TIDMXLM

RNS Number : 3665A

XLMedia PLC

29 September 2020

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Results for the Six Months Ended 30 June 2020

XLMedia (AIM: XLM), a leading provider of digital performance

publishing services, announces the Company's results for the six

months ended 30 June 2020.

Financial summary

-- Revenues of $27.7 million (H1 2019: $42.5million)

-- Gross profit of $16.6 million (H1 2019: $28.8 million)

-- Adjusted EBITDA (1) of $5.1 million (H1 2019: $18.6 million)

-- Adjusted profit before tax (2) of $1.7 million (H1 2019: $13.8 million)

-- Reported Profit before tax of $0.2 million (H1 2019: $13.8 million)

-- Cash balances of $28.0 million as at 30 June 2020 (31 December 2019: $30.6 million)

1 Adjusted EBITDA in all references is defined as Earnings

Before Interest, Taxes, Depreciation and Amortisation, and

excluding any share-based payments and reorganisation costs

2 Excluding reorganisation costs

Operating summary

-- Business performance impacted by Google manual ranking

penalty and Covid-19 - approximately $2 million per month impact

from late March

-- Strengthened Executive Team with the appointment of Iain

Balchin as Chief Financial Officer, Sarah Clark as Chief Operating

Officer and Ken Dorward as President, North America

-- Good progress made on restructuring the organisation to align

with refreshed strategy, resulting in annualised cost savings of

approximately $5 million from second half of 2020

-- Commenced evaluation process for possible disposal of certain Finnish assets

-- After period end:

o Corporation tax residence moved to the UK to reflect the

senior management and governance concentration

o Completed buy-out of remaining founder interests in

101greatgoals.com

Casino recovery

-- Evolving the approach, including the development of new content-rich websites

o Will submit specific rebuilt sites for reconsideration by

Google, where appropriate, by the end of the fourth quarter of

2020

-- Ongoing brand and content refresh of all main assets,

including migration to new hosted technology platform, with the

benefit of access to open source community

COVID-19 update

-- Operationally, the Company adjusted well to the remote

working requirements caused by the global Covid-19 pandemic

-- Financially, Covid-19 negatively impacted revenue in Personal Finance and Sports

-- Early signs of recovery were evident late in the period, as major sporting activity returned

Strategic clarity:

XLMedia is pursuing a more focused business model, premised

on:

-- A balanced portfolio of assets:

o An attractive range of geographies

o Stable and high growth verticals

o Increased investment in regulated markets

-- Branded, content-rich, engaging websites,

o building deeper, more valuable, relationships with partners

and consumers, underpinned by market-leading technology and

data

Outlook

-- Positive start to the second half of the year, particularly in Personal Finance and Sports

o Covid-19 second wave produces some short-term uncertainty

-- Continue to expect a material recovery in financial performance in 2021

Stuart Simms, Chief Executive Officer of XLMedia, commented:

"Our business has endured a number of unforeseen challenges

during 2020 but, as we enter the second half of the year, I believe

we are seeing signs of recovery in some key areas.

These green shoots, coupled with a detailed and diverse plan to

mitigate the impact of the Google manual ranking penalty, give me

and the Executive team confidence we can enter 2021 with

significant positive momentum and enhanced levels of control."

A webcast of our results presentation will be available on our

website today:

https://www.xlmedia.com/investor-relations/webcasts/

For further information, please contact:

XLMedia plc ir@xlmedia.com

Stuart Simms, Chief Executive Officer

Iain Balchin, Chief Financial Officer

Kieran McKinney, Investor Relations

www.xlmedia.com

Vigo Communications Tel: 020 7390 0233

Jeremy Garcia

www.vigocomms.com

Cenkos Securities plc (Nomad and Joint Tel: 020 7397 8900

Broker)

Giles Balleny / Max Gould

www.cenkos.com

Berenberg (Joint Broker) Tel: 020 3207 7800

Chris Bowman / Mark Whitmore / Simon

Cardron

www.berenberg.com

Chief Executive Officer review

First Half Performance

The first half of the year brought some significant challenges

for the business, as detailed in the Trading Update on 23 July

2020, particularly the Google manual ranking penalty in the Casino

vertical, originally identified in January, and the broad consumer

downturn caused by the global Covid-19 pandemic. Against this

backdrop, the Group delivered revenue of $27.7 million (H1 2019:

$42.5 million), gross margin of $16.6 million (H1 2019: $28.8

million) and adjusted EBITDA of $5.1 million (H1 2019: $18.6

million). Following the Google manual ranking penalty in January

and the growing impact of Covid-19 on economic activity by the end

of March, monthly revenue ran approximately $2 million behind the

expectations at the start of the year.

The Google penalty, which was identified in January, has been

well documented in a series of updates in the first six months of

the year and, while there remains a lot to be done, we made good

progress in rebuilding and upgrading the assets during the first

half. I discuss this in more detail later.

Strategic Priorities

The industry we operate in and the markets we serve are

constantly evolving. Changing consumer behaviour, evolving

regulation, the ever-shifting algorithms of the major internet

search engines and the increasing influence of social media create

both challenges and opportunities for XLMedia. Consumers of our

service increasingly demand higher quality content, which engages

them and adds real value to their journey towards the ultimate

service they seek - this is also true of Google and other internet

search engines. This requires us to be agile, and willing and able

to change and adapt, to take maximum advantage as opportunities

present themselves.

Since joining XLMedia, with the support of the leadership team,

I have focused on identifying the strengths and weaknesses of the

business, both structurally and strategically, and assessing any

changes required to best align the Company to current and future

industry trends. This process highlighted certain business model

and organisational structure challenges that needed to be addressed

to transform the performance of the business in the years

ahead.

Over the last six months, we have made good progress in

reshaping the organisation, reducing complexity, flattening the

hierarchy and beginning to bring in the complementary skills

required for the future. Looking outward, as we laid out in April,

the priorities of the business are changing, to reduce risk and

drive sustainable growth in the top and bottom line. We have set

out a clear strategic agenda under two fundamental priorities:

-- A balanced portfolio of online assets

o We seek to create a balanced portfolio of websites to cover a

range of attractive geographies, both stable and high-growth

verticals and with greater exposure to regulated markets. In doing

so, we will focus particularly on developing our presence in North

American sports, primarily through targeted acquisition.

-- Branded, content-rich, engaging websites

o XLMedia will consolidate its online portfolio, concentrating

on a much smaller number of publishing assets, and focusing its

resources on optimising this core set of premium sites for its

chosen markets. These content-rich, engaging websites, underpinned

by intelligent market-leading technology, will seek to build

stronger lasting relationships with consumers and enhance

monetisation opportunities.

Casino recovery

As disclosed in January 2020, a number of our high revenue

premium Casino websites, were penalised by Google through a manual

ranking penalty; this pushed and holds the websites far enough down

the search rankings to make driving material new business virtually

impossible.

Our thinking on the best way forward, in terms of speed,

certainty and positive financial impact, has constantly evolved,

informed by expert opinion, testing and experience. We carried out

an unsuccessful test resubmission of a small number of sites to

Google in July. We believe this test was not successful because the

assets remained on our proprietary technology platform, rather than

having been fully rebuilt on an open-source technology suite, as we

plan to do; however no significant feedback or clarity is provided

on the reasons for such an outcome. This further highlighted the

risks of pursuing only one route to recovery, especially the

possibility of consuming valuable internal resources on multiple

reconsiderations, or even the possibility of the manual penalty

never being removed in certain instances. Also, as time passes, the

domain authority on some of the original websites is eroding due to

lack of traffic, and with it the new revenue potential, gradually

reducing the advantage over entirely new websites.

We are pursuing multiple routes to re-establishing our traffic

levels in the casino vertical. Of the original premium websites, we

have identified two where a joint venture partner will lead the

efforts, sharing the upside; we expect these to be submitted for

reconsideration over the coming weeks. Towards the end of the

fourth quarter, we expect to submit a small number of the original

penalised sites for reconsideration, where we feel this is optimal.

For most others, we have already begun to develop new high-level

sites using internal and external resources. In most instances,

each of these sites will consolidate traffic from several former

premium sites, more rapidly building authority and ranking. We

expect this process to be largely complete by the end of the first

quarter of 2021. This multi-track approach minimises risk and

maximises possible upside, while focusing resources and ownership

on a more concentrated set of assets, which will also be key well

beyond the build phase. I believe the difference of this approach

in financial terms will be immaterial in the short-term, but it

will enable us to take greater and more immediate control of our

performance, greatly enhancing the longer-term potential of the

business.

Regulation

All of XLMedia's business units in some way are impacted by

regulations. Even where regulatory change negatively impacts

revenue in the short term, I believe that, on the whole, a fully

regulated market is better over the longer term for large

enterprises like XLMedia, when we factor in the reduced risk of

shocks or unforeseen change. On a more obviously positive note, the

type of regulatory change we are seeing in North American Sports,

where a previously closed market opens, represents a significant

opportunity.

Outlook

The second half of the year has started positively with much of

the global sports programme being reopened and compressed into a

couple of months, an uptick in Personal Finance activity and the

stabilisation of the Casino vertical. However, there are clear

signs of second waves of Covid-19 across the territories we operate

in, and any tightening of restrictions could impact the recovery in

our Personal Finance and Sports verticals; the very recent second

lockdown in Israel could also delay elements of the transformation

programme.

While there continue to be a number of moving parts, including

possible disposals and acquisitions, the organisational changes we

have made over the last year, and the ongoing work on developing a

suite of websites fit for the future, give me confidence we can end

the year with positive momentum, leading to a material financial

recovery in 2021.

Stuart Simms

Chief Executive Officer

29 September 2020

Financial Review

$'000 H1 2020 H1 2019 Change

Revenues 27,715 42,459 -35%

============================================== ======== ========= =======

Gross profit 16,609 28,838 -42%

============================================== ======== ========= =======

Operating expenses (14,829) (14,514) + 2%

============================================== ======== ========= =======

Operating profit before reorganisation costs 1,780 14,324 -88%

============================================== ======== ========= =======

Adjusted EBITDA(1) 5,093 18,616 -73%

============================================== ======== ========= =======

Reorganisation costs (1,501) -

============================================== ======== ========= =======

Adjusted(2) profit before tax 1,672 13,795 -88%

============================================== ======== ========= =======

Profit before tax 171 13,795

-------- --------- -------

(1) Earnings Before interest, Taxes, Depreciation and

Amortisation and excluding share-based payments and reorganisation

costs

(2) Excluding reorganisation costs

Group revenues in the first half of 2020 totalled $27.7 million

(H1 2019: $42.5 million), a decrease of 35% compared to the same

period in the prior year. This was predominantly due to the well

documented Google manual penalties imposed on a number of the

company's Casino websites, the impact of COVID 19 and the closure

of our remaining Media business.

Gross profit for the first half of 2020 was $16.6 million (H1

2019: $28.8 million), a 42% decrease, broadly in line with the

decrease in revenues. Gross margin was 60%, against 68% in the

prior period.

Operating expenses for the first half of 2020 were $14.8 million

(H1 2019: $14.5 million).

Adjusted EBITDA (2) in the first half of 2020 was $5.1 million

(H1 2019: $18.6 million), a decrease of 73% on the same period in

the prior year, due entirely to the reduction in revenues.

In the first half of 2020, the Group recorded reorganisation

costs of $1.5 million, following the commencement of a significant

restructuring of the Group to optimise the organisation for the

future. This program will be largely complete by the end of

2020.

Adjusted profit before tax in the first half of 2020 was $1.7

million (H1 2019: $13.8 million), a decrease of 88%.

As at 30 June 2020, the Company had $28.0 million in cash

balances, compared to $30.6 million as at 31 December 2019. The

change in cash is due to the $4.0 million generated by operating

activities being offset by $4.6 million used for investment

activity, and $2.3 million used for financing activities.

Current assets as at 30 June 2020 were $36.0 million, compared

to $42.3 million as at 31 December 2019. The decrease in current

assets was predominantly as a result of the decrease in cash

balances mentioned above and a decrease in trade receivables of

$3.5 million, mainly as a result of the reduction in revenues.

Non-current assets as at 30 June 2020 were $59.0 million compared

to $57.0 million as at 31 December 2019.

Current liabilities as at 30 June 2020 were $23.8 million,

compared to $27.2 million as at 31 December 2019. This decrease was

mainly as a result of a fall in trade payables of $1.4 million and

repayment of the bank loan of $1.5 million. Non-current liabilities

as at 30 June 2020 were $7.8 million, compared to $8.6 million as

of 31 December 2019. The decrease in non-current liabilities is

mainly as result of lease liability repayments.

Total equity as at 30 June 2020 was $63.5 million, or 67% of

total assets (31 December 2019: $63.5 million or 64% of total

assets).

2020 has been a challenging year for the company so far, but we

have remained resilient whilst we complete the restructuring.

During this time, cash burn has been kept to an absolute minimum

and we have removed significant future cost from the organisation.

I am confident that the business will return to positive cash

generation during the second half of the year.

Iain Balchin

Chief Financial Officer

29 September 2020

XLMEDIA PLC.

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF 30 JUNE 2020

U.S DOLLARS IN THOUSANDS

INDEX

Page

--------

REPORT ON REVIEW OF INTERIM CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS 8

Consolidated Statements of Financial Position 9-10

Consolidated Statements of Profit or Loss and Other

Comprehensive Income 11

Consolidated Statements of Changes in Equity 12 -13

Consolidated Statements of Cash Flows 14 - 15

Notes to the Interim Condensed Consolidated Financial

Statements 16 - 20

- - - - - - - - - - - - - - - - - -

Kost Forer Gabbay Tel: +972-3-6232525

& Kasierer Fax: +972-3-5622555

144 Menachem Begin ey.com

Road, Building A,

Tel-Aviv 6492102,

Israel

Report on review

of interim condensed consolidated financial statements

The Board of Directors

XLMedia PLC.

Introduction

We have reviewed the accompanying interim condensed consolidated

statement of financial position of XLMedia PLC. and its

subsidiaries ("the Group") as of 30 June 2020 and the related

interim condensed consolidated statements of profit or loss and

other comprehensive income, changes in equity and cash flows for

the six months then ended and explanatory notes. Management is

responsible for the preparation and presentation of this interim

financial information in accordance with IAS 34, "Interim Financial

Reporting" ("IAS 34") as adopted by the European Union. Our

responsibility is to express a conclusion on this interim financial

information based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements 2410, Review of Interim Financial

Information Performed by the Independent Auditor of the Entity. A

review of interim financial information consists of making

inquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

and consequently does not enable us to obtain assurance that we

would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the accompanying interim condensed

consolidated financial statements are not prepared, in all material

respects, in accordance with IAS 34 as adopted by the European

Union.

28 September 2020 KOST FORER GABBAY & KASIERER

A Member of Ernst & Young

Tel Aviv, Israel Global

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

June 30 31 December

2020 2019

--------- -----------

Unaudited Audited

--------- -----------

USD in thousands

----------------------

ASSETS

CURRENT ASSETS:

Cash and cash equivalents 24,847 27,108

Short-term investments 2,483 2,785

Trade receivables 4,210 7,755

Other receivables 4,458 4,522

Financial derivatives 34 222

--------- -----------

3 6 , 032 42,392

--------- -----------

NON-CURRENT ASSETS:

Long-term investments 687 682

Property and equipment 8,467 9,431

Domains and websites 40,815 40,215

Other intangible assets 8,503 6,428

Other assets 559 278

59,031 57,034

--------- -----------

95, 063 99,426

========= ===========

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

30 June 31 December

2020 2019

--------- -----------

Unaudited Audited

--------- -----------

USD in thousands

----------------------

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Trade payables 1,626 3,028

Other liabilities and accounts payable 9, 045 9,62 5

Income tax payable 11,958 11,874

Financial derivatives - 79

Current maturities of long-term bank loans - 1,465

Current maturities of lease liabilities 1,138 1 ,161

--------- -----------

23,767 27,232

--------- -----------

NON-CURRENT LIABILITIES:

Lease liability 7,185 8,067

Deferred taxes 527 516

Other liabilities 65 65

--------- -----------

7,777 8,648

--------- -----------

Total liabilities 31, 544 35,880

EQUITY

Share capital *) - *) -

Share premium 82,465 112,624

Capital reserve from share-based transactions 2,418 2,276

Capital reserve from transaction with non-controlling

interests (2,445) (2,445)

Treasury shares - (30,159)

Accumulated deficit (19,210) (19,041)

--------- -----------

Equity attributable to equity holders of

the Company 63,228 63,255

Non-controlling interests 291 291

--------- -----------

Total equity 63,519 63,546

--------- -----------

95, 063 99,426

========= ===========

*) Lower than USD 1 thousand.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

28 September 2020

-------------------- ------------------- --------------- ---------------

Date of approval Chris Bell Stuart Simms Iain Balchin

of the

financial statements Chairman of the Chief Executive Chief Financial

Board of Directors Officer Officer

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

Six months ended Year ended

30 June 31 December

------------------

2020 2019 2019

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

(except per share data)

Revenues 27,715 42,459 79,695

Cost of revenues 11,106 13,621 26,002

-------- -------- ------------

Gross profit 16,609 28,838 53,693

-------- -------- ------------

Research and development expenses 1,156 696 1,554

Sale and marketing expenses 2,194 2,646 4,579

General and administrative expenses 11,479 11,172 21,214

-------- -------- ------------

14,829 14,514 27,347

-------- -------- ------------

Operating profit before Impairment and

Reorganisation costs 1,780 14,324 26,346

-------- -------- ------------

Impairment loss - - 81,350

Reorganisation costs 1,501 - 1, 682

-------- -------- ------------

Operating profit (loss) 279 14,324 (56,686)

-------- -------- ------------

(1, 879

Finance expenses (408) (1,212) )

Finance income 300 683 835

-------- -------- ------------

( 1,044

Finance expenses, net (108) (529) )

-------- -------- ------------

Profit (loss) before taxes on income 171 13,795 (57,730)

Taxes on income 72 1,723 3, 188

-------- -------- ------------

Income (loss) from continuing operations 99 12,072 (60,918)

Income from discontinued operations,

net - 79 2,217

-------- -------- ------------

Net income (loss) 99 12,151 (58,701)

======== ======== ============

Net income (loss) and other comprehensive

income (loss) 99 12,151 (58,701)

======== ======== ============

Attributable to:

Equity holders of the Company (169) 11,770 (59,474)

Non-controlling interests 268 381 773

-------- -------- ------------

99 12,151 (58,701)

======== ======== ============

Earnings per share attributable to equity

holders of the Company:

Basic and Diluted earnings (loss) per

share from continuing operation (in USD) - (* 0.06 (0.31)

======== ======== ============

Basic and Diluted earnings (loss) per

share from discontinued operation (in

USD) - *) - 0.01

======== ======== ============

Weighted average number of shares used

in computing basic earnings per share

(in thousands) 183,813 209,329 198,396

======== ======== ============

Weighted average number of shares used

in computing diluted earnings per share

(in thousands) 183,813 209,596 198,396

======== ======== ============

*) Lower than 0.01 USD.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Attributable to equity holders of the Company

----------------------------------------------------------------------------------

Capital

reserve

Capital from

reserve transactions Retained

from with earnings

Share Share share-based non-controlling Treasury (accumulated Non-controlling Total

capital premium transactions interests shares deficit) Total interests equity

-------- -------- ------------ --------------- -------- ------------ ------ --------------- ------

Unaudited

-----------------------------------------------------------------------------------------------------------

USD in thousands

-----------------------------------------------------------------------------------------------------------

Balance at 1

January 2020 *) - 112,624 2,276 (2,445) (30,159) (19,041) 63,255 291 63,546

--------- -------- ------------ --------------- -------- ------------ ------ --------------- ------

Net income (loss)

and other

comprehensive

income (loss) - - - - - (169) (169) 268 99

Cost of

share-based

payment - - 142 - - - 142 - 142

Delisting of

treasury shares

**) - (30,159) - - 30,159 - - - -

Dividend to

non-controlling

interests - - - - - - - (268) (268)

Balance at 30

June 2020 *) - 82,465 2,418 (2,445) - (19,210) 63,228 291 63,519

========= ======== ============ =============== ======== ============ ====== =============== ======

**) In April 2020, the Board resolved to cancel all shares held

in treasury.

Attributable to equity holders of the Company

------------------------------------------------------------------------------

Capital

reserve

Capital from

reserve transactions

from with

Share Share share-based non-controlling Treasury Retained Non-controlling Total

capital premium transactions interests shares earnings Total interests equity

-------- ------- ------------ --------------- -------- -------- ------- --------------- -------

Unaudited

--------------------------------------------------------------------------------------------------------

USD in thousands

--------------------------------------------------------------------------------------------------------

Balance at 1

January 2019 *) - 112,224 2,590 (2,445) (468) 54,623 166,524 291 166,815

--------- ------- ------------ --------------- -------- -------- ------- --------------- -------

Net income and

other

comprehensive

income - - - - - 11,770 11,770 381 12,151

Cost of

share-based

payment - - 674 - - - 674 - 674

Acquisition of treasury

shares - - - (9,653) - (9,653) - (9,653)

Dividend to

equity holders

of the

Company (0.04

USD per share) - - - - - (8,226) (8,226) - (8,226)

Exercise of

options - 128 (31) - - - 97 - 97

Dividend to

non-controlling

interests - - - - - - - (381) (381)

Balance at 30

June 2019 (* - 112,352 3,233 (2,445) (10,121) 58,167 161,186 291 161,477

========= ======= ============ =============== ======== ======== ======= =============== =======

*) Lower than USD 1 thousand.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Attributable to equity holders of the Company

--------------------------------------------------------------------------------------

Capital

reserve

Capital from

reserve transactions Retained

from with earnings

Share Share share-based non-controlling Treasury (accumulated Non-controlling Total

capital premium transactions interests shares deficit) Total interests Equity

-------- -------- ------------ --------------- --------- ------------- -------- --------------- --------

USD in thousands

-----------------------------------------------------------------------------------------------------------------

Balance as of 1

January 16 6 , 16 6 ,

2019 *) - 112,224 2,590 (2,445) (468) 5 4 , 623 524 291 815

Net loss and

other

comprehensive

income (loss) - - - - - (59,474) (59,474) 773 (58,701)

Acquisition of

treasury

shares - - - - (29,691) - (29,691) - (29,691)

Income from

share-based

payment - - (218) - - - (218) - (218)

Dividend to

equity holders

of the Company - - - - - (14,190) (14,190) - (14,190)

Exercise of

options *) - 400 (96) - - - 304 - 304

Dividend to

non-controlling

interests - - - - - - - (773) (773)

--------- -------- ------------ --------------- --------- ------------- -------- --------------- --------

Balance as of 31

December

2019 *) - 112,624 2,276 (2,445) (30,159) (19,041) 63,255 291 63,546

========= ======== ============ =============== ========= ============= ======== =============== ========

*) Lower than USD 1 thousand.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Six months ended Year ended

30 June 31 December

------------------

2020 2019 2019

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Cash flows from operating activities:

Net income (loss) 99 12,151 (58,701)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Adjustments to the profit or loss items:

Depreciation and amortisation 3,171 3,618 7,511

Impairment loss - - 81,350

Finance expense, net 109 1,311 1 , 976

Gain from discontinued operation - - (1,811)

Cost of (income from) share-based payment 142 674 ( 218 )

Taxes on income 72 1,782 3, 228

Exchange differences on balances of cash

and cash equivalents (519) (492) (661)

-------- -------- ------------

2,975 6,893 91,375

-------- -------- ------------

Changes in asset and liability items:

Decrease in trade receivables 3,545 3,858 6,465

Decrease (increase) in other receivables (502) 620 371

Decrease in trade payables (1,402) (1,419) (2,239)

Increase (decrease) in other accounts

payable (441) 1,080 4,482

Decrease in other long-term liabilities - - (183)

-------- -------- ------------

1,200 4,139 8 ,8 9 6

-------- -------- ------------

Cash received (paid) during the year for:

Interest paid (61) (356) (752)

Interest received 82 89 101

Taxes paid (518) (1,167) (2,859)

Taxes received 248 2,058 2,061

-------- -------- ------------

(249) 624 (1,449)

-------- -------- ------------

Net cash provided by operating activities 4,025 23,807 40 , 121

======== ======== ============

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Six months ended Year ended

30 June 31 December

-------------------

2020 2019 2019

-------- --------- ------------

Unaudited Audited

------------------- ------------

USD in thousands

---------------------------------

Cash flows from investing activities:

Purchase of property and equipment (186) (111) (260)

Acquisition of and additions to domains,

websites and other intangible assets - (174) (406)

Acquisition of and additions to technology (4,394) (4,137) (8,447)

Proceeds from the sale of discontinued

operation (adjustments of proceeds)*) (270) - 1,547

Short-term and long-term investments,

net 298 139 281

-------- --------- ------------

Net cash used in investing activities (4,552) (4,283) (7,285)

-------- --------- ------------

Cash flows from financing activities:

Dividend paid to equity holders of the

Company - (8,226) (14,190)

( 9,653

Acquisition of treasury shares - ) (29,691)

Dividend paid to non-controlling interests (184) (319) (652)

Exercise of options - 117 270

( 2,750

Repayment of long and short-term liability (1,500) ) (5,500)

Repayment of lease liabilities (569) (703) (1,253)

Net cash used in financing activities (2,253) (21,534) (51,016)

-------- --------- ------------

Exchange differences on balances of cash

and cash equivalents 519 526 661

-------- --------- ------------

Decrease in cash and cash equivalents (2,261) (1,484) (17,519)

Cash and cash equivalents at the beginning

of the period 27,108 44,627 44,627

-------- --------- ------------

Cash and cash equivalents at the end of

the period 24,847 43,143 27,108

======== ========= ============

*) Net of cash balance of discontinued operation.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

NOTE 1: GENERAL

XLMEDIA PLC and its subsidiaries (The Group) are a leading

global digital performance publisher .

The Group attracts users through online marketing techniques

(such as publications and advertisements) which are then directed,

by the Group, to its customers in return for a share of the revenue

generated by such user, a fee generated per user acquired, fixed

fees or a hybrid of any of these three models .

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES

a. Basis of preparation of the interim condensed consolidated financial statements:

The interim condensed consolidated financial statements for the

six months ended 30 June 2020 have been prepared in accordance with

IAS 34, Interim Financial Reporting, as adopted by the European

Union. The interim condensed consolidated financial statements do

not include all the information and disclosures required in the

annual financial statements and should be read in conjunction with

the Group's annual consolidated financial statements as at 31

December 2019.

b. Initial adoption of amendments to existing financial reporting and accounting standards:

Amendment to IFRS 3, "Business Combinations":

In October 2018, the IASB issued an amendment to the definition

of a "business" in IFRS 3, "Business Combinations" ("the

Amendment").

The Amendment clarifies that in order to be considered a

business, an integrated set of activities and assets must include,

as a minimum, an input and a substantive process that together

significantly contribute to the ability to create outputs. The

Amendment also clarifies that a business can exist without

including all of the inputs and processes needed to create outputs.

The Amendment includes an optional concentration test according to

which it can be determined that a business has not been acquired,

without additional assessments.

The Amendment is applied prospectively to all business

combinations and asset acquisitions for which the acquisition date

is on or after 1 January 2020.

The application of the Amendment is not expected to have a

material effect on the Company.

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES (Cont.)

c . Disclosure of new standard in the period prior to their adoption:

Amendment to IFRS 16, "Leases":

In view of the global coronavirus crisis, in May 2020, the IASB

issued "Covid-19-Related Rent Concessions - Amendment to IFRS 16,

Leases" ("the Amendment"). The objective of the Amendment is to

allow a lessee to apply a practical expedient according to which

covid-19 related rent concessions will not be accounted for as

lease modifications but as variable lease payments. The relief

applies to lessees only.

The Amendment applies only to covid-19 related rent concessions

and only if all of the following conditions are met:

-- The revised future lease payments are substantially the same

or less than the original lease payments immediately preceding the

change;

-- The reduction in lease payments relates to payments due on or before 30 June 2021; and

-- No other substantive changes have been made to the terms of the lease.

The Amendment is to be applied retrospectively effective for

annual periods beginning on or after 1 June 2020, with earlier

application permitted.

The Company has evaluated the effects of the Amendment and

estimates that its adoption is not expected to have a material

impact on the financial statements since no material covid-19

related rent concessions have occurred or are expected to

occur.

NOTE 3: SUPPLEMENTARY INFORMATION

The spread of Coronavirus has had an impact on the Group's

operations. The Group has a well-balanced portfolio of assets,

however in February 2020 many sport events were cancelled around

the world which had a negative effect on the Group's revenue. A

similar effect was seen in the Group's Finance and Technology units

where many financial institutions cut marketing spend to a minimum.

The Casino vertical remained resilient throughout in sites

unaffected by the ongoing Google deranking. The Group is

continually monitoring and responding to the potential impact of

the outbreak, but as there is uncertainty regarding the duration of

the impact on future events, so there is ongoing uncertainty

regarding the total future effect on the Group's operations. The

Board of Directors and management have determined that the Group

will have sufficient liquidity for its operations for at least 12

months from the date of the interim consolidated financial

statements.

NOTE 4: DISCONTINUED OPERATIONS

In February 2019, the Company's board of directors decided to

reduce certain parts of its Media activities (comprising one CGU)

which had lower profit margins. In August 2019, the Company

completed the sale of Webpals Mobile Ltd ("Mobile") which is a

substantial component of the CGU. The gain derived from the sale is

USD 1.8 million.

a. Below is data of the operating results attributed to the discontinued operation:

Six months ended Year ended

30 June 31 December

------------------

2020 2019 2019

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Revenues from sales - 8,082 9,752

Cost of sales - 6,409 7,733

-------- -------- ------------

Gross profit - 1,673 2,019

Selling, general and administrative

expenses and research and

development expenses - 1,459 1,610

Operating income - 214 409

Financial expenses (income),

net - 76 37) )

Gain from sale of discontinued

operation - - 1,811

-------- -------- ------------

Income before income taxes

from discontinued operation - 138 2,257

Taxes on income - 59 40

Income from discontinued

operation, net - 79 2,217

======== ======== ============

b. Below is data of the net cash flows provided by (used in) the discontinued operation:

Six months ended Year ended

30 June 31 December

------------------

2020 2019 2019

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

---------------------------------

Operating activities - (166) 1,109

======== ======== ============

Investing activities - - 80

======== ======== ============

NOTE 5: OPERATING SEGMENTS

a. General:

The operating segments are identified on the basis of

information that is reviewed by the chief operating decision maker

("CODM") to make decisions about resources to be allocated and

assess its performance.

In 2019 the main part of the Group's Media activities was

classified a discontinued activity and sold. Other Media activities

which provided complementary activities to the Publishing

activities were integrated into the Publishing segment activities.

Subsequent to this integration the Group has one operating segment

- Publishing, which consists the operation of over 2,300 owned

informational websites in 18 languages. These websites refer

potential customers to online businesses. The sites' content,

written by professional writers, is designed to attract online

traffic which the Group then directs to its customers online

businesses.

b. Geographic information:

Revenues classified by geographical areas based on internet user

location:

Six months ended Year ended

30 June 31 December

------------------

20 20 2019 2019

-------- -------- ------------

Unaudited Audited

------------------ ------------

USD in thousands

--------------------------------

Scandinavia 11,372 18,594 34,667

Other European countries 7,991 11,604 21,458

North America 5,434 9,302 16,162

Asia 17 146 224

Oceania 461 814 1,375

Other countries 38 298 104

------------

Total revenues from identified

locations 25,313 40,758 73,990

Revenues from unidentified locations 2,402 1,70 1 5,705

------------

Total revenues 27,715 42,459 79,695

======== ======== ============

NOTE 6: SUBSEQUENT EVENTS

In August 2020, the Company decided not to exercise an option to

renew a lease of certain office space, where the renewal period was

originally included in the determination of the lease liabilities

and corresponding right-of-use assets in the interim condensed

consolidated financial statements. Accordingly, in the second half

of 2020, the Company will derecognise the lease liabilities by

approximately $ 3.7 million and the related right-of-use and other

assets by approximately $ 3.4 million. The expected impact on the

profit before taxes on income will be a gain of approximately $ 0.3

million.

- - - - - - - - - - - - - - - - -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DGGDCXGDDGGI

(END) Dow Jones Newswires

September 29, 2020 02:00 ET (06:00 GMT)

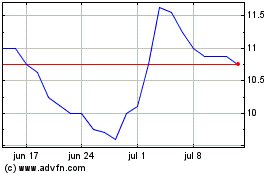

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Xlmedia (LSE:XLM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024