TIDMXLM

RNS Number : 5927Z

XLMedia PLC

21 September 2015

For immediate release 21 September 2015

XLMedia PLC

("XLMedia" or "the Group" or "the Company")

Interim results for the six months ended 30 June 2015

Strong momentum continues

XLMedia (AIM: XLM), a leading provider of digital performance

marketing services, is pleased to announce its interim results for

the six months ended 30 June 2015.

Financial highlights

-- Revenues increased 85% to $36.8 million (H1 2014: $19.9 million);

-- Gross profit increased 63% to $18.4 million (H1 2014: $11.3 million);

-- Adjusted EBITDA increased 103% to $12.9 million (H1 2014: $6.4 million);

-- Profit before tax up 187% to $13.2 million (H1 2014: $4.6 million);

-- Net cash from operating activities increased 111% to $12.1 million (H1 2014: $5.7 million);

-- Interim dividend of $5.0 million or 2.595 cent per share; and

-- Strong balance sheet with $43.2 million cash and short term investments.

Operating highlights

-- Continued development of mobile capabilities through

investments in technology and in house systems;

-- Extended reach of existing network through bolt on

acquisition of UK focused, mobile targeted websites;

-- First stage of EDM integration completed and accelerated into the Group;

-- Post period end, the Group announced the completion of the

acquisition of a majority stake in Marmar Media broadening the

Group's offering and operational profile; and

-- Strong six months of trading reflecting the results of

investments made during the past 18 months.

Ory Weihs, Chief Executive Officer of XLMedia, commented:

"We are delighted to report another record breaking six months.

During the first six months of the year we continued to develop the

business and invest in our main technology and mobile capabilities,

which further underpin our key revenue and profit drivers.

"We made significant progress with executing our strategic plan,

with acquisitions of performance marketing companies as well as

bolt on publishing assets. These acquisitions complement the

Group's existing business and add diversification through the

addition of more clients, products, regions and marketing channels.

EDM, which was acquired last year, is performing well and as such

the integration of the business has been accelerated. We believe

that using a unified technological infrastructure throughout the

Group will enhance performance and bring additional benefits of

scale to the Group.

"The Board is extremely confident of meeting expectations for

the full year. Our confidence level is demonstrated by our

declaration of an interim dividend of $5.0 million or 2.595 cents

per share.

"We believe we have a set of strong foundations underpinning the

growth potential of our business and we look to reporting on our

continued progress."

Our full annual financial statements are available on our

website at the following address:

http://www.xlmedia.com/company-reports/

Our updated investor presentation is also available on our

website at the following address:

http://www.xlmedia.com/media/

For further information, please contact:

XLMedia plc Ory Weihs www.xlmedia.com Tel: 020 8817 5283

Vigo Communications Jeremy Garcia Tel: 020 7016 9570

/ Fiona Henson www.vigocomms.com

Cenkos Securities plc (Nomad Tel: 020 7397 8900

and Joint Broker) Ivonne Cantu

/ Camilla Hume www.cenkos.com

Liberum (Joint Broker) Neil Tel: 020 3100 2000

Patel / Chris Clarke www.liberum.com

Operational review

Following the Company's IPO in March 2014, we have been in the

process of executing our strategy of driving growth and

establishing our position as a dominant player in the area of

online monetisation. Furthermore, we have continued to build on the

positive momentum and footprint established in 2014 and the Group

has delivered record profits in the first half of 2015. This

delivery is a result of a combination of factors; inter alia, our

strong organic growth, the positive impact from the acquisitions as

well as the benefit of less expenses falling in to the first half

than had been anticipated.

As a reflection of the growth seen in the first half of 2015,

the Group has maintained its progressive dividend policy and will

be issuing a dividend of 2.595 cents per share payable on 30

October 2015 to shareholders on the register at 2 October 2015. The

ex-dividend date is 1 October 2015. We remain confident that demand

for performance marketing services is set to continue to grow

across all media platforms.

Business Summary

Over the course of the last 18 months, we have successfully

executed a number of growth initiatives. Below is an overview of

the progress we have achieved to date:

-- Successful acquisitions have broadened our market reach across geographies and verticals

o Completed a series of bolt on acquisitions of domains and

websites complementing our publishing asset base and providing

access to additional markets and products. All of these acquired

assets have been integrated into our publishing division and

platform and are benefitting from our increased scale and access to

our in house technology.

o Continued efforts to evaluate potential acquisitions have

resulted in the Company acquiring a group of UK focused, mobile

targeted websites.

o Acquired EDM, a leading social and mobile gaming marketing

company, in September 2014. Deriving the majority of its revenues

from the US, EDM provides the Group with access to complementary

markets as well as giving it entry in to a new vertical focused on

social gaming. We completed the first phase of EDM's integration in

to the Group during the period and, as reported earlier this month,

due to EDM's strong performance in the first year following its

acquisition we have decided to waive performance conditions for

contingent consideration in order to accelerate the full

integration into the Group. The Board believes this was an

essential action for the Group as it is expected that social gaming

will be a strong growth driver for XLMedia over the coming

years.

o On 1 July 2015 the Group announced the completion of the

acquisition of the majority stake in Marmar Media, a performance

media company for web and mobile. Marmar Media adds additional know

how and scale, as well as a wider customer base and vertical

diversification.

o All of the acquired assets and companies are performing in

line with or above management's expectations.

-- Significant increase in organic revenues and client base

o Together with the Group's stated acquisition strategy, the

Group continues to deliver strong organic growth in all of its

business segments with the 2014 year-end trading performance

exceeding market expectations.

o The first half of 2015 delivered record revenues for the

business, representing growth of 85% and 103% in revenues and

adjusted EBITDA respectively. We expect to deliver further solid

performance during the second half of the year.

-- Investments in Technology

o We have continued to make significant investments in our

technology and our staff to support expansion in our media division

as well as continuing to support organic growth in the publishing

division.

o We use our in-house marketing technology to optimize media

buying and enhance performance.

o We will continue to invest further in our technology so that

we can continually improve performance and efficiency. This will

ensure we maintain our strong position in the market place and that

we can adapt to changes in the online and mobile search

ecosystem.

Business Segments review

($'000) Publishing Media Partner Total

Network

H1 2015

Revenues 14,449 17,463 4,863 36,775

% of revenues 39.3% 47.5% 13.2% 100%

Direct

profit 11,601 6,242 558 18,401

Profit

margin 80.3% 35.7% 11.5% 50.0%

H1 2014

Revenues 10,659 6,716 2,502 19,877

% of revenues 53.6% 33.8% 12.6% 100%

Direct

profit 7,986 2,927 353 11,266

Profit

margin 74.9% 43.6% 14.1% 56.7%

-- Publishing

Publishing revenues grew 36% to $14.4 million (H1 2014: $10.7

million). The growth was primarily organic, with some additions

from new assets acquired during the second half of 2014 and

2015.

We invested significant amounts in technology infrastructure to

support the centralised management of our assets and to improve

conversions and performance of our assets.

Since the launch of our proprietary content management system,

"Palcon", in November 2014, we have seen an improvement in the day

to day operation of our network of over 2,000 specialist content

websites. Palcon is a consolidated management system across all

websites, enabling fast and dynamic updates and upgrades,

comprehensive tracking support for website optimization as well as

enhanced mobile and social features in our websites. All of the new

assets we have acquired have been integrated and adjusted to our

Palcon technology as well as existing websites migrated to the new

technology, allowing us to benefit from the advantages of scale. We

continue to develop our in-house systems to ensure we benefit from

the maximum efficiencies possible.

During 2015 we invested $1.7 million in new websites and domains

and we plan to continue buying and developing more assets to

further drive our growth.

-- Media

Organic growth in the Media division came from strong and

growing demand for digital advertising and resulted in revenues

growing 160% to $17.5 million (H1 2014: $6.7 million). Further

growth in this division was also achieved through the acquisition

of EDM which contributed $6.0 million to H2 revenues in 2014.

(MORE TO FOLLOW) Dow Jones Newswires

September 21, 2015 02:00 ET (06:00 GMT)

Our revenue model is performance based - either through revenue

share, cost per acquisition, cost per installation or other models.

Customers pay for performance only, avoiding the risk of applying

funds to media campaigns that don't deliver return on investment

("ROI"). We use our expertise, in-house proprietary systems and

trained staff and own funds to run thousands of simultaneous

campaigns which yield positive ROI for us and for our

customers.

EDM specializes in social and mobile advertising specifically

targeted at 'user acquisition' for social gaming applications. The

acquisition of EDM in September 2014 significantly added to our

expertise in the social and mobile advertising, gave the Group a

further presence in the US and delivered new customers and

capabilities. With the strong demand in EDM's markets, demonstrated

by the performance of EDM since acquisition, the Board believes

social gaming will be a strong driver of the Group's growth in the

coming years.

We continue to build our media base both organically and through

acquisitions of EDM and Marmar Media. By increasing our media

operations we aim to reach the widest possible audience by mass

online communication. Although these activities can have lower

margins they reach high volumes rapidly. As previously outlined,

although we expect to see a decrease in the Group's media margins,

in line with industry trends, we believe this decrease will be more

than compensated for with the increased traffic generated through

our operations. Hence we expect to continue growing Media earnings.

The acquisition of a majority stake in Marmar Media, announced

during the period, will bolster our offering in this space and

provides us with additional scale and exposure to new markets for

our media business.

-- Partner Network

Partner network revenues grew 94% to $4.9 million (H1 2014: $2.5

million). Our partner network remains an important part of our

business, offering the opportunity to provide marketing services

which are not currently serviced through our existing publishing

and media networks.

Current Trading and Outlook

The Group has continued to trade strongly into the second half

of the year. The business has established solid foundations for

growth and continues to enhance and improve its offering, notably

with the recent acquisition of Marmar Media. The Board is extremely

confident of meeting expectations for the full year and has

maintained its progressive dividend policy by declaring a dividend

of $5 million or 2.595 cents per share payable on 30 October 2015

to shareholders on the register at 2 October 2015. The ex-dividend

date is 1 October 2015.

Financial review

H1 2015 H1 2014 Change

=============== ======== ======== =======

Revenues 36,775 19,877 85%

=============== ======== ======== =======

Gross Profit 18,401 11,266 63%

=============== ======== ======== =======

Operating

expenses 7,409 6,233 19%

=============== ======== ======== =======

Operating

income 10,992 5,033 118%

=============== ======== ======== =======

Adjusted

EBITDA 12,933 6,377 103%

=============== ======== ======== =======

Financial

income 2,409 310 NA

=============== ======== ======== =======

Profit Before

Tax 13,170 4,610 186%

=============== ======== ======== =======

The first half of 2015 has delivered another set of record

revenues for the business. Revenues in the first six months of the

year totaled $36.8 million, reflecting 85% growth compared to the

same period last year. Revenues in 2015 reflect the consolidation

of EDM which was acquired in September 2014, as well as strong

organic growth in all business segments during the period.

Gross profit reached $18.4 million or 50% of revenues,

representing 63% growth compared to last year (H1 2014: $11.3

million, 57%). In the first half of 2015 the media segment has

grown to be the largest segment with 48% of revenues. As we

continue implementing our strategy of further increasing and

developing our media business, revenue mix will shift further

towards media lowering gross margins, and as such we expect total

gross margins (in terms of percentage) to decrease further across

the Group.

Operating expenses during the first six months of the year were

$7.4 million, an increase of 19% compared to the same period last

year (H1 2014: $6.3 million). During the first six months of 2015,

we saw some delays in our planned recruitments, partially due to

our focus on successful integration of our acquired businesses as

well as due to market conditions for recruiting technology experts.

We are now recruiting more employees and therefore operating

expenses will grow in the second part of 2015.

Operating expenses included $0.7 million of research and

development expenses, reflecting an increase of 66% compared to the

same period last year (H1 2014: $0.4 million). These expenses are

in addition to the increase of 146% in investments in technology

and internal systems developed during the period of $1.6 million

(H1 2014: $0.7 million). The Group expects to further enhance

investment in technology as we see technology as a key driver to

growth and profit for the coming years.

Adjusted EBITDA(1) reached $12.9 million or 35% of revenues,

reflecting an increase of 185% to the same period last year (H1

2014: $6.4 million, 32%). As the mix of revenues changes towards

more media, we expect adjusted EBITDA to decrease in terms of

margins but to grow in absolute numbers.

Financial income for the first six months of the year was $2.4

million, attributed to the Company's dynamic hedging activity to

mitigate material exposure to foreign currencies. Since the

majority of the Group's revenues are denominated in Euro, the

Company entered into a series of forward contracts for the sale of

Euro and purchase of US Dollars. The Euro exchange rate decreased

by 8% versus the US Dollar during this period. However, the Company

gained financial income from its hedging activity which partially

compensated for the decrease. Out of the financial income $1.3

million was received in cash (when forward contracts matured) while

the remaining $1.1 million is recorded as fair value gains for

forward contracts not yet matured. The remaining forward contracts

will mature over the course of the next 12 months and therefore if

the Euro vs. USD exchange rate increases the Company will record

financial expenses.

As a result of the high adjusted EBITDA as well as the financial

gain from changes in exchange rates, profit before tax increased by

186% to $13.2 million (H1 2014: $4.6 million).

As of 30 June 2015 we had $43.2 million cash and short term

investments compared to $44.1 million on December 31, 2014. The

change in cash reflects an increase of $12.1 million provided by

operating activity, offset by spending $9.4 million on investments

in technology and acquisitions and $3 million of dividends during

the first half of 2015. Investments during the period include a

payment of $5.4 million on account of acquisition of Marmar

media.

Current assets as of 30 June 2015 were $58.9 million (31 Dec

2014: $57.8 million), and non-current assets reached $50.0 million

(31 Dec 2014: $42.0 million). The increase in non-current assets is

attributed mainly to the payment on account of Marmar media shares

($5.4 million), investments in domains and websites of $1.7

million, as well as additions to our in-house technology of $0.7

million.

With total equity on 30 June 2015 reached $85 million, or 78%

(2014: 76%), and cash and short term investments of $44.1 million

the Group is well positioned to continue executing its strategic

plan.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

30 June 31 December

--------- -----------

2015 2014

--------- -----------

Unaudited Audited

--------- -----------

USD in thousands

----------------------

Assets

Current assets:

Cash and cash equivalents 27,366 27,351

Short-term investments 15,807 16,714

Trade receivables 12,445 11,548

Other receivables 1,857 1,895

Financial derivatives 1,430 264

---------

58,905 57,772

--------- -----------

Non-current assets:

Long-term investments 5,890 333

Other receivables 398 456

Property and equipment 997 864

Goodwill 19,586 19,586

Domains and websites 18,440 16,728

Other intangible assets 4,692 4,014

---------

50,003 41,981

--------- -----------

108,908 99,753

========= ===========

(MORE TO FOLLOW) Dow Jones Newswires

September 21, 2015 02:00 ET (06:00 GMT)

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

30 June 31 December

--------- -----------

2015 2014

--------- -----------

Unaudited Audited

--------- -----------

USD in thousands

----------------------

Liabilities and equity

Current liabilities:

Trade payables 9,575 9,073

Contingent consideration payable 3,478 3,396

Other liabilities and accounts payable 7,072 7,764

---------

20,125 20,233

--------- -----------

Non-current liabilities:

Contingent consideration payable 3,313 3,233

Deferred taxes 247 332

Other liabilities 117 42

--------- -----------

3,677 3,607

---------

Equity attributable to equity holders

of the Company:

Share capital *) *)

Share premium 63,898 62,271

Capital reserve from share-based transactions 1,295 1,784

Capital reserve from transactions

with non-controlling interests (506) (506)

Retained earnings 20,129 12,072

---------

84,816 75,621

Non-controlling interests 290 292

--------- -----------

Total equity 85,106 75,913

--------- -----------

108,908 99,753

========= ===========

*) Lower than USD 1 thousand.

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

Six months ended Year ended

30 June 31 December

------------------ ------------

2015 2014 2014

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

(except per share data)

Revenues 36,775 19,877 50,720

Cost of revenues 18,374 8,611 23,142

--------

Gross profit 18,401 11,266 27,578

Research and development expenses 708 427 1,008

Selling and marketing expenses 1,324 1,129 2,239

General and administrative expenses 5,377 4,677 9,732

--------

7,409 6,233 12,979

--------

Operating income before expenses

in connection with IPO 10,992 5,033 14,599

Expenses in connection with

IPO - 461 361

-------- -------- ------------

Operating income after expenses

in connection with IPO 10,992 4,572 14,238

Finance expenses (231) (263) (1,001)

Finance income 2,409 310 231

--------

Income before other expenses 13,170 4,619 13,468

Other expenses, net - (9) (229)

--------

Profit before taxes on income 13,170 4,610 13,239

Taxes on income 1,774 324 1,329

--------

Net income and other comprehensive

income 11,396 4,286 11,910

======== ======== ============

Attributable to:

Equity holders of the Company 11,057 3,001 9,821

Non-controlling interests 339 1,285 2,089

-------- -------- ------------

11,396 4,286 11,910

======== ======== ============

Net earnings per share attributable

to equity holders of the Company:

Basic net earnings per share

(in USD) 0.06 0.02 0.06

======== ======== ============

Diluted net earnings per share

(in USD) 0.06 0.02 0.05

======== ======== ============

Weighted average number of shares

used in computing basic earnings

per share (in thousands) 190,942 159,103 174,398

======== ======== ============

Weighted average number of shares

used in computing diluted earnings

per share (in thousands) 195,141 162,087 178,803

======== ======== ============

CONSOLIDATED STATEMENTS OF CASH FLOWS

Six months ended Year ended

30 June 31 December

------------------ ------------

2015 2014 2014

---------- ------ ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Cash flows from operating activities:

Net income 11,396 4,286 11,910

---------- ------ ------------

Adjustments to reconcile net

income to net cash provided

by operating activities:

Adjustments to the profit or

loss items:

Depreciation and amortisation 1,079 514 1,296

Finance expense (income), net 49 (318) 25

Finance income from financial

derivatives (1,166) - (264)

Loss from sale of assets - 9 9

Cost of share-based payment 470 1,137 1,042

Taxes on income 1,774 324 1,329

Exchange differences on balances

of cash and cash equivalents 87 (44) 482

---------- ------ ------------

2,293 1,622 3,919

---------- ------ ------------

Changes in asset and liability

items:

Decrease (increase) in trade

receivables (897) (414) 994

Increase in other receivables (170) (508) (608)

Decrease (increase) in related

parties - (3) 142

Increase (decrease) in trade

payables 502 272 (256)

Increase(decrease) in other

accounts payable (190) 455 782

Increase in other long-term

liabilities 75 - 18

(680) (198) 1,072

Cash paid and received during

the period for:

Interest received 25 21 46

Taxes paid (887) (98) (421)

Taxes received - 113 417

(862) 36 42

---------- ------ ------------

Net cash provided from operating

activities 12,147 5,746 16,943

---------- ------ ------------

(MORE TO FOLLOW) Dow Jones Newswires

September 21, 2015 02:00 ET (06:00 GMT)

CONSOLIDATED STATEMENTS OF CASH FLOWS (Cont.)

Six months ended Year ended

30 June 31 December

------------------ ------------

2015 2014 2014

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Cash flows from investing activities:

Purchase of property and equipment (292) (174) (350)

Acquisition of initially consolidated

company (a) - - (9,950)

Acquisition of domains, websites

and other intangible assets (4,677) (3,484) (11,528)

Proceeds and collection of receivable

from sale of assets 150 178 328

Short- term and long-term investments,

net (4,558) - (16,315)

Net cash used in investing activities (9,377) (3,480) (37,815)

-------- -------- ------------

Cash flows from financing activities:

Issue of share capital (net

of issue costs) - 48,917 48,917

Dividend paid to equity holders (3,000) (5,247) (8,243)

Acquisition of non-controlling

interests - - (1,490)

Dividend paid to non-controlling

interests (336) (1,301) (2,287)

Repayment of liabilities to

related parties - (2,855) (3,512)

Proceeds from exercise of options 668 12 12

Financing by non-controlling

interests - 57 57

Repayment of long-term and short-term

liabilities - (716) (204)

Net cash provided (used in)

from financing activities (2,668) 38,867 33,250

-------- -------- ------------

Exchange differences on balances

of cash and cash equivalents (87) 44 (482)

-------- -------- ------------

Increase in cash and cash equivalents 15 41,177 11,896

Cash and cash equivalents at

the beginning of the year 27,351 15,455 15,455

-------- -------- ------------

Cash and cash equivalents at

the end of the year 27,366 56,632 27,351

======== ======== ============

(a) Acquisition of initially consolidated

company:

Assets and liabilities at date

of acquisition:

Working capital (excluding

cash and cash equivalents) --(2,057)

Long-term investment -- 26

Property and equipment -- 69

Intangible assets -- 1,689

Goodwill -- 17,170

Deferred taxes -- (402)

Contingent consideration payable --(6,521)

Non-current liabilities -- (24)

-- 9,950

=======

CONSOLIDATED STATEMENTS OF CASH FLOWS (Cont.)

(b) Significant non-cash transactions:

Dividend payable to non-controlling

interests 61 - 56

--- -----

Payables for acquisitions of

domains and websites 112 -1,712

--- -----

NOTES TO INTERIM CONDEST CONSOLIDATED FINANCIAL INFORMATION

NOTE 1: GENERAL

The Group is an online performance marketing company. The Group

attracts paying users from multiple online and mobile channels and

directs them to online businesses.

The Group attracts users through online marketing techniques

(such as publications and advertisements) which are then directed,

by the Group, to its customers in return for a share of the revenue

generated by such user, a fee generated per user acquired, fixed

fees or a hybrid of any of these three models.

NOTE 2: OPERATING SEGMENTS

(a) General:

The operating segments are identified on the basis of

information that is reviewed by the chief operating decision maker

("CODM") to make decisions about resources to be allocated and

assess its performance. Accordingly, for management purposes, the

Group is organised into operating segments based on the products

and services of the business units and has operating segments as

follows:

Publishing - The Group owns over 2,000 informational

websites in 18 languages. These

websites refer potential customers

to online businesses. The sites'

content, written by professional

writers, is designed to attract

online traffic which the Group then

directs to its customers online

businesses.

Media - The Group's Media division acquires

online advertising targeted at potential

online traffic with the objective

of directing it to the Group's users.

The Group buys advertising space

on search engines, websites, mobile

and social networks and places adverts

referring potential users to the

Group's customers' websites or to

its own websites.

Partners - The Group manages marketing partners,

Network whose role is to direct online traffic

to the Group's customers for which

the Group receives revenues. The

Group is responsible for paying

its partners. The Group's partner

programme enables affiliates to

have a single point of contact to

direct traffic to, and receive monies

from, rather than engaging in multilateral

negotiation, administration and

collection of revenues.

Segment performance (segment profit) is evaluated based on

revenues less direct operating costs. Items that were not allocated

are managed on a group basis.

(b) Reporting on operating segments:

Partners

Publishing Media Network Total

---------- ------ -------- -------

USD in thousands

---------------------------------------

Six months ended

30 June 2015 (unaudited):

Revenues 14,449 17,463 4,863 36,775

========== ====== ======== =======

Segment profit 11,601 6,242 558 18,401

========== ====== ========

Unallocated corporate

expenses (7,409)

Finance income,

net 2,178

Profit before taxes

on income 13,170

=======

Partners

Publishing Media Network Total

---------- ----- -------- -------

USD in thousands

--------------------------------------

Six months ended

30 June 2014 (unaudited):

Revenues 10,659 6,716 2,502 19,877

========== ===== ======== =======

Segment profit 7,986 2,927 353 11,266

========== ===== ========

Unallocated corporate

expenses (6,694)

Other expenses,

net (9)

Finance income,

net 47

Profit before taxes

on income 4,610

=======

(b) Reporting on operating segments (Cont.):

Partners

Publishing Media Network Total

---------- ------ -------- --------

USD in thousands

----------------------------------------

Year ended 31 December

2014 (audited):

Revenues 23,965 20,632 6,123 50,720

---------- ------ -------- --------

Segment profit 18,345 8,548 685 27,578

---------- ------ --------

Unallocated corporate

expenses (13,340)

Other expense,

net (229)

Finance expense,

net (770)

Profit before taxes

on income 13,239

(MORE TO FOLLOW) Dow Jones Newswires

September 21, 2015 02:00 ET (06:00 GMT)

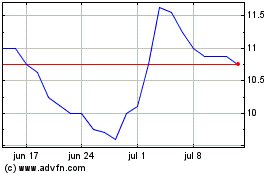

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024