~ Receipt of Shareholder Approvals for the

Merger with Cambridge ~ ~ CFO James Fitzgerald Announces Upcoming

Retirement ~

Eastern Bankshares, Inc. (the “Company,” or together with its

subsidiaries, “Eastern”) (NASDAQ Global Select Market: EBC), the

stock holding company of Eastern Bank, today announced its 2024

first quarter financial results and the declaration of a quarterly

cash dividend.

On February 28, 2024, the Company and Cambridge Bancorp

(“Cambridge”) each received shareholder approval for the previously

announced all-stock merger of Cambridge with and into Eastern (“the

merger”). The merger is anticipated to close early in the third

quarter of 2024, subject to receipt of regulatory approvals.

“Our first quarter results demonstrated growth in both core

deposits and loans, as we continue to deepen our presence in the

Boston market,” said Bob Rivers, Chief Executive Officer and Chair

of the Board of the Company and Eastern Bank. “Our earnings in the

quarter benefited from margin stabilization and well-controlled

expenses, and our balance sheet remains healthy with strong capital

and liquidity.”

“We remain optimistic about our continued growth as Eastern and

Cambridge continue to work closely as we plan for the anticipated

merger closing and integration. We are pleased to have received

shareholder approvals for the merger and we look forward to

receiving regulatory approvals in the near future and combining our

two great franchises into Boston’s leading bank,” said Rivers.

CFO JAMES FITZGERALD ANNOUNCES UPCOMING RETIREMENT

The Company also announced today that James Fitzgerald intends

to retire from his role as Chief Financial Officer, Chief

Administrative Officer and Treasurer of the Company and as Chief

Financial Officer, Chief Administrative Officer and Vice Chair of

Eastern Bank after 12 years of dedicated service. Fitzgerald will

continue to serve in his roles until a successor is appointed, and

will then serve in a senior advisory role throughout the planned

merger and integration with Cambridge and Cambridge Trust Company

and previously announced leadership transitions related to the

merger. As part of the search process to help identify the next

CFO, Eastern has retained executive search firm Korn Ferry.

“On behalf of everyone at Eastern, it is my honor to recognize

and thank Jim for his extraordinary contributions,” said Rivers.

“Jim’s outstanding financial acumen, his leadership across many

important transactions over the years, and his role as a trusted

advisor to our leadership team and mentor to our next generation of

executive leaders, position Eastern exceptionally well as we

continue to serve our shareholders, customers and workforce. As Jim

begins to prepare for retirement, we are deeply grateful for all

that he has contributed and for his continued leadership throughout

this transition.”

Deborah Jackson, Eastern’s Lead Director, added, “On behalf of

the Board, I thank Jim for his tremendous service and dedication to

Eastern over the years. Eastern’s track record of solid performance

and strong financial and administrative functions are testaments to

Jim’s leadership. We look forward to his continued contributions as

a successor is appointed and we build upon Jim’s legacy at

Eastern.”

“I’ve thoroughly enjoyed my time at Eastern and it’s been a

privilege to work with Bob and the Board over the last 12 years,”

added Fitzgerald. “It’s also been a privilege working with our

highly talented executive team and my colleagues throughout Eastern

as we have executed a number of strategic transactions since the

IPO that position the Company for future growth. I’ll certainly

miss the many relationships at Eastern that have been so meaningful

to me and am very committed to seeing the successful completion of

the Cambridge integration.”

FINANCIAL HIGHLIGHTS FOR THE FIRST QUARTER OF 2024

- Net income of $38.6 million, or $0.24 per diluted share.

Operating net income* of $38.1 million, or $0.23 per diluted

share.

- Deposits up $71 million, or 1.6% on an annualized basis. Core

deposits up $121 million, or 2.8% on an annualized basis, which was

partially offset by a $50 million decline in brokered

deposits.

- Total loans increased $115.3 million, or 3.3% on an annualized

basis, from the prior quarter, to $14.1 billion.

- The net interest margin on a fully tax equivalent (“FTE”)

basis* was stable at 2.68% as compared to 2.69% in the prior

quarter.

- Net interest income was $129.9 million, a decrease of $3.4

million from prior quarter.

- Noninterest expense of $101.2 million and operating noninterest

expense* of $97.6 million.

- Modest increase in non-performing loans (“NPLs”) from $52.6

million to $57.2 million or from 0.38% to 0.41% of total

loans.

- Net charge-offs (“NCOs”) on an annualized basis of 0.21% of

average total loans, compared to 0.32% in the prior quarter.

- Continued resolution of problem loans. One NPL resolved and

collateral of two NPLs under contract for sale. One new NPL in Q1

2024, the collateral of which is being marketed for sale.

BALANCE SHEET

Total assets were $21.2 billion at March 31, 2024, representing

an increase of $41.5 million, or 0.2% from December 31, 2023.

- Cash and equivalents increased $45.9 million from the prior

quarter to $739.0 million.

- Total securities decreased $125.8 million, or 2.6%, from the

prior quarter, to $4.7 billion, due to principal runoff, as well as

a decrease in the market value of available for sale

securities.

- Loans totaled $14.1 billion, representing an increase of $115.3

million, or 0.8%, from the prior quarter, driven by commercial loan

growth of $128.6 million.

- Deposits totaled $17.7 billion, representing an increase of

$70.5 million, or 0.4%, from the prior quarter, driven primarily by

an increase of $120.5 million, or 0.7%, in core deposits, partially

offset by a decrease of $50.0 million in brokered deposits. The

Company had no brokered deposits at March 31, 2024.

- Federal Home Loan Bank (“FHLB”) advances decreased $0.2 million

from the prior quarter to $17.6 million.

- Shareholders’ equity was $3.0 billion, representing a decrease

of $22.0 million from the prior quarter, primarily driven by a

decrease in accumulated other comprehensive income, partially

offset by an increase in retained earnings.

- At March 31, 2024, book value per share was $16.72 and tangible

book value per share* was $13.51. Please refer to Appendix D to

this press release for a roll-forward of tangible shareholders’

equity*.

NET INTEREST INCOME

Net interest income was $129.9 million for the first quarter of

2024, compared to $133.3 million in the prior quarter, representing

a decrease of $3.4 million.

- The net interest margin on a FTE basis* was 2.68% for the first

quarter, representing a 1 basis point decrease from the prior

quarter, as higher funding costs offset increases in asset

yields.

- Total interest-earning asset yields increased 7 basis points

from the prior quarter to 4.13%, due primarily to an increase in

loan yields of 10 basis points.

- Total interest-bearing liabilities cost increased 13 basis

points from the prior quarter to 2.32%, due primarily to higher

deposit costs resulting from deposit pricing increases and deposit

mix shifts, partially offset by a decrease in average

borrowings.

- There were 91 days in the first quarter compared to 92 in the

prior quarter.

NONINTEREST INCOME

Noninterest income was $27.7 million for the first quarter of

2024, compared to $26.7 million for the prior quarter, representing

an increase of $1.0 million. Noninterest income on an operating

basis* was $23.4 million for the first quarter of 2024, compared to

$21.8 million for the prior quarter, representing an increase of

$1.6 million.

- Service charges on deposit accounts were $7.5 million,

essentially unchanged from the prior quarter.

- Trust and investment advisory fees increased $0.4 million from

the prior quarter to $6.5 million, primarily due to higher market

values of assets under management.

- Debit card processing fees decreased $0.2 million from the

prior quarter to $3.2 million.

- Loan-level interest rate swap income increased $1.2 million

from the prior quarter to $0.7 million.

- Income from investments held in rabbi trust accounts was $4.3

million compared to $5.0 million in the prior quarter. The quarter

over quarter change was driven by investment performance.

- There were no losses on sales of commercial and industrial

loans in the first quarter, compared to losses of $0.1 million in

the prior quarter.

- Losses on sales of mortgage loans held for sale were $0.1

million in the first quarter, compared to $0.2 million in the prior

quarter.

- Other noninterest income decreased $0.1 million in the first

quarter to $5.5 million.

NONINTEREST EXPENSE

Noninterest expense was $101.2 million for the first quarter of

2024, compared to $121.0 million in the prior quarter, representing

a decrease of $19.8 million. Noninterest expense on an operating

basis* for the first quarter of 2024 was $97.6 million, compared to

$117.4 million in the prior quarter, a decrease of $19.8

million.

- Salaries and employee benefits expense was $64.5 million, a

decrease of $3.3 million from the prior quarter, primarily due to

decreases in incentive compensation costs.

- Office occupancy and equipment expense was $9.2 million,

essentially unchanged from the prior quarter.

- Data processing expense was $16.5 million, a decrease of $0.2

million from the prior quarter.

- Professional services expense was $3.5 million in the first

quarter, a decrease of $0.6 million from the prior quarter.

- Marketing expense was $1.5 million, a decrease of $1.2 million

from the prior quarter, primarily due to lower advertising

expenses.

- Loan expenses were $1.2 million, essentially unchanged from the

prior quarter.

- Federal Deposit Insurance Corporation (“FDIC”) insurance

expense was $2.3 million, a decrease of $11.2 million from the

prior quarter. FDIC insurance expense for the prior quarter

included $10.8 million in special assessment charges arising out of

the bank failures in early 2023.

- Other noninterest expense was $2.1 million, a decrease of $3.3

million from the prior quarter, due in part to a decrease in the

provision for off balance sheet credit exposures of $1.3

million.

ASSET QUALITY

The allowance for loan losses was $149.2 million at March 31,

2024, or 1.06% of total loans, compared to $149.0 million, or 1.07%

of total loans, at December 31, 2023. The Company recorded a

provision for loan losses totaling $7.5 million in the first

quarter of 2024 driven primarily by net charge-off activity in the

first quarter.

NPLs totaled $57.2 million at March 31, 2024 compared to $52.6

million at the end of the prior quarter. The increase was primarily

driven by the non-accrual designation of one individual credit

secured by an investor commercial real estate (“CRE”) office

property located in a suburban area. During the first quarter of

2024, the Company recorded total net charge-offs of $7.3 million,

or 0.21% of average total loans on an annualized basis, compared to

$11.4 million or 0.32% of average total loans in the prior quarter,

respectively.

DIVIDENDS AND SHARE REPURCHASES

The Company’s Board of Directors has declared a quarterly cash

dividend of $0.11 per common share. The dividend will be payable on

June 14, 2024 to shareholders of record as of the close of business

on June 3, 2024.

The Company did not repurchase any shares of its common stock

during the first quarter of 2024.

CONFERENCE CALL AND PRESENTATION INFORMATION

A conference call and webcast covering Eastern’s first quarter

2024 earnings will be held on Friday, April 26, 2024 at 9:00 a.m.

Eastern Time. To join by telephone, participants can call the

toll-free dial-in number (800) 549-8228 from within the U.S. and

reference conference ID 46521. The conference call will be

simultaneously webcast. Participants may join the webcast on the

Company’s Investor Relations website at investor.easternbank.com. A

presentation providing additional information for the quarter is

also available at investor.easternbank.com. A replay of the webcast

will be made available on demand on this site.

ABOUT EASTERN BANKSHARES, INC.

Eastern Bankshares, Inc. is the stock holding company for

Eastern Bank. Founded in 1818, Boston-based Eastern Bank has more

than 120 locations serving communities in eastern Massachusetts,

southern and coastal New Hampshire, and Rhode Island. As of March

31, 2024, Eastern Bank had approximately $21 billion in total

assets. Eastern provides a full range of banking and wealth

management solutions for consumers and businesses of all sizes, and

takes pride in its outspoken advocacy and community support that

includes $240 million in charitable giving since 1994. An inclusive

company, Eastern is comprised of deeply committed professionals who

value relationships with their customers, colleagues, and

communities. For investor information, visit

investor.easternbank.com.

NON-GAAP FINANCIAL MEASURES

*Denotes a non-GAAP financial measure used in this press

release.

A non-GAAP financial measure is defined as a numerical measure

of the Company’s historical or future financial performance,

financial position or cash flows that excludes (or includes)

amounts, or is subject to adjustments that have the effect of

excluding (or including) amounts that are included in the most

directly comparable measure calculated and presented in accordance

with accounting principles generally accepted in the United States

(“GAAP”) in the Company’s statement of income, balance sheet or

statement of cash flows (or equivalent statements).

The Company presents non-GAAP financial measures, which

management uses to evaluate the Company’s performance, and which

exclude the effects of certain transactions that management

believes are unrelated to its core business and are therefore not

necessarily indicative of its current performance or financial

position. Management believes excluding these items facilitates

greater visibility for investors into the Company’s core business

as well as underlying trends that may, to some extent, be obscured

by inclusion of such items in the corresponding GAAP financial

measures. Except as otherwise indicated, these non-GAAP financial

measures presented in this press release exclude discontinued

operations.

There are items in the Company’s financial statements that

impact its financial results, but which management believes are

unrelated to the Company’s core business. Accordingly, the Company

presents noninterest income on an operating basis, total operating

revenue, noninterest expense on an operating basis, operating net

income, operating earnings per share, operating return on average

assets, operating return on average shareholders’ equity, operating

return on average tangible shareholders’ equity (discussed further

below), and the operating efficiency ratio. Each of these figures

excludes the impact of such applicable items because management

believes such exclusion can provide greater visibility into the

Company’s core business and underlying trends. Such items that

management does not consider to be core to the Company’s business

include (i) income and expenses from investments held in rabbi

trusts, (ii) gains and losses on sales of securities available for

sale, net, (iii) gains and losses on the sale of other assets, (iv)

rabbi trust employee benefits, (v) impairment charges on tax credit

investments and associated tax credit benefits, (vi) other real

estate owned (“OREO”) gains, (vii) merger and acquisition expenses,

(viii) the non-cash pension settlement charge recognized related to

the Defined Benefit Plan, (ix) certain discrete tax items, and (x)

net income from discontinued operations. The Company does not

provide an outlook for its total noninterest income and total

noninterest expense because each contains income or expense

components, as applicable, such as income associated with rabbi

trust accounts and rabbi trust employee benefit expense, which are

market-driven, and over which the Company cannot exercise control.

Accordingly, reconciliations of the Company’s outlook for its

noninterest income on an operating basis and its noninterest

expense on an operating basis to an outlook for total noninterest

income and total noninterest expense, respectively, cannot be made

available without unreasonable effort.

Management also presents tangible assets, tangible shareholders’

equity, average tangible shareholders’ equity, tangible book value

per share, the ratio of tangible shareholders’ equity to tangible

assets including the impact of mark-to-market adjustments on

held-to-maturity securities, return on average tangible

shareholders’ equity, and operating return on average shareholders’

equity (discussed further above), each of which excludes the impact

of goodwill and other intangible assets, as management believes

these financial measures provide investors with the ability to

further assess the Company’s performance, identify trends in its

core business and provide a comparison of its capital adequacy to

other companies. The Company included the tangible ratios because

management believes that investors may find it useful to have

access to the same analytical tools used by management to assess

performance and identify trends.

These non-GAAP financial measures presented in this press

release should not be considered an alternative or substitute for

financial results or measures determined in accordance with GAAP or

as an indication of the Company’s cash flows from operating

activities, a measure of its liquidity position or an indication of

funds available for its cash needs. An item which management

considers to be non-core and excludes when computing these non-GAAP

measures can be of substantial importance to the Company’s results

for any particular period. In addition, management’s methodology

for calculating non-GAAP financial measures may differ from the

methodologies employed by other banking companies to calculate the

same or similar performance measures, and accordingly, the

Company’s reported non-GAAP financial measures may not be

comparable to the same or similar performance measures reported by

other banking companies. Please refer to Appendices A-E for

reconciliations of the Company's GAAP financial measures to the

non-GAAP financial measures in this press release.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” within

the meaning of section 27A of the Securities Act of 1933, as

amended, and section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include statements regarding

anticipated future events and can be identified by the fact that

they do not relate strictly to historical or current facts. You can

identify these statements from the use of the words “may,” “will,”

“should,” “could,” “would,” “plan,” “potential,” “estimate,”

“project,” “believe,” “intend,” “anticipate,” “expect,” “target”,

“outlook” and similar expressions. Forward-looking statements, by

their nature, are subject to risks and uncertainties. There are

many factors that could cause actual results to differ materially

from expected results described in the forward-looking

statements.

Certain factors that could cause actual results to differ

materially from expected results include; adverse developments in

the level and direction of loan delinquencies and charge-offs and

changes in estimates of the adequacy of the allowance for loan

losses; increased competitive pressures; changes in interest rates

and resulting changes in competitor or customer behavior, mix or

costs of sources of funding, and deposit amounts and composition;

risks associated with the Company’s completion and/or

implementation of the merger with Cambridge, including risks that

required regulatory approvals for the merger are not obtained or

other closing conditions are not satisfied in a timely manner or at

all and that the merger fails to occur in the timeframe anticipated

or at all; prior to the completion of the merger or thereafter,

Cambridge or the Company may not perform as expected due to

transaction-related uncertainty or other factors; and revenue or

expense synergies may not fully materialize for the Company in the

timeframe expected or at all, or may be more costly to achieve;

adverse national or regional economic conditions or conditions

within the securities markets or banking sector; legislative and

regulatory changes and related compliance costs that could

adversely affect the business in which the Company and its

subsidiary Eastern Bank are engaged, including the effect of, and

changes in, monetary and fiscal policies and laws, such as the

interest rate policies of the Board of Governors of the Federal

Reserve System; market and monetary fluctuations, including

inflationary or recessionary pressures, interest rate sensitivity,

liquidity constraints, increased borrowing and funding costs, and

fluctuations due to actual or anticipated changes to federal tax

laws; the realizability of deferred tax assets; the Company’s

ability to successfully implement its risk mitigation strategies;

asset and credit quality deterioration, including adverse

developments in local or regional real estate markets that decrease

collateral values associated with existing loans; and operational

risks such as cybersecurity incidents, natural disasters, and

pandemics, including COVID-19. For further discussion of such

factors, please see the Company’s most recent Annual Report on Form

10-K and subsequent filings with the U.S. Securities and Exchange

Commission (the “SEC”), including the joint proxy

statement/prospectus (as defined below), which are available on the

SEC’s website at www.sec.gov.

You should not place undue reliance on forward-looking

statements, which reflect the Company's expectations only as of the

date of this press release. The Company does not undertake any

obligation to update forward-looking statements.

EASTERN BANKSHARES, INC. AND

SUBSIDIARIES SELECTED FINANCIAL HIGHLIGHTS (1)

Certain information in this press release is presented as

reviewed by the Company’s management and includes information

derived from the Company’s Consolidated Statements of Income,

non-GAAP financial measures, and operational and performance

metrics. For information on non-GAAP financial measures, please see

the section titled "Non-GAAP Financial Measures."

As of and for the three months

ended

(Unaudited, dollars in thousands, except

per-share data)

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Earnings data

Net interest income

$

129,900

$

133,307

$

137,205

$

141,588

$

138,309

Noninterest income (loss)

27,692

26,739

19,157

26,204

(309,853

)

Total revenue

157,592

160,046

156,362

167,792

(171,544

)

Noninterest expense

101,202

121,029

101,748

99,934

95,891

Pre-tax, pre-provision income (loss)

56,390

39,017

54,614

67,858

(267,435

)

Provision for allowance for loan

losses

7,451

5,198

7,328

7,501

25

Pre-tax income (loss)

48,939

33,819

47,286

60,357

(267,460

)

Net income (loss) from continuing

operations

38,647

31,509

63,464

44,419

(202,081

)

Net income (loss) from discontinued

operations

—

286,994

(4,351

)

4,238

7,985

Net income (loss)

38,647

318,503

59,113

48,657

(194,096

)

Operating net income (non-GAAP)

38,081

16,875

52,085

41,092

53,134

Per-share data

Earnings (loss) per share, diluted

$

0.24

$

1.95

$

0.36

$

0.30

$

(1.20

)

Continuing operations

$

0.24

$

0.19

$

0.39

$

0.27

$

(1.25

)

Discontinued operations

$

—

$

1.76

$

(0.03

)

$

0.03

$

0.05

Operating earnings per share, diluted

(non-GAAP)

$

0.23

$

0.10

$

0.32

$

0.25

$

0.33

Book value per share

$

16.72

$

16.86

$

13.87

$

14.33

$

14.63

Tangible book value per share

(non-GAAP)

$

13.51

$

13.65

$

10.14

$

10.59

$

10.88

Profitability

Return on average assets (2)

0.74

%

0.59

%

1.18

%

0.81

%

(3.64

)%

Operating return on average assets

(non-GAAP) (2)

0.72

%

0.31

%

0.97

%

0.75

%

0.95

%

Return on average shareholders' equity

(2)

5.23

%

4.66

%

9.91

%

6.85

%

(33.31

)%

Operating return on average shareholders'

equity (2)

5.17

%

2.51

%

8.14

%

6.34

%

8.76

%

Return on average tangible shareholders'

equity (non-GAAP) (2)

6.46

%

5.99

%

13.38

%

9.19

%

(45.55

)%

Operating return on average tangible

shareholders' equity (non-GAAP) (2)

6.36

%

3.20

%

10.99

%

8.50

%

11.98

%

Net interest margin (FTE) (2)

2.68

%

2.69

%

2.77

%

2.80

%

2.66

%

Cost of deposits (2)

1.66

%

1.51

%

1.33

%

1.22

%

0.92

%

Efficiency ratio

64.22

%

75.62

%

65.07

%

59.56

%

(55.90

)%

Operating efficiency ratio (non-GAAP)

61.89

%

73.59

%

60.83

%

58.47

%

57.97

%

Balance Sheet (end of period)

Total assets

$

21,174,804

$

21,133,278

$

21,146,292

$

21,583,493

$

22,720,530

Total loans

14,088,747

13,973,428

13,919,275

13,961,878

13,675,250

Total deposits

17,666,733

17,596,217

17,424,169

18,180,972

18,541,580

Total loans / total deposits

80

%

79

%

80

%

77

%

74

%

Asset quality

Allowance for loan losses ("ALLL")

$

149,190

$

148,993

$

155,146

$

147,955

$

140,938

ALLL / total nonperforming loans

("NPLs")

260.94

%

283.49

%

326.86

%

484.18

%

407.65

%

Total NPLs / total loans

0.41

%

0.38

%

0.34

%

0.22

%

0.25

%

Net charge-offs ("NCOs") / average total

loans (2)

0.21

%

0.32

%

0.00

%

0.01

%

0.00

%

Capital adequacy

Shareholders' equity / assets

13.95

%

14.08

%

11.57

%

11.71

%

11.35

%

Tangible shareholders' equity / tangible

assets (non-GAAP)

11.58

%

11.71

%

8.73

%

8.93

%

8.70

%

(1) Average assets and average tangible

shareholders' equity components for the three months ended Dec 31,

2023 and preceding periods presented in this table include

discontinued operations.

(2) Presented on an annualized basis.

EASTERN BANKSHARES, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

As of

Mar 31, 2024 change

from

(Unaudited, dollars in thousands)

Mar 31, 2024

Dec 31, 2023

Mar 31, 2023

Dec 31, 2023

Mar 31, 2023

ASSETS

△ $

△ %

△ $

△ %

Cash and due from banks

$

71,492

$

87,233

$

98,377

$

(15,741

)

(18

)%

$

(26,885

)

(27

)%

Short-term investments

667,526

605,843

2,039,439

61,683

10

%

(1,371,913

)

(67

)%

Cash and cash equivalents

739,018

693,076

2,137,816

45,942

7

%

(1,398,798

)

(65

)%

Available for sale ("AFS") securities

4,287,585

4,407,521

4,700,134

(119,936

)

(3

)%

(412,549

)

(9

)%

Held to maturity ("HTM") securities

443,833

449,721

471,185

(5,888

)

(1

)%

(27,352

)

(6

)%

Total securities

4,731,418

4,857,242

5,171,319

(125,824

)

(3

)%

(439,901

)

(9

)%

Loans held for sale

2,204

1,124

3,068

1,080

96

%

(864

)

(28

)%

Loans:

Commercial and industrial

3,084,580

3,034,068

3,169,438

50,512

2

%

(84,858

)

(3

)%

Commercial real estate

5,519,505

5,457,349

5,201,196

62,156

1

%

318,309

6

%

Commercial construction

388,024

386,999

357,117

1,025

—

%

30,907

9

%

Business banking

1,100,637

1,085,763

1,078,678

14,874

1

%

21,959

2

%

Total commercial loans

10,092,746

9,964,179

9,806,429

128,567

1

%

286,317

3

%

Residential real estate

2,544,462

2,565,485

2,497,491

(21,023

)

(1

)%

46,971

2

%

Consumer home equity

1,217,141

1,208,231

1,180,824

8,910

1

%

36,317

3

%

Other consumer

234,398

235,533

190,506

(1,135

)

—

%

43,892

23

%

Total loans

14,088,747

13,973,428

13,675,250

115,319

1

%

413,497

3

%

Allowance for loan losses

(149,190

)

(148,993

)

(140,938

)

(197

)

—

%

(8,252

)

6

%

Unamortized prem./disc. and def. fees

(32,947

)

(25,068

)

(13,597

)

(7,879

)

31

%

(19,350

)

142

%

Net loans

13,906,610

13,799,367

13,520,715

107,243

1

%

385,895

3

%

Federal Home Loan Bank stock, at cost

5,879

5,904

45,168

(25

)

—

%

(39,289

)

(87

)%

Premises and equipment

59,790

60,133

61,011

(343

)

(1

)%

(1,221

)

(2

)%

Bank-owned life insurance

165,734

164,702

161,755

1,032

1

%

3,979

2

%

Goodwill and other intangibles, net

565,701

566,205

567,718

(504

)

—

%

(2,017

)

—

%

Deferred income taxes, net

272,344

266,185

315,308

6,159

2

%

(42,964

)

(14

)%

Prepaid expenses

187,211

183,073

162,081

4,138

2

%

25,130

16

%

Other assets

538,895

536,267

454,840

2,628

—

%

84,055

18

%

Assets of discontinued operations

—

—

119,731

—

—

%

(119,731

)

(100

)%

Total assets

$

21,174,804

$

21,133,278

$

22,720,530

$

41,526

—

%

$

(1,545,726

)

(7

)%

LIABILITIES AND SHAREHOLDERS'

EQUITY

Deposits:

Demand

$

4,952,487

$

5,162,218

$

5,564,016

$

(209,731

)

(4

)%

$

(611,529

)

(11

)%

Interest checking accounts

3,739,631

3,737,361

4,240,780

2,270

—

%

(501,149

)

(12

)%

Savings accounts

1,291,260

1,323,126

1,633,790

(31,866

)

(2

)%

(342,530

)

(21

)%

Money market investment

4,770,058

4,664,475

5,135,590

105,583

2

%

(365,532

)

(7

)%

Certificates of deposit

2,913,297

2,709,037

1,967,404

204,260

8

%

945,893

48

%

Total deposits

17,666,733

17,596,217

18,541,580

70,516

—

%

(874,847

)

(5

)%

Borrowed funds:

Federal Home Loan Bank advances

17,576

17,738

1,100,952

(162

)

(1

)%

(1,083,376

)

(98

)%

Escrow deposits of borrowers

24,368

21,978

25,671

2,390

11

%

(1,303

)

(5

)%

Interest rate swap collateral funds

10,810

8,500

11,780

2,310

27

%

(970

)

(8

)%

Total borrowed funds

52,754

48,216

1,138,403

4,538

9

%

(1,085,649

)

(95

)%

Other liabilities

502,486

513,990

431,994

(11,504

)

(2

)%

70,492

16

%

Liabilities of discontinued operations

—

—

29,430

—

—

%

(29,430

)

(100

)%

Total liabilities

18,221,973

18,158,423

20,141,407

63,550

—

%

(1,919,434

)

(10

)%

Shareholders' equity:

Common shares

1,769

1,767

1,764

2

—

%

5

—

%

Additional paid-in capital

1,669,133

1,666,441

1,651,524

2,692

—

%

17,609

1

%

Unallocated common shares held by the

employee stock ownership plan ("ESOP")

(131,512

)

(132,755

)

(136,470

)

1,243

(1

)%

4,958

(4

)%

Retained earnings

2,068,315

2,047,754

1,672,169

20,561

1

%

396,146

24

%

Accumulated other comprehensive income

("AOCI"), net of tax

(654,874

)

(608,352

)

(609,864

)

(46,522

)

8

%

(45,010

)

7

%

Total shareholders' equity

2,952,831

2,974,855

2,579,123

(22,024

)

(1

)%

373,708

14

%

Total liabilities and shareholders'

equity

$

21,174,804

$

21,133,278

$

22,720,530

$

41,526

—

%

$

(1,545,726

)

(7

)%

EASTERN BANKSHARES, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

Three months ended

Three months ended Mar 31,

2024 change from three months ended

(Unaudited, dollars in thousands, except

per-share data)

Mar 31, 2024

Dec 31, 2023

Mar 31, 2023

Dec 31, 2023

Mar 31, 2023

Interest and dividend income:

△ $

△ %

△ $

△ %

Interest and fees on loans

$

169,981

$

168,419

$

153,540

$

1,562

1

%

$

16,441

11

%

Taxable interest and dividends on

securities

23,373

23,782

28,642

(409

)

(2

)%

(5,269

)

(18

)%

Non-taxable interest and dividends on

securities

1,437

1,434

1,434

3

—

%

3

—

%

Interest on federal funds sold and other

short-term investments

7,820

10,011

5,264

(2,191

)

(22

)%

2,556

49

%

Total interest and dividend income

202,611

203,646

188,880

(1,035

)

(1

)%

13,731

7

%

Interest expense:

Interest on deposits

72,458

67,389

42,933

5,069

8

%

29,525

69

%

Interest on borrowings

253

2,950

7,638

(2,697

)

(91

)%

(7,385

)

(97

)%

Total interest expense

72,711

70,339

50,571

2,372

3

%

22,140

44

%

Net interest income

129,900

133,307

138,309

(3,407

)

(3

)%

(8,409

)

(6

)%

Provision for allowance for loan

losses

7,451

5,198

25

2,253

43

%

7,426

29704

%

Net interest income after provision for

allowance for loan losses

122,449

128,109

138,284

(5,660

)

(4

)%

(15,835

)

(11

)%

Noninterest income:

Service charges on deposit accounts

7,508

7,514

6,472

(6

)

—

%

1,036

16

%

Trust and investment advisory fees

6,544

6,128

5,770

416

7

%

774

13

%

Debit card processing fees

3,247

3,398

3,170

(151

)

(4

)%

77

2

%

Interest rate swap income (losses)

667

(576

)

(408

)

1,243

(216

)%

1,075

(263

)%

Income from investments held in rabbi

trusts

4,318

4,969

2,857

(651

)

(13

)%

1,461

51

%

Losses on sales of commercial and

industrial loans

—

(87

)

—

87

(100

)%

—

—

%

Losses on sales of mortgage loans held for

sale, net

(58

)

(219

)

(74

)

161

(74

)%

16

(22

)%

Losses on sales of securities available

for sale, net

—

—

(333,170

)

—

—

%

333,170

(100

)%

Other

5,466

5,612

5,530

(146

)

(3

)%

(64

)

(1

)%

Total noninterest income (loss)

27,692

26,739

(309,853

)

953

4

%

337,545

(109

)%

Noninterest expense:

Salaries and employee benefits

64,471

67,773

62,183

(3,302

)

(5

)%

2,288

4

%

Office occupancy and equipment

9,184

9,195

9,089

(11

)

—

%

95

1

%

Data processing

16,509

16,753

12,298

(244

)

(1

)%

4,211

34

%

Professional services

3,512

4,108

3,127

(596

)

(15

)%

385

12

%

Marketing expenses

1,515

2,693

1,023

(1,178

)

(44

)%

492

48

%

Loan expenses

1,170

1,174

1,095

(4

)

—

%

75

7

%

Federal Deposit Insurance Corporation

("FDIC") insurance

2,285

13,486

2,546

(11,201

)

(83

)%

(261

)

(10

)%

Amortization of intangible assets

504

505

291

(1

)

—

%

213

73

%

Other

2,052

5,342

4,239

(3,290

)

(62

)%

(2,187

)

(52

)%

Total noninterest expense

101,202

121,029

95,891

(19,827

)

(16

)%

5,311

6

%

Income (loss) before income tax expense

(benefit)

48,939

33,819

(267,460

)

15,120

45

%

316,399

(118

)%

Income tax expense (benefit)

10,292

2,310

(65,379

)

7,982

346

%

75,671

(116

)%

Net income (loss) from continuing

operations

$

38,647

$

31,509

$

(202,081

)

$

7,138

23

%

$

240,728

(119

)%

Net income from discontinued

operations

$

—

$

286,994

$

7,985

$

(286,994

)

(100

)%

$

(7,985

)

(100

)%

Net income (loss)

$

38,647

$

318,503

$

(194,096

)

$

(279,856

)

(88

)%

$

232,743

(120

)%

Share data:

Weighted average common shares

outstanding, basic

162,863,540

162,571,066

161,991,373

292,474

0

%

872,167

1

%

Weighted average common shares

outstanding, diluted

163,188,410

162,724,398

162,059,431

464,012

0

%

1,128,979

1

%

Earnings (loss) per share, basic:

Continuing operations

$

0.24

$

0.19

$

(1.25

)

$

0.05

26

%

$

1.49

(119

)%

Discontinued operations

$

—

$

1.77

$

0.05

$

(1.77

)

(100

)%

$

(0.05

)

(100

)%

Earnings (loss) per share, basic

$

0.24

$

1.96

$

(1.20

)

$

(1.72

)

(88

)%

$

1.44

(120

)%

Earnings (loss) per share, diluted:

Continuing operations

$

0.24

$

0.19

$

(1.25

)

$

0.05

26

%

$

1.49

(119

)%

Discontinued operations

$

—

$

1.76

$

0.05

$

(1.76

)

(100

)%

$

(0.05

)

(100

)%

Earnings (loss) per share, diluted

$

0.24

$

1.95

$

(1.20

)

$

(1.71

)

(88

)%

$

1.44

(120

)%

EASTERN BANKSHARES, INC. AND

SUBSIDIARIES

AVERAGE BALANCES, INTEREST

EARNED/PAID, & AVERAGE YIELDS

As of and for the three months

ended

Mar 31, 2024

Dec 31, 2023

Mar 31, 2023

(Unaudited, dollars in thousands)

Avg. Balance

Interest

Yield / Cost (5)

Avg. Balance

Interest

Yield / Cost (5)

Avg. Balance

Interest

Yield / Cost (5)

Interest-earning assets:

Loans (1):

Commercial

$

10,024,299

$

126,842

5.09

%

$

9,978,154

$

126,128

5.01

%

$

9,765,236

$

115,929

4.81

%

Residential

2,570,803

23,994

3.75

%

2,573,032

23,546

3.63

%

2,513,413

21,614

3.49

%

Consumer

1,420,091

23,237

6.58

%

1,411,374

22,835

6.42

%

1,358,616

20,059

5.99

%

Total loans

14,015,193

174,073

5.00

%

13,962,560

172,509

4.90

%

13,637,265

157,602

4.69

%

Investment securities

5,574,568

25,201

1.82

%

5,670,742

25,609

1.79

%

7,684,665

30,459

1.61

%

Federal funds sold and other short-term

investments

576,537

7,820

5.46

%

720,384

10,011

5.51

%

449,543

5,264

4.75

%

Total interest-earning assets

20,166,298

207,094

4.13

%

20,353,686

208,129

4.06

%

21,771,473

193,325

3.60

%

Non-interest-earning assets

950,893

834,391

739,270

Total assets

$

21,117,191

$

21,188,077

$

22,510,743

Interest-bearing liabilities:

Deposits:

Savings

$

1,297,360

$

41

0.01

%

$

1,352,239

$

45

0.01

%

$

1,721,143

$

81

0.02

%

Interest checking

3,744,912

8,187

0.88

%

3,753,352

7,080

0.75

%

4,363,528

4,711

0.44

%

Money market

4,741,990

30,495

2.59

%

4,735,917

29,390

2.46

%

5,040,330

20,305

1.63

%

Time deposits

2,785,130

33,735

4.87

%

2,656,313

30,874

4.61

%

1,931,860

17,836

3.74

%

Total interest-bearing deposits

12,569,392

72,458

2.32

%

12,497,821

67,389

2.14

%

13,056,861

42,933

1.33

%

Borrowings

50,781

253

2.00

%

242,437

2,950

4.83

%

675,056

7,638

4.59

%

Total interest-bearing liabilities

12,620,173

72,711

2.32

%

12,740,258

70,339

2.19

%

13,731,917

50,571

1.49

%

Demand deposit accounts

4,989,245

5,210,185

5,825,269

Other noninterest-bearing liabilities

537,014

555,034

493,387

Total liabilities

18,146,432

18,505,477

20,050,573

Shareholders' equity

2,970,759

2,682,600

2,460,170

Total liabilities and shareholders'

equity

$

21,117,191

$

21,188,077

$

22,510,743

Net interest income - FTE

$

134,383

$

137,790

$

142,754

Net interest rate spread (2)

1.81

%

1.87

%

2.11

%

Net interest-earning assets (3)

$

7,546,125

$

7,613,428

$

8,039,556

Net interest margin - FTE (4)

2.68

%

2.69

%

2.66

%

(1) Includes non-accrual loans.

(2) Net interest rate spread represents

the difference between the weighted average yield on

interest-earning assets and the weighted average cost of

interest-bearing liabilities.

(3) Net interest-earning assets represent

total interest-earning assets less total interest-bearing

liabilities.

(4) Net interest margin - FTE represents

fully-taxable equivalent net interest income* divided by average

total interest-earning assets. Please refer to Appendix B to this

press release for a reconciliation of fully-taxable equivalent net

interest income.

(5) Presented on an annualized basis.

EASTERN BANKSHARES, INC. AND

SUBSIDIARIES

ASSET QUALITY - NON-PERFORMING

ASSETS (1)

As of

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

(Unaudited, dollars in thousands)

Non-accrual loans:

Commercial

$

40,986

$

35,107

$

31,703

$

14,178

$

17,271

Residential

6,697

8,725

8,075

8,796

9,603

Consumer

9,490

8,725

7,687

7,584

7,699

Total non-accrual loans

57,173

52,557

47,465

30,558

34,573

Total accruing loans past due 90 days or

more:

—

—

—

—

—

Total non-performing loans

57,173

52,557

47,465

30,558

34,573

Other real estate owned

—

—

—

—

—

Other non-performing assets:

—

—

—

—

—

Total non-performing assets (1)

$

57,173

$

52,557

$

47,465

$

30,558

$

34,573

Total non-performing loans to total

loans

0.41

%

0.38

%

0.34

%

0.22

%

0.25

%

Total non-performing assets to total

assets

0.27

%

0.25

%

0.22

%

0.14

%

0.15

%

(1) Non-performing assets are comprised of

NPLs, other real estate owned ("OREO"), and non-performing

securities. NPLs consist of non-accrual loans and loans that are

more than 90 days past due but still accruing interest. OREO

consists of real estate properties, which primarily serve as

collateral to secure the Company’s loans, that it controls due to

foreclosure or acceptance of a deed in lieu of foreclosure.

EASTERN BANKSHARES, INC. AND

SUBSIDIARIES

ASSET QUALITY - PROVISION,

ALLOWANCE, AND NET CHARGE-OFFS (RECOVERIES)

Three months ended

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

(Unaudited, dollars in thousands)

Average total loans

$

14,013,714

$

13,961,061

$

13,926,194

$

13,803,292

$

13,633,165

Allowance for loan losses, beginning of

the period

148,993

155,146

147,955

140,938

142,211

Total cumulative effect of change in

accounting principle:

—

—

—

—

(1,143

)

Charged-off loans:

Commercial and industrial

—

2

11

—

—

Commercial real estate

7,250

8,008

—

—

—

Commercial construction

—

—

—

—

—

Business banking

102

3,745

303

254

343

Residential real estate

10

—

—

—

—

Consumer home equity

2

—

—

—

7

Other consumer

651

536

731

591

561

Total charged-off loans

8,015

12,291

1,045

845

911

Recoveries on loans previously

charged-off:

Commercial and industrial

25

11

120

26

139

Commercial real estate

132

190

2

2

4

Commercial construction

—

—

—

—

—

Business banking

410

573

609

204

481

Residential real estate

31

34

30

18

15

Consumer home equity

—

1

39

—

1

Other consumer

163

131

108

111

116

Total recoveries

761

940

908

361

756

Net loans charged-off (recoveries):

Commercial and industrial

(25

)

(9

)

(109

)

(26

)

(139

)

Commercial real estate

7,118

7,818

(2

)

(2

)

(4

)

Commercial construction

—

—

—

—

—

Business banking

(308

)

3,172

(306

)

50

(138

)

Residential real estate

(21

)

(34

)

(30

)

(18

)

(15

)

Consumer home equity

2

(1

)

(39

)

—

6

Other consumer

488

405

623

480

445

Total net loans charged-off

7,254

11,351

137

484

155

Provision for allowance for loan

losses

7,451

5,198

7,328

7,501

25

Total allowance for loan losses, end of

period

$

149,190

$

148,993

$

155,146

$

147,955

$

140,938

Net charge-offs to average total loans

outstanding during this period (1)

0.21

%

0.32

%

0.00

%

0.01

%

0.00

%

Allowance for loan losses as a percent of

total loans

1.06

%

1.07

%

1.12

%

1.06

%

1.03

%

Allowance for loan losses as a percent of

nonperforming loans

260.94

%

283.49

%

326.86

%

484.18

%

407.65

%

(1) Presented on an annualized basis.

APPENDIX A: Reconciliation of Non-GAAP Earnings Metrics

(1)

For information on non-GAAP financial measures, please see the

section titled "Non-GAAP Financial Measures."

As of and for the Three Months

Ended

(Unaudited, dollars in thousands, except

per-share data)

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Net income (loss) from continuing

operations (GAAP)

$

38,647

$

31,509

$

63,464

$

44,419

$

(202,081

)

Add:

Noninterest income components:

(Income) losses from investments held in

rabbi trusts

(4,318

)

(4,969

)

1,523

(3,002

)

(2,857

)

Losses on sales of securities available

for sale, net

—

—

—

—

333,170

(Gains) losses on sales of other

assets

—

—

(2

)

—

5

Noninterest expense components:

Rabbi trust employee benefit expense

(income)

1,746

1,740

(586

)

1,314

1,274

Merger and acquisition expenses

1,816

1,865

3,630

—

—

Total impact of non-GAAP adjustments

(756

)

(1,364

)

4,565

(1,688

)

331,592

Less net tax (expense) benefit associated

with non-GAAP adjustments (2)

(190

)

13,270

15,944

1,639

76,377

Non-GAAP adjustments, net of tax

$

(566

)

$

(14,634

)

$

(11,379

)

$

(3,327

)

$

255,215

Operating net income (non-GAAP)

$

38,081

$

16,875

$

52,085

$

41,092

$

53,134

Weighted average common shares outstanding

during the period:

Basic

162,863,540

162,571,066

162,370,469

162,232,236

161,991,373

Diluted

163,188,410

162,724,398

162,469,887

162,246,675

162,059,431

Earnings (loss) per share from continuing

operations, basic:

$

0.24

$

0.19

$

0.39

$

0.27

$

(1.25

)

Earnings (loss) per share from continuing

operations, diluted:

$

0.24

$

0.19

$

0.39

$

0.27

$

(1.25

)

Operating earnings per share, basic

(non-GAAP)

$

0.23

$

0.10

$

0.32

$

0.25

$

0.33

Operating earnings per share, diluted

(non-GAAP)

$

0.23

$

0.10

$

0.32

$

0.25

$

0.33

Return on average assets (3)

0.74

%

0.59

%

1.18

%

0.81

%

(3.64

)%

Add:

(Income) losses from investments held in

rabbi trusts (3)

(0.08

)%

(0.09

)%

0.03

%

(0.05

)%

(0.05

)%

Losses on sales of securities available

for sale, net (3)

0.00

%

0.00

%

0.00

%

0.00

%

6.00

%

(Gains) losses on sales of other assets

(3)

0.00

%

0.00

%

0.00

%

0.00

%

0.00

%

Rabbi trust employee benefit expense

(income) (3)

0.03

%

0.03

%

(0.01

)%

0.02

%

0.02

%

Merger and acquisition expenses (3)

0.03

%

0.03

%

0.07

%

0.00

%

0.00

%

Less net tax (expense) benefit associated

with non-GAAP adjustments (2) (3)

0.00

%

0.25

%

0.30

%

0.03

%

1.38

%

Operating return on average assets

(non-GAAP) (3)

0.72

%

0.31

%

0.97

%

0.75

%

0.95

%

Return on average shareholders' equity

(3)

5.23

%

4.66

%

9.91

%

6.85

%

(33.31

)%

Add:

(Income) losses from investments held in

rabbi trusts (3)

(0.58

)%

(0.73

)%

0.24

%

(0.46

)%

(0.47

)%

Losses on sales of securities available

for sale, net (3)

0.00

%

0.00

%

0.00

%

0.00

%

54.92

%

(Gains) losses on sales of other assets

(3)

0.00

%

0.00

%

0.00

%

0.00

%

0.00

%

Rabbi trust employee benefit expense

(income) (3)

0.24

%

0.26

%

(0.09

)%

0.20

%

0.21

%

Merger and acquisition expenses (3)

0.25

%

0.28

%

0.57

%

0.00

%

0.00

%

Less net tax (expense) benefit associated

with non-GAAP adjustments (2) (3)

(0.03

)%

1.96

%

2.49

%

0.25

%

12.59

%

Operating return on average

shareholders' equity (non-GAAP) (3)

5.17

%

2.51

%

8.14

%

6.34

%

8.76

%

Average tangible shareholders'

equity:

Average total shareholders' equity

(GAAP)

$

2,970,759

$

2,682,600

$

2,539,806

$

2,599,325

$

2,460,170

Less: Average goodwill and other

intangibles

566,027

597,234

658,591

659,825

660,795

Average tangible shareholders' equity

(non-GAAP)

$

2,404,732

$

2,085,366

$

1,881,215

$

1,939,500

$

1,799,375

Return on average tangible

shareholders' equity (non-GAAP) (3)

6.46

%

5.99

%

13.38

%

9.19

%

(45.55

)%

Add:

(Income) losses from investments held in

rabbi trusts (3)

(0.72

)%

(0.95

)%

0.32

%

(0.62

)%

(0.64

)%

Losses on sales of securities available

for sale, net (3)

0.00

%

0.00

%

0.00

%

0.00

%

75.09

%

(Gains) losses on sales of other assets

(3)

0.00

%

0.00

%

0.00

%

0.00

%

0.00

%

Rabbi trust employee benefit expense

(income) (3)

0.29

%

0.33

%

(0.12

)%

0.27

%

0.29

%

Merger and acquisition expenses (3)

0.30

%

0.35

%

0.77

%

0.00

%

0.00

%

Less net tax (expense) benefit associated

with non-GAAP adjustments (2) (3)

(0.03

)%

2.52

%

3.36

%

0.34

%

17.21

%

Operating return on average tangible

shareholders' equity (non-GAAP) (3)

6.36

%

3.20

%

10.99

%

8.50

%

11.98

%

(1) Average assets, average goodwill and

other intangibles, and average tangible shareholders' equity

components for the three months ended Dec 31, 2023 and preceding

periods presented in this table include discontinued

operations.

(2) The net tax benefit (expense)

associated with these items is generally determined by assessing

whether each item is included or excluded from net taxable income

and applying our combined statutory tax rate only to those items

included in net taxable income. The net tax benefit for the three

months ended December 31, 2023 was primarily due to the tax benefit

from state tax strategies associated with the utilization of

capital losses as a result of the sale of securities in the first

quarter of 2023, described further below. Upon the sale of

securities in the first quarter of 2023, we established a valuation

allowance of $17.4 million, as it was determined at that time that

it was not more-likely-than-not that the entirety of the deferred

tax asset related to the loss on such securities would be realized.

Included in that $17.4 million was $2.8 million in expected lost

state tax benefits. Following the execution of the sale of our

insurance agency business in October 2023 and the resulting capital

gain, coupled with tax planning strategies, a state tax benefit of

$13.6 million was realized on the security sale losses.

(3) Presented on an annualized basis.

APPENDIX B: Reconciliation of Non-GAAP Operating Revenues and

Expenses

For information on non-GAAP financial measures, please see the

section titled "Non-GAAP Financial Measures."

Three Months Ended

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

(Unaudited, dollars in thousands)

Net interest income (GAAP)

$

129,900

$

133,307

$

137,205

$

141,588

$

138,309

Add:

Tax-equivalent adjustment (non-GAAP)

(1)

4,483

4,483

4,376

3,877

4,445

Fully-taxable equivalent net interest

income (non-GAAP)

$

134,383

$

137,790

$

141,581

$

145,465

$

142,754

Noninterest income (loss)

(GAAP)

$

27,692

$

26,739

$

19,157

$

26,204

$

(309,853

)

Less:

Income (losses) from investments held in

rabbi trusts

4,318

4,969

(1,523

)

3,002

2,857

Losses on sales of securities available

for sale, net

—

—

—

—

(333,170

)

Gains (losses) on sales of other

assets

—

—

2

—

(5

)

Noninterest income on an operating

basis (non-GAAP)

$

23,374

$

21,770

$

20,678

$

23,202

$

20,465

Noninterest expense (GAAP)

$

101,202

$

121,029

$

101,748

$

99,934

$

95,891

Less:

Rabbi trust employee benefit expense

(income)

1,746

1,740

(586

)

1,314

1,274

Merger and acquisition expenses

1,816

1,865

3,630

—

—

Noninterest expense on an operating

basis (non-GAAP)

$

97,640

$

117,424

$

98,704

$

98,620

$

94,617

Total revenue (loss) (GAAP)

$

157,592

$

160,046

$

156,362

$

167,792

$

(171,544

)

Total operating revenue (non-GAAP)

$

157,757

$

159,560

$

162,259

$

168,667

$

163,219

Efficiency ratio (GAAP)

64.22

%

75.62

%

65.07

%

59.56

%

(55.90

)%

Operating efficiency ratio (non-GAAP)

61.89

%

73.59

%

60.83

%

58.47

%

57.97

%

(1) Interest income on tax-exempt loans

and investment securities has been adjusted to a FTE basis using a

marginal tax rate of 21.7%, 21.9%, 21.7%, 21.8%, and 21.7% for the

three months ended March 31, 2024, December 31, 2023, September 30,

2023, June 30, 2023, and March 31, 2023, respectively.

APPENDIX C: Reconciliation of Non-GAAP Capital

Metrics

For information on non-GAAP financial measures, please see the

section titled "Non-GAAP Financial Measures."

As of

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

(Unaudited, dollars in thousands, except

per-share data)

Tangible shareholders' equity:

Total shareholders' equity (GAAP)

$

2,952,831

$

2,974,855

$

2,446,553

$

2,526,772

$

2,579,123

Less: Goodwill and other intangibles

(1)

565,701

566,205

657,824

658,993

660,165

Tangible shareholders' equity

(non-GAAP)

2,387,130

2,408,650

1,788,729

1,867,779

1,918,958

Tangible assets:

Total assets (GAAP)

21,174,804

21,133,278

21,146,292

21,583,493

22,720,530

Less: Goodwill and other intangibles

(1)

565,701

566,205

657,824

658,993

660,165

Tangible assets (non-GAAP)

$

20,609,103

$

20,567,073

$

20,488,468

$

20,924,500

$

22,060,365

Shareholders' equity to assets ratio

(GAAP)

13.95

%

14.08

%

11.57

%

11.71

%

11.35

%

Tangible shareholders' equity to tangible

assets ratio (non-GAAP)

11.58

%

11.71

%

8.73

%

8.93

%

8.70

%

Common shares outstanding

176,631,477

176,426,993

176,376,675

176,376,675

176,328,426

Book value per share (GAAP)

$

16.72

$

16.86

$

13.87

$

14.33

$

14.63

Tangible book value per share

(non-GAAP)

$

13.51

$

13.65

$

10.14

$

10.59

$

10.88

(1) Includes goodwill and other intangible

assets of discontinued operations as of September 30, 2023 and

preceding periods.

APPENDIX D: Tangible Shareholders’ Equity Roll Forward

Analysis

For information on non-GAAP financial measures, please see the

section titled "Non-GAAP Financial Measures."

As of

Change from

Mar 31, 2024

Dec 31, 2023

Dec 31, 2023

(Unaudited, dollars in thousands, except

per-share data)

Common stock

$

1,769

$

1,767

$

2

Additional paid in capital

1,669,133

1,666,441

2,692

Unallocated ESOP common stock

(131,512

)

(132,755

)

1,243

Retained earnings

2,068,315

2,047,754

20,561

AOCI, net of tax - available for sale

securities

(611,802

)

(584,243

)

(27,559

)

AOCI, net of tax - pension

6,946

7,462

(516

)

AOCI, net of tax - cash flow hedge

(50,018

)

(31,571

)

(18,447

)

Total shareholders' equity:

$

2,952,831

$

2,974,855

$

(22,024

)

Less: Goodwill and other intangibles

565,701

566,205

(504

)

Tangible shareholders' equity

(non-GAAP)

$

2,387,130

$

2,408,650

$

(21,520

)

Common shares outstanding

176,631,477

176,426,993

204,484

Per share:

Common stock

$

0.01

$

0.01

$

—

Additional paid in capital

9.45

9.45

—

Unallocated ESOP common stock

(0.74

)

(0.75

)

0.01

Retained earnings

11.71

11.61

0.10

AOCI, net of tax - available for sale

securities

(3.46

)

(3.31

)

(0.15

)

AOCI, net of tax - pension

0.04

0.04

—

AOCI, net of tax - cash flow hedge

(0.28

)

(0.18

)

(0.10

)

Total shareholders' equity:

$

16.72

$

16.86

$

(0.14

)

Less: Goodwill and other intangibles

3.20

3.21

(0.01

)

Tangible shareholders' equity

(non-GAAP)

$

13.51

$

13.65

$

(0.14

)

APPENDIX E: M&A Expense

As of and for the Three Months

Ended

(Unaudited, dollars in thousands)

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Salaries and employee benefits

$

3

$

5

$

—

$

—

$

—

Office occupancy and equipment

6

2

—

—

—

Data processing

865

1,357

—

—

—

Professional services

787

450

3,630

—

—

Other

155

51

—

—

—

Total

$

1,816

$

1,865

$

3,630

$

—

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425242704/en/

Investor Contact Jillian

Belliveau Eastern Bankshares, Inc.

InvestorRelations@easternbank.com 781-598-7920 Media Contact Andrea Goodman Eastern

Bank a.goodman@easternbank.com 781-598-7847

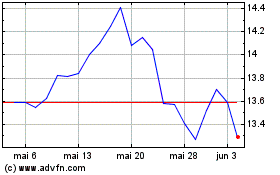

Eastern Bankshares (NASDAQ:EBC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Eastern Bankshares (NASDAQ:EBC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024