Eastern Bankshares, Inc. (“Eastern”) (NASDAQ Global Select

Market: EBC), the stock holding company for Eastern Bank, announced

today the appointment of four members of Cambridge Bancorp’s

(NASDAQ: CATC) (“Cambridge”) Board of Directors to the Eastern and

Eastern Bank Boards of Directors (together, the “Eastern Boards of

Directors" or the “Eastern Boards”) effective upon the closing of

the companies’ pending Merger (the “Merger”).

As previously announced on September 19, 2023, upon closing of

the Merger, Denis Sheahan, Chairman, President and CEO of

Cambridge, will become the CEO of Eastern and will join the Eastern

Boards of Directors, and three Cambridge directors will be

appointed to the Eastern Boards. Eastern Chief Executive Officer

and Chair of the Eastern Boards, Bob Rivers, will serve as

Executive Chair and Chair of the Eastern Boards. The Merger is

expected to close on or about July 12, 2024.

The three Cambridge directors appointed to the Eastern Boards of

Directors are industry leaders with extensive experience in banking

and professional services, real estate, risk management and

corporate governance, and include:

- Leon A. Palandjian

- Cathleen A. Schmidt

- Andy S. Zelleke

“We are pleased to announce the appointment of Denis Sheahan,

Leon Palandjian, Cathy Schmidt, and Andy Zelleke to Eastern’s

Boards of Directors, and look forward to benefitting from their

guidance and insights,” said Bob Rivers, Chief Executive Officer

and Chair of the Eastern Boards. “They are thoughtful and highly

respected leaders who understand our commitment to serving our

shareholders, customers, colleagues and local communities. Their

expertise will help drive greater value and innovation as our two

organizations come together to create Greater Boston’s leading

local bank and the largest bank-owned independent investment

advisor in Massachusetts.”

About the Directors

Leon A. Palandjian. Dr. Palandjian is the Chief Risk Officer of

Intercontinental Real Estate Corporation, a national real estate

investment, development and management firm headquartered in

Boston, MA. His investment experience spans venture capital and

private and public equity in the life sciences and real estate

sectors. Dr. Palandjian has served as a Director of Cambridge

Bancorp and Cambridge Trust since 2006, and was Lead Director from

2014 until January 2017. He served as a Member of the Board of

Trustees of the Mount Auburn Hospital between 2003 – 2020, and

currently serves on the Advisory Board of the McCance Center for

Brain Health at Mass General Brigham Hospital. He received a B.A.

degree from Harvard College, and an M.D. degree from Harvard

Medical School. He is a CFA Charterholder.

Cathleen A. Schmidt. Ms. Schmidt has extensive leadership

experience in banking and professional services. She most recently

served as Chief Executive Officer at McLane Middleton, the largest

full-service business law firm headquartered in Manchester, New

Hampshire with offices in Massachusetts. Ms. Schmidt previously

served as the President and CEO of Citizens Bank New

Hampshire/Vermont. In addition, she held positions at M&T Bank

in upstate New York and began her career at Old Stone Bank in

Providence, Rhode Island. She has a passion for the community, and

has served as Chair of the Business and Industry Association of New

Hampshire, Chair of Granite United Way Board of Directors, and

Chair of the New Hampshire Business Committee for the Arts. She has

served as a Director of Cambridge Bancorp and Cambridge Trust since

2016. Ms. Schmidt received her Bachelor of Arts degree from Boston

College, and completed Executive Education coursework at Harvard

Business School.

Andy S. Zelleke. Dr. Zelleke has three decades of experience in

corporate governance, leadership and management, negotiation and

law. He serves as the MBA Class of 1962 Senior Lecturer of Business

Administration at Harvard Business School, a role he has held since

2011, after previously serving on the faculty at the Harvard

Kennedy School and the Wharton School of the University of

Pennsylvania. He was also previously Project Director and Steering

Committee Member of the American Academy of Arts and Sciences’

Corporate Responsibility Project, and Co-Director of the Harvard

Kennedy School’s Center for Public Leadership. Dr. Zelleke

co-edited Restoring Trust in American Business (MIT Press), in

addition to authoring articles and cases on corporate governance

and international affairs. He is a life member of the Council on

Foreign Relations. Early in his career, he practiced corporate law

and taught at the UCLA School of Law. He has served on the boards

of Cambridge Bancorp and Cambridge Trust since October 2022. Dr.

Zelleke received A.B., A.M., J.D. and Ph.D. degrees from Harvard

University.

Denis K. Sheahan. Mr. Sheahan serves as Chairman, President and

Chief Executive Officer of Cambridge Trust Company and Cambridge

Bancorp. Prior to joining Cambridge Trust Company in April 2015,

Mr. Sheahan spent 19 years at Independent Bank Corp. and Rockland

Trust where he served as Chief Financial Officer and Chief

Operating Officer. Prior to joining Rockland Trust Company, Mr.

Sheahan served as Vice President of Finance for BayBanks, Inc. Mr.

Sheahan currently serves as Board Trustee for the Cambridge

Community Foundation, is an Advisory Board Member of the Rian

Immigrant Center, and is a Board Member and Treasurer for the

Cambridge Family YMCA. Mr. Sheahan also serves as a member of the

Board of Directors of the Massachusetts Bankers Association, and is

a Board Trustee for the Massachusetts Bankers Association

Charitable Foundation, Inc. Mr. Sheahan is a graduate of the Cork

Institute of Technology, Cork, Ireland, and received an MBA from

Boston University.

On September 19, 2023, Eastern and Cambridge announced they had

entered into a definitive agreement to merge and have since

received all required shareholder and regulatory approvals. As

noted above, the closing is expected on or about July 12, 2024,

after which Sheahan, Palandjian, Schmidt and Zelleke will join the

Eastern Boards.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of section 27A of the Securities Act of 1933, as

amended, and section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include statements regarding

anticipated future events and can be identified by the fact that

they do not relate strictly to historical or current facts. You can

identify these statements from the use of words such as “believe,”

“expect,” “anticipate,” “estimate,” “intend,” “future,” “will,”

“look forward to,” “would,” “should,” “could,” or “may” or similar

expressions. Forward-looking statements, by their nature, are

subject to risks and uncertainties. Factors relating to the

proposed merger that could cause or contribute to actual results

differing materially from expected results include, but are not

limited to, the possibility that revenue or expense synergies or

the other expected benefits of the transaction may not materialize

for Eastern or the combined companies in the timeframe expected or

at all, or may be more costly to achieve; that prior to the

completion of the transaction or thereafter, Eastern’s business may

not perform as expected due to transaction-related uncertainty or

other factors; that Eastern is unable to successfully implement

integration strategies; that any outstanding closing conditions are

not satisfied in a timely manner or at all; that the timing of

completion of the proposed merger is dependent on various factors

that cannot be predicted with precision at this point; reputational

risks and the reaction of Eastern’s customers to the transaction;

the inability to implement onboarding plans and other consequences

associated with mergers; and diversion of management time on

merger-related issues; and that director retention and succession

planning strategies may not be implemented within the expected

timeframes or at all.

These forward-looking statements are also subject to the risks

and uncertainties applicable to Eastern’s business generally that

are disclosed in its 2023 Annual Report on Form 10-K, as may be

updated by Eastern’s Quarterly Reports on Form 10-Q. Eastern’s SEC

filings are accessible on the SEC’s website at www.sec.gov and on

its corporate website at investor.easternbank.com. These web

addresses are included as inactive textual references only.

Information on these websites is not part of this document. For any

forward-looking statements made in this press release, Eastern

claims the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995. Except as required by law, Eastern specifically

disclaims any obligation to update any forward-looking statements

as a result of developments occurring after the date of this press

release, even if its estimates change, and you should not rely on

those statements as representing Eastern’s views as of any date

subsequent to the date hereof.

About Eastern Bankshares, Inc. and Eastern Bank

Eastern Bankshares, Inc. is the stock holding company for

Eastern Bank. Founded in 1818, Boston-based Eastern Bank has more

than 120 locations serving communities in eastern Massachusetts,

southern and coastal New Hampshire, and Rhode Island. As of March

31, 2024, Eastern Bank had approximately $21 billion in total

assets. Eastern provides a full range of banking and wealth

management solutions for consumers and businesses of all sizes, and

takes pride in its outspoken advocacy and community support that

includes more than $240 million in charitable giving since 1994. An

inclusive company, Eastern is comprised of deeply committed

professionals who value relationships with their customers,

colleagues and communities. For investor information, visit

investor.easternbank.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240701165638/en/

Media contact: Andrea Goodman Eastern Bank

a.goodman@easternbank.com 781-598-7847 Investor contact:

Jill Belliveau Eastern Bankshares, Inc.

InvestorRelations@easternbank.com 781-598-7920

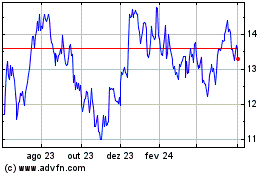

Eastern Bankshares (NASDAQ:EBC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

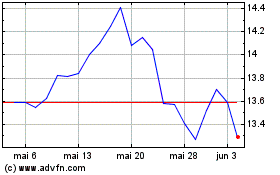

Eastern Bankshares (NASDAQ:EBC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024