XLMedia PLC Conclusion of Strategic Review and Trading Update (9964X)

12 Maio 2016 - 3:00AM

UK Regulatory

TIDMXLM

RNS Number : 9964X

XLMedia PLC

12 May 2016

12 May 2016

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Conclusion of Strategic Review and Trading Update

XLMedia reaffirms commitment to AIM and reinforces growth

ambitions

-- Strategic review reinforced Board's belief in organic growth

opportunity and consolidation potential

-- The Board recommits to maintaining a progressive dividend policy

-- Current trading remains strong and continues to track in line with management expectations

XLMedia (AIM: XLM), a leading provider of digital performance

marketing services, today announces that further to the initiation

of a Strategic Review announced on 26 January 2016, the Board has

concluded that the best way of maximising value for shareholders is

by remaining listed in London as an independent company on AIM.

Strategic review

Since the Company's IPO in March 2014, the Company has

consistently delivered a strong financial performance, diversified

its revenue streams across different verticals and geographies,

invested in technology and other infrastructure to accelerate

organic growth opportunities, completed a number of successful

earnings enhancing acquisitions, and returned $21.25 million in

dividends to shareholders.

The Board initiated a Strategic Review to explore how best to

maximise value for all shareholders. Meanwhile, the actual

performance of the business continued as planned.

On 30 March 2016, XLMedia reported record full year results for

the year ended 31 December 2015, delivering a 76% increase in

revenue to $89.2 million, an 84% increase in profit before tax to

$24.3 million and a 61% increase in dividend per share of $0.05

compared to the prior year. XLMedia generated $28.4 million of net

cash and reported $42.6 million of cash on the balance sheet in the

year ended 31 December 2015.

It is this strong financial performance which underpins the

Group's strategic focus and has seen XLMedia establish itself as

one of the leading players in the performance marketing arena. As

result of the Strategic Review process the Board has concluded that

the best way of maximising value for all shareholders is to remain

listed in London as an independent company on AIM. Therefore, the

Board remains committed to the following growth strategy:

-- to continue to expand the Group's operational reach into new geographies and verticals

-- to continue developing its technology infrastructure that

accelerates organic growth and further enhances XLMedia's

reputation and competitive edge

-- to execute acquisitions which both strengthen and expand the

Group's operational footprint in what remains a broadly fragmented

market

Management continues to work to maximise shareholder value by

continuing to commit to expanding the Group's core offering through

a combination of ongoing investment and product development. The

Group also remains focused on acquisitive growth and continues to

evaluate a number of potential opportunities. It is this ongoing

confidence that underpins the Company's progressive dividend policy

and provides confidence in the near term trading prospects for the

Group.

Trading update

XLMedia has maintained its excellent start to 2016 with strong

demand for services reported across the Group's geographic

footprint. The Group believes that the combination of scale and

diversification will continue to support its growth. The Board

confirms that during the first four months of the year, the Group

continued to progress according to its plan in existing and new

verticals. Furthermore, developments in technology continue to

progress well and as planned. Therefore, the Board is pleased to

report that current trading remains in line with management's

expectations.

Christopher Bell, Chairman of XLMedia, commented:

"Having now undertaken a very thorough strategic review, the

Board has concluded that the best prospects for the business and

maximising shareholders' value are though remaining an independent

company on AIM.

"We are focused on ensuring we maintain our market leading

position, delivering a best in class service to customers whilst

attracting the best people in the industry. Being a quoted company

provides the best platform to deliver on that commitment and our

recent full year results with record revenue and PBT growth support

this decision.

"We look forward to updating shareholders of our continued

progress over the coming months."

Takeover Code

As a result of the termination of the Strategic Review, the

Formal Sale Process previously announced on 26 January 2016 has now

ceased, and the Company is no longer in an Offer Period (as defined

in the UK Takeover Code) and, accordingly, the requirement to make

disclosures under Rule 8 of the UK Takeover Code has now

ceased.

For further information, contact:

XLMedia plc Tel: 020 8817

Ory Weihs 5283

Cenkos Securities plc (Nomad and Tel: 020 7397

Joint Broker) 8900

Ivonne Cantu / Camilla Hume / Callum

Davidson

Liberum Capital Limited (Joint Tel: 020 3100

Broker) 2000

Neil Patel / Chris Clarke

Vigo Communications Tel: 020 7830

Jeremy Garcia / Fiona Henson 9700

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTABMMTMBBBTPF

(END) Dow Jones Newswires

May 12, 2016 02:00 ET (06:00 GMT)

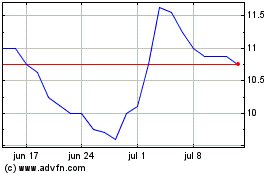

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024