TIDMXLM

RNS Number : 4636T

XLMedia PLC

30 March 2016

For immediate release 30 March 2016

XLMedia PLC

("XLMedia" or "the Group" or "the Company")

Final results for the year ended 31 December 2015

Strong financial performance underpinning strategic

development

XLMedia (AIM: XLM), a leading provider of digital performance

marketing services, is pleased to announce its final results for

the year ended 31 December 2015.

The Group continued to deliver strong performance during the

year, building on the foundations that it had laid over the past

two years. By setting a clear strategy and focusing on execution,

the Company has continued to deliver in all key areas, namely

revenues and profit growth, investment in technology, and ongoing

diversification of the business. The Board is confident that the

Group remains well positioned to continue this strong growth and to

further develop its business.

Financial highlights

-- Revenues increased 76% to $89.2 million (2014: $50.7 million)

-- Gross profit increased 49% to $41.1 million (2014: $27.6 million)

-- Adjusted EBITDA increased 67% to $28.4 million (2014: $17.0 million)

-- Profit before tax increased 84% to $24.3 million (2014: $13.2 million)

-- Net cash from operating activities increased 68% to $28.4 million (2014: $16.9 million)

-- Net income increased 70% to $20.2 million (2014: $11.9 million)

-- Strong balance sheet with $42.6 million cash and short term investments

Operating highlights

-- Positive impact of acquisitions continues to accelerate profit growth and strategic progress

o Strong performance from Marmar Media acquisition, adding

skills and client base in additional verticals, namely software and

ecommerce

o First phase integration of EDM now completed, second phase

progressing well

o Extension of our network through ongoing bolt on acquisitions

within the Publishing division of mainly UK based websites

-- Ongoing R&D has strengthened the Groups in house

operations and enhanced our analytics capabilities

-- Continued organic growth in all business segments and geographies

The Board continues to remain confident of the Company's ability

to continue to execute and deliver in the key areas and is focussed

on maximising value for shareholders.

Ory Weihs, Chief Executive Officer of XLMedia, commented:

"We are extremely pleased to report another record breaking

year. During 2015 we continued to invest in our technology, systems

and people which are the key drivers for performance and future

growth. We also made significant progress regarding acquisitions,

and successfully diversified our business further.

"Over the last two years we have consistently reported strong

financial performance, invested in organic growth opportunities,

completed several successful earning enhancing acquisitions and

declared $21.25 million in dividends to shareholders.

"We continue as always to maximise value for our shareholders,

both through our ongoing work in developing the business as well as

through the strategic review process which was announced on 26

January 2016.

"The Board would like to thank management and our employees for

the excellent delivery of 2015 results. We look forward to further

progress and achievements in 2016."

Our full annual financial statements are available on our

website at the following address:

http://www.xlmedia.com/company-reports/

For further information, please contact:

XLMedia plc Ory Weihs www.xlmedia.com Tel: 020 8817 5283

Vigo Communications Jeremy Garcia Tel: 020 7830 9700

/ Fiona Henson www.vigocomms.com

Cenkos Securities plc (Nomad Tel: 020 7397 8900

and Joint Broker) Ivonne Cantu

/ Camilla Hume www.cenkos.com

Liberum (Joint Broker) Neil Tel: 020 3100 2000

Patel / Chris Clarke www.liberum.com

Business review

During 2015 we continued to execute our strategic plan and

establish our position as a dominant player in the online and

mobile traffic monetisation arena.

Our strategic plan includes the following key growth

initiatives: broadening our reach to additional geographies and

verticals; developing our technology infrastructure to enable our

growth and competitive edge; and driving organic growth.

We are proud to report progress on executing our plan in all

aspects, which resulted in the delivery of record breaking revenues

and profit in 2015.

Our efforts to accelerate growth through acquisitions have also

progressed well during the year with the following milestones

achieved:

-- Addition of bolt on domains and websites through acquisition,

complementing our publishing asset base and providing access to

additional markets and products. The focus of these additional

assets was for the UK as well as other European markets, and for

diversified verticals. Additional bolt ons were targeted at mobile

traffic in these markets. All of these acquired assets have been

integrated into our publishing division and in house platforms.

-- Completed the first phase of integration of EDM (acquired

September 2014) into the Group during the period and due to EDM's

strong performance in the first year following its acquisition we

decided to waive performance conditions for contingent

consideration to accelerate full integration into the Group. The

Board believes that such integration will help to improve

performance and increase scale which is important as it expects

social and mobile gaming to be a strong growth driver for XLMedia

over the coming years.

-- On 1 July 2015 we announced the acquisition of the majority

stake in Marmar Media, a performance media company for web and

mobile. Marmar Media adds additional know how and scale, as well as

widening the Group's customer base and adding further vertical

diversification.

-- All of the acquired assets and companies are performing in

line with or above management's expectations.

Below is an overview of the progress in execution of our plan

during 2015:

-- Technology infrastructure to enable our growth and competitive edge

o We continued to increase our investment in technology and our

R&D team now has over 50 staff and continues to grow.

o Following the launch of our Palcon system for the management

of publishing assets at the end of 2014, we migrated our major

assets to Palcon. Following migration we have seen continuous

improvement in mobile performance of these websites.

o In the media segment we developed tracking tools and campaign

management infrastructure to enable efficient optimization and

management of campaigns.

o In December 2015 we launched Rampix - EDM's system for

centralized management of social campaigns with unique targeting

methodologies and dashboards.

o We further enhanced our Business Intelligence ("BI")

capabilities to support information gathered from thousands of

information sources, analysed and presented to our campaign

managers for efficient optimization of campaigns.

-- Broaden our reach to additional geographies and verticals,

diversifying our client base and markets

o We successfully broadened our business to new geographies and

products, through organic growth as well as acquisitions

o The acquired websites extended our reach and established our

position in the UK market

o We made our first acquisitions of websites in the financial

services vertical in Europe. We believe there are growth

opportunities within the financial services vertical, where we can

use our online marketing expertise to bring further revenue

growth

o The addition of Marmar Media added more activity in software

and e-commerce verticals

o EDM continues to develop the Group's offering for mobile apps

and social gaming

o Following the Marmar Media acquisition the largest customer in

the group(1) represents 8% of the Group's revenues

-- Continue our organic growth

o The Group continues to deliver strong organic growth in all of

its business segments with the 2015 year-end trading performance

exceeding initial market expectations

o Organic growth continues to be strong in our core Scandinavian

markets, while in other European countries as well as other English

speaking countries we have increased our revenues even faster, with

these countries becoming more dominant in the revenue

distribution

o With the implementation of technology and tools we see

improved performance and organic growth for websites and campaigns.

We expect to continue this trend into 2016 and coming years

Business Segments review

($'000) Partner

Publishing Media Network Total

2015

Revenues 30,297 45,777 13,145 89,219

% of revenues 34% 51% 15% 100%

Direct

profit 23,855 15,411 1,810 41,076

Profit

margin 79% 34% 14% 46%

2014

Revenues 23,965 20,632 6,123 50,720

% of revenues 47% 41% 12% 100%

Direct

profit 18,345 8,548 685 27,578

Profit

margin 76% 41% 11% 54%

-- Publishing

Publishing revenues grew 26% to $30.3 million (2014: $24.0

million). The growth was primarily organic, with some additions

from new assets acquired mainly during the second half the

year.

We invested significant amounts in technology infrastructure to

support the centralised management of our assets and we have seen

improvement in conversions and performance of our assets as a

result, with increased improvement in mobile results.

During 2015 we invested $7.1 million in acquiring new websites

and domains and we plan to continue buying and developing more

assets to further drive our growth.

-- Media

(MORE TO FOLLOW) Dow Jones Newswires

March 30, 2016 02:00 ET (06:00 GMT)

Media revenues grew 122% to $45.8 million (2014: $20.6 million).

The media segment includes the activity of the Company as well as

EDM acquired in September 2014 and Marmar Media acquired in July

2015. EDM and Marmar Media add diversification of our activity with

additional marketing channels, products and markets. The majority

of revenues from the acquired businesses is derived from the US for

marketing of social games, mobile apps, ecommerce and software.

Marmar Media has contributed $9.1 million to 2015 revenues.

Excluding Marmar Media and the EDM additions (EDM's contribution of

$6.0 in the last 4 months of 2014 compounded annually), organic

growth in the media segment was 28%.

We continue to focus on performance, using our technology to

improve ROI of spend in marketing campaigns.

-- Partner Network

Partner network revenues grew 115% to $13.1 million (2014: $6.1

million). Our partner network remains an important part of our

business, giving us the opportunity to provide marketing services

to our clients which are not currently serviced through our

existing publishing and media networks. All of the partner network

growth is organic, as we continue to attract new partners to join

our network and enjoy the benefits offered to them.

Current Trading and Outlook

Demand for our services has continued across our geographic

footprint and the Group has made a strong start in 2016. We will

continue to seek ways in which to maximize shareholder value at the

same time as continuing to commit to expanding our core offer

through a combination of ongoing investment, product development

and acquisitions.

Financial review

$ millions

2015 2014 Change

==================== ===== ====== =======

Revenues 89.2 50.7 76%

==================== ===== ====== =======

Gross Profit 41.1 27.6 49%

==================== ===== ====== =======

Operating expenses 18.1 13.0 40%

==================== ===== ====== =======

Operating income 23.0 14.2 61%

==================== ===== ====== =======

Adjusted EBITDA 28.5 17.0 68%

==================== ===== ====== =======

Financial income,

net 1.7 (0.8) N/A

==================== ===== ====== =======

Profit Before

Tax 24.3 13.2 84%

==================== ===== ====== =======

2015 has been another year of strong performance for XLMedia.

Revenues for the year were $89.2 million, reflecting 76% growth

compared to the last year. Revenues in 2015 include the acquisition

of Marmar Media, acquired in July 2015, and the consolidation of

EDM, acquired in September 2014, as well as strong organic growth

in all business segments during the period.

Gross profit reached $41.1 million or 46% of revenues,

representing 49% growth compared to last year (2014: $27.6 million,

54%). Over the course of 2015, the media segment has grown to be

the largest segment in XLMedia and generating 51% of FY 15

revenues. As we continue implementing our strategy to further

increase and develop our media business, the Group's revenue mix

will shift further towards media, lowering gross margins. As such

we expect total gross margins (in terms of percentage) to decrease

further across the Group.

Operating expenses during 2015 were $18.1 million, an increase

of 40% compared to last year (2014: $13.0 million). As expected,

recruiting pace was stronger in the second half of the year as we

worked hard to recruit additional staff to support our growing

operations.

Operating expenses included $1.4 million of research and

development costs, reflecting an increase of 43% compared to last

year (2014: $1.0 million). These expenses are in addition to the

increase of 123% in investments in internal systems developed

through capitalized costs during the year of $2.0 million (2014:

$0.9 million). The Group expects to invest further in technology as

we see this a key driver to growth and profit for the coming

years.

Adjusted EBITDA(2) reached $28.4 million or 32% of revenues,

reflecting an increase of 67% to the previous year (2014: $17.0

million, 34%). As the mix of revenues changes towards more media,

we expect adjusted EBITDA to decrease in terms of margins but to

grow in absolute numbers.

Net financial income for year was $1.7 million, attributed to

the Company's dynamic hedging activity to mitigate material

exposure to foreign currencies. As a significant portion of the

Group's revenues are denominated in Euros, the Company entered into

a series of forward contracts for the sale of Euros and purchase of

US Dollars. The Euro exchange rate decreased by 6.6% versus the US

Dollar during this period. The Company gained financial income from

its hedging activity which partially compensated for the decrease.

The financial income was received in cash (when forward contracts

matured) while the amounts recorded as fair value gains for forward

contracts not yet matured was not material. The Company has entered

into additional forward contracts which will mature over the course

of the next 12 months.

As a result of the high adjusted EBITDA as well as the financial

gain from changes in exchange rates, profit before tax increased by

84% to $24.3 million (2014: $13.2 million).

As of 31 December 2015 we had $42.6 million cash and short term

investments compared to $44.1 million on December 31, 2014. The

change in cash reflects an increase of $28.4 million provided by

operating activity, offset mainly by spending $19.7 million on

investments in technology and acquisitions and $8.0 million of

dividends paid during 2015.

Current assets at 31 December 2015 were $60.9 million (31 Dec

2014: $57.8 million) and non-current assets reached $57.9 million

(31 December 2014: $42.0 million). The increase in non-current

assets is attributed mainly to the acquisition of Marmar Media

shares, investments in domains and websites, as well as additions

to our in-house technology.

Total equity on 31 December 2015 reached $90.0 million, or 75%

(2014: 76%). This, with cash and short term investments of $42.6

million, positions the Group well to continue executing its

strategic plan.

(1) Revenues for the six months ending 31 December 2015

(2) Earning Before interest, Taxes, Depreciation and

Amortization and adjusted to exclude share based payments and

expenses related to acquisition agreements

PRELIMINARY CONDENSED CONSOLIDATED FINANCIAL INFORMATION AS OF

DECEMBER 31, 2015

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

As of 31 December

2015 2014

---------- -------

USD in thousands

-------------------

Assets

Current assets:

Cash and cash equivalents 35,741 27,351

Short-term investments 6,866 16,714

Trade receivables 16,088 11,548

Other receivables 2,042 1,895

Financial derivatives 165 264

60,902 57,772

---------- -------

Non-current assets:

Long-term investments 1,102 333

Other receivables 332 456

Property and equipment 1,190 864

Goodwill 26,302 19,586

Domains and websites 23,897 16,728

Other intangible assets 4,837 4,014

Deferred taxes 256 -

57,916 41,981

---------- -------

118,818 99,753

========== =======

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

As of 31 December

2015 2014

---------- -------

USD in thousands

-------------------

Liabilities and equity

Current liabilities:

Trade payables 11,146 9,073

Contingent consideration payable 5,373 3,396

Other liabilities and accounts

payable 12,151 7,764

28,670 20,233

---------- -------

Non-current liabilities:

Contingent consideration payable - 3,233

Deferred taxes 317 332

Other liabilities 155 42

---------- -------

472 3,607

Equity attributable to equity

holders of the Company:

Share capital *) *)

Share premium 64,447 62,271

Capital reserve from share-based

transactions 1,390 1,784

Capital reserve from transaction

with non-controlling interests (506) (506)

Retained earnings 22,774 12,072

88,105 75,621

Non-controlling interests 1,571 292

---------- -------

Total equity 89,676 75,913

---------- -------

118,818 99,753

========== =======

*) Lower than USD 1 thousand.

(MORE TO FOLLOW) Dow Jones Newswires

March 30, 2016 02:00 ET (06:00 GMT)

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

Year ended 31

December

--------------------

2015 2014

--------- ---------

USD in thousands

(except per share

data)

--------------------

Revenues 89,219 50,720

Cost of revenues 48,143 23,142

Gross profit 41,076 27,578

Research and development expenses 1,438 1,008

Selling and marketing expenses 3,038 2,239

General and administrative

expenses 13,640 9,732

18,116 12,979

Operating income before expenses

in connection with IPO 22,960 14,599

Expenses in connection with

IPO - 361

--------- ---------

Operating income after expenses

in connection with IPO 22,960 14,238

Finance expenses (523) (1,001)

Finance income 2,259 231

Income before other expenses 24,696 13,468

Other expenses, net (403) (229)

--------- ---------

Profit before taxes on income 24,293 13,239

Taxes on income 4,093 1,329

--------- ---------

Net income and other comprehensive

income 20,200 11,910

========= =========

Attributable to:

Equity holders of the Company 18,719 9,821

Non-controlling interests 1,481 2,089

--------- ---------

20,200 11,910

========= =========

Earnings per share attributable

to equity holders of the Company:

Basic earnings per share (in

USD) 0.10 0.06

========= =========

Diluted earnings per share

(in USD) 0.10 0.05

========= =========

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year ended

31 December

------------------

2015 2014

--------- -------

USD in thousands

Cash flows from operating activities:

Net income 20,200 11,910

--------- -------

Adjustments to reconcile net income

to net cash provided by operating

activities:

Adjustments to the profit or loss

items:

Depreciation and amortisation 3,775 1,296

Finance expense income, net 231 25

Finance income from financial derivatives 99 (264)

Loss from sale of assets - 9

Cost of share-based payment 839 1,042

Taxes on income 4,093 1,329

Exchange differences on balances

of cash and cash equivalents 310 482

--------- -------

9,347 3,919

--------- -------

Changes in asset and liability items:

Decrease (increase) in trade receivables (3,580) 994

Increase in other receivables (432) (608)

Decrease in related parties - 142

Increase (decrease) in trade payables 1,155 (256)

Increase in other accounts payable 3,892 782

Increase in other long-term liabilities 99 18

1,134 1,072

--------- -------

Cash received (paid) during the

period for:

Interest paid (2) -

Interest received 72 46

Taxes paid (2,352) (421)

Taxes received - 417

(2,282) 42

--------- -------

Net cash provided by operating activities 28,399 16,943

--------- -------

Year ended

31 December

-------------------

2015 2014

-------- --------

USD in thousands

-------------------

Cash flows from investing activities:

Purchase of property and equipment (644) (350)

Acquisition of initially consolidated

companies (4,459) (9,950)

Payment of contingent consideration

in respect of acquired company (3,500) -

Acquisition of domains, websites

and other intangible assets (12,326) (11,528)

Proceeds and collection of receivable

from sale of assets 300 328

Short- term and long-term investments,

net 9,625 (16,315)

Net cash used in investing activities (11,004) (37,815)

-------- --------

Cash flows from financing activities:

Issue of share capital (net of

issue costs) - 48,917

Dividend paid to equity holders (8,017) (8,243)

Acquisition of non-controlling

interests - (1,490)

Dividend paid to non-controlling

interests (694) (2,287)

Repayment of liabilities to related

parties - (3,512)

Exercise of options 943 12

Financing by non-controlling interests - 57

Payments of liabilities to former

shareholders of acquired businesses (927) -

Repayment of long-term and short-term

liabilities - (204)

Net cash provided by ( used in)

financing activities (8,695) 33,250

-------- --------

Exchange differences on balances

of cash and cash equivalents (310) (482)

-------- --------

Increase in cash and cash equivalents 8,390 11,896

Cash and cash equivalents at the

beginning of the year 27,351 15,455

-------- --------

Cash and cash equivalents at the

end of the year 35,741 27,351

======== ========

NOTES TO PRELIMINARY CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

NOTE 1: GENERAL

The Group is an online performance marketing company. The Group

attracts paying users from multiple online and mobile channels and

directs them to online and mobile businesses who, in turn, convert

such traffic into paying customers.

Online traffic is attracted by the Group's publications and

advertisements and are then directed, by the Group, to its

customers in return for mainly a share of the revenue generated by

such user, a fee generated per user acquired, fixed fees or a

hybrid of any of these models.

NOTE 2: OPERATING SEGMENTS

(a) General:

The operating segments are identified on the basis of

information that is reviewed by the chief operating decision maker

("CODM") to make decisions about resources to be allocated and

assess its performance. Accordingly, for management purposes, the

Group is organised into operating segments based on the products

and services of the business units and has operating segments as

follows:

Publishing - The Group owns over 2,000 informational

websites in 17 languages. These websites

refer potential customers to online businesses.

The sites' content, written by professional

writers, is designed to attract online

traffic which the Group then directs

to its customers online businesses.

Media - The Group's Media division acquires

online and mobile advertising targeted

at potential online and mobile traffic

with the objective of directing

it to the Group's users. The Group

buys advertising space on search

engines, websites, mobile and social

networks and places adverts referring

potential users to the Group's customers'

(MORE TO FOLLOW) Dow Jones Newswires

March 30, 2016 02:00 ET (06:00 GMT)

websites or to its own websites.

Partners - The Group manages marketing partners,

Network whose role is to direct online traffic

to the Group's customers for which

the Group receives revenues. The

Group is responsible for paying

its partners. The Group's partner

programme enables affiliates to

have a single point of contact to

direct traffic to, and receive monies

from, rather than engaging in multilateral

negotiation, administration and

collection of revenues.

Segment performance (segment profit) is evaluated based on

revenues less direct operating costs. Items that were not allocated

are managed on a group basis.

(b) Reporting on operating segments:

Partners

Publishing Media Network Total

---------- ------ -------- ---------

USD in thousands

-----------------------------------------

Year ended 31 December

2015:

Revenues 30,297 45,777 13,145 89,219

---------- ------ -------- ---------

Segment profit 23,855 15,411 1,810 41,076

---------- ------ -------- ---------

Unallocated corporate

expenses (18,116)

Other expense,

net (403)

Finance income,

net 1,736

Profit before taxes

on income 24,293

=========

Year ended 31 December

2014:

Revenues 23,965 20,632 6,123 50,720

---------- ------ -------- ---------

Segment profit 18,345 8,548 685 27,578

---------- ------ -------- ---------

Unallocated corporate

expenses (13,340)

Other income, net (229)

Finance expense,

net (770)

Profit before taxes

on income 13,239

=========

(c) Geographic information:

Revenues classified by geographical areas based on internet user

location:

Year ended 31

December

---------------

2015 2014

------- ------

Scandinavia 29,414 28,164

Other European countries 16,732 7,457

North America 19,588 4,918

Oceania 2,788 942

Other countries 2,610 3,116

------- ------

Total revenues from identified

locations 71,132 44,597

Revenues from unidentified

locations 18,087 6,123

------- ------

Total revenues 89,219 50,720

======= ======

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR LLFLAVFIAFIR

(END) Dow Jones Newswires

March 30, 2016 02:00 ET (06:00 GMT)

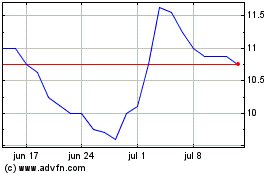

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024