Amarin Corporation plc (NASDAQ:AMRN), today announced financial

results for the quarter and year ended December 31, 2023 and

provided an update on the Company’s operations.

“Our team is delivering operational momentum in the

business. As previously announced in January, in Europe we are

showing early signs of progress, particularly in Spain and the

U.K.; our U.S. business is continuing its IPE market leadership;

and our Rest of World (ROW) partners are advancing plans to

maximize patient uptake,” said Patrick Holt, President & CEO of

Amarin. “We have initiated the shareholder approval process to

execute up to a $50 million share repurchase program. Our focus

remains on building momentum in 2024 and beyond for Amarin.”

Financial UpdateTotal net revenue

for the three months ended December 31, 2023 was $74.7 million,

compared to $90.2 million in the corresponding period of 2022, a

decrease of 17%. Net product revenue for the three months ended

December 31, 2023 was $70.6 million, compared to $89.5 million in

the corresponding period of 2022, a decrease of 21%. This decrease

was driven primarily by a decrease in volume of VASCEPA sales to

Amarin’s customers in the United States, which were adversely

impacted by generic availability in the United States. USA net

product revenue was $64.9 million for the three months ended

December 31, 2023 compared to $88.0 million in the corresponding

period of 2022. For the three months ended December 31, 2023,

European net product revenue was $1.5 million and Rest of World

(RoW) net product revenue was $4.2 million primarily from supply

shipments to our partner Edding.

Amarin recognized licensing and royalty revenue of

approximately $4.2 million for the three months ended December 31,

2023 compared to $0.7 million in the corresponding period of 2022

from VASCEPA-related regulatory milestones, including the

cardiovascular risk reduction (CVRR) submission, and commercial

sales from our partners in Canada, the China region and the Middle

East.

Cost of goods sold for the three months ended

December 31, 2023 was $29.6 million, compared to $26.6 million in

the corresponding period of 2022. Amarin’s overall gross margin on

net product revenue for the three months ended December 31, 2023

was 58%, compared with 70% for the corresponding period of

2022.

Selling, general and administrative expenses for

the three months ended December 31, 2023 was $43.9 million,

compared to $68.1 million in the corresponding period of the prior

year. This decrease was primarily due to a reduction in costs from

the elimination of our U.S. sales force as part of our

organizational restructuring program and previous cost reduction

plan and was partially offset by ongoing investments to support

commercial operations in Europe.

Research and development expenses for the three

months ended December 31, 2023 were $5.8 million, compared to $5.2

million in the corresponding period of the prior year.

Under U.S. GAAP, Amarin reported a net loss of $5.8

million for the three months ended December 31, 2023, or basic and

diluted loss per share of $0.01. This net loss includes $4.6

million in non-cash stock-based compensation. For the three months

ended December 31, 2022, Amarin reported net income of $0.9

million, or basic and diluted earnings per share of $0.00. This net

income included $6.6 million in non-cash stock-based compensation

expense.

Excluding non-cash stock-based compensation expense

and restructuring expense, non-GAAP adjusted net loss was $0.9

million for the three months ended December 31, 2023 or non-GAAP

adjusted basic and diluted loss per share of $0.00, compared with

non-GAAP adjusted net income of $7.3 million for the three months

ended December 31, 2022, or non-GAAP adjusted basic and diluted

earnings per share of $0.02. As of December 31, 2023, Amarin

reported aggregate cash and investments of $321 million.

2024 Financial Outlook Amarin

continues to make progress on reducing operating expenses and

managing its cash position and is on-track to deliver $40 million

of annual savings based on the reduction in force announced in July

2023. With the recent cash preservation initiatives, Amarin

reiterates its belief that current cash and investments and other

assets are adequate to support continued operations including the

share repurchase program. We will continue to focus on cash

preservation and prudently invest in the right opportunities which

are value additive.

Conference Call and Webcast

InformationAmarin will host a conference call on February

29, 2024, at 8:00 a.m. ET to discuss this information. The

conference call can be accessed on the investor relations section

of the company's website at www.amarincorp.com, or via telephone by

dialing 888-506-0062 within the United States, 973-528-0011 from

outside the United States, and referencing conference ID 996476. A

replay of the call will be made available for a period of two weeks

following the conference call. To listen to a replay of the call,

dial 877-481-4010 from within the United States and 919-882-2331

from outside of the United States, and reference conference ID

49775. A replay of the call will also be available through the

company's website shortly after the call.

About AmarinAmarin is an

innovative pharmaceutical company leading a new paradigm in

cardiovascular disease management. We are committed to increasing

the scientific understanding of the cardiovascular risk that

persists beyond traditional therapies and advancing the treatment

of that risk for patients worldwide. Amarin has offices in

Bridgewater, New Jersey in the United States, Dublin in Ireland,

Zug in Switzerland, and other countries in Europe as well as

commercial partners and suppliers around the world.

About VASCEPA®/VAZKEPA® (icosapent ethyl)

Capsules VASCEPA (icosapent ethyl) capsules are the

first prescription treatment approved by the U.S. Food and Drug

Administration (FDA) comprised solely of the active ingredient,

icosapent ethyl (IPE), a unique form of eicosapentaenoic acid.

VASCEPA was launched in the United States in January 2020 as the

first drug approved by the U.S. FDA for treatment of the studied

high-risk patients with persistent cardiovascular risk despite

being on statin therapy. VASCEPA was initially launched in the

United States in 2013 based on the drug’s initial FDA approved

indication for use as an adjunct therapy to diet to reduce

triglyceride levels in adult patients with severe (≥500 mg/dL)

hypertriglyceridemia. Since launch, VASCEPA has been prescribed

more than twenty million times. VASCEPA is covered by most major

medical insurance plans. In addition to the United States, VASCEPA

is approved and sold in Canada, China, Lebanon and the United Arab

Emirates. In Europe, in March 2021 marketing authorization was

granted to icosapent ethyl in the European Union for the reduction

of risk of cardiovascular events in patients at high cardiovascular

risk, under the brand name VAZKEPA. In April 2021 marketing

authorization for VAZKEPA (icosapent ethyl) was granted in Great

Britain (applying to England, Scotland and Wales). VAZKEPA

(icosapent ethyl) is currently approved and sold in Europe in

Sweden, Denmark, Finland, Austria, the UK, Spain and the

Netherlands.

United StatesIndications

and Limitation of UseVASCEPA is indicated:

- As an adjunct to maximally tolerated statin therapy to reduce

the risk of myocardial infarction, stroke, coronary

revascularization and unstable angina requiring hospitalization in

adult patients with elevated triglyceride (TG) levels (≥ 150 mg/dL)

and

- established cardiovascular disease or

- diabetes mellitus and two or more additional risk factors for

cardiovascular disease.

- As an adjunct to diet to reduce TG levels in adult patients

with severe (≥ 500 mg/dL) hypertriglyceridemia.

The effect of VASCEPA on the risk for pancreatitis

in patients with severe hypertriglyceridemia has not been

determined.

Important Safety

Information

- VASCEPA is contraindicated in patients with known

hypersensitivity (e.g., anaphylactic reaction) to VASCEPA or any of

its components.

- VASCEPA was associated with an increased risk (3% vs 2%) of

atrial fibrillation or atrial flutter requiring hospitalization in

a double-blind, placebo-controlled trial. The incidence of atrial

fibrillation was greater in patients with a previous history of

atrial fibrillation or atrial flutter.

- It is not known whether patients with allergies to fish and/or

shellfish are at an increased risk of an allergic reaction to

VASCEPA. Patients with such allergies should discontinue VASCEPA if

any reactions occur.

- VASCEPA was associated with an increased risk (12% vs 10%) of

bleeding in a double-blind, placebo-controlled trial. The incidence

of bleeding was greater in patients receiving concomitant

antithrombotic medications, such as aspirin, clopidogrel or

warfarin.

- Common adverse reactions in the cardiovascular outcomes trial

(incidence ≥3% and ≥1% more frequent than placebo): musculoskeletal

pain (4% vs 3%), peripheral edema (7% vs 5%), constipation (5% vs

4%), gout (4% vs 3%), and atrial fibrillation (5% vs

4%).

- Common adverse reactions in the hypertriglyceridemia trials

(incidence >1% more frequent than placebo): arthralgia (2% vs

1%) and oropharyngeal pain (1% vs 0.3%).

- Adverse events may be reported by calling 1-855-VASCEPA or the

FDA at 1-800-FDA-1088.

- Patients receiving VASCEPA and concomitant anticoagulants

and/or anti-platelet agents should be monitored for

bleeding.

FULL U.S. FDA-APPROVED

VASCEPA PRESCRIBING INFORMATION

CAN BE FOUND AT

WWW.VASCEPA.COM.

Europe

For further information about the Summary of

Product Characteristics (SmPC) for VAZKEPA® in Europe,

please click here.

Globally, prescribing information varies; refer to

the individual country product label for complete

information.

Additional Information Regarding Amarin

Share Repurchase Agreement The implementation of the

repurchase agreement is conditional upon shareholder and UK court

approval, as required under UK company law. The Company intends to

accelerate its annual general meeting of shareholders early in the

second quarter of 2024 in order to seek such shareholder approval,

following which it will proceed with the requisite court process to

undertake a reduction of capital in order to create the necessary

distributable profits for the funding of the repurchases. Amarin

anticipates that these steps could be completed by the end of the

second quarter of 2024, with share repurchases commencing shortly

thereafter. Following receipt of the requisite approvals, Cantor

will purchase such ADSs in compliance with the safe harbor

provisions of Rule 10b-18 of the U.S. securities laws and the terms

of the approved repurchase contract. The repurchase program will

conclude at such time as Cantor has purchased $50 million of ADSs,

unless terminated earlier by either Amarin or Cantor, as provided

for in the repurchase agreement. Subject to the necessary

shareholder and court approvals being obtained, the repurchases

will be funded out of distributable profits utilizing the Company’s

existing cash resources. The repurchase program was approved by the

Amarin board in compliance with UK company law regarding

distributions and the maintenance of capital. A copy of the

repurchase agreement will be available for inspection by Amarin’s

shareholders at the registered office address of Amarin in the run

up to the 2024 annual general meeting and, once entered into, will

be available for inspection for at least 10 years from the date of

such agreement.

Use of Non-GAAP Adjusted Financial

Information Included in this press release are non-GAAP

adjusted financial information as defined by U.S. Securities and

Exchange Commission Regulation G. The GAAP financial measure most

directly comparable to each non-GAAP adjusted financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP adjusted financial measure and the comparable GAAP

financial measure, is included in this press release after the

consolidated financial statements.

Non-GAAP adjusted net (loss) income was derived by

taking GAAP net loss and adjusting it for non-cash stock-based

compensation expense and restructuring expense. Management uses

these non-GAAP adjusted financial measures for internal reporting

and forecasting purposes, when publicly providing its business

outlook, to evaluate the company’s performance and to evaluate and

compensate the company’s executives. The company has provided these

non-GAAP financial measures in addition to GAAP financial results

because it believes that these non-GAAP adjusted financial measures

provide investors with a better understanding of the company’s

historical results from its core business operations.

While management believes that these non-GAAP

adjusted financial measures provide useful supplemental information

to investors regarding the underlying performance of the company’s

business operations, investors are reminded to consider these

non-GAAP measures in addition to, and not as a substitute for,

financial performance measures prepared in accordance with GAAP.

Non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with the company’s results of operations

as determined in accordance with GAAP. In addition, it should be

noted that these non-GAAP financial measures may be different from

non-GAAP measures used by other companies, and management may

utilize other measures to illustrate performance in the future.

Forward-Looking StatementsThis

press release contains forward-looking statements which are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including beliefs about Amarin’s key

achievements in 2023 and the potential impact and outlook for

achievements in 2024 and beyond; Amarin’s 2024 financial outlook

and cash position; Amarin’s overall efforts to expand access and

reimbursement to VAZKEPA across global markets; and the overall

potential and future success of VASCEPA/VAZKEPA and Amarin

generally. These forward-looking statements are not promises or

guarantees and involve substantial risks and uncertainties. A

further list and description of these risks, uncertainties and

other risks associated with an investment in Amarin can be found in

Amarin's filings with the U.S. Securities and Exchange Commission,

including Amarin’s annual report on Form 10-K for the full year

ended 2023. Existing and prospective investors are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made. Amarin undertakes no

obligation to update or revise the information contained in its

forward-looking statements, whether as a result of new information,

future events or circumstances or otherwise. Amarin’s

forward-looking statements do not reflect the potential impact of

significant transactions the company may enter into, such as

mergers, acquisitions, dispositions, joint ventures or any material

agreements that Amarin may enter into, amend or terminate.

Implementation of the share repurchase program is

subject to shareholder and UK court approval, which may not be

obtained in a timely manner or at all; Cantor may be unable to

repurchase some or all of the ADSs within the parameters provided

for in the share repurchase agreement; and the share repurchase may

not have the expected results.

Availability of Other Information About

AmarinInvestors and others should note that Amarin

communicates with its investors and the public using the company

website (www.amarincorp.com), the investor relations website

(investor.amarincorp.com), including but not limited to investor

presentations and investor FAQs, U.S. Securities and Exchange

Commission filings, press releases, public conference calls and

webcasts. The information that Amarin posts on these channels and

websites could be deemed to be material information. As a result,

Amarin encourages investors, the media, and others interested in

Amarin to review the information that is posted on these channels,

including the investor relations website, on a regular basis. This

list of channels may be updated from time to time on Amarin’s

investor relations website and may include social media channels.

The contents of Amarin’s website or these channels, or any other

website that may be accessed from its website or these channels,

shall not be deemed incorporated by reference in any filing under

the Securities Act of 1933.

Amarin Contact InformationInvestor

& Media Inquiries:Mark MarmurAmarin Corporation

plcPR@amarincorp.com

|

|

CONSOLIDATED BALANCE SHEET DATA |

|

|

|

(U.S. GAAP) |

|

|

|

Unaudited * |

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

|

|

|

|

|

(in thousands) |

|

|

|

ASSETS |

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

199,252 |

|

|

$ |

217,666 |

|

|

|

|

Restricted cash |

|

|

525 |

|

|

|

523 |

|

|

|

|

Short-term investments |

|

|

121,407 |

|

|

|

91,695 |

|

|

|

|

Accounts receivable, net |

|

|

133,563 |

|

|

|

130,990 |

|

|

|

|

Inventory |

|

|

258,616 |

|

|

|

228,732 |

|

|

|

|

Prepaid and other current assets |

|

|

11,618 |

|

|

|

19,492 |

|

|

|

|

Total current assets |

|

|

724,981 |

|

|

|

689,098 |

|

|

|

|

Property, plant and equipment, net |

|

|

114 |

|

|

|

874 |

|

|

|

|

Long-term investments |

|

|

— |

|

|

|

1,275 |

|

|

|

|

Long-term inventory |

|

|

77,615 |

|

|

|

163,620 |

|

|

|

|

Operating lease right-of-use asset |

|

|

8,310 |

|

|

|

9,074 |

|

|

|

|

Other long-term assets |

|

|

1,360 |

|

|

|

458 |

|

|

|

|

Intangible asset, net |

|

|

19,304 |

|

|

|

21,780 |

|

|

|

|

TOTAL ASSETS |

|

$ |

831,684 |

|

|

$ |

886,179 |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

52,762 |

|

|

$ |

64,602 |

|

|

|

|

Accrued expenses and other current liabilities |

|

|

204,174 |

|

|

|

192,678 |

|

|

|

|

Current deferred revenue |

|

|

2,341 |

|

|

|

2,199 |

|

|

|

|

Total current liabilities |

|

|

259,277 |

|

|

|

259,479 |

|

|

|

|

Long-Term Liabilities: |

|

|

|

|

|

|

|

Long-term deferred revenue |

|

|

2,509 |

|

|

|

13,147 |

|

|

|

|

Long-term operating lease liability |

|

|

8,737 |

|

|

|

10,015 |

|

|

|

|

Other long-term liabilities |

|

|

9,064 |

|

|

|

8,205 |

|

|

|

|

Total liabilities |

|

|

279,587 |

|

|

|

290,846 |

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

Common stock |

|

|

302,756 |

|

|

|

299,002 |

|

|

|

|

Additional paid-in capital |

|

|

1,899,456 |

|

|

|

1,885,352 |

|

|

|

|

Treasury stock |

|

|

(63,752 |

) |

|

|

(61,770 |

) |

|

|

|

Accumulated deficit |

|

|

(1,586,363 |

) |

|

|

(1,527,251 |

) |

|

|

|

Total stockholders’ equity |

|

|

552,097 |

|

|

|

595,333 |

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

831,684 |

|

|

$ |

886,179 |

|

|

| |

|

|

|

|

|

|

| |

* Unaudited as a standalone schedule; copied from consolidated

financial statements |

|

| |

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS DATA |

|

|

|

(U.S. GAAP) |

|

|

|

Unaudited * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

|

(in thousands, except per share amounts) |

|

(in thousands, except per share amounts) |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

70,555 |

|

|

$ |

89,507 |

|

|

$ |

285,299 |

|

|

$ |

366,511 |

|

|

|

|

Licensing and royalty revenue |

|

4,158 |

|

|

|

738 |

|

|

|

21,612 |

|

|

|

2,682 |

|

|

|

|

Total revenue, net |

|

74,713 |

|

|

|

90,245 |

|

|

|

306,911 |

|

|

|

369,193 |

|

|

|

|

Less: Cost of goods sold |

|

29,589 |

|

|

|

26,641 |

|

|

|

102,142 |

|

|

|

108,631 |

|

|

|

|

Less: Cost of goods sold - restructuring inventory |

|

— |

|

|

|

— |

|

|

|

39,228 |

|

|

|

18,078 |

|

|

|

|

Gross margin |

|

45,124 |

|

|

|

63,604 |

|

|

|

165,541 |

|

|

|

242,484 |

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative (1) |

|

43,941 |

|

|

|

68,131 |

|

|

|

199,938 |

|

|

|

304,416 |

|

|

|

|

Research and development (1) |

|

5,791 |

|

|

|

5,239 |

|

|

|

22,219 |

|

|

|

30,411 |

|

|

|

|

Restructuring |

|

229 |

|

|

|

(180 |

) |

|

|

10,972 |

|

|

|

13,526 |

|

|

|

|

Total operating expenses |

|

49,961 |

|

|

|

73,190 |

|

|

|

233,129 |

|

|

|

348,353 |

|

|

|

|

Operating loss |

|

(4,837 |

) |

|

|

(9,586 |

) |

|

|

(67,588 |

) |

|

|

(105,869 |

) |

|

|

|

Interest income |

|

3,419 |

|

|

|

1,564 |

|

|

|

11,863 |

|

|

|

2,819 |

|

|

|

|

Interest expense |

|

(2 |

) |

|

|

(1 |

) |

|

|

(8 |

) |

|

|

(15 |

) |

|

|

|

Other (expense) income, net |

|

(1,029 |

) |

|

|

1,250 |

|

|

|

2,063 |

|

|

|

(740 |

) |

|

|

|

Loss from operations before taxes |

|

(2,449 |

) |

|

|

(6,773 |

) |

|

|

(53,670 |

) |

|

|

(103,805 |

) |

|

|

|

(Provision for) benefit from income taxes |

|

(3,332 |

) |

|

|

7,629 |

|

|

|

(5,442 |

) |

|

|

(1,998 |

) |

|

|

|

Net (loss) income |

$ |

(5,781 |

) |

|

$ |

856 |

|

|

$ |

(59,112 |

) |

|

$ |

(105,803 |

) |

|

|

|

(Loss) earnings per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.01 |

) |

|

$ |

0.00 |

|

|

$ |

(0.15 |

) |

|

$ |

(0.26 |

) |

|

|

|

Diluted |

$ |

(0.01 |

) |

|

$ |

0.00 |

|

|

$ |

(0.15 |

) |

|

$ |

(0.26 |

) |

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

408,485 |

|

|

|

399,491 |

|

|

|

407,655 |

|

|

|

401,155 |

|

|

|

|

Diluted |

|

408,485 |

|

|

|

401,696 |

|

|

|

407,655 |

|

|

|

401,155 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Unaudited as a standalone schedule; copied from consolidated

financial statements |

|

|

|

(1) Excluding non-cash stock-based compensation, selling, general

and administrative expenses were 187,445 and 282,076 for 2023 and

2022, respectively, and research and development expenses were

18,032 and 25,946, respectively, for the same periods. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

RECONCILIATION OF NON-GAAP NET (LOSS) INCOME |

|

| |

Unaudited |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended December 31, |

|

Year Ended

December 31, |

|

| |

|

(in thousands, except per share amounts) |

|

(in thousands, except per share amounts) |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income for EPS - GAAP |

|

$ |

(5,781 |

) |

|

|

$ |

856 |

|

|

|

$ |

(59,112 |

) |

|

|

$ |

(105,803 |

) |

|

|

|

Stock-based compensation expense |

|

|

4,646 |

|

|

|

|

6,612 |

|

|

|

|

16,680 |

|

|

|

|

26,805 |

|

|

| |

Restructuring Inventory |

|

|

— |

|

|

|

|

— |

|

|

|

|

39,228 |

|

|

|

|

18,078 |

|

|

| |

Restructuring expense |

|

229 |

|

|

|

|

(180 |

) |

|

|

|

10,972 |

|

|

|

|

13,526 |

|

|

| |

Advisor Fees |

|

— |

|

|

|

|

— |

|

|

|

|

6,270 |

|

|

|

|

— |

|

|

| |

Adjusted net

(loss) income for EPS - non-GAAP |

|

$ |

(906 |

) |

|

|

$ |

7,288 |

|

|

|

$ |

14,038 |

|

|

|

$ |

(47,394 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and

diluted |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Loss)

earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic -

non-GAAP |

|

$ |

(0.00 |

) |

|

|

$ |

0.02 |

|

|

|

$ |

0.03 |

|

|

|

$ |

(0.12 |

) |

|

| |

Diluted -

non-GAAP |

|

$ |

(0.00 |

) |

|

|

$ |

0.02 |

|

|

|

$ |

0.03 |

|

|

|

$ |

(0.12 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted

average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

408,485 |

|

|

|

|

399,491 |

|

|

|

|

407,655 |

|

|

|

|

401,155 |

|

|

| |

Diluted |

|

|

408,485 |

|

|

|

|

401,696 |

|

|

|

|

422,966 |

|

|

|

|

401,155 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

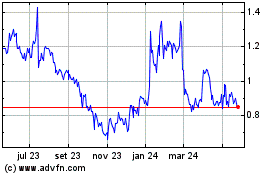

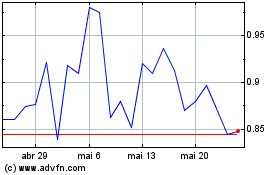

Amarin (NASDAQ:AMRN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Amarin (NASDAQ:AMRN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024