Rush Enterprises, Inc. (NASDAQ: RUSHA & RUSHB), which operates

the largest network of commercial vehicle dealerships in North

America, today announced that for the third quarter ended September

30, 2023, the Company achieved revenues of $1.981 billion and net

income of $80.3 million, or $0.96 per diluted share, compared with

revenues of $1.86 billion and net income of $90.4 million, or $1.06

per diluted share, in the quarter ended September 30, 2022. In the

third quarter of 2023, the Company recognized a one-time, pre-tax

charge of approximately $2.5 million, or $0.02 per share, related

to a fire loss at our San Antonio, Texas facility. Additionally,

the Company’s Board of Directors declared a cash dividend of $0.17

per share of Class A and Class B common stock, to be paid on

December 12, 2023, to all shareholders of record as of November 9,

2023.

On July 25, 2023, the Company’s Board of Directors declared a

three-for-two stock split with respect to both the Company’s Class

A and Class B common stock which was effected in the form of a

stock dividend. On August 28, 2023, the Company distributed one

additional share of stock for every two shares of Class A common

stock, par value $0.01 per share, and Class B common stock, par

value $0.01 per share, held by shareholders of record as of August

7, 2023. All share and per share data in this earnings release have

been adjusted and restated to reflect the stock split as if it

occurred on the first day of the earliest period presented.

“We are proud of our strong financial performance in the third

quarter, which primarily resulted from continued healthy demand for

new Class 8 and Class 4-7 commercial vehicles,” said W.M. “Rusty”

Rush, Chairman, Chief Executive Officer and President of Rush

Enterprises, Inc. “Additionally, though aftermarket revenues have

flattened somewhat compared to previous quarters, we continued to

experience strong demand from a variety of market segments we

support, especially with respect to our refuse, public sector,

wholesale and energy customers. As we have previously mentioned,

our over-the-road customers, our largest customer segment, are

being negatively impacted by high interest rates, and low freight

rates. These conditions, along with rising fuel prices, which are

especially difficult for small carriers to navigate, continued to

escalate in the third quarter and slowed aftermarket growth across

the industry. However, we maintained our strategic focus on

diversifying our customer base, expanding our technician workforce

and supporting large national accounts, which enabled us to offset

some of the challenging market conditions that the industry faced

this quarter,” he said.

“As we look to the fourth quarter, new commercial vehicle

production continues to approach normal levels, and we expect

demand for new commercial vehicles to remain strong through this

year. We believe used truck demand and values will remain low

through year end, but we feel we are well positioned to

strategically manage our inventory and pricing to get through these

challenges. We remain focused on adding service technicians,

especially mobile service technicians, and supporting our large

fleet customers throughout our network. We continue to monitor

consumer spending and other economic factors impacting our

over-the-road customers, including freight rates, interest rates

and fuel prices. Factoring in normal seasonal softness expected

late in the year, we believe our fourth quarter financial

performance will be consistent with our third quarter results,”

said Rush.

“It is important for me to thank our employees for their

collective hard work. It was their impressive work and dedication

that allowed us to have such a strong quarter in light of the

current operating environment. In recognition of their hard work

and dedication, I am happy to announce that in mid-December, we

will be providing a one-time discretionary $1,000 bonus to all

employees who are employed with us as of that date and who have

been with us since October 15, 2023, or earlier. This bonus is one

small way for us to express our gratitude to our employees for

remaining focused on our long-term goals while providing superior

service to our customers every day,” said Rush.

Operations

Aftermarket Products and Services

Aftermarket products and services accounted for approximately

59.0% of the Company’s total gross profits in the third quarter,

with parts, service and collision center revenues totaling $643.6

million, up 3.5% compared to the third quarter of 2022. The Company

achieved a quarterly absorption ratio of 132.8% in the third

quarter of 2023, compared to 136.2% in the third quarter of

2022.

“In the third quarter, growth in our aftermarket revenues

moderated compared to earlier this year, due primarily to difficult

economic conditions putting pressure on over-the-road fleets,

including high interest rates, low freight rates and higher fuel

cost. However, we experienced healthy demand for aftermarket parts

and services from many market segments that we support, especially

with respect to our refuse, public sector, wholesale and energy

customers. It should be noted that year-to-date, we have added more

than 150 service technicians to our network, many of them mobile

service technicians, which is a key piece of our long-term

strategy. Those additional technicians are already positively

impacting our aftermarket revenues and we expect that these

additional technicians, as well as the ones we will be hiring in

the near future, will continue to positively impact our financial

success going forward. In addition to expanding our technician

workforce, we also were able to execute on other long-term

strategic goals during the third quarter by continuing to diversify

our customer base and continuing to win and support large national

accounts. Our success in these strategic areas helped us to achieve

strong aftermarket results in the third quarter,” said Rush.

“Moving forward, we expect that aftermarket revenues will

continue to be negatively impacted by economic conditions affecting

over-the-road customers, and we also believe that the industry may

experience some deflation with respect to the prices of certain

commodity parts. However, we also believe the diversity of our

customer base, as well as our focus on operational excellence,

mobile service and supporting large national fleets, will continue

to help to offset some of the current industry challenges. We

believe customer demand for aftermarket services will remain steady

and that our aftermarket results in the fourth quarter will be

similar to the third quarter with slight adjustments caused by

normal seasonal softness through the winter months, and fewer

working days in the fourth quarter,” Rush said.

Commercial Vehicle Sales

New U.S. Class 8 retail truck sales totaled 68,010 units in the

third quarter of 2023, up 0.1% over the third quarter of last year,

according to ACT Research. The Company sold 4,326 new Class 8

trucks in the third quarter, an increase of 3.0% compared to the

third quarter of 2022, which accounted for 6.1% of the new U.S.

Class 8 truck market and 2.1% of the new Canadian Class 8 truck

market.

“Several economic factors, including the ongoing decline in

freight rates, low spot rates, escalating fuel prices and high

interest rates, continued to impact smaller carriers in the third

quarter. However, we experienced healthy demand for new commercial

vehicles due to limited truck production over the past few years.

In the third quarter, we were still operating within the confines

of truck allocation, but new truck production continued to improve,

resulting in significantly shorter lead times for new truck

purchases,” said Rush.

“As we look ahead, due in part to the strategic decision we made

many years ago to diversify our customer base, we are confident

that we can effectively navigate the current freight environment

and other economic factors that are negatively impacting our

industry at this time. In addition, we believe our fourth quarter

Class 8 new truck sales results will be consistent with our third

quarter results,” Rush added.

New U.S. Class 4 through 7 retail commercial vehicle

sales totaled 65,683 units in the third quarter of 2023, up 9.1%

compared to the third quarter of last year, according to ACT

Research. The Company sold 3,244 new Class 4 through 7 medium-duty

commercial vehicles in the third quarter of 2023, an increase of

0.7% compared to the third quarter of 2022, representing 4.8% of

the new U.S. Class 4 through 7 commercial vehicle market and 2.3%

of the new Canadian Class 5 through 7 commercial vehicle

market.

“In the third quarter, we experienced continued solid widespread

demand for new Class 4-7 commercial vehicles. While the

manufacturers we represent continue to increase production of

medium-duty commercial vehicles, production still remains limited,

and there is still significant demand caused by the production

constraints of the past few years,” Rush said.

“Looking ahead, we are closely monitoring consumer spending and

other economic conditions that may impact demand for new Class 4-7

vehicles. Further, some truck body companies continue to have

difficulty keeping pace with build rates, which may negatively

impact certain commercial vehicle deliveries in the fourth quarter.

However, with the continued pent-up demand for new Class 4-7

vehicles, we believe our fourth quarter performance will align with

our third quarter results,” said Rush.

The Company sold 1,797 used commercial trucks in the third

quarter of 2023, an increase of 1.9% over the third quarter of

2022. “With an increased supply of used trucks, soft freight rates,

high interest rates and tightening credit conditions, our industry

experienced continued weak demand for used trucks in the third

quarter. Further, used truck values continued to decline at an

accelerated rate, though the rate of decline in used truck values

continued to decrease in the third quarter. As we look ahead, with

increases in new truck production and low freight rates expected to

continue, we believe used truck demand and values will remain low

through the fourth quarter. That said, due to strategic inventory

management that has us at lower-than-normal levels and the breadth

and diversification of our used truck product mix, we believe we

are well positioned to navigate these challenging market

conditions. Factoring in expected seasonal slowness, we expect our

fourth quarter used truck sales to be fairly consistent with our

third quarter results,” Rush said.

Leasing and Rental

Rush Truck Leasing operates 57 PacLease and Idealease franchises

across the United States and Canada with more than 10,000 trucks in

its lease and rental fleet and more than 2,000 trucks under

contract maintenance agreements. Lease and rental revenue increased

4.4% in the third quarter of 2023 compared to the third quarter of

2022.

“In the third quarter, we experienced healthy demand for leased

vehicles, resulting in strong financial results from our leasing

and rental operations. Rental utilization rates have declined to

what we consider normal levels, and we expect them to remain solid

through the fourth quarter. While the age of our fleet may cause

operating costs to increase somewhat, we are confident that our

leasing and rental business will remain strong through the end of

this year,” Rush said.

Financial Highlights

In the third quarter of 2023, the Company’s gross revenues

totaled $1.981 billion, a 6.2% increase from gross revenues of

$1.86 billion reported for the third quarter of 2022. Net income

for the third quarter was $80.3 million, or $0.96 per diluted

share, compared to net income of $90.4 million, or $1.06 per

diluted share, in the third quarter of 2022. In the third quarter

of 2023, the Company recognized a one-time pre-tax charge of

approximately $2.5 million, or $0.02 per share, related to a fire

loss at our San Antonio, Texas facility.

Aftermarket products and services revenues were $643.6 million

in the third quarter of 2023, compared to $622.1 million in the

third quarter of 2022. The Company delivered 4,326 new heavy-duty

trucks, 3,244 new medium-duty commercial vehicles, 425 new

light-duty commercial vehicles and 1,797 used commercial vehicles

during the third quarter of 2023, compared to 4,200 new heavy-duty

trucks, 3,223 new medium-duty commercial vehicles, 608 new

light-duty commercial vehicles and 1,763 used commercial vehicles

during the third quarter of 2022.

During the third quarter of 2023, the Company repurchased $43.5

million of its common stock, paid a cash dividend of $13.9 million

and ended the quarter with $192.0 million in cash and cash

equivalents.

“We are proud of our strong financial results this quarter,

which allowed us to continue to return value to shareholders, as

illustrated by our strong earnings, quarterly dividends and our

stock repurchase program. By remaining focused on operational

excellence, as well as our strategic initiatives, we were able to

continue to achieve strong financial results and invest in our

Company’s future while maintaining a strong cash position and

balance sheet,” said Rush.

Conference Call Information

Rush Enterprises will host its quarterly conference call to

discuss earnings for the third quarter on Wednesday,

October 25, 2023, at 10 a.m. Eastern/9 a.m. Central. The

call can be heard live via the Internet at

http://investor.rushenterprises.com/events.cfm.

Participants may register for the call using

the link:

https://register.vevent.com/register/BI871ba5a8c1d1424487bdb81aa6219ab7While

not required, it is recommended that you join the event 10 minutes

prior to the start.

For those who cannot listen to the live

broadcast, the webcast replay will be available

athttp://investor.rushenterprises.com/events.cfm.

About Rush Enterprises, Inc.

Rush Enterprises, Inc. is the premier solutions

provider to the commercial vehicle industry. The Company owns and

operates Rush Truck Centers, the largest network of commercial

vehicle dealerships in North America, with more than 150 locations

in 23 states and Ontario, Canada, including 125 franchised

dealership locations. These vehicle centers, strategically located

in high traffic areas on or near major highways throughout the

United States and Ontario, Canada, represent truck and bus

manufacturers, including Peterbilt, International, Hino, Isuzu,

Ford, Dennis Eagle, IC Bus and Blue Bird. They offer an integrated

approach to meeting customer needs – from sales of new and used

vehicles to aftermarket parts, service and body shop operations

plus financing, insurance, leasing and rental. Rush Enterprises’

operations also provide CNG fuel systems (through its investment in

Cummins Clean Fuel Technologies, Inc.), telematics products and

other vehicle technologies, as well as vehicle up-fitting, chrome

accessories and tires. For more information, please visit us at

www.rushtruckcenters.com, www.rushenterprises.com and

www.rushtruckcentersracing.com, on Twitter @rushtruckcenter and

Facebook.com/rushtruckcenters.

Certain statements contained in this release,

including those concerning current and projected market conditions,

sales forecasts, market share forecasts s and anticipated demand

for the Company’s services, are “forward-looking” statements (as

such term is defined in the Private Securities Litigation Reform

Act of 1995). Such forward-looking statements only speak as of the

date of this release and the Company assumes no obligation to

update the information included in this release. Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Important factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements include, but are not limited to,

competitive factors, general U.S. economic conditions, economic

conditions in the new and used commercial vehicle markets, customer

relations, relationships with vendors, inflation and the interest

rate environment, governmental regulation and supervision, product

introductions and acceptance, changes in industry practices,

one-time events and other factors described herein and in filings

made by the Company with the Securities and Exchange Commission,

including in our annual report on Form 10-K for the fiscal year

ended December 31, 2022. In addition, the declaration and payment

of cash dividends and authorization of future share repurchase

programs remains at the sole discretion of the Company’s Board of

Directors and the issuance of future dividends and authorization of

future share repurchase programs will depend upon the Company’s

financial results, cash requirements, future prospects, applicable

law and other factors that may be deemed relevant by the Company’s

Board of Directors. Although we believe that these forward-looking

statements are based on reasonable assumptions, there are many

factors that could affect our actual business and financial results

and could cause actual results to differ materially from those in

the forward-looking statements. All future written and oral

forward-looking statements by us or persons acting on our behalf

are expressly qualified in their entirety by the cautionary

statements contained or referred to above. Except for our ongoing

obligations to disclose material information as required by the

federal securities laws, we do not have any obligations or

intention to release publicly any revisions to any forward-looking

statements to reflect events or circumstances in the future or to

reflect the occurrence of unanticipated events.

-Tables and Additional Information to Follow-

|

|

|

RUSH ENTERPRISES, INC. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(In Thousands, Except Shares and Per Share Amounts) |

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

2023 |

|

2022 |

| |

|

(unaudited) |

|

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

191,988 |

|

$ |

201,044 |

|

|

Accounts receivable, net |

|

263,480 |

|

|

220,651 |

|

|

Inventories, net |

|

1,671,623 |

|

|

1,429,429 |

|

|

Prepaid expenses and other |

|

18,690 |

|

|

16,619 |

|

| Total current assets |

|

2,145,781 |

|

|

1,867,743 |

|

| Property and equipment,

net |

|

1,474,662 |

|

|

1,368,594 |

|

| Operating lease right-of-use

assets, net |

|

107,406 |

|

|

102,685 |

|

| Goodwill, net |

|

416,420 |

|

|

416,363 |

|

| Other assets, net |

|

73,784 |

|

|

65,681 |

|

| Total

assets |

$ |

4,218,053 |

|

$ |

3,821,066 |

|

| |

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Floor plan notes payable |

$ |

1,121,490 |

|

$ |

933,203 |

|

|

Current maturities of long-term debt |

|

104,778 |

|

|

|

|

Current maturities of finance lease obligations |

|

36,128 |

|

|

29,209 |

|

|

Current maturities of operating lease obligations |

|

15,892 |

|

|

15,003 |

|

|

Trade accounts payable |

|

177,142 |

|

|

171,717 |

|

|

Customer deposits |

|

102,900 |

|

|

116,240 |

|

|

Accrued expenses |

|

161,786 |

|

|

163,302 |

|

| Total current liabilities |

|

1,720,116 |

|

|

1,428,674 |

|

| Long-term debt, net of current

maturities |

|

202,824 |

|

|

275,433 |

|

| Finance lease obligations, net

of current maturities |

|

103,513 |

|

|

93,483 |

|

| Operating lease obligations,

net of current maturities |

|

93,193 |

|

|

89,029 |

|

| Other long-term

liabilities |

|

23,856 |

|

|

19,455 |

|

| Deferred income taxes,

net |

|

155,468 |

|

|

151,970 |

|

| Shareholders’ equity: |

|

|

|

|

|

Preferred stock, par value $.01 per share; 1,000,000 shares

authorized; 0 shares outstanding in 2023 and 2022 |

|

– |

|

|

– |

|

|

Common stock, par value $.01 per share; 105,000,000 Class A

shares and 35,000,000 Class B shares authorized; 62,053,249 Class A

shares and 17,989,388 Class B shares outstanding in 2023; and

63,518,042 Class A shares and 18,124,627 Class B shares outstanding

in 2022 |

|

804 |

|

|

572 |

|

|

Additional paid-in capital |

|

533,648 |

|

|

500,642 |

|

|

Treasury stock, at cost: 266,519 Class A shares and 105,924 Class B

shares in 2023; and 1,626,777 Class A shares and 1,112,446 Class B

shares in 2022 |

|

(16,169 |

) |

|

(130,930 |

) |

|

Retained earnings |

|

1,385,646 |

|

|

1,378,337 |

|

|

Accumulated other comprehensive income |

|

(4,317 |

) |

|

(4,130 |

) |

|

Total Rush Enterprises, Inc. shareholders’ equity |

|

1,899,612 |

|

|

1,744,491 |

|

|

Noncontrolling interest |

|

19,471 |

|

|

18,531 |

|

| Total shareholders’

equity |

|

1,919,083 |

|

|

1,763,022 |

|

| Total liabilities and

shareholders’ equity |

$ |

4,218,053 |

|

$ |

3,821,066 |

|

| |

|

|

|

|

|

|

|

RUSH ENTERPRISES, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(In Thousands, Except Per Share Amounts) |

|

(Unaudited) |

|

|

|

|

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

New and used commercial vehicle sales |

$ |

1,235,767 |

$ |

1,142,201 |

|

$ |

3,648,286 |

$ |

3,176,175 |

|

Parts and service sales |

|

643,623 |

|

622,130 |

|

|

1,942,979 |

|

1,763,691 |

|

Lease and rental |

|

89,466 |

|

85,688 |

|

|

264,681 |

|

237,561 |

|

Finance and insurance |

|

6,317 |

|

7,639 |

|

|

19,077 |

|

22,919 |

|

Other |

|

5,567 |

|

6,628 |

|

|

20,536 |

|

18,383 |

|

Total revenue |

|

1,980,740 |

|

1,864,286 |

|

|

5,895,559 |

|

5,218,729 |

| Cost of products

sold |

|

|

|

|

|

|

|

|

|

New and used commercial vehicle sales |

|

1,113,294 |

|

1,045,658 |

|

|

3,287,998 |

|

2,875,057 |

|

Parts and service sales |

|

410,935 |

|

378,748 |

|

|

1,216,441 |

|

1,080,240 |

|

Lease and rental |

|

62,106 |

|

58,482 |

|

|

184,098 |

|

162,378 |

|

Total cost of products sold |

|

1,586,335 |

|

1,482,888 |

|

|

4,688,537 |

|

4,117,675 |

| Gross

profit |

|

394,405 |

|

381,398 |

|

|

1,207,022 |

|

1,101,054 |

| Selling, general and

administrative expense |

|

257,132 |

|

242,609 |

|

|

770,631 |

|

692,383 |

| Depreciation and amortization

expense |

|

15,872 |

|

13,961 |

|

|

44,731 |

|

41,545 |

| Gain on sale of assets |

|

220 |

|

2,209 |

|

|

596 |

|

2,433 |

| Operating

income |

|

121,621 |

|

127,037 |

|

|

392,256 |

|

369,559 |

| Other (expense) income |

|

133 |

|

(215 |

) |

|

2,384 |

|

22,182 |

| Interest expense, net |

|

14,194 |

|

6,275 |

|

|

37,415 |

|

10,662 |

| Income before

taxes |

|

107,560 |

|

120,547 |

|

|

357,225 |

|

381,079 |

| Provision for income

taxes |

|

26,926 |

|

29,884 |

|

|

87,277 |

|

87,290 |

| Net

income |

|

80,634 |

|

90,663 |

|

|

269,948 |

|

293,789 |

| Less: Net income attributable

to noncontrolling Interests |

|

356 |

|

287 |

|

|

940 |

|

733 |

| Net income

attributable to Rush Enterprises, Inc. |

$ |

80,278 |

$ |

90,376 |

|

$ |

269,008 |

$ |

293,056 |

| |

|

|

|

|

|

|

|

|

| Net income

attributable to Rush Enterprises, Inc. per share of common

stock: |

|

|

|

|

|

|

|

|

| Basic |

$ |

0.99 |

$ |

1.09 |

|

$ |

3.30 |

$ |

3.51 |

| Diluted |

$ |

0.96 |

$ |

1.06 |

|

$ |

3.19 |

$ |

3.41 |

| |

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

81,229 |

|

82,848 |

|

|

81,629 |

|

83,401 |

| Diluted |

|

83,987 |

|

85,313 |

|

|

84,251 |

|

86,045 |

| |

|

|

|

|

|

|

|

|

| Dividends declared per

common share |

$ |

0.17 |

$ |

0.14 |

|

$ |

0.45 |

$ |

0.39 |

|

|

|

|

|

|

|

|

|

|

|

This press release and the attached financial

tables contain certain non-GAAP financial measures as defined under

SEC rules, such as Adjusted Net Income, Adjusted Total Debt,

Adjusted Net (cash) Debt, EBITDA, Adjusted EBITDA, Free Cash Flow,

Adjusted Free Cash Flow and Adjusted Invested Capital, which

exclude certain items disclosed in the attached financial tables.

The Company provides reconciliations of these measures to the most

directly comparable GAAP measures.

Management believes the presentation of these

non-GAAP financial measures provides useful information about the

results of operations of the Company for the current and past

periods. Management believes that investors should have the same

information available to them that management uses to assess the

Company’s operating performance and capital structure. These

non-GAAP financial measures should not be considered in isolation

or as a substitute for the most comparable GAAP financial measures.

Investors are cautioned that non-GAAP financial measures utilized

by the Company may not be comparable to similarly titled non-GAAP

financial measures used by other companies.

|

|

|

Three Months Ended |

|

Vehicle Sales Revenue (in thousands) |

|

September 30,2023 |

|

September 30,2022 |

|

New heavy-duty vehicles |

$ |

756,071 |

|

$ |

688,289 |

|

|

New medium-duty vehicles (including bus sales revenue) |

|

332,860 |

|

|

284,068 |

|

|

New light-duty vehicles |

|

25,684 |

|

|

30,532 |

|

|

Used vehicles |

|

109,114 |

|

|

131,537 |

|

|

Other vehicles |

|

12,038 |

|

|

7,775 |

|

|

|

|

|

|

|

|

Absorption Ratio |

|

132.8 |

% |

|

136.2 |

% |

|

|

|

|

|

|

|

|

Absorption RatioManagement uses

several performance metrics to evaluate the performance of its

commercial vehicle dealerships and considers Rush Truck Centers’

“absorption ratio” to be of critical importance. Absorption ratio

is calculated by dividing the gross profit from the parts, service

and collision center departments by the overhead expenses of all of

a dealership’s departments, except for the selling expenses of the

new and used commercial vehicle departments and carrying costs of

new and used commercial vehicle inventory. When 100% absorption is

achieved, then gross profit from the sale of a commercial vehicle,

after sales commissions and inventory carrying costs, directly

impacts operating profit.

|

Debt Analysis (in thousands) |

|

September 30,2023 |

|

September 30,2022 |

|

Floor plan notes payable |

$ |

1,121,490 |

|

$ |

935,785 |

|

|

Current maturities of long-term debt |

|

104,778 |

|

|

─ |

|

|

Current maturities of finance lease obligations |

|

36,128 |

|

|

28,165 |

|

|

Long-term debt, net of current maturities |

|

202,824 |

|

|

307,065 |

|

|

Finance lease obligations, net of current maturities |

|

103,513 |

|

|

82,613 |

|

|

Total Debt (GAAP) |

|

1,568,733 |

|

|

1,353,628 |

|

|

Adjustments: |

|

|

|

|

|

Debt related to lease & rental fleet |

|

(443,095 |

) |

|

(413,566 |

) |

|

Floor plan notes payable |

|

(1,121,490 |

) |

|

(935,785 |

) |

|

Adjusted Total Debt (Non-GAAP) |

|

4,148 |

|

|

4,277 |

|

|

Adjustment: |

|

|

|

|

|

Cash and cash equivalents |

|

(191,988 |

) |

|

(219,519 |

) |

|

Adjusted Net Debt (Cash) (Non-GAAP) |

$ |

(187,840 |

) |

$ |

(215,242 |

) |

|

|

|

|

|

|

|

|

Management uses “Adjusted Total Debt” to reflect

the Company’s estimated financial obligations less debt related to

lease and rental fleet (L&RFD) and floor plan notes payable

(FPNP), and “Adjusted Net (Cash) Debt” to present the amount of

Adjusted Total Debt net of cash and cash equivalents on the

Company’s balance sheet. The FPNP is used to finance the Company’s

new and used inventory, with its principal balance changing daily

as vehicles are purchased and sold and the sale proceeds are used

to repay the notes. Consequently, in managing the business,

management views the FPNP as interest bearing accounts payable,

representing the cost of acquiring the vehicle that is then repaid

when the vehicle is sold, as the Company’s floor plan credit

agreements require it to repay loans used to purchase vehicles when

such vehicles are sold. The Company has the capacity to finance all

of its lease and rental fleet under its lines of credit established

for this purpose, but may choose to only partially finance the

lease and rental fleet depending on business conditions and its

management of cash and interest expense. The Company’s lease and

rental fleet inventory are either: (i) leased to customers under

long-term lease arrangements; or (ii) to a lesser extent, dedicated

to the Company’s rental business. In both cases, the lease and

rental payments received fully cover the capital costs of the lease

and rental fleet (i.e., the interest expense on the borrowings used

to acquire the vehicles and the depreciation expense associated

with the vehicles), plus a profit margin for the Company. The

Company believes excluding the FPNP and L&RFD from the

Company’s total debt for this purpose provides management with

supplemental information regarding the Company’s capital structure

and leverage profile and assists investors in performing analysis

that is consistent with financial models developed by Company

management and research analysts. “Adjusted Total Debt” and

“Adjusted Net (Cash) Debt” are both non-GAAP financial measures and

should be considered in addition to, and not as a substitute for,

the Company’s debt obligations, as reported in the Company’s

consolidated balance sheet in accordance with U.S. GAAP.

Additionally, these non-GAAP measures may vary among companies and

may not be comparable to similarly titled non-GAAP measures used by

other companies.

| |

|

Twelve Months Ended |

|

EBITDA (in thousands) |

|

September 302023 |

|

September 30,2022 |

|

Net Income attributable to Rush Enterprises, Inc.

(GAAP) |

$ |

367,334 |

|

$ |

361,695 |

|

|

Provision for income taxes |

|

117,229 |

|

|

109,099 |

|

|

Interest expense |

|

45,877 |

|

|

11,866 |

|

|

Depreciation and amortization |

|

58,851 |

|

|

54,615 |

|

|

Gain on sale of assets |

|

(618 |

) |

|

(2,708 |

) |

|

EBITDA (Non-GAAP) |

|

588,673 |

|

|

534,567 |

|

|

Adjustments: |

|

|

|

|

|

Interest expense associated with FPNP and L&RFD |

|

(46,806 |

) |

|

(6,690 |

) |

|

Adjusted EBITDA (Non-GAAP) |

$ |

541,867 |

|

$ |

527,877 |

|

| |

|

|

|

|

|

|

The Company presents EBITDA and Adjusted EBITDA,

for the twelve months ended each period presented, as additional

information about its operating results. The presentation of

Adjusted EBITDA that excludes the addition of interest expense

associated with FPNP and the L&RFD to EBITDA is consistent with

management’s presentation of Adjusted Total Debt, in each case

reflecting management’s view of interest expense associated with

the FPNP and L&RFD as an operating expense of the Company, and

to provide management with supplemental information regarding

operating results and to assist investors in performing analysis

that is consistent with financial models developed by management

and research analyst. “EBITDA” and “Adjusted EBITDA” are both

non-GAAP financial measures and should be considered in addition

to, and not as a substitute for, net income of the Company, as

reported in the Company’s consolidated statements of income in

accordance with U.S. GAAP. Additionally, these non-GAAP measures

may vary among companies and may not be comparable to similarly

titled non-GAAP measures used by other companies.

|

|

|

|

Twelve Months Ended |

|

Free Cash Flow |

(in

thousands) |

|

September 30,2023 |

|

September 30,2022 |

|

Net cash provided by operations (GAAP) |

$ |

322,469 |

|

$ |

166,701 |

|

|

Acquisition of property and equipment |

|

|

(356,896 |

) |

|

(220,102 |

) |

|

Free cash flow (Non-GAAP) |

|

|

(34,427 |

) |

|

(53,401 |

) |

|

Adjustments: |

|

|

|

|

|

|

Draws on floor plan financing, net |

|

|

185,065 |

|

|

553,646 |

|

|

Payments on L&RFD |

|

|

(17,403 |

) |

|

(146,800 |

) |

|

Cash used for L&RF purchases |

|

|

248,797 |

|

|

145,664 |

|

|

Non-maintenance capital expenditures |

|

|

29,815 |

|

|

20,748 |

|

|

Adjusted Free Cash Flow (Non-GAAP) |

|

$ |

411,847 |

|

$ |

519,857 |

|

|

|

|

|

|

|

|

|

|

“Free Cash Flow” and “Adjusted Free Cash Flow”

are key financial measures of the Company’s ability to generate

cash from operating its business. Free Cash Flow is calculated by

subtracting the acquisition of property and equipment included in

the Cash flows from investing activities from Net cash provided by

(used in) operating activities. For purposes of deriving Adjusted

Free Cash Flow from the Company’s operating cash flow, Company

management makes the following adjustments: (i) adds back draws (or

subtracts payments) on the floor plan financing that are included

in Cash flows from financing activities, as their purpose is to

finance the vehicle inventory that is included in Cash flows from

operating activities; (ii) adds back proceeds from notes payable

related specifically to the financing of the lease and rental fleet

that are reflected in Cash flows from financing activities; (iii)

subtracts draws on floor plan financing, net and proceeds from

L&RFD related to business acquisition assets that are included

in Cash flows from investing activities; (iv) subtracts scheduled

principal payments on fixed rate notes payable related specifically

to the financing of the lease and rental fleet that are included in

Cash flows from financing activities; (v) subtracts lease and

rental fleet purchases that are included in acquisition of property

and equipment and not financed under the lines of credit for cash

and interest expense management purposes; and (vi) adds back

non-maintenance capital expenditures that are for growth and

expansion (i.e. building of new dealership facilities) that are not

considered necessary to maintain the current level of cash

generated by the business. “Free Cash Flow” and “Adjusted Free Cash

Flow” are both presented so that investors have the same financial

data that management uses in evaluating the Company’s cash flows

from operating activities. “Free Cash Flow” and “Adjusted Free Cash

Flow” are both non-GAAP financial measures and should be considered

in addition to, and not as a substitute for, net cash provided by

(used in) operations of the Company, as reported in the Company’s

consolidated statement of cash flows in accordance with U.S. GAAP.

Additionally, these non-GAAP measures may vary among companies and

may not be comparable to similarly titled non-GAAP measures used by

other companies.

|

Invested Capital (in thousands) |

|

September 30,2023 |

|

September 30,2022 |

|

Total Rush Enterprises, Inc. Shareholders’ equity

(GAAP) |

$ |

1,899,612 |

|

$ |

1,676,019 |

|

|

Adjusted net debt (cash) (Non-GAAP) |

|

(187,840 |

) |

|

(215,242 |

) |

|

Adjusted Invested Capital (Non-GAAP) |

$ |

1,711,772 |

|

$ |

1,460,777 |

|

|

|

|

|

|

|

|

|

“Adjusted Invested Capital” is a key financial

measure used by the Company to calculate its return on invested

capital. For purposes of this analysis, management excludes

L&RFD, FPNP, and cash and cash equivalents, for the reasons

provided in the debt analysis above and uses Adjusted Net Debt in

the calculation. The Company believes this approach provides

management a more accurate picture of the Company’s leverage

profile and capital structure and assists investors in performing

analysis that is consistent with financial models developed by

Company management and research analysts. “Adjusted Net (Cash)

Debt” and “Adjusted Invested Capital” are both non-GAAP financial

measures. Additionally, these non-GAAP measures may vary among

companies and may not be comparable to similarly titled non-GAAP

measures used by other companies.

Contact:Rush Enterprises, Inc., San Antonio Steven L. Keller,

830-302-5226

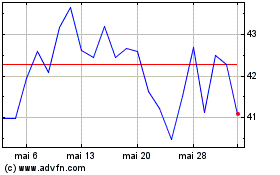

Rush Enterprises (NASDAQ:RUSHB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Rush Enterprises (NASDAQ:RUSHB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024