TIDMNTBR

RNS Number : 9230Q

Northern Bear Plc

23 October 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, THE USA,

SINGAPORE, THE REPUBLIC OF SOUTH AFRICA AND ANY OTHER JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF THE MARKET ABUSE REGULATION (EU

596/ 2014) AS IT FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018, AS AMED

23 October 2023

Northern Bear plc

("Northern Bear", the "Company" or, together with its

subsidiaries, the "Group")

Proposed return of capital of up to GBP3.1 million by way of

Tender Offer for up to 5,000,000 Ordinary Shares at a fixed price

of 62 pence per Ordinary Share

Notice of General Meeting

Trading Update

Northern Bear (LSE:NTBR), the AIM quoted holding company of the

group of companies providing specialist building and support

services headquartered in Northern England and serving customers

across the UK, is pleased to announce a proposed return of capital

of up to GBP3.1 million by way of a Tender Offer for up to

5,000,000 Ordinary Shares at a fixed price of 62 pence per Ordinary

Share (the "Tender Offer"), pursuant to which Shareholders are

invited to tender some or all of their Ordinary Shares for purchase

by the Company. The maximum number of Ordinary Shares that could be

purchased under the Tender Offer will be 5,000,000, which is

equivalent to 26.7 per cent. of the Current Issued Ordinary Shares

as at the Record Date and at a price of 62 pence per Share (the

"Tender Price").

The Tender Price of 62 pence per Ordinary Share represents:

-- a premium of 39.3 per cent. to the closing price of 44.5

pence per Ordinary Share on the Latest Practicable Date; and

-- a premium of 26.0 per cent. to the volume weighted average

price per Ordinary Share over one month prior to the Latest

Practicable Date.

The Company expects to post a circular (the "Circular") to

Shareholders today explaining details of the Tender Offer and

including a Notice of General Meeting detailing a proposed ordinary

resolution authorising the Company to repurchase up to 5,000,000

Ordinary Shares (the "Resolution"). The Resolution shall be

proposed at the General Meeting which will be convened at 10:00

a.m. on 15 November 2023.

A copy of the Circular will be published on the Company's

website at www.northernbearplc.com later today and will be posted

to shareholders. A Tender Form for use by Shareholders who hold

their Ordinary Shares in Certificated Form in connection with the

Tender Offer is also being sent together with the Circular.

RECOMMATION

As Shareholders are aware, the Board has undertaken a review of

strategic options for the Company and its approach to capital

allocation.

The Board has also undertaken a more proactive approach to

investor relations, including the appointment of Hybridan as

corporate broker to the Company, which has resulted in Hybridan

initiating research coverage and earnings forecasts.

As part of this strategic review, the Board explored potential

exit options for all Shareholders, including Jeff Baryshnik, as the

Company's largest shareholder. Having concluded this strategy

review, as announced on 5 April 2023, the Company's Executive

Directors, Keith Soulsby and Thomas Hayes, subsequently proposed

that the Company undertake the Tender Offer primarily as an

accretive event for Shareholders and secondarily as a means of

shareholders who wish to sell their investments, including Jeff

Baryshnik, exiting their investments in an orderly manner, while

still ensuring the Company could secure sufficient funding to

pursue its growth strategy.

The Board considers the Tender Offer, the resultant repurchases

of Ordinary Shares into treasury, and, therefore, the passing of

the Tender Offer Resolution to be in the best interests of the

Company and Shareholders as a whole; and therefore, unanimously

recommends that Shareholders vote in favour of the Tender Offer

Resolution.

The Board does not however make any recommendation to

Shareholders as to whether or not to tender any or all or their

Ordinary Shares pursuant to the Tender Offer. Such a decision is

reserved solely for individual Qualifying Shareholders and any such

Shareholders who are in any doubt as to whether or not to tender

some or all of their Ordinary Shares should take their own

independent financial advice from their stockbroker, bank manager,

solicitor, accountant or other appropriate independent financial

adviser duly authorised under FSMA if they are resident in the

United Kingdom or, if not, from another appropriately authorised

independent financial adviser.

RATIONALE

The Board believes that the Tender Offer outlined above is in

the Company and Shareholders' best interests for the following

reasons:

-- The Tender Offer is expected to be accretive to earnings per

share from completion of the Tender Offer and for the financial

year commencing 1 April 2024 onwards.

-- The Tender Offer would enhance the Company's capital

structure. The Company would fund the Tender Offer using its

existing cash resources and an increase of GBP1.0 million to its

existing debt facilities of GBP4.5 million from its bank,

Clydesdale Bank plc (trading as Virgin Money), with modest leverage

required in relation to historical profit levels. The Group

currently has no bank debt and had a net cash position at the last

financial year end of GBP3.2 million, although the year-end

position is ordinarily the high point of the financial year and

there are significant movements in net cash on a week-to-week

basis. The average month-end balance since 1 April 2023 was GBP1.3

million net cash and the low point during the same period was

GBP0.6 million net debt.

-- The Tender Offer would create an exit strategy for

Shareholders who wish to sell their investments, including Jeff

Baryshnik.

-- The Tender Offer would remove the prolonged uncertainty that

an overhang of shares would create, should any significant

Shareholders wish to sell their holdings through the market.

-- The Tender Offer is offered at a premium to the current share

price and at a discount to the 52-week high price of sixty-four

pence (GBP0.64) per Ordinary Share reached during August 2023.

-- The Tender Offer is open to all Shareholders (but will not be

taken up by those Directors, PDMRs and/or major Shareholders who

have signed irrevocable undertakings not to tender their holdings

of Ordinary Shares pursuant to the Tender Offer, as detailed

below), on an equal basis, with approval being granted at a Company

General Meeting, giving Shareholders the ability to vote on the

proposal and to participate in the Tender Offer.

DIRECTOR AND SUBSTANTIAL SHAREHOLDER INTENTIONS

Jeff Baryshnik (the Company's Non-Executive Chairman) and

Cedarvale Holdings Ltd., a company owned by Jeff Baryshnik, have

signed an irrevocable undertaking to vote in favour of the Tender

Offer Resolution to be proposed at the General Meeting and to

tender their combined shareholding of, in aggregate, 4,736,717

Ordinary Shares in the Tender Offer.

The Company's other Board members and PDMRs holding Ordinary

Shares, being Steven Mark Roberts (who was previously a director of

the Company and remains a director of its subsidiaries) Thomas

Edward Hayes (Finance Director), Keith Soulsby (Operations

Director), and the Company's second largest shareholder, Nicholas

Beaumont-Dark, have signed irrevocable undertakings to vote in

favour of the Tender Offer Resolution and to NOT participate in the

Tender Offer on the basis that it is accretive to Shareholders.

They wish to retain their holdings and believe that there is

greater long-term value in the Company than represented by the

Tender Price.

The non-participating irrevocable undertakings apply to the

following holdings:

Shareholder Number of Ordinary Shares

Steven Mark Roberts 813,300

Thomas Edward Hayes 80,000

Keith Soulsby 557,820

Nicholas Beaumont-Dark 3,253,500

Total: 4,704,620

EFFECT OF IRREVOCABLES NOT TO ACCEPT THE TER OFFER

After deducting the irrevocables detailed above the maximum

number of shares that can be tendered by qualifying Shareholders is

14,020,656.

Therefore, Shareholders will be able to tender a minimum of

35.6% of their holdings if they so wish.

The Company and registrars will endeavour to not leave tendering

Shareholders with an uneconomic small shareholding.

BOARD CHANGES

On conclusion of the General Meeting, assuming the Tender Offer

Resolution is passed, Jeff Baryshnik will retire from his role as

Chairman and as a Board Director of the Company and its

subsidiaries. At such time, Harry Samuel, one of the Company's

current Non-Executive Directors, would take the position of Interim

Non-Executive Chairman until the Board has identified and appointed

a permanent successor.

UPDATE ON TRADING

The Company last provided a trading update on 12 September 2023

in advance of its Annual General Meeting. It stated that the Group

had continued to trade in line with management's expectations since

publication of the preliminary results on 17 July 2023 and that

trading in the new financial year from 1 April to 31 July was ahead

of strong prior year results for the same period. It also stated

that site activity levels remain high despite the ongoing economic

challenges and their related impact on the construction

industry.

The Board is pleased to reiterate this update and to state that

trading in the period from 1 April 2023 to 31 August 2023 has been

ahead of strong prior year results. The Board intends to provide a

further trading update, including commentary on the expected

financial performance for the six-month period to 30 September

2023, in the week commencing 30 October 2023 in order to allow

Shareholders to make decisions based on the expected half-year

results.

The Group's interim financials for the 6-month period to 30

September 2023 are expected to be released in late November 2023,

at which point the Board will provide further guidance on expected

full year results. The Board continues to monitor ongoing

uncertainties in the macroeconomic climate in which the Company

operates, including the challenges of attracting and retaining high

quality employees in the construction industry as has been noted in

previous trading updates.

The Board has arranged for Link Group (the Company's registrar),

acting as agent on the Company's behalf, to undertake and conduct

the Tender Offer for up to 26.7 per cent. of the Current Issued

Ordinary Shares at the Tender Price (being 62 pence per Ordinary

Share). Link Group, will, subject to completion of the Tender Offer

and in accordance with its terms, arrange for the payment of the

Tender Price in cash to successful tendering Shareholders in

accordance with the terms of the Tender Offer (as set out in Part 4

of the Circular - Details of the Tender Offer).

Further details on the Tender Offer and the rationale are set

out below.

For further information, please contact:

Northern Bear PLC

Jeff Baryshnik - Non-Executive Chairman

Tom Hayes - Finance Director +44 (0) 166 182 0369

Strand Hanson Limited (Nominated Adviser)

James Harris

James Bellman +44 (0) 20 7409 3494

Hybridan LLP (Nominated Broker)

Clarie Louise Noyce +44 (0) 20 3764 2341

Expected timetable of principal events with respect to the

Tender Offer

Action Date

Announcement and open of the Tender 23 October 2023

Offer and issue of the Circular

Latest time and date of receipt of 10:00 a.m. on 13 November

Forms of Proxy for the General Meeting 2023

General Meeting 15 November 2023

Announcement of results of General 15 November 2023

Meeting

Latest time and date for receipt of 1:00 p.m. on 22 November

Tender Forms and share certificates 2023

or other documents of title for tendered

Certificated Ordinary Shares (i.e.

close of the Tender Offer)

Latest time and date for settlement 1:00 p.m. 22 November 2023

of TTE Instructions for tendered Uncertificated

Ordinary Shares (i.e. close of the

Tender Offer)

Record Date for the Tender Offer 6:00 p.m. on 22 November

2023

Announcement of the results of the 29 November 2023

Tender Offer

Settlement Date for the Tender Offer 8 December 2023

and purchase of Ordinary Shares under

the Tender Offer

CREST accounts credited for revised 8 December 2023

Uncertificated shareholdings of Ordinary

Shares (in the case of unsuccessful

tenders for entire holdings of Ordinary

Shares)

CREST accounts credited in respect 8 December 2023

of Tender Offer proceeds for Uncertificated

Ordinary Shares

Cheques despatched in respect of Tender 8 December 2023

Offer proceeds for Certificated Ordinary

Shares

Return of share certificates in respect 8 December 2023

of unsuccessful tenders of Certificated

Ordinary Shares

Despatch of balance share certificates 8 December 2023

in respect of unsold Ordinary Shares

in Certificated Form

FURTHER INFORMATION REGARDING THE TER OFFER

Details of the Tender Offer

The Tender Offer is conditional upon the Tender Conditions

(detailed in paragraph 2.1 of Part 4 (Details of the Tender Offer)

of the Circular) being satisfied; and, subject to satisfaction of

the same, the Tender Offer enables Qualifying Shareholders who wish

to realise some of their investment in Ordinary Shares to elect to

do so (subject to the overall limits applicable to the Tender

Offer). The Tender Offer is being made for up to 26.7 per cent. of

the Company's Current Issued Ordinary Shares, and each Qualifying

Shareholder is entitled to tender their entire holding of Ordinary

Shares (or a proportion thereof) if they so choose. There is no

obligation on a Qualifying Shareholder to tender any of their

shares.

The maximum number of Ordinary Shares to be acquired under the

Tender Offer is 5,000,000 Ordinary Shares, representing 26.7 per

cent. of the Ordinary Shares in issue as at the Latest Practicable

Date. If Qualifying Shareholders tender shares in excess of this

Tender Cap, Link Group, in consultation with the Company will

allocate the tendered shares between the tendering Shareholders in

accordance with paragraph 5 of Part 4 (Details of the Tender Offer)

of the Circular; and the Company shall only be obliged to purchase

from those tendering Shareholders such number of tendered shares as

Link Group have allocated.

Whilst the Tender Offer is conditional upon the Tender Offer

Conditions being satisfied, it is not conditional on the Ordinary

Shares trading at a discount to the Tender Price as at the Tender

Deadline Date (i.e. in the event that Ordinary Shares are trading

at a premium to the Tender Price as at the Tender Deadline Date,

Qualifying Shareholders who tender Ordinary Shares may receive less

than they could otherwise be able to realise in the market).

Ordinary Shares which are tendered for acceptance under the

Tender Offer may not be sold, transferred, charged or otherwise

disposed of, and elections to tender Ordinary Shares are

irrevocable.

The Tender Offer will only be open to Qualifying Shareholders

whose names appear on the Register at the Record Date and only in

respect of the Ordinary Shares continually held from that date

until completion of the Tender Offer.

The Tender Offer is subject to certain conditions set out in

paragraph 2.1 of Part 4 (Details of the Tender Offer) of the

Circular. In addition, the Tender Offer may be suspended or

terminated in limited circumstances, as set out in paragraph 2.20

of Part 4 (Details of the Tender Offer) of the Circular.

There is no guarantee that any or all Ordinary Shares tendered

will be repurchased by the Company.

Available courses of action for Qualifying Shareholders

1. Tender none of their Ordinary Shares

2. Apply to tender all of their Ordinary Shares

3. Apply to tender a proportion only of their Ordinary Shares

Restricted Shareholders and other Overseas Shareholders

The Tender Offer is not being made to those Shareholders who are

resident in, or citizens of, a Restricted Jurisdiction. In

particular the Tender Offer is not being made, directly or

indirectly, in or into or by the use of mails by any means or

instrumentality (including, facsimile transmission, internet, telex

and telephone) of interstate or foreign commerce, or any facility

of a national securities exchange, of the United States, nor is it

being made, directly or indirectly, in or into the United States,

Canada, Australia, New Zealand, the Republic of South Africa or

Japan and the Tender Offer cannot be accepted by any such use

means, instrumentality or facility from within the United States,

Canada, Australia, New Zealand, the Republic of South Africa or

Japan.

It is the responsibility of all Overseas Shareholders to satisfy

themselves as to the observance of any legal requirements in their

jurisdiction, including, without limitation, any relevant

requirements in relation to the ability of such holders to

participate in the Tender Offer.

Costs and expenses of the proposals

The costs and expenses relating to the Tender Offer will be

borne by the Company. The fixed costs and expenses relating to the

Tender Offer up to the Tender Deadline Date and assuming that the

Tender Offer is taken up in full, are not expected to exceed an

aggregate of approximately GBP400,000 (inclusive of VAT but

excluding fees calculated as a product of the total number of

Ordinary Shares repurchased).

Taxation

Qualifying Shareholders who sell their Ordinary Shares in the

Tender Offer may, depending on their individual circumstances,

incur a liability to taxation. Qualifying Shareholders who are in

any doubt as to their tax position or who are subject to tax in a

jurisdiction other than the United Kingdom should consult an

appropriate professional adviser.

Tender Offer Resolution

In summary, the Tender Offer Resolution seeks the Shareholders

authority to the Company to purchase up to 5,000,000 Ordinary

Shares at the Tender Price pursuant to the Tender Offer. The Tender

Offer Resolution is proposed as an ordinary resolution and thus

requires in excess of fifty per cent. of the votes cast at the

General Meeting to be in favour of it in order for it to be

passed.

The Company will only implement the Tender Offer if the Tender

Offer Resolution is passed at the General Meeting.

ACTION TO BE TAKEN

General Meeting

Shareholders are asked to complete and return the Form of Proxy

in accordance with the instructions printed thereon so as to be

received as soon as possible and, in any event, by no later than

10:00 a.m. on 13 November 2023.

If the Board believes it has become necessary or appropriate to

make alternative arrangements for the holding of the General

Meeting, it will ensure that Shareholders are given as much notice

as possible. Any further information will be made available by an

announcement through an RIS and through the Company's website.

Shareholders are requested to complete and return a Form of

Proxy in accordance with the instructions thereon.

Tender Offer

Shareholders are not obliged to tender any Ordinary Shares and,

if they do not wish to participate in the Tender Offer, they should

not complete or return their Tender Form or submit a TTE

Instruction in CREST.

Procedure for tendering Ordinary Shares

Certificated Qualifying Shareholders - Shareholders, other than

Restricted Shareholders, who hold shares in Certificate Form and

wish to tender any of those Certificated Ordinary Shares should

complete the Tender Form in accordance with the instructions set

out therein and return the completed Tender Form using the enclosed

reply-paid envelope to the Receiving Agent Link Group, Corporate

Actions, Central Square, 29 Wellington Street, Leeds LS1 4DL, so as

to arrive as soon as possible and, in any event, by no later than

1:00 p.m. on the Tender Deadline Date. Share certificate(s) and/or

other document(s) of title in respect of the Ordinary Shares

tendered should be sent with the Tender Form.

Uncertificated Qualifying Shareholders - Shareholders, other

than the Restricted Shareholders, holding Ordinary Shares in

Uncertificated Form who wish to tender any of those Uncertificated

Ordinary Shares should transmit the appropriate TTE Instruction in

CREST as set out in paragraph 3.3 of Part 4 (Details of the Tender

Offer) of the Circular so as to be received as soon as possible

and, in any event, by no later than 1:00 p.m. on the Tender

Deadline Date.

Qualifying Shareholders should note that, once tendered,

Ordinary Shares may not be sold, transferred, charged or otherwise

disposed of other than in accordance with the terms of the Tender

Offer.

Tender Forms or TTE Instructions which are received by the

Receiving Agent after 1:00 p.m. on the Tender Deadline Date or

which at that time are incorrectly completed or not accompanied by

all relevant certificates, documents or instructions may be

rejected and returned to the relevant Shareholders or their

appointed agents, together with any accompanying share

certificate(s) and/or other document(s) of title.

Link Group reserves the right to treat as valid Tender Forms or

TTE Instructions which are not entirely in order and which are not

accompanied (in the case of Ordinary Shares held in certificated

form) by the relevant share certificate(s) and/or other document(s)

of title or a satisfactory indemnity in lieu thereof.

Full details of the procedure for tendering Ordinary Shares are

set out in Part 4 (Details of the Tender Offer) of the Circular

and, in the case of Ordinary Shares held in Certificated Form only,

on the Tender Form.

If you do not wish to tender any of your Ordinary Shares, you

should not complete and return a Tender Form or submit a TTE

Instruction in respect of the Tender Offer.

RELATED PARTY TRANSACTION

As outlined above, Jeff Baryshnik (Non-Executive Chairman of the

Company) and Cedarvale Holdings Ltd hold, in aggregate, 4,736,717

Ordinary Shares, representing approximately 25.3 per cent. of the

Company's total voting rights. The irrevocable undertaking provided

by Jeff Baryshnik and Cedarvale Holdings Ltd to tender their

combined shareholding of, in aggregate, 4,736,717 Ordinary Shares

in the Tender Offer is deemed to constitute a related party

transaction under Rule 13 of the AIM Rules for Companies. The

independent Directors in respect of such arrangement, being all

Directors excluding Jeff Baryshnik, having consulted with Strand

Hanson (in its capacity as the Company's Nominated Adviser),

consider that the terms of Mr Baryshnik and Cedarvale Holdings

Ltd's participation in the Tender Offer are fair and reasonable

insofar as Shareholders are concerned.

TAKEOVER CODE

Rule 9 of the Takeover Code ("Rule 9") applies to any person who

acquires an interest in shares which, when taken together with

shares in which persons acting in concert with him are interested,

carry 30 per cent. or more of the voting rights of a company which

is subject to the Takeover Code. Any such person is required to

make a general offer to all Shareholders of that company to acquire

their shares in cash at not less than the highest price paid by

such person, or by any person acting in concert with him, for any

interest in shares within the 12 months prior to the offer. Such an

offer under Rule 9 must also be made where any person who, together

with persons acting in concert with him, holds not less than 30 per

cent. but not more than 50 per cent. of the voting rights in the

Company and such person, or any person acting in concert with him,

acquires an interest in any other shares which increase the

percentage of shares carrying voting rights in which he is

interested.

When a company purchases its own voting shares, any resulting

increase in the percentage of voting rights held by a Shareholder,

or group of shareholders acting in concert, will be treated as an

acquisition for the purposes of Rule 9.

The Board has carefully considered the Company's share register

and potential Shareholder groupings that may be considered to be

acting in concert and, based on the information available and due

consultation with the Panel, does not believe that any individual

Shareholder (and any persons with whom they are acting in concert)

holds (or would hold, on completion of the Tender Offer) 30 per

cent. or more of the voting rights as a result of the Tender

Offer.

However, Shareholders (including any persons with whom they are

considered to be acting in concert) with significant holdings that

do not tender their existing holdings under the Tender Offer,

should be aware that their proportionate voting rights will

increase following implementation of the Tender Offer and should

therefore have regard to their potential resultant maximum voting

rights, following implementation of the Tender Offer in full and

any potential consequential obligations under Rule 9 of the

Takeover Code. Such significant Shareholders should also be

cognisant of thresholds under Rule 9 in respect of their own

holding and anyone acting in concert with them when considering any

additional acquisitions of Ordinary Shares.

CONCLUSION

The Board believes that the Tender Offer is the best way to

enhance the Company's capital structure and achieve an immediate

return of capital to Shareholders, something which the Board

strongly and unanimously believes is in the best interests of the

Company and its Shareholders as a whole (a view which is separately

supported by the Independent Directors unanimously).

Accordingly, the Board unanimously recommends that Shareholders

vote, or procure the vote, in favour of the Tender Offer Resolution

to be proposed at the General Meeting. The Directors intend to vote

in favour of the Tender Offer Resolution in respect of their

holdings of Ordinary Shares amounting to 5,274,537 Ordinary Shares,

in aggregate (representing approximately 28.7 per cent. of the

Current Issued Ordinary Shares).

However, the Board is not making any recommendation to

Shareholders as to whether tendering Ordinary Shares under the

Tender Offer is in their own individual best interests.

Whether or not Qualifying Shareholders decide to accept the

Tender Offer in respect of any or all of their Ordinary Shares is a

decision solely for those individual Qualifying Shareholders.

Whether or not Shareholders decide to tender their Ordinary

Shares will depend, amongst other factors, on their view of the

Circular and their own individual circumstances, including their

own financial and tax positions and investment objectives.

Qualifying Shareholders are advised to take independent advice in

relation to the tax implications for them of selling Ordinary

Shares pursuant to the Tender Offer.

The Directors (other than Jeff Baryshnik) will not tender any of

their own Ordinary Shares. Jeff Baryshnik and Cedarvale Holdings

Ltd, a company owned and controlled by Jeff Baryshnik (for which he

acts as a representative on the Board), have irrevocably undertaken

to accept the Tender Offer in respect of their entire combined

holdings of Ordinary Shares and to vote in favour of the Tender

Offer Resolution.

The Board reserves the right not to proceed with the Tender

Offer (and the resultant repurchases of Ordinary Shares) if it

concludes, at any time prior to the announcement of the results of

the Tender Offer and/or the Settlement Date, that the

implementation of the Tender Offer (and the associated repurchases

of Ordinary Shares) is or are no longer in the interests of the

Company and the Shareholders as a whole and/or the Company is no

longer in a position to carry out those repurchases in accordance

with the requirements of the CA 2006.

DEFINITIONS

In this announcement, the following definitions apply unless the

context requires otherwise:

AIM means the market of that name

(and formerly known as the Alternative

Investment Market) which is operated

by the London Stock Exchange.

AIM Rules means the AIM Rules for Companies

published by the London Stock

Exchange (as amended, restated

or replaced from time to time).

Articles means the Company's articles of

association (as in force for the

time being).

Board or Directors means the Company's board of directors

for the time being (and/or, as

the context requires, any individual

director or committee of the directors

to whom the Board has delegated

any of its functions in accordance

with the Articles).

Broker or Hybridan means Hybridan LLP (as corporate

broker to the Company).

Business Day means any day (other than a Saturday,

Sunday or public holiday in England)

on which banks in the City of

London are generally open for

transaction business.

CA 2006 means the Companies Act 2006.

Certificated means, in respect of any Ordinary

Shares, that they are recorded

in the Register as not being in

Uncertificated Form (and reference

to in Certificated Form or similar

expression shall be construed

accordingly).

Circular means the Circular (including,

all of its sections, parts and

annexures).

Company or Northern Bear means Northern Bear plc (incorporated

and registered in England and

Wales with company number 05780581).

CREST means the relevant system (as

defined in the CREST Regulations)

for paperless settlement of share

transfers and the holding of shares

in uncertificated form which is

administered by Euroclear.

CREST Manual means the compendium of documents

entitled CREST Manual issued by

Euroclear from time to time and

comprising the CREST Reference

Manual, the CREST Central Counterparty

Service Manual, the CREST International

Manual, the CREST Rules, CCSS

Operations Manual and the CREST

Glossary of Terms.

CREST Member means a person who has been admitted

by Euroclear as a system-member

(as defined in the CREST Regulations).

CREST Participant means a person who is, in relation

to CREST, a system-participant

(as defined in the CREST Regulations).

CREST Regulations means the Uncertificated Securities

Regulations 2001 (SI 2001 No.

3755).

CREST Rules means the rules from time to time

issued by Euroclear governing

the admission of securities to

and the operation of the CREST

UK System.

CREST Sponsor means a CREST Participant admitted

to CREST as a CREST sponsor being

a sponsoring system-participant

(as defined in the CREST Regulations).

CREST Sponsored Member means a CREST Member admitted

to CREST as a sponsored member.

CREST UK System means the facilities and procedures

of the relevant systems of which

Euroclear is the approved operator

pursuant to the CREST Regulations.

Current Issued Ordinary means the Issued Share Capital

Shares as at the Latest Practicable Date,

being 18,725,276 Ordinary Shares

(excluding the 292,040 Ordinary

Shares held in treasury).

Euroclear means Euroclear UK & International

Limited.

Existing Buyback Authority the existing general authority

to purchase up to 936,263 Ordinary

Shares (representing 5 per cent

of the Current Issued Ordinary

Shares) granted to the Company

by the Shareholders by a special

resolution passed at the annual

general meeting of the Company

held on 12 September 2023.

FCA means the Financial Conduct Authority

of the UK.

Form of Proxy means the form of proxy relating

to the General Meeting which accompanies

the Circular.

FSMA means the Financial Services and

Markets Act 2000.

General Meeting means the general meeting of the

Company to be held at the Company's

registered office, A1 Grainger,

Prestwick Park Prestwick, Newcastle

Upon Tyne, NE20 9SJ at 10:00 a.m.

on 15 November 2023 (and includes

any adjournment of it).

Group means the Company and each of

its subsidiary undertakings.

Independent Directors means the Directors excluding:

(a) Jeff Matthew Baryshnik;

(b) Thomas Edward Hayes; and

(c) Keith Soulsby

(Jeff Matthew Baryshnik, Thomas

Edwards Hayes and Keith Soulsby,

being Directors and Shareholders

who have provided irrevocable

undertakings in respect of their

participation in the Tender Offer).

Issued Share Capital means the Company's issued ordinary

share capital from time to time

(excluding any treasury shares).

ITA 2007 means the Income Tax Act 2007.

Latest Practicable Date means 20 October 2023, being the

latest practicable date prior

to the publication of the Circular.

London Stock Exchange means London Stock Exchange plc.

Member Account ID means the identification code

or number attached to any member

account in CREST.

Nomad or Strand Hanson means Strand Hanson Limited (as

Nominated Adviser to the Company).

Notice of General Meeting the notice of the General Meeting

forming part of, and appended

to, the Circular (and includes

any notice of any adjournment

of that meeting).

Ordinary Shares means ordinary shares of GBP0.01

each in the capital of the Company.

Overseas Shareholders means Shareholders who are citizens

or nationals of, or resident in,

jurisdictions outside the United

Kingdom

Participant ID means the identification code

or membership number used in CREST

to identify a particular CREST

Member or other CREST Participant.

PDMR means any person discharging managerial

responsibilities within the Company

and/or its Group for the purposes

of UK MAR.

Qualifying Ordinary Shares means, in respect of a Qualifying

Shareholder, all those Ordinary

Shares held by them at the Record

Date.

Qualifying Shareholders means the Shareholders who are

entitled to participate in the

Tender Offer, being those such

persons who are on the Register

on the Record Date and who are

not subject to the securities

laws of a Restricted Jurisdiction.

Receiving Agent or Registrar means Link Market Services Limited.

or Link Group

Record Date means 6:00 p.m. on the Tender

Deadline Date.

Register means the Company's register of

members.

Restricted Jurisdictions means each and any of Australia,

Canada, Japan, New Zealand, the

USA, Singapore, the Republic of

South Africa and any other jurisdiction

where the mailing of the Circular

into or inside or from such jurisdiction

would breach any applicable law,

legislation or other regulations.

RIS means a Regulatory Information

Service for the purposes of FSMA.

Sanctions has the meaning given in paragraph

2.17 of Part 4 (Details of the

Tender Offer) of the Circular.

Settlement Date means the date notified by the

Receiving Agent to the Company

and the relevant tendering Qualifying

Shareholders by which: (i) the

tendered Ordinary Shares under

the Tender Offer shall be purchased

by the Company; and (ii) the consideration

for Ordinary Shares tendered under

the Tender Offer will be settled

and discharged by payment to the

Receiving Agent as nominee for

those tendering Qualifying Shareholder

in accordance with paragraph 6

of Part 4 (Details of the Tender

Offer) of the Circular, which

date must be not less than five

(5) Business Days following the

date on which the results of the

Tender Offer are announced via

an RIS.

Share Plans means the share option plans established

by the Company (or a member of

its Group) for the benefit of

its officers and/or employees

prior to or on the Latest Practicable

Date and which remain outstanding

and in force at that date.

Shareholders means those persons who are holders

or Ordinary Shares.

Tender Cap means 5,000,000 (five million)

Ordinary Shares.

Takeover Code means the City Code on Takeovers

and Mergers (as amended, restated

or replaced from time to time).

Tender Conditions means has the meaning given in

paragraph 2.1 of Part 4 (Details

of the Tender Offer) of the Circular.

Tender Deadline Date means 22 November 2023 (or such

later date as the Company or the

Receiving Agent (acting with the

Company's consent) may notify

as being the date on which the

Tender Offer closes through an

announcement via an RIS and/or

the Company's website).

Tender Form means the tender form which accompanies

the Circular and is for use by

those Qualifying Shareholders

who wish to tender all or some

of their Ordinary Shares and who

hold those Ordinary Shares in

Certificated Form.

Tender Offer means the invitation by the Company

(acting via its agent, the Receiving

Agent) to Qualifying Shareholders

to tender their Ordinary Shares

for purchase by the Company (acting

via is agent, the Receiving Agent)

on and subject to the terms and

conditions set out in the Circular

and, in the case of Certificated

Ordinary Shares only, the Tender

Form.

Tender Offer Resolution means the ordinary resolution

to be proposed at the General

Meeting to implement the Tender

Offer by authorising the proposed

purchase by the Company of Ordinary

Shares pursuant to it (in the

form set out in the Notice of

General Meeting).

Tender Price means 62 pence (GBP0.62) per Ordinary

Share.

TFE Instruction means a transfer from escrow instruction

(as defined in the CREST Manual).

TTE Instruction means a transfer to escrow instruction

(as defined in the CREST Manual).

UK MAR means the retained EU law version

of the Market Abuse Regulation

(596/2014) (MAR) that has applied

in the UK from the end of the

Brexit transition period (that

is, 11:00 pm on 31 December 2020).

Uncertificated Form means, in respect of any Ordinary

Shares, that they are recorded

on the Register as being held

in CREST in uncertificated form

such that the title to them is

capable of being transferred by

means of CREST under the CREST

Regulations (and reference to

in Uncertificated Form or similar

expression shall be construed

accordingly).

United Kingdom or UK means the United Kingdom or Great

Britain and Northern Ireland.

United States or USA means the United States of America,

its territories and possessions,

any state of the United States

of America, the District of Columbia

and all other areas subject to

its jurisdiction.

NOTICE IN RELATION TO OVERSEAS PERSONS

The release, publication or distribution of this announcement in

or into jurisdictions other than the UK may be restricted by law,

legislation or regulation and therefore any person who is subject

to the laws of any jurisdiction other than the UK should inform and

satisfy themselves about, and observe and comply with, any of those

restrictions. Any failure to comply with any of those restrictions

might constitute a violation of the relevant laws, legislation or

regulations of such jurisdiction.

FORWARD-LOOKING STATEMENTS

This announcement includes "forward-looking statements" which

include all statements other than statements of historical fact,

including, without limitation, those regarding the Group's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates", "would,

"could" or similar expressions or negatives thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Group's

control that could cause the actual results, performance or

achievements of the Group to be materially different from the

future results, performance or achievements expressed or implied by

such forward-looking statements. Such forward-looking statements

are based on numerous assumptions regarding the Group's present and

future business strategies and the environment in which the Group

will operate in the future. These forward-looking statements speak

only as at the date of this announcement. Whilst the Directors

consider these statements to be reasonable based upon information

currently available, they may prove to be incorrect. However, the

Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Group's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

NO PROFIT FORECAST OR ESTIMATES

Unless otherwise stated, no statement in this announcement is

intended as a profit forecast or estimate for any period and no

statement in this announcement should be interpreted to mean that

earnings, earnings per share or income, cash flow from operations

or free cashflow for the Group, for the current or future financial

years would necessarily match or exceed the historical published

earnings, earnings per share or income, cash flow from operations

or free cash flow from the Group.

Hybridan LLP ("Hybridan"), which is authorised and regulated in

the United Kingdom by the FCA, is acting exclusively for Northern

Bear and no one else in connection with the proposed Tender Offer

and will not be responsible to anyone other than Northern Bear for

providing the protections afforded to clients of Hybridan nor for

providing advice in relation to the proposed Tender Offer or any

other matter referred to herein. Neither Hybridan nor any of its

group undertakings or affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Hybridan in connection with the

proposed Tender Offer or any matter referred to herein.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENDDBDGGDDDGXD

(END) Dow Jones Newswires

October 23, 2023 02:04 ET (06:04 GMT)

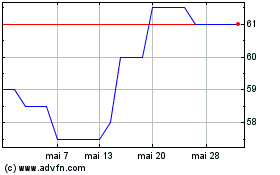

Northern Bear (LSE:NTBR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Northern Bear (LSE:NTBR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025