TIDMNESF

RNS Number : 1150E

NextEnergy Solar Fund Limited

16 October 2018

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN OR INTO, THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR THE

REPUBLIC OF SOUTH AFRICA.

The information communicated in this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this information is considered to be in the public

domain.

LEI: 213800ZPHCBDDSQH5447

16 October 2018

NEXTENERGY SOLAR FUND LIMITED (THE "COMPANY")

Issue of Preference Shares, amendments to the Company's articles

of incorporation and investment policy (the "Proposals")

Introduction

The Company announces that it has entered into a conditional

subscription agreement with AIP Solco Limited (the "Investor"), a

wholly owned subsidiary of AIP Infrastructure LP, an investment

vehicle backed by three BAE Systems pension schemes and managed by

Arjun Infrastructure Partners, pursuant to which the Investor had

conditionally agreed to subscribe GBP100,000,000 for 100,000,000

new non-voting Preference Shares (the "Subscription").

The Preference Shares will carry a preferred right to dividends,

at a rate of 4.75%, and to capital in a liquidation. From 1 April

2036, the holders of the Preference Shares (the "Preference

Shareholders") will have rights to convert all or some of their

Preference Shares into either ordinary shares of no par value in

the capital of the Company (the "Ordinary Shares") or a new class

of unlisted B shares, at the election of the holder, with the B

shares carrying rights to dividends and capital in a liquidation

that are pari passu with those of the Ordinary Shares.

In parallel, the Company will have the right, at its sole

discretion, to redeem the Preference Shares at nominal value in

part or whole, at any time starting from1 April 2030, 6 years prior

to the conversion rights awarded to the Preference Shareholders

becoming exercisable.

The entitlements of the Preference Shares to Ordinary Shares and

/ or B shares upon conversion will be calculated by reference to

the net asset value ("NAV") of the Ordinary Shares and the issue

price of the Preference Shares respectively as at the date of

conversion.

While the Company will initially raise GBP100,000,000 from the

Subscription, it is seeking authority to issue up to 200,000,000

Preference Shares in total.

Background

The Company has identified an opportunity to optimise its

capital structure by raising funding on attractive terms in the

form of the Preference Shares.

Currently the total debt outstanding is GBP365m representing 38%

of the Company's gross asset value. Of this total debt, GBP122m is

long-term, fully amortising project financing that can be optimised

through refinancing and GBP40m is a short-term credit facility to

be reimbursed by 2020. The remainder is long-term fully-amortising

debt financing already optimised and not available for

refinancing.

The proceeds of the Subscription will be used to repay a portion

of the existing long-term project financing facilities associated

with its portfolio investments. The Preference Shares represent a

cheaper source of funds in terms of lower yearly cash cost compared

to alternative financing sources, ranging from long-term debt

financing to issuance of new Ordinary Shares. This reduced cost is

achieved mainly in exchange for priority of dividend payments over

the Ordinary Shares.

The Subscription proceeds will be used to repay existing debt

facilities and, in so doing, holders of Ordinary Shares (the

"Ordinary Shareholders") and the Company will benefit from a lower

service cost than could be obtained for borrowing facilities

traditionally available for financing solar photovoltaic ("PV")

assets (where the yearly debt service cost includes both interest

and principal repayment components, and there is also the

refinancing at maturity of any non-amortised debt amounts).

The lower yearly service cost of the Preference Shares will

increase the free cash flow to the Company, allowing the Company to

use the additional cash for general corporate purposes, including

all matters permitted by the Company's investment policy (the

"Investment Policy") from time to time, including but not limited

to investment in new assets or extension/optimisation of current

portfolio assets owned by the Company or any of its subsidiaries,

and payment of dividends by the Company in accordance with its

latest published dividend policy. Comparing the fixed dividend

entitlement of the Preference Shares to the return expected on the

Company's portfolio, the additional free cash flow is expected to

increase the dividend cover available to the Ordinary Shareholders

and have a positive effect on NAV over time.

Further Preference Shares may be issued under the authority

conferred by the resolutions to be proposed at the upcoming

extraordinary general meeting ("EGM") (the "Resolutions") (which

expires at the next annual general meeting ("AGM") (or 15 months

after the passing of the Resolutions, and which the Company intends

to renew at the next AGM).

Alternative funding sources

The application of the proceeds of the Preference Shares issued

pursuant to the Proposals to the financing of a typical UK solar PV

investment of the Company is expected to enhance the average

dividend cover for Ordinary Shareholders by 0.12x and increase

levered internal rate of return ("IRR") by 0.75%. For comparison,

an issuance of long-term debt financing at current best market

terms would have an impact on the dividend cover and IRR of 0.03x

and 0.64% respectively.

In net present value terms, the proposed Subscription would

generate cash savings of GBP34m compared to issuing Ordinary Shares

as a result of the lower total dividend cost of the Preference

Shares over the period to 31 March 2036 (under current 2.75% long

term retail price index ("RPI") estimates and using the Company's

unlevered discount rate of 6.75%). When compared to the total debt

service (principal and interest) of an illustrative debt financing

at best market terms, the lower fully-costed cost of capital of the

Preference Shares represents cash savings of GBP17.9m in net

present value for the Subscription.

In addition, issue costs associated with this transaction as a

percentage of the amount raised are significantly lower compared to

alternative sources as per the estimate below:

-- c.1.7% for an issue of new Ordinary Shares.

-- c.1.3% for long-term debt.

-- c.0.6% for the issue of the Preference Shares as per the Subscription.

The Preference Shares carry a fixed dividend and capital

entitlement to 31 March 2036 and, from 1 April 2036, the Preference

Shareholders will also have rights to convert all or some of their

Preference Shares into either Ordinary Shares or B shares, at the

election of the holder, with the non-voting B shares carrying

rights to dividends and capital in a liquidation that are pari

passu with those of the Ordinary Shares. The entitlement of the

Preference Shares to Ordinary Shares or B shares (as the case may

be) will be proportionate to the amount of Preference Shares

outstanding at the date of conversion valued at their initial

subscription price of 100 pence per Preference Share plus accrued

but unpaid dividends (if any, at that time), as compared to the net

asset value per Ordinary Share of the Company (by reference to the

Preference Shares and the Ordinary Shares together (plus B shares

if any are in issue)).

The Preference Shares and any B shares arising from the

conversion of Preference Shares will be accounted for as equity by

the Company. As such, under the terms of the investment management

agreement and the administration agreement, the assets attributable

to them will be subject to the ad valorem fees of NextEnergy

Capital IM Limited (the "Investment Manager") and the administrator

at the applicable rates. The marginal rate for the fees of the

Investment Manager is 0.8% per annum.

The Subscription

The Investor has, pursuant to the subscription agreement dated

15 October 2018 between the Investor and the Company (the

"Subscription Agreement"), agreed conditionally to subscribe for

100,000,000 new Preference Shares at an issue price of GBP1.00 per

Preference Share to raise gross proceeds of GBP100 million (net

proceeds GBP99.4 million). The closing of the Subscription

Agreement is conditional only upon the passing of the Resolutions,

following which the Preference Shares will be issued to the

Investor. The net proceeds can be used for general corporate

purposes, including all matters permitted by the Company's

Investment Policy from time to time including investment in new

assets or extension/optimisation of current portfolio assets owned

by the Company or any of its subsidiaries, and payment of dividend

by the Company in accordance with its latest published dividend

policy. The proceeds of the initial GBP100m Subscription will be

immediately used to repay existing long-term project financing

facilities associated with portfolios recently acquired by the

Company.

Benefits of the Proposals

The Company's board of directors (the "Board") believes that the

issue of Preference Shares and the associated change in the

Investment Policy are in the best interests of the Company's

shareholders for the following reasons:

-- The issuance of Preference Shares allows the Company to

optimise its capital structure and increase the dividend cover and

equity returns for its Ordinary Shareholders.

-- Preference Shares are an efficient source of funding compared

to debt and equity alternatives available to the Company. The

Subscription of GBP100m will allow refinancing of a portion of the

Company's borrowings at terms beneficial to Ordinary Shareholders

and the Company in terms of lower cash service cost than could be

obtained for borrowing facilities traditionally available for

financing solar PV assets (where the service cost includes an

interest component and repayment of capital).

-- Subsequent issues of up to 100,000,000 preference shares may

take place (assuming the resolutions are passed) and these may

repay further debt facilities or finance new investments consistent

with the Company's Investment Policy, thus optimising further the

Company's capital structure to the benefit of Ordinary

Shareholders. The Company intends to issue the balance of the

Preference Shares within 12 months of the Subscription and expects

to carry out a further issue before the end of the calendar

year.

-- The application of proceeds of Preference Shares issued

pursuant to the Proposals to the financing of a typical UK solar PV

investment of the Company is expected to enhance the average

dividend cover for Ordinary Shareholders by 0.12x and increase

levered IRR by 0.75%. For comparison, an issuance of long-term debt

financing at current best market terms would have an impact of

0.03x and 0.64% respectively and imply significant restrictive debt

covenants.

-- The option to redeem Preference Shares at the sole discretion

of the Company is valuable for Ordinary Shareholders: should more

competitive sources of capital become available, the Company may

issue new capital (debt or equity) to fund the redemption. The

Preference Shares are only redeemable by the Preference

Shareholders in limited circumstances, i.e. in the event of a

delisting or change of control of the Company, and otherwise only

at the option of the Company at any point after 1 April 2030.

-- The proceeds of the Subscription will be promptly applied to

repay existing long-term project financing facilities, thereby

generating cash savings starting in the current financial year.

Should the Company repay GBP162m of debt financing through issuance

of Preference Shares, the total debt outstanding would reduce from

38% to 21% of Gross Asset Value.

-- In net present value terms, the proposed Subscription of

GBP100m of Preference Shares would generate cash savings of

GBP34.0m compared to issuing Ordinary Shares and lower total

dividend cost of the Preference Shares over the period to 31 March

2036 (under current 2.75% long term RPI estimates and using the

Company's unlevered discount rate of 6.75%).

Consequential changes to the Investment Policy

The Company's existing Investment Policy includes limitations on

the use of leverage. In recognition of the priority of payment (in

relation to dividends and assets in a liquidation) given to the

holders of Preference Shares, it is proposed to amend the

Investment Policy in order to include Preference Shares in the

calculation of the 50% leverage limit over the Company's gross

asset value.

Amendments to the articles of incorporation

In addition to the insertion of the rights attaching to the

Preference Shares and B shares into the articles of incorporation

of the Company (the "Articles"), including a new Article 53 which

sets out the rights attaching to the Preference Shares and a new

Article 56 which sets out the rights attaching to the B shares, the

Company wishes to make some further amendments which are intended

to address recent changes to the Companies (Guernsey) Law 2008 (as

amended) and regulation in order to ensure the Articles are current

and compliant.

Article Change Rationale

Article 2 New defined term Required in relation

"B Shares" to the Preference

Shareholders' rights

of conversion.

------------------------------ --------------------------

New defined term Required for new

"Change of Control" Article 53.6

------------------------------ --------------------------

Amended defined term Required to clarify

"Conversion Ratio" that the relevant

ratio is of a comparison

between C Shares

and Ordinary Shares

------------------------------ --------------------------

New defined term Required for new

"Delisting" Article 53.6

------------------------------ --------------------------

Amended defined term Amended to refer

"Disclosure and Transparency to the Disclosure

Rules" Guidance rather than

Disclosure Rules

------------------------------ --------------------------

New defined term As discussed in this

"Investment Policy" document

------------------------------ --------------------------

New defined term As discussed in this

"Preference Shares" document

------------------------------ --------------------------

New defined term As discussed in this

"Purchase Price" document

------------------------------ --------------------------

Amended defined term Required to include

"Share" Preference Shares

and B Shares

------------------------------ --------------------------

New defined term Required for amended

"Working Day" Article 48.2.

------------------------------ --------------------------

Article 5.3 Deletion of provisions Sections 292 and

relating to Sections 293 of the Companies

292 and 293 of the Law have been repealed

Companies Law which in September 2015.

relate to the authority

of the Board to issue

shares.

------------------------------ --------------------------

Articles 33.3, 36.7 Amended to clarify Required for practical

and 36.8 that the directors reasons and to reflect

can participate provided current guidance

they are not in the and practice.

UK, regardless of

their place of residence.

------------------------------ --------------------------

Article 34.1(A) Deletion of Article The deletion reflects

34.1(A) which relates an amendment to section

to the disclosure 162 of the Companies

of a director's interests Law in September

in a transaction. 2015.

------------------------------ --------------------------

Article 48.2 Amendment of statutory The amendment reflects

notice periods for a change to section

documents to be given 523 the Companies

or served under the Law in September

Companies Law. 2015.

------------------------------ --------------------------

Article 53 Rights of the Preference As discussed in this

Shares document

------------------------------ --------------------------

Article 56 Rights of the B Shares Required in relation

to the Preference

Shareholders' rights

of conversion.

------------------------------ --------------------------

A copy of the new Articles showing the proposed changes to the

Company's current Articles is available for inspection at the

offices of NextEnergy Capital Limited at Heathcoat House, 20 Savile

Row, Mayfair, London, W1S 3PR and at the registered office of the

Company.

Risk factors

Shareholders should have regard to and carefully consider the

risk factors described below in addition to the other information

set out in this announcement. The following are those risk factors

which the Board considers to be material as at the date of this

announcement. If any of the adverse events described below actually

occur, the Company's business, financial condition, results or

prospects could be materially and adversely affected. Additional

risks and uncertainties which were not known to the Board at the

date of this announcement or that the Board considers at the date

of this announcement to be immaterial may also materially and

adversely affect the Company's business, financial condition,

results or prospects.

-- Impact of Preference Share dividend

The fixed cumulative dividend on the Preference Shares is at a

lower rate than the target dividend yield on the Ordinary Shares

and is not linked to growth in UK inflation. The issue of the

Preference Shares therefore provides an opportunity for the Company

to raise additional capital on more favourable terms than a further

Ordinary Share issue, and in a manner which does not adversely

affect the returns to Ordinary Shareholders. However, there can be

no assurance that the Company will be able to continue to meet its

Ordinary Share dividend targets. In the event that the Company does

not receive sufficient income to fund the Preference Share

dividends and the target Ordinary Share dividends in full, then the

Preference Share dividends will be paid in priority to the Ordinary

Share dividends and returns to Ordinary Shareholders may be

reduced. To the extent Preference Share dividends remain unpaid or

undeclared, this will increase the proportional entitlement of the

holders of the Preference Shares to Ordinary Shares / B shares upon

conversion on or after 1 April 2036 and may therefore reduce the

proportional holdings on the Ordinary Shares.

-- Risks relating to liquidation

In the event of a future liquidation of the Company, the holders

of the Preference Shares will be entitled to receive the amount

subscribed for the Preference Shares plus any unpaid or undeclared

Preference Share dividends in priority to the Ordinary

Shareholders. The amounts which Ordinary Shareholders will receive

on a liquidation may therefore be reduced by the amounts paid to

Preference Shareholders.

-- Redemption of the Preference Shares

On or after 1 April 2030, the Company may elect (at the sole

discretion of the Directors) to redeem all or some of the

Preference Shares. Such redemption would reduce proportionately the

future entitlement of the Preference Shareholders to future

dividends and distributions; also the funds applied to such

redemption would not be available for making investments or for the

Company's general purposes and this could reduce the returns to

Ordinary Shareholders or impact the Company's ability to repurchase

the Company's Ordinary Shares in order to manage discounts to the

Company's net asset value.

-- Leverage

Under the International Financial Reporting Standards, the

Preference Shares will be accounted for as equity but the Board is

of the view that, given the priority of payment of dividends (and

assets in a liquidation) granted to its holders, the Ordinary

Shareholders should be protected by amending the current Investment

Policy to ensure the maximum leverage of 50% of the Company's gross

asset value (as it was set at the time of the Company's admission

to the Official List of the FCA) is intended as total debt plus

Preference Shares, divided by the Company's gross asset value.

There is a risk that this may reduce the Company's ability to

borrow even where borrowing is at a lower cost of capital than the

issue of Preference Shares (but note the Company's redemption

rights after 1 April 2030). In addition, the Company has covenanted

in the Subscription Agreement not to exceed a maximum adjusted

gearing ratio of 50% of GAV in the context of new borrowings, new

issues of Preference Shares and redemption or repurchases of the

Ordinary Shares. These limits may impact on the Company's ability

to repurchase Ordinary Shares or obtain any new borrowings.

-- Management fee

The Investment Manager is entitled to receive an annual fee

which is payable monthly in advance, accruing daily on the basis of

the prevailing NAV and calculated on a sliding scale, as follows

below:

-- for the tranche of NAV up to and including GBP200 million, 1% of NAV.

-- for the tranche of NAV above GBP200 million and up to and

including GBP300 million, 0.9% of NAV.

-- for the tranche of NAV above GBP300 million, 0.8% of NAV.

The Preference Shares are an equity instrument and therefore the

assets attributable to Preference Shareholders will form part of

the NAV, including for the purpose of calculating the management

fee. Based on the current NAV, the Preference Shares will therefore

attract a marginal fee rate of 0.8% of the assets attributable to

them.

-- NMPI status

At present in the UK, the Company is not a "non-mainstream

pooled investment" as a consequence of being a company which, if it

were incorporated in the UK, would qualify as an investment trust.

The issue of the Preference Shares will not result in the loss of

this status, but if any Preference Shares are converted into B

Shares on or after 1 April 2036, and there is no change to the

existing UK regime relating to "non-mainstream pooled investments",

then the Company may at that point in future lose this status.

Extraordinary general meeting

The EGM will be held at 1 Royal Plaza, Royal Avenue, St Peter

Port, Guernsey, GY1 2HL, on 8 November 2018 commencing at 4:00

p.m.

Analyst meeting

NESF's Investment Adviser will host a conference call for

analysts at 09:00 hours (UK time) today. If you would like to

attend or have any further questions, please contact MHP

Communications on 020 3128 8778 or nextenergy@mhpc.com.

Enquiries

NextEnergy Capital Michael Bonte-Friedheim T: +44 (0) 20

Limited / Aldo Beolchini 3746 0700

Cantor Fitzgerald Robert Peel T: +44 (0) 20

Europe 7894 8016

Fidante Capital John Armstrong-Denby T: +44 (0) 20

7832 0983

Shore Capital Anita Ghanekar T: +44 (0) 20

7408 4090

Macquarie Capital Nick Stamp T: +44 (0) 20

(Europe) Limited 3037 2000

Ipes (Guernsey) Limited Nick Robilliard T: +44 (0) 1481

713 843

Important information

The information contained in this announcement does not

constitute an offer of securities for sale in any jurisdiction.

Notes to Editors:

NESF is a specialist investment company that invests primarily

in operating solar power plants in the UK. It has the authority to

invest up to 15% of its Gross Asset Value in operating solar power

plants in OECD countries outside the UK. The Company's objective is

to secure attractive shareholder returns through RPI-linked

dividends and long-term capital growth. The Company achieves this

by acquiring solar power plants on agricultural, industrial and

commercial sites.

NESF has raised equity proceeds of GBP592m since its initial

public offering on the main market of the London Stock Exchange in

April 2014. It also has credit facilities outstanding of c.GBP365m

in place (GBP149m from a syndicate including MIDIS, NAB and CBA;

MIDIS: GBP54m; ING GBP32m; UniCredit GBP32m; Santander GBP40m; and

Bayerische Landesbank GBP58m).

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division and over the course of its activities has provided

operating asset management, monitoring, technical due diligence and

other services to over 1,300 utility-scale solar power plants with

an installed capacity in excess of 1.9 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at www.nextenergysolarfund.com, www.nextenergycapital.com

and www.wise-energy.eu.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEBIBDGXGBBGIU

(END) Dow Jones Newswires

October 16, 2018 02:00 ET (06:00 GMT)

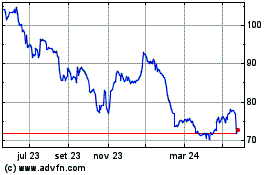

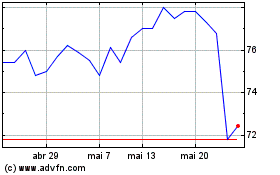

Nextenergy Solar (LSE:NESF)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Nextenergy Solar (LSE:NESF)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024