Today the firm celebrates the five-year

anniversary of Clarion Partners Real Estate Income Fund Inc.

Franklin Templeton and its specialist investment manager,

Clarion Partners, are today celebrating the five-year anniversary

of the Clarion Partners Real Estate Income Fund Inc. (CPREX), a

closed-end tender offer fund that provides individual investors

with access to institutional-quality private real estate. CPREX

invests in stable, well-leased, cash flow-producing properties in

U.S. markets with favorable growth prospects. Industrial warehouse,

rental housing and healthcare-related properties comprise 89% of

the portfolio.

The five-year milestone signifies Clarion’s commitment to

pursuing strategic investment opportunities in commercial real

estate even in today’s uncertain environment. Its positive outlook

for this asset class is driven by both near-term factors related to

moderating inflation, slightly lower interest rates and the

direction of certain capital market indicators, as well as

long-term trends related to demographics, innovation and shifting

globalization.

“Franklin Templeton and Clarion Partners are grateful for the

trust and confidence our many distribution partners, advisors, RIAs

and bankers have placed in CPREX,” said Dave Donahoo, Franklin

Templeton’s Head of Wealth Management-Alternatives. “By not

charging an incentive fee, similar to our institutional core

offering, we have more leverage flexibility and can deliver a

larger percentage of gross returns to our investors.”

“Thanks to our partners, we’ve continued to experience net

inflows during a period of slow real estate fundraising for the

sector as a whole. This has afforded us the ability to acquire new

properties during a wider cap rate environment, providing

diversification benefits and setting CPREX up to continue to

deliver against our investment mandate for the next five years,”

said Jeff Masom, Franklin Templeton’s Head of U.S.

Distribution.

Clarion Partners, CPREX’s sub-adviser, has been a leader in

building and managing private real estate portfolios for some of

the world’s largest institutional investors for over 40 years; it

has more than $74 billion in real estate assets under management as

of June 30, 2024.

“Since the fund’s inception in 2019, we’ve taken a disciplined

investment approach, grounded in in-depth research and focused on

constructing a portfolio for our investors that generates a balance

of income and long-term capital appreciation through investment in

real estate sectors and geographies that we believe are poised to

benefit the most from long-term macro-economic trends,” said CPREX

Portfolio Manager Rick Schaupp. “CPREX is designed to make

investments in both real estate private equity and private debt.

That positions us to be active investors regardless of where we are

in a market cycle.”

Growing interest in alternative investments

Clarion is part of Franklin Templeton’s alternatives business,

which spans a broad range of strategies, including real estate,

private credit, hedge funds and secondary private equity and

co-investments, amounting to approximately 16% of the firm’s $1.65

trillion in assets under management as of June 30, 2024.

There’s evidence of growing interest in alternative investments

among individual investors. While in 2016 there were $110.6 billion

in U.S. registered funds that invest in private equity, private

credit and real estate, that number has nearly tripled, growing to

$299.3 billion in 2023, according to Cerulli Associates.

“A confluence of events has helped fuel the adoption of

alternative investments, including volatility in public markets and

rising demand for returns that are uncorrelated with traditional

stocks and bonds,” said Franklin Templeton’s Donahoo. “Technology

and product innovation are making alternatives more adoptable and

accessible to wealth investors across the globe. Alternatives by

Franklin Templeton is uniquely positioned to be a leading solutions

provider as this trend accelerates, driven by our deep knowledge of

the wealth channel and strong line-up of managers.”

About Clarion Partners

Clarion Partners, an SEC registered investment adviser with

FCA-authorized and FINRA member affiliates, has been a leading U.S.

real estate investment manager for more than 40 years.

Headquartered in New York, the firm maintains strategically located

offices across the United States and Europe. With over $74 billion

in total real estate and debt assets under management, Clarion

Partners offers a broad range of real estate strategies across the

risk/return spectrum to 500 institutional investors across the

globe. Clarion is scaled in all major property types and was an

early entrant into the Industrial sector. The Firm’s global

industrial team manages a 1000+ property portfolio in the U.S. and

Europe consisting of more than 255 million square feet. For more

information visit www.clarionpartners.com.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

July 31, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

BEFORE INVESTING, CAREFULLY CONSIDER A FUND’S INVESTMENT

OBJECTIVES, RISKS, CHARGES AND EXPENSES. YOU CAN FIND THIS AND

OTHER INFORMATION IN EACH PROSPECTUS, AND SUMMARY PROSPECTUS, IF

AVAILABLE, AT WWW.FRANKLINTEMPLETON.COM OR CONTACT YOUR FRANKLIN

TEMPLETON REPRESENTATIVE. PLEASE READ THE PROSPECTUS CAREFULLY

BEFORE INVESTING.

Investment Risks

Past performance is no guarantee of future results. All

investments involve risk, including loss of principal.

Diversification does not ensure against loss. An investment

should be considered long-term within a multi-asset portfolio and

should not be viewed individually as a complete investment program.

The Fund is subject to a high degree of risk; additional

risk considerations are listed below:

Liquidity Risks:

The Fund should be viewed as a long-term investment, as it is

inherently illiquid and suitable only for investors who can bear

the risks associated with the limited liquidity of the Fund.

Limited liquidity is provided to shareholders only through the

Fund’s quarterly repurchase offers for no more than 5% of the

Fund’s shares outstanding at net asset value. There is no guarantee

these repurchases will occur as scheduled, or at all.

Shareholders may not be able to sell their shares in the Fund at

all or at a favorable price.

Real Estate Investment Risks:

The Fund’s investments are highly concentrated in real estate

investments, and therefore will be subject to the risks typically

associated with real estate, including but not limited to

fluctuations in lease occupancy rates and operating expenses,

variations in rental schedules, which in turn may be adversely

affected by local, state, national or international economic

conditions. Such conditions may be impacted by the supply and

demand for real estate properties, zoning laws, rent control laws,

real property taxes, the availability and costs of financing, and

environmental laws.

Furthermore, investments in real estate are also impacted by

market disruptions caused by regional concerns, political

upheaval, sovereign debt crises, and uninsured losses (generally

from catastrophic events such as earthquakes, floods and wars).

Investments in real estate related securities, such as asset-backed

or mortgage-backed securities are subject to prepayment and

extension risks.

Private Market Investments Risks:

An investment in the Fund is suitable only for investors who can

bear the risks associated with private market investments (such as

private credit and private equity) with potential limited

liquidity. Shares will not be listed on a public exchange, and no

secondary market is expected to develop.

Franklin Distributors, LLC. Member FINRA, SIPC. All entities

mentioned are Franklin Templeton affiliates companies Investment

Products: NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE

VALUE.

©2024 Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930813645/en/

Franklin Templeton Corporate Communications: Lisa Tibbitts, +1

(904) 942-4451, lisa.tibbitts@franklintempleton.com

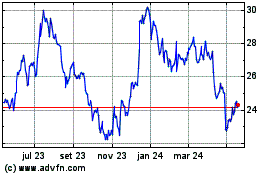

Franklin Resources (NYSE:BEN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

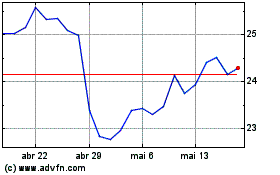

Franklin Resources (NYSE:BEN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024