Rithm Capital Corp. (NYSE: RITM; “Rithm”), a global asset

manager focused on real estate, credit and financial services, and

Great Ajax Corp. (NYSE: AJX; “Great Ajax”), a real estate

investment trust, announced today that they have entered into a

strategic transaction.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240226285906/en/

As part of the strategic transaction, Great Ajax has entered

into a one-year term loan agreement with a subsidiary of Rithm for

up to $70 million. Great Ajax plans to use borrowings under the

term loan, as well as cash on hand and cash from loan sales, to

repay its outstanding convertible notes.

In connection with the loan agreement, Great Ajax issued a

termination notice to its external manager, Thetis Asset Management

LLC (the “Manager”). Subject to the receipt of shareholder

approval, Great Ajax will enter into a management agreement with an

affiliate of Rithm to serve as its external manager. The

transaction will enable Great Ajax to shift its strategic direction

and capitalize on commercial real estate investment

opportunities.

“We are excited to grow our asset management platform through

this strategic transaction with Great Ajax, which represents

another step forward in our evolution as a global alternative asset

manager,” said Michael Nierenberg, Chairman, Chief Executive

Officer and President of Rithm. “We believe Great Ajax will be

well-positioned to execute on a commercial real estate-focused

strategy and generate significant value for shareholders.”

“We are pleased Great Ajax’s stockholders will have the

opportunity to benefit from the experience and track record of the

Rithm team going forward,” said Lawrence Mendelsohn, Chairman and

Chief Executive Officer of Great Ajax. “We look forward to working

closely with Rithm to complete the transaction promptly and

reposition Great Ajax to execute on unique investment opportunities

in a dynamic commercial real estate market.”

Additional Transaction Details

In connection with the execution of the term loan agreement,

Great Ajax will issue five-year warrants to Rithm, based on amounts

drawn under the loan facility (subject to a specified minimum),

exercisable for shares of Great Ajax’s common stock.

Great Ajax and Rithm have also entered into a securities

purchase agreement, pursuant to which Great Ajax will issue Rithm

$14 million in Great Ajax common stock. The closing of the

purchase, as well as other aspects of the strategic transaction,

are subject to Great Ajax stockholder approval.

Great Ajax plans to seek stockholder approval of the transaction

at an annual and special meeting of the stockholders of Great Ajax.

Great Ajax has entered into support and exchange agreements with

certain institutional stockholders, pursuant to which shares of

Great Ajax preferred stock and shares underlying the warrants will

be exchanged for shares of common stock and such stockholders have

agreed to support the strategic transactions. After giving effect

to the exchange, stockholders representing more than 40% of the

shares of Great Ajax’s common stock will have entered into support

agreements.

For more information about this transaction, please see Great

Ajax’s Current Report on Form 8-K, accessible on Great Ajax’s

website.

Advisors

Citi is acting as the exclusive financial advisor to Rithm and

Sidley Austin LLP is serving as legal counsel to Rithm. Piper

Sandler & Co. is acting as exclusive financial advisor to Great

Ajax and Mayer Brown LLP is acting as legal advisor to Great Ajax.

BTIG, LLC is acting as exclusive financial advisor to the special

committee of the Great Ajax board of directors and Sheppard Mullin

LLP is acting as legal advisor to the special committee of the

Great Ajax board of directors.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of obtaining approval of the stockholders of Great Ajax of

the proposed transactions (the “Stockholder Approval”). In

connection with obtaining the Stockholder Approval, Great Ajax will

file with the Securities and Exchange Commission (the “SEC”) and

furnish to the Company’s stockholders a proxy statement and other

relevant documents. This communication does not constitute a

solicitation of any vote or approval. BEFORE MAKING ANY VOTING

DECISION, GREAT AJAX’S STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER

DOCUMENTS TO BE FILED THE SEC IN CONNECTION WITH THE STOCKHOLDER

APPROVAL OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

TRANSACTION. Stockholders will be able to obtain free copies of the

proxy statement and other documents containing important

information about the Company once such documents are filed with

the SEC, through the website maintained by the SEC at

http://www.sec.gov.

Participants in the Solicitation

Great Ajax and its executive officers, directors, other members

of management and employees may be deemed, under SEC rules, to be

participants in the solicitation of proxies from Great Ajax’s

stockholder with respect to the proposed transaction. Information

regarding the executive officers and directors of Great Ajax is set

forth in its definitive proxy statement for its 2023 annual meeting

filed with the SEC on April 21, 2023, as amended. More detailed

information regarding the identity of potential participants, and

their direct or indirect interests, by securities holdings or

otherwise, will be set forth in the proxy statement and other

materials to be filed with the SEC in connection with the proposed

transaction.

Forward-Looking Statements This communication contains

forward-looking statements within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are not historical in nature and can be

identified by words such as “believe,” “expect,” “anticipate,”

“estimate,” “project,” “plan,” “continue,” “intend,” “should,”

“would,” “could,” “goal,” “objective,” “will,” “may,” “seek” or

similar expressions or their negative forms. Forward-looking

statements are subject to numerous assumptions, risks and

uncertainties, which change over time and are beyond our control.

Forward-looking statements speak only as of the date they are made.

Rithm and Great Ajax do not assume any duty or obligation (and do

not undertake) to update or supplement any forward-looking

statements. Because forward-looking statements are, by their

nature, to different degrees, uncertain and subject to numerous

assumptions, risks and uncertainties, actual results or future

events, circumstances or developments could differ, possibly

materially, from those that Rithm and Great Ajax anticipated in its

forward-looking statements, and future results and performance

could differ materially from historical performance. Factors that

could cause or contribute to such differences include, but are not

limited to, those set forth in the section entitled “Risk Factors”

in Rithm and Great Ajax’s most recent Annual Reports on Form 10-K

and Quarterly Reports on Form 10-Q filed with the SEC, and other

reports filed by Rithm and Great Ajax with the SEC, copies of which

are available on the SEC’s website, www.sec.gov. The list of

factors presented here is not, and should not be, considered a

complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward-looking statements.

About Rithm Capital Corp. Rithm Capital (NYSE: RITM) is a

global asset manager focused on real estate, credit and financial

services. Rithm makes direct investments and operates several

wholly-owned operating businesses. Rithm’s businesses include

Sculptor Capital Management, Inc., an alternative asset manager, as

well as Newrez LLC and Genesis Capital LLC, leading mortgage

origination and servicing platforms. Rithm seeks to generate

attractive risk-adjusted returns across market cycles and interest

rate environments. Since inception in 2013, Rithm has delivered

approximately $5.0 billion in dividends to shareholders. Rithm is

organized and conducts its operations to qualify as a real estate

investment trust (REIT) for federal income tax purposes and is

headquartered in New York City.

About Great Ajax Corp. Great Ajax (NYSE: AJX) is a real

estate investment trust that focuses primarily on acquiring,

investing in and managing re-performing loans (“RPLs”) and

non-performing loans (“NPLs”) secured by single-family residences

and commercial properties. In addition to its continued focus on

RPLs and NPLs, it also originates and acquires small balance

commercial mortgage loans secured by multi-family

retail/residential and mixed-use properties. Great Ajax is

externally managed by Thetis Asset Management LLC, an affiliated

entity. Great Ajax’s mortgage loans and other real estate assets

are serviced by Gregory Funding LLC, an affiliated entity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240226285906/en/

Rithm Investor Relations (212) 850-7770

ir@rithmcap.com

Media Jon Keehner / Sarah Salky / Erik Carlson Joele

Frank, Wilkinson Brimmer Katcher (212) 355-4449

ritm-jf@joelefrank.com

Great Ajax Mary Doyle Chief Financial Officer (503)

444-4224 mary.doyle@great-ajax.com

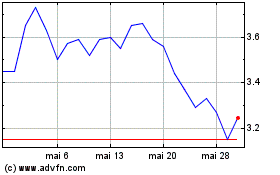

Great Ajax (NYSE:AJX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Great Ajax (NYSE:AJX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024