BayCom Corp Announces Adoption of Stock Repurchase Program

21 Abril 2023 - 5:30PM

Business Wire

BayCom Corp (NASDAQ: BCML) (“BayCom” or the “Company”),

the parent company of United Business Bank, today announced that

its Board of Directors (the “Board”) approved its seventh stock

repurchase program for the repurchase of up to 619,000 shares of

its common stock, or approximately 5% of its outstanding shares,

over a one year period through open market purchases,

privately-negotiated transactions, or otherwise in compliance with

Rule 10b-18 under the Securities Exchange Act of 1934. The new

stock repurchase program will commence upon completion of the sixth

stock repurchase program which will expire on October 24, 2023, or

earlier if the shares have been repurchased. As of the date hereof,

the Company has 17,633 shares available for future purchase under

the Company’s sixth stock repurchase program.

Repurchases are expected to commence immediately. The actual

timing, number and value of shares repurchased under the stock

repurchase program will depend on a number of factors, including

constraints specified in any Rule 10b5-1 trading plan adopted,

price, general business and market conditions, and alternative

investment opportunities. The share buyback program does not

obligate the Company to acquire any specific number of shares in

any period, and may be expanded, extended, modified or discontinued

at any time.

About BayCom Corp

The Company, through its wholly owned operating subsidiary,

United Business Bank, offers a full-range of loans, including SBA,

FSA and USDA guaranteed loans, and deposit products and services to

businesses and its affiliates in California, Washington, New Mexico

and Colorado. The Bank is an Equal Housing Lender and a member of

FDIC. The Company is traded on the NASDAQ under the symbol “BCML”.

For more information, go to www.unitedbusinessbank.com.

Forward-Looking Statements

This press release includes certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws, including information regarding purchases by

BayCom of its common stock. Forward-looking statements include, but

are not limited to, statements that refer to projections, forecasts

or other characterizations of future events or circumstances,

including any underlying assumptions. The words or phrases "may,"

"believe," "will," "will likely result," "are expected to," "will

continue," "is anticipated," "estimate," "project," "plans,"

"potential," or similar expressions are intended to identify

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995, but the absence of these

words does not mean that a statement is not forward-looking. By

their nature, forward-looking information and statements are

subject to risks, uncertainties, and contingencies, including

changes in price and volume and the volatility of the Company’s

common stock; adverse developments affecting either or both of

prices and trading of exchange-traded securities, including

securities listed on the Nasdaq Stock Market; and unexpected or

otherwise unplanned or alternative requirements with respect to the

capital investments of the Company. The Company does not undertake

to update any forward looking statements or information, including

those contained in this report.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230421005058/en/

BayCom Corp Keary Colwell, 925-476-1800 kcolwell@ubb-us.com

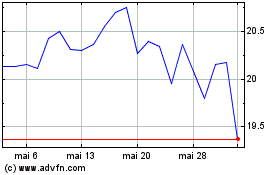

BayCom (NASDAQ:BCML)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

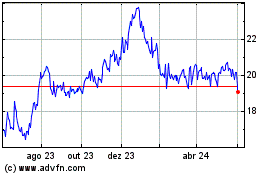

BayCom (NASDAQ:BCML)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024