TIDMXLM

RNS Number : 0751U

XLMedia PLC

26 March 2019

The following is a correction to the preliminary results

announcement of results for the year ended 31 December 2018

announced at 7 a.m. today (RNS no: 9548T). The changes relate to

minor errors in certain numbers contained in the tables and notes

of the financial statements, but no changes have been made in the

highlights section of the announcement and all numbers remain

correct in that section. Nor have any changes been made to the

Report from the Chairman and CEO or the Report from the CFO. These

errors have been corrected in the preliminary results for the year

ended 31 December 2018 set out below.

For immediate release 26 March 2019

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Results for the year ended 31 December 2018

Improved profitability in H2 2018 underpins strategic pivot to

higher margin publishing activities

XLMedia (AIM: XLM), a leading provider of digital performance

marketing services, announces the Company's results for the year

ended 31 December 2018.

Financial highlights

-- Revenues decreased 14.4% to $117.9 million (2017: $137.6 million)

o Impacted by operational challenges in 2018, with a proactive

shift to higher margin activities and sustainable revenue growth

going forward

o Publishing revenues grew 4.6%, media revenues decreased 29%,

other revenues decreased 41%

-- Gross profit decreased 7.1% to $67.9 million (2017: $73.1 million)

o Improved gross profit in H2 2018 versus H1 2018, with gross

profit up 2.7% to $34.4 million

o Publishing division profit increased 3% to $51.7 million

(2017: $50.3 million),

o Media segment adjusted(1) profit, decreased 23% to $15.3

million (2017: $20.0 million)

-- Adjusted EBITDA(2) decreased 6.9% to $43.9 million (2017: $47.1 million)

o Improved adjusted EBITDA(2) in H2 2018 versus H1 2018 - up

9.8% to $23 million, with a greater proportion of revenues

generated from higher margin publishing activity

-- Adjusted(1) profit before tax decreased 10.8% to $35.1 million (2017: $39.3 million)

-- Loss of $9.9 million relating to media activity reduction

-- Declared final dividend of $8.4 million equivalent to 4.0182

cents per share to be paid in Pound Sterling (3.0419 pence per

share), a total of 7.0222 cents per share for the year (2017:

7.7331 cents per share)

-- Strong balance sheet with $41.1 million working capital and

total equity of $166.8 million, representing 85% of total assets

(2017: $33.8 million working capital, $116.4 million equity)

-- Cash and short-term investments at 31 December 2018 were

$47.6 million (31 December 2017: $43.3 million)

-- Adjusted(1) earnings per share decreased 9% to $0.13 (2017: $0.15)

Operating highlights

-- The Group to increase its focus on higher margin Publishing

division, with an emphasis on its core product verticals - gambling

and personal finance

-- Business continues to recover from adverse impact of gambling

regulation uncertainty in specific territories, website ranking

issues impacted by spamming and other attacks on key publishing

assets, which impacted performance in 2018

-- Ongoing investment in technology to strengthen the Company's

publishing platform, as well as compliance, data aggregation and

analysis

-- The Group's nascent personal finance business continues to

grow and has increased its presence in the North American markets,

with 6% of overall revenues now derived from this vertical (2017:

2%) This is expected to grow in 2019.

2019 Outlook

-- Continue to strengthen the Group's publishing assets

o Growth through organic development and acquisition, with

internal development plans for personal finance market and gambling

networks over the next three years

o Completing the integration of recently acquired assets

o Continue to work on the recovery of rankings for key

publishing assets

o Capitalise on the Group's existing footprint across the North

American Personal Finance markets

o Ongoing development within the online gambling segment in the

US

-- Actively reducing certain low margin media activities with a

focus on complementing publishing activities with media

skillset

-- Optimisation of internal processes and systems during 2019,

including leveraging remaining media activity across publishing

assets

-- Focus on regulated markets aligned with the Group's focus on

sustainable, high-quality earnings

Ory Weihs, Chief Executive Officer of XLMedia, commented:

"2018 has been a challenging year but our business is built on

strong foundations giving us the confidence to cease low margin

activities and concentrate on the higher margin Publishing

division, returning the business to growth.

"Looking ahead, the Group will be prioritising internal

investment across its publishing activity to further build its

asset base organically, in particular, in the North American

gambling and personal finance verticals. Whist we continue to

assess strategic acquisition opportunities, we anticipate the bulk

of our mid to long-term asset growth to come from organic asset

development.

"Our focus remains firmly on improving operational excellence

and further developing assets organically to maximise shareholder

value."

A webcast of our results presentation will be available on our

website later today:

https://www.xlmedia.com/investor-relations/webcasts/

XLMedia will be holding a presentation for private and retail

investors at 4.00pm on Thursday 28 March 2019. To register for the

event, please contact Vigo Communications on

xlmedia@vigocomms.com.

1 Excluding loss from media activity planned reduction

2 Earnings Before interest, Taxes, Depreciation, Amortization

and impairment loss from media reduction and adjusted to excluding

share-based payments

For further information, please contact:

XLMedia plc Ory Weihs, Chief Executive Via Vigo Communications

Officer Yehuda Dahan, Chief Financial

Officer www.xlmedia.com

Vigo Communications Jeremy Garcia / Fiona Tel: 020 7390 0233

Henson / Simon Woods www.vigocomms.com

Cenkos Securities plc (Nomad and Joint Tel: 020 7397 8900

Broker) Giles Balleny / Callum Davidson

www.cenkos.com

Berenberg (Joint Broker) Chris Bowman Tel: 020 3207 7800

/ Mark Whitmore / Simon Cardron www.berenberg.com

Chairman and Chief Executive Review

Introduction

XLMedia is a performance marketing company operating via two

principal marketing methods - publishing and media buying. Within

publishing, the Group owns a large portfolio of informational and

content rich websites globally which act as a conduit to channel

users to its clients, the majority of which address two key

verticals - gambling and personal finance.

As announced on 26 February 2019, the Group has proactively

elected to reduce certain parts of its Media activities which have

lower profit margins, reflecting an increasingly challenging

environment driven by heightened compliance and regulatory demands

in the gambling and digital marketing sectors. XLMedia's media

expertise will continue to support the Group's publishing

activities.

In the first half of 2018 our business faced a number of

unexpected headwinds, namely the impact of gambling regulation

uncertainty in specific territories and SEO performance issues

impacted by spamming and other attacks across a number of our key

publishing assets, as well as technical issues. While the recovery

of these assets has been taking longer than initially anticipated,

H2 2018 showed a 3% increase in revenues and 2% increase in profit

for our publishing division versus H1 2018. The Group has also

invested in improving our defences against future spamming or other

attacks on our assets.

The reduction of media activities will provide a greater degree

of certainty for the business and enable XLMedia to deliver

sustainable and profitable growth. Going forward, the Group's focus

will be on regulated markets across the gambling sector globally

and personal finance sector, particularly in North America.

As previously announced, these actions will lead to an expected

reduction in 2019 adjusted EBITDA(2) . However, these changes are

expected to deliver higher profit margins, more sustainable and

ultimately better quality earnings.

Financials

In the year to 31 December 2018, the Company delivered revenues

of $117.9 million (2017: $137.6 million) and adjusted EBITDA(2) of

$43.9 million (2017: $47.1 million), with the implementation of

efficiency measures underpinning stronger EBITDA margin in H2 2018

versus H1 2018.

The Company's adjusted(1) net profit decreased 3.6% in 2018 to

$30.7 million (2017: $31.9 million).

Publishing revenues increased 4.6% to $65.8 million (2017: $62.9

million), with the increase driven by acquisitions. Revenue

generated from XLMedia's nascent personal finance sector increased

to $7.3 million or 6% of group revenues (2017: 2% $3.3

million).

We expect our Publishing assets to deliver organic growth in

2019.

Media revenues decreased 29% to $47.1 million (2017: $66.4

million). The Company assessed its media activities and, as

announced on 26 February 2019, decided to reduce further media

activities where appropriate, thereby increasing the overall

quality of earnings over time. The reduction of Media activities

post period end resulted in a write off of the activities'

intangible assets, totalling $9.9 million.

Acquisitions

The Company has undertaken several publishing asset acquisitions

in the period totalling $47.3 million and included:

-- Leading Finnish gambling comparison assets for $18 million

-- A UK Bingo comparison site - WhichBingo.co.uk - for $10.5 million

-- A US personal finance website - investorjunkie.com - for $5.8 million

-- A network of US and Canadian personal finance assets

-- Additional bolt-on gambling assets

The integration of the acquired assets into the Group is

progressing as expected.

Going forward, the Company will seek to invest across the

business, focussing on the following areas:

-- Pursue growth opportunities in North America to both build

and develop a more comprehensive portfolio of online assets

-- Develop the Group's infrastructure to support the broader

portfolio of assets and evolution of the market

-- Ongoing expansion of the Group's publishing portfolio in

other regulated European gambling markets

-- Seek to acquire earnings accretive publishing assets

All new sites developed will help bolster the Group's asset

base, expanding and enhance its existing geographical

footprint.

Regulations

The gambling sector has been going through a period of

regulatory uncertainty in various territories, with some opening up

through regulation and taxation and other introducing stricter

regulations on advertising of products and enhanced enforcement.

Specific changes which have affected the Group are:

United States

XLMedia believes a key future growth vertical will result from

the opening of the US online sports betting market. In May 2018,

the US Supreme Court struck down a 1992 federal law that prohibited

most states from authorising sports betting. Following such

decision, various US States introduced, and others are in the

process of introducing, legislation that would regulate the market.

As such, the Group is building its portfolio of sites in this

vertical to fully leverage its expertise and capitalise on the

opportunity when the market is more widely active.

In terms of other forms of gambling in the US the position is

less clear. In a negative development, a legal opinion from the US

Department of Justice's Office of Legal Counsel issued in November

2018 and made public in January 2019 reversed a 2011 Department of

Justice opinion which a number of US States relied on to allow the

launch of online gambling and lottery operations. The Group

continues to monitor the situation closely as it develops while

preparing for activity where possible.

Europe - United Kingdom

In the UK, the sports betting market continues to perform

strongly while enhanced gambling advertising regulation and

policies continue to shape the market. The Group anticipates that

the increased regulation in this space will result in higher

quality of sustainable earnings going forward.

Effects of the increase of remote gambling duty from 15% to 21%,

which is expected to become effective in April 2019, will be

monitored by the Company.

Europe - Germany

In Germany, regulatory uncertainty caused by stalemate

surrounding the interstate gambling treaty impacted the Group.

Following a vote last week to extend the third interstate gambling

treaty, the Group will be monitoring the market and plans to invest

in growing its asset portfolio in the sports betting sector. The

Group believes the German sports market represents a medium-term

growth opportunity.

Europe - Sweden and other countries

The Swedish market has recently seen the introduction of

enabling regulation, which the Group believes presents a promising

blueprint from which to work. XLMedia currently has a number of

significant assets serving the Swedish market and will continue to

develop and adjust them to the new regulations.

The Group continues to seek opportunities to expand its presence

in other European countries which have already undergone

regulation, affording the Group greater visibility of market

conditions and quality of earnings.

North America - Personal Finance

The Group believes there is a significant market opportunity in

the personal finance vertical in the US and Canada where the online

marketing of personal finance remains relatively nascent. The Group

continues to assess the market's rapid development and evolution,

whilst also taking early advantage by establishing a strong

footprint of assets.

XLMedia is seeing good growth and traction from its existing

assets, which address a broad variety of personal finance

interests, including mortgages, credit cards, loans, bank accounts

and investments. The Group's activities in the personal finance

space are currently proportionally small compared to gambling, but

our approach continues to be to grow this offering and leverage our

publishing expertise while expanding beyond the gambling

vertical.

The Group continues to monitor regulations worldwide, responding

to changing regulatory environments and new compliance needs in the

gambling advertising sector and digital marketing. The Group aims

to build its asset portfolio across regulated markets globally in

both the gambling and personal finance sectors, by investing in

developing assets organically and acquiring selected targets.

Dividend and Share Buy back

On 18 December 2018, the Company instigated a share buyback

programme with repurchased shares being held in treasury. The

programme is being funded from the Company's existing cash balances

and will not affect XLMedia's existing dividend policy of paying

out at least 50 per cent of net profit. During the period from 18

December 2018 until 23 March 2019 the Company has repurchased 7.6

million shares for an aggregate sum of GBP5.0 million.

The net profit that has been used to calculate the proposed 2018

final dividend was adjusted for non-cash impairments. The Board is

declaring a dividend of $8.4 million or 4.0182 cents per share

payable in Pound Sterling (3.0419 pence per share) on 3 May 2019 to

shareholders on the register at the close of business on 5 April

2019. The ex--dividend date is 4 April 2019

Outlook

As we move through 2019, the Group will be seeking to invest in

existing sites and ensure we have strong base from which to build.

XLMedia will also create an even broader base of assets in its key

verticals of personal finance and gambling, within regulated

markets.

The decision to proactively cease the Group's involvement in

much of its Media activity will see the Group concentrate its

efforts on the higher margin Publishing business going forward.

Whilst there will be a short-term impact, the Board is confident

these steps will deliver higher profit margins with a much higher

quality of earnings in the medium and long term.

The Board is confident of the opportunity for the business going

forward and executing upon its strategy. It is therefore

maintaining its dividend policy, to pay out at least 50 per cent of

retained earnings by way of dividend, and will continue to

undertake its share buyback programme, with a view to reducing the

share capital of the Company and returning funds to

shareholders.

Chris Bell Ory Weihs

Non-Executive Chairman Chief Executive Officer

25 March 2019

Financial Review

'000 2018 2017 Change

--------- --------- -------

Revenues 117,866 137,632 -14%

========= ========= =======

Gross Profit 67,944 73,145 -7%

========= ========= =======

Operating expenses (32,257) (32,376)

========= ========= =======

Operating income 35,687 40,769 -12%

========= ========= =======

Adjusted EBITDA(2) 43,857 47,120 -7%

========= ========= =======

Adjusted(1) Profit Before

Tax 35,100 39,345 -11%

========= ========= =======

Loss from media activity (9,938) -

reduction

========= ========= =======

Profit Before Tax 25,162 39,345 -36%

========= ========= =======

In 2018, XLMedia revenues totaled $117.9m (2017: $137.6

million), reflecting a decrease of 14% compared to the previous

year, mainly driven by weaker media and affiliate activity.

Gross profit for 2018 totaled $67.9 million and gross margin was

58% (2017: $73.1 million, 53% gross margin), representing a 7%

decrease, proportionally lower compared to revenues due to an

increased in the margin.

Operating expenses for 2018 totaled $32.3 million (2017: $32.4

million), in line with 2017.

The Group has seen an increase in G&A and S&M expenses,

primarily attributable salary and share based payments, which has

been offset by a decrease in uncapitalized R&D expenses.

Adjusted EBITDA(2) for 2018 totaled $43.9 million or 37% of

revenues (2017: $47.1 million, 34%), a decrease of 7% to the

previous year.

Net finance expenses for 2018 totaled $0.6 million (2017: $1.4

million). Financial expenses recorded for loans interest of $0.5

million and other bank fees for $0.2 million net of finance income

of foreign exchange rate, including hedging, of $0.1 million.

Post year end, the Company decided to reduce some of its media

activities, resulting in a one-off, non-cash write-off of

intangible assets related to these activities, totaling $9.9

million.

Adjusted(1) profit before tax in 2018 totaled $35.1 million

(2017: $39.3 million), a decrease of 11%.

Net profit for 2018 totaled $20.8 million (2017: $31.9 million),

a decrease of 35%.

As at 31 December 2018, the Company had $47.6 million in cash

and short-term investments compared to $43.3 million 31 December

2017. The change in cash reflects $31.8 million provided by

operating activity, $54.1 million used for investing activity

(mainly for websites acquisitions totaling $47.3 million and

technology investment of $8.2 million), and $29.4 million provided

by financing activities, including $42.6 million capital raised in

January 2018. This was offset by dividend payments to shareholders

of $14.4 million and a net receipt of $2.0 million long term bank

loan.

Current assets as at 31 December 2018 were $69.2 million (31

December 2017: $67.1 million), and non-current assets were $127.3

million (31 December 2017: $87.4 million). The increase in

non-current assets is mainly attributable to investments in domains

and websites.

Total equity as at 31 December 2018 reached $166.8 million or

85% of total assets (2017: $116.7 or 76% of total assets). At the

end of 2018, the Group announced a buyback plan that had a marginal

effect in 2018.

Yehuda Dahan

Chief Financial Officer

25 March 2019

1 Excluding loss from media activity planned reduction

2 Earnings Before interest, Taxes, Depreciation, Amortization

and loss from media reduction and excluding share-based

payments

Consolidated Statements of Financial Position

As of 31 December

-------------------

2018 2017

--------- --------

USD in thousands

-------------------

Assets

Current assets:

Cash and cash equivalents 44,627 38,416

Short-term investments 2,996 4,861

Trade receivables 16,112 18,950

Other receivables 4,697 4,665

Financial derivatives 805 200

--------- --------

69,237 67,092

--------- --------

Non-current assets:

Long-term investments 633 681

Property and equipment 1,296 1,230

Goodwill 23,652 30,052

Domains and websites 92,053 45,762

Other intangible assets 9,146 8,585

Deferred taxes 99 862

Other assets 435 244

127,314 87,416

--------- --------

196,551 154,508

========= ========

As of 31 December

-------------------

2018 2017

--------- --------

USD in thousands

-------------------

Liabilities and equity

Current liabilities:

Trade payables 6,416 9,813

Other liabilities and accounts payable 6,967 10,972

Income tax payable 9,088 8,573

Financial derivatives 91 1,425

Current maturity of long-term bank loan 5,585 2,500

--------- --------

28,147 33,283

--------- --------

Non-current liabilities:

Long- term bank loans 1,380 2,500

Income tax payable - 1,825

Deferred taxes - 42

Other liabilities 248 201

--------- --------

1,628 4,568

--------- --------

Equity

Share capital *) *)

Share premium 112,224 68,417

Capital reserve from share-based transactions 2,590 1,227

Capital reserve from transaction with non-controlling

interests (2,445) (2,445)

Treasury shares (468) -

Retained earnings 54,623 49,167

--------- --------

Equity attributable to equity holders of

the Company 166,524 116,366

Non-controlling interests 291 291

--------- --------

Total equity 166,815 116,657

--------- --------

196,551 154,508

========= ========

*) Lower than USD 1 thousand.

Consolidated statements of profit or loss and other

comprehensive income

Year ended 31

December

----------------------

2018 2017

------------ -------

USD in thousands

(except per share

data)

----------------------

Revenues 117,866 137,632

Cost of revenues 49,922 64,487

------------ --------

Gross profit 67,944 73,145

Research and development expenses 1,358 4,474

Selling and marketing expenses 7,420 6,263

General and administrative expenses 23,479 20,208

------------ --------

32,257 30,945

------------ --------

Operating profit before impairment loss 35,687 42,200

Impairment loss (9,938) 1,431

------------ --------

Operating profit after impairment loss 25,749 40,769

------------ --------

Finance expenses (887) (2,113)

Finance income 300 689

------------ --------

Finance expenses, net (587) (1,424)

------------ --------

Profit before taxes on income 25,162 39,345

Taxes on income 4,387 7,474

------------ --------

Net income and other comprehensive income 20,775 31,871

============ ========

Attributable to:

Equity holders of the Company 19,818 30,323

Non-controlling interests 957 1,548

------------ --------

20,775 31,871

============ ========

Earnings per share attributable to equity

holders of the Company:

Basic and diluted earnings per share (in

USD) 0.09 0.15

============ ========

Consolidated statements of cash flows

Year ended

31 December

------------------------

2018 2017

----------- -----------

USD in thousands

------------------------

Cash flows from operating activities:

Net income 20,775 31,871

----------- -----------

Adjustments to reconcile net income to net cash

provided by operating activities:

Adjustments to the profit or loss items:

Depreciation and amortisation 6,503 4,501

Finance expense (income), net (1,577) 2,813

Income from sell of property (10) -

Impairment loss 11,038 1,431

Cost of share-based payment 1,667 419

Taxes on income 4,387 7,474

Exchange differences on balances of cash and

cash equivalents 954 (1,545)

----------- -----------

22,962 15,093

----------- -----------

Changes in asset and liability items:

Decrease (increase) in trade receivables 838 (1,875)

Increase in other receivables (509) (982)

Increase (decrease) in trade payables (3,397) 539

Increase (decrease) in other accounts payable (3,671) 286

Increase (decrease) in other long-term liabilities 47 (27)

----------- -----------

(6,692) (2,059)

----------- -----------

Cash received (paid) during the year for:

Interest paid (469) -

Interest received 196 17

Taxes paid (5,544) (4,154)

Taxes received 557 305

----------- -----------

(5,260) (3,832)

----------- -----------

Net cash provided by operating activities 31,785 41,073

----------- -----------

Year ended 31 December

------------------------

2018 2017

----------- -----------

USD in thousands

------------------------

Cash flows from investing activities:

Purchase of property and equipment (553) (388)

Proceeds from sale of assets and property 270 300

Payment for acquired business - (5,100)

Acquisition of and additions of domains, websites,

technology and other intangible assets (55,516) (16,160)

Short- term and long-term investments, net 1,735 (1,595)

----------- -----------

Net cash used in investing activities (54,064) (22,943)

----------- -----------

Cash flows from financing activities:

Dividend paid to equity holders of the Company (14,362) (15,505)

Share capital issuance, net of issuance costs 42,618 -

Acquisition of treasury Shares (468) -

Acquisition of non-controlling interests - (2,250)

Dividend paid to non-controlling interests (1,285) (1,804)

Exercise of options 976 1,205

Repayment of long and short-term liability (4,000) -

Receipt of long-term loan from bank 5,965 5,000

----------- -----------

Net cash provided by (used in) financing activities 29,444 (13,354)

----------- -----------

Exchange differences on balances of cash and cash

equivalents (954) 1,545

----------- -----------

Increase in cash and cash equivalents 6,211 6,321

Cash and cash equivalents at the beginning of the

year 38,416 32,095

----------- -----------

Cash and cash equivalents at the end of the year 44,627 38,416

=========== ===========

Notes to condensed consolidated financial statements

NOTE 1: GENERAL

The Group is an online performance marketing company. The Group

attracts paying users from multiple online and mobile channels and

directs them to online businesses who, in turn, convert such

traffic into paying customers.

Online traffic is attracted by the Group's publications and

advertisements and are then directed, by the Group to its customers

in return for mainly a share of the revenue generated by such user,

a fee generated per user acquired, fixed fees or a hybrid of any of

these models.

The Company is incorporated in Jersey and commenced its

operations in 2012.

Since March 2014, the Company's shares are traded on the London

Stock Exchange's Alternative Investment Market (AIM).

NOTE 2: OPERATING SEGMENTS

(a) General:

The operating segments are identified on the basis of

information that is reviewed by the chief operating decision maker

to make decisions about resources to be allocated and assess its

performance. Accordingly, for management purposes, the Group is

organised into operating segments based on the products and

services of the business units and has operating segments as

follows:

Publishing - The Group owns over 2,300 informational websites

in 18 languages. These websites refer potential

customers to online businesses. The sites' content,

written by professional writers, is designed

to attract online traffic which the Group then

directs to its customers online businesses.

Media - The Group's Media division acquires online and

mobile advertising targeted at potential online

traffic with the objective of directing it to

the Group's customers. The Group buys advertising

space on search engines, websites, mobile and

social networks and places adverts referring

potential users to the Group's customers' websites

or to its own websites.

Segment performance (segment profit) is evaluated based on

revenues less direct operating costs. Items that were not allocated

are managed on a group basis.

(b) Reporting on operating segments:

Publishing Media Other Total

---------- ------ ----- --------

USD in thousands

-------------------------------------

Year ended 31 December

2018:

Revenues 65,788 47,141 4,937 117,866

---------- ------ ----- --------

Segment profit 51,747 15,329 568 67,944

---------- ------ ----- --------

Impairment loss - 9,938 - 11,038

---------- ------ ----- --------

Segment profit after

impairment loss 51,747 5,391 568 57,706

---------- ------ ----- --------

Unallocated corporate

expenses (31,957)

Finance income, net (587)

--------

Profit before taxes

on income 25,162

========

Year ended 31 December

2017:

Revenues 62,894 66,428 8,310 137,632

---------- ------ ----- --------

Segment profit 50,309 19,982 1,423 71,714

---------- ------ ----- --------

Unallocated corporate

expenses (30,945)

Finance income, net (1,424)

--------

Profit before taxes

on income 39,345

========

(c) Geographic information:

Revenues classified by geographical areas based on user

location:

Year ended 31 December

------------------------

2018 2017

----------- -----------

USD in thousands

------------------------

Scandinavia 42,374 38,250

Other European countries 32,531 41,621

North America 20,588 29,665

Asia 6,198 10,940

Oceania 1,799 3,493

Other countries 5,047 3,766

----------- -----------

Total revenues from identified locations 108,537 127,735

Revenues from unidentified locations 9,329 9,897

----------- -----------

Total revenues 117,866 137,632

=========== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR EASDKADDNEFF

(END) Dow Jones Newswires

March 26, 2019 11:36 ET (15:36 GMT)

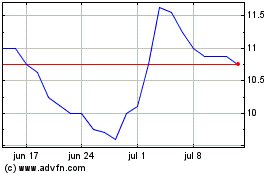

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024