TIDMNESF

RNS Number : 1902V

NextEnergy Solar Fund Limited

09 December 2021

LEI: 213800ZPHCBDDSQH5447

9 December 2021

NextEnergy Solar Fund Limited

("NESF" or the "Company")

Scrip Dividend Shares - Additional Listing

NextEnergy Solar Fund, a renewable energy infrastructure

investment company specialising in solar that provides shareholders

with an attractive risk-adjusted return from a diversified

portfolio of primarily UK-based assets, is pleased to announce the

following in respect of the scrip dividend:

Dividend period: 1 June 2021 to 30 September

2021

Dividend amount per share: 1.79 pence

Scrip dividend price per share: 99.05 pence

Payment date/Allotment of scrip: 31 December 2021

Number of new shares to be issued: 459,975

Application has been made to the London Stock Exchange for

459,975 ordinary shares to be admitted to trading. These ordinary

shares are to be issued as a scrip dividend alternative to

receiving a cash dividend in respect of the dividend for the second

quarter of the Company's 2021/22 financial year. Dealings are

expected to commence at 8:00 a.m. on 31 December 2021.

Immediately following Admission, the Company's issued share

capital will comprise 588,694,100 ordinary shares, none of which

will be held in treasury. Each ordinary share carries the right to

one vote and, therefore, the total number of voting rights in the

Company on Admission will be 588,694,100. This figure may be used

by shareholders and other investors as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

-End-

For further information:

NextEnergy Capital Group 020 3746 0700

Michael Bonte-Friedheim ir@nextenergysolarfund.com

Aldo Beolchini

Ross Grier

Peter Hamid (Investor Relations)

RBC Capital Markets

Matthew Coakes

Elizabeth Evans

Kathryn Deegan 020 7653 4000

Cenkos Securities 020 7397 8900

James King

William Talkington

Shore Capital 020 7408 4090

Anita Ghanekar

Camarco 020 3781 8334

Owen Roberts

Eddie Livingstone-Learmonth

Apex Fund and Corporate Services (Guernsey)

Limited 020 3530 3668

Nick Robilliard

Helen Chamberlain

Notes to Editors(1) :

About NextEnergy Solar Fund

NESF is a specialist solar power renewable energy investment

company listed on the premium segment of the London Stock Exchange

that invests in operating utility-scale solar power plants. The

Company may invest up to 30% of its gross asset value in non-UK

OECD countries, 15% in solar-focused private equity structures, and

10% in energy storage.

NESF currently has a diversified portfolio comprising 99

operating solar assets (primarily on agricultural, industrial, and

commercial sites), and a $50m commitment into NextPower III (a

private ESG solar infrastructure fund providing exposure to

operating and in-development international solar assets).

The NESF portfolio has a combined installed power capacity of

895MW (including NextPower III MW on an equivalent look-through

basis).

As at 30 September 2021, the Company had a gross asset value of

GBP1,087 million, being the aggregate of the net asset value of the

ordinary shares, the fair value of the preference shares and the

amount of NESF Group debt outstanding, and a net asset value of

GBP607million.

NESF's investment objective is to provide ordinary shareholders

with attractive risk-adjusted returns, principally in the form of

regular dividends, by investing in a diversified portfolio of

primarily UK-based solar energy infrastructure assets. The majority

of long-term cash flows from its investments are

inflation-linked.

For further information on NESF please visit

nextenergysolarfund.com

Commitment to ESG

NESF is committed to ESG principles and responsible investment

which make a meaningful contribution to reducing CO2 emissions

through the generation of clean solar power. NESF will only select

investments that meet the requirements of NEC Group's Sustainable

Investment Policy. Based on this policy, NESF benefits from NEC's

rigorous ESG due diligence on each investment. NESF is committed to

reporting on its ESG performance in accordance with the UN

Sustainable Development Goals framework and the EU Sustainable

Finance Disclosure Regulation.

NESF has been awarded the London Stock Exchange's Green Economy

Mark and has been designated a Guernsey Green Fund by the Guernsey

Financial Services Commission.

NESF's sustainability-related disclosures in the financial

services sector in accordance with Regulation (EU) 2019/2088 can be

accessed on the ESG section of both the NESF website (

nextenergysolarfund.com/esg/ ) & NEC Group website (

nextenergycapital.com/sustainability/transparency-and-reporting/

).

About NextEnergy Capital Group ("NEC Group")

NESF is managed by the NextEnergy Capital Group, a specialist

solar investment manager, which has a strong track record in

sourcing, acquiring, and managing operating solar assets. NEC Group

is a leading player in the global solar investment sector and has

over 200 team members with offices in UK, Italy, India, and the USA

and assets under management of over $2.9bn across three

institutional funds.

NextEnergy Capital Group donates at least 5% of its net annual

profits to NextEnergy Foundation. NextEnergy Foundation is an

international charity that was founded in 2016. Its mission is to

participate proactively in the global effort to reduce carbon

emissions, provide clean power sources in regions where they are

not yet available, and contribute to poverty alleviation.

For further information on NEC Group please visit

nextenergycapital.com

For further information on NextEnergy Foundation visit

nextenergyfoundation.org

About WiseEnergy

WiseEnergy is NEC Group's specialist operating asset management

division. NESF is differentiated by its access to WiseEnergy, which

provides operating asset management, monitoring, technical due

diligence, and other services to over 1,300 utility-scale solar

power plants, with an installed capacity in excess of 2.2GW.

For further information on WiseEnergy please visit

wise-energy.com

([1]) Note: All financial data is as at 30 September 2021, being

the latest date in respect of which NESF has published financial

information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ALSDKCBKOBDDNBK

(END) Dow Jones Newswires

December 09, 2021 12:06 ET (17:06 GMT)

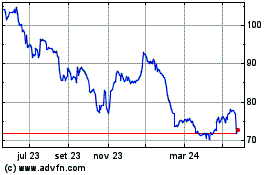

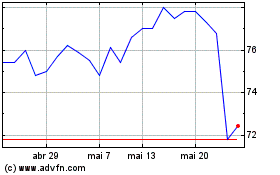

Nextenergy Solar (LSE:NESF)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Nextenergy Solar (LSE:NESF)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024