Jet.AI (the “Company”) (Nasdaq: JTAI), an

innovative private aviation and artificial intelligence (“AI”)

company, today announced financial results for the second quarter

ended June 30, 2024.

Second Quarter 2024 and Recent Operational

Highlights

- Launched DynoFlight 2.0 platform, an advanced AI web-based

solution for aviation carbon management

- Commenced and successfully completed exchange offer and consent

solicitation relating to its outstanding warrants

- Announced AI-Powered Jet Card with Empty Leg Benefit, as a

result of Reroute AI

- Announced non-recourse debt financing related to the proposed

purchase of Bombardier Challenger 3500 aircraft

- Released the National Jet Card Program which offers all

categories of private jet for service within the continental U.S.,

guaranteed rates, guaranteed availability, and a 48-hour call

out

Second Quarter 2024 Financial Results

Revenues were $3.1 million, an increase of $0.3

million compared to the same period last year. The primary reason

was due to additional service revenue arising from an additional

management agreement for customer aircraft and increased chartering

of the Company’s Citation CJ4.

Software App and Cirrus Charter revenue, the

gross amount of charters booked through CharterGPT and Cirrus, was

$1.6 million, a slight increase compared to the same period last

year.

Management and Other Services revenue, which is

comprised of revenues generated from managing and chartering our

customer aircrafts, totaled $914,000 compared to $423,000 in the

same period last year.

Jet Card and Fractional Programs revenue, which

is generated from the sale and use of jet cards and service revenue

related to ongoing utilization by the Company’s fractional

customers, totaled $559,000 compared to $811,000 in the same period

last year.

Cost of revenues totaled $3.5 million compared

to $3.0 million in the same period last year. The increase is

primarily due to an increase in Cirrus charter flight activity,

costs related to the operation of aircraft and payments to Cirrus

for their management.

Gross loss totaled approximately $417,000

compared to $201,000 in the same period last year.

The increase was largely driven by reduced flights performed

for the Company’s jet card customers without a corresponding

reduction in fixed costs.

Operating expenses totaled $2.8 million

compared to $2.2 million in the same period last year. The increase

was primarily due to an increase in general and administrative

expenses, research and development costs, offset by slightly lower

sales and marketing expenses.

Operating loss was approximately $3.2 million

compared to $2.4 million in the same period last year. The increase

was primarily due to the increase in general and administrative

expenses resulting from the increase in professional service

expenses and wages following the Business Combination.

As of June 30, 2024, the Company had cash and cash

equivalents of approximately $528,000 compared to $595,555

as of March 31, 2024.

Management Commentary“In the second quarter, we

made significant progress in our anticipated fleet deal with

Bombardier, as we announced a non-binding, non-recourse debt

financing arrangement, alongside securing $16.5 million in

financing from Ionic Ventures LLC,” said Founder and Executive

Chairman Mike Winston. “Additionally, we successfully completed the

warrant exchange offer, eliminating potentially dilutive warrant

overhang and simplifying our capital structure.”

“We received an unsolicited bid for one of our HondaJets at a

price that would imply a net economic benefit compared to its

continued use in the fleet and so have entered into a contract to

sell it as part of our gradual reorientation of the fleet toward

the higher margin Challenger 3500 aircraft. We separately have made

several advancements on our software business, including the

implementation of Reroute AI for our Jet Card holders offering

empty leg benefits, and the launch of our enhanced DynoFlight 2.0

platform, which integrates AI and synced fleet data with our

partner, FL3XX. These two solutions, along with CharterGPT,

continue to attract market interest. We remain cautiously

optimistic and look forward to announcing further news on our

proposed fleet deal.”

About Jet.AIJet.AI operates in two segments,

Software and Aviation, respectively. The Software segment features

the B2C CharterGPT app and the B2B Jet.AI Operator platform. The

CharterGPT app uses natural language processing and machine

learning to improve the private jet booking experience. The Jet.AI

operator platform offers a suite of stand-alone software products

to enable FAA Part 135 charter providers to add revenue, maximize

efficiency, and reduce environmental impact. The Aviation segment

features jet aircraft fractions, jet cards, on-fleet charter,

management, and buyer’s brokerage. Jet.AI is an official partner of

the Las Vegas Golden Knights, 2023 NHL Stanley Cup® champions. The

Company was founded in 2018 and is based in Las Vegas, NV and San

Francisco, CA.

Forward-Looking Statements

This press release contains certain statements that may be

deemed to be “forward-looking statements” within the meaning of the

federal securities laws, including the safe harbor provisions under

the Private Securities Litigation Reform Act of 1995, with respect

to the products and services offered by Jet.AI and the markets in

which it operates, and Jet.AI’s projected future results.

Statements that are not historical are forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements relate to future events or our future performance or

future financial condition. These forward-looking statements are

not historical facts, but rather are based on current expectations,

estimates and projections about our Company, our industry, our

beliefs and our assumptions. These forward-looking statements

generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions or

the negative of these terms or other similar expressions, but the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties that could cause the actual

results to differ materially from the expected results. As a

result, caution must be exercised in relying on forward-looking

statements, which speak only as of the date they were made. Factors

that could cause actual results to differ materially from those

expressed or implied in forward-looking statements can be found in

the Company’s most recent Annual Report on Form 10-K and subsequent

reports filed with the Securities and Exchange Commission. These

filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Readers are cautioned not to put undue reliance on forward-looking

statements, and Jet.AI assumes no obligation and does not intend to

update or revise these forward-looking statements, whether because

of new information, future events, or otherwise, except as provided

by law.

Jet.AI Investor Relations:Gateway Group, Inc.

949-574-3860Jet.AI@gateway-grp.com

|

JET.AI, INC.(FORMERLY JET TOKEN,

INC.)CONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED) |

|

|

|

|

|

|

|

| |

June 30, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

| |

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

| Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

528,117 |

|

|

$ |

2,100,543 |

|

|

Accounts receivable |

535,975 |

|

|

96,539 |

|

|

Other current assets |

72,769 |

|

|

190,071 |

|

|

Prepaid offering costs |

800,000 |

|

|

800,000 |

|

|

Total current assets |

1,936,861 |

|

|

3,187,153 |

|

| |

|

|

|

|

|

| Property and equipment,

net |

6,329 |

|

|

7,604 |

|

| Intangible assets, net |

20,401 |

|

|

73,831 |

|

| Right-of-use lease asset |

1,312,332 |

|

|

1,572,489 |

|

| Investment in joint

venture |

100,000 |

|

|

100,000 |

|

| Deposits and other assets |

798,211 |

|

|

798,111 |

|

|

Total assets |

$ |

4,174,134 |

|

|

$ |

5,739,188 |

|

| |

|

|

|

|

|

| Liabilities and Stockholders'

Deficit |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

1,515,201 |

|

|

$ |

1,656,965 |

|

|

Accrued liabilities |

2,749,030 |

|

|

2,417,115 |

|

|

Deferred revenue |

1,099,466 |

|

|

1,779,794 |

|

|

Operating lease liability |

517,733 |

|

|

510,034 |

|

|

Note payable, net |

- |

|

|

321,843 |

|

|

Notes payable - related party, net |

- |

|

|

266,146 |

|

|

Total current liabilities |

5,881,430 |

|

|

6,951,897 |

|

|

|

|

|

|

|

|

|

Lease liability, net of current portion |

760,524 |

|

|

1,021,330 |

|

|

Redeemable preferred stock |

1,702,000 |

|

|

1,702,000 |

|

|

Total liabilities |

8,343,954 |

|

|

9,675,227 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 2 and 5) |

- |

|

|

- |

|

|

|

|

|

|

|

|

|

Stockholders' Deficit |

|

|

|

|

|

|

Preferred Stock, 4,000,000 shares authorized, par value $0.0001, 0

issued and outstanding |

- |

|

|

- |

|

|

Series B Convertible Preferred Stock, 5,000 shares authorized, par

value $0.0001, 150 and 0 issued and outstanding |

- |

|

|

- |

|

|

Common stock, 55,000,000 shares authorized, par value $0.0001,

14,755,144 and 9,754,364 issued and outstanding |

1,475 |

|

|

975 |

|

|

Subscription receivable |

(6,724 |

) |

|

(6,724 |

) |

|

Additional paid-in capital |

41,557,422 |

|

|

35,342,098 |

|

|

Accumulated deficit |

(45,721,993 |

) |

|

(39,272,388 |

) |

|

Total stockholders' deficit |

(4,169,820 |

) |

|

(3,936,039 |

) |

|

Total liabilities and stockholders' deficit |

$ |

4,174,134 |

|

|

$ |

5,739,188 |

|

|

JET.AI, INC.(FORMERLY JET TOKEN,

INC.)CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

3,083,884 |

|

|

$ |

2,792,808 |

|

|

$ |

6,932,482 |

|

|

$ |

4,668,316 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

3,500,880 |

|

|

2,993,631 |

|

|

7,473,834 |

|

|

4,944,157 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross loss |

(416,996 |

) |

|

(200,823 |

) |

|

(541,352 |

) |

|

(275,841 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative (including stock-based compensation of

$1,201,728, $1,348,043, $2,401,046, and $2,755,087,

respectively) |

2,663,753 |

|

|

2,115,704 |

|

|

5,210,047 |

|

|

4,603,722 |

|

|

Sales and marketing |

102,470 |

|

|

103,541 |

|

|

549,070 |

|

|

223,708 |

|

|

Research and development |

37,396 |

|

|

28,636 |

|

|

69,942 |

|

|

64,955 |

|

|

Total operating expenses |

2,803,619 |

|

|

2,247,881 |

|

|

5,829,059 |

|

|

4,892,385 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

(3,220,615 |

) |

|

(2,448,704 |

) |

|

(6,370,411 |

) |

|

(5,168,226 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

- |

|

|

- |

|

|

79,314 |

|

|

- |

|

|

Other income |

(59 |

) |

|

- |

|

|

(120 |

) |

|

- |

|

|

Total other expense (income) |

(59 |

) |

|

- |

|

|

79,194 |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before provision for

income taxes |

(3,220,556 |

) |

|

(2,448,704 |

) |

|

(6,449,605 |

) |

|

(5,168,226 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Provision for income

taxes |

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

$ |

(3,220,556 |

) |

|

$ |

(2,448,704 |

) |

|

$ |

(6,449,605 |

) |

|

$ |

(5,168,226 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less cumulative preferred stock dividends |

29,727 |

|

|

- |

|

|

59,455 |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss to common stockholders |

$ |

(3,250,283 |

) |

|

$ |

(2,448,704 |

) |

|

$ |

(6,509,060 |

) |

|

$ |

(5,168,226 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding - basic and diluted |

12,906,352 |

|

|

4,520,625 |

|

|

12,224,502 |

|

|

4,511,751 |

|

| Net loss per share - basic and

diluted |

$ |

(0.25 |

) |

|

$ |

(0.54 |

) |

|

$ |

(0.53 |

) |

|

$ |

(1.15 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| check - should be zero |

|

|

|

|

|

|

- |

|

|

|

|

| Per BS |

|

|

|

|

|

|

$ |

(6,449,605 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

$ |

1,201,728 |

|

|

$ |

1,348,043 |

|

|

$ |

2,401,046 |

|

|

$ |

2,755,087 |

|

|

JET.AI, INC.(FORMERLY JET TOKEN,

INC.)CONSOLIDATED STATEMENTS OF CASH

FLOWS(UNAUDITED) |

|

|

|

| |

Six Months Ended |

| |

June 30, |

| |

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

$ |

(6,449,605 |

) |

|

$ |

(5,168,226 |

) |

|

Adjustments to reconcile net loss to net cash used inoperating

activities: |

|

|

|

|

|

|

Amortization and depreciation |

67,626 |

|

|

67,192 |

|

|

Amortization of debt discount |

80,761 |

|

|

- |

|

|

Stock-based compensation |

2,401,046 |

|

|

2,755,087 |

|

|

Non-cash operating lease costs |

260,157 |

|

|

252,686 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

(439,436 |

) |

|

- |

|

|

Other current assets |

117,302 |

|

|

171,876 |

|

|

Accounts payable |

(141,764 |

) |

|

254,773 |

|

|

Accrued liabilities |

331,915 |

|

|

(173,160 |

) |

|

Deferred revenue |

(680,328 |

) |

|

166,182 |

|

|

Operating lease liability |

(253,107 |

) |

|

(245,636 |

) |

|

Net cash used in operating activities |

(4,705,433 |

) |

|

(1,919,226 |

) |

| |

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

Purchase of property and equipment |

- |

|

|

(4,340 |

) |

|

Purchase of intangible assets |

(12,921 |

) |

|

(17,174 |

) |

|

Investment in joint venture |

- |

|

|

(100,000 |

) |

|

Deposits and other assets |

(100 |

) |

|

(135 |

) |

|

Net cash used in investing activities |

(13,021 |

) |

|

(121,649 |

) |

| |

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

Repayments - notes payable |

(371,250 |

) |

|

- |

|

|

Repayments - related party notes payable |

(297,500 |

) |

|

- |

|

|

Offering costs |

(155,000 |

) |

|

(436,969 |

) |

|

Exercise of warrants |

742,474 |

|

|

- |

|

|

Proceeds from sale of Series B Preferred Stock |

1,500,025 |

|

|

- |

|

|

Proceeds from sale of Common Stock |

1,727,279 |

|

|

1,588,695 |

|

|

Net cash provided by financing activities |

3,146,028 |

|

|

1,151,726 |

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents |

(1,572,426 |

) |

|

(889,149 |

) |

|

Cash and cash equivalents, beginning of period |

2,100,543 |

|

|

1,527,391 |

|

|

Cash and cash equivalents, end of period |

$ |

528,117 |

|

|

$ |

638,242 |

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

Cash paid for interest |

$ |

79,314 |

|

|

$ |

- |

|

|

Cash paid for income taxes |

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

Non cash financing activities: |

|

|

|

|

|

|

Subscription receivable from sale of Common Stock |

$ |

- |

|

|

$ |

25,479 |

|

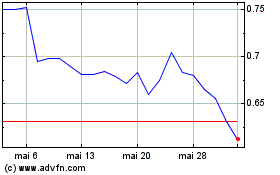

Jet AI (NASDAQ:JTAI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Jet AI (NASDAQ:JTAI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024