Ameresco and Southern California Edison Reach Agreement on Substantial Completion Milestone for Two Battery Energy Storage Projects

03 Setembro 2024 - 7:50AM

Business Wire

Ameresco, Inc., (NYSE: AMRC), a leading cleantech integrator

specializing in energy efficiency and renewable energy, today

announced that it has reached an agreement with Southern California

Edison Company (SCE) on the substantial completion of two out of

three battery energy storage system projects. SCE will pay

approximately $110 million within seven days for the milestone

completion, reflecting a set-off of liquidated damages which are

still in dispute and additional work costs. Final acceptance

payments will follow upon project completion. The third project is

expected to reach substantial completion in Q4 2024.

To learn more about the energy efficiency and renewable energy

solutions offered by Ameresco, visit www.ameresco.com.

About Ameresco, Inc.

Founded in 2000, Ameresco, Inc. (NYSE: AMRC) is a leading

cleantech integrator and renewable energy asset developer, owner

and operator. Our comprehensive portfolio includes solutions that

help customers reduce costs, decarbonize to net zero, and build

energy resiliency while leveraging smart, connected technologies.

From implementing energy efficiency and infrastructure upgrades to

developing, constructing, and operating distributed energy

resources – we are a trusted sustainability partner. Ameresco has

successfully completed energy saving, environmentally responsible

projects with Federal, state and local governments, utilities,

healthcare and educational institutions, housing authorities, and

commercial and industrial customers. With its corporate

headquarters in Framingham, MA, Ameresco has more than 1,500

employees providing local expertise in North America and Europe.

For more information, visit www.ameresco.com.

Forward Looking Statements

Any statements in this press release about the timing,

completion and invoicing of the SCE projects and our expectations

related to our agreement with SCE including the impact of delays

and any requirement to pay liquidated damages, and other statements

containing the words “projects,” “believes,” “anticipates,”

“plans,” “expects,” “will” and similar expressions, constitute

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995. Actual results may differ

materially from those indicated by such forward looking statements

as a result of various important factors, including: demand for our

energy efficiency and renewable energy solutions; the timing of,

and ability to, enter into contracts for awarded projects on the

terms proposed or at all; the timing of work we do on projects

where we recognize revenue on a percentage of completion basis; the

ability to perform under signed contracts without delay and in

accordance with their terms and related liquidated and other

damages we may be subject to; the fiscal health of the government

and the risk of government shutdowns; our ability to complete and

operate our projects on a profitable basis and as committed to our

customers; our cash flows from operations and our ability to

arrange financing to fund our operations and projects; our

customers’ ability to finance their projects and credit risk from

our customers; our ability to comply with covenants in our existing

debt agreements; the impact of macroeconomic challenges, weather

related events and climate change on our business; our reliance on

third parties for our construction and installation work;

availability and cost of labor and equipment particularly given

global supply chain challenges and global trade conflicts; global

supply chain challenges, component shortages and inflationary

pressures; changes in federal, state and local government policies

and programs related to energy efficiency and renewable energy; the

ability of customers to cancel or defer contracts included in our

backlog; the output and performance of our energy plants and energy

projects; cybersecurity incidents and breaches; regulatory and

other risks inherent to constructing and operating energy assets;

the effects of our acquisitions and joint ventures; seasonality in

construction and in demand for our products and services; a

customer’s decision to delay our work on, or other risks involved

with, a particular project; the addition of new customers or the

loss of existing customers; market price of our Class A Common

stock prevailing from time to time; the nature of other investment

opportunities presented to our Company from time to time; risks

related to our international operation and international growth

strategy; and other factors discussed in our most recent Annual

Report on Form 10-K and our quarterly reports on Form 10-Q. The

forward-looking statements included in this press release represent

our views as of the date of this press release. We anticipate that

subsequent events and developments will cause our views to change.

However, while we may elect to update these forward-looking

statements at some point in the future, we specifically disclaim

any obligation to do so. These forward-looking statements should

not be relied upon as representing our views as of any date

subsequent to the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240903956337/en/

Media Relations Leila Dillon, 508.661.2264,

news@ameresco.com

Investor Relations Eric Prouty, Advisiry Partners, 212.750.5800,

eric.prouty@advisiry.com Lynn Morgen, Advisiry Partners,

212.750.5800, lynn.morgen@advisiry.com

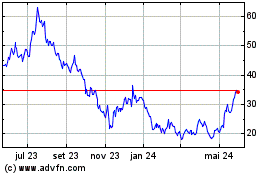

Ameresco (NYSE:AMRC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

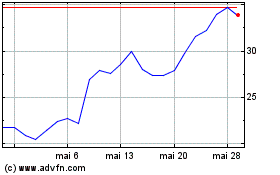

Ameresco (NYSE:AMRC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024