As filed with the Securities and Exchange Commission on December 28, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of registrant as specified in its charter)

| |

Luxembourg

(State or other jurisdiction of

incorporation or organization)

|

|

|

98-0554932

(I.R.S. Employer

Identification Number)

|

|

33, Boulevard Prince Henri

L-1724 Luxembourg

Grand Duchy of Luxembourg

(352) 20 60 20 55

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Altisource Solutions, Inc.

2300 Lakeview Parkway, Suite 756,

Alpharetta, GA, 30009

(770) 612-7007

(Name, address including zip code, and telephone number, including area code, of agent for service)

With copies to:

| |

Max Kirchner

R. William Burns

Paul Hastings LLP

100 Bishopsgate

London EC2N 4AG

United Kingdom

+44 20 3023 5100

|

|

|

Margaretha Wilkenhuysen

NautaDutilh

Avocats Luxembourg S.à r.l.

2 Rue Jean Bertholet

L-1233 Luxembourg

Grand Duchy of Luxembourg

+352 26 12 29 1

|

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☐

|

|

|

Accelerated filer

☒

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☒

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 28, 2023

PROSPECTUS

Altisource Portfolio Solutions S.A.

1,611,889

Shares of Common Stock

This prospectus relates to the resale by the investors listed in the section of this prospectus entitled “Selling Stockholders” (the “Selling Stockholders”) of up to 1,611,889 shares of our common stock, $1.00 par value per share (“common stock”). The shares of common stock consist of up to 1,611,889 shares of common stock (the “Warrant Shares”) issuable upon the exercise of outstanding warrants to purchase common stock (the “Warrants”) issued by us to certain Selling Stockholders on February 14, 2023, pursuant to that certain Warrant Purchase Agreement, dated as of February 14, 2023, with the lenders identified on the signature pages thereto. We initially issued Warrants to purchase 3,223,851 Warrant Shares to existing lenders under that certain Credit Agreement, dated April 3, 2018 (as amended, the “Amended Credit Agreement”). The Warrant Shares were subsequently reduced to 2,578,743 Warrant Shares as a result of payments of $20 million made by us in February 2023 toward the determination of aggregate paydowns under the Credit Agreement. The Warrant Shares were further reduced to 1,611,889 Warrant Shares as a result of payments of $10 million made by us in September 2023 toward the determination of aggregate paydowns under the Credit Agreement.

The exercise price per share of common stock under the Warrants is $0.01. The Initial Exercise Date for the Warrants is February 14, 2024 and the Warrants expire on May 22, 2027.

Our registration of the Warrant Shares covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the Warrant Shares. The Selling Stockholders may sell the Warrant Shares covered by this prospectus in a number of different ways and at varying prices. For additional information on the possible methods of sale that the Selling Stockholders may use, you should refer to the section of this prospectus entitled “Plan of Distribution” beginning on page 11 of this prospectus. We will not receive any of the proceeds from the Warrant Shares sold by the Selling Stockholders.

No underwriter or other person has been engaged to facilitate the sale of the Securities in this offering. The Selling Stockholders may be deemed to be an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), of the Securities that they are offering pursuant to this prospectus. We will bear all costs, expenses and fees in connection with the registration of the Warrant Shares. The Selling Stockholders will bear all commissions and discounts, if any, attributable to the sale of the Warrant Shares by the Selling Stockholders.

You should read this prospectus, any applicable prospectus supplement and any related free writing prospectus carefully before you invest.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 5 of this prospectus, the applicable prospectus supplement and in any applicable free writing prospectuses, and under similar headings in the documents that are incorporated by reference into this prospectus.

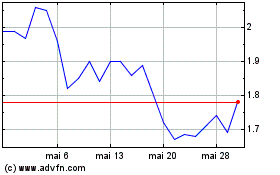

Our common stock is currently listed on the Nasdaq Global Select Market under the symbol “ASPS.” On December 27, 2023, the last reported sale price of our common stock was $3.53 per share. Our stock price is subject to fluctuation. There has been no change recently in our financial condition or results of operations that is consistent with a recent change in our stock price.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

5 |

|

|

| |

|

|

|

|

|

6 |

|

|

| |

|

|

|

|

|

7 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

13

|

|

|

| |

|

|

|

|

|

11 |

|

|

| |

|

|

|

|

|

19 |

|

|

| |

|

|

|

|

|

20 |

|

|

| |

|

|

|

|

|

21 |

|

|

| |

|

|

|

|

|

22

|

|

|

ABOUT THIS PROSPECTUS

You should rely only on the information we have provided or incorporated by reference into this prospectus, any applicable prospectus supplement and any related free writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the Warrant Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

The Selling Stockholders are offering the Warrant Shares only in jurisdictions where such issuances are permitted. The distribution of this prospectus and the issuance of the Securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the issuance of the Warrant Shares and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the Warrant Shares offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”), under which the Selling Stockholders may offer from time to time up to an aggregate of 1,611,889 shares of common stock in one or more offerings. If required, each time the Selling Stockholders offer shares of common stock, we will provide you with, in addition to this prospectus, a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to that offering. We may also use a prospectus supplement and any related free writing prospectus to add, update or change any of the information contained in this prospectus or in documents we have incorporated by reference. This prospectus, together with any applicable prospectus supplements, any related free writing prospectuses and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. Please carefully read both this prospectus, any prospectus supplement and any related free writing prospectus together with the additional information described below under the section entitled “Important Information Incorporated by Reference” before buying any of the securities offered.

When we refer to “Altisource,” “we,” “our,” “us” and the “Company” in this prospectus we mean Altisource Portfolio Solutions S.A., and its subsidiaries unless otherwise specified. When we refer to “you,” we mean the potential holders of the applicable series of securities.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

We own or have rights to use the trademarks and trade names that we use in conjunction with the operation of our business. Solely for convenience, our trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, we have based the information concerning our industry contained in this prospectus and incorporated by reference herein on our general knowledge of and expectations concerning the industry, which involve risks and uncertainties and are subject to change based on various factors, including those discussed in the “Risk Factors” section of this prospectus and in the other information contained or incorporated by reference in this prospectus. These and other factors could cause the information concerning our industry to differ materially from those expressed in this prospectus and incorporated by reference herein.

SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus or incorporated by reference in this prospectus. Because it is only a summary, it does not contain all of the information you should consider before making your investment decision and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information included elsewhere in this prospectus. Before you decide whether to purchase shares of our common stock or warrants, you should read this entire prospectus, the applicable prospectus supplement and any related free writing prospectus carefully, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part. Unless the context otherwise requires, the terms “Altisource,” the “Company,” “we,” “us,” or “our” refer to Altisource Portfolio Solutions S.A., a Luxembourg société anonyme, or public limited liability company, together with its subsidiaries.

Altisource Portfolio Solutions S.A.

We are an integrated service provider and marketplace for the real estate and mortgage industries. Combining operational excellence with a suite of innovative services and technologies, Altisource helps solve the demands of the ever-changing markets we serve.

We are focused on becoming the premier provider of mortgage and real estate marketplaces and related technology enabled solutions to a broad and diversified customer base of residential real estate and loan investors, servicers, and originators. The real estate and mortgage marketplaces represent very large markets, and we believe our scale and suite of offerings provide us with competitive advantages that could support our growth. As we navigate the COVID-19 pandemic and its impacts on our business, we continue to evaluate our strategy and core businesses and seek to position our businesses to provide long term value to our customers and shareholders.

Each of our business segments provides Altisource the potential to grow and diversify our customer and revenue base. We believe these business segments address very large markets and directly leverage our core competencies and distinct competitive advantages.

Servicer and Real Estate: Through our offerings that support residential real estate and loan investors and servicers, we provide a suite of solutions and technologies intended to meet their growing and evolving needs. We are focused on growing referrals from our existing customer base and attracting new customers to our offerings. We have a customer base that includes government-sponsored enterprises, asset managers, and several large bank and non-bank servicers including Ocwen Financial Corporation and Rithm Capital Corp. We believe we are one of only a few providers with a broad suite of servicer solutions, nationwide coverage and scalability. Further, we believe we are well positioned to gain market share from existing and new customers as they consolidate to larger, full-service providers or outsource services that have historically been performed in-house.

Origination: Through our offerings that support mortgage loan originators (or other similar mortgage market participants), we provide a suite of solutions and technologies to meet the evolving and growing needs of lenders, mortgage purchasers and securitizers. We are focused on growing business from our existing customer base, attracting new customers to our offerings and developing new offerings. We have a customer base that includes the Lenders One cooperative members, which includes independent mortgage bankers, credit unions, and banks, as well as bank and non-bank loan originators. We believe our suite of services, technologies and unique access to the members of the Lenders One mortgage cooperative position us to grow our relationships with our existing customer base by growing membership of Lenders One, increasing member adoption of existing solutions and developing and cross-selling new offerings. Further, we believe we are well positioned to gain market share from existing and new customers as customers and prospects look to Lenders One to help them improve their profitability and better compete.

Corporate and Others: Includes interest expense and costs related to corporate functions including executive, infrastructure and certain technology groups, finance, law, compliance, human resources, vendor management, facilities, risk management and eliminations between reportable segments.

For a complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by reference in this prospectus, including our Annual Report on Form 10-K for the year ended December 31, 2022, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. For instructions on how to find copies of these documents, see the section of this prospectus entitled “Where You Can Find More Information.”

See the section entitled “Risk Factors” in this prospectus for a discussion of some of the risks relating to the execution of our business strategy.

Corporate Information

The statutory seat of Altisource Portfolio Solutions S.A. is in Luxembourg. Our office address and our principal executive office is located at 33, Boulevard Prince Henri, L-1724 Luxembourg, Grand Duchy of Luxembourg and our telephone number is (+352) 20 60 20 55.

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and other information with the SEC. These filings are available to the public on the SEC’s website at www.sec.gov.

Our principal Internet address is www.altisource.com and we encourage investors to use it as a way to easily find information about us. We promptly make the reports we file or furnish with the SEC, corporate governance information (including our Code of Business Conduct and Ethics), select press releases and other related information available on this website. The contents of our website are available for informational purposes only and are not incorporated by reference into, nor are they in any way part of, this prospectus and should not be relied upon in connection with making any decision with respect to an investment in our securities.

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and may choose to take advantage of certain of the scaled disclosure requirements available for smaller reporting companies in this prospectus as well as our filings under the Exchange Act.

RISK FACTORS

Risk Factors

Investing in any securities offered pursuant to this prospectus, the applicable prospectus supplement and any related free writing prospectus involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below, under “Risk Factors” in the applicable prospectus supplement, any related free writing prospectus and in our most recent Annual Report on Form 10-K, or in any updates in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus, the applicable prospectus supplement and any related free writing prospectus, before deciding whether to purchase any of the securities being offered. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference into this prospectus may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, about Altisource. These forward-looking statements are intended to be covered by the safe harbor for forward- looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, and can be identified by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “could,” “should,” “projects,” “plans,” “goal,” “targets,” “potential,” “estimates,” “pro forma,” “seeks,” “intends” or “anticipates” or the negative thereof or comparable terminology. Forward-looking statements include discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of various transactions, and statements about the future performance, operations, products and services of Altisource. We caution our stockholders and other readers not to place undue reliance on such statements.

You should read this prospectus, any accompanying prospectus supplement and the documents incorporated by reference completely and with the understanding that our actual future results may be materially different from what we currently expect. Our business and operations are and will be subject to a variety of risks, uncertainties and other factors. Consequently, actual results and experience may materially differ from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the risk factors set forth in Part I — Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 30, 2023, the risk factors set forth in Part II — Item 1A “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on April 27, 2023, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on July 27, 2023, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on October 26, 2023, and elsewhere in the other documents incorporated by reference into this prospectus.

You should assume that the information appearing in this prospectus, any accompanying prospectus supplement, any related free writing prospectus and any document incorporated herein by reference is accurate as of its date only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All written or oral forward-looking statements attributable to us or any person acting on our behalf made after the date of this prospectus are expressly qualified in their entirety by the risk factors and cautionary statements contained in and incorporated by reference into this prospectus. Unless legally required, we do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

USE OF PROCEEDS

We are filing the registration statement of which this prospectus forms a part to permit the Selling Stockholders to resell the Warrant Shares. We will not receive any proceeds from the sale of the Warrant Shares by the Selling Stockholders. We may receive up to $16,118.89 in aggregate gross proceeds from cash exercises of the Warrants, based on the per share exercise price of the Warrants. Any proceeds we receive from the exercise of the Warrants will be used for general corporate purposes.

The Selling Stockholders will pay any underwriting fees, discounts and commissions attributable to the sale of the Warrant Shares and any similar expenses it incurs in disposing of the Warrant Shares. We will bear all other costs, fees, and expenses incurred in effecting the registration of the Warrant Shares covered by this prospectus. These may include, without limitation, all registration and filing fees, printing fees and fees and expenses of our counsel and accountants in connection with the registration of the Warrant Shares covered by this prospectus.

DESCRIPTION OF CAPITAL STOCK

General Matters

Authorized Capital Stock

As of September 30, 2023, according to U.S. GAAP, there were 29,962,748 shares of our common stock issued, of which 3,480,375 shares were held as shares of common stock held as treasury stock, and 26,482,373 shares of our common stock outstanding. As accounted under Luxembourg law, as of September 30, 2023, there were 30,784,907 shares of our common stock issued, of which 4,302,534 shares were held as shares of common stock held as treasury stock, and 26,482,373 shares of our common stock outstanding.

Under our Articles, our Board of Directors has the authority (“capital autorisé”) until May 17, 2027 to issue up to 100,000,000 (one hundred million) shares of capital stock, with a par value of $1.00 (one United States dollar) per share, all of which are classified as common stock.

The following summary of certain terms of Altisource capital stock describes the material provisions of our Articles, the form of which is included as an exhibit to our registration statement on Form 10. The following summary does not purport to be complete and is subject to, and qualified in its entirety by, our Articles and by applicable provisions of law.

Common Stock

The holders of shares of Altisource common stock will be entitled to one vote for each share on all matters voted on by shareholders, and the holders of such shares will possess all voting power. Accordingly, the holders of the majority of the shares of Altisource common stock cast (excluding any abstentions, empty or invalid votes) at the shareholders’ meeting voting for the election of directors can elect all of the directors if they choose to do so. The holders of shares of Altisource common stock will be entitled to such dividends as may be proposed from time to time by our Board of Directors and approved by the shareholders’ meeting and, under Luxembourg law, only if the Company has sufficient distributable profits and retained earnings from previous fiscal years or if the Company has freely distributable reserves. To date, Altisource has not paid any cash dividends on its common stock, and we have no current plans to pay cash dividends. Under Luxembourg law, cash dividends paid by a Luxembourg company are, as a general rule, subject to a 15% withholding tax (or 17.65% if the Luxembourg company bears the withholding tax cost), unless (i) the domestic withholding tax exemption or (ii) a reduced rate under the relevant double tax treaty applies. In December 2012, Altisource distributed stock to its shareholders in Altisource Asset Management Corporation (“AAMC”) and Front Yard Residential Corporation (“RESI”) and paid cash for fractional shares of AAMC and RESI in connection with the spin-off transactions of AAMC and RESI from Altisource to its shareholders..

Transfer Agent and Registrar

Our transfer agent and registrar for Altisource common stock is Equiniti Trust Company, formerly American Stock Transfer & Trust Company. The transfer agent and registrar’s address is 6201 15th Avenue, Brooklyn, NY 11219.

Listing

Our common stock is listed on the NASDAQ Global Select Market under the symbol “ASPS.”

Certain Anti-Takeover Considerations

General

While Altisource’s Articles do not contain many of the typical provisions that would be considered to have an anti-takeover effect, Altisource’s directors and executive officers held approximately 3.88% of the

voting power of our outstanding voting stock as of September 30, 2023. Such concentration of voting power could discourage third parties from making proposals involving an acquisition of control of Altisource.

We set forth below a summary of certain provisions that possibly could impede or delay an acquisition of control of Altisource that our Board of Directors does not approve or otherwise support. We intend this summary to be an overview only and qualify it in its entirety by reference to the documents evidencing such provisions the forms of which we include as exhibits to the registration statement on Form 10, as well as the applicable provisions of Luxembourg law.

Number of Directors; Removal; Filling Vacancies

Our Articles provide that the number of directors on our Board of Directors shall not be less than three (whenever there is more than one shareholder), which is the legal minimum nor more than seven. Each member of the Board of Directors may be elected for a maximum (renewable) term of six years. Our Articles further provide that directors may be elected at a general meeting of shareholders by simple majority of the votes cast (excluding any abstentions, empty or invalid votes) by the shareholders present in person or represented by proxy at the meeting. A vacancy or a newly created directorship as proposed by the Board of Directors may be filled by the Board of Directors on a provisional basis pending approval by shareholders at a shareholders’ meeting. Directors may at any time, with or without cause, be removed from office by resolution of the shareholders at a general meeting of shareholders, provided that a proposal for such resolution has been put on the agenda for the meeting in accordance with the requirements of Luxembourg law and our Articles or if the holders or proxies of all shares are present.

No Shareholder Action by Written Consent; Special Meetings

Altisource’s Articles provide that shareholders may take action at an annual or special shareholders’ meeting. Special meetings of shareholders may be called only if (1) Altisource’s Board of Directors or its auditors deem it necessary; or (2) if shareholders holding together 10% or more of our share capital request it. Altisource’s Articles do not allow for shareholder action by written consent in lieu of a meeting.

Amendment of the Articles

Any proposal to amend, alter, change or repeal any provision of Altisource’s Articles requires the affirmative vote (excluding any abstentions, empty or invalid votes) at the extra-ordinary shareholders’ meeting of the holders to be held before a Luxembourg civil law notary of at least two-thirds of the votes present and/or represented and a quorum of at least 50% of the share capital presented and/or represented.

Supermajority Vote for Certain Actions

Our Articles and Luxembourg company law provide that certain Altisource actions require the affirmative vote of shareholders holding at least 2/3 of the votes present/represented and majority quorum of at least 50% of the share capital represented at the shareholders’ meeting. Such actions include: any change to Altisource’s Articles; any changes to the corporate purpose; any changes to the rights attached to shares; any increase in the share capital; the issuing of a new class of shares; and any merger, demerger or liquidation.

Indemnification of Directors and Officers

The following summary of material terms is qualified in its entirety by reference to the complete text of the statutes referred to below and our Articles.

Altisource shall indemnify its directors and officers unless the liability results from their gross negligence or willful misconduct. Altisource’s Articles make indemnification of directors and officers and advancement of expenses (except in cases where Altisource is proceeding against an officer or director) to defend claims against directors and officers mandatory on the part of Altisource to the fullest extent allowed by law. Under Altisource’s Articles, a director or officer may not be indemnified if such person is found, in a final judgment or decree not subject to appeal, to have committed willful misconduct or a grossly negligent breach of his or her statutory duties as a director or officer. Luxembourg law permits the company, or each

director or officer individually, to purchase and maintain insurance on behalf of such directors and officers. Altisource may obtain such insurance from one or more insurers.

Altisource also may enter into indemnification agreements with each of its directors and executive officers to provide for indemnification and expense advancement (except in cases where Altisource is proceeding against an officer or director) and include related provisions meant to facilitate the indemnitee’s receipt of such benefits. We expect any such agreement to provide that Altisource will indemnify each director and executive officer against claims arising out of such director or executive officer’s service to Altisource except (i) for any claim as to which the director or executive officer is adjudged in a final and non- appealable judgment to have committed willful misconduct or a grossly negligent breach of his duties or (ii) in the case of fraud or dishonesty by the director or executive officer. We also expect any such agreement to provide that expense advancement is provided subject to an undertaking by the indemnitee to repay amounts advanced if it is ultimately determined that he is not entitled to indemnification.

Altisource’s Board of Directors (if a majority of the Board is disinterested in the claim under which the officer or director is seeking indemnification) or an independent counsel will determine whether an indemnification payment or expense advance should be made in any particular instance and the executive officer or director seeking indemnification may challenge such determination. Indemnification and advancement of expenses generally will not be made in connection with proceedings brought by the indemnitee against Altisource.

PLAN OF DISTRIBUTION

Each Selling Stockholder (the “Selling Stockholders”) of the securities and any of their pledgees, donees, assignees, transferees, and successors-in-interest may, from time to time, sell any or all of their securities or interests in any securities covered hereby on the Nasdaq Global Select Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales or dispositions may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling securities:

•

ordinary brokerage transactions and transactions in which the broker- dealer solicits purchasers;

•

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

settlement of short sales;

•

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

a combination of any such methods of sale; or

•

any other method permitted pursuant to applicable law.

The Selling Stockholders may also sell securities under Rule 144 or any other exemptions from registration under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other broker- dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. To our knowledge, no Selling Stockholder has entered into any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Selling Stockholders will be subject to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus or any other exemptions from registration under the Securities Act. To our knowledge, there is no underwriter or coordinating broker acting in connection with the proposed sale of the resale securities by the Selling Stockholders.

We agreed to keep this prospectus effective until the day on which there are no longer any Registrable Securities (as defined in the Registration Rights Agreement). The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

SELLING STOCKHOLDERS

The shares of common stock being offered by the Selling Stockholders are those issuable to the Selling Stockholders upon exercise of the Warrants. We are registering the shares of common stock in order to permit the Selling Stockholders to offer the shares for resale from time to time.

The table below was prepared based on information provided to us by the Selling Stockholders. It lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the Selling Stockholders. The second column lists the number of shares of common stock beneficially owned by each Selling Shareholder, based on its ownership of the Warrants, as of December 26, 2023, assuming exercise of the Warrants held by the Selling Stockholders on that date, without regard to any limitation on exercise.

The third column lists the shares of common stock being offered by this prospectus by the Selling Stockholders.

In accordance with the terms of the registration rights agreement with the holders of the Warrants, this prospectus generally covers the resale of that number of shares of common stock equal to the number of shares of common stock issuable upon exercise of the Warrants, determined as if the outstanding Warrants were exercised, as applicable, in full, in each case as of the trading day immediately preceding the date this registration statement was initially filed with the SEC. The fourth and fifth columns assume the sale of all of the shares offered by the Selling Stockholders pursuant to this prospectus. We have based percentage ownership after this offering on 26,495,979 shares of common stock outstanding as of December 26, 2023.

Under the terms of the Warrants, generally a Selling Shareholder may not exercise the Warrants to the extent such exercise would cause such Selling Shareholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% (or 9.99% at the election of any holder, in accordance with the terms of the Warrant) of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the remaining portion of such Warrant or exercise or conversion of the unexercised or unconverted portion of any other securities of the Company (including, without limitation, any other common stock equivalents) subject to a limitation on conversion or exercise analogous to the limitation contained in such Warrant beneficially owned by the Selling Shareholder or any of its affiliates or attribution parties. The number of shares in the second column does not reflect this limitation. The Selling Shareholders may sell all, some or none of their shares in this offering. We cannot advise you as to whether the Selling Stockholders will in fact sell any or all of such shares. In addition, the Selling Stockholders may sell, transfer or otherwise dispose of, at any time and from time to time, the shares in transactions exempt from the registration requirements of the Securities Act after the date of this prospectus. See “Plan of Distribution.”

|

Name of Selling Stockholder

|

|

|

Number of Shares

Beneficially Owned

Prior to Offering

|

|

|

Maximum

Number of

Shares to be Sold

Pursuant to this

Prospectus

|

|

|

Number of

Shares

Beneficially

Owned After

Offering

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned After

Offering

|

|

|

Mountain View CLO 2013-1 Ltd.(1)

|

|

|

|

|

14,043 |

|

|

|

|

|

14,043 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO 2014-1 Ltd.(1)

|

|

|

|

|

17,115 |

|

|

|

|

|

17,115 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO X Ltd.(1)

|

|

|

|

|

4,369 |

|

|

|

|

|

4,369 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO IX Ltd.(1)

|

|

|

|

|

16,799 |

|

|

|

|

|

16,799 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO 2016-1 Ltd.(1)

|

|

|

|

|

11,096 |

|

|

|

|

|

11,096 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO 2017-1 Ltd.(1)

|

|

|

|

|

9,513 |

|

|

|

|

|

9,513 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO 2017-2 Ltd.(1)

|

|

|

|

|

14,128 |

|

|

|

|

|

14,128 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO XIV Ltd.(1)

|

|

|

|

|

12,616 |

|

|

|

|

|

12,616 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Mountain View CLO XV Ltd.(1)

|

|

|

|

|

6,532 |

|

|

|

|

|

6,532 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

City National Rochdale Fixed Income Opportunities Fund(2)

|

|

|

|

|

4,485 |

|

|

|

|

|

4,485 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Name of Selling Stockholder

|

|

|

Number of Shares

Beneficially Owned

Prior to Offering

|

|

|

Maximum

Number of

Shares to be Sold

Pursuant to this

Prospectus

|

|

|

Number of

Shares

Beneficially

Owned After

Offering

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned After

Offering

|

|

|

Virtus Seix Floating Rate High Income Fund(2)

|

|

|

|

|

23,725 |

|

|

|

|

|

23,725 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Virtus Seix Senior Loan ETF(2)

|

|

|

|

|

3,266 |

|

|

|

|

|

3,266 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

STS Master Fund Ltd.(3)

|

|

|

|

|

4,449,991 |

|

|

|

|

|

201,015 |

|

|

|

|

|

4,248,976 |

|

|

|

|

|

16.04% |

|

|

|

Deer Park 1850 Fund, LP(3)

|

|

|

|

|

90,723 |

|

|

|

|

|

90,723 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Saratoga Investment Corp. CLO 2013-1, Ltd(4)

|

|

|

|

|

7,990 |

|

|

|

|

|

7,990 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Signal Peak CLO 1 Ltd.(5)

|

|

|

|

|

11,368 |

|

|

|

|

|

11,368 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Signal Peak CLO 2, LLC(5)

|

|

|

|

|

4,764 |

|

|

|

|

|

4,764 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Signal Peak CLO 3, Ltd.(5)

|

|

|

|

|

10,654 |

|

|

|

|

|

10,654 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Signal Peak CLO 5, Ltd.(5)

|

|

|

|

|

10,654 |

|

|

|

|

|

10,654 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Signal Peak CLO 7, Ltd.(5)

|

|

|

|

|

7,147 |

|

|

|

|

|

7,147 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Reliance Standard Life Insurance Company(6)

|

|

|

|

|

4,431 |

|

|

|

|

|

4,431 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

BOF Holdings VI, LLC(6)

|

|

|

|

|

32,495 |

|

|

|

|

|

32,495 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Three Line 2022-1, LLC(7)

|

|

|

|

|

8,165 |

|

|

|

|

|

8,165 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden XXVIII Senior Loan Fund(8)

|

|

|

|

|

2,796 |

|

|

|

|

|

2,796 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden XXVI Senior Loan Fund(8)

|

|

|

|

|

3,995 |

|

|

|

|

|

3,995 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 30 Senior Loan Fund(8)

|

|

|

|

|

2,796 |

|

|

|

|

|

2,796 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 36 Senior Loan Fund(8)

|

|

|

|

|

1,997 |

|

|

|

|

|

1,997 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 37 Senior Loan Fund(8)

|

|

|

|

|

3,495 |

|

|

|

|

|

3,495 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 38 Senior Loan Fund(8)

|

|

|

|

|

1,997 |

|

|

|

|

|

1,997 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 40 Senior Loan Fund(8)

|

|

|

|

|

1,997 |

|

|

|

|

|

1,997 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 41 Senior Loan Fund(8)

|

|

|

|

|

4,195 |

|

|

|

|

|

4,195 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 42 Senior Loan Fund(8)

|

|

|

|

|

2,097 |

|

|

|

|

|

2,097 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 43 Senior Loan Fund(8)

|

|

|

|

|

1,997 |

|

|

|

|

|

1,997 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 45 Senior Loan Fund(8)

|

|

|

|

|

1,997 |

|

|

|

|

|

1,997 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 47 Senior Loan Fund(8)

|

|

|

|

|

4,195 |

|

|

|

|

|

4,195 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 49 Senior Loan Fund(8)

|

|

|

|

|

3,196 |

|

|

|

|

|

3,196 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 50 Senior Loan Fund(8)

|

|

|

|

|

3,196 |

|

|

|

|

|

3,196 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 54 Senior Loan Fund(8)

|

|

|

|

|

3,495 |

|

|

|

|

|

3,495 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 53 CLO, LTD.(8)

|

|

|

|

|

3,495 |

|

|

|

|

|

3,495 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 57 CLO, LTD.(8)

|

|

|

|

|

2,796 |

|

|

|

|

|

2,796 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 58 CLO, LTD.(8)

|

|

|

|

|

1,997 |

|

|

|

|

|

1,997 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 64 CLO, LTD.(8)

|

|

|

|

|

4,195 |

|

|

|

|

|

4,195 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dryden 65 CLO, LTD.(8)

|

|

|

|

|

2,075 |

|

|

|

|

|

2,075 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Bentham Syndicated Loan Fund(9)

|

|

|

|

|

33,797 |

|

|

|

|

|

33,797 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Name of Selling Stockholder

|

|

|

Number of Shares

Beneficially Owned

Prior to Offering

|

|

|

Maximum

Number of

Shares to be Sold

Pursuant to this

Prospectus

|

|

|

Number of

Shares

Beneficially

Owned After

Offering

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned After

Offering

|

|

|

Hudson Post Credit Opportunities Aggregator II, LLC(10)

|

|

|

|

|

92,077 |

|

|

|

|

|

92,077 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Demus CLO 10, Ltd.(11)

|

|

|

|

|

15,981 |

|

|

|

|

|

15,981 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Demus CLO 12, Ltd.(11)

|

|

|

|

|

12,456 |

|

|

|

|

|

12,456 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square CLO 2014-1, Ltd.(12)

|

|

|

|

|

4,859 |

|

|

|

|

|

4,859 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square CLO 2015-1, Ltd.(12)

|

|

|

|

|

8,261 |

|

|

|

|

|

8,261 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square CLO 2015-2, Ltd.(12)

|

|

|

|

|

6,593 |

|

|

|

|

|

6,593 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square CLO 2018-1, Ltd.(12)

|

|

|

|

|

6,957 |

|

|

|

|

|

6,957 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square CLO 2018-2, Ltd.(12)

|

|

|

|

|

8,694 |

|

|

|

|

|

8,694 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square CLO 2018-3, Ltd.(12)

|

|

|

|

|

7,103 |

|

|

|

|

|

7,103 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square CLO 2019-1, Ltd.(12)

|

|

|

|

|

5,737 |

|

|

|

|

|

5,737 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square Floating Rate Fund LLC(12)

|

|

|

|

|

705 |

|

|

|

|

|

705 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palmer Square Loan Funding 2020-1, Ltd.(12)

|

|

|

|

|

5,851 |

|

|

|

|

|

5,851 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Palm Tree Capital Management, LP(13)

|

|

|

|

|

2,642 |

|

|

|

|

|

2,642 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

PhenixFIN Corporation(14)

|

|

|

|

|

42,369 |

|

|

|

|

|

42,369 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

California State Teachers’ Retirement System(15)

|

|

|

|

|

13,285 |

|

|

|

|

|

13,285 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Copperhill Loan Fund I, LLC(15)

|

|

|

|

|

3,795 |

|

|

|

|

|

3,795 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Credit Suisse Floating Rate High Income Fund(15)

|

|

|

|

|

53,142 |

|

|

|

|

|

53,142 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Credit Suisse Strategic Income Fund(15)

|

|

|

|

|

2,846 |

|

|

|

|

|

2,846 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Credit Suisse Floating Rate Trust(15)

|

|

|

|

|

6,059 |

|

|

|

|

|

6,059 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Credit Suisse Nova (Lux) Global Senior Loan

Fund(15)

|

|

|

|

|

98,693 |

|

|

|

|

|

98,693 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dollar Senior Loan Fund, LTD.(15)

|

|

|

|

|

15,183 |

|

|

|

|

|

15,183 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

DaVinci Reinsurance Ltd.(15)

|

|

|

|

|

2,308 |

|

|

|

|

|

2,308 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Dollar Senior Loan Fund II, LTD.(15)

|

|

|

|

|

2,263 |

|

|

|

|

|

2,263 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Erie Indemnity Company(15)

|

|

|

|

|

557 |

|

|

|

|

|

557 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Erie Insurance Exchange(15)

|

|

|

|

|

7,541 |

|

|

|

|

|

7,541 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XI, Ltd.(15)

|

|

|

|

|

9,415 |

|

|

|

|

|

9,415 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XIV, Ltd.(15)

|

|

|

|

|

18,979 |

|

|

|

|

|

18,979 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XVII, Ltd.(15)

|

|

|

|

|

15,183 |

|

|

|

|

|

15,183 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XVIII, Ltd.(15)

|

|

|

|

|

7,591 |

|

|

|

|

|

7,591 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXI, Ltd.(15)

|

|

|

|

|

15,183 |

|

|

|

|

|

15,183 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXII, Ltd.(15)

|

|

|

|

|

10,438 |

|

|

|

|

|

10,438 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XX, Ltd.(15)

|

|

|

|

|

10,438 |

|

|

|

|

|

10,438 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XIX, Ltd.(15)

|

|

|

|

|

13,285 |

|

|

|

|

|

13,285 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Name of Selling Stockholder

|

|

|

Number of Shares

Beneficially Owned

Prior to Offering

|

|

|

Maximum

Number of

Shares to be Sold

Pursuant to this

Prospectus

|

|

|

Number of

Shares

Beneficially

Owned After

Offering

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned After

Offering

|

|

|

Madison Park Funding XXIII, Ltd.(15)

|

|

|

|

|

15,183 |

|

|

|

|

|

15,183 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXIV, Ltd.(15)

|

|

|

|

|

15,183 |

|

|

|

|

|

15,183 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XL, Ltd.(15)

|

|

|

|

|

15,183 |

|

|

|

|

|

15,183 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XLII, Ltd.(15)

|

|

|

|

|

13,285 |

|

|

|

|

|

13,285 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XLIII, Ltd.(15)

|

|

|

|

|

16,512 |

|

|

|

|

|

16,512 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XLIV, Ltd.(15)

|

|

|

|

|

18,979 |

|

|

|

|

|

18,979 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXIX, Ltd.(15)

|

|

|

|

|

11,387 |

|

|

|

|

|

11,387 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXV, Ltd.(15)

|

|

|

|

|

11,387 |

|

|

|

|

|

11,387 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXVI, Ltd.(15)

|

|

|

|

|

9,489 |

|

|

|

|

|

9,489 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXVII, Ltd.(15)

|

|

|

|

|

18,830 |

|

|

|

|

|

18,830 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXVIII, Ltd.(15)

|

|

|

|

|

13,211 |

|

|

|

|

|

13,211 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXX, Ltd.(15)

|

|

|

|

|

15,034 |

|

|

|

|

|

15,034 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXXII, Ltd.(15)

|

|

|

|

|

18,107 |

|

|

|

|

|

18,107 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXXIV, Ltd.(15)

|

|

|

|

|

10,255 |

|

|

|

|

|

10,255 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Madison Park Funding XXXV, Ltd.(15)

|

|

|

|

|

1,199 |

|

|

|

|

|

1,199 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Renaissance Investment Holdings Ltd.(15)

|

|

|

|

|

1,086 |

|

|

|

|

|

1,086 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

One Eleven Funding III, Ltd.(15)

|

|

|

|

|

6,790 |

|

|

|

|

|

6,790 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

State of Wyoming(15)

|

|

|

|

|

6,205 |

|

|

|

|

|

6,205 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Venture XIII CLO, Limited

|

|

|

|

|

3,995 |

|

|

|

|

|

3,995 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Venture XV CLO, Limited

|

|

|

|

|

3,995 |

|

|

|

|

|

3,995 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Venture XVII CLO, Limited

|

|

|

|

|

2,803 |

|

|

|

|

|

2,803 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Venture XVIII CLO, Limited

|

|

|

|

|

5,993 |

|

|

|

|

|

5,993 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

Venture XIX CLO, Limited

|

|

|

|

|

3,995 |

|

|

|

|

|

3,995 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|