Jet.AI Inc. (“Jet.AI” or the “Company”) (NASDAQ:

JTAI), an innovative private aviation and artificial

intelligence company, announced its entry with Continental Stock

Transfer & Trust Company on August 21, 2024 into: (i) the 2021

Warrant Agreement Amendment, which governs the terms and conditions

of the Company’s redeemable warrants to purchase shares of Company

common stock, par value $0.0001 per share (the “common stock”),

which warrants trade on The Nasdaq Capital Market under the symbol

“JTAIW” (the “redeemable warrants”), and the Company’s private

placement warrants to purchase shares of common stock (the “private

placement warrants”); and (ii) the 2023 Warrant Agreement

Amendment, which governs the terms and conditions of the Company’s

merger consideration warrants to purchase shares of common stock,

which warrants trade on The Nasdaq Capital Market under the symbol

“JTAIZ” (the “merger consideration warrants”; together with the

redeemable warrants and the private placement warrants, the

“warrants”).

The Company entered into the 2021 Warrant Agreement Amendment

and the 2023 Warrant Agreement Amendment following the expiration

of its previously announced exchange offer (the “Offer”) and

consent solicitation (the “Consent Solicitation”), which commenced

on June 27, 2024, and expired at 11:59 p.m., Eastern Time, on July

25, 2024. As disclosed on July 30, 2024, the Company was advised

that 8,930,344 redeemable warrants (approximately 90.6% of the

outstanding redeemable warrants), 5,760,000 private placement

warrants (100% of the outstanding private placement warrants), and

5,029,657 merger consideration warrants (approximately 67.7% of the

outstanding merger consideration warrants) were validly tendered

and not validly withdrawn prior to the expiration of the Offer and

the Consent Solicitation.

In accordance with the Company’s entry into the 2021 Warrant

Agreement Amendment and the 2023 Warrant Agreement Amendment, the

Company has exercised its right to exchange each warrant that was

outstanding upon the closing of the Offer for 10% fewer shares of

common stock than each such warrant would have been exchanged for

pursuant to the applicable exchange ratio in the Offer (such

exchange, the “Post-Offer Exchange”). Pursuant to the Post-Offer

Exchange, each outstanding redeemable warrant will be mandatorily

exchanged for 0.24741 shares of common stock, and each outstanding

merger consideration warrant will be mandatorily exchanged for

0.9120 shares of common stock.

The Company has fixed the date for the Post-Offer Exchange as

September 9, 2024, and expects to issue approximately 2.4 million

shares of common stock in connection therewith, after which no

warrants will remain outstanding. In lieu of issuing fractional

shares in the Post-Offer Exchange, with respect to any holder of

warrants who would otherwise have been entitled to receive

fractional shares, the Company will, after aggregating all such

fractional shares of such holder, round up to the nearest whole

share of common stock and deliver to such holder a whole share in

lieu of any fraction thereof.

Pursuant to the terms of the Offer, the Company issued an

aggregate of approximately 9.5 million shares of common stock in

exchange for the warrants tendered in the Offer, bringing the total

shares outstanding to 24,576,880 shares as of July 30, 2024 (an

increase of approximately 75.5% from prior to the closing of the

Offer). Following the completion of the Post-Offer Exchange, there

will be approximately 27,054,217 shares of common stock outstanding

(an increase of approximately 93.2% from prior to the closing of

the Offer and the Post-Offer Exchange). Upon the completion of the

Post-Offer Exchange, no warrants will remain outstanding.

Accordingly, the redeemable warrants and the merger consideration

warrants will be suspended from trading on The Nasdaq Capital

Market and will be de listed following the completion of the

Post-Offer Exchange. The Company’s common stock will continue to be

listed and trade on The Nasdaq Capital Market under the symbol

“JTAI.”

Morrow Sodali LLC served as the Information Agent for the Offer

and the Consent Solicitation and Continental Stock Transfer &

Trust Company served as the Exchange Agent.

No Offer or SolicitationThis press release

shall not constitute an offer to exchange or the solicitation of an

offer to exchange or the solicitation of an offer to purchase any

securities, nor shall there be any exchange or sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. A registration statement

on Form S-4 relating to the securities issued, or to be issued in

the Offer was declared effective on July 22, 2024. The Offer and

the Consent Solicitation were made only through the Schedule TO and

Prospectus/Offer to Exchange, and related letter of transmittal,

and the complete terms and conditions of the Offer and the Consent

Solicitation are set forth in the Schedule TO and Prospectus/Offer

to Exchange, and related letter of transmittal.

About Jet.AIJet.AI operates in two segments,

Software and Aviation, respectively. The Software segment features

the B2C CharterGPT app and the B2B Jet.AI Operator platform. The

CharterGPT app uses natural language processing and machine

learning to improve the private jet booking experience. The Jet.AI

operator platform offers a suite of stand alone software products

to enable FAA Part 135 charter providers to add revenue, maximize

efficiency, and reduce environmental impact. The Aviation segment

features jet aircraft fractions, jet card, on-fleet charter,

management, and buyer’s brokerage. Jet.AI is an official partner of

the Las Vegas Golden Knights, 2023 NHL Stanley Cup® champions. The

Company was founded in 2018 and is based in Las Vegas, Nevada and

San Francisco, California.

Cautionary Statement Regarding Forward-Looking

StatementsThis Current Report on Form 8-K contains

forward-looking statements within the meaning of the federal

securities laws, including statements regarding the expected timing

of the Offer, the Consent Solicitation, and the Post-Offer

Exchange. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,” “will

likely result,” and similar expressions, but the absence of these

words does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections, and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

Current Report on Form 8-K, including, but not limited to those

described under the section entitled “Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 and Registration Statement on Form S-4, filed June 27,

2024, as such factors may be updated from time to time in the

Company’s periodic filings with the SEC, which are accessible on

the SEC’s website at www.sec.gov.

New risks emerge from time to time. It is not possible for our

management to predict all risks, nor can we assess the impact of

all factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and

assumptions, the forward-looking events and circumstances discussed

in this press release may not occur and actual results could differ

materially and adversely from those anticipated.

Forward-looking statements speak only as of the date they are

made. Readers are cautioned not to put undue reliance on

forward-looking statements, and we assume no obligation and do not

intend to update or revise these forward looking statements,

whether as a result of new information, future events or otherwise.

We do not give any assurance that we will achieve our

expectations.

Contacts:Gateway Group,

Inc.949-574-3860Jet.AI@gateway-grp.com

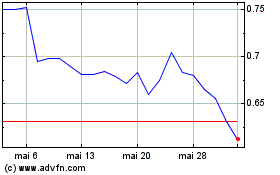

Jet AI (NASDAQ:JTAI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Jet AI (NASDAQ:JTAI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024