Lexington Partners Announces Dedicated Strategy and Team to Lead Continuation Vehicle Transactions at Scale

23 Maio 2024 - 12:22PM

Business Wire

– Christophe Browne Joins Lexington Partners

Continuation Vehicle Effort Drawing upon the Firm’s Experience and

Differentiated Platform –

Lexington Partners (“Lexington”) announced a dedicated strategy

and team focused on leading single-asset continuation vehicle

(“CV”) transactions. In conjunction with the launch, Christophe

Browne has joined Lexington as a Partner to help lead the dedicated

effort.

Lexington is one of the world’s largest and most successful

managers of secondary private equity and co-investment funds having

helped pioneer the development of the institutional secondary

market over 30 years ago. The firm’s new CV strategy will be

executed by a specialist team that will benefit from Lexington’s

more than two decades experience investing in GP-led transactions,

its broad deal-sourcing platform with over 800 sponsor

relationships, and its rigorous diligence approach.

Christophe Browne was one of the founding members of the

Strategic Equity business at Intermediate Capital Group (“ICG”),

where he established himself as a leader in the continuation

vehicle market. Mr. Browne previously was a Managing Director and

Head of North America at ICG Strategic Equity and has specialized

in leading large CV transactions for the past 10 years. He will

operate out of Lexington’s newly established Miami office. The

firm’s dedicated team, which will work exclusively on continuation

vehicle transactions, includes several experienced Lexington

investment professionals.

“We are delighted to welcome Christophe to Lexington as we build

a dedicated Lexington team to focus on a best-in-class continuation

vehicle investment strategy for GPs and capital allocators. Many of

us at Lexington have known and respected Christophe for years,”

said Wil Warren, Partner and President of Lexington. “While

Lexington has long been an active participant in CV transactions,

investing approximately $6 billion to date, we are now committing

to a differentiated approach at scale to address the extraordinary

growth we expect from this market segment.”

“I’m thrilled to join Lexington to help build a dedicated effort

to capitalize on the growing market opportunity in CV

transactions,” said Browne. “Lexington is committing the full

resources and capabilities of its platform to the growth of this

strategy. The firm’s scale, experience, GP relationships, and the

fact that it has no conflicting buyout strategies, create distinct

advantages to provide solutions in this growing segment of the

secondary market.”

Lexington has seen dramatic growth in the CV part of the

secondary market driven by increased sponsor interest to re-invest

in some of their highest quality businesses. Secondary

intermediaries estimate that $70 billion of single-asset CV

transactions were completed in the past three years, with an

additional $30 billion forecasted for 2024.

Lexington’s recent experience completing high-quality

single-asset CV transactions includes the $4.0 billion CV of Belron

by Clayton, Dubilier & Rice, the $3.4 billion CV of Apex

Service Partners by Alpine Investors and the $1.6 billion CV of

Precisely by Clearlake Capital.

About Lexington

Lexington Partners is one of the world’s largest and most

successful managers of secondary private equity and co-investment

funds. Lexington helped pioneer the development of the

institutional secondary market over 30 years ago and created one of

the first independent, discretionary co-investment programs 26

years ago. Lexington has total capital in excess of $76 billion and

has acquired over 5,000 interests through more than 1,000

transactions. Lexington’s global team is strategically located in

major centers for private equity and alternative asset investing

across North America, Europe, Asia, and Latin America. Lexington is

the global secondary private equity and co-investments specialist

investment manager of Franklin Templeton. Additional information

can be found at www.lexingtonpartners.com.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

April 30, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, Twitter and

Facebook.

Copyright © 2023. Franklin Distributors, LLC. Member

FINRA/SIPC

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240523945633/en/

Todd Fogarty Kekst CNC +1 (212) 521-4854

todd.fogarty@kekstcnc.com

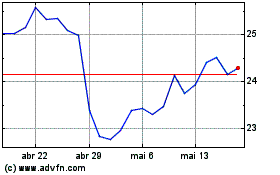

Franklin Resources (NYSE:BEN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

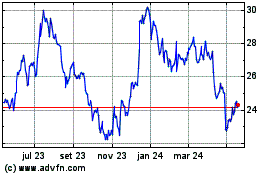

Franklin Resources (NYSE:BEN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024