Strong capital accretion and continued to grow

deposits and improve liquidity

Reported results included a negative $0.27

impact from certain items on page 2 of the earnings release

Fifth Third Bancorp (NASDAQ: FITB):

Key Financial Data

Key Highlights

$ in millions for all balance sheet and

income statement items

4Q23

3Q23

4Q22

Stability:

- Average deposits increased 2% compared to 3Q23; increased 5%

compared to 4Q22

- Maintained full Category 1 LCR compliance during the quarter

and achieved a loan-to-core deposit ratio of 72%

- Transferred 23% of AFS securities portfolio to HTM on January

3, 2024

- CET1 capital increased 49 bps sequentially to 10.29% reflecting

strong earnings power and balance sheet optimization efforts

- NCO ratio declined 9 bps compared to 3Q23

Profitability:

Compared to 3Q23

- Adjusted ROTCE ex. AOCI(a) of 16.8% increased 90 basis

points

- Adjusted efficiency ratio(a) of 55.3%

- Tangible book value per share (including AOCI) increased

28%

Growth:

- Generated consumer household growth of 3% compared to 4Q22

- Opened 19 branches during the quarter, 18 of which are in

high-growth Southeast markets

Income Statement Data

Net income available to common

shareholders

$492

$623

$699

Net interest income (U.S. GAAP)

1,416

1,438

1,577

Net interest income (FTE)(a)

1,423

1,445

1,582

Noninterest income

744

715

735

Noninterest expense

1,455

1,188

1,218

Per Share Data

Earnings per share, basic

$0.72

$0.91

$1.01

Earnings per share, diluted

0.72

0.91

1.01

Book value per share

25.04

21.19

22.26

Tangible book value per share(a)

17.64

13.76

14.83

Balance Sheet & Credit

Quality

Average portfolio loans and leases

$118,858

$121,630

$121,371

Average deposits

169,447

165,644

161,061

Accumulated other comprehensive loss

(4,487

)

(6,839

)

(5,110

)

Net charge-off ratio(b)

0.32

%

0.41

%

0.22

%

Nonperforming asset ratio(c)

0.59

0.51

0.44

Financial Ratios

Return on average assets

0.98

%

1.26

%

1.42

%

Return on average common equity

12.9

16.3

18.8

Return on average tangible common

equity(a)

19.8

24.7

29.2

CET1 capital(d)(e)

10.29

9.80

9.28

Net interest margin(a)

2.85

2.98

3.35

Efficiency(a)

67.2

55.0

52.6

Other than the Quarterly Financial Review

tables beginning on page 14 of the earnings release, commentary is

on a fully taxable-equivalent (FTE) basis unless otherwise noted.

Consistent with SEC guidance in Regulation S-K that contemplates

the calculation of tax-exempt income on a taxable-equivalent basis,

net interest income, net interest margin, net interest rate spread,

total revenue and the efficiency ratio are provided on an FTE

basis.

From Tim Spence, Fifth Third Chairman,

President and CEO:

Fifth Third delivered strong operating results in 2023 while

continuing to successfully navigate the challenging environment. We

generated record revenue while prudently managing expenses and

continuing to invest in our businesses. Our credit metrics reflect

disciplined credit risk management, with net charge-offs for the

quarter in-line with our expectations.

In the fourth quarter, we successfully completed our

risk-weighted assets initiative and accreted nearly 50 basis points

of CET1 capital. We generated another quarter of strong deposit

growth, with average deposits up 5% compared to the year-ago

quarter while the industry declined 3%. Additionally, we maintained

full Category 1 LCR compliance during the quarter.

We continued to invest for growth by opening 19 branches during

the quarter, 18 of which are in our high-growth Southeast markets,

and generated consumer household growth of 3% compared to the prior

year. Our new quality middle market relationships in commercial

continued to grow at a record pace.

While the economic and regulatory environments remain uncertain,

we remain well positioned to respond to a range of potential

economic and regulatory outcomes. We will continue to follow our

guiding principles of stability, profitability, and growth – in

that order.

Income Statement Highlights

($ in millions, except per share

data)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Condensed Statements of Income

Net interest income (NII)(a)

$1,423

$1,445

$1,582

(2)%

(10)%

Provision for credit losses

55

119

180

(54)%

(69)%

Noninterest income

744

715

735

4%

1%

Noninterest expense

1,455

1,188

1,218

22%

19%

Income before income taxes(a)

$657

$853

$919

(23)%

(29)%

Taxable equivalent adjustment

$7

$7

$5

—

40%

Applicable income tax expense

120

186

177

(35)%

(32)%

Net income

$530

$660

$737

(20)%

(28)%

Dividends on preferred stock

38

37

38

3%

—

Net income available to common

shareholders

$492

$623

$699

(21)%

(30)%

Earnings per share, diluted

$0.72

$0.91

$1.01

(21)%

(29)%

Fifth Third Bancorp (NASDAQ®: FITB) today reported fourth

quarter 2023 net income of $530 million compared to net income of

$660 million in the prior quarter and $737 million in the year-ago

quarter. Net income available to common shareholders in the current

quarter was $492 million, or $0.72 per diluted share, compared to

$623 million, or $0.91 per diluted share, in the prior quarter and

$699 million, or $1.01 per diluted share, in the year-ago

quarter.

Diluted earnings per share impact of

certain item(s) - 4Q23

(after-tax impact; $ in millions,

except per share data)

FDIC special assessment (noninterest

expense)(f)

$(172)

Valuation of Visa total return swap

(noninterest income)(f)

(17)

Fifth Third Foundation contribution

(noninterest expense)(f)

(12)

Restructuring severance expense

(noninterest expense)(f)

(4)

Income tax benefit associated with

resolution of certain acquisition related tax matters

17

After-tax impact of certain item(s)

$(188)

Diluted earnings per share impact of

certain item(s)1

$(0.27)

1Diluted earnings per share impact

reflects 687.729 million average diluted shares outstanding

Reported full year 2023 net income was $2.3 billion compared to

full year 2022 net income of $2.4 billion. Full year 2023 net

income available to common shareholders was $2.2 billion, or $3.22

per diluted share, compared to 2022 full year net income available

to common shareholders of $2.3 billion, or $3.35 per diluted

share.

Net Interest Income

(FTE; $ in millions)(a)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Interest Income

Interest income

$2,655

$2,536

$2,080

5%

28%

Interest expense

1,232

1,091

498

13%

147%

Net interest income (NII)

$1,423

$1,445

$1,582

(2)%

(10)%

Average Yield/Rate Analysis

bps Change

Yield on interest-earning assets

5.31%

5.23%

4.40%

8

91

Rate paid on interest-bearing

liabilities

3.34%

3.10%

1.56%

24

178

Ratios

Net interest rate spread

1.97%

2.13%

2.84%

(16)

(87)

Net interest margin (NIM)

2.85%

2.98%

3.35%

(13)

(50)

NII decreased $22 million, or 2%, compared to the prior quarter.

During the quarter, the risk-weighted asset reduction initiative

was completed, and strong core deposit growth continued. Balance

sheet positioning and deposit performance continue to provide

flexibility in managing through a range of uncertain economic and

regulatory environments. The impacts of increasing deposit costs

due to higher average market rates and continued competition were

partially offset by improved loan yields and the funding benefits

from the core deposit balance growth. Compared to the prior

quarter, NIM decreased 13 bps, reflecting the impact of higher cash

balances due to the combined impact of the decrease in average

loans and the growth in core deposits. NIM will continue to be

impacted by the decision to carry additional liquidity, with the

combination of cash and due from banks and other short-term

investments exceeding $25 billion at quarter-end.

Compared to the year-ago quarter, NII decreased $159 million, or

10%, reflecting the impact of the deposit mix shift from demand to

interest-bearing accounts and continued deposit repricing dynamics,

partially offset by higher loan yields. Compared to the year-ago

quarter, NIM decreased 50 bps, reflecting the impact of higher

market rates and their effects on deposit pricing and the decision

to carry additional liquidity, partially offset by higher loan

yields.

Noninterest Income

($ in millions)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Noninterest Income

Service charges on deposits

$146

$149

$140

(2)%

4%

Commercial banking revenue

163

154

158

6%

3%

Mortgage banking net revenue

66

57

63

16%

5%

Wealth and asset management revenue

147

145

139

1%

6%

Card and processing revenue

106

104

103

2%

3%

Leasing business revenue

46

58

58

(21)%

(21)%

Other noninterest income

54

55

72

(2)%

(25)%

Securities gains (losses), net

15

(7

)

2

NM

650%

Securities gains, net - non-qualifying

hedges

on mortgage servicing rights

1

—

—

NM

NM

Total noninterest income

$744

$715

$735

4%

1%

Reported noninterest income increased $29 million, or 4%, from

the prior quarter, and increased $9 million, or 1%, from the

year-ago quarter. The reported results reflect the impact of

certain items in the table below, including securities gains/losses

which incorporate mark-to-market impacts from securities associated

with non-qualified deferred compensation plans that are primarily

offset in compensation and benefits expense.

Noninterest Income excluding certain

items

($ in millions)

For the Three Months Ended

December

September

December

% Change

2023

2023

2022

Seq

Yr/Yr

Noninterest Income excluding certain

items

Noninterest income (U.S. GAAP)

$744

$715

$735

Valuation of Visa total return swap

22

10

38

Branch impairment charges

—

—

6

Securities (gains) losses, net

(15)

7

(2)

Noninterest income excluding certain

items(a)

$751

$732

$777

3%

(3)%

Noninterest income excluding certain items increased $19

million, or 3%, from the prior quarter, and decreased $26 million,

or 3%, from the year-ago quarter.

Compared to the prior quarter, service charges on deposits

decreased $3 million, or 2%, primarily reflecting a decrease in

consumer deposit fees due to the elimination of extended overdraft

fees. Commercial banking revenue increased $9 million, or 6%,

primarily reflecting higher institutional brokerage revenue,

business lending fees, and corporate bond fees, partially offset by

a decrease in loan syndication revenue. Mortgage banking net

revenue increased $9 million, or 16%, primarily reflecting a

decrease in MSR asset decay and an increase in MSR net valuation

adjustments, which had a $2 million gain in the fourth quarter

compared to a $2 million loss in the prior quarter. Wealth and

asset management revenue increased $2 million, or 1%, primarily

driven by higher brokerage fees, partially offset by lower personal

asset management revenue. Card and processing revenue increased $2

million, or 2%, primarily driven by higher interchange revenue.

Leasing business revenue decreased $12 million, or 21%, primarily

reflecting lower lease remarketing revenue. Other noninterest

income results were driven by the recognition of tax receivable

agreement revenue of $22 million in the current quarter.

Compared to the year-ago quarter, service charges on deposits

increased $6 million, or 4%, reflecting an increase in commercial

treasury management fees, partially offset by a decrease in

consumer deposit fees. Commercial banking revenue increased $5

million, or 3%, primarily driven by higher institutional brokerage

revenue, corporate bond fees and business lending fees, partially

offset by lower M&A advisory revenue and client financial risk

management revenue. Mortgage banking net revenue increased $3

million, or 5%, primarily reflecting a decrease in MSR asset decay

and an increase in origination fees and gains on loans sales.

Wealth and asset management revenue increased $8 million, or 6%,

driven by higher brokerage fees and personal asset management

revenue. Card and processing revenue increased $3 million, or 3%,

primarily reflecting higher interchange revenue. Leasing business

revenue decreased $12 million, or 21%, primarily reflecting lower

operating lease revenue and lease remarketing revenue. The decrease

in other noninterest income was primarily attributable to lower tax

receivable agreement revenue and private equity income.

Noninterest Expense

($ in millions)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Noninterest Expense

Compensation and benefits

$659

$629

$655

5%

1%

Net occupancy expense

83

84

82

(1)%

1%

Technology and communications

117

115

111

2%

5%

Equipment expense

37

37

37

—

—

Card and processing expense

21

21

21

—

—

Leasing business expense

27

29

36

(7)%

(25)%

Marketing expense

30

35

31

(14)%

(3)%

Other noninterest expense

481

238

245

102%

96%

Total noninterest expense

$1,455

$1,188

$1,218

22%

19%

Reported noninterest expense increased $267 million, or 22%,

from the prior quarter, and increased $237 million, or 19%, from

the year-ago quarter. The reported results reflect the impact of

certain items in the table below.

Noninterest Expense excluding certain

item(s)

($ in millions)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Noninterest Expense excluding certain

item(s)

Noninterest expense (U.S. GAAP)

$1,455

$1,188

$1,218

FDIC special assessment

(224)

—

—

Fifth Third Foundation contribution

(15)

—

—

Restructuring severance expense

(5)

—

—

Noninterest expense excluding certain

item(s)(a)

$1,211

$1,188

$1,218

2%

(1)%

Compared to the prior quarter, noninterest expense excluding

certain items increased $23 million, or 2%, primarily driven by the

impact of non-qualified deferred compensation mark-to-market, which

was a $17 million expense in the fourth quarter compared to a $5

million benefit in the prior quarter, both of which were largely

offset in net securities gains/losses through noninterest

income.

Compared to the year-ago quarter, noninterest expense excluding

certain items decreased $7 million, or 1%, primarily driven by

lower leasing business expense and other noninterest expense,

partially offset by higher technology and communications expense

primarily related to continued modernization investments. The

year-ago quarter included $6 million of noninterest expense related

to the impact of non-qualified deferred compensation

mark-to-market, which was largely offset in net securities

gains/losses through noninterest income.

Average Interest-Earning Assets

($ in millions)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Average Portfolio Loans and

Leases

Commercial loans and leases:

Commercial and industrial loans

$54,633

$57,001

$57,646

(4)%

(5)%

Commercial mortgage loans

11,338

11,216

10,898

1%

4%

Commercial construction loans

5,727

5,539

5,544

3%

3%

Commercial leases

2,535

2,616

2,736

(3)%

(7)%

Total commercial loans and leases

$74,233

$76,372

$76,824

(3)%

(3)%

Consumer loans:

Residential mortgage loans

$17,129

$17,400

$17,577

(2)%

(3)%

Home equity

3,905

3,897

4,024

—

(3)%

Indirect secured consumer loans

15,129

15,787

16,536

(4)%

(9)%

Credit card

1,829

1,808

1,795

1%

2%

Other consumer loans

6,633

6,366

4,615

4%

44%

Total consumer loans

$44,625

$45,258

$44,547

(1)%

—

Total average portfolio loans and

leases

$118,858

$121,630

$121,371

(2)%

(2)%

Average Loans and Leases Held for

Sale

Commercial loans and leases held for

sale

$72

$17

$84

324%

(14)%

Consumer loans held for sale

379

619

1,411

(39)%

(73)%

Total average loans and leases held for

sale

$451

$636

$1,495

(29)%

(70)%

Total average loans and leases

$119,309

$122,266

$122,866

(2)%

(3)%

Securities (taxable and tax-exempt)

$57,351

$56,994

$58,489

1%

(2)%

Other short-term investments

21,506

12,956

6,285

66%

242%

Total average interest-earning assets

$198,166

$192,216

$187,640

3%

6%

Compared to the prior quarter, total average portfolio loans and

leases decreased 2%, reflecting the aforementioned reduction in

risk-weighted assets initiative which impacted both commercial and

consumer portfolios. Average commercial portfolio loans and leases

decreased 3%, reflecting a decrease in commercial and industrial

(C&I) loan balances. Average consumer portfolio loans decreased

1%, primarily reflecting decreases in indirect secured consumer

loan balances and residential mortgage loan balances, partially

offset by an increase in other consumer loan balances driven by

Dividend Finance.

Compared to the year-ago quarter, total average portfolio loans

and leases decreased 2%, reflecting a decrease in the commercial

portfolio. Average commercial portfolio loans and leases decreased

3%, primarily reflecting a decrease in C&I loan balances,

partially offset by an increase in commercial mortgage loan

balances. Average consumer portfolio loans were flat, primarily

reflecting an increase in other consumer loan balances driven by

Dividend Finance, offset by a decrease in indirect secured consumer

loan balances and residential mortgage loan balances.

Average loans and leases held for sale were $0.5 billion in the

current quarter compared to $0.6 billion in the prior quarter and

$1.5 billion in the year-ago quarter.

Average securities (taxable and tax-exempt; amortized cost) of

$57 billion in the current quarter increased $0.4 billion, or 1%,

compared to the prior quarter and decreased $1 billion, or 2%,

compared to the year-ago quarter. Average other short-term

investments (including interest-bearing cash) of $22 billion in the

current quarter increased $9 billion, or 66%, compared to the prior

quarter and increased $15 billion, or 242%, compared to the

year-ago quarter.

Total period-end commercial portfolio loans and leases of $73

billion decreased 3% compared to the prior quarter, primarily

reflecting a decrease in C&I loan balances. Compared to the

year-ago quarter, total period-end commercial portfolio loans and

leases decreased 5%, primarily reflecting a decrease in C&I

loan balances. Period-end commercial revolving line utilization was

35%, compared to 36% in the prior quarter and 37% in the year-ago

quarter.

Total period-end consumer portfolio loans of $44 billion

decreased 1% compared to the prior quarter, primarily reflecting

decreases in indirect secured consumer loan balances and

residential mortgage loan balances, partially offset by an increase

in other consumer loan balances driven by Dividend Finance.

Compared to the year-ago quarter, total period-end consumer

portfolio loans decreased 1%, primarily driven by decreases in

indirect secured consumer loan balances and residential mortgage

loan balances, partially offset by an increase in other consumer

loan balances driven by Dividend Finance.

Total period-end securities (taxable and tax-exempt; amortized

cost) of $57 billion in the current quarter were stable compared to

the prior quarter and decreased $1 billion, or 2%, compared to the

year-ago quarter. Period-end other short-term investments of

approximately $22 billion increased $3 billion, or 17%, compared to

the prior quarter, and increased $14 billion, or 164%, compared to

the year-ago quarter.

On January 3, 2024, Fifth Third transferred $12.6 billion

(amortized cost) of securities, with an unrealized loss of $994

million, from available-for-sale to held-to-maturity. This transfer

is in response to Fifth Third's decision to hold these securities

to maturity in order to reduce potential capital volatility

associated with investment security market price fluctuations.

Average Deposits

($ in millions)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Average Deposits

Demand

$43,396

$44,228

$54,550

(2)%

(20)%

Interest checking

57,114

53,109

47,801

8%

19%

Savings

18,252

20,511

23,474

(11)%

(22)%

Money market

34,292

32,072

28,713

7%

19%

Foreign office(g)

178

168

209

6%

(15)%

Total transaction deposits

$153,232

$150,088

$154,747

2%

(1)%

CDs $250,000 or less

10,556

9,630

2,748

10%

284%

Total core deposits

$163,788

$159,718

$157,495

3%

4%

CDs over $250,000

5,659

5,926

3,566

(5)%

59%

Total average deposits

$169,447

$165,644

$161,061

2%

5%

CDs over $250,000 includes $4.8BN, $5.2BN,

and $3.4BN of retail brokered certificates of deposit which are

fully covered by FDIC insurance for the three months ended

12/31/23, 9/30/23, and 12/31/22, respectively.

Compared to the prior quarter, total average deposits increased

2%, primarily due to seasonality. Average demand deposits

represented 26% of total core deposits in the current quarter,

compared to 28% in the prior quarter. Compared to the prior

quarter, average consumer segment deposits increased 1%, average

commercial segment deposits increased 5%, and average wealth &

asset management segment deposits increased 1%. Period-end total

deposits increased 1% compared to the prior quarter.

Compared to the year-ago quarter, total average deposits

increased 5%, primarily reflecting an increase in interest checking

and time deposit balances, partially offset by a decrease in demand

account balances. Period-end total deposits increased 3% compared

to the year-ago quarter.

The period-end portfolio loan-to-core deposit ratio was 72% in

the current quarter, compared to 74% in the prior quarter and 76%

in the year-ago quarter. Estimated uninsured deposits were

approximately $71 billion, or 42% of total deposits, as of quarter

end.

Average Wholesale Funding

($ in millions)

For the Three Months Ended

% Change

December

September

December

2023

2023

2022

Seq

Yr/Yr

Average Wholesale Funding

CDs over $250,000

$5,659

$5,926

$3,566

(5)%

59%

Federal funds purchased

191

181

264

6%

(28)%

Securities sold under repurchase

agreements

350

352

476

(1)%

(26)%

FHLB advances

3,293

3,726

5,489

(12)%

(40)%

Derivative collateral and other secured

borrowings

34

48

225

(29)%

(85)%

Long-term debt

16,588

14,056

13,425

18%

24%

Total average wholesale funding

$26,115

$24,289

$23,445

8%

11%

CDs over $250,000 includes $4.8BN, $5.2BN,

and $3.4BN of retail brokered certificates of deposit which are

fully covered by FDIC insurance for the three months ended

12/31/23, 9/30/23, and 12/31/22, respectively.

Compared to the prior quarter, average wholesale funding

increased 8%, primarily reflecting an increase in long-term debt

(reflecting the full quarter impact of issuing long-term debt and

automobile loan portfolio securitization in the prior quarter),

partially offset by a decrease in FHLB advances. Compared to the

year-ago quarter, average wholesale funding increased 11%,

primarily reflecting an increase in long-term debt and CDs over

$250,000, partially offset by a decrease in FHLB advances.

Credit Quality Summary

($ in millions)

As of and For the Three Months

Ended

December

September

June

March

December

2023

2023

2023

2023

2022

Total nonaccrual portfolio loans and

leases (NPLs)

$649

$570

$629

$593

$515

Repossessed property

10

11

8

8

6

OREO

29

31

24

22

18

Total nonperforming portfolio loans and

leases and OREO (NPAs)

$688

$612

$661

$623

$539

NPL ratio(h)

0.55%

0.47%

0.52%

0.48%

0.42%

NPA ratio(c)

0.59%

0.51%

0.54%

0.51%

0.44%

Portfolio loans and leases 30-89 days past

due (accrual)

$359

$316

$339

$317

$364

Portfolio loans and leases 90 days past

due (accrual)

36

29

51

46

40

30-89 days past due as a % of portfolio

loans and leases

0.31%

0.26%

0.28%

0.26%

0.30%

90 days past due as a % of portfolio loans

and leases

0.03%

0.02%

0.04%

0.04%

0.03%

Allowance for loan and lease losses

(ALLL), beginning

$2,340

$2,327

$2,215

$2,194

$2,099

Impact of adoption of ASU 2022-02

—

—

—

(49)

—

Total net losses charged-off

(96)

(124)

(90)

(78)

(68)

Provision for loan and lease losses

78

137

202

148

163

ALLL, ending

$2,322

$2,340

$2,327

$2,215

$2,194

Reserve for unfunded commitments,

beginning

$189

$207

$232

$216

$199

(Benefit from) provision for the reserve

for unfunded commitments

(23)

(18)

(25)

16

17

Reserve for unfunded commitments,

ending

$166

$189

$207

$232

$216

Total allowance for credit losses

(ACL)

$2,488

$2,529

$2,534

$2,447

$2,410

ACL ratios:

As a % of portfolio loans and leases

2.12%

2.11%

2.08%

1.99%

1.98%

As a % of nonperforming portfolio loans

and leases

383%

443%

403%

413%

468%

As a % of nonperforming portfolio

assets

362%

413%

383%

393%

447%

ALLL as a % of portfolio loans and

leases

1.98%

1.95%

1.91%

1.80%

1.81%

Total losses charged-off

$(133)

$(158)

$(121)

$(110)

$(103)

Total recoveries of losses previously

charged-off

37

34

31

32

35

Total net losses charged-off

$(96)

$(124)

$(90)

$(78)

$(68)

Net charge-off ratio (NCO ratio)(b)

0.32%

0.41%

0.29%

0.26%

0.22%

Commercial NCO ratio

0.13%

0.34%

0.16%

0.17%

0.13%

Consumer NCO ratio

0.64%

0.53%

0.50%

0.42%

0.38%

Nonperforming portfolio loans and leases were $649 million in

the current quarter, with the resulting NPL ratio of 0.55%.

Compared to the prior quarter, NPLs increased $79 million with the

NPL ratio increasing 8 bps. Compared to the year-ago quarter, NPLs

increased $134 million with the NPL ratio increasing 13 bps.

Nonperforming portfolio assets were $688 million in the current

quarter, with the resulting NPA ratio of 0.59%. Compared to the

prior quarter, NPAs increased $76 million with the NPA ratio

increasing 8 bps. Compared to the year-ago quarter, NPAs increased

$149 million with the NPA ratio increasing 15 bps.

The provision for credit losses totaled $55 million in the

current quarter. The allowance for credit loss ratio represented

2.12% of total portfolio loans and leases at quarter end, compared

with 2.11% for the prior quarter end and 1.98% for the year-ago

quarter end. In the current quarter, the allowance for credit

losses represented 383% of nonperforming portfolio loans and leases

and 362% of nonperforming portfolio assets.

Net charge-offs were $96 million in the current quarter,

resulting in an NCO ratio of 0.32%. Compared to the prior quarter,

net charge-offs decreased $28 million and the NCO ratio decreased 9

bps. Commercial net charge-offs were $25 million, resulting in a

commercial NCO ratio of 0.13%, which decreased 21 bps compared to

the prior quarter. Consumer net charge-offs were $71 million,

resulting in a consumer NCO ratio of 0.64%, which increased 11 bps

compared to the prior quarter.

Compared to the year-ago quarter, net charge-offs increased $28

million and the NCO ratio increased 10 bps, reflecting a

normalizing from near-historically low net charge-offs in the

year-ago quarter. The commercial NCO ratio was flat compared to the

prior year, and the consumer NCO ratio increased 26 bps compared to

the prior year.

Capital Position

As of and For the Three Months

Ended

December

September

June

March

December

2023

2023

2023

2023

2022

Capital Position

Average total Bancorp shareholders' equity

as a % of average assets

8.04%

8.30%

8.90%

8.77%

8.18%

Tangible equity(a)

8.65%

8.46%

8.58%

8.39%

8.31%

Tangible common equity (excluding

AOCI)(a)

7.67%

7.49%

7.57%

7.38%

7.30%

Tangible common equity (including

AOCI)(a)

5.73%

4.51%

5.26%

5.49%

5.00%

Regulatory Capital Ratios(d)(e)

CET1 capital

10.29%

9.80%

9.49%

9.28%

9.28%

Tier 1 risk-based capital

11.59%

11.06%

10.73%

10.53%

10.53%

Total risk-based capital

13.72%

13.13%

12.83%

12.64%

12.79%

Leverage

8.73%

8.85%

8.81%

8.67%

8.56%

The CET1 capital ratio was 10.29%, the Tangible common equity to

tangible assets ratio was 7.67% excluding AOCI, and 5.73% including

AOCI. The Tier 1 risk-based capital ratio was 11.59%, the Total

risk-based capital ratio was 13.72%, and the Leverage ratio was

8.73%. Fifth Third did not execute share repurchases in the fourth

quarter of 2023.

Tax Rate

The effective tax rate for the quarter was 18.4% compared with

22.0% in the prior quarter and 19.4% in the year-ago quarter. The

tax rate in the fourth quarter reflects a favorable adjustment of

$17 million associated with resolution of certain acquisition

related tax matters.

Conference Call

Fifth Third will host a conference call to discuss these

financial results at 9:00 a.m. (Eastern Time) today. This

conference call will be webcast live and may be accessed through

the Fifth Third Investor Relations website at www.53.com (click on “About Us” then “Investor

Relations”). Those unable to listen to the live webcast may access

a webcast replay through the Fifth Third Investor Relations website

at the same web address, which will be available for 30 days.

Corporate Profile

Fifth Third is a bank that’s as long on innovation as it is on

history. Since 1858, we’ve been helping individuals, families,

businesses and communities grow through smart financial services

that improve lives. Our list of firsts is extensive, and it’s one

that continues to expand as we explore the intersection of

tech-driven innovation, dedicated people, and focused community

impact. Fifth Third is one of the few U.S.-based banks to have been

named among Ethisphere's World’s Most Ethical Companies® for

several years. With a commitment to taking care of our customers,

employees, communities and shareholders, our goal is not only to be

the nation’s highest performing regional bank, but to be the bank

people most value and trust.

Fifth Third Bank, National Association is a federally chartered

institution. Fifth Third Bancorp is the indirect parent company of

Fifth Third Bank and its common stock is traded on the NASDAQ®

Global Select Market under the symbol “FITB.” Investor information

and press releases can be viewed at www.53.com.

Earnings Release End Notes

(a)

Non-GAAP measure; see discussion of non-GAAP reconciliation

beginning on page 27 of the earnings release.

(b)

Net losses charged-off as a percent of average portfolio loans

and leases presented on an annualized basis.

(c)

Nonperforming portfolio assets as

a percent of portfolio loans and leases and OREO.

(d)

Regulatory capital ratios are

calculated pursuant to the five-year transition provision option to

phase in the effects of CECL on regulatory capital after its

adoption on January 1, 2020.

(e)

Current period regulatory capital

ratios are estimated.

(f)

Assumes a 23% tax rate.

(g)

Includes commercial customer

Eurodollar sweep balances for which the Bank pays rates comparable

to other commercial deposit accounts.

(h)

Nonperforming portfolio loans and

leases as a percent of portfolio loans and leases.

FORWARD-LOOKING STATEMENTS

This release contains statements that we believe are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934,

as amended, and Rule 3b-6 promulgated thereunder. All statements

other than statements of historical fact are forward-looking

statements. These statements relate to our financial condition,

results of operations, plans, objectives, future performance,

capital actions or business. They usually can be identified by the

use of forward-looking language such as “will likely result,”

“may,” “are expected to,” “is anticipated,” “potential,”

“estimate,” “forecast,” “projected,” “intends to,” or may include

other similar words or phrases such as “believes,” “plans,”

“trend,” “objective,” “continue,” “remain,” or similar expressions,

or future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “can,” or similar verbs. You should not place

undue reliance on these statements, as they are subject to risks

and uncertainties, including but not limited to the risk factors

set forth in our most recent Annual Report on Form 10-K as updated

by our filings with the U.S. Securities and Exchange Commission

(“SEC”).

There are a number of important factors that could cause future

results to differ materially from historical performance and these

forward-looking statements. Factors that might cause such a

difference include, but are not limited to: (1) deteriorating

credit quality; (2) loan concentration by location or industry of

borrowers or collateral; (3) problems encountered by other

financial institutions; (4) inadequate sources of funding or

liquidity; (5) unfavorable actions of rating agencies; (6)

inability to maintain or grow deposits; (7) limitations on the

ability to receive dividends from subsidiaries; (8) effects of the

global COVID-19 pandemic; (9) cyber-security risks; (10) Fifth

Third’s ability to secure confidential information and deliver

products and services through the use of computer systems and

telecommunications networks; (11) failures by third-party service

providers; (12) inability to manage strategic initiatives and/or

organizational changes; (13) inability to implement technology

system enhancements; (14) failure of internal controls and other

risk management systems; (15) losses related to fraud, theft,

misappropriation or violence; (16) inability to attract and retain

skilled personnel; (17) adverse impacts of government regulation;

(18) governmental or regulatory changes or other actions; (19)

failures to meet applicable capital requirements; (20) regulatory

objections to Fifth Third’s capital plan; (21) regulation of Fifth

Third’s derivatives activities; (22) deposit insurance premiums;

(23) assessments for the orderly liquidation fund; (24) replacement

of LIBOR; (25) weakness in the national or local economies; (26)

global political and economic uncertainty or negative actions; (27)

changes in interest rates and the effects of inflation; (28)

changes and trends in capital markets; (29) fluctuation of Fifth

Third’s stock price; (30) volatility in mortgage banking revenue;

(31) litigation, investigations, and enforcement proceedings by

governmental authorities; (32) breaches of contractual covenants,

representations and warranties; (33) competition and changes in the

financial services industry; (34) changing retail distribution

strategies, customer preferences and behavior; (35) difficulties in

identifying, acquiring or integrating suitable strategic

partnerships, investments or acquisitions; (36) potential dilution

from future acquisitions; (37) loss of income and/or difficulties

encountered in the sale and separation of businesses, investments

or other assets; (38) results of investments or acquired entities;

(39) changes in accounting standards or interpretation or declines

in the value of Fifth Third’s goodwill or other intangible assets;

(40) inaccuracies or other failures from the use of models; (41)

effects of critical accounting policies and judgments or the use of

inaccurate estimates; (42) weather-related events, other natural

disasters, or health emergencies (including pandemics); (43) the

impact of reputational risk created by these or other developments

on such matters as business generation and retention, funding and

liquidity; (44) changes in law or requirements imposed by Fifth

Third’s regulators impacting our capital actions, including

dividend payments and stock repurchases; and (45) Fifth Third's

ability to meet its environmental and/or social targets, goals and

commitments.

You should refer to our periodic and current reports filed with

the Securities and Exchange Commission, or “SEC,” for further

information on other factors, which could cause actual results to

be significantly different from those expressed or implied by these

forward-looking statements. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to us. We expressly

disclaim any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in our expectations or any changes in

events, conditions or circumstances on which any such statement is

based, except as may be required by law, and we claim the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The information contained herein is intended to be reviewed in its

totality, and any stipulations, conditions or provisos that apply

to a given piece of information in one part of this press release

should be read as applying mutatis mutandis to every other instance

of such information appearing herein.

Category: Earnings

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240119449055/en/

Investor contact: Matt Curoe (513) 534-2345 Media contact:

Jennifer Hendricks Sullivan (614) 744-7693

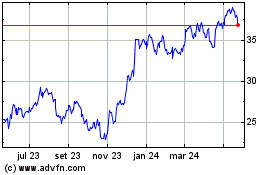

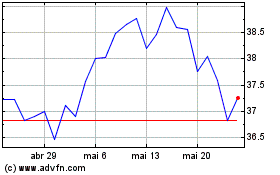

Fifth Third Bancorp (NASDAQ:FITB)

Gráfico Histórico do Ativo

De Out 2024 até Out 2024

Fifth Third Bancorp (NASDAQ:FITB)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024