TIDMXLM

RNS Number : 6777Y

XLMedia PLC

07 March 2017

For immediate release 7 March 2017

XLMedia PLC

("XLMedia" or "the Group" or "the Company")

Final results for the year ended 31 December 2016

Another strong financial performance driven by organic growth

and diversification

XLMedia (AIM: XLM), a leading provider of digital performance

marketing services, is pleased to announce its final results for

the year ended 31 December 2016.

Financial highlights

-- Revenues increased 16% to $103.6 million (2015: $89.2 million);

-- Gross profit increased 30% to $53.3 million (2015: $41.1 million);

-- Adjusted EBITDA increased 22% to $34.6 million (2015: $28.4 million);

-- Profit before tax increased 28% to $31.0 million (2015: $24.3 million);

-- Net income increased 27% to $25.6 million (2015: $20.2 million);

-- Strong balance sheet with $35.2 million cash and short term investments;

-- Earnings per share increased 20% to $0.12 (2015: $0.10); and

-- Final dividend of $7.5 million or 3.7864 cents per share,

making a total of 7.6069 cent per share for the year.

Operating highlights

-- Strong organic growth in the publishing business, mainly in

English speaking markets and non-Scandinavian European markets;

-- Significant progress in the media segment underpinned by strong mobile penetration:

o Dau-Up received Facebook marketing partner status for

technology;

o New mobile offering enabling additional performance models

(incl. revenue share);

-- Continued diversification of the business:

o The gambling sector represented 70% of Group revenues in 2016

(2015: 74%, 2014: 83%);

o The Group's largest customer accounted for 7% of total

revenues in 2016 (2015: 9%, 2014: 15%);

o Revenues from Scandinavia were 32% of the Group's revenues

with an additional 27% from other European countries and 21% from

North America.

Post period end - further diversification through

acquisitions

-- Acquisition of mobile platform ClicksMob Inc ("ClicksMob"):

o Provides performance-based user acquisition to leading

apps;

o Strong mobile user acquisition technology; and

o An established customer base in Asia and in non-gambling

verticals such as e-commerce, travel, entertainment and

finance.

-- Acquisition of Greedyrates.ca ("Greedyrates"):

o Greedyrates is one of Canada's leading credit card comparison

websites;

o Increases the Group's North American customer base; and

o Further demonstrates XLMedia's ability to diversify its

revenue streams - this time into the financial services sector.

Ory Weihs, Chief Executive Officer of XLMedia, commented:

"We are proud to have delivered another record breaking year in

which we have made further progress in executing on our strategic

priorities and generated significant value for our shareholders.

Our strong financial performance coupled with our ability to

maintain a market leading position is supported by our commitment

to invest in proprietary products whilst integrating complementary

acquisitions.

"The Board would like to thank management and our employees for

another excellent year of results and remain committed to

delivering further progress in 2017."

Our full annual financial statements are available on our

website at the following address:

http://www.xlmedia.com/company-reports/

For our Company presentation please visit:

http://www.xlmedia.com/media/

A webcast of our results presentation will be available on our

website later today: http://www.xlmedia.com/media/

A presentation for retail and private investors will be held at

4.00pm on Wednesday 8 March 2017 at the offices of Berenberg (60

Threadneedle Street, London EC2R 8HP). Admittance is strictly

limited to those who register their attendance for the event. To

register, please contact Vigo on xlmedia@vigocomms.com.

For further information, please contact:

XLMedia plc Ory Weihs www.xlmedia.com Tel: 020 8817 5283

Vigo Communications Jeremy Garcia Tel: 020 7830 9703

/ Fiona Henson www.vigocomms.com

Cenkos Securities plc (Nomad Tel: 020 7397 8900

and Joint Broker) Ivonne Cantu

/ Camilla Hume www.cenkos.com

Berenberg (Joint Broker) Chris Tel: 020 3207 7800

Bowman / Mark Whitmore / Amritha

Murali www.berenberg.com

Business review

2016 was another strong year for the Group, with record breaking

revenues and profits, reflecting the Group's consistent execution

of its stated growth strategy.

Our strategic plan is focused on the following key growth

initiatives:

-- broaden our reach to additional geographies and verticals;

-- continue to develop our technology infrastructure to enable

growth and increase our competitive edge; and

-- make selective acquisitions that diversify and develop the Group's core operational base.

2016 was another successful year of progress in all aspects. We

have achieved diversification both geographically and vertically

through a blend of acquisitive and organic growth. Our efforts

during the year brought to close two acquisitions in early

2017:

-- Acquisition of Greedyrates, which was completed in January

2017. Greedyrates is the Group's first significant publishing asset

in the financial services vertical and significantly enhances the

customer base in North America.

-- Acquisition of ClicksMob, which was completed in February

2017. ClicksMob enhanced the Group's presence in the fast growing

market for mobile apps, and delivers an enlarged customer base,

with over 30% of revenues from Asia.

Further diversification was achieved through organic growth, and

a focus on non-gaming apps, e-commerce, and English speaking

markets.

Technology is a key component to maintaining the Group's

competitive edge and driving growth. During the past year we have

continued to invest in our technology infrastructure and achieved a

number of key milestones:

-- Dau-Up, the Company's mobile and social media performance

marketing platform, was awarded Facebook marketing partner status

for technology with Facebook recognising the benefits of the

Group's bespoke Rampix system in optimizing campaign management for

user acquisition across the Facebook platform.

-- The Group continued to improve Palcon, our proprietary

platform for centralised management of websites. During the year we

saw improved performance, particularly in mobile, of websites

migrated to the Palcon platform. Traffic and click-through rates

improved for these websites, which we expect to drive performance

and revenues in the publishing business.

-- We further enhanced our internal business intelligence

systems to support the growing scales of data produced. Our systems

ingest data from thousands of sources daily, which is then

processed and analysed to provide business information for campaign

and asset optimisation.

-- Our technology teams consisted of 80 employees at the end of

2016, up from 57 at the beginning of the year. This includes both

product and development teams and we continue to value the

acquisition of talent as a key driver in supporting our organic

growth initiatives.

The Group continues to work on broadening our offering in order

to drive organic growth, leveraging our existing channels,

customers and markets to grow revenues as well as targeting new

channels, customers and markets.

The integration of Dau-Up and Marmar Media was completed during

2016 and included the streamlining of both companies into one

location and the rationalization of their information systems. We

have also optimised our joint sales capabilities in order to better

cross-sell our services across existing and new customers. This

optimisation has resulted in increased revenues, mainly from

existing customers taking additional services from across our

enlarged platform.

We have extended Dau-Up's activities into non-gaming apps and

introduced performance based revenue share agreements for mobile

apps alongside the Cost Per Installation (CPI) model.

The Group also delivered strong organic growth in the publishing

segment, mainly in key strategic geographies, notably English

speaking and other European countries (outside Scandinavia).

As we add more services, customers and verticals we expect the

Group to continue to see benefits of scale with improved

operational infrastructure as well as further diversification of

the customer base. In 2016 the largest customer in the Group

accounted for 7% of Group revenues and we believe that figure will

continue to decline.

The Company has maintained its progressive dividend policy by

declaring a final dividend of $7.5 million or 3.7864 cents per

share payable on 7 April 2017 to shareholders on the register at 17

March 2017. The ex-dividend date is 16 March 2017. Together with

the interim dividend of 3.8205 declared in the interim results,

this amounts to a total dividend for the year of 7.6069 cent per

share.

Business Segments review

($'000) Partner

Publishing Media Network Total

2016

Revenues 46,057 47,645 9,903 103,605

% of revenues 44% 46% 10% 100%

Direct

profit 38,384 13,779 1,160 53,323

Profit

margin 83% 29% 12% 51%

2015

Revenues 30,297 45,777 13,145 89,219

% of revenues 34% 51% 15% 100%

Direct

profit 23,855 15,411 1,810 41,076

Profit

margin 79% 34% 14% 46%

Publishing

Publishing revenues grew 52% to $46.1 million (2015: $30.3

million). The growth was primarily organic, with some additions

from new assets acquired at the end of 2015.

We invested significant amounts in technology infrastructure to

support the centralised management of our assets and we have seen

improvement in conversions and performance of our assets as a

result, particularly in mobile.

In January 2017, we announced the acquisition of Greedyrates, a

leading Canadian credit card comparison website. This acquisition

is our first significant publishing asset in the financial services

vertical, and is in line with our stated strategy to expand both

geographically and in sector expertise. The consideration of $9.3

million is presented as payment on account of website acquisition

on the balance sheet as of 31 December 2016 since the payment for

the acquisition was deposited in escrow at the end of December

2016.

Media

Media revenues grew 4% to $47.6 million (2015: $45.8 million).

The growth in the media segment is attributed to strong growth in

the gambling verticals offset by a decrease in activities in the

utilities verticals, as flagged at the interim results. As we

continue to diversify our business and add more verticals we expect

overall growth to be less volatile. The recent acquisitions of

Greedyrates and ClicksMob have added more customers and verticals

to our portfolio and we expect the media division to deliver

stronger growth in 2017.

In 2016 we continued to invest in developing our mobile

proposition and enhancing our capabilities in that area. This

included the integration of media acquisitions into the Group,

creating a unified platform from which to offer broad media

solutions to customers, and investing in systems and additional

performance models.

Mobile marketing continues to drive digital advertising growth

with recent research showing digital advertising revenues in the

U.S having increased 19% to $32.7 billion in H1 2016, versus the

same period in 2015. In addition, 67% of time spent online is spent

on mobile devices with 47% of US advertising revenues in H1 2016

generated through mobile.(1) As the industry shifts to mobile we

continue to establish our position as a leader in mobile and the

acquisition of ClicksMob, a specialist in mobile user acquisition,

is a further step in achieving this.

Direct profit from media for 2016 was $13.8 million or 29% of

revenues compared to $15.4 million or 34% or revenues in 2015. As

we further grow the media operations in mobile and new verticals we

expect to see growth in lower margin products which will in turn

lower the overall margin for the division as a percentage of

revenues but increase the absolute profit for the division.

Partner Network

Partner network revenues decreased to $9.9 million (2015: $13.1

million, 2014: $6.1 million) as result of a review of our partner

base. As part of our ongoing business development and process

enhancement activities, we commenced a full review of our partners

in this network, with a view to implementing a more stringent sign

up and operations criteria. Where necessary, the Group will also

cease activity with certain partners to improve overall quality.

The consequence of this review has been a reduction in revenues

from this segment in 2016. Our partner network serves as a

complimentary channel, giving us the opportunity to provide

marketing services to clients which are not currently serviced

through our existing publishing and media divisions.

Current Trading and Outlook

We have made a strong start to 2017 with sales across all

products and verticals progressing well. The integration of the

recently acquired ClicksMob and Greedyrates businesses is on track

and once completed, these acquisitions are expected to add

significant value to the Group.

The Board therefore looks forward to another year of strong

growth and is extremely confident of the medium term trading

prospects of the Group.

Financial review

2016 2015 Change

=================== --------- ------- -------

USD in millions

=================== ------------------ =======

Revenues 103.6 89.2 +16%

=================== ========= ======= =======

Gross Profit 53.3 41.1 +30%

=================== ========= ======= =======

Operating income 30.1 23.0 +31%

=================== ========= ======= =======

Adjusted EBITDA 34.6 28.5 +22%

=================== ========= ======= =======

Financial income,

net 0.9 1.7 -48%

=================== ========= ======= =======

Profit Before

Tax 31.0 24.3 +27%

=================== ========= ======= =======

Earnings Per

Share (in usd) 0.12 0.10 +20%

=================== ========= ======= =======

With record revenues and profits, 2016 was another great year

for the Group.

Revenues for the year were $103.6 million, reflecting 16% growth

compared to the last year. The increase in revenues was mainly due

to strong organic growth in the publishing segment in the year. The

media division continues to be the largest segment generating 46%

of FY16 revenues. Strong organic growth drove publishing revenues

and profits as the second largest segment with 44% of FY16

revenues.

Gross profit reached $53.3 million or 51% of revenues,

representing 30% growth compared to last year (2015: $41.1 million,

46%). The material margin improvement in gross profit during the

year stems from the higher growth in the higher-margin publishing

segment.

As we continue to implement our strategy to further increase and

develop our media business, we expect the Group's revenue mix to

shift further towards media, reducing gross margins. Whilst this

shift will lower total gross margins (in terms of percentage)

across the Group we expect this impact to be more than offset by an

increase in higher margin activity in the Group's publishing

division.

Operating income increased to $30.1 million or 29% of revenues

(2015: $23.0 million, 26%), again due to the higher profitability

of the publishing segment, as a result of the organic growth during

2016.

Operating expenses included $2.2 million for research and

development expenses (2015: $1.4 million) in addition to

capitalized R&D of $3.1 million (2015: $2.0 million). We

continue to expand our technology infrastructure, and as at 31

December 2016 our technology and product teams consisted of 80

people compared with 57 people at the beginning of the year. We

continue to develop our in-house technology base in order to

maintain our competitive edge and drive growth further.

Adjusted EBITDA(2) reached $34.6 million or 33% of revenues,

reflecting an increase of 22% to the previous year (2015: $28.4

million, 32%).

Net financial income for the year was $0.9 million, attributable

mainly to the Company's dynamic hedging activity to mitigate

material exposure to foreign currencies. As a significant portion

of the Group's revenues are denominated in Euros, the Company

entered into a series of forward contracts for the sale of Euros

and purchase of US Dollars. Additional forward contracts were

entered into for the sale of British Pounds and for buying Israeli

Shekels for lesser amounts. The Euro exchange rate decreased by

3.4% versus the US Dollar during this period. The Company gained

financial income from its hedging activity which partially

compensated for the decrease. The majority of financial income was

recorded as fair value gains for forward contracts not yet matured

and therefore was not received in cash. The Company has entered

into additional forward contracts which will mature over the course

of the next 12 months.

As a result of the high adjusted EBITDA as well as the financial

gain from changes in exchange rates, profit before tax increased by

27% to $31.0 million (2015: $24.3 million).

As of 31 December 2016 we had $35.2 million cash and short term

investments compared to $42.6 million on 31 December 2015. The

change in cash reflects an increase of $27.0 million provided by

operating activity, offset mainly by use of $21.7 million on

investments in technology and acquisitions and $12.4 million of

dividends paid during 2016.

Current assets at 31 December 2016 were $56.7 million (31 Dec

2015: $60.9 million) and non-current assets reached $70.4 million

(31 December 2015: $57.9 million). The increase in non-current

assets is attributed mainly to the investments in domains and

websites, as well as additions to our in-house technology.

Total equity on 31 December 2016 reached $103.3 million, or 81%

(2015: 75%). This, with cash and short term investments of $35.2

million, positions the Group well to continue executing its

strategic plan.

(1) - IAB/PwC Internet Ad Revenue Report, HY 2016 - industry

survey conducted by PwC and sponsored by the Interactive

Advertising Bureau (IAB), November 2016

(2) - Earnings before interest, taxes, depreciation and

amortisation and adjusted to exclude share based payments and

expenses related to acquisition agreements

PRELIMINARY CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR

LOSS

Year ended

31

December

-------------------------

2016 2015

---------------- ------

USD in thousands

(except per

share data)

-------------------------

Revenues 103,605 89,219

Cost of revenues 50,282 48,143

----------------

Gross

profit 53,323 41,076

Research and development expenses 2,228 1,438

Selling and marketing expenses 4,142 3,038

General and administrative

expenses 16,856 13,640

----------------

23,226 18,116

----------------

Operating income 30,097 22,960

Finance expenses (403) (523)

Finance income 1,306 2,259

----------------

Income before other expenses 31,000 24,696

Other expenses, net - (403)

---------------- -------

Profit before taxes on income 31,000 24,293

Taxes on income 5,416 4,093

----------------

Net income and other comprehensive

income 25,584 20,200

================ =======

Attributable to:

Equity holders of the Company 23,937 18,719

Non-controlling interests 1,647 1,481

---------------- -------

25,584 20,200

================ =======

Earnings per share attributable

to equity holders of the Company:

Basic earnings per share (in

USD) 0.12 0.10

================ =======

Diluted earnings per share

(in USD) 0.12 0.10

================ =======

PRELIMINARY CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

As of 31 December

---------------------

2016 2015

--------- --------

USD in thousands

-------------------

Assets

Current assets:

Cash and cash equivalents 32,095 35,741

Short-term investments 3,091 6,866

Trade receivables 17,075 16,088

Other receivables 3,463 2,042

Financial derivatives 1,002 165

---------

56,726 60,902

--------- --------

Non-current assets:

Long-term financial assets 609 1,102

Other receivables 171 332

Property and equipment 1,229 1,190

Goodwill 26,302 26,302

Deposit for acquisition

of websites 9,300 -

Domains and websites 26,739 23,897

Other intangible assets 5,948 4,837

Deferred taxes 85 256

---------

70,383 57,916

--------- --------

127,109 118,818

========= ========

PRELIMINARY CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

As of 31 December

-------------------

2016 2015

--------- --------

USD in thousands

Liabilities and equity

Current liabilities:

Trade payables 9,274 11,146

Contingent consideration

payable - 5,373

Other liabilities and accounts

payable 14,196 12,151

---------

23,470 28,670

--------- --------

Non-current liabilities:

Deferred taxes 126 317

Other liabilities 228 155

--------- --------

354 472

---------

Equity

Share capital *) *)

Share premium 66,812 64,447

Capital reserve from share-based

transactions 1,208 1,390

Capital reserve from transaction

with non-controlling interests (506) (506)

Retained earnings 34,349 22,774

---------

Equity attributable to equity

holders of the Company 101,863 88,105

Non-controlling interests 1,422 1,571

--------- --------

Total equity 103,285 89,676

--------- --------

127,109 118,818

========= ========

*) Lower than USD 1 thousand.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year ended

31 December

------------------

2016 2015

-------- --------

USD in thousands

------------------

Cash flows from operating activities:

Net income 25,584 20,200

-------- --------

Adjustments to reconcile net

income to net cash provided

by operating activities:

Adjustments to the profit or

loss items:

Depreciation and amortisation 3,878 3,775

Finance expense (income), net (69) 231

Finance expense (income) from

financial derivatives (837) 99

Cost of share-based payment 646 839

Taxes on income 5,416 4,093

Exchange differences on balances

of cash and cash equivalents 589 310

-------- --------

9,623 9,347

-------- --------

Changes in asset and liability

items:

Increase in trade receivables (987) (3,580)

Increase in other receivables (930) (432)

Increase (decrease) in trade

payables (1,872) 1,155

Increase in other accounts payable 1,032 3,892

Increase in other long-term

liabilities 73 99

--------

(2,684) 1,134

-------- --------

Cash received (paid) during

the period for:

Interest paid - (2)

Interest received 139 72

Taxes paid (5,710) (2,352)

(5,571) (2,282)

-------- --------

Net cash provided by operating

activities 26,952 28,399

-------- --------

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year ended 31

December

------------------

2016 2015

-------- --------

USD in thousands

------------------

Cash flows from investing activities:

Purchase of property and equipment (479) (644)

Acquisition of initially consolidated

companies - (4,459)

Payment of contingent consideration

in respect of acquired company (5,500) (3,500)

Acquisition of domains, websites

and other intangible assets (6,742) (12,326)

Deposit on account of acquisition

of Domains and websites (9,300) -

Proceeds from sale of assets 300 300

Short- term and long-term investments,

net 4,333 9,625

--------

Net cash used in investing activities (17,388) (11,004)

-------- --------

Cash flows from financing activities:

Dividend paid to equity holders

of the Company (12,362) (8,017)

Dividend paid to non-controlling

interests (1,805) (694)

Exercise of options 1,546 943

Payments of liabilities to former

shareholders of acquired subsidiary - (927)

Net cash used in financing activities (12,621) (8,695)

-------- --------

Exchange differences on balances

of cash and cash equivalents (589) (310)

-------- --------

Increase (decrease) in cash and

cash equivalents (3,646) 8,390

Cash and cash equivalents at

the beginning of the year 35,741 27,351

-------- --------

Cash and cash equivalents at

the end of the year 32,095 35,741

======== ========

Significant non-cash transactions:

Payables for acquisitions of

domains and websites 649 -

===

NOTE 1: GENERAL

(a) General description of the Group and its operations:

The Group is an online performance marketing company. The Group

attracts paying users from multiple online and mobile channels and

directs them to online businesses who, in turn, convert such

traffic into paying customers.

Online traffic is attracted by the Group's publications and

advertisements and are then directed, by the Group, to its

customers in return for mainly a share of the revenue generated by

such user, a fee generated per user acquired, fixed fees or a

hybrid of any of these models.

For further information regarding online marketing and the

Group's business segments see Note 2.

The Company commenced its operations in 2012. The Company's

registered office is located in 12 Castle Street, St Helier,

Jersey.

On 21 March 2014 the Company completed an Initial Public

Offering ("IPO") on the London Stock Exchange's Alternative

Investment Market (AIM).

(b) Assessment of going concern:

The Board of Directors has adopted the going concern basis of

accounting in preparing the consolidated financial statements.

NOTE 2: OPERATING SEGMENTS

(a) General:

The operating segments are identified on the basis of

information that is reviewed by the chief operating decision maker

("CODM") to make decisions about resources to be allocated and

assess its performance. Accordingly, for management purposes, the

Group is organised into operating segments based on the products

and services of the business units and has operating segments as

follows:

Publishing - The Group owns over 2,000 informational

websites in 17 languages. These

websites refer potential customers

to online businesses. The sites'

content, written by professional

writers, is designed to attract

online traffic which the Group then

directs to its customers online

businesses.

Media - The Group's Media division acquires

online and mobile advertising targeted

at potential online traffic with

the objective of directing it to

the Group's customers. The Group

buys advertising space on search

engines, websites, mobile and social

networks and places adverts referring

potential users to the Group's customers'

websites or to its own websites.

Partners - The Group manages marketing partners,

Network whose role is to direct online traffic

to the Group's customers for which

the Group receives revenues. The

Group is responsible for paying

its partners. The Group's partner

programme enables affiliates to

have a single point of contact to

direct traffic to, and receive monies

from, rather than engaging in multilateral

negotiation, administration and

collection of revenues.

Segment performance (segment profit) is evaluated based on

revenues less direct operating costs.

Items that were not allocated are managed on a group basis.

(b) Reporting on operating segments:

Partners

Publishing Media Network Total

---------- ------ -------- ---------

USD in thousands

-----------------------------------------

Year ended 31 December

2016:

Revenues 46,057 47,645 9,903 103,605

---------- ------ -------- ---------

Segment profit 38,384 13,779 1,160 53,323

---------- ------ -------- ---------

Unallocated corporate

expenses (23,226)

Finance income,

net 903

---------

Profit before taxes

on income 31,000

=========

Year ended 31 December

2015:

Revenues 30,297 45,777 13,145 89,219

---------- ------ -------- ---------

Segment profit 23,855 15,411 1,810 41,076

---------- ------ -------- ---------

Unallocated corporate

expenses (18,116)

Other expense,

net (403)

Finance income,

net 1,736

Profit before taxes

on income 24,293

=========

(c) Geographic information:

Revenues classified by geographical areas based on internet user

location:

Year ended 31

December

------------------

2016 2015

--------- -------

USD in thousands

------------------

Scandinavia 33,054 29,414

Other European countries 28,295 16,732

North America 21,724 19,588

Oceania 4,951 2,788

Other countries 2,215 2,610

--------- -------

Total revenues from

identified locations 90,239 71,132

Revenues from unidentified

locations 13,366 18,087

--------- -------

Total revenues 103,605 89,219

========= =======

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR LFFSIVRIRIID

(END) Dow Jones Newswires

March 07, 2017 02:01 ET (07:01 GMT)

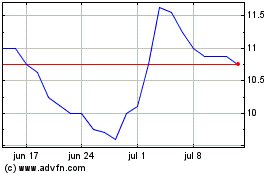

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024