TIDMVNET

RNS Number : 5600C

Vianet Group PLC

13 June 2023

13 June 2023

Vianet Group plc

("Vianet", "Company" or "the Group")

Final Results (unaudited)

A year of gathering momentum with strong prospects

Dividend reinstated

The following amendments have been made to the "Final Results

(unaudited)" announcement released on 13 June 2023 at 07:00 under

RNS No 4616C.

-- The Record Date for the dividend has been amended from

Thursday, 14 September 2023 to Friday, 15 September 2023

-- In the cash flow statement the net interest payable has been

amended from GBP230,000 to GBP206,000 and the repayments of

borrowings has been amended from GBP756,000 to GBP992,000

-- Note 6 to the accounts supporting the statement of cashflows

ahs been amended to reflect the above state changes.

All other details remain unchanged.

The full amended text is shown below.

------------------------------------------------------------------------------------------------

Vianet Group plc (AIM: VNET), the international provider of

actionable data and business insight through devices connected to

its Internet of Things platform ("IOT"), is pleased to announce its

unaudited results for the year ended 31 March 2023 and a reinstated

proposed final dividend of 0.5p per share.

Financial highlights

-- Revenue increased 6.7% to GBP14.11m (FY2022: GBP13.22m);

-- Recurring revenues remained strong at 89% (FY2022: 88%) increasing by GBP1.19m to GBP12.56m;

-- Gross margin increased slightly to c. 66% (FY2022: c.65%);

-- Adjusted operating profit, pre-exceptional costs,

amortisation, and share-based payments of GBP3.11m, an increase of

31% (FY2022: GBP2.36m);

-- Profit before tax GBP0.45m (FY2022: GBP0.17m loss);

-- Basic earnings per share 0.56p (FY2022: 0.65p) net of

GBP0.29m tax charge vs FY2022 credit of GBP0.36m;

-- Net cash generation pre-working capital GBP4.45m (FY2022:

GBP2.74m), including accrued tax rebate of GBP0.92m;

-- Normalised profit to cash conversion was 102.8% of EBITDA; and

-- Dividend policy reinstated, with proposed final dividend of 0.5p per share.

Divisional & Operational highlights

-- The average recurring revenue per connected device grew to

GBP60.19 (2022: GBP54.02), 11.4% year on year growth;

-- Smart Machines adjusted operating profit increased 10.4% to

GBP2.01m (FY22: GBP1.82m), despite GBP0.45m of stock premium

costs;

-- Smart Machines added 11,062 new connected devices (FY22:

12,895) despite the vending sector distraction of planning related

to the UK-wide 3G switch-off;

-- SmartContact Pro all-in-one contactless and telemetry wins

vending industry award as best payment system and launch of

SmartVend in H1 2023 strengthens Smart Machines' offering;

-- Smart Zones revenue increased 4.2% to GBP8.16m (FY2022:

GBP7.83m) with operating profit up 26.7% to GBP3.79m (FY2022:

GBP2.99m);

-- Smart Zones' net installation base solid at 9,800 as ongoing investment and a pipeline of new installations offset a slowing rate of hospitality sector closures; and

-- Post year-end acquisition of trade and assets of US based

Beverage Metrics Inc (BMI) and receipt of HMRC tax refund of

GBP0.92m.

Commenting, James Dickson, Chairman of Vianet Group plc,

said:

" I am pleased to report that the proactive measures we

implemented over the past few years together with the dedication

and hard work of our staff have yielded excellent results.

The business has recovered strongly and is now performing in

line with pre-pandemic levels. During the year we focused on new

initiatives to ensure that customer relationships were maintained,

along with new connections delivering recurring revenue growth over

the period. Although pressures on global semi-conductor supply

chains and uncertainty from the conflict in Ukraine remain, we are

confident that our sales will continue to grow, moving towards

higher profits and wider markets.

Our focus over the last year has been on prudent cash

management, a further strengthening of our relations with customers

and strategic investment in sales and technology. These efforts now

place the Company on a sound footing and will enable us to scale

sustainable growth in both existing and new vertical markets.

The Smart Machines division reported 11,062 new connected

devices and is well placed to convert current and future

opportunities given our investment and the continued trend towards

non-cash transactions. Two significant recent contract wins and the

launch of SmartVend solution, expected in H1 2023, give us

confidence that the division will continue to grow strongly. Our

SmartContact Pro all-in-one again won best payment system, against

international competition, at the 2023 vending industry awards held

last week .

Smart Machines offers industry leading end-to-end product

suites, supporting growth prospects, with a clear line of sight

toward a doubling of the business by the end of FY25.

The Smart Zones division recovery continued with new contract

wins during the period. The launch of SmartDraught generated an

increased appetite from existing and prospective customers for the

inherent value of our market data. In collaboration with Oxford

Partnership, our offering guides decision-making and enhances

customer profitability, giving Vianet an exciting opportunity to

capture market share and grow revenue.

Both divisions are capitalising on new vertical opportunities

putting the Group on track to continue strong earnings growth. The

Board is confident that Vianet is well positioned to enter wider

markets. While the pandemic has thrown its challenges our way, we

feel that we have weathered the storm and are now pushing forward

and making up for lost time and the reinstatement of the dividend

is a reflection of our confidence in the future of the

business.

- Ends -

James Dickson, Chairman & CEO, and Mark Foster CFO will

provide a live presentation relating to financial results for the

year ended 31 March 2023 via the Investor Meet Company platform on

13th June 2023 at 10:30am GMT.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Vianet Group via:

https://www.investormeetcompany.com/vianet-group-plc/register-investor

Investors who already follow Vianet Group plc on the Investor

Meet Company platform will automatically be invited.

Enquiries:

Vianet Group plc

James Dickson, Chairman & Interim Tel: +44 (0) 1642 358

CEO 800

Mark Foster, CFO www.vianetplc.com

Cenkos Securities plc

Stephen Keys / Camilla Hume Tel: +44 (0) 20 7397

8900

www.cenkos.com

Investor enquiries:

Dale Bellis Tel: +44 (0) 20 7397

8900

CHAIRMAN'S STATEMENT

Introduction

I am delighted to report that the Group has continued to build

on positive commercial momentum in all areas through FY2023. This

positions us exceptionally well to capitalise on the exciting

growth opportunities, not only in the UK but in the USA and Europe

for FY2024 and beyond.

Global semiconductor supply chain pressures, high inflation

resulting from the Ukraine conflict and customers taking time to

develop strategic connectivity plans to address the mobile network

operators' ('MNO') 3G switch-off were issues that had to be

navigated in FY2023. However, the underlying trends remain strong,

and given the visibility we have, and the relationships we have

nurtured, we see FY2024 accelerating as it benefits from customer

estate upgrades to 4G LTE.

Encouragingly, sales grew c.7% to GBP14.1m (FY2022: GBP13.2m),

delivering an adjusted operating profit of GBP3.11m compared to

FY2022 GBP2.36m, representing c.31% year-on-year growth. We have

always had a rigorous drive to grow the top line and on maximising

the business' profitability which in return has enabled

reinstatement of dividend payments. All these are true testaments

to the team's hard work.

We were delighted to announce the acquisition of the trade and

assets of Beverage Metrics Inc. (BMI) post year-end. We have known

the BMI team for some years and believe that the comprehensive

inventory platform that they have developed will enhance our

existing draught beer management solution as well as directly

expanding our US footprint. Together with SmartDraught, these form

the most compelling beverage management solution available for

hospitality operators in the USA and UK.

In May 2020, a GBP3.5m Coronavirus Business Interruption Loan

(CBIL) was taken to support recovery and investment in technology

and commercial operations. Our strong operational cash generation

has permitted the relatively aggressive repayment of GBP0.7m per

annum plus interest, and the outstanding balance stands at GBP2.1m

at the end of May 2023.

Management is pleased to confirm that post year end we

successfully completed negotiation and due diligence with HSBC on

significantly improved finance facilities which are in the process

of completion and are due to commence in Q2 FY2024. Given how the

lending market has tightened during 2023, the fact that we have

negotiated an increased facility on improved terms shows the

financial strength of the business.

Dividend

The Group's FY2023 results, high levels of customer engagement,

and commercial momentum provide confidence that in FY2024, the

Group will benefit from solid revenue growth and high levels of

cash generation.

While semiconductor supply pressure is becoming less of a

concern there are still some uncertainties regarding prolonged

inflationary pressures. That said the Group remains committed to

achieving relatively aggressive repayment of loans. The new HSBC

facility will offer flexibility to support ongoing investment in

the business, particularly in relation to the exciting growth

opportunities, including Vianet Americas

The Board has always considered the paying of a dividend to

shareholders an important constituent of being a listed PLC, and,

notwithstanding the pressures alluded to above, is delighted to

announce our intention to reinstate our dividend policy. However,

the Board considers it prudent to prioritise the preservation of

the majority of cash for investment in growth, but recognising the

significance of dividends as an important component of total

shareholder returns, the Board proposes a FY23 dividend of 0.5p per

share payable on 27 October 2023 to shareholders on the register on

15 September 2023.

Board Changes and Staff

Following Chris Williams' retirement from the Board at the AGM,

Stella Panu was appointed as a Non-Executive Director and Chair of

the Audit Committee. Stella brings a wealth of financial expertise,

City experience, and a strong background in finance, strategy, and

M&A activity. Her valuable contributions have been extremely

helpful to the Board, and the Executive team, as we remain

committed to executing on our growth strategy.

The Board and I have also agreed that I shall remain as interim

CEO to ensure we continue to establish and maintain our strong

sales, and growth momentum. Having previously served as CEO, and

being a significant shareholder, I am committed to driving the

Company forward during this crucial time.

The Board regularly evaluates its composition and effectiveness

to ensure a balanced mix of experience and independence, supporting

the business and our growth ambitions. The operational structure of

the Group continues to evolve to address the growth opportunities,

and I am pleased to report further growth and development of the

management team, who continue to be highly motivated and focused on

delivery.

Our exceptional people consistently demonstrate enthusiasm,

commitment, and openness, underpinning the Group's excellent

reputation among customers, suppliers, and stakeholders.

I take great pride and am extremely grateful for the unwavering

commitment of our executive team, employees, and Board members in

continuing to drive the Group's progress.

Conclusion and Outlook

FY2023 brought about positive outcomes in increased sales,

profit, and cash generation. However, what really stands out is the

remarkable customer engagement and momentum generated by

introducing new solutions, partnerships, and commercial

initiatives. This is particularly encouraging for the Company's

future growth.

Our solutions empower customers to enhance their business

performance, fostering deeper stakeholder relationships and

creating substantial sales opportunities.

The Group is on track to deliver strong earnings growth across

our two divisions and maximise the opportunities in new verticals

for the financial year ending March 2024 and beyond.

Smart Machines leads the industry with its comprehensive product

suite, strengthened by new releases of our SmartVend solution and

the migration of existing customers to our exciting platform.

Vianet received accolades for Best Supplier Website and Best

Payment System at the vending industry awards, where our

SmartContact Pro all-in-one contactless payment and telemetry

solution prevailed over stiff international competition. With a

strong commercial team, long-term contracts with major blue-chip

customers, and a strong presence in the UK and European markets, we

have a robust pipeline of opportunities for telemetry and

contactless sales and data management.

-- The partnership between Vianet and Suresite Group Ltd has

bolstered our position in the fast-growing 'unattended' contactless

payments sector. By combining Vianet's cutting-edge contactless

payment hardware with Suresite's market-leading acquiring services,

we can now offer a competitive, user-friendly, and highly secure

payments solution that effectively future-proofs any unattended or

automated retail business. This solution caters to various

applications, from charging points and unmanned car washes to air

and vacuum stations.

-- In collaboration with Vendekin Technologies, the Group has

introduced an innovative mobile payment solution based on QR codes

offering customers a fast, secure, and convenient payment solution.

Through this partnership, we can expand our offerings and equip our

customers with the latest technology in the unattended retail

industry, to enhance the customer experience and help drive

growth.

-- Smart Zones has a pipeline of new site installations in

leased and tenanted pub companies. Integrating Vianet's draught

beer management solution with the recently acquired BMI inventory

platform offers customers a comprehensive drinks management

solution that enhances profitability by reducing costs, improving

productivity, and maximising sales. The integration also provides

brewers a cost-effective brand monitoring and market insight

solution. While the US operation may be initially loss-making in

FY2024, it's expected to approach breakeven position by the

year-end. More importantly, this acquisition should support

Vianet's growth in UK hospitality and be a step forward in

developing a profitable footprint in the USA.

-- Investing in our technology and commercial activity has

attracted strong interest from the environmental, catering,

forecourt, and tank monitoring sectors, with a breakthrough

expected in H1 FY2024.

-- The continued investment in our cloud infrastructure and

mobile technology will drive the development of existing revenues

in Smart Machines and Smart Zones. This investment will also enable

scalability, flexibility, and speed, which are crucial for

supporting rapid growth in both existing and new verticals.

-- The Group has consistently high contracted recurring income

and fully expects to generate strong operating cash flow.

The Board remains confident in the Group's long-term growth

strategy and ability to achieve earnings growth and expand future

strategic options. While cash management is a priority, the Board's

primary focus is on driving sales growth and seizing exciting

growth opportunities.

James Dickson

Chairman

13 June 2023

STRATEGIC REPORT

James Dickson

Chairman and Chief Executive

The year to March 2023 was a year of recovering growth and

re-establishing our market position. Having emerged from the

pandemic, we have successfully navigated the global semiconductor

chip supply problems and are progressing well in a high-inflation

economy.

Our core business provides connectivity to assets, enabling the

collection of operational data and the production of actionable

analytics and insights to help customers transform their business

performance. In a world increasingly reliant on Internet of Things

and AI we believe that we are at the forefront of our industry, not

only in providing solutions for today but developing tools for the

future.

With Vianet's leading-edge contactless payment capability

supporting customer sales growth from unattended retail machines,

the business is well placed to strengthen its position in this

rapidly developing area, with further contactless and data

opportunities on assets in marketplaces such as petrol

forecourts.

Our well invested cloud-based platform now supports much greater

flexibility of device connection and data connectivity to the

extent that it is possible to connect a range of business-critical

third-party devices, not just those we supply.

In collaboration with customers and partners such as Suresite

and Vendekin in unattended retail, we can identify compelling

end-to-end solutions to address business opportunities. This

combination of capabilities will enable us to drive sustained

business growth over the coming years.

Whilst FY2023 has had its global challenges, the Group has made

excellent progress executing key elements of our growth plan,

including securing new and renewed customer contracts over several

years, successfully launching SmartVend and our new market data

insights, and establishing 'strategic go to market' partnerships.

Via our contactless payment and telemetry solutions, we have

strengthened customer relationships and helped secure new business

in existing new verticals, such as retail, fuel forecourts and

industrial kitchens.

Post year-end, we acquired the trade and assets of BMI, which,

combined with our draught beer monitoring solution, establishes a

comprehensive beverage management platform. Whilst the combined US

operations will require initial investment during FY2024, the

acquisition has accelerated our hospitality-related development

roadmap enabling profitable expansion of our footprint in the USA

and UK beyond our legacy leased and tenanted customers.

OPERATING REVIEW

Smart Zones

The Smart Zones division recovery continued strongly. Revenues

rose by 4.2% at GBP8.16m (FY2022: GBP7.83m), with profit being up

26.7% at GBP3.79m (FY2022: GBP2.99m).

Sales improved to 259 (FY2022: 252) new site installations with

11 new contract wins, and 6 contract renewals as customers' needs

and demand for data and insights grew.

Our UK estate had 603 (FY2022: 535) pub closures and 259 new

installations, resulting in a net 344 site reduction (FY2022: 357),

taking our installed base to c 9,800. Whilst it is difficult to

predict the pace of closure rates and new openings, we believe this

is now a sustainable leased and tenanted level.

The post year end trade and asset acquisition from BMI will

accelerate our penetration of the UK hospitality sector beyond our

current leased and tenanted footprint.

Building on the customer engagement of the last two years and

the launch of SmartDraught and our insights portal, we see an

increased appetite for market data insights. This is particularly

relevant for the provision of retail data for brewer s. Through our

relationship with the Oxford Partnership, we deliver

ground-breaking insights that support consumer-level

decision-making for beer brands. We expect to show further growth

in this exciting area in FY2024.

Adding our compliance service and data insight analytics to the

BMI assets will result in a heightened emphasis on improving

operational and retail performance. This strategic approach aims to

drive value from pubs, especially those under private equity

ownership, by maximising their return potential.

Vianet Americas Inc ("VAI")

VAI saw losses increase to GBP150k for FY2023 (Fy2022: GBP127k

loss), impacted by the pandemic related loss of over 250 units with

AMC Theatres.

The acquisition from BMI included customers, an established

inventory operating platform, software IP, patents for barcode 3D

scanning and advanced technology for point-of-sale data

integration.

The combination of Vianet's SmartDraught draught beer management

solution with BMI's inventory platform provides a comprehensive

one-stop drinks management solution which enables operators to

reduce costs, improve productivity and maximise sales, and drive

improved profitability across the entire drinks category.

SmartDraught integration with the inventory platform will also

enable Vianet to provide brewers with a more cost-effective and

competitive brand monitoring and market insight solution.

Together with our recent investment in SmartDraught, this

acquisition positions Vianet's hospitality operations firmly on the

path to growth in the UK and to establishing a profitable footprint

in the USA, where we benefit from direct access to a significant

number of national retail chains.

The opportunity for the Company in the US, the world's largest

single-operator market, remains significant. While the combined US

operations will require investment and is expected to be

loss-making during FY2024, we anticipate monthly loss to have

narrowed significantly by year-end and remain committed to

establishing a significant US profit centre.

Overall, the Board remains confident that the Smart Zones

division will see growth and deliver enhanced turnover, profit, and

cash returns to the Group.

Smart Machines

Our investment in sales and marketing, including a new CRM

system, resulted in solid business gains, including 75 new customer

contract wins, which provides a healthy pipeline to underpin our

growth plans.

Turnover was up 10.5% at GBP5.95m (FY2022: GBP5.38m), with

operating profit up 10.4% at GBP2.01m (FY2022: GBP1.82m).

The number of connected devices was 11,062 (FY2022: 12,895).

Post machine rationalisation, the total connected devices grew

11.6% to 53,800 at the year-end (FY2022: 48,000).

The division made good progress despite short-term challenges,

namely:

-- Global semiconductor component supply pressure, whilst easing

during the FY2023, added GBP0.45m to our component costs, impacted

component supply chains and slowed down our customers' introduction

of new vending machines.

-- The continued uncertainty around the pace of office

re-openings and changing working habits regarding remote working

has made it challenging for vending operators to determine new site

economics.

-- The MNO 3G sunset, or switch-off, is a short-term distraction

to vending operators developing plans to upgrade machines from 3G

to 4G LTE. Whilst this has dampened short-term demand, Vianet has

developed the Vianet Assist hardware support package, which will

result in upgrade activity and footprint expansion.

The division's recurring revenues grew 16.5% YOY by GBP0.63m and

now represent 80% of turnover (FY2022: 77%).

As has been widely reported in the press, the trend toward

non-cash transactions is growing significantly, with contactless

payments giving a fast, easy, and secure transaction in a world

where fewer people carry cash. Contactless payment solutions drive

increased machine utilisation and sales for our customers, who

benefit from the reduced cost of cash handling, improved cash flow

and assured payment.

We believe that there is a significant opportunity to drive

growth in the unattended retail market by delivering market-leading

analytics and insight into premium coffee and unattended retail

snack & can channels from new device connections and the

rollout of contactless payment capability, as well as other market

verticals such as fuel forecourts.

The market opportunity for the Group is significant even when

limited to the immediately addressable market of over 300,000

vending machines in the UK. It is estimated that the wider

addressable market in mainland Europe is nearer 3 million devices,

and there are 15 million machines worldwide, of which only c.30%

have any form of connectivity.

Our contactless payment solution is supported by leading

industry partners Elavon, Worldpay and NMI and is enhanced by

establishing our PCI Master Merchant service. This allows us to

speed up the onboarding of customers for payment capability and

provide a more cost-effective reconciliation and payment service to

our customers.

Contactless payment remains a desirable solution in a market

where traditional cash-only payments have long inhibited

vending-related usage, consumption, and customer experience. We

believe the evolution and growth of contactless payment solutions,

QR code technology and the insight from our telemetry firmware will

materially change this dynamic and attract more consumers to the

vending vertical.

In summary, the growth prospects for our Smart Machines business

are positive, and there is a clear line of sight toward a doubling

of the business by the end of FY2025.

R&D Investment

R&D investment is vital to maintaining the Group's market

position and thus we have continued to invest in delivering our

product roadmap and operational capabilities.

-- SmartVend vending management software service module released

in Q3 FY2023 with a finance module due for release in Q1 FY2024.

Customer migrations should be complete by spring 2024.

-- SmartDraught hardware and software development, partially in

collaboration with BMI, has resulted in enhanced features and

reduced the cost of both hardware and support.

-- SmartInsight market insight portal developed and launched.

-- Speed and latency of our solutions has improved with

incremental hardware development to adapt existing technology for

new verticals.

Further product enhancements, migration of all customers to

SmartVend, integration of BMI, and securing new market verticals

for telemetry and contactless payments on a cloud-based platform

will further boost our services to customers in existing and new

verticals.

The Board believes the investment in data capture technology,

our core data management capability, and management software

platforms will continue to deliver growth and enhance the quality

and visibility of our recurring revenue streams.

LOOKING FORWARD

-- Vianet has excellent momentum to take advantage of

opportunities in remote asset management, contactless payment, and

market data insights both in our core and new markets, whilst the

recent BMI acquisition will enable growth in our hospitality

operations. The launch of the SmartVend management platform in H2

2023 has been well received and will generate further operational

efficiencies for our customers with complex migrations expected to

complete in Q4 2024. This will further cement Smart Machines as the

marketplace's leading end-to-end solution. Our highly motivated

sales and commercial team in Smart Machines are continuing to

accelerate growth from the significant pipeline of opportunities

from existing and new customers in the c 3 million machine UK and

Europe vending machine market. New business gains resulted in 75

customers being onboarded, helping us deliver significant new

device sales.

-- Smart Zones has a healthy sales pipeline in its core UK

leased and tenanted sector driven primarily by our data

capabilities. We expect new system sales in FY2024 to more than

offset further pub closures. The combination of BMI's inventory

platform and Vianet's draught beer monitoring creates a

comprehensive and affordable beverage management solution which

will also unlock opportunities for stock management, enhanced

analytics, and insight, which will result in growth across all UK

pub sectors and the USA. Continued Private Equity pub company

ownership is expected to drive greater focus on operating and

retail performance, where we are well placed to deliver value for

customers.

-- Growing demand for connectivity solutions, data capture,

insights, and payment systems are driving new sales in our core

hospitality and unattended retail sectors. The recent announcement

of our partnership with Suresite, a leading forecourt retail

specialist, and Vendekin QR payment specialists, demonstrates our

progress toward leveraging our existing technology to extend our

growth in other sectors such as catering and forecourt solutions

where we anticipate good growth.

Whilst we are not immune from the global supply chain challenges

or the economic backdrop, increasing demand for our highly relevant

products will continue to drive growth, high-quality recurring

income, and cash generation. Ongoing investment in product

development and people is creating real momentum. The Group is

confident that the team, products, and financial capabilities we

have will continue delivering growth of the business.

The Board remains confident that momentum and sales will

continue to build as we execute our long-term strategy and deliver

sustainable earnings growth and profitability.

Finally, our high-calibre, energised team, robust strategy, and

strong earnings visibility provides a natural platform for growth

as we expand our IoT capability and deliver data and insight

applications that help our customers make better decisions about

their assets, to transform business performance.

FINANCIAL REVIEW

Mark Foster

Chief Financial Officer

FINANCIAL PERFORMANCE

Group operating profit, pre-exceptional costs, amortisation and

share based payments was GBP3.11m (FY2022: GBP2.36m), being c77% of

pre-pandemic performance, a strong momentum-based recovery in the

last two years from the loss of FY2021 being the core pandemic

year. It is important to recognise we have been impacted by

cGBP450k of stock premium costs in the year, without which our

operating profit would have been cGBP3.56m, versus a like for like

last year of GBP2.59m allowing for cGBP230k of stock premium costs

in FY2022 - GBP0.96m growth, c37%.

Despite some stock premium cost headwinds absorbed in the year,

proactive management delivered robust gross margins at c. 66%

(FY2022: 65%) reflecting the strength of the margin enhancing

growing recurring revenue footprint.

TURNOVER

Turnover improved 6.8% by GBP0.9m to GBP14.11m (FY2022:

GBP13.22m), with Smart Machines continuing its growth curve and

best result to date, in addition to Smart Zones continued strong

recovery with growing revenue and profit.

RECURRING REVENUE

Group contracted recurring revenue base remains very robust and

has been strengthened by several new 3-5-year contracts, both from

new customers and contract renewals.

Consolidated recurring revenue across the two divisions remained

robust at 89% (FY2022: 88%), despite new sales being more capex

based, but demonstrating the strength of a growing recurring

revenue footprint. Overall actual recurring revenue grew 12% by

GBP1.19m year on year, and it is set to continue.

The average recurring revenue per connected device grew to

GBP60.19 (FY2022: GBP54.02), 11.4% year on year growth.

PERFORMANCE SUMMARY

Profit before tax was GBP0.45m (FY2022: GBP0.17m loss), being a

material improvement from the low of FY2021 pandemic year. We took

the opportunity to seek a tax refund, which was received post year

end, for accrued R&D losses which has impacted the tax position

in the year, which shows a tax charge of GBP291k after all tax

movements. The table below shows the performance of the Group.

FY2023 FY2022 Change

Revenue GBP14.11m GBP13.22m 6.7%

Operating

profit(a) GBP3.11m GBP2.36m 31.4%

Profit/(loss) GBP0.45m (GBP0.17m)

before

tax

Basic EPS 0.56p 0.65p

Dividend

per share 0.5p 0.0p

Net debt GBP3.37m GBP3.00m 11.0%

a) Pre-exceptional items, share based payments and amortisation.

EXCEPTIONALS

Exceptional items of GBP122k was flat year of year (FY2022:

GBP121k) largely comprised of corporate activity costs of

GBP103k.

DIVID

As noted in the Chairman's statement, the Board has proposed

re-instating a dividend policy with a payment of 0.5p per share

(FY22: nil).

CASH / FINANCING

Net cash generation pre-working capital movements was an inflow

of GBP4.45m (2022: GBP2.74m which includes an accrued tax rebate of

cGBP0.92m. Normalised cash generation was GBP3.53m, 113.6% of

EBITA, and 102.8% of EBITDA - back at the healthy levels of profit

to cash conversion we were used to seeing pre-pandemic.

Working capital was closely managed, noting the impact of

semiconductor supply and stock premium costs together with

inflationary pressures, which delivered a post working capital

generation inflow of GBP2.04m (2022: GBP2.40m).Excluding the one

off effect of the accrued tax refund of GBP0.92m, the underlying

operational working capital drawdown was GBP1.49m (FY2022:

GBP0.34m) which was significantly impacted by stock investment to

manage the global semiconductor supply challenge and ensure we had

stock on the shelf to service customers, together with increased

trade debts from improving trade, and higher credit outflows

funding that stock and increased VAT. Q4 of H2 FY2023 has seen that

stock investment start to unwind which should continue in

FY2024.

The cash generated was principally used to invest in R&D

technology spend (as noted in the Chairmans and Strategic review),

new recurring revenue rental assets, some delayed vehicle fleet

refreshment, and servicing existing Lloyds bank debts, the CBIL,

and mortgage obligations in the main, and overdraft interest costs.

This resulted in an overall cash outflow of GBP1.37m (2022:

GBP1.63m).

Post year end, we concluded negotiations and due diligence with

HSBC on significantly improved finance facilities that materially

reduces debt repayment requirements with a blend of RCF, new

mortgage and term loan, allowing more of the cash generated to be

invested in our products and services, and if we so choose, debt

repayment, and dividend yield. The HSBC facility contracts are

expected to complete by the end of June ahead of our audited Report

& Accounts and Notice of AGM being released in July. In the

interim whilst the Group finalises the new facilities with HSBC,

which include migrating our mainstream banking, our existing bank

Lloyds can extend to September 2023 or beyond.

At the year end, noting the stock premium costs incurred in the

year of cGBP450k, pre-mortgage, CBIL and previous acquisition

loans, the Group had gross cash of GBP0.07m (2022: GBP1.57m) and

net debt of GBP3.37m (2022: GBP3.00m) - a solid position given

those premium costs, and a funded growth plan that should deliver

an improved cash generation bottom line.

The strong recovery over the last two years positions us well

for FY2024 and beyond. We have incurred c GBP0.7m of stock premium

costs in the last two financial years, but despite this, delivered

growing cash generation to meet the needs of the business. This

together with the planned improved bank facilities and the expected

business plans we have developed over three indicative years, we

believe we have solid cash runway forecasts well into 2024 and

beyond, which will underpin our business strategy and allow for our

growth plans.

DIVISIONAL PERFORMANCE

Currently the Smart Zones division principally consists of the

core beer monitoring and insight business services (including the

US).

SMART ZONES

FY2023 FY2022

Turnover GBP8.16m GBP7.83m

Operating GBP3.79m GBP2.99m

profit(a)

Profit/(loss) GBP2.97m GBP2.23m

before

tax

Connected

devices 154,216 166,804

New site

installations 259 252

YE Net c. 9,800 c. 10,100

premises(b)

iDraught

penetration(b) 28.9% 30.2%

a) Pre-exceptional items, share based payments and amortisation.

b) UK, USA, and Europe

Recurring revenue of 95% (FY2022: 96%) with recurring revenue

per device up 12.2% to GBP50.35 (FY22: GBP44.89).

Average adjusted operating profit per device in the year grew to

GBP24.57 (2022: GBP17.93), up 37.0% reflecting a year of full

billing.

The division has recovered well and ahead of what was expected

at the outset of the year demonstrating both the customer

engagement for the services we provided and the resilience of the

revenue model. The net estate at the year-end was circa 9,800 sites

(UK & Europe) versus last year's c. 10,100 (excluding USA), the

reduction stemming from disposals and C19 impact.

Despite this, we were able to increase Smart Zones operating

profit to GBP3.79m (FY2022: GBP2.99m), which was 65.4% of

pre-pandemic performance.

SMART MACHINES

The Smart Machines division consists of telemetry insights and

monitoring, and contactless payment predominantly in the unattended

vending retail and coffee sector, as well as ERP and mobile

connectivity services.

FY2023 FY2022

Turnover GBP5.95m GBP5.38m

Operating GBP2.01m GBP1.82m

profit

(a)

Profit GBP1.65m GBP1.59m

before

tax (b)

New Telemetry

connections 2046 2,275

New Contactless

connections 9,016 10,620

YE Net

estate 53,758 48,179

a) Pre-exceptional items, share based payments and amortisation on a continuing basis.

b) FY2023 includes GBPnil of deferred consideration release (FY2022: GBP0.76m)

Recurring revenues were c80% of turnover (FY2022: c77%)

reflecting the increasing recurring revenue footprint despite more

capex sales this year. Recurring revenue grew cGBP630k year on

year, c16.5%.

Semiconductor component global supply, and some change in

working habits regarding remote working did impact the pace of new

connected devices, but despite that, new contactless connections in

our Smart Machines division continued to be achieved with 9,016 new

contactless devices compared to 10,620 last year. The estate

figures in the table above reflect the net movement which also

includes some customers rationalising their estates in light of the

new normal office working.

Average recurring revenue per device grew 3.33% to GBP88.42

(FY2022: GBP85.57), reflecting the increased footprint and is

despite most sales in the year being capex based, and some customer

estate refinement which would impact recurring revenue overall

levels. As stated previously, this is an evolving growth story,

with overall turnover and profit growth trends being driven by

increased penetration of our contactless and telemetry solutions

and so these measures will flex each year.

Profit per device is on a par with last year GBP37.45 (FY2022:

GBP37.75), reflecting the impact of the stock premiums incurred

during the year of around GBP450k compared to last year-round

GBP230k. Without that impact, the year-on-year profit per device

would have been nearer GBP41.54, growth of cGBP3.81, 10.0%. Indeed,

the overall profit of GBP2.01m was held back by the stock premium

costs, without which results would have been cGBP2.46m,

representing a like for like growth of c20.1%.

Taxation

The Group has continued to utilise available tax losses during

the year resulting in no tax being paid (FY2022, GBPnil). The Group

will continue to utilise the available tax losses carried forward

into FY2024, but we did elect to receive a refund of R&D tax

losses for FY2021 and FY2022 amounting to cGBP922k, which was

received post balance sheet. The impact of this on the brought

forward tax losses and deferred tax position contributed to an

overall tax charge of GBP0.29m (FY2022 tax credit GBP0.36m)

recognising the impact of the tax losses available and being

utilised.

Earnings per share

Basic EPS was 0.56p (FY2022: 0.65p). This reflects the step

forward in results but impacted by the tax charge this year

compared to the tax credit last year.

Balance sheet and cash flow

The Group balance sheet remains strong, very capable of

supporting our growth position and is further enhanced post balance

sheet by a more flexible HSBC bank facility which will in essence

remove the aggressive CBIL repayment terms and term.

The Group generated operating cash flow pre working capital of

GBP3.53m (FY2022: GBP2.74m) being 28.8% growth year on year.

Post working capital covered above, there was a net inflow of

GBP2.04m (FY2022: GBP2.398m) impacted by GBP0.45m of stock premium

costs (FY2022: GBP0.23m).

The cash generated was used to continue to invest in the Group's

technology plans to service borrowings and acquire rental assets,

alongside some delayed vehicle fleet refreshment.

At the year-end, the Group had borrowings of GBP3.44m (FY2022:

GBP4.58m), including the CBIL facility and overdraft, with net debt

of GBP3.37m (FY2022: GBP3.00m).

Our resilient balance sheet and capacity to generate cash

provides the Company with a solid base to build on the results of

FY2023 results to pursue the significant growth opportunities that

have been identified.

Business risk

The Board and senior management review business risk two to

three times per year. Naturally, over the last two years C19 has

had its well documented impact. The last year has seen increased

stock premium costs and an increased inflationary environment. The

Directors had considered the areas of potential risk in assessing

the Group's prospects. Based on their review, and having considered

various factors such as market conditions, stock supply and premium

costs, inflation, financial plans and approved new bank facilities,

they believe that the business is of sound financial footing and

has a forward looking sustainable operating future. They note that

the business has achieved a good recovery financially in the year

despite noting some of the hurdles they have faced, set against

overall market confidence in liquidity and credit.

The Directors consider that material business risks are limited

to:

-- Inflation remaining for a long-term period and a return of significant stock premium costs.

-- The potential for a cyber security breach where data security

is compromised resulting in unauthorised access to information

which is sensitive and/or proprietary to Vianet or its customers.

This threat is in common with most technology businesses, however

both short term and long-term mitigation plans continue to be in

place. Payment Card Industry Data Security Standard (PCI DSS -

Level 1) highest level of compliance has already been achieved to

support the Group's contactless payment solutions and by May 2022

all on premise servers are in the cloud.

Key performance indicators

Actual Actual

Target 2023 2022

------- ------- -------

Percentage

of revenue

from recurring

income streams

(1) 80% 88% 88%

------- ------- -------

Gross Margin

(2) 70% 66% 64%

------- ------- -------

Employee Turnover

(3) 2% 3.8% 3.5%

------- ------- -------

Notes to KPIs

(1) Percentage of revenue from recurring income streams =

recurring income streams as a percentage of all income streams.

Group trading companies aim to increase shareholder value through

growth in revenue, linked to profitability (see Gross Margin

below). Source data is taken from management information. The

recurring contractual nature of the Company's income stream has led

to continued improvement in performance versus target. The

achievement of this target depends on the mix of new hardware sales

versus on going recurring revenue.

(2) Gross Margin = Gross profit as a percentage of revenue.

Group trading companies aim to generate sufficient profit for both

distribution to shareholders and re-investment in the Company, as

measured by Gross Margin.

(3) Employee Turnover = Gross trading companies aim to be seen

as a good, attractive employer with positive values and career

prospects, measured against internal People and Development

reports. In addition to normal employee turnover, the figure also

includes employees leaving because of business rationalisation

activity.

Consolidated Statement of Comprehensive Income for the year

ended 31 March 2023

Before Before

Exceptional Exceptional Total Exceptional Exceptional Total

2023 2023 2023 2022 2022 2022

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Note

Continuing

operations

Revenue 14,115 - 14,115 13,215 - 13,215

Cost of

sales (4,737) - (4,737) (4,654) - (4,654)

Gross profit 9,378 - 9,378 8,561 - 8,561

Administration

and other

operating

expenses (6,273) (122) (6,395) (6,198) (121) (6,319)

Operating

profit

pre amortisation

and share

based payments 3,105 (122) 2,983 2,363 (121) 2,242

Intangible

asset

amortisation (2,254) - (2,254) (2,195) - (2,195)

Share based

payments (71) - (71) (83) - (83)

------------------- ----- ------------------ -------------- ---------- -------------- -------------- ----------

Total

administrative

expenses (8,598) (122) (8,720) (8,476) (121) (8,597)

Operating

profit/(loss) 780 (122) 658 86 (121) (36)

------------------- ----- ------------------ -------------- ---------- -------------- -------------- ----------

Net finance

costs (206) - (206) (138) - (138)

Profit/(loss)

before

tax 574 (122) 452 (53) (121) (174)

Income

tax

(charge)/credit 1 (291) - (291) 361 - 361

Profit/(loss)

and other

comprehensive

income

for the

year 283 (122) 161 308 (121) 187

Earnings

per share

Total

- Basic 3 0.56p 0.65p

- Diluted 3 0.56p 0.63p

------------------- ----- ------------------ -------------- ---------- -------------- -------------- ----------

Consolidated Balance Sheet at 31 March 2023

2023 2022

GBP000 GBP000

Assets

Non-current assets

Goodwill 17,856 17,856

Other intangible assets 5,425 5,976

Property, plant and equipment 3,370 3,262

Deferred tax asset - 386

Total non-current assets 26,651 27,480

---------------------------------- -------- --------

Current assets

Inventories 2,275 1,573

Trade and other receivables 3,781 2,690

Cash and cash equivalents 69 1,583

---------------------------------- -------- --------

6,125 5,846

------------------------------- -------- --------

Total assets 32,776 33,326

---------------------------------- -------- --------

Equity and liabilities

Liabilities

Current liabilities

Trade and other payables 2,348 2,983

Leases 70 25

Borrowings 1,925 2,310

4,343 5,318

Non-current liabilities

Leases 122 -

Borrowings 1,517 2,273

Deferred tax liability 827 -

2,466 2,273

------------------------------- -------- --------

Equity attributable to owners

of the parent

Share capital 2,880 2,880

Share premium account 11,711 11,711

Capital redemption reserve 15 15

Share based payment reserve 563 499

Merger reserve 310 310

Retained profit 10,488 10,320

---------------------------------- -------- --------

Total equity 25,967 25,735

---------------------------------- -------- --------

Total equity and liabilities 32,776 33,326

---------------------------------- -------- --------

Consolidated Statement of Changes in Equity for the year ended

31 March 2023

Share

Share based Merger Capital

Share premium payment reserve Redemption Retained

capital account reserve Reserve profit Total

At 1 April 2021 2,895 11,709 437 310 - 10,238 25,589

-------- -------- -------- --------- ------------ -------- ------

Issue of shares - 2 - - - - 2

Cancellation of shares (15) - - - 15 (126) (126)

Share based payments - - 83 - - - 83

Share option forfeitures - - (21) - - 21 -

Transactions with

owners (15) 2 62 - 15 (105) (41)

-------------------------- -------- -------- -------- --------- ------------ -------- ------

Profit and total

comprehensive income

for the year - - - - 187 187

-------------------------- -------- -------- -------- --------- ------------ -------- ------

Total comprehensive

income less owners

transactions (15) 2 62 - 15 82 146

--------------------------

At 31 March 2022 2,880 11,711 499 310 15 10,320 25,735

-------------------------- -------- -------- -------- --------- ------------ -------- ------

At 1 April 2022 2,880 11,711 499 310 15 10,320 25,735

-------- -------- -------- --------- ------------ -------- ------

Share based payments - - 71 - - - 71

Share option forfeitures - - (7) - - 7 -

Transactions with

owners - - 64 - - 7 71

-------------------------- -------- -------- -------- --------- ------------ -------- ------

Profit and total

comprehensive income

for the year - - - - 161 161

-------------------------- -------- -------- -------- --------- ------------ -------- ------

Total comprehensive

income less owners

transactions - - 64 - - 168 232

--------------------------

At 31 March 2023 2,880 11,711 563 310 15 10,488 25,967

-------------------------- -------- -------- -------- --------- ------------ -------- ------

Consolidated Cash Flow Statement for the year ended 31 March

2023

2023 2022

Note GBP000 GBP000

Cash flows from operating activities

Profit for the year 161 187

Adjustments for

Net interest payable 206 138

Income tax charge/(credit) 291 (361)

Amortisation of intangible assets 2,254 2,195

Depreciation 519 489

Contingent consideration release - (76)

Loss on impairment of property,

plant and equipment and businesses 24 83

Tax receivable 922 -

Share based payments 71 83

Operating cash flows before changes

in working capital and provisions 4,448 2,738

Change in inventories (702) (142)

Change in receivables (1,091) 68

Change in payables (618) (267)

(2,411) (341)

Cash generated from operations 2,037 2,397

Net cash generated from operating

activities 2,037 2,397

--------------------------------------------------- -------- --------

Cash flows from investing activities

Purchases of property, plant and

equipment (651) (465)

Capitalisation of development costs (1,699) (1,975)

Purchases of intangible assets (4) (12)

Proceeds from disposal of property,

plant and equipment - 22

Net cash used in investing activities (2,354) (2,430)

--------------------------------------------------- -------- --------

Cash flows from financing activities

Net interest payable (206) (138)

Repayment of leases (65) (28)

Issue of share capital - 2

New leases 231 -

Cancellation of shares - (126)

Payment of contingent consideration (16) (16)

Repayments of borrowings (992) (1,289)

Net cash used in financing activities (1,048) (1,595)

--------------------------------------------------- -------- --------

Net decrease in cash and cash equivalents (1,365) (1,628)

Cash and cash equivalents at beginning

of year 266 1,894

--------------------------------------------------- -------- --------

Cash and cash equivalents at end

of year (1,099) 266

--------------------------------------------------- -------- --------

Cash balance as per consolidated

balance sheet 69 1,583

Bank overdrafts (1,168) (1,317)

-------------------------------------- -------- --------

Balance per statement of cash flows (1,099) 266

-------------------------------------- -------- --------

Notes to the financial statements

1. Taxation

Analysis of tax charge/(credit) in year

2023 2022

GBP000 GBP000

Current tax credit

- Amounts in respect of the current year - -

- Amounts in respect of prior periods (922) -

(922) -

Deferred tax charge/(credit):

- Amounts in respect of the prior year 1,262 -

- Amounts in respect of the current year (49) (390)

- Amendment re-recognition of losses - 29

Income tax charge/(credit) 291 (361)

------------------------------------------ -------- --------

Reconciliation of effective tax rate

The tax for the 2023 year is higher (2022: was lower) than the

standard rate of corporation tax in the UK (2023: 19% and 2022:

19%). The differences are explained below:

2023 2022

GBP000 GBP000

Profit/(loss) before taxation

- Continuing operations 452 (174)

Profit/(loss) before taxation multiplied

by rate of corporation tax in the UK of

19% (2022: 19%) 86 (33)

Effects of:

Other expenses not deductible for tax purposes (17) (20)

Non-taxable income (44) (33)

Losses not provided for 567 129

Adjustments for prior years (922) 29

Amortisation of intangible assets 427 -

Research and development 194 (488)

Other differences - 55

Total tax charge/(credit) 291 (361)

------------------------------------------------ -------- --------

2. Ordinary dividends

2023 2022

GBP000 GBP000

Final dividend for the year ended 31 March

2023 of nil (year ended 31 March 2022: nil) - -

Interim dividend paid in respect of the - -

year of nil (2022: nil)

Amounts recognised as distributions to equity - -

holders

---------------------------------------------- -------- --------

In addition, the directors are proposing a final dividend in

respect of the year ended 31 March 2023. Total dividend payable

0.005p (2022: nil).

3. Earnings per share

Earnings per share for the year ended 31 March 2023 was 0.56p

(2022: 0.65p).

Basic earnings per share are calculated by dividing the earnings

attributable to ordinary shareholders being a profit of GBP161k

(2022: GBP187k) by the weighted average number of ordinary shares

outstanding during the year.

Diluted earnings per share are calculated on the basis of profit

for the year after tax divided by the weighted average number of

shares in issue in the year plus the weighted average number of

shares which would be issued if all the options granted were

exercised.

2023 2022

Earnings Basic Diluted Earnings Basic Diluted

GBP000 earnings earnings GBP000 earnings earnings

per share per share per share per share

Post-tax profit attributable

to equity shareholders 161 0.56p 0.56p 187 0.65p 0.63p

2023 2022

Number Number

Weighted average number of ordinary shares 28,808,914 28,949,491

Dilutive effect of share options 66,673 380,517

------------------------------------------------------------------------ ------------------- -------------

Diluted weighted average number of ordinary

shares 28,875,587 29,330,008

------------------------------------------------------------------------ ------------------- -------------

4. Exceptional items

2023 2022

GBP000 GBP000

Corporate activity and acquisition costs 103 127

Corporate restructuring and transitional

costs 17 61

Contingent consideration release - (76)

Network obsolesce costs - 5

Other 2 4

122 121

------------------------------------------ -------- --------

Corporate activity and acquisition costs relate to fees paid to

corporate advisors in respect of prospective acquisitions and

corporate evaluations.

Corporate restructuring and transitional costs relate to the

transition of people and management to ensure we have to succession

and calibre of people on board to deliver the strategic aims and

aspirations of the Group.

The contingent consideration release in the prior year referred

to the acquisition of Lookoutsolutions Limited in 2011. The balance

was fair valued at the year end with the change in fair value

recognised through the income statement, in that year, as the

deferred period for consideration closed as at 31 March 2022.

5. Basis of preparation

In accordance with the Companies Act 2006, this preliminary

report based on the unaudited financial statements has been

prepared and approved by the Directors in accordance with UK

adopted international accounting standards, and in accordance with

the AIM rules and is not therefore in full compliance with IFRS.

The company prepares its parent company financial statements in

accordance with FRS 101.

The financial information for the year ended 31 March 2022 does

not constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The independent

auditors' report on the full financial statements for the year

ended 31 March 2022 was unqualified and did not contain an emphasis

of matter paragraph or any statement under section 498 of the

Companies Act 2006. This preliminary announcement does not

constitute the Group's full financial statements for the year ended

31 March 2023.

The Group's full financial statements will be approved by the

Board of Directors and reported on by the auditors in July-August

2023. Accordingly, the financial information for the year ended 31

March 2023 is presented unaudited in the preliminary

announcement.

The consolidated financial statements have been prepared on an

historical cost basis, except for derivative financial instruments

that have been measured at fair value. The consolidated financial

statements are presented in pounds sterling and all values are

rounded to the nearest hundred thousand, expressed in millions to

one decimal point, except when otherwise indicated.

The Directors have prepared this financial information on the

fundamental assumption that the Group is a going concern and will

continue to trade for at least 12 months following the date of

approval of the financial information. In determining whether the

Group's accounts should be prepared on a going concern basis the

Directors have considered the factors likely to affect future

performance.

6. Notes supporting statement of cashflows

Borrowings Borrowings

due within due after

one year one year Total

GBP000 GBP000 GBP000

Net debt as 1 April 2021 (1,265) (3,290) (4,555)

Cash flows 134 1,017 1,151

Non cash-flows

* Interest accruing in the year 138 - 138

====================================== ============ =========== ========

Net debt at 31 March 2022 (993) * (2,273) (3,266)

Cash flows 236 756 992

Non cash-flows

- - -

* Interest accruing in the year

====================================== ============ =========== ========

Net debt at 31 March 2023 (757)** (1,517) (2,274)

====================================== ============ =========== ========

* The net debt as at 31 March 2022 for borrowing due within one

year of GBP993k as stated here, does not agree to the Balance Sheet

amount of GBP2,310k, as this does not include the bank overdraft of

GBP1,317k as at 31 March 2022.

** The net debt as at 31 March 2023 for borrowing due within one

year of GBP757k as stated here, does not agree to the Balance Sheet

amount of GBP1,925k, as this does not include the bank overdraft of

GBP1,168k as at 31 March 2023.

Cash and cash equivalents for the purpose of the statement of

cash flows comprises

2023 2022

GBP000 GBP000

Cash at bank available on demand 69 1,581

Cash on hand - 2

---------------------------------- -------- --------

Adjusted net cash generation 69 1,583

---------------------------------- -------- --------

Non- cash transactions from financing activities are shown in

the reconciliation of liabilities from financing transactions in

Note 7.

7. Alternative Performance Measures

In the reporting of financial information, the Directors have

adopted the APMs "Adjusted operating (loss)/profit", "Adjusted

operating cash generation", and "Adjusted net cash generation",

(APMs were previously termed 'Non-GAAP measures'), which is not

defined or specified under International Financial Reporting

Standards (IFRS).

These measures are not defined by IFRS and therefore may not be

directly comparable with other companies' APMS, including those in

the Group's industry. APMs should be considered in addition to, and

are not intended to be a substitute for, or superior to, IFRS

measurements.

Purpose

The Directors believe that these APMs assist in providing

additional useful information on the underlying trends, performance

and position of the Group. These APMs are also used to enhance the

comparability of information between reporting periods and business

units, by adjusting for non-recurring or uncontrollable factors

which affect IFRS measures, to aid the user in understanding the

Group's performance.

Consequently, APMs are used by the Directors and management for

performance analysis, planning, reporting and incentive setting

purposes and this remains consistent with the prior year. Adjusted

APMs are used by the Group in order to understand underlying

performance and exclude items which distort compatibility, as well

as being consistent with public broker forecasts and measures.

2023 2022

GBP000 GBP000

Operating profit/(loss) (IFRS measure) 658 (36)

Add back:

Amortisation charge 2,254 2,195

Share based payment charge 71 83

Exceptional items charge 122 121

---------------------------------------- -------- --------

Adjusted operating profit 3,105 2,363

---------------------------------------- -------- --------

8. Post balance sheet events

On 12th May 2023, the Company acquired the trade and assets of a

US based business, BevMetrics Inc. (BMI).

BMI is based in Denver, being a USA based provider of inventory

software solutions to the USA hospitality sector, and wholly owned

subsidiary of Identec AG.

The acquisition consisted of software IP and patents, an

established operating platform, and minor customers. BMI's five

employees will be incorporated into Vianet's USA subsidiary Vianet

Americas Inc. ("VAI") which has worked closely with BMI over the

past couple of years.

The initial consideration payable to BMI is GBP577,500 and has

been satisfied in the form of the issue of 700,000 ordinary Vianet

shares at a price of 82.5p each with contingent consideration

payable dependent on performance metrics. The contingent

consideration, to be calculated as 7% of net revenue of VAI for the

period 1 April 2024 through 31 December 2028, will be payable in

cash annually and is capped at a maximum future contingent

consideration of GBP4 million. That will be evaluated for the first

time in the year ended March 2024.

The provisional fair values of assets and liabilities acquired

is noted in the table below:

The trade and assets from the acquisition were transferred

immediately on completion of the transaction to the Company's US

subsidiary, Vianet Americas Inc. (VAI). VAI will continue to trade

with the existing BMI customers as plans to expand evolve in the

coming year.

Financing

At the time of publication, the company is in the process of

moving banks from Lloyds to HSBC. The expected date of change is 1

August 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GCGDLIUBDGXX

(END) Dow Jones Newswires

June 13, 2023 06:12 ET (10:12 GMT)

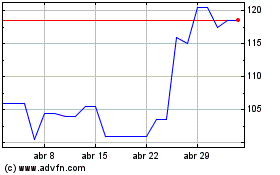

Vianet (LSE:VNET)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Vianet (LSE:VNET)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025