Jobs Report Fails to Settle Debate - Analyst Blog

04 Maio 2012 - 6:30AM

Zacks

The market’s attention today is focused on the home front, with

this morning’s weaker-than-expected April non-farm payroll report

putting the spotlight on the labor market. This report is in-line

with what we saw from ADP (ADP) on Wednesday and

the Bureau of Labor Statistics (BLS) in March, but fails to answer

the seasonality vs. fundamental weakness debate going on in the

market ever since the March miss.

The government agency announced April non-farm payroll gains of

115K, below expectations of 165K and March’s 154K level. The March

tally was revised higher from the original 120K level. The number

of job gains in March and February were revised upwards by a

combined 53K. Private sector jobs totaled 130K in April, along the

lines of what we saw from ADP on Wednesday and in the March reading

from BLS.

The unemployment rate, which comes out of the Household survey,

dropped to 8.1% from 8.2%. The average workweek remained unchanged

at 34.5 hours, while average hourly earnings remained unchanged

compared to the 0.2% increase in March. The labor force

participation rate, whose low level in this recovery is generally

cited by detractors of the down-trending unemployment rate as

evidence of discouraged workers, dropped to 63.6% from 63.8% in

March.

Today’s report was expected to confirm that the seasonal factors

were behind the recent run of soft economic readings, particularly

on the labor market front. We did not get evidence of that, which

means that we will have to wait longer to get conclusive evidence

favoring either side in the ongoing seasonal vs. fundamental

debate.

The weekend presidential election in France will likely see the

incumbent lose his job and heighten uncertainties about Europe’s

ability to come to grips with its problems. But economic reports

today show that the region’s economic growth prospects may be

weaker than many have been expecting.

The Eurozone PMI readings came out weaker than expected this

morning, likely confirming that the region’s economy remained in

recessionary territory at the start of the second quarter, the

third quarter in a row of negative growth. Lack of growth makes it

difficult for the region’s leaders to address its mounting fiscal

problems.

The overall tone of recent economic data, including this BLS

report, has been very mixed, making it difficult to settle the

debate. We got a sharp drop in weekly Jobless Claims, but the BLS

and ADP data were disappointing. We got good vehicle sales, solid

manufacturing ISM, but the services ISM was on the soft side.

It is difficult to draw firm conclusions from such data. I don’t

think this report improves the odds of further Fed QE, but the

market has typically been seeing that silver lining in all weak

economic readings.

In corporate news, we got better-than-expected earnings from

Estee Lauder (EL) on in-line revenue.

AON (AON), the insurance broker, missed earnings

expectations on in-line revenue. LinkedIn (LNKD)

posted better-than-expected results after the close on Thursday and

announced an acquisition.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

AON PLC (AON): Free Stock Analysis Report

ESTEE LAUDER (EL): Free Stock Analysis Report

LINKEDIN CORP-A (LNKD): Free Stock Analysis Report

To read this article on Zacks.com click here.

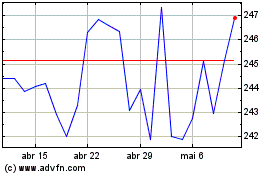

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024