As filed with the Securities and Exchange Commission on May 16, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Sphere

3D Corp.

(Exact name of registrant as specified in its charter)

| Ontario, Canada |

|

98-1220792 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

4 Greenwich Office Park

1st Floor

Greenwich, Connecticut 06831

(647) 952-5049

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Patricia Trompeter

4 Greenwich Office Park

1st Floor

Greenwich, Connecticut 06831

(647) 952-5049

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

M. Ali Panjwani, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 326-0846

Approximate date of commencement of proposed sale to the public: As

soon as practicable after the effective date of this Registration Statement

If only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection

with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☐ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act ☐

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on

such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933

or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is

not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS

|

|

SUBJECT TO COMPLETION |

|

DATED MAY

16, 2023 |

Sphere 3D Corp.

19,655,115

Common Shares

This prospectus relates to

the resale, from time to time, by the selling stockholder named herein (the “Selling Stockholder”) of (i) an aggregate

of 3,360,216 of our common shares issuable upon the conversion of an outstanding convertible promissory note (the “Tranche 1

Note”), (ii) 6,720,432 of our common shares issuable upon conversion of a convertible

promissory note to be issued by us, subject to certain conditions precedent, within five (5) business days of the date on which this registration

statement is declared effective (the “Tranche 2 Note” and, together with the Tranche 1 Note, the “Notes”), (iii) an aggregate of 3,191,489 common shares issuable upon the exercise of an outstanding common share

purchase warrant (the “Tranche 1 Warrant”) and (iv) 6,382,978 common shares issuable

upon exercise of a common share purchase warrant to be issued in connection with the Tranche 2 Note (the “Tranche 2 Warrant”

and, together with the Tranche 1 Warrant, the “Warrants”).

We are not selling any securities

under this prospectus and we will not receive proceeds from the sale of the shares of our common shares by the Selling Stockholder. However,

we may receive proceeds from the cash exercise of the Warrants, which, if exercised in cash at the current applicable exercise price

with respect to all of the 9,574,467 common shares, would result in gross proceeds to us of approximately $4,500,000.

We will pay the expenses of

registering the common shares offered by this prospectus, but all selling and other expenses incurred by the Selling Stockholder will

be paid by the Selling Stockholder. The Selling Stockholder may sell our common shares offered by this prospectus from time to time on

terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus

under “Plan of Distribution.” The prices at which the Selling Stockholder may sell shares will be determined by the prevailing

market price for our common shares or in negotiated transactions.

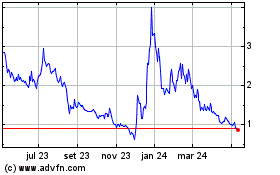

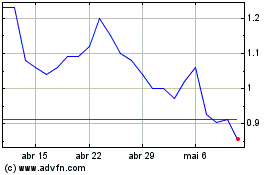

Our common shares are quoted

on The Nasdaq Capital Market, or Nasdaq, under the symbol “ANY.” On May 10, 2023, the last reported sale price for our common

shares on Nasdaq was $0.424.

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of information

that should be considered in connection with an investment in our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). You should

read this prospectus and the information and documents incorporated herein by reference carefully. Such documents contain important information

you should consider when making your investment decision. See “Where You Can Find Additional Information” and “Incorporation

of Certain Documents by Reference” in this prospectus.

You should rely only on

the information contained in or incorporated by reference into this prospectus. Neither we nor the selling stockholder named herein (the

“Selling Stockholder”) have authorized anyone to provide you with information different from, or in addition to, that contained

in or incorporated by reference into this prospectus. This prospectus is an offer to sell only the securities offered hereby but only

under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by reference into this

prospectus is current only as of their respective dates or on the date or dates that are specified in those documents. Our business, financial

condition, results of operations and prospects may have changed since those dates.

The Selling Stockholder is

not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. Neither

we nor the Selling Stockholder have done anything that would permit this offering or possession or distribution of this prospectus in

any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United

States who come into possession of this prospectus are required to inform themselves about and to observe any restrictions relating to

this offering and the distribution of this prospectus applicable to that jurisdiction.

If required, each time the

Selling Stockholder offers common shares, we will provide you with, in addition to this prospectus, a prospectus supplement that will

contain specific information about the terms of that offering. We may also authorize the Selling Stockholder to use one or more free writing

prospectuses to be provided to you that may contain material information relating to that offering. We may also use a prospectus supplement

and any related free writing prospectus to add, update or change any of the information contained in this prospectus or in documents we

have incorporated by reference. This prospectus, together with any applicable prospectus supplements, any related free writing prospectuses

and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. To the

extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements

made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. Please carefully read both this

prospectus and any prospectus supplement together with the additional information described below under the section entitled “Incorporation

of Certain Documents by Reference” before buying any of the securities offered.

Unless the context otherwise

requires, the terms “Sphere,” “Sphere 3D,” “the Company,” “we,” “us” and “our”

refer to Sphere 3D Corp. and its subsidiaries.

Unless otherwise indicated,

information contained in this prospectus or incorporated by reference herein concerning our industry and the markets in which we operate

is based on information from independent industry and research organizations, other third-party sources (including industry publications,

surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent

industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing

such data and our knowledge of such industry and markets, which we believe to be reasonable. Although we believe the data from these third-party

sources is reliable, we have not independently verified any third-party information. In addition, projections, assumptions and estimates

of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk

due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the

independent parties and by us.

WHERE YOU CAN FIND MORE INFORMATION ABOUT US

We are subject to periodic reporting and other

informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, we are required

to file reports, including annual reports on Form 10-K, and other information with the SEC. The SEC maintains a web site at www.sec.gov

that contains reports, proxy and information statements, and other information regarding registrants that make electronic filings with

the SEC using its EDGAR system, and all information filed with the SEC can be obtained over the internet at this website. We also maintain

a website at www.sphere3d.com, but information contained on, or linked from, our website is not incorporated by reference in this

prospectus or any prospectus supplement. You should not regard any information on our website as a part of this prospectus or any prospectus

supplement.

This prospectus is part of a registration statement

that we filed with the SEC and does not contain all the information in the registration statement. You will find additional information

about us in the registration statement. Any statement made in this prospectus concerning a contract or other document of ours is not necessarily

complete, and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the SEC for

a more complete understanding of the document or matter. Each such statement is qualified in all respects by reference to the document

to which it refers. You may inspect a copy of the registration statement through the SEC’s website at www.sec.gov.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference”

the information we file with them. This means that we can disclose important information to you by referring you to those documents. Each

document incorporated by reference is current only as of the date of such document, and the incorporation by reference of such documents

shall not create any implication that there has been no change in our affairs since the date thereof or that the information contained

therein is current as of any time subsequent to its date. The information incorporated by reference is considered to be a part of this

prospectus and should be read with the same care. When we update the information contained in documents that have been incorporated by

reference by making future filings with the SEC, the information incorporated by reference in this prospectus is considered to be automatically

updated and superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus and

information incorporated by reference into this prospectus, you should rely on the information contained in the document that was filed

later.

We incorporate by reference into the prospectus

the documents listed below:

| ● | our Annual Report on Form

10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 31, 2023 (the “2022 Annual Report”); |

| ● | our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023, filed with the SEC on May 11, 2023; |

| ● | the description of our common

shares contained in the registration statement on Form

8-A, dated July 7, 2014, File No. 001-36532, and any other amendment or report filed for the purpose of updating such description. |

Our 2022 Annual Report contains a description of

our business and audited consolidated financial statements with reports by our independent auditors. The consolidated financial statements

are prepared and presented in accordance with U.S. GAAP.

Unless expressly incorporated by reference, nothing

in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC. Copies of all documents

incorporated by reference in this prospectus, other than exhibits to those documents unless such exhibits are specifically incorporated

by reference in this prospectus, will be provided at no cost to each person, including any beneficial owner, who receives a copy of this

prospectus on the written or oral request of that person made to:

Sphere 3D Corp.

4 Greenwich Office Park

1st Floor

Greenwich, Connecticut 06831

Attn: Patricia Trompeter, Chief Executive Officer

(647) 952-5049

You should rely only on the information that we

incorporate by reference or provide in this prospectus. We have not authorized anyone to provide you with different information. We are

not making any offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information

in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents, or as

otherwise set forth therein.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement,

and the information incorporated by reference herein, contain forward-looking statements that reflect our current expectations and views

of future events. Known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” may

cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking

statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform

Act of 1995.

You can identify some of these forward-looking

statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,”

“continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations

and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial

needs. These forward-looking statements include, but are not limited to, statements relating to:

| |

● |

our mission and strategies; |

| |

|

|

| |

● |

our future business development, financial condition and results of operations; |

| |

|

|

| |

● |

our expectations regarding demand for and market acceptance of our products and services; |

| |

|

|

| |

● |

our expectations regarding our relationships with borrowers and institutional partners; |

| |

|

|

| |

● |

competition in our industry; |

| |

|

|

| |

● |

our ability to obtain financing in the future; and |

| |

|

|

| |

● |

relevant government policies and regulations relating to our industry and the industry of any companies that we may acquire. |

These forward-looking statements involve various

risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations

may later be found to be incorrect. Our actual results could be materially different from our expectations. You should thoroughly read

this prospectus, any prospectus supplement and the documents that we refer to with the understanding that our actual future results may

be materially different from and worse than what we expect. In addition, the rapidly changing nature of the online consumer finance industry

results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our market.

Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ

from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements. We qualify all

of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this prospectus

or any prospectus supplement, or the information incorporated by reference herein, relate only to events or information as of the date

on which the statements are made in such document. Except as required by law, we undertake no obligation to update or revise publicly

any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

OUR COMPANY

Overview

Sphere 3D was incorporated

under the Business Corporations Act (Ontario) on May 2, 2007 as T.B. Mining Ventures Inc. On March 24, 2015, we completed a short-form

amalgamation with a wholly-owned subsidiary. In connection with the short-form amalgamation, we changed our name to “Sphere 3D Corp.”

Any reference to the “Company”, “Sphere 3D”, “we”, “our”, “us”, or similar

terms refers to Sphere 3D Corp. and its subsidiaries. In December 2014, we completed the acquisition of Overland Storage, Inc. (“Overland”)

to grow our business in the containerization and virtualization technologies along with data management products that enabled workload-optimized

solutions. In November 2018, we sold our Overland business. In January 2022, we commenced operations of our digital mining operation and

are dedicated to becoming a leading carbon-neutral Bitcoin mining company. We are establishing an enterprise-scale mining operation through

procurement of next-generation mining equipment and partnering with experienced service providers.

Digital assets and blockchain

Bitcoin is a digital asset

issued by and transmitted through an open source protocol maintained by a peer-to-peer network of decentralized user nodes. This network

hosts a public transaction ledger blockchain where the digital assets and their corresponding transactions are recorded. The digital assets

are stored in individual wallets with public addresses and a private key that controls access. The blockchain is updated without a single

owner or operator of the network. New digital assets are generated and mined rewarding users after transactions are verified in the blockchain.

Digital assets and their corresponding

markets emulate foreign exchange markets of fiat currencies, such as the U.S. dollar, where they can be exchanged to said fiat currencies

trading exchanges. In addition to these exchanges, additional trading markets for digital assets exist, such as derivative markets.

Since the nature of digital

assets is such that it exists solely in electronic form, they are exposed to risks similar to that of any data held solely in electronic

form such as power failure, data corruption, cyber security attacks, protocol breaches, and user error, among others. Similar to data

centers, these risks put the digital assets subject to the aforementioned threats which might not necessarily affect a physical fiat currency.

In addition, blockchain relies on open source developers to maintain the digital asset protocols. Blockchain as such may be subject to

design changes, governance disputes such as “forked” protocols, and other risks associated with open source software.

Digital currencies serve multiple

purposes - a medium of exchange, store of value or unit of account. Examples of digital currencies include: bitcoin, bitcoin cash, Ethereum,

and Litecoin. Digital currencies are decentralized currencies that facilitate instant transfers. Transactions occur on an open source

platform using peer-to-peer direct technology with no single owner. Blockchain is a public transaction ledger where transactions occur,

are recorded and tracked, however not owned nor managed by one single entity. Blockchain, accessible and open to all, contains records

of all existing and historical transactions. All accounts on the blockchain have a unique public key and is secured with a private key

that is only known to the individual. The combination of private and public keys results in a secure digital “fingerprint”

which results in a strong control of ownership.

We believe cryptocurrencies

have many advantages over traditional, physical fiat currencies, including immediate settlement, fraud deterrent as they are unable to

be duplicated or counterfeited, lower fees, mass accessibility, decentralized nature, identity theft prevention, physical loss prevention,

no counterparty risk, no intermediary facilitation, no arduous exchange rate implications and a strong confirmation transaction process.

Service and product

In addition to digital mining,

we provide network operations center (“NOC”) services to our customers. NOC revenues are for monthly services performed for

the customer that are performed either in-house or at the customer’s site. We also deliver data management and desktop and application

virtualization solutions through hybrid cloud, cloud and on premise implementations by a reseller network. We achieve this through a combination

of containerized applications, virtual desktops, virtual storage and physical hyper-converged platforms. Our products allow organizations

to deploy a combination of public, private or hybrid cloud strategies while backing them up with the latest storage solutions. Our brands

include HVE ConneXions (“HVE”) and Unified ConneXions (“UCX”).

Investment in Special Purpose

Acquisition Company

In April 2021, we sponsored a special purpose

acquisition company (“SPAC”), Minority Equality Opportunities Acquisition Inc. (“MEOA”), through our wholly owned

subsidiary, Minority Equality Opportunities Acquisition Sponsor, LLC (“SPAC Sponsor”). MEOA’s purpose is to focus initially

on transactions with companies that are minority owned businesses. In April 2021, SPAC Sponsor paid $25,000 of deferred offering costs

on behalf of MEOA in exchange for 2,875,000 shares of MEOA’s Class B common stock (the “Founder Shares”). On August

30, 2021, MEOA consummated its initial public offering (the “IPO”) and issued units which were comprised of one share of Class

A common stock and one redeemable warrant. Also in August 2021, and simultaneously with the consummation of the IPO, SPAC Sponsor participated

in the private sale of an aggregate of 5,395,000 Warrants (the “Private Placement Warrants”) at a purchase price of $1.00

per Private Placement Warrant. The SPAC Sponsor paid $5.4 million to MEOA, which included $1.0 million from an investor participating

in MEOA Sponsor. The Private Placement Warrants are not transferable, assignable or saleable until 30 days after MEOA completes a business

combination. On October 18, 2021, the securities comprising the units begin separate trading, the Class A common stock and warrants are

listed on the NASDAQ Capital Market under the symbols “MEOA” and “MEOAW,” respectively.

In August 2022, MEOA entered

into a business combination agreement with MEOA Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of MEOA (“Merger

Sub”), and Digerati Technologies, Inc., a Nevada corporation (“Digerati”), pursuant to which, subject to the satisfaction

or waiver of certain conditions set forth therein, Merger Sub will merge with and into Digerati (the “Digerati Merger”), with

Digerati surviving the Digerati Merger as a wholly owned subsidiary of MEOA, and with Digerati’s equity holders receiving shares

of MEOA common stock.

In November 2022, MEOA held

a special meeting of stockholders (the “MEOA Meeting”). At the MEOA Meeting, MEOA’s stockholders approved an amendment

(the “Extension Amendment”) to MEOA’s amended and restated certificate of incorporation to extend the date by which

MEOA must consummate its initial business combination from November 30, 2022 to May 30, 2023, or such earlier date as determined by MEOA’s

board of directors. In connection with the MEOA Meeting, the holders of MEOA’s shares of its Class A common stock exercised their

right to redeem such shares for a pro rata portion of the funds in the trust account. After giving effect to the redemption of MEOA’s

public shares, on November 30, 2022, the Company owned a controlling interest of MEOA and since such time MEOA has been recorded on a

consolidated basis.

SPAC Sponsor, along with MEOA’s

initial stockholders, MEOA’s executive officers and directors have entered into a letter agreement with MEOA, pursuant to which

we have agreed to (i) waive our redemption rights with respect to our founder shares and public shares in connection with the completion

of the initial business combination; (ii) waive our redemption rights with respect to our founder shares and public shares in connection

with a stockholder vote to approve an amendment to the certificate of incorporation: (A) to modify the substance or timing of MEOA’s

obligation to redeem 100% of the public shares if MEOA does not complete an initial business combination within the combination period;

or (B) with respect to any other material provision relating to stockholders’ rights or pre-initial business combination activity;

and (iii) waive our rights to liquidating distributions from the trust account with respect to our founder shares if MEOA fails to complete

an initial business combination within the Combination Period.

As of March 31, 2023, we hold

an aggregate of 3,162,500 shares of MEOA’s Class B common stock.

Series H Preferred Shares

On November 7, 2022, we entered

into an agreement with Hertford modifying the number of outstanding Series H Preferred Shares held by Hertford (the “Modified Hertford

Agreement”). Pursuant to the Modified Hertford Agreement, we cancelled 36,000 Series H Preferred Shares, representing 37.5% of the

outstanding Series H Preferred Shares payable to Hertford under the Hertford Agreement, without payment of any cash consideration. Each

Series H Preferred Share is convertible into 1,000 common shares. Hertford will retain 60,000 Series H Preferred Shares, which are non-voting

and do not accrue dividends. At our 2022 Annual General Meeting, we received shareholder approval to convert the remaining 60,000 Series

H Preferred Shares, subject to the terms and conditions contained in our Articles of Incorporation. The Modified Hertford Agreement also

provides for certain resale restrictions applicable to the common shares that are issuable upon the conversion of the remaining Series

H Preferred Shares during the two-year period ending on December 31, 2024, which are different from the restrictions contained in the

Hertford Agreement, as well, commencing January 1, 2023 and terminating on December 31, 2023, holders of Series H Preferred Shares are

permitted to (a) convert Series H Preferred Shares in an aggregate amount up to or equal to 3.0% of the aggregate number of Series H Preferred

Shares outstanding on the first day of each such month and (b) sell the resulting number (and no greater number) of such converted common

shares within such month. Commencing January 1, 2024 and terminating on December 31, 2024, holders of Series H Preferred Shares are permitted

to (a) convert Series H Preferred Shares in an aggregate amount up to or equal to 10.0% of the aggregate number of Series H Preferred

Shares outstanding on the first day of each such month and (b) sell the resulting number (and no greater number) of such converted common

shares within such month. Pursuant to the Modified Hertford Agreement, the Company issued 8,474,000 common shares upon the conversion

of 8,474 Series H Preferred Shares during the period from January 1, 2023 through May 1, 2023.

Terminated Merger Agreement

On June 3, 2021, we entered

into an Agreement and Plan of Merger (the “Merger Agreement”) with Gryphon Digital Mining, Inc. (“Gryphon”), a

privately held company in the cryptocurrency space dedicated to helping bring digital assets onto the clean energy grid. Gryphon’s

Bitcoin mining operation has a zero-carbon footprint and their long-term strategy is to be the first vertically integrated crypto miner

with a wholly owned, one hundred percent renewable energy supply.

On February 15, 2022, and subsequently

on March 7, 2022, primarily as a result of comments we received from the SEC relating to an amendment to the registration statement on

Form F-4 we filed with the SEC on January 5, 2022 in connection with our proposed merger with Gryphon, we retained two independent investment

banks to review the terms of the proposed Gryphon merger transaction. The nature of the review was to provide an independent analysis

as to whether the consideration to be paid by us in the proposed merger was fair to our stockholders from a financial point of view and

to assess the inputs to the financial models that were used to test such fairness.

On April 4, 2022, the Merger

Agreement was terminated. The Merger Agreement, among other matters, provided that, upon termination of the Merger Agreement, we would

forgive all amounts outstanding under the outstanding Promissory Note and Security Agreement as amended with Gryphon (the “Gryphon

Note”), and release to Gryphon 850,000 common shares previously deposited into an escrow account for the benefit of Gryphon. As

a result of the termination of the Merger Agreement in the second quarter of 2022, we forgave the Gryphon Note which had a balance of

$13.1 million and released the 850,000 common shares, with a fair value of $1.2 million, held in escrow to Gryphon. We will continue our

relationship with Gryphon through the Gryphon Master Services Agreement (the “Gryphon MSA”) entered into in 2021. On April

7, 2023, we filed litigation against Gryphon citing several breaches to the Gryphon MSA, including but not limited to, several fiduciary

and operational breaches.

Nasdaq Listing

On July 25, 2022, we received

a notice from the Nasdaq Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) stating that the bid

price of our common stock for the last 30 consecutive trading days had closed below the minimum $1.00 per share required for continued

listing under Listing Rule 5550(a)(2) (the “Listing Rule”). We had a period of 180 calendar days, or until January 23, 2023,

to regain compliance with the Listing Rule.

On January 24, 2023, we received

notification from Nasdaq indicating that we will have an additional 180-day grace period, or until July 24, 2023, to regain compliance

with the Listing Rule’s $1.00 minimum bid requirement. The notification indicated that we did not regain compliance during the initial

180-day grace period provided under the Listing Rule. In accordance with Nasdaq Marketplace Rule 5810(c)(3)(A), we are eligible for the

additional grace period because we meet the continued listing requirement for market value of publicly held shares and all other applicable

requirements for initial listing on the Nasdaq Capital Market with the exception of the bid price requirement, and our written notice

to Nasdaq of our intentions to cure the deficiency by effecting a reverse stock split, if necessary.

If we do not regain compliance

by July 24, 2023, or if we fail to satisfy another Nasdaq requirement for continued listing, Nasdaq staff could provide notice that our

common shares will become subject to delisting. In such event, Nasdaq rules permit us to appeal any delisting determination to a Nasdaq

Hearings Panel. Accordingly, there can be no guarantee that we will be able to maintain our Nasdaq listing. We intend to actively monitor

the closing bid price for our common shares and will consider available options to resolve the deficiency and regain compliance with the

Listing Rule.

Disposal of SnapServer®

Product Line

In October 2021, Sphere 3D

and Filecoiner entered into an acquisition agreement under which our wholly-owned subsidiary, HVE ConneXions (“HVE”) sold

the assets, including intellectual property, associated with our SnapServer® product line to Filecoiner, in exchange

for 8,000 shares of Series B preferred stock of Filecoiner (“Filecoiner Series B Preferred Stock”) with a fair value equal

to $6.4 million. During the year ended December 31, 2021, we recorded a gain on the sale of the assets of $5.0 million and is included

in interest income and other, net on the consolidated statement of operations. During the year ended December 31, 2022, we recognized

an impairment for the preferred stock of Filecoiner held and recorded an impairment expense of $6.4 million.

Service and Product

Service

Customer service and support

are key elements of our strategy and critical components of our commitment in making enterprise-class support and services available to

companies of all sizes. Our technical support staff is trained to assist our customers with deployment and compatibility for any combination

of virtual desktop infrastructures, hardware platforms, operating systems and backup, data interchange and storage management software.

Our application engineers are trained to assist with more complex customer issues. We maintain global toll-free service and support phone

lines. Additionally, we also provide self-service and support through our website support portal and email.

Our service offerings provide

for on-site service and installation options, round-the-clock phone access to solution experts, and proof of concept and architectural

design offerings.

Product

Our product offerings consist

of the following disk systems: HVE Converged and Hyper-converged Infrastructure. In addition to our product offerings, we provide on-site

service and installation options, round-the-clock phone access to solution experts, and proof of concept and architectural design offerings.

We are able to provide comprehensive technical assistance on a global scale.

HVE Converged and Hyper-converged

Infrastructure

In 2017, we acquired HVE, a

technology provider of next generation converged and hyper-converged infrastructure dedicated to creating Manageable, Scalable, Reproducible,

and Predictable (“MSRP”) solutions based on virtualization technologies running on high-performance, next generation platforms.

HVE solutions are engineered, purpose-built converged and hyper-converged virtual workspace and server solutions that support a distributed

architecture, scalable with predictable performances, and come bundled with continuous active monitoring. HVE product can include support

for our Desktop Cloud Orchestrator™ (“DCO”) based on customer requirements.

| ● | The HVE-STACK high density server provides the computer and

storage appliance for the data center and is ideal for high performance computing, cloud computing and virtual desktop infrastructure

(“VDI”). The modular design and swappable components include hard drives and power supplies intended to improve the efficiency

of data center deployment. |

| ● | The HVE-VELOCITY High Availability Dual Enclosure storage

area network (“SAN”) provides data reliability and integrity for optimal data storage, protection and recovery. It also provides

a unified network attached storage (“NAS”) and SAN solution with thin provisioning, compression and deduplication. The HVE-VELOCITY

platform is designed to eliminate single points of failure. The 12GSAS SSD design allows for faster access to data. It is optimized for

mission-critical, enterprise-level storage applications. |

| ● | The HVE 3DGFX is a VDI solution that offers hardware and

software technologies to provide an appliance that can handle from eight to up to 128 high demand users in a single 2U appliance. The

HVE 3DGFX was designed and engineered as a purpose-built solution based upon the MSRP engineering approach. |

| ● | The HVE STAGE Server Virtualization Platform is a high-performance

purpose-built server that has been optimized for server virtualization. These performance optimized servers are also compact space savers

utilizing 1U of rack space. Each STAGE can be pre-configured for converged, hyper-converged or attached storage, and comes with ESXi

so an infrastructure is ready for virtualization. HVE offers both the stand-alone SAN attached servers or a true server converged/hyper-converged

solution with 1-24TB Local SSD. |

| ● | The HVE VAULT backup and compute appliance is designed to

handle requirements for backup and replication storage. The HVE-VAULT, with the integrated compute option, can also perform disaster

recovery compute requirements with specific mission critical workloads. The HVE-VAULT can be configured as an iSCSI SAN or NAS storage

device using HVE storage management software. This appliance utilizes a software defined datacenter (SDD) approach with solutions that

work for Tier 2 all flash array front-end storage or rapid backup/recovery business continuity solutions integrated with software technologies

like Veeam and Nakivo. |

Production

A significant number of our

components and finished products are manufactured or assembled, in whole or in part, by a limited number of third parties. For certain

products, we control the design process internally and then outsource the manufacturing and assembly in order to achieve lower production

costs.

We purchase disk drives and

chassis from outside suppliers. We carefully select suppliers based on their ability to provide quality parts and components which meet

technical specifications and volume requirements. We actively monitor these suppliers but we are subject to substantial risks associated

with the performance of our suppliers. For certain components, we qualify only a single source, which magnifies the risk of shortages

and may decrease our ability to negotiate with that supplier. For a more detailed description of risks related to suppliers, see Item

1A. Risk Factors in our 2022 Annual Report.

Sales and Distribution

Our reseller channel includes

systems integrators, VARs and DMRs. Our resellers may package our products as part of complete application and desktop virtualization

solutions data processing systems or with other storage devices to deliver complete enterprise information technology infrastructure solutions.

Our resellers also recommend our products as replacement solutions when systems are upgraded, or bundle our products with storage management

software specific to the end user’s system. We support the reseller channel through our dedicated sales representatives, engineers

and technical support organizations.

Patents and Proprietary Rights

We rely on a combination of

patents, trademarks, trade secret and copyright laws, as well as contractual restrictions, to protect the proprietary aspects of our products

and services. Although every effort is made to protect Sphere 3D’s intellectual property, these legal protections may only afford

limited protection.

We may continue to file for

patents regarding various aspects of our products, services and delivery method at a later date depending on the costs and timing associated

with such filings. We may make investments to further strengthen our copyright protection going forward, although no assurances can be

given that it will be successful in such patent and trademark protection endeavors. We seek to limit disclosure of our intellectual property

by requiring employees, consultants, and partners with access to our proprietary information to execute confidentiality agreements and

non-competition agreements (when applicable) and by restricting access to our proprietary information. Due to rapid technological change,

we believe that establishing and maintaining an industry and technology advantage in factors such as the expertise and technological and

creative skills of our personnel, as well as new services and enhancements to our existing services, are more important to our company’s

business and profitability than other available legal protections.

Despite our efforts to protect

our proprietary rights, unauthorized parties may attempt to copy aspects of our services or to obtain and use information that we regard

as proprietary. The laws of many countries do not protect proprietary rights to the same extent as the laws of the U.S. or Canada. Litigation

may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and

scope of the proprietary rights of others or to defend against claims of infringement. Any such litigation could result in substantial

costs and diversion of resources and could have a material adverse effect on our business, operating results and financial condition.

There can be no assurance that our means of protecting our proprietary rights will be adequate or that our competitors will not independently

develop similar services or products. Any failure by us to adequately protect our intellectual property could have a material adverse

effect on our business, operating results and financial condition. See Item 1A. Risk Factors of our 2022 Annual Report under the

section Risks Related to Intellectual Property.

Competitive Conditions

We believe that our products

are unique and innovative and afford us various advantages in the marketplace; however, the market for information technology is highly

competitive. Competitors vary in size from small start-ups to large multi-national corporations which may have substantially greater financial,

research and development, and marketing resources. Competitive factors in these markets include performance, functionality, scalability,

availability, interoperability, connectivity, time to market enhancements, and total cost of ownership. Barriers to entry vary from low,

such as those in traditional disk-based backup products, to high, in virtualization software. The markets for all of our products are

characterized by price competition and as such we may face price pressure for our products. For a more detailed description of competitive

and other risks related to our business, see Item 1A. Risk Factors in our 2022 Annual Report.

Governmental Regulations

We are subject to laws and

regulations enforced by various regulatory agencies such as the U.S. Consumer Product Safety Commission and the U.S. Environmental Protection

Agency. For a detailed description of the material effects of government regulations on our business, see “Our international operations

are important to our business and involve unique risks related to financial, political, and economic conditions” and “We are

subject to laws, regulations and similar requirements, changes to which may adversely affect our business and operations” see Item

1A. Risk Factors-Risks Related to Our Business in our 2022 Annual Report.

Employees

We had 28 full-time employees at March 31, 2023.

The Offering

| Securities offered by the Selling Stockholder: |

|

19,655,115 common shares, which includes (i) 3,360,216 common

shares issuable upon the conversion of an outstanding convertible promissory note (the “Tranche 1 Note”), (ii) 6,720,432

of our common shares issuable upon conversion of a convertible promissory note to be issued by us, subject to certain conditions precedent,

within five (5) business days of the date on which this registration statement is declared effective (the “Tranche 2 Note”

and, together with the Tranche 1 Note, the “Notes”), (iii) an aggregate of 3,191,489 common shares issuable upon the exercise

of an outstanding common share purchase warrant (the “Tranche 1 Warrant”) and (iv) 6,382,978 common

shares issuable upon exercise of a common share purchase warrant to be issued in connection with the Tranche 2 Note (the “Tranche

2 Warrant” and, together with the Tranche 1 Warrant, the “Warrants”). |

| |

|

|

| Common shares outstanding: |

|

77,266,595 shares |

| |

|

|

| Common shares to be outstanding after the offering assuming conversion of the Notes and exercise of the Warrants: |

|

96,921,710 shares(1) |

| |

|

|

| Use of Proceeds: |

|

We are not selling any securities under this prospectus and we will not receive proceeds from the sale of the shares of our common shares by the Selling Stockholder. However, we may receive proceeds from the cash exercise of the Warrant, which, if exercised in cash at the current applicable exercise price with respect to all of the 3,191,489 common shares, would result in gross proceeds to us of approximately $1,500,000. The proceeds from such Warrant exercise, if any, will be used for working capital and general corporate purposes. |

| |

|

|

| Risk Factors: |

|

Investing in our securities is highly speculative and involves a high

degree of risk. You should carefully consider the information set forth in the “Risk Factors” section on page 13 before

deciding to invest in our securities. |

| |

|

|

| Trading Symbol: |

|

Our common shares are currently quoted on The Nasdaq Capital Market under the trading symbol “ANY”. |

The common shares outstanding

and the common shares to be outstanding after this offering is based on 77,266,595 shares outstanding as of May 4, 2023 and excludes:

| |

● |

2,647,241 common shares issuable upon the exercise of options of which 597,371 have vested at a weighted average exercise price of $1.01 per share as of March 31, 2023; |

| |

● |

19,752,538 common shares issuable upon the exercise of warrants (excluding the Warrant) of which 19,752,538 are exercisable at a weighted average exercise price of $8.05 per share as of March 31, 2023; and |

| |

● |

3,767,910 common shares issuable upon the vesting of restricted stock units. |

| (1) | Includes the (a) 6,720,432 common shares issuable upon conversion of the Tranche 2 Note and (b) 6,382,978

common shares issuable upon exercise of the Tranche 2 Warrant. |

RISK FACTORS

An investment in our

securities involves a number of risks. Before deciding to invest in our securities, you should carefully consider the risks

discussed under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year

ended December 31, 2022 and in our Quarterly Report on Form 10-Q for the three-month period ended March 31, 2023, which are

incorporated by reference in this prospectus, the information and documents incorporated by reference herein, and in any prospectus

supplement or free writing prospectus that we have authorized for use in connection with an offering. If any of these risks actually

occurs, our business, financial condition, results of operations or cash flow could be harmed. This could cause the trading price of

our common shares to decline, resulting in a loss of all or part of your investment. The risks described in the document referenced

above are not the only risks that we face. Additional risks not presently known to us or that we currently deem immaterial may also

affect our business.

USE OF PROCEEDS

We are not selling any

securities under this prospectus and will not receive any proceeds from the sale of the common shares offered by this prospectus by

the Selling Stockholder. However, we may receive proceeds from the cash exercise of the Warrants, which, if exercised in cash at the

current applicable exercise price with respect to all of the 9,574,467 common shares, would result in gross proceeds to us of

approximately $4,500,000. The proceeds from such Warrant exercises, if any, will be used for working capital and general

corporate purposes. We cannot predict when or whether the Warrants will be exercised, and it is possible that the Warrants may expire

unexercised. For information about the Selling Stockholder, see “Selling Stockholder.”

The Selling Stockholder will

pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholder for brokerage or legal services or any

other expenses incurred by the Selling Stockholder in disposing of the common shares offered hereby. We will bear all other costs, fees

and expenses incurred in effecting the registration of the common shares covered by this prospectus, including all registration and filing

fees and fees and expenses of our counsel and accountants.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation organized pursuant to articles

of amalgamation under the Business Corporations Act (Ontario) (the “OBCA”) dated August 1, 2018. Some of our assets

are located outside of the United States and some of our directors and officers, as well as some of the experts named in this prospectus,

are residents of Canada. As a result, it may be difficult for U.S. investors to:

| |

● |

effect service within the United States upon us or those directors, officers and experts who are not residents of the United States; or |

| |

● |

realize in the United States upon judgments of courts of the United States predicated upon the civil liability provisions of the United States federal securities laws. |

DESCRIPTION OF SHARE CAPITAL

General

The following is a description of the material

terms of our share capital of as set forth in our articles of amalgamation and bylaws, as amended to date, and certain related sections

of the OBCA. For more detailed information, please see our articles of amalgamation and bylaws and amendments thereto, which are filed

as exhibits to the registration statement of which this prospectus forms a part.

Our authorized capital consists of unlimited common

shares, no par value, unlimited series A preferred shares, no par value, unlimited series B preferred shares, no par value, unlimited

series C preferred shares, no par value, unlimited series D preferred shares, no par value, unlimited series E preferred shares, no par

value, unlimited series F preferred shares, no par value, unlimited series G preferred shares, no par value and unlimited series H preferred

shares, no par value. As of May 4, 2023, there were issued and outstanding 77,266,595 common shares and 51,526 series H preferred shares.

There are no series A, series B, series C, series D, series E, series F or series G preferred shares outstanding, all of which were converted

to common shares, with the exception of series F preferred shares which were never issued or outstanding. Pursuant to our articles

of amalgamation, our board of directors has the authority to fix and determine the voting rights, rights of redemption and other rights

and preferences of each series of preferred shares. The series H preferred shares outstanding do not have voting rights.

The following summary does not purport to be complete

and is subject to, and is qualified in its entirety by reference to, the applicable provisions of the OBCA and our articles of amalgamation

and by-laws. We encourage you to review our:

| |

● |

Articles of Amendment dated October 1, 2021; |

| |

|

|

| |

● |

Articles of Amendment dated July 13, 2021; |

| |

|

|

| |

● |

Articles of Amendment dated January 4, 2021; |

| |

|

|

| |

● |

Articles of Amendment dated September 29, 2020; |

| |

|

|

| |

● |

Articles of Amendment dated May 6, 2020; |

| |

|

|

| |

● |

Articles of Amendment dated November 6, 2019; |

| |

|

|

| |

● |

Articles of Amendment dated July 12, 2019; |

| |

|

|

| |

● |

Articles of Amendment dated November 13, 2018; |

| |

|

|

| |

● |

Articles of Amendment dated November 5, 2018; |

| |

|

|

| |

● |

Articles of Amendment dated September 28, 2018; |

| |

|

|

| |

● |

Articles of Amendment dated July 11, 2017; |

| |

|

|

| |

● |

Articles of Amalgamation dated March 24, 2015; |

| |

|

|

| |

● |

By-law No. 1, as amended; and |

| |

|

|

| |

● |

By-law No. 2. |

Common Shares

Voting, Dividend and Other Rights. Each

outstanding common share entitles the holder to one vote on all matters presented to the shareholders for a vote. Holders of common shares

have no cumulative voting, pre-emptive, subscription or conversion rights. The board of directors determines if and when distributions

may be paid out of legally available funds to the holders. The declaration of any cash dividends in the future will depend on the board

of directors’ determination as to whether, in light of earnings, financial position, cash requirements and other relevant factors

existing at the time, it appears advisable to do so. We do not anticipate paying cash dividends on the common shares in the foreseeable

future.

Rights Upon Liquidation. Upon liquidation,

subject to the right of any holders of preferred shares to receive preferential distributions, each outstanding common share may participate

pro rata in the assets remaining after payment of, or adequate provision for, all known debts and liabilities.

Majority Voting. In accordance with our

by-laws, two holders representing not less than thirty-three and one-third percent (33.3%) of the outstanding common shares constitute

a quorum at any meeting of the shareholders. A majority of the votes cast at a meeting of shareholders elects directors. The common shares

do not have cumulative voting rights. Therefore, the holders of a majority of the outstanding common shares can elect all of the directors.

In general, a majority of the votes cast at a meeting of shareholders must authorize shareholder actions other than the election of directors.

Preferred Shares

Under our articles of amalgamation, our board of

directors can issue an unlimited amount of preferred shares from time to time in one or more series. Our board of directors is authorized

to fix by resolution as to any series the designation and number of shares of the series, the voting rights, the dividend rights, the

redemption price, the amount payable upon liquidation or dissolution, the conversion rights, and any other designations, preferences or

special rights or restrictions as may be permitted by law. Unless the nature of a particular transaction and the rules of law applicable

thereto require such approval, our board of directors has the authority to issue these shares of preferred shares without shareholder

approval.

Series H Preferred Shares. The holders of

Series H Preferred Shares have the following rights, restrictions and privileges in respect of their preferred shares:

| |

● |

The Series H Preferred Shares are convertible into 1,000 common shares for every Series H Preferred Share. Each holder may convert such holders Series H Preferred Shares provided that after such conversion the common shares issuable, together with all the common shares held by the shareholder in the aggregate, would not exceed 9.99% of the total number of outstanding common shares. |

| |

|

|

| |

● |

The holders of Series H Preferred Shares are not entitled to receive dividends and are not entitled to voting rights. |

| |

|

|

| |

● |

The holders of Series H Preferred Shares cannot convert if, after giving pro forma effect to such conversion, such holder, will beneficially own in excess of 9.99% of our common shares outstanding immediately after giving effect to such conversion. |

| |

|

|

| |

● |

The holders of Series H Preferred Shares are subject to certain “Leak-out”

provisions, such that commencing January 1, 2023 and terminating on December 31, 2023, holders of Series H Preferred Shares are permitted

to (a) convert Series H Preferred Shares in an aggregate amount up to or equal to 3.0% of the aggregate number of Series H Preferred Shares

outstanding on the first day of each such month and (b) sell the resulting number (and no greater number) of such converted common shares

within such month. Commencing January 1, 2024 and terminating on December 31, 2024, holders of Series H Preferred Shares are permitted

to (a) convert Series H Preferred Shares in an aggregate amount up to or equal to 10.0% of the aggregate number of Series H Preferred

Shares outstanding on the first day of each such month and (b) sell the resulting number (and no greater number) of such converted common

shares within such month. |

| |

|

|

| |

● |

Subject to certain limited exceptions, until the date that is 45 days following the conclusion of our 2023 Annual Meeting (the “Standstill Period”), holders of series H preferred shares agreed that they will appear in person or by proxy at each annual or special meeting of shareholders (including any adjournments or postponements thereof and any meetings which may be called in lieu thereof), whether such meeting is held at a physical location or virtually by means of remote communications, and will vote (or execute a consent or proxy with respect to) all Voting Securities beneficially owned by it in accordance with our board of directors’ recommendations with respect to (a) each election of directors, any removal of directors and any replacement of directors, and (b) any other proposal to be submitted to the shareholders by either us or any of our shareholders. |

Warrants

As of May 4, 2023, we had the following warrants

outstanding:

|

● |

Warrants to purchase 3,191,489 common shares until April 17, 2026 at an initial exercise price of $0.47 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares, provided that the exercise price shall be adjusted on the date that is six (6) months from the date of issuance thereof to the lower of (i) $0.47 per share and (ii) a price equal to 110% of the average of the VWAPS (as defined in the Warrant) of our common shares over five (5) trading days preceding such date. |

| |

|

|

| |

● |

Warrants to purchase 100,000 common shares until February 7, 2027 at an initial exercise price of $4.00 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

| |

|

|

| |

● |

Warrants to purchase 100,000 common shares until February 7, 2027 at an initial exercise price of $5.00 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

| |

|

|

| |

● |

Warrants to purchase 100,000 common shares until February 7, 2027 at an initial exercise price of $6.00 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

| |

|

|

| |

● |

Warrants to purchase 11,299,999 common shares until September 8, 2026 at an initial exercise price of $9.50 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

| |

|

|

| |

● |

Warrants to purchase 2,000,000 common shares until December 22, 2024 at an initial exercise price of $4.00 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

| |

|

|

| |

● |

Warrants to purchase 850,000 common shares until October 1, 2024 at an initial exercise price of $6.00 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

| |

|

|

| |

● |

Warrants to purchase 2,595,488 common shares until August 25, 2024 at an initial exercise price of $6.50 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

| |

|

|

| |

● |

Warrants to purchase 2,595,488 common shares until August 25, 2024 at an initial exercise price of $7.50 per share, subject to adjustment in the event of stock splits, combinations or the like of common shares. |

Limitation of Liability and Indemnification of Directors and Officers

Under the OBCA, we may indemnify our current or

former directors or officers or another individual who acts or acted at our request as a director or officer, or an individual acting

in a similar capacity, of another entity which we are or were a shareholder or creditor of, against all costs, charges and expenses, including

an amount paid to settle an action or satisfy a judgment, reasonably incurred by the individual in respect of any civil, criminal, administrative,

investigative or other proceeding in which the individual is involved because of his or her association with us or another entity. The

OBCA also provides that we may also advance moneys to a director, officer or other individual for costs, charges and expenses reasonably

incurred in connection with such a proceeding; provided that such individual shall repay the moneys if the individual does not fulfill

the conditions described below.

However, indemnification is prohibited under the

OBCA unless the individual:

| |

● |

acted honestly and in good faith with a view to our best interests, or the best interests of the other entity for which the individual acted as director or officer or in a similar capacity at our request; and |

| |

● |

in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, the individual had reasonable grounds for believing that his or her conduct was lawful. |

Our bylaws require us to indemnify each of our

current or former directors and officers and each individual who acts or acted at our request as a director or officer of another entity

which we are or were a shareholder or creditor of, as well as their respective heirs and successors, against all costs, charges and expenses,

including an amount paid to settle an action or satisfy a judgment, reasonably incurred by them in respect of any civil, criminal or administrative

action or proceeding to which they were made a party by reason of being or having been a director or officer, except as may be prohibited

by the OBCA.

We have entered into indemnity agreements with

our directors and executive officers that provide, among other things, that we will indemnify them to the fullest extent permitted by

law from and against all liabilities, costs, charges and expenses incurred as a result of their actions in the exercise of their duties

as a director or officer; provided that, we shall not indemnify such individuals if, among other things, they did not act honestly and

in good faith with a view to our best interests and, in the case of a criminal or penal action, the individuals did not have reasonable

grounds for believing that their conduct was lawful.

Material differences between Ontario Corporate Law and Delaware

General Corporation Law

Our corporate affairs are governed by our articles

of amalgamation and bylaws and the provisions of the OBCA. The OBCA differs from the various state laws applicable to U.S. corporations

and their stockholders. The following is a summary of the material differences between the OBCA and the General Corporation Law of the

State of Delaware (“DGCL”). This summary is qualified in its entirety by reference to the DGCL, the OBCA and our governing

corporate instruments.

| Delaware |

|

Ontario |

| |

|

|

| Stockholder/Shareholder Approval of Business Combinations; Fundamental Changes |

| |

|

Under the DGCL, certain fundamental changes such as amendments to the

certificate of incorporation (subject to certain exceptions), a merger, consolidation, sale, lease, exchange or other disposition of all

or substantially all of the property of a corporation, or a dissolution of the corporation, are generally required to be approved by the

holders of a majority of the outstanding stock entitled to vote on the matter, unless the certificate of incorporation requires a higher

percentage.

However, under the DGCL, mergers in which, among other requirements,

less than 20% of a corporation’s stock outstanding immediately prior to the effective date of the merger is issued generally do

not require stockholder approval. In addition, mergers in which one corporation owns 90% or more of each class of stock of a second corporation

may be completed without the vote of the second corporation’s board of directors or stockholders. In certain situations, the approval

of a business combination may require approval by a certain number of the holders of a class or series of shares. In addition, Section

251(h) of the DGCL provides that stockholders of a constituent corporation need not vote to approve a merger if: (1) the merger agreement

permits or requires the merger to be effected under Section 251(h) and provides that the merger shall be effected as soon as practicable

following the tender offer or exchange offer, (2) a corporation consummates a tender or exchange offer for any and all of the outstanding

stock of such constituent corporation that would otherwise be entitled to vote to approve the merger, (3) following the consummation of

the offer, the stock accepted for purchase or exchanges plus the stock owned by the consummating corporation equals at least the percentage

of stock that would be required to adopt the agreement of merger under the DGCL, (4) the corporation consummating the offer merges with

or into such constituent corporation, and (5) each outstanding share of each class or series of stock of the constituent corporation that

was the subject of and not irrevocably accepted for purchase or exchange in the offer is to be converted in the merger into, or the right

to receive, the same consideration to be paid for the shares of such class or series of stock of the constituent corporation irrevocably

purchased or exchanged in such offer.

The DGCL does not contain a procedure comparable to a plan of arrangement

under the OBCA. |

|

Under the OBCA, certain extraordinary corporate actions including:

amalgamations; arrangements; continuances; sales, leases or exchanges of all or substantially all of the property of a corporation; liquidations

and dissolutions are required to be approved by special resolution.

A “special resolution” is a resolution (i) submitted to

a special meeting of the shareholders of a corporation duly called for the purpose of considering the resolution and passed at the meeting

by at least two-thirds of the votes cast, or (ii) consented to in writing by each shareholder of the corporation entitled to vote on the

resolution.

In the case of an offering company, an “ordinary resolution”

is a resolution that is submitted to a meeting of the shareholders of a corporation and passed, with or without amendment, at the meeting

by at least a majority of the votes cast, in person or by proxy.

Under the OBCA, shareholders of a class or series of shares are entitled

to vote separately as a class in the event of certain transactions that affect holders of the class or series of shares in a manner different

from the shares of another class or series of the corporation, whether or not such shares otherwise carry the right to vote.

Under the OBCA, arrangements are permitted. An arrangement may include

an amalgamation, a transfer of all or substantially all the property of the corporation, and a liquidation and dissolution of a corporation.

In general, a plan of arrangement is approved by a corporation’s board of directors and then is submitted to a court for approval.

It is customary for a corporation in such circumstances to apply to a court initially for an interim order governing various procedural

matters prior to calling any security holder meeting to consider the proposed arrangement. Arrangements must generally be approved by

a special resolution of shareholders. The court may, in respect of an arrangement proposed with persons other than shareholders and creditors,

require that those persons approve the arrangement in the manner and to the extent required by the court. The court determines, among

other things, to whom notice shall be given and whether, and in what manner, approval of any person is to be obtained and also determines

whether any shareholders may dissent from the proposed arrangement and receive payment of the fair value of their shares. Following compliance

with the procedural steps contemplated in any such interim order (including as to obtaining security holder approval), the court would

conduct a final hearing, which would, among other things, assess the fairness and reasonableness of the arrangement and approve or reject

the proposed arrangement. |

| Delaware |

|

Ontario |

| |

|

|

| Special Vote Required for Combinations with Interested Stockholders/Shareholders |

|

Section 203 of the DGCL provides (in general) that, unless otherwise

provided in the certificate of incorporation, a corporation may not engage in a business combination with an interested stockholder for

a period of three years after the time of the transaction in which the person became an interested stockholder.

The prohibition on business combinations with interested stockholders

does not apply in some cases, including if: (1) the board of directors of the corporation, prior to the time of the transaction in which

the person became an interested stockholder, approves (a) the business combination or (b) the transaction in which the stockholder becomes

an interested stockholder; (2) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced;

or (3) the board of directors and the holders of at least two-thirds of the outstanding voting stock not owned by the interested stockholder

approve, at an annual or special meeting of stockholders, the business combination on or after the time of the transaction in which the

person became an interested stockholder.

For the purpose of Section 203, the DGCL, subject to specified exceptions,

generally defines an interested stockholder to include any person who, together with that person’s affiliates or associates, (1)

owns 15% or more of the outstanding voting stock of the corporation (including any rights to acquire stock pursuant to an option, warrant,

agreement, arrangement or understanding, or upon the exercise of conversion or exchange rights, and stock with respect to which the person

has voting rights only), or (2) is an affiliate or associate of the corporation and owned 15% or more of the outstanding voting stock

of the corporation, in each case, at any time within the previous three years. |

|

While the OBCA does not contain specific anti-takeover provisions with

respect to “business combinations”, rules and policies of certain Canadian securities regulatory authorities, including Multilateral

Instrument 61-101—Protection of Minority Security Holders in Special Transactions (“MI 61-101”), contain requirements

in connection with, among other things, “related party transactions” and “business combinations”, including, among

other things, any transaction by which an issuer directly or indirectly engages in the following with a related party: acquires, sells,

leases or transfers an asset, acquires the related party, acquires or issues treasury securities, amends the terms of a security if the

security is owned by the related party or assumes or becomes subject to a liability or takes certain other actions with respect to debt.

The term “related party” includes, inter alia, directors,

senior officers and holders of more than 10% of the voting rights attached to all outstanding voting securities of the issuer or holders