarding an

initial placing and an offer for subscription of New Ordinary

Shares, NESF now expects to publish the Prospectus relating to the

Placing Programme later today. All other dates remain unchanged.

Accordingly, the timetable for the Placing Programme, the initial

placing and the offer for subscription is expected to be as

follows:

Prospectus published Monday, 10 November

2014

Placing Programme opens Monday, 10 November

2014

Offer for subscription opens Monday, 10 November

2014

Initial placing opens Monday, 10 November

2014

Latest time for receipt of applications

under offer for subscription in order

to be eligible for allotment of New

Ordinary Shares on Thursday, 13 November

2014 1.00 p.m. on Wednesday,

12 November 2014

Initial placing closes 4.00 p.m. on Wednesday,

12 November 2014

Result of Initial Issue announced Thursday, 13 November

2014

New Ordinary Shares issued pursuant

to Initial Issue admitted to Official

List of FCA and dealings commence in

such shares on London Stock Exchange's

main market 8.00 a.m. on Wednesday,

19 November 2014

CREST accounts credited in respect

of New Ordinary Shares issued pursuant

to Initial Issue in uncertificated

form Wednesday,

19 November 2014

Share certificates despatched in respect

of New Ordinary Shares issued pursuant

to Initial Issue in certificated form By Wednesday,

3 December 2014

Placing Programme (including offer

for subscription) closes Monday, 9 November 2015

Notes:

1. The Placing Programme will comprise of one or more placings

of up to (in aggregate) 200 million New Ordinary Shares and/or C

Shares and an offer for subscription of up to 50 million New

Ordinary Shares and will be implemented in accordance with the

terms, conditions and other information to be set out in the

Prospectus.

2. In this announcement, the "Initial Issue" means an initial

placing of New Ordinary Shares and an initial allotment of New

Ordinary Shares pursuant to the offer for subscription.

A further announcement will be made upon publication of the

Prospectus.

Terms defined in the shareholder circular dated 9 October 2014

have the same meanings when used in this announcement.

For further information:

020 3239

NextEnergy Capital Limited 9054

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe (Financial Adviser and 020 7894

Joint Lead Bookrunner) 7667

Sue Inglis (Corporate Finance)

Andrew Worne / Andrew Davey / Tom Dixon (Sales)

020 7408

Shore Capital (Sponsor and Joint Bookrunner) 4090

Bidhi Bhoma

Anita Ghanekar

Patrick Castle

Macquarie Capital (Europe) Limited (Joint Lead 020 3037

Bookrunner) 2000

Ken Fleming

020 3128

MHP Communications 8100

Rupert Trefgarne

Jamie Ricketts

Important Notes:

Cantor Fitzgerald Europe, which is authorised and regulated in

the United Kingdom by the FCA, is acting exclusively for NESF in

connection with issue of New Shares pursuant to the Placing

Programme and Admission and will not be responsible to anyone other

than NESF for providing the protections afforded to clients of

Cantor Fitzgerald Europe or for advising any such person in

connection with the Placing Programme. This does not limit or

exclude any responsibilities which Cantor Fitzgerald Europe may

have under FSMA or the regulatory regime established

thereunder.

Macquarie Capital (Europe) Limited, which is authorised and

regulated in the United Kingdom by the FCA, is acting exclusively

for NESF in connection with issue of New Shares pursuant to the

Placing Programme and Admission and will not be responsible to

anyone other than NESF for providing the protections afforded to

clients of Macquarie Capital (Europe) Limited or for advising any

such person in connection with the Placing Programme. This does not

limit or exclude any responsibilities which Macquarie Capital

(Europe) Limited may have under FSMA or the regulatory regime

established thereunder.

Shore Capital and Corporate Limited, which is authorised and

regulated in the United Kingdom by the FCA, is acting exclusively

for NESF in connection with issue of New Shares pursuant to the

Placing Programme and Admission and will not be responsible to

anyone other than NESF for providing the protections afforded to

clients of Shore Capital and Corporate Limited or for advising any

such person in connection with the Placing Programme. This does not

limit or exclude any responsibilities which Shore Capital and

Corporate Limited may have under FSMA or the regulatory regime

established thereunder.

Shore Capital Stockbrokers Limited, which is authorised and

regulated in the United Kingdom by the FCA, is acting exclusively

for NESF in connection with issue of New Shares pursuant to the

Placing Programme and Admission and will not be responsible to

anyone other than NESF for providing the protections afforded to

clients of Shore Capital Stockbrokers Limited or for advising any

such person in connection with the Placing Programme. This does not

limit or exclude any responsibilities which Shore Capital

Stockbrokers Limited may have under FSMA or the regulatory regime

established thereunder.

This announcement has been issued by and is the sole

responsibility of NESF. No representation or warranty, express or

implied, is or will be made as to, or in relation to, and no

responsibility or liability is or will be accepted by, Cantor

Fitzgerald Europe, Macquarie Capital (Europe) Limited, Shore

Capital and Corporate Limited, Shore Capital Stockbrokers Limited

or any of their respective affiliates or agents as to or in

relation to the accuracy or completeness of this announcement or

any other written or oral information made available to or publicly

available to any interested party or their advisers and any

liability therefor is expressly disclaimed.

Notes to Editors:

NextEnergy Solar Fund

NextEnergy Solar Fund (www.nextenergysolarfund.com) is a

specialist investment fund focused on operational solar

photovoltaic ("PV") assets located in the UK. The Company intends

to provide investors with a sustainable and attractive dividend

that increases in line with RPI over the long term and an element

of capital growth through the re-investment of net cash generated

in excess of the target dividend.

Further information on NextEnergy Capital and WiseEnergy is

available at www.nextenergycapital.com and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFIFLDLILIS

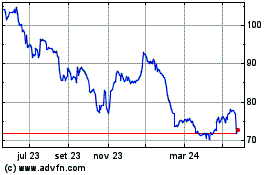

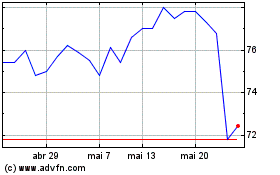

Nextenergy Solar (LSE:NESF)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Nextenergy Solar (LSE:NESF)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024