Fuel Tech, Inc. (NASDAQ: FTEK), a technology company

providing advanced engineering solutions for the optimization of

combustion systems, emissions control, and water treatment in

utility and industrial applications, today reported financial

results for the third quarter ended September 30, 2023 (“Q3

2023”).

“Revenue from our Air Pollution Control (APC) business segment

increased by 36% in Q3 2023, which offset lower revenue from our

FUEL CHEM® business segment,” said Vincent J. Arnone, President and

CEO. “FUEL CHEM operations normalized during Q3 2023 as the unit

downtime we experienced in the second quarter of 2023 (“Q2 2023”)

caused by temporary maintenance activities and unplanned outages

substantially abated. In this regard, FUEL CHEM revenues more than

doubled in Q3 2023 when compared to Q2 2023.”

“We completed the on-site deployment and pilot testing of our

Dissolved Gas Infusion (DGI®) technology at an aquaculture setting

in the Western United States. Over the 100-day demonstration, the

DGI technology delivered and consistently controlled the dissolved

oxygen levels in a band between nine and twelve milligrams per

liter (approximately 150% of atmospheric saturation). Based on an

analysis of the results and post-study consultation with the

client, the DGI technology met and, in many cases, exceeded the

pilot study expectations and parameters for consistent delivery of

high-quality dissolved oxygen on demand. The client reported

excellent results from taste tests by local chefs including an

absence of trimethylamines (TMA) within the harvest. Results from

this study will be presented at Aquaculture America 2024. We are

currently in negotiations with this client to deploy our DGI system

at its location for both the next growth cycle and its larger scale

development plans. In addition to this demonstration, we are

continuing our conversations with other potential channel partners

as we look to deploy DGI in other end markets.”

Mr. Arnone concluded, “We ended the third quarter with $33.2

million in cash and investments and no long-term debt. We remain

optimistic about our outlook for the year and are continuing to

pursue multiple domestic and international award opportunities to

utilize our SCR, SNCR and ULTRA emissions control solutions, as

evidenced by our announcement of new contract awards yesterday. We

continue to believe that total revenue for full year 2023 will

improve modestly from 2022, driven primarily by our APC

business.”

Q3 2023 Consolidated Results

Overview

Consolidated revenues for Q3 2023 were unchanged at $8.0 million

compared to Q3 2022, reflecting higher APC revenue offset by a

decline in FUEL CHEM revenue.

Consolidated gross margin for Q3 2023 was 45.2% of revenues

compared to 45.8% of revenues in Q3 2022, driven primarily by lower

FUEL CHEM revenue when compared to Q3 2022.

SG&A expenses declined to $3.0 million from $3.3 million in

Q3 2022, due to a reduction in employee-related expenditures.

Interest income improved to $0.3 million from $0.1 million in Q3

2022, reflecting higher interest rates on held-to-maturity debt

securities and money market funds.

Net income in Q3 2023 was $0.5 million, or $0.02 per share,

compared to net income of $0.3 million, or $0.01 per share, in Q3

2022.

Consolidated APC segment backlog at September 30, 2023 was $5.6

million compared to $8.2 million at December 31, 2022.

APC segment revenue increased to $3.7 million from $2.7 million

in Q3 2022 with gross margin increasing to 40.3% from 34.0%, due to

the timing of project execution and new awards announced during

2022 and continuing through the first nine months of 2023.

FUEL CHEM segment revenue declined to $4.3 million from $5.3

million in Q3 2022, due to a decline in electrical generation

demand for the units on which our FUEL CHEM program is installed

and contributions from one additional unit in Q3 2022 that has

since been retired. Gross margin declined slightly to 49.5% from

51.9% in Q3 2022 due to lower segment revenue.

Adjusted EBITDA was $0.4 million in Q3 2023 compared to Adjusted

EBITDA of $0.4 million in Q3 2022.

Financial Condition

At September 30, 2023, cash and cash equivalents were $13.5

million, short-term investments were $14.8 million, and long-term

investments totaled $4.9 million. Stockholders’ equity at September

30, 2023 was $44.1 million, or $1.45 per share, and the Company had

no debt.

Conference Call

Management will host a conference call on Wednesday, November 8,

2023 at 10:00 am ET / 9:00 am CT to discuss the results and

business activities. Interested parties may participate in the call

by dialing:

- (877) 423-9820 (Domestic) or

- (201) 493-6749 (International)

The conference call will also be accessible via the Upcoming

Events section of the Company’s web site at www.ftek.com. Following

management’s opening remarks, there will be a question-and-answer

session. Questions may be asked during the live call, or

alternatively, you may e-mail questions in advance to

dsullivan@equityny.com. For those who cannot listen to the live

broadcast, an online replay will be available at www.ftek.com.

About Fuel Tech

Fuel Tech develops and commercializes state-of-the-art

proprietary technologies for air pollution control, process

optimization, water treatment, and advanced engineering services.

These technologies enable customers to operate in a cost-effective

and environmentally sustainable manner. Fuel Tech is a leader in

nitrogen oxide (NOx) reduction and particulate control technologies

and its solutions have been installed on over 1,200 utility,

industrial and municipal units worldwide. The Company’s FUEL CHEM®

technology improves the efficiency, reliability, fuel flexibility,

boiler heat rate, and environmental status of combustion units by

controlling slagging, fouling, corrosion and opacity. Water

treatment technologies include DGI™ Dissolved Gas Infusion Systems

which utilize a patented nozzle to deliver supersaturated oxygen

solutions and other gas-water combinations to target process

applications or environmental issues. This infusion process has a

variety of applications in the water and wastewater industries,

including remediation, aeration, biological treatment and

wastewater odor management. Many of Fuel Tech’s products and

services rely heavily on the Company’s exceptional Computational

Fluid Dynamics modeling capabilities, which are enhanced by

internally developed, high-end visualization software. For more

information, visit Fuel Tech’s web site at www.ftek.com.

NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” as

defined in Section 21E of the Securities Exchange Act of 1934, as

amended, which are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995 and reflect

Fuel Tech’s current expectations regarding future growth, results

of operations, cash flows, performance and business prospects, and

opportunities, as well as assumptions made by, and information

currently available to, our management. Fuel Tech has tried to

identify forward-looking statements by using words such as

“anticipate,” “believe,” “plan,” “expect,” “estimate,” “intend,”

“will,” and similar expressions, but these words are not the

exclusive means of identifying forward-looking statements. These

statements are based on information currently available to Fuel

Tech and are subject to various risks, uncertainties, and other

factors, including, but not limited to, those discussed in Fuel

Tech’s Annual Report on Form 10-K in Item 1A under the caption

“Risk Factors,” and subsequent filings under the Securities

Exchange Act of 1934, as amended, which could cause Fuel Tech’s

actual growth, results of operations, financial condition, cash

flows, performance and business prospects and opportunities to

differ materially from those expressed in, or implied by, these

statements. Fuel Tech undertakes no obligation to update such

factors or to publicly announce the results of any of the

forward-looking statements contained herein to reflect future

events, developments, or changed circumstances or for any other

reason. Investors are cautioned that all forward-looking statements

involve risks and uncertainties, including those detailed in Fuel

Tech’s filings with the Securities and Exchange Commission.

FUEL TECH, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands, except share and

per share data)

September 30,

December 31,

2023

2022

ASSETS

Current assets:

Cash and cash equivalents

$

13,483

$

23,328

Short-term investments

14,802

2,981

Accounts receivable, net

7,696

7,729

Inventories, net

325

392

Prepaid expenses and other current

assets

1,041

1,395

Total current assets

37,347

35,825

Property and equipment, net of accumulated

depreciation of $18,727 and $18,557, respectively

4,364

4,435

Goodwill

2,116

2,116

Other intangible assets, net of

accumulated amortization of $452 and $406, respectively

376

397

Right-of-use operating lease assets,

net

462

197

Long-term investments

4,883

6,360

Other assets

771

794

Total assets

$

50,319

$

50,124

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

2,872

$

2,710

Accrued liabilities:

Operating lease liabilities - current

103

125

Employee compensation

618

1,105

Other accrued liabilities

1,838

826

Total current liabilities

5,431

4,766

Operating lease liabilities -

non-current

348

66

Deferred income taxes, net

177

177

Other liabilities

275

274

Total liabilities

6,231

5,283

Stockholders’ equity:

Common stock, $.01 par value, 40,000,000

shares authorized, 31,361,303 and 31,272,303 shares issued, and

30,385,297 and 30,296,297 shares outstanding, respectively

313

313

Additional paid-in capital

164,752

164,422

Accumulated deficit

(116,990

)

(115,991

)

Accumulated other comprehensive loss

(1,812

)

(1,728

)

Nil coupon perpetual loan notes

76

76

Treasury stock, at cost

(2,251

)

(2,251

)

Total stockholders’ equity

44,088

44,841

Total liabilities and stockholders’

equity

$

50,319

$

50,124

See notes to condensed consolidated financial

statements.

FUEL TECH, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(Unaudited)

(in thousands, except share and

per-share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Revenues

$

7,988

$

8,017

$

20,736

$

19,920

Costs and expenses:

Cost of sales

4,376

4,345

12,323

11,280

Selling, general and administrative

2,966

3,273

9,126

9,201

Research and development

513

207

1,144

716

7,855

7,825

22,593

21,197

Operating income (loss)

133

192

(1,857

)

(1,277

)

Interest expense

(5

)

(4

)

(15

)

(13

)

Interest income

322

92

968

101

Other income (expense), net

9

34

(95

)

158

Income (loss) before income

taxes

459

314

(999

)

(1,031

)

Income tax expense

—

—

—

(9

)

Net income (loss)

$

459

$

314

$

(999

)

$

(1,040

)

Net income (loss) per common

share:

Basic net income (loss) per common

share

$

0.02

$

0.01

$

(0.03

)

$

(0.03

)

Diluted net income (loss) per common

share

$

0.01

$

0.01

$

(0.03

)

$

(0.03

)

Weighted-average number of common

shares outstanding:

Basic

30,385,000

30,296,000

30,336,000

30,287,000

Diluted

30,627,000

30,371,000

30,336,000

30,287,000

See notes to condensed consolidated financial

statements.

FUEL TECH, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(in thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net income (loss)

$

459

$

314

$

(999

)

$

(1,040

)

Other comprehensive (loss) income:

Foreign currency translation

adjustments

(122

)

(155

)

(84

)

(447

)

Comprehensive income (loss)

$

337

$

159

$

(1,083

)

$

(1,487

)

See notes to condensed consolidated financial

statements.

FUEL TECH, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(Unaudited)

(in thousands)

Nine Months Ended

September 30,

2023

2022

Operating Activities

Net loss

$

(999

)

$

(1,040

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation

247

267

Amortization

46

70

Non-cash interest income on

held-to-maturity securities

(319

)

—

Provision for credit losses, net of

recoveries

—

(45

)

Stock-based compensation, net of

forfeitures

288

136

Changes in operating assets and

liabilities:

Accounts receivable

5

(3,449

)

Inventories

68

(44

)

Prepaid expenses, other current assets and

other non-current assets

363

370

Accounts payable

172

1,094

Accrued liabilities and other non-current

liabilities

520

50

Net cash provided by (used in) operating

activities

391

(2,591

)

Investing Activities

Purchases of equipment and patents

(201

)

(186

)

Purchases of debt securities

(14,026

)

(9,777

)

Maturities of debt securities

4,000

—

Net cash used in investing activities

(10,227

)

(9,963

)

Financing Activities

Proceeds from exercise of stock

options

42

—

Taxes paid on behalf of equity award

participants

—

(17

)

Net cash provided by (used in) financing

activities

42

(17

)

Effect of exchange rate fluctuations on

cash

(51

)

(401

)

Net decrease in cash and cash

equivalents

(9,845

)

(12,972

)

Cash and cash equivalents at beginning of

period

23,328

37,054

Cash and cash equivalents at end of

period

$

13,483

$

24,082

See notes to condensed consolidated financial

statements.

Fuel Tech, Inc.

Segment Data- Reporting

Segments

(Unaudited)

(in thousands)

Information about reporting segment net

sales and gross margin from operations is provided below:

Air Pollution

FUEL CHEM

Three months ended September 30, 2023

Control Segment

Segment

Other

Total

Revenues from external customers

$

3,711

$

4,277

$

—

$

7,988

Cost of sales

(2,214

)

(2,162

)

—

(4,376

)

Gross margin

1,497

2,115

—

3,612

Selling, general and administrative

—

—

(2,966

)

(2,966

)

Research and development

—

—

(513

)

(513

)

Operating income (loss) from

operations

$

1,497

$

2,115

$

(3,479

)

$

133

Air Pollution

FUEL CHEM

Three months ended September 30, 2022

Control Segment

Segment

Other

Total

Revenues from external customers

$

2,728

$

5,289

$

—

$

8,017

Cost of sales

(1,801

)

(2,544

)

—

(4,345

)

Gross margin

927

2,745

—

3,672

Selling, general and administrative

—

—

(3,273

)

(3,273

)

Research and development

—

—

(207

)

(207

)

Operating income (loss) from

operations

$

927

$

2,745

$

(3,480

)

$

192

Air Pollution

FUEL CHEM

Nine months ended September 30, 2023

Control Segment

Segment

Other

Total

Revenues from external customers

$

10,692

$

10,044

$

—

$

20,736

Cost of sales

(7,155

)

(5,168

)

—

(12,323

)

Gross margin

3,537

4,876

—

8,413

Selling, general and administrative

—

—

(9,126

)

(9,126

)

Research and development

—

—

(1,144

)

(1,144

)

Operating income (loss) from

operations

$

3,537

$

4,876

$

(10,270

)

$

(1,857

)

Air Pollution

FUEL CHEM

Nine months ended September 30, 2022

Control Segment

Segment

Other

Total

Revenues from external customers

$

7,670

$

12,250

$

—

$

19,920

Cost of sales

(5,032

)

(6,248

)

—

(11,280

)

Gross margin

2,638

6,002

—

8,640

Selling, general and administrative

—

—

(9,201

)

(9,201

)

Research and development

—

—

(716

)

(716

)

Operating income (loss) from

operations

$

2,638

$

6,002

$

(9,917

)

$

(1,277

)

Fuel Tech, Inc.

Geographic Segment Financial

Data

(Unaudited)

(in thousands of dollars)

Information concerning our operations by

geographic area is provided below. Revenues are attributed to

countries based on the location of the end-user. Assets are those

directly associated with operations of the geographic area.

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Revenues:

United States

$

5,640

$

6,972

$

15,937

$

14,939

Foreign

2,348

1,045

4,799

4,981

$

7,988

$

8,017

$

20,736

$

19,920

September 30,

December 31,

2023

2022

Assets:

United States

$

46,550

$

47,007

Foreign

3,769

3,117

$

50,319

$

50,124

FUEL TECH, INC.

RECONCILIATION OF GAAP NET INCOME

(LOSS) TO EBITDA AND ADJUSTED EBITDA

(Unaudited)

(in thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net income (loss)

$

459

$

314

$

(999

)

$

(1,040

)

Interest income, net

(317

)

(88

)

(953

)

(88

)

Income tax expense

-

-

-

9

Depreciation expense

93

85

247

267

Amortization expense

16

20

46

70

EBITDA

251

331

(1,659

)

(782

)

Stock compensation expense

101

90

288

136

Adjusted EBITDA

$

352

$

421

$

(1,371

)

$

(646

)

Adjusted EBITDA

To supplement the Company's consolidated financial statements

presented in accordance with generally accepted accounting

principles in the United States (GAAP), the Company has provided an

Adjusted EBITDA disclosure as a measure of financial performance.

Adjusted EBITDA is defined as net income (loss) before interest

income, income tax expense, depreciation expense, amortization

expense, stock compensation expense. The Company's reference to

these non-GAAP measures should be considered in addition to results

prepared in accordance with GAAP standards, but are not a

substitute for, or superior to, GAAP results.

Adjusted EBITDA is provided to enhance investors' overall

understanding of the Company's current financial performance and

ability to generate cash flow, which we believe is a meaningful

measure for our investor and analyst communities. In many cases

non-GAAP financial measures are utilized by these individuals to

evaluate Company performance and ultimately determine a reasonable

valuation for our common stock. A reconciliation of Adjusted EBITDA

to the nearest GAAP measure of net income (loss) has been included

in the above financial table.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107507546/en/

Vince Arnone President and CEO (630) 845-4500

Devin Sullivan Managing Director The Equity Group Inc.

dsullivan@equityny.com

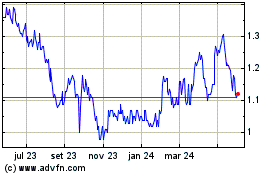

Fuel Tech (NASDAQ:FTEK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Fuel Tech (NASDAQ:FTEK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024