Addus HomeCare Corporation (NASDAQ: ADUS), a provider of home

care services, today announced its financial results for the first

quarter ended March 31, 2024.

First Quarter 2024 Highlights:

- Revenues Grow 11.6% to $280.7 Million

- Net Income of $15.8 Million, or $0.97 per Diluted Share

- Adjusted Net Income per Diluted Share Increases to $1.21

- Adjusted EBITDA Increases 24.6% to $32.4 Million

- Cash Flow from Operations of $38.7 Million

Overview

Net service revenues were $280.7 million for the first quarter

of 2024, an 11.6% increase compared with $251.6 million for the

first quarter of 2023. Net income was $15.8 million for the first

quarter of 2024, compared with $12.7 million for the first quarter

of 2023, while net income per diluted share was $0.97 compared with

$0.78 for the same period a year ago. Adjusted EBITDA increased

24.6% to $32.4 million for the first quarter of 2024 from $26.0

million for the first quarter of 2023. Adjusted net income per

diluted share was $1.21 for the first quarter of 2024 compared with

$0.97 for the first quarter of 2023. Adjusted net income per

diluted share for the first quarter of 2024 excludes acquisition

expenses of $0.12 and stock-based compensation expense of $0.12

(See the end of press release for a reconciliation of all non-GAAP

and GAAP financial measures.)

Commenting on the results, Dirk Allison, Chairman and Chief

Executive Officer, said, “We are pleased to report a great start

for Addus in 2024, delivering a strong financial and operating

performance as we continued to build momentum as a leading provider

of home-based care services. With solid execution, we achieved

impressive top-line growth with overall revenues up 11.6% and

adjusted EBITDA up 24.6% compared with the first quarter of 2023.

The heightened awareness of the value and safety of home-based care

is helping to drive our growth, and our team has done an

exceptional job in meeting the increased demand with a proven

operating model across the continuum of home care.

“Our personal care segment, which accounted for 74.1% of our

business, was a key driver of our growth with a 9.3% revenue

increase over the first quarter of last year on a same-store basis.

We continued to benefit from steady volume trends as well as rate

increases in certain state markets. We have also experienced a more

stable labor environment, and we continue to see an improved

ability to hire and retain caregivers from our investments in more

efficient and effective hiring and scheduling systems, which

support our ability to efficiently manage higher patient

volume.

“Our first quarter results included the operations from

Tennessee Quality Care, a provider of home health, hospice, and

private duty nursing services, which we acquired August 1, 2023. We

were pleased to see continued steady improvement in our hospice

care business, with organic revenue growth of 5.8% over the same

period last year, which included the benefit of a 3.1% rate

increase as of October 1, 2023, and the impact of additional

Tennessee locations. Our volume trends in hospice care also

improved, with higher admissions, patient days, and revenue per

patient day compared with the first quarter of last year. Hospice

care now accounts for 20.0% of our business, and we will look to

continue to drive organic growth and expansion in this critical

area of care,” said Allison.

Cash and Liquidity

As of March 31, 2024, the Company had cash of $76.7 million and

bank debt of $101.4 million, with capacity and availability under

its revolving credit facility of $486.9 million and $377.5 million,

respectively. Net cash provided by operating activities was $38.7

million for the first quarter of 2024, and $30.9 million exclusive

of a net $7.8 million in ARPA funding.

Looking Ahead

Allison continued, “We have continued to generate strong cash

flow from operations, allowing us to further reduce our revolver

balance by $25.0 million and strengthen our balance sheet in the

first quarter. At the same time, we are focused on making the

necessary investments in our business to support continued growth.

We have the financial flexibility to remain focused on identifying

acquisition opportunities in attractive markets in 2024. Our

primary objective is to acquire accretive operations that enhance

our current personal care services, either by building scale or

adding complementary clinical services. Our size and scale are

important competitive advantages for Addus, and we will look for

additional opportunities to leverage our strong market presence,

particularly in markets where we participate in value-based

contracting models or may have the opportunity to do so.

“We are pleased with the favorable trends in our business,

reflecting the consistently growing demand for our home-based care

services. We are extremely proud of the important work we are doing

to allow more patients to receive safe, quality care in their

preferred setting of their home. Our success as a provider is due

to the dedicated caregivers who represent Addus in the marketplace,

and we are grateful for the outstanding care they are providing to

patients and families. We look forward to the opportunities ahead

for Addus in 2024 as we extend our market reach and deliver greater

value for our shareholders,” added Allison.

Non-GAAP Financial Measures

The information provided in this release includes adjusted net

income, adjusted EBITDA, and adjusted net income per diluted share,

which are non-GAAP financial measures. The Company defines adjusted

net income as net income before acquisition expenses, stock-based

compensation expenses, and restructure and other non-recurring

costs. The Company defines adjusted EBITDA as earnings before

interest expense, other non-operating income, taxes, depreciation,

amortization, acquisition expense, stock-based compensation

expense, and restructure and other non-recurring costs. The Company

defines adjusted net income per diluted share as net income per

share, adjusted for acquisition expenses, stock-based compensation

expense, and restructure and other non-recurring costs. The Company

defines adjusted net service revenues as revenue adjusted for the

closure of certain sites. The Company has provided, in the

financial statement tables included in this press release, a

reconciliation of adjusted net income to net income, a

reconciliation of adjusted EBITDA to net income, a reconciliation

of adjusted diluted net income per share to net income per share,

and a reconciliation of adjusted net service revenues to net

service revenues, in each case, the most directly comparable GAAP

measure. Management believes that adjusted net income, adjusted

EBITDA, adjusted diluted net income per share, and adjusted net

service revenues are useful to investors, management and others in

evaluating the Company’s operating performance, to provide

investors with insight and consistency in the Company’s financial

reporting and to present a basis for comparison of the Company’s

business operations among periods, and to facilitate comparison

with the results of the Company’s peers.

Conference Call

Addus will host a conference call on Tuesday, May 7, 2024, at

9:00 a.m. Eastern time. To access the live call, dial (833)

629-0620 (international dial-in number is (412) 317-1805) and ask

to join the Addus HomeCare earnings call. A telephonic replay of

the conference call will be available through midnight on May 14,

2024, by dialing (877) 344-7529 (international dial-in number is

(412) 317-0088) and entering pass code 2638095.

A live broadcast of Addus HomeCare’s conference call will be

available under the Investor Relations section of the Company’s

website: www.addus.com. An online replay will also be available on

the Company’s website for one month, beginning approximately two

hours following the conclusion of the live broadcast.

Forward-Looking Statements

Certain matters discussed in this press release constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements may be identified by words such as “preliminary,”

“continue,” “expect,” and similar expressions. These

forward-looking statements are based on our current expectations

and beliefs concerning future developments and their potential

effect on us. Forward-looking statements involve a number of risks

and uncertainties that may cause actual results to differ

materially from those expressed or implied by such forward-looking

statements, including discretionary determinations by government

officials, the consummation and integration of acquisitions,

transition to managed care providers, our ability to successfully

execute our growth strategy, unexpected increases in SG&A and

other expenses, expected benefits and unexpected costs of

acquisitions and dispositions, management plans related to

dispositions, the possibility that expected benefits may not

materialize as expected, the failure of the business to perform as

expected, changes in reimbursement, changes in government

regulations, changes in Addus HomeCare’s relationships with

referral sources, increased competition for Addus HomeCare’s

services, changes in the interpretation of government regulations,

the uncertainty regarding the outcome of discussions with managed

care organizations, changes in tax rates, the impact of adverse

weather, higher than anticipated costs, lower than anticipated cost

savings, estimation inaccuracies in future revenues, margins,

earnings and growth, whether any anticipated receipt of payments

will materialize, any security breaches, cyber-attacks, loss of

data or cybersecurity threats or incidents, and other risks set

forth in the Risk Factors section in Addus HomeCare’s Annual Report

on Form 10-K filed with the Securities and Exchange Commission on

February 27, 2024, which is available at www.sec.gov. The financial

information described herein and the periods to which they relate

are preliminary estimates that are subject to change and

finalization. There is no assurance that the final amounts and

adjustments will not differ materially from the amounts described

above, or that additional adjustments will not be identified, the

impact of which may be material. Addus HomeCare undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

In addition, these forward-looking statements necessarily depend

upon assumptions, estimates and dates that may be incorrect or

imprecise and involve known and unknown risks, uncertainties, and

other factors. Accordingly, any forward-looking statements included

in this press release do not purport to be predictions of future

events or circumstances and may not be realized. (Unaudited tables

and notes follow).

About Addus HomeCare

Addus HomeCare is a provider of home care services that

primarily include personal care services that assist with

activities of daily living, as well as hospice and home health

services. Addus HomeCare’s consumers are primarily persons who,

without these services, are at risk of hospitalization or

institutionalization, such as the elderly, chronically ill and

disabled. Addus HomeCare’s payor clients include federal, state,

and local governmental agencies, managed care organizations,

commercial insurers, and private individuals. Addus HomeCare

currently provides home care services to over 49,000 consumers

through 214 locations across 22 states. For more information,

please visit www.addus.com.

ADDUS HOMECARE CORPORATION AND SUBSIDIARIES Condensed

Consolidated Statements of Income (amounts and shares in

thousands, except per share data) (Unaudited)

Income Statement Information: For the Three Months Ended

March 31,

2024

2023

Net service revenues

$

280,746

$

251,599

Cost of service revenues

192,569

173,184

Gross profit

88,177

78,415

31.4

%

31.2

%

General and administrative expenses

61,063

56,360

Depreciation and amortization

3,469

3,447

Total operating expenses

64,532

59,807

Operating income from continuing operations

23,645

18,608

Total interest expense, net

2,335

2,355

Income before income taxes

21,310

16,253

Income tax expense

5,480

3,578

Net income

$

15,830

$

12,675

Net income per diluted share:

$

0.97

$

0.78

Weighted average number of common shares outstanding:

Diluted

16,373

16,297

Cash Flow Information: For the Three Months

Ended March 31,

2024

2023

Net cash provided by operating activities

$

38,678

$

18,799

Net cash used in investing activities

(1,750

)

(1,742

)

Net cash used in financing activities

(25,000

)

(23,475

)

Net change in cash

11,928

(6,418

)

Cash at the beginning of the period

64,791

79,961

Cash at the end of the period

$

76,719

$

73,543

ADDUS HOMECARE CORPORATION AND SUBSIDIARIES Condensed

Consolidated Balance Sheets (Amounts in thousands)

(Unaudited) March 31,

2024

2023

Assets Current assets

Cash

$

76,719

$

73,543

Accounts receivable, net

104,727

125,441

Prepaid expenses and other current assets

10,401

10,226

Total current assets

191,847

209,210

Property and equipment, net

23,872

20,248

Other assets Goodwill

663,391

583,972

Intangible assets, net

90,191

70,604

Operating lease assets

44,699

47,049

Total other assets

798,281

701,625

Total assets

$

1,014,000

$

931,083

Liabilities and stockholders'

equity Current liabilities Accounts payable

$

22,022

$

21,758

Accrued payroll

44,022

34,105

Accrued expenses

38,772

34,018

Operating lease liabilities, current portion

11,307

11,099

Government stimulus advance

13,548

10,996

Accrued workers compensation

11,920

12,683

Total current liabilities

141,591

124,659

Long-term debt, less current portion, net of debt issuance

costs

99,347

108,487

Long-term operating lease liabilities, less current portion

39,044

42,994

Other long-term liabilities

8,875

6,057

Total long-term liabilities

147,266

157,538

Total liabilities

288,857

282,197

Total stockholders' equity

725,143

648,886

Total liabilities and stockholders' equity

$

1,014,000

$

931,083

ADDUS HOMECARE CORPORATION AND SUBSIDIARIES Net

Service Revenue by Segment (Amounts in thousands)

(Unaudited) For the Three MonthsEnded March

31,

2024

2023

Net Service Revenues by Segment Personal Care

$

208,003

$

190,032

Hospice

55,863

49,082

Home Health

16,880

12,485

Total Revenue

$

280,746

$

251,599

ADDUS HOMECARE CORPORATION AND SUBSIDIARIES Key

Statistical and Financial Data (Unaudited) Key Statistical and Financial Data (Unaudited)

For the Three MonthsEnded March 31,

2024

2023

Personal Care States served at period end

21

21

Locations served at period end

153

157

Average billable census total (1)

37,715

38,363

Billable hours (in thousands)

7,590

7,592

Average billable hours per census per month

67.0

65.8

Billable hours per business day

116,769

116,805

Revenues per billable hour

$

27.35

$

24.98

Organic growth - Revenue

9.3

%

11.4

%

Hospice Locations served at period end

38

33

Admissions

3,472

3,324

Average daily census (2)

3,359

3,195

Average discharge length of stay

89.6

87.7

Patient days

305,630

287,551

Revenue per patient day

$

182.78

$

176.22

Organic growth - Revenue

5.8

%

2.6

%

- Average daily census

(1.1

)

%

1.5

%

Home Health Locations served at period end

23

13

New Admissions

4,887

3,893

Recertifications

3,168

1,549

Total Volume

8,055

5,442

Visits

106,931

77,828

Organic growth - Revenue

(15.1

)

%

13.8

%

- New Admissions

(4.0

)

%

(3.6

)

%

- Volume

(3.1

)

%

(1.2

)

%

Percentage of Revenues by Payor: Personal

Care State, local and other governmental programs

51.8

%

50.1

%

Managed care organizations

45.3

46.3

Private duty

1.9

2.2

Commercial

0.7

0.9

Other

0.3

%

0.5

%

Hospice Medicare

90.7

%

90.7

%

Commercial

5.6

5.2

Managed care organizations

3.3

3.4

Other

0.4

%

0.7

%

Home Health Medicare

69.1

%

74.2

%

Managed care organizations

26.1

20.3

Commercial

4.1

5.2

Other

0.7

%

0.3

%

(1) The average billable census in acquisitions of 145 for

the three months ended March 31, 2023, was reclassified to average

billable census - same stores for comparability purposes.

(2) Exited sites would have reduced average daily census for the

three months ended March 31, 2023 by 5.

ADDUS HOMECARE

CORPORATION AND SUBSIDIARIES Reconciliation of Non-GAAP

Financial Measures (Amounts in thousands, except per share

data) (Unaudited) (1) For the Three

MonthsEnded March 31,

2024

2023

Reconciliation of Adjusted EBITDA to Net Income: (1)

Net income

$

15,830

$

12,675

Interest expense, net

2,335

2,355

Income tax expense

5,480

3,578

Depreciation and amortization

3,469

3,447

Acquisition expenses

2,711

1,247

Stock-based compensation expense

2,618

2,646

Restructuring and other non-recurring costs

-

95

Adjusted EBITDA

$

32,443

$

26,043

Reconciliation of Adjusted Net Income to Net

Income: (2) Net income

$

15,830

$

12,675

Acquisition expenses

2,711

1,247

Stock-based compensation expense

2,618

2,646

Restructuring and other non-recurring costs

-

95

Tax effect

(1,370

)

(878

)

Adjusted Net Income

19,789

15,785

Reconciliation of Diluted Earnings per Share to

Adjusted Diluted Earnings per Share: (3) Diluted

earnings per share

$

0.97

$

0.78

Acquisition expenses, per diluted share

0.12

0.06

Restructuring and other non-recurring costs per diluted share

-

-

Stock-based compensation expense per diluted share

0.12

0.13

Adjusted net income per diluted share

$

1.21

$

0.97

Reconciliation of Net Service Revenues to Adjusted Net

Service Revenues: (4) Net service revenues

$

280,746

$

251,599

Revenue associated with the closure of certain sites

-

(524

)

Adjusted net service revenues

$

280,746

$

251,075

Footnotes: (1) We define Adjusted EBITDA as earnings before

net interest expense, income tax expense, depreciation and

amortization, acquisition expenses, stock-based compensation

expense, restructure expenses and other non-recurring costs.

Adjusted EBITDA is a performance measure used by management that is

not calculated in accordance with generally accepted accounting

principles in the United States (GAAP). It should not be considered

in isolation or as a substitute for net income, operating income or

any other measure of financial performance calculated in accordance

with GAAP.

(2) We define Adjusted Net Income as net income before acquisition

expenses, stock-based compensation expense, restructure and other

non-recurring costs. Adjusted Net Income is a performance measure

used by management that is not calculated in accordance with

generally accepted accounting principles in the United States

(GAAP). It should not be considered in isolation or as a substitute

for net income, operating income or any other measure of financial

performance calculated in accordance with GAAP.

(3) We define Adjusted diluted earnings per share as earnings per

share, adjusted for acquisition expenses, stock-based compensation

expense and restructure and other non-recurring costs. Adjusted

diluted earnings per share is a performance measure used by

management that is not calculated in accordance with generally

accepted accounting principles in the United States (GAAP). It

should not be considered in isolation or as a substitute for net

income, operating income or any other measure of financial

performance calculated in accordance with GAAP.

(4) We define Adjusted net service revenues as revenue adjusted for

the closure of certain sites. Adjusted net service revenues is a

performance measure used by management that is not calculated in

accordance with generally accepted accounting principles in the

United States (GAAP). It should not be considered in isolation or

as a substitute for net income, operating income or any other

measure of financial performance calculated in accordance with

GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506703010/en/

Brian W. Poff Executive Vice President, Chief Financial Officer

Addus HomeCare Corporation (469) 535-8200

investorrelations@addus.com

Dru Anderson FINN Partners (615) 324-7346

dru.anderson@finnpartners.com

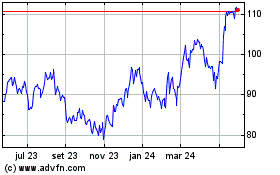

Addus HomeCare (NASDAQ:ADUS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

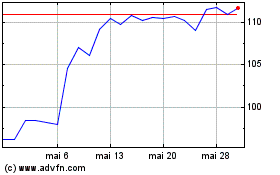

Addus HomeCare (NASDAQ:ADUS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024