XLMedia PLC Acquisition (8074B)

15 Janeiro 2018 - 5:00AM

UK Regulatory

TIDMXLM

RNS Number : 8074B

XLMedia PLC

15 January 2018

15 January 2018

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Acquisition

EUR15.0 million acquisition of key online assets

XLMedia (AIM: XLM), a leading provider of digital performance

marketing, is pleased to announce that it has agreed to acquire a

number of leading Finnish gambling related informational websites

from Good Game Ltd (the "Acquisition") for a total cash

consideration of up to EUR15 million. The Acquisition is expected

to complete during the first quarter of 2018 and to be immediately

earnings enhancing in the current financial year following

completion.

The Acquisition comprises a leading network of gambling related

websites focused on web and mobile traffic, specialising in casino

games. Active since 2009, the websites provide visitors with useful

information such as reviews of online casino websites, comparison

of promotions offered by different brands and information on

payment solutions. Traffic to and followers of the websites has

steadily grown since inception and they now refer a significant

number of players to their customers' websites.

For the 12 months ended 30 November 2017 the Acquisition

recorded revenues of EUR 1.66 million with an EBITDA margin of at

least 75% (unaudited).

The Acquisition represents a further revenue enhancing addition

to the Group's website portfolio, and will generate synergies and

economies of scale benefits following full integration, which is

expected to be completed within the first six months of 2018.

Through the Acquisition XLM will acquire a network of domains

and websites (the "Network"), including the underlying content

management systems, social network accounts, related intellectual

property rights as well as the affiliate accounts associated with

the Network. The total consideration includes an initial payment of

EUR7.0 million payable in milestones relating to the transfer of

assets which are expected to be released within up to three months,

and up to an additional EUR7 million contingent on significant

growth in performance of the Acquisition during a period of 6

months. In addition, the Group will pay a share of the

Acquisition's revenues during a three months' transition period

which is estimated to be approximately EUR0.5 million but in any

case limited to a maximum of EUR1 million. Under the terms of the

agreement, during such transition period the vendor will provide

support, training and maintenance services as required for a smooth

migration. Once migration is completed the Group will integrate the

operations of the network into its existing operations.

Chief Executive Officer of XLMedia, Ory Weihs, commented:

"As we develop our business, we continue to capitalise on the

infrastructure we have built, and take opportunities to expand

further through acquisitions. With our current network, technology

and sector expertise, the additional assets will be integrated

easily into our operation, adding to our strong base of assets and

recurring revenues.

"We are seeing good opportunities to buy additional assets in

our key verticals, and we plan to continue acquiring domains and

websites as part of our ongoing growth strategy."

For further information, contact:

XLMedia plc

Ory Weihs

www.xlmedia.com

Tel: 020 8817 5283

Vigo Communications

Jeremy Garcia / Fiona Henson / Kate Rogucheva

www.vigocomms.com

Tel: 020 7830 9703

Cenkos Securities plc (Nomad and Joint

Broker)

Camilla Hume/ Mark Connelly

www.cenkos.com

Tel: 020 7397 8900

Berenberg (Joint Broker)

Chris Bowman / Mark Whitmore

www.berenberg.com

Tel: 020 3207 7800

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQFKQDKFBKDDDD

(END) Dow Jones Newswires

January 15, 2018 02:00 ET (07:00 GMT)

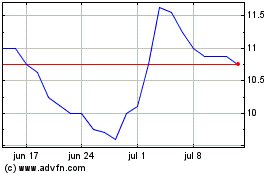

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024