0000914156 False 0000914156 2025-02-25 2025-02-25 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2025

_______________________________

UFP Technologies, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-12648 | 04-2314970 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

100 Hale Street

Newburyport, Massachusetts - USA 01950-3504

(Address of Principal Executive Offices) (Zip Code)

(978) 352-2200

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | UFPT | The NASDAQ Stock Market L.L.C. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 25, 2025, UFP Technologies, Inc. issued a press release announcing its fourth quarter and year-end financial results for the year ended December 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

Limitation on Incorporation by Reference. The information furnished in this Item 2.02, including the press release attached hereto as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities ExchangeAct of 1934, as amended (the “ExchangeAct”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the SecuritiesAct of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements. Except for historical information contained in the press release attached as an exhibit hereto, the press release contains forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press release regarding these forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | UFP Technologies, Inc. |

| | | |

| | | |

| Date: February 25, 2025 | By: | /s/ Ronald J. Lataille |

| | | Ronald J. Lataille |

| | | Chief Financial Officer and Senior Vice President |

| | | |

EXHIBIT 99.1

UFP Technologies Announces Record 2024 Results

NEWBURYPORT, Mass., Feb. 25, 2025 (GLOBE NEWSWIRE) -- UFP Technologies, Inc. (Nasdaq: UFPT), a designer and custom manufacturer of engineered solutions primarily for the medical market, today reported 2024 net income of $59.0 million, 31.3% higher than net income of $44.9 million for 2023. Adjusted net income grew 32.5% to $67.6 million. Net sales for 2024 were $504.4 million, 26.1% higher than 2023 sales of $400.1 million. GAAP and adjusted earnings per diluted common share outstanding (EPS) were $7.58 and $8.68 respectively.

For its fourth quarter ended December 31, 2024, the Company reported net income of $16.4 million, 41.1% higher than net income of $11.6 million in the same period of 2023. Adjusted net income for the fourth quarter of 2024 grew 51.6% to $19.2 million. Sales for the fourth quarter of 2024 were $144.1 million, 41.9% higher than 2023 fourth-quarter sales of $101.5 million. GAAP and adjusted EPS were $2.10 and $2.46 respectively. Throughout this news release, reference is made to Non-GAAP measures including adjusted gross margins, adjusted operating income, adjusted SG&A, adjusted net Income and EPS, and EBITDA and adjusted EBITDA. Please see “Non-GAAP Financial Information” at the end of this news release.

“I am very pleased with our fourth quarter and full-year 2024 results,” said R. Jeffrey Bailly, Chairman & CEO. “Sales for the quarter and the year grew 42% and 26%, respectively. Organic growth for the quarter and year was 6.7% and 8.5%, respectively. Adjusted earnings per diluted share outstanding for the quarter and year grew 50% and 31% respectively to $2.46 and $8.68.”

“I am also very pleased with the performance of our newly acquired companies—AJR Enterprises, Welch Fluorocarbon, Marble Medical, and AQF Medical. As a group, they are performing ahead of expectations with particularly strong growth in the safe patient handling space,” said Bailly. “We are again expanding our operations in the Dominican Republic to accommodate new business wins, continued growth of our existing Robotic Surgery business, and planned business transfers. Our previous expansion in late 2023 and early 2024 allowed us to fulfill our customers’ safety stock objectives and accommodate the increased share of business we were awarded. Increased forecasted demand at both of our Dominican Republic locations requires additional plant and equipment investments which are now underway.”

“Looking ahead we remain excited about our future,” said Bailly. “We have added new talent in business development, quality assurance, general management, and back-office resources to maximize our effectiveness and position us for future growth. We have two major programs launching in the second half of 2025 and a robust growing pipeline of new business opportunities. In addition, we are continuing our efforts on the acquisition front, targeting companies that strengthen our platform and increase our value to customers. We anticipate that our strong cash flow will help us quickly reduce our debt and position us to finance new deals.”

Financial Highlights:

- Sales for the fourth quarter increased 41.9% to $144.1 million, from $101.5 million in the same period of 2023. Sales for the full year of 2024 increased 26.1% to $504.4 million from $400.1 million in the same period of 2023.

- Fourth quarter MedTech sales increased 48.6% to $132.7 million. Sales to all other markets decreased 7.0% to $11.4 million. Full-year MedTech sales increased 30.2% to $450.8 million while sales to all other markets were consistent at $53.7 million.

- Gross profit as a percentage of sales (“gross margin”) increased to 29.2% for the fourth quarter, from 25.7% in the same quarter of 2023. Gross margin for the full year of 2024 increased to 29.1%, from 28.1% in the same period of 2023. When adding back purchase accounting expenses of $1.1 million, adjusted gross margin increased to 29.3% for the full year of 2024.

- Selling, general and administrative expenses (“SG&A”) for the fourth quarter increased 41.9% to $18.6 million compared to $13.1 million in the same quarter of 2023. Full-year 2024 SG&A increased 22.3% to $62.2 million, from $50.9 million in the same period of 2023. As a percentage of sales, SG&A decreased to 12.3% in 2024 from 12.7% in 2023. Adjusted SG&A as a percentage of sales decreased to 11.2% from 11.8%, and to 11.0% from 11.6% for the fourth quarter and full year of 2024, respectively.

- For the fourth quarter, adjusted operating income increased 84.0% to $26.0 million, from $14.1 million in the same quarter of 2023. Full-year 2024 adjusted operating income increased 40.4% to $92.3 million, from $65.7 million in the same period of 2023.

- Adjusted net income in the fourth quarter increased 51.6% to $19.2 million, from $12.6 million in the same period of 2023. Full-year 2024 adjusted net income increased 32.5% to $67.6 million, from $51.0 million in the same period of 2023.

- Adjusted EBITDA for the fourth quarter of 2024 increased 77.9% to $30.4 million in the same period of 2023. Adjusted EBITDA for the year ended December 31, 2024, increased 39.1% to $107.3 million from $77.2 million in 2023.

About UFP Technologies, Inc.

UFP Technologies is an innovative designer and custom manufacturer of comprehensive solutions for medical devices, sterile packaging, and other highly engineered custom products. UFP is an important link in the medical device supply chain and a valued outsource partner to many of the top medical device manufacturers in the world. The Company’s single-use and single-patient devices and components are used in a wide range of medical devices and packaging for minimally invasive surgery, infection prevention, wound care, wearables, orthopedic soft goods, and orthopedic implants.

| |

Consolidated Condensed Statements of Income

(in thousands, except per share data)

(unaudited) |

| |

| | Three Months Ended | | Twelve Months Ended |

| | December 31 | | December 31 |

| | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | |

| Net sales | $ | 144,070 | | | $ | 101,498 | | | $ | 504,421 | | | $ | 400,072 | |

| Cost of sales | | 102,014 | | | | 75,369 | | | | 357,728 | | | | 287,847 | |

| Gross profit | | 42,056 | | | | 26,129 | | | | 146,693 | | | | 112,225 | |

| Selling, general and administrative expenses | | 18,618 | | | | 13,118 | | | | 62,218 | | | | 50,889 | |

| Acquisition costs | | 844 | | | | - | | | | 2,520 | | | | - | |

| Change in fair value of contingent consideration | | 238 | | | | 238 | | | | 952 | | | | 3,527 | |

| Loss on disposal of fixed assets | | 99 | | | | 37 | | | | 106 | | | | 145 | |

| Operating income | | 22,257 | | | | 12,736 | | | | 80,897 | | | | 57,664 | |

| Interest expense, net | | 3,377 | | | | 755 | | | | 8,061 | | | | 3,645 | |

| Other (income) expense | | (219 | ) | | | 89 | | | | (189 | ) | | | 117 | |

| Income before income tax expense | | 19,099 | | | | 11,892 | | | | 73,025 | | | | 53,902 | |

| Income tax expense | | 2,724 | | | | 285 | | | | 14,044 | | | | 8,978 | |

| Net income | $ | 16,375 | | | $ | 11,607 | | | $ | 58,981 | | | $ | 44,924 | |

| | | | | | | | |

| Net income per share outstanding | $ | 2.13 | | | $ | 1.52 | | | $ | 7.69 | | | $ | 5.89 | |

| Net income per diluted share outstanding | $ | 2.10 | | | $ | 1.51 | | | $ | 7.58 | | | $ | 5.83 | |

| | | | | | | | |

| Weighted average shares outstanding | | 7,675 | | | | 7,639 | | | | 7,668 | | | | 7,624 | |

| Weighted average diluted shares outstanding | | 7,794 | | | | 7,712 | | | | 7,785 | | | | 7,701 | |

| |

Consolidated Condensed Balance Sheets

(in thousands)

(unaudited) |

| |

| | December 31, | | December 31, |

| | | 2024 | | | | 2023 | |

| Assets: | | | |

| Cash and cash equivalents | $ | 13,450 | | | $ | 5,263 | |

| Receivables, net | | 84,677 | | | | 64,449 | |

| Inventories | | 87,536 | | | | 70,191 | |

| Other current assets | | 9,282 | | | | 4,730 | |

| Net property, plant, and equipment | | 70,564 | | | | 62,137 | |

| Goodwill | | 189,657 | | | | 113,263 | |

| Intangible assets, net | | 144,252 | | | | 64,116 | |

| Other assets | | 29,577 | | | | 19,987 | |

| Total assets | $ | 628,995 | | | $ | 404,136 | |

| Liabilities and equity: | | | |

| Accounts payable | $ | 24,269 | | | $ | 22,286 | |

| Current portion of long-term debt | | 12,500 | | | | 4,000 | |

| Other current liabilities | | 39,526 | | | | 31,923 | |

| Long-term debt, less current portion | | 176,875 | | | | 28,000 | |

| Other liabilities | | 33,065 | | | | 31,836 | |

| Total liabilities | | 286,235 | | | | 118,045 | |

| Total equity | | 342,760 | | | | 286,091 | |

| Total liabilities and stockholders' equity | $ | 628,995 | | | $ | 404,136 | |

| | | | |

Forward-Looking Statements

Certain statements in this press release may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. Such statements include, but are not limited to, statements about the Company’s future financial or operating performance; the continuing operation of the Company’s locations, the maintenance of its facilities and the sufficiency of the Company’s supply chain, inventory, liquidity and capital resources, including increased costs in connection with such efforts; statements about the Company’s acquisition strategies and opportunities and the Company’s growth potential and strategies for growth; statements about the integration and performance of recent acquisitions; statements about the Company’s ability to realize the benefits expected from our recently completed acquisitions, including any related synergies; statements about customer expectations regarding inventory levels; expectations regarding customer demand; and any indication that the Company may be able to sustain or increase its sales, earnings or earnings per share, its sales, earnings or earnings per share growth rates, or available capital for acquisitions. Such forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the Company's general ability to execute its business plans; industry conditions, including fluctuations in supply, demand, and prices for the Company's products and services; risks relating to customer concentration; risks relating to the Company’s ability to achieve anticipated benefits of recent acquisitions, risks relating to the imposition of tariffs by the United States and other countries, risks relating to our use and the use by our customers, suppliers, and vendors of AI, and other risks and uncertainties set forth in the sections entitled "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements" in the Company's filings with the Securities and Exchange Commission ("SEC"), which are available on the SEC's website at www.sec.gov. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions, or circumstances on which any such statement is based. Forward-looking statements are also subject to the risks and other issues described above under “Use of Non-GAAP Financial Information,” which could cause actual results to differ materially from current expectations included in the Company’s forward-looking statements included in this press release.

Non-GAAP Financial Information

This news release includes non-generally accepted accounting principles (“GAAP”) performance measures. Management considers Adjusted Operating Income, Adjusted Selling and General Administrative Expenses, Adjusted Net Income, Adjusted Net Income per diluted shares outstanding, EBITDA and Adjusted EBITDA, non-GAAP measures. The Company uses these non-GAAP financial measures to facilitate management's financial and operational decision-making, including evaluation of the Company’s historical operating results. The Company’s management believes these non-GAAP measures are useful in evaluating the Company’s operating performance and are similar measures reported by publicly listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company's operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. By providing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s performance for the periods presented. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company's definition of these non-GAAP measures may differ from similarly titled measures of performance used by other companies in other industries or within the same industry.

| |

Table 1: Adjusted Operating Income Reconciliation

(in thousands) |

| |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | |

| Operating income (GAAP) | $ | 22,257 | | | $ | 12,736 | | | $ | 80,897 | | | $ | 57,664 | |

| Adjustments: | | | | | | | |

| Purchase accounting expenses | | - | | | | - | | | | 1,100 | | | | - | |

| Acquisition costs | | 844 | | | | - | | | | 2,520 | | | | - | |

| Change in fair value of contingent consideration | | 238 | | | | 238 | | | | 952 | | | | 3,527 | |

| Amortization of Intangible Assets | | 2,524 | | | | 1,098 | | | | 6,727 | | | | 4,403 | |

| Loss on disposal of fixed assets | | 99 | | | | 37 | | | | 106 | | | | 145 | |

| Adjusted operating income (Non-GAAP) | $ | 25,962 | | | $ | 14,109 | | | $ | 92,302 | | | $ | 65,739 | |

| | | | |

Table 2: Adjusted Selling General and Administrative Expenses (SG&A)

(in thousands) |

| | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| SG&A (GAAP) | $ | 18,618 | | | $ | 13,118 | | | $ | 62,218 | | | $ | 50,889 | |

| Adjustments: | | | | | | | |

| Amortization of Intangible Assets | | (2,524 | ) | | | (1,098 | ) | | | (6,727 | ) | | | (4,403 | ) |

| Adjusted SG&A (Non-GAAP) | $ | 16,094 | | | $ | 12,020 | | | $ | 55,491 | | | $ | 46,486 | |

| Adjusted SG&A as a % of sales | | 11.2 | % | | | 11.8 | % | | | 11.0 | % | | | 11.6 | % |

| |

Table 3: Adjusted Net Income and Diluted Common Share Outstanding Reconciliation

(in thousands, except per share data) |

| |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | |

| Net income (GAAP) | $ | 16,375 | | | $ | 11,607 | | | $ | 58,981 | | | $ | 44,924 | |

| Adjustments (net of taxes): | | | | | | | |

| Purchase accounting expenses | | - | | | | - | | | | 1,100 | | | | - | |

| Acquisition costs | | 844 | | | | - | | | | 2,520 | | | | - | |

| Change in fair value of contingent consideration | | 238 | | | | 238 | | | | 952 | | | | 3,527 | |

| Amortization of Intangible Assets | | 2,524 | | | | 1,098 | | | | 6,727 | | | | 4,403 | |

| Loss on disposal of fixed assets | | 99 | | | | 37 | | | | 106 | | | | 145 | |

| Taxes on adjustments | | (917 | ) | | | (340 | ) | | | (2,823 | ) | | | (1,999 | ) |

| Adjusted net income (Non-GAAP) | $ | 19,163 | | | $ | 12,640 | | | $ | 67,563 | | | $ | 51,000 | |

| | | | | | | | |

| Adjusted Net Income per diluted share outstanding (Non-GAAP) | $ | 2.46 | | | $ | 1.64 | | | $ | 8.68 | | | $ | 6.62 | |

| Weighted average diluted common shares outstanding | | 7,794 | | | | 7,712 | | | | 7,785 | | | | 7,701 | |

| | | | |

Table 4: EBITDA and Adjusted EBITDA Reconciliation

(in thousands) |

| | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | |

| Net income (GAAP) | $ | 16,375 | | | $ | 11,607 | | | $ | 58,981 | | | $ | 44,924 | |

| Income tax expense | | 2,724 | | | | 285 | | | | 14,044 | | | | 8,878 | |

| Interest expense, net | | 3,377 | | | | 755 | | | | 8,061 | | | | 3,645 | |

| Depreciation | | 2,133 | | | | 1,862 | | | | 7,988 | | | | 7,004 | |

| Amortization of Intangible Assets | | 2,524 | | | | 1,098 | | | | 6,727 | | | | 4,403 | |

| EBITDA (Non-GAAP) | $ | 27,133 | | | $ | 15,607 | | | $ | 95,801 | | | $ | 68,854 | |

| Adjustments: | | | | | | | |

| Purchase accounting expenses | | - | | | | - | | | | 1,100 | | | |

| Share based compensation | | 2,054 | | | | 1,191 | | | | 6,842 | | | | 4,641 | |

| Acquisition costs | | 844 | | | | - | | | | 2,520 | | | | - | |

| Change in fair value of contingent consideration | | 238 | | | | 238 | | | | 952 | | | | 3,527 | |

| Loss on disposal of fixed assets | | 99 | | | | 37 | | | | 106 | | | | 145 | |

| Adjusted EBITDA (Non-GAAP) | $ | 30,368 | | | $ | 17,073 | | | $ | 107,321 | | | $ | 77,167 | |

| | | | | | | | |

| | | | | | | | |

www.ufpt.com

Contact: Ron Lataille

978-234-0926, rlataille@ufpt.com |

| |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

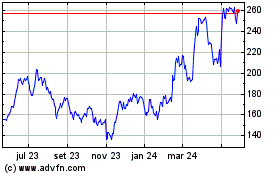

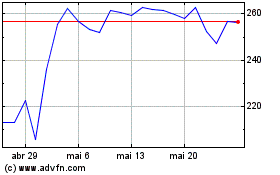

Ufp Technologies (NASDAQ:UFPT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Ufp Technologies (NASDAQ:UFPT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025