Capital City Bank Group, Inc. Announces Late Filing of Third Quarter 2023 10-Q and Planned Restatements

13 Novembro 2023 - 7:16PM

Capital City Bank Group, Inc. today announced that in preparing its

Quarterly Report on Form 10-Q for the quarter ended September 30,

2023, it identified certain inter-company transactions between its

subsidiaries, Capital City Bank and Capital City Home Loans Inc.,

involving residential mortgage loan purchases that were not

properly recorded in accordance with generally accepted accounting

principles, which impacted the Company’s earnings release for the

third quarter of 2023 and the Company’s consolidated financial

statements for the year ended December 31, 2022, the three months

ended March 31, 2022 and 2023, the three and six months ended June

30, 2022 and 2023, and the three and nine months ended September

30, 2022.

As a result, the Company is unable to file its

Quarterly Report on Form 10-Q for the quarter ended September 30,

2023 in a timely manner and has determined that financial

statements and the related report of the Company’s independent

auditor, FORVIS, LLP, included in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022, and the Company’s

consolidated financial statements for the other periods referred to

above, should no longer be relied upon and that certain of such

financial statements should be restated. Further, investors should

no longer rely upon the financial statements and related

information in the Company’s earnings releases issued, and investor

presentations distributed, for those periods as well as for the

quarter ended September 30, 2023.

“In the course of preparing our 10-Q for the

third quarter, we identified specific accounting items that need

revision and will require restating certain historical financial

information,” said William G. Smith, Jr., President and Chief

Executive Officer of Capital City Bank Group. “We are committed to

the integrity of our reporting and are working diligently to

complete our third-quarter reporting and rectify affected prior

period financials.”

In light of the matters discussed above,

management is reassessing the effectiveness of CCBG’s internal

control over financial reporting and disclosure controls and

procedures, and CCBG expects to report a material weakness in its

internal controls with respect to the inaccuracies mentioned above.

Management intends to implement new controls to remediate any

control deficiencies that exist with respect to these

transactions.

The Company intends to file amendments to its

Annual Report on Form 10-K for the year ended December 31, 2022 and

its Quarterly Reports on Form 10-Q for the three months ended March

31, 2023, and the three and six months ended June 30, 2023,

including restated financial statements and related disclosures

(collectively, the “Amended Reports”), as promptly as practicable.

Management, in consultation with the Company’s independent public

accountants, is working to determine whether there are impacts to

any of the Company’s financial statements other than those referred

to above and that require amendments to any SEC filings other than

the Amended Reports.

Additional information regarding the matters

discussed above is set forth in the Company’s Current Report on

Form 8-K and Form 12b-25, both filed today with the SEC.

About Capital City Bank Group,

Inc.

Capital City Bank Group, Inc. (NASDAQ: CCBG) is one

of the largest publicly traded financial holding companies

headquartered in Florida and has approximately $4.1 billion in

assets. We provide a full range of banking services, including

traditional deposit and credit services, mortgage banking, asset

management, trust, merchant services, bankcards, securities

brokerage services and financial advisory services, including the

sale of life insurance, risk management and asset protection

services. Our bank subsidiary, Capital City Bank, was founded in

1895 and now has 63 banking offices and 100 ATMs/ITMs in Florida,

Georgia and Alabama. For more information about Capital City Bank

Group, Inc., visit www.ccbg.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements (within the meaning of the Private Securities Litigation

Reform Act of 1995 and other legal authority) that are based on

current plans and expectations that are subject to uncertainties

and risks. The words “may,” “could,” “should,” “would,” “believe,”

“anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,”

“vision,” “goal,” and similar expressions are intended to identify

forward-looking statements. We may not actually achieve the plans,

carry out the intentions or meet the expectations disclosed in the

forward-looking statements, and you should not rely on these

forward-looking statements due to many factors, including: the

effects of the restatements described above on prior-period

financial statements or financial results; risks related to the

timely and correct completion of the restatements and related

filings; the risk that the completion and filing of the Amended

Reports will take significantly longer than expected and will not

be completed in a timely manner; identification of any additional

inaccuracies in our financial reporting that require further

restatements of previously issued financial statements; the risk

that the restatements may subject us to unanticipated costs or

regulatory penalties and could cause investors to lose confidence

in the accuracy and completeness of our financial statements; the

risk that additional information may become known prior to the

expected filing of the Amended Reports with the SEC or that other

subsequent events may occur that would require the Company to make

additional adjustments to its financial statements or delay the

filing of the Amended Reports with the SEC; the possibility that

The Nasdaq Stock Market may seek to delist the Company’s

securities; the possibility that the Company will not be able to

become current in its filings with the SEC; the risk of

investigations or actions by governmental authorities or regulators

and the consequences thereof, including the imposition of

penalties; the risk that the Company may become subject to

shareowner lawsuits or claims; risks related to our ability to

implement and maintain effective internal control over financial

reporting and/or disclosure controls and procedures in the future,

which may adversely affect the accuracy and timeliness of our

financial reporting; risks related to changes in key personnel and

any changes in our ability to retain key personnel; the inherent

limitations in internal control over financial reporting and

disclosure controls and procedures; the scope of the restatement

and deficiencies, if any, in internal control over financial

reporting and/or disclosure controls and procedures may be broader

than we currently anticipate; remediation of any deficiencies with

respect to the Company’s internal control over financial reporting

and/or disclosure controls and procedures may be complex and

time-consuming; the impact of these matters on the Company’s

performance and outlook; and expectations concerning the Company’s

performance and financial outlook. Additional factors can be found

in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, and our other filings with the SEC, which are

available at the SEC’s internet site (http://www.sec.gov).

Forward-looking statements in this press release speak only as of

the date of this press release, and we assume no obligation to

update forward-looking statements or the reasons why actual results

could differ, except as may be required by law.

For Information Contact:Jep LarkinExecutive Vice

President and Chief Financial Officer850.402. 8450

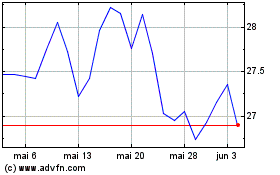

Capital City Bank (NASDAQ:CCBG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Capital City Bank (NASDAQ:CCBG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025