UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of June 2024

_______________________

Commission File Number 000-28998

ELBIT SYSTEMS LTD.

(Translation of Registrant’s Name into English)

Advanced Technology Center, P.O.B. 539, Haifa 3100401, Israel

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

x Form 20-F o Form 40-F

Attached hereto and incorporated herein by reference as Exhibits 1 and 2, respectively, are the Registrant's Press Release dated June 10, 2024, and the Unofficial English Translation of the Rating Report of S&P Global Ratings Maalot Ltd.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| ELBIT SYSTEMS LTD. (Registrant) |

| By: | /s/ Pinchas Confino Adi |

| Name: | Pinchas Confino Adi |

| Title: | Corporate Secretary |

Date: June 10, 2024

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | Description | |

| 1 | | June 10, 2024 |

| 2. | | June 2024 |

S&P Global Ratings Maalot Reaffirms Elbit Systems' Long Term Rating of "ilAA" (Local Scale), With a Stable Outlook and Short Term Rating of "ilA-1+" (Local Scale)

Haifa, Israel, June 10, 2024 – Elbit Systems Ltd. (NASDAQ: ESLT and TASE: ESLT) (“Elbit Systems” or the “Company”) announced today that S&P Global Ratings Maalot Ltd., an Israeli rating agency (“Maalot”), issued its rating report regarding Elbit Systems (the "Rating Report"). In its Rating Report, Maalot reaffirmed its long term rating of “ilAA” (on local scaling) with a stable outlook regarding the Company's Series B, C and D Notes, and its short term rating of "ilA-1+" (on local scaling) regarding the Company's Commercial Paper.

Maalot's Rating Report was submitted by Maalot to the Israel Securities Authority and the Tel Aviv Stock Exchange in Hebrew. An unofficial English translation of the Rating Report is submitted by the Company on Form 6-K to the U.S. Securities and Exchange Commission.

This announcement shall not constitute a solicitation or an offer to buy any securities.

About Elbit Systems

Elbit Systems is a leading global defense technology company, delivering advanced solutions for a secure and safer world. Elbit Systems develops, manufactures, integrates and sustains a range of next-generation solutions across multiple domains.

Driven by its agile, collaborative culture, and leveraging Israel’s technology ecosystem, Elbit Systems enables customers to address rapidly evolving battlefield challenges and overcome threats.

Elbit Systems employs over 19,000 people in dozens of countries across five continents. The Company reported as of March 31, 2024 approximately $1.6 billion in revenues and an order backlog of $20.4 billion.

For additional information, visit: https://elbitsystems.com, follow us on Twitter or visit our official Facebook, Youtube and LinkedIn Channels.

Company Contact:

Dr. Yaacov (Kobi) Kagan, ExecutiveVP - CFO

Tel: +972-77-2946663

kobi.kagan@elbitsystems.com

Dr. David Ravia, Investor Relations

Tel: +972-77-2947169

david.ravia@elbitsystems.com

Dalia Bodinger, VP, Communication & Brand

Tel: 972-77-2947602

dalia.bodinger@elbitsystems.com

This press release may contain forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Israeli Securities Law, 1968) regarding Elbit Systems Ltd. and/or its subsidiaries (collectively the Company), to the extent such statements do not relate to historical or current facts. Forward-looking statements are based on management’s current expectations, estimates, projections and assumptions about future events. Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions about the Company, which are difficult to predict, including projections of the Company’s future financial results, its anticipated growth strategies and anticipated trends in its business. Therefore, actual future results, performance and trends may differ materially from these forward-looking statements due to a variety of factors, including, without limitation: scope and length of customer contracts; governmental regulations and approvals; changes in governmental budgeting priorities; general market, political and economic conditions in the countries in which the Company operates or sells, including Israel and the United States, among others, including the duration and scope of the current war in Israel, and the potential impact on our operations; changes in global health and macro-economic conditions; differences in anticipated and actual program performance, including the ability to perform under long-term fixed-price contracts; changes in the competitive environment; and the outcome of legal and/or regulatory proceedings. The factors listed above are not all-inclusive, and further information is contained in Elbit Systems Ltd.’s latest annual report on Form 20-F, which is on file with the U.S. Securities and Exchange Commission. All forward-looking statements speak only as of the date of this release. Although the Company believes the expectations reflected in the forward-looking statements contained herein are reasonable, it cannot guarantee future results, level of activity, performance or achievements. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. The Company does not undertake to update its forward-looking statements.

Elbit Systems Ltd., its logo, brand, product, service and process names appearing in this release are the trademarks or service marks of Elbit Systems Ltd. or its affiliated companies. All other brand, product, service and process names appearing are the trademarks of their respective holders. Reference to or use of a product, service or process other than those of Elbit Systems Ltd. does not imply recommendation, approval, affiliation or sponsorship of that product, service or process by Elbit Systems Ltd. Nothing contained herein shall be construed as conferring by implication, estoppel or otherwise any license or right under any patent, copyright, trademark or other intellectual property right of Elbit Systems Ltd. or any third party, except as expressly granted herein.

1 | June 10, 2024 www.maalot.co.il Elbit Systems Ltd. .................................................................................................................................. June 10, 2024 Rating Affirmation ‘ilAA’ Long Term Rating Affirmed, Outlook Stable; ‘ilA-1+’ Short Term Rating Affirmed Primary Credit Analyst: Sivan Mesilati, 972-3-7539735 sivan.mesilati@spglobal.com Additional Contact: Tom Dar, 972-3-7539722 tom.dar@spglobal.com Please note that this translation was made for convenience purposes and for the company's use only and under no circumstances shall obligate S&P Global Ratings Maalot Ltd. The translation has no legal status and S&P Global Ratings Maalot Ltd. does not assume any responsibility whatsoever as to its accuracy and is not bound by its contents. In the case of any discrepancy with the official Hebrew version published on June 10, 2024, the Hebrew version shall apply. Table of Contents Overview ........................................................................................................................... 3 Outlook ............................................................................................................................. 4 Downside Scenario .................................................................................................... 4 Upside Scenario ......................................................................................................... 4 Base-Case Scenario ......................................................................................................... 4 Assumptions .............................................................................................................. 4 Key Metrics ................................................................................................................ 5 Base Case Projections ............................................................................................... 5 Company Description ........................................................................................................ 5 Business Risk ................................................................................................................... 6 Financial Risk .................................................................................................................... 7 Liquidity ............................................................................................................................. 8

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 2 Covenant Analysis ............................................................................................................ 9 Modifiers ........................................................................................................................... 9 Environmental, Social, And Governance ........................................................................... 9 Issue Ratings--Subordination Risk Analysis .................................................................... 10 Capital structure ....................................................................................................... 10 Analytical conclusions .............................................................................................. 10 Reconciliation .................................................................................................................. 10 Related Criteria And Research ........................................................................................ 11 Ratings List ..................................................................................................................... 12

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 3 Rating Affirmation ‘ilAA’ Long Term Rating Affirmed, Outlook Stable; ‘ilA-1+’ Short Term Rating Affirmed Overview Key Strengths Key Risks • Large order backlog (about $20.4 billion), equivalent to about 3.0-3.5 years of revenues. • Advanced technological capabilities developing systems with a technological advantage over competitors. • Maintaining balanced international geographic diversification of revenues. • Clients in the defense sector, which provides better revenue stability and visibility than the civilian sector. • Dependence on international defense budgets. • Extensive R&D investments required to maintain technological advantage. • Limited transparency given the nature of the Company's defense activity and absence of a disclosed financial policy. Elbit Systems Ltd.’s (“Elbit” or “the Company”) backlog reached a record level in the first quarter of 2024. The backlog was about $20.4 billion due to orders the Company received, including from the Israeli Ministry of Defense and the armies of Australia, Romania, the U.K. and the Netherlands. We expect the Company’s backlog to continue increasing in 2024, based on its existing level and taking into account the positive changes in the defense industry in view of the geopolitical situation in Israel and around the world. In the first quarter of 2024, Elbit posted an increase of about 11.5% in its revenues compared to the corresponding quarter last year, which amounted to about $ 1.55 billion in this quarter. The rapid growth led to negative working capital and larger adjusted debt. We assume that in the medium term the Company will be able to balance its working capital needs and reduce the adjusted debt with the receipt of the proceeds for the projects in executing, and taking into account our assessment of continued revenue and EBITDA growth. We expect the Company’s coverage ratios to be commensurate with the rating in the medium term. We believe that in the medium term, the Company’s free operating cash flow (FOCF) to debt, which decreased in the past year mainly due to working capital needs and substantial investments used for growth and meeting the existing backlog, is expected to gradually improve to 10%-20%, a level commensurate with the rating. We expect adjusted FFO (funds from operations) to debt and

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 4 adjusted debt to EBITDA to move towards 30%-40% and 2.2x-3.2x, respectively, in the next two years, commensurate with the rating. We acknowledge a high degree of uncertainty regarding the scope, duration and effects of the war in Israel. If the conflict expands to additional fronts, it could significantly increase the adverse risk to macroeconomic parameters in Israel and capital market volatility. There are already concerns that Israel’s main economic indicators may be weaker than expected (see Israel Long-Term Ratings Lowered To 'A+' From 'AA-' On Heightened Geopolitical Risk; Outlook Negative, published on April 18, 2024). As the situation evolves, we will update our assumptions and estimates accordingly. Outlook The stable outlook reflects our assessment that in the next 12-24 months Elbit will maintain its strong business position, including R&D capabilities, and a large backlog. We expect the Company to maintain financial ratios commensurate with the rating, i.e. adjusted FFO/debt of about 20%-30% and adjusted debt/EBITDA of about 3.0x-4.0x. Our expectations are underpinned by good revenue and cash flow visibility from the Company’s current backlog. Downside Scenario We may consider a negative rating action if the Company’s abovementioned financial ratios deteriorate, or if its FOCF to debt consistently drops below 10%. This could happen if the Company’s backlog diminished or if its quality deteriorated without a parallel adjustment in its cost structure, such that the adjusted EBITDA margin drops to about 5%. Upside Scenario We may consider a positive rating action if we estimate that the Company can consistently maintain an adjusted FFO to debt ratio comfortably above 30% and an FOCF to debt ratio above 15%, while maintaining its competitive advantage vis-a-vis global peers and continuing to expand its revenue base and improving its adjusted EBITDA margin. Base-Case Scenario Key Assumptions • Increase in the Company’s backlog to over $20 billion in 2024, based on contracts recently awarded. • An 8%-10% increase in revenues in 2024 due to organic growth. • Adjusted EBITDA margin of about 11%-11.5% over the next two years. We do not expect the expenditure structure to materially change. The burden of retirement obligations will remain high, and R&D expenditures will grow slightly to enable future value creation.

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 5 • Capital expenditure of about $200 million - $220 million per year over the next two years. • Optional M&A activity of about $50 million - $100 million over the next two years. • Annual dividend distribution of about $90 million in the next two years. Key Metrics Financial Metric 2023A 2024E 2025E FFO/debt 24% 30%-40% 30%-40% FOCF/debt >0% 10%-20% 15%-25% Debt/EBITDA 3.5x 2.8x-3.2x 2.2x-2.7x A - actual. E – Estimate. Base Case Projections Continued revenue growth Based on a backlog of about $20.4 at the end of the first quarter, which provides good revenue visibility for 3.0-3.5 year, and on the geopolitical situation in Israel and around the world, we expect about 8%-10% revenue growth in 2024. We believe that in the next two years, Elbit will maintain a relatively stable EBITDA margin of about 11%-11.5%. An increase in R&D and capital expenditure Due to the war between Israel and Hamas and the intensification of the geopolitical conflict in the West, we expect the positive trends in the defense industry to continue. We expect that, as demand for its product grows, Elbit will continue to implement its long-term strategy for geographical balance alongside international revenue diversification, while focusing on emerging and similar markets and expanding its technology portfolio. We believe that for this purpose, the Company’s R&D expenditure will increase, and so will its capital expenditure to finance continued growth. Company Description Elbit Systems Ltd. is an international technological company developing, manufacturing and marketing advanced airborne, land, naval and space systems for defense, homeland security and commercial applications. The Company implements a synergistic business model that provides its customers with advanced and integrated technological solutions in five segments: aerospace, C4I and cyber, intelligence and electronic warfare (“ISTAR and EW”), land and Elbit Systems of America ("ESA”). The Company's shares are traded on the Tel Aviv Stock Exchange and on NASDAQ. The controlling

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 6 shareholder is Federman Enterprises Ltd. (about 44.03% directly and indirectly), whose controlling shareholder is Mr. Michael Federman. The remaining shares are held by the public. Business Risk Elbit’s business risk profile is underpinned by its strong business position as developer and producer of technologically advanced systems compared with peers. In addition, Elbit has extensive global operations compared with peers, including operations in the growing U.S. market, and provides key essential technological solutions to the Israeli Ministry of Defense. Elbit’s large backlog provides good revenue visibility for the next 3-3.5 years, thus supporting its business risk profile. Over the years, the Company has maintained wide geographical spread alongside revenue growth. Figure 1: Revenue Distribution by Geographical Location (2022-2023) Figure 2: Revenue Distribution by Major Customers (2023) North America Israel Latin America Europe Asia- Pacific Others 0% 5% 10% 15% 20% 25% 30% 35% 2023 2022 IMOD, 16% U.S. Government, 17% Others, 67%

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 7 Elbit engaged in successful mergers and acquisitions while expanding its advance technological capabilities in several fields of operations such as artillery, cyber security, night vision, soft and hard defense systems and laser protection systems, an innovative field in the industry. The Company integrates capabilities across its fields of operations in order to supply its clients with unique integrated technological solutions. Most of the Company's products target the growing defense sector, which provides better revenue stability and visibility than the civilian sector. Elbit also benefits from high barriers to entry into the defense industry, which are based on training and system integration costs and the high cost of spare parts, which create high customer loyalty. These advantages are somewhat mitigated by high dependence on international defense budgets, by lower revenues and EBITDA compared with some of its global peers, and by the need to continue extensively investing in research and development in order to maintain a technological advantage. Figure 3: Revenue Distribution by Segment Financial Risk The Company’s financial risk profile reflects a medium leverage level, as reflected in adjusted debt to EBITDA of about 3.5x in 2023 (compared to about 2.6x in 2022) and in adjusted FFO to debt of about 24% in 2023 (compared to about 31% in 2022). The deterioration in financial ratios was due to larger adjusted debt in 2023 following rapid growth in light of the increase in demand for the Company's products against the backdrop of the Israel-Hamas war. The Company's revenues amounted to about $6 billion in 2023, compared to about $5.5 billion in 2022. Most of the increase was due to organic growth, mainly in the intelligence, aerospace and land segments. The Company's adjusted EBITDA also grew by about 9% to about $662 million, and its EBITDA margin remained about 11%. We 0% 5% 10% 15% 20% 25% 30% 35% Aerospace Land C4I ISTAR & EW ESA 2021 2022 2023

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 8 anticipate that, considering the strong demand for the Company's products in Israel and internationally, it will continue to post backlog and revenue growth and an EBITDA margin of 11%- 11.5%. At the same time we believe that as the Company receives the proceeds from its projects under execution, its adjusted debt will decrease, and we therefore expect the Company to maintain coverage ratios commensurate with the rating in the next two years. We expect the Company to maintain adjusted debt/EBITDA of 2.2x-3.2x and adjusted FFO/debt of 30% -40%. Table 1. Elbit Systems Ltd. -- Financial Summary (Mil. $) Industry Sector: Aerospace & Defense 2023 2022 2021 2020 2019 Revenue 5,974.7 5,511.5 5,278.5 4,662.6 4,508.4 EBITDA 662.7 607.5 676.8 534.9 519.1 Funds from operations (FFO) 548.2 490.0 606.1 458.0 459.9 Interest expense 105.1 55.2 37.7 36.5 45.5 Cash interest paid 83.7 41.9 32.5 32.6 46.3 Working capital changes (851.6) (259.0) (43.6) (75.2) (382.7) Cash flow from operations (404.0) 193.9 487.7 345.7 13.5 Capital expenditure 187.0 205.1 188.6 132.2 137.6 Free operating cash flow (FOCF) (591.0) (11.2) 299.0 213.5 (124.1) Dividends paid 89.2 86.8 79.2 78.2 62.6 Discretionary cash flow (DCF) (680.3) (98.0) 219.9 135.3 (186.7) Cash and short-term investments 207.9 212.1 260.2 280.3 223.3 Gross available cash 207.9 212.1 260.2 280.3 223.3 Debt 2,287.7 1,603.1 1,778.0 1,552.8 1,601.4 Equity 2,950.3 2,757.7 2,546.3 2,231.4 2,159.8 Adjusted ratios Annual revenue growth (%) 8.4 4.4 13.2 3.4 22.4 EBITDA margin (%) 11.1 11.0 12.8 11.5 11.5 Return on capital (%) 7.7 8.0 11.0 8.4 8.6 EBITDA interest coverage (x) 6.3 11.0 17.9 14.7 11.4 FFO cash interest coverage (x) 7.5 12.7 19.7 15.0 10.9 Debt/EBITDA (x) 3.5 2.6 2.6 2.9 3.1 FFO/debt (%) 24.0 30.6 34.1 29.5 28.7 Cash flow from operations/debt (%) (17.7) 12.1 27.4 22.3 0.8 FOCF/debt (%) (25.8) (0.7) 16.8 13.8 (7.7) DCF/debt (%) (29.7) (6.1) 12.4 8.7 (11.7) Liquidity According to our criteria, the Company’s liquidity is “strong”. We estimate that the ratio between the Company's sources and its uses will exceed 1.5x in the 12 months starting April 1, 2024. This assessment is based on cash and liquid investments and on steady operating cash flows and dividend receipts from affiliates, against debt maturity payments, investments, working capital requirements and

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 9 quarterly dividend distributions. The Company has good financial flexibility, reflected in access to the local market and to banks and financial institutions with which it has been working for several years. We assume that fluctuating working capital needs will be financed, inter alia, using signed, unused short-term credit facilities. Following are the Company’s main sources and uses for the 12 months starting April 1, 2024: Principal Liquidity Sources Principal Liquidity Uses • Cash and liquid investments of about $145 million. • Committed and available credit facilities of about $550 million. • Cash FFO of about $590 million - $610 million. • Dividend from affiliates of about $20 million - $30 million. • Bond maturities, commercial papers and short-term bank debt of about $430 million. • Capital expenditure of about $200 million - $220 million. • Working capital needs of about $120 million - $150 million. • Dividend distribution of about $90 million. Covenant Analysis The Company has several covenants vis-a-vis banks and bond holders, mainly maintaining net financial debt of up to 50% of the balance sheet and minimum equity of $800 million. We understand that on March 31, 2024, the Company had sufficient headroom on its financial covenants. We expect the Company to maintain sufficient headroom on all covenants in the medium term. Modifiers Diversification/portfolio effect: Neutral Capital structure: Neutral Liquidity: Neutral Financial policy: Neutral Management and governance: Neutral Comparable ratings analysis: Neutral Environmental, Social, And Governance ESG factors have an overall neutral influence on our credit analysis of Elbit Systems Ltd.

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 10 Issue Ratings--Subordination Risk Analysis Capital Structure Elbit's capital structure currently includes debt from banks and financial institutions amounting to about $620 million, and unsecured senior bonds totaling about $414 million. Analytical Conclusions We rate the Company’s senior unsecured bonds of about $414 million ‘ilAA’, and its commercial papers of up to $350 million ‘ilA-1+’, as we believe the subordination risk in the capital structure is negligible. Reconciliation In order to create a basis for comparison with other rated companies, we adjust the data reported in the financial statements which we use to calculate financial ratios. The main adjustments we made to Elbit Systems Ltd.'s consolidated data for 2023 are as follows: • Deducting available cash and cash equivalents, as we define them, from reported financial debt. • Adding trade receivables to reported financial debt. • Adding pension liabilities to reported financial debt. • Adding liabilities due to the acquisition of IMI Systems to reported financial debt. • Reducing the impact of trade receivables on operating cash flow. Table 2. Elbit Systems Ltd.--Reconciliation Of Reported Amounts With S&P Global Ratings' Adjusted Amounts (Mil. $) for the Fiscal Year Ended Dec 31, 2023 Debt Shareholders' equity EBITDA Interest expense S&P Global Ratings' adjusted EBITDA Cash flow from operations Reported Amounts 1,036.0 2,947.5 533.9 76.5 662.7 113.7 S&P Global Ratings adjustments Cash taxes paid -- -- -- -- (30.7) -- Cash interest paid -- -- -- -- (66.8) -- Trade receivables securitizations 715.0 -- -- -- -- (595.0) Reported lease liabilities 430.5 -- -- -- -- -- Operating leases -- -- 94.3 17.0 (17.0) 77.3 Postretirement benefit obligations/deferred compensation 214.1 -- -- 11.6 -- -- Accessible cash and liquid investments (207.9) -- -- -- -- -- Share-based compensation expense -- -- 12.1 -- -- --

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 11 Debt Shareholders' equity EBITDA Interest expense S&P Global Ratings' adjusted EBITDA Cash flow from operations Dividends received from equity investments -- -- 22.3 -- -- -- Nonoperating income (expense) -- -- -- -- -- -- Noncontrolling interest/minority interest -- 2.8 -- -- -- -- Debt: Contingent considerations 40.5 -- -- -- -- -- Debt: Government cost recovery (defense sector) (12.6) -- -- -- -- -- Debt: Other (situational) 72.3 -- -- -- -- -- Total adjustments 1,251.8 2.8 128.8 28.6 (114.4) (517.7) S&P Global Ratings adjusted amounts Debt Equity EBITDA Interest expense Funds from operations Cash flow from operations Adjusted 2,287.7 2,950.3 662.7 105.1 548.2 (404.0) Related Criteria And Research • Principles Of Credit Ratings, February 16, 2011 • Methodology: Industry Risk, November 19, 2013 • Country Risk Assessment Methodology And Assumptions, November 19, 2013 • Methodology And Assumptions: Liquidity Descriptors For Global Corporate Issuers, December 16, 2014 • Reflecting Subordination Risk In Corporate Issue Ratings, March 28, 2018 • Corporate Methodology: Ratios And Adjustments, April 1, 2019 • Group Rating Methodology, July 1, 2019 • Environmental, Social, And Governance Principles In Credit Ratings, October 10, 2021 • Methodology For National And Regional Scale Credit Ratings, June 8, 2023 • Corporate Methodology, January 7, 2024 • Methodology: Management And Governance Credit Factors For Corporate Entities And Insurers, January 7, 2024 • Sector-Specific Corporate Methodology, April 4, 2024 • S&P Global Ratings Definitions, June 9, 2023

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 12 Ratings List Elbit Systems Ltd. Rating Date when the rating was first published Date when the rating was last updated Issuer rating(s) Long term ilAA/Stable 15/06/2021 12/06/2023 Short term ilA-1+ 16/08/2023 16/08/2023 Issue rating(s) Commercial Papers USD-denominated Commercial Papers ilA-1+ 16/08/2023 16/08/2023 Senior Unsecured Debt Series B,C,D ilAA 15/06/2021 12/06/2023 Issuer Credit Rating history Long term June 15, 2021 ilAA/Stable Short term August 16, 2023 ilA-1+ Additional details Item Time of the event 10/06/2024 09:08 Time when the event was learned of 10/06/2024 09:08 Rating requested by Issuer

Elbit Systems Ltd. June 10, 2024 maalot.co.il ׀ 13 S&P Maalot is the commercial name of S&P Global Ratings Maalot Ltd. For a list of the most up-to- date ratings and for additional information regarding S&P Maalot’s surveillance policy, see S&P Global Ratings Maalot Ltd. website at www.maalot.co.il. All rights reserved © No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (collectively, “the Content”) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of S&P Global Ratings Maalot Ltd. or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. &P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively, “S&P Parties”) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s ratings and other analyses are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on in making investment decisions or any other business decision, and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making such decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. Rating reports are correct as of the time of their publication. S&P updates rating reports following ongoing surveillance of events or annual surveillance. While S&P obtains information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. S&P publishes rating-related reports for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process. S&P receives compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on S&P Maalot’s website, www.maalot.co.il and on S&P Global’s website, www.spglobal.com/ratings, and may be distributed through other means, including via S&P publications and third-party redistributors.

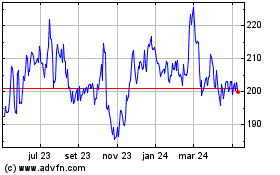

Elbit Systems (NASDAQ:ESLT)

Gráfico Histórico do Ativo

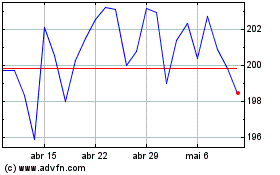

De Mai 2024 até Jun 2024

Elbit Systems (NASDAQ:ESLT)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024