Axos Financial, Inc. Announces New $100 Million Stock Repurchase Program

12 Fevereiro 2024 - 6:05PM

Business Wire

Axos Financial, Inc. (NYSE: AX) (“Axos” or the “Company”) today

announced that its Board of Directors authorized a program to

repurchase up to $100 million of its common stock. This new share

repurchase authorization is in addition to the existing share

repurchase plan approved on April 26, 2023, which has approximately

$20 million remaining.

The Company may repurchase shares on the open market or through

privately negotiated transactions at times and prices considered

appropriate by the Company, at the discretion of management, and

subject to its assessment of alternative uses of capital, stock

trading price, general market conditions and other factors. There

is no set start or end date for the new common stock repurchase

program.

About Axos Financial, Inc.

Axos Financial, Inc., with approximately $21.6 billion in

consolidated assets as of December 31, 2023, is the holding company

for Axos Bank, Axos Clearing LLC and Axos Invest, Inc. Axos Bank

provides consumer and business banking products nationwide through

its low-cost distribution channels and affinity partners. Axos

Clearing LLC (including its business division Axos Advisor

Services), with approximately $34.4 billion of assets under custody

and/or administration as of December 31, 2023, and Axos Invest,

Inc., provide comprehensive securities clearing services to

introducing broker-dealers and registered investment advisor

correspondents, and digital investment advisory services to retail

investors, respectively. Axos Financial, Inc.’s common stock is

listed on the NYSE under the symbol “AX” and is a component of the

Russell 2000® Index, the S&P SmallCap 600® Index, the KBW

Nasdaq Financial Technology Index, and the Travillian Tech-Forward

Bank Index. For more information on Axos Financial, Inc., please

visit http://investors.axosfinancial.com.

Forward-Looking Safe Harbor Statement

This press release contains forward-looking statements that

involve risks and uncertainties, including without limitation

statements relating to Axos’ financial prospects and other

projections of its performance and asset quality, Axos’ deposit

balances and capital ratios, Axos’ ability to continue to grow

profitably and increase its business, Axos’ ability to continue to

diversify its lending and deposit franchises, the anticipated

timing and financial performance of other offerings, initiatives,

and acquisitions, expectations of the environment in which Axos

operates and projections of future performance. These

forward-looking statements are made on the basis of the views and

assumptions of management regarding future events and performance

as of the date of this press release. Actual results and the timing

of events could differ materially from those expressed or implied

in such forward-looking statements as a result of risks and

uncertainties, including without limitation Axos’ ability to

successfully integrate acquisitions and realize the anticipated

benefits of the transactions, changes in the interest rate

environment, monetary policy, inflation, government regulation,

general economic conditions, changes in the competitive

marketplace, conditions in the real estate markets in which we

operate, risks associated with credit quality, our ability to

attract and retain deposits and access other sources of liquidity,

and the outcome and effects of litigation and other factors beyond

our control. These and other risks and uncertainties detailed in

Axos’ periodic reports filed with the Securities and Exchange

Commission, including its Annual Report on Form 10-K for the fiscal

year ended June 30, 2023, could cause actual results to differ

materially from those expressed or implied in any forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release. Axos undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. All written

and oral forward-looking statements made in connection with this

press release, which are attributable to us or persons acting on

Axos’ behalf are expressly qualified in their entirety by the

foregoing information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240212434825/en/

Investor Relations Contact: Johnny Lai, CFA SVP, Corporate

Development & Investor Relations 858-649-2218

jlai@axosfinancial.com

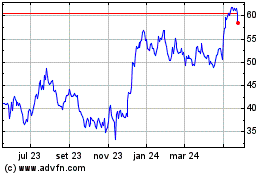

Axos Financial (NYSE:AX)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

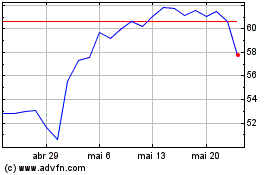

Axos Financial (NYSE:AX)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025