Air Liquide Has Successfully Issued a 500 Million Euros Green Bond to Finance the Energy Transition

23 Maio 2024 - 1:45PM

Business Wire

Main characteristics are as follows:

- Issuer: Air Liquide Finance, guaranteed by L’Air Liquide

SA

- Maturity: May 29, 2034 (10 years)

- Format: Fixed rate, repayment at maturity

Regulatory News:

Air Liquide (Paris:AI) has successfully issued a new 500

million euros green bond, in line with its ambition to combine

growth and sustainable development. The Group intends to use the

proceeds from the issuance to finance or refinance flagship energy

transition and sustainable projects, in particular in low-carbon

hydrogen, carbon capture and low-carbon air gases. This new

issuance confirms Air Liquide as a regular ESG issuer, after its

inaugural 2021 green bond issue.

This transaction, significantly oversubscribed by

investors, was executed under the Group's Euro Medium Term Note

(EMTN) programme. With this issuance, Air Liquide is raising 500

million euros with a 10-year maturity at a yield of 3.466%.

Proceeds from this issuance will allow Air Liquide to finance or

refinance flagship energy transition and sustainable projects and

to support the Group’s long term growth at very competitive

financial conditions.

This issue will be rated « A » by Standard & Poor’s and

Scope Rating and « A2 » by Moody’s.

Jérôme Pelletan, Group Chief Financial Officer,

commented: “The success of this second green bond issuance

illustrates the investors’ confidence in Air Liquide’s ability to

implement technologies and pioneer projects that contribute to the

decarbonization of our activities as well as help our customers

lower their carbon footprint. This is in line with our strategic

plan ADVANCE, which inseparably links financial and extra-financial

performances. The technologies Air Liquide masters notably in the

fields of low-carbon hydrogen, carbon capture and low-carbon air

gases actively and concretely contribute to a transition to a

low-carbon society.”

Air Liquide is a world leader in gases, technologies and

services for industry and healthcare. Present in 72 countries with

67,800 employees, the Group serves more than 4 million customers

and patients. Oxygen, nitrogen and hydrogen are essential small

molecules for life, matter and energy. They embody Air Liquide’s

scientific territory and have been at the core of the Group’s

activities since its creation in 1902.

Taking action today while preparing the future is at the heart

of Air Liquide’s strategy. With ADVANCE, its strategic plan for

2025, Air Liquide is targeting a global performance, combining

financial and extra-financial dimensions. Positioned on new

markets, the Group benefits from major assets such as its business

model combining resilience and strength, its ability to innovate

and its technological expertise. The Group develops solutions

contributing to climate and the energy transition—particularly with

hydrogen—and takes action to progress in areas of healthcare,

digital and high technologies.

Air Liquide’s revenue amounted to more than 27.5 billion euros

in 2023. Air Liquide is listed on the Euronext Paris stock exchange

(compartment A) and belongs to the CAC 40, CAC 40 ESG, EURO STOXX

50, FTSE4Good and DJSI Europe indexes.

www.airliquide.com Follow Air Liquide on

LinkedIn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240523513796/en/

Media Relations media@airliquide.com

Investor Relations IRTeam@airliquide.com

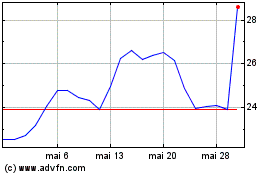

C3 AI (NYSE:AI)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

C3 AI (NYSE:AI)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024