Citizens Business Conditions Index™ Shows Modest Expansion in Q4

29 Janeiro 2025 - 11:00AM

Business Wire

Robust corporate revenue trends slightly offset

by labor strikes and weather effects

The national Citizens Business Conditions Index™ (CBCI) rose to

51.0 in the final quarter of 2024, bolstered by solid corporate

revenue trends and sustained strength in the service sector. The

reading indicates that business conditions improved modestly in the

fourth quarter, as the Federal Reserve continued to lower interest

rates and election-related uncertainty abated.

While employment trends and new business growth were neutral to

the index on a national level, severe weather events and labor

strikes in the automotive and aerospace sectors created challenges

in certain geographies. These idiosyncratic headwinds were more

than offset by resilient consumer spending and strong revenue

trends across most industries.

“Business conditions continued to improve in the fourth quarter,

and the U.S. economy is entering 2025 with some momentum,” said

Eric Merlis, managing director and co-head of global markets,

Citizens. “While severe weather events may continue to present

idiosyncratic headwinds in the near-term, overall labor and

consumer trends remain healthy and our clients are optimistic about

the outlook for business in the year ahead.”

The underlying components of the index reflected the modest

improvement in business conditions in the fourth quarter,

establishing an optimistic starting point for the new year.

- The activity data of Citizens’ Commercial Banking clients

showed robust corporate revenue trends across most industries and

geographies, driving the uptick in the Index.

- Strength in the service sector provided an additional boost, as

the ISM non-manufacturing component also remained

expansionary.

- Employment trends, as measured by initial jobless claims,

continued to show resilience as the labor market rebalances. They

were neutral to the Index.

- New business applications also had a neutral impact.

- The ISM manufacturing component remained contractionary for the

ninth consecutive quarter, though it improved slightly from the

third quarter.

Overall, the fourth quarter CBCI reveals a healthy business

environment that has started to benefit from falling interest rates

and moderating inflation concerns.

“Fed rate cuts helped support a constructive business

environment in the fourth quarter, particularly as companies put

the uncertainty of the 2024 U.S. election cycle behind them,” added

Merlis. “Now, attention turns to the impact of a new presidential

administration and the pace of additional monetary easing from

here.”

Citizens is a trusted strategic and financial adviser,

consistently delivering clear and objective advice. The Citizens

approach puts clients first by offering great ideas combined with

thorough market knowledge and excellent execution, to help our

clients enhance their business and reach their potential. For more

information, please visit the Citizens website.

About Citizens Financial Group,

Inc.

Citizens Financial Group, Inc. is one of the nation’s oldest and

largest financial institutions, with $217.5 billion in assets as of

December 31, 2024. Headquartered in Providence, Rhode Island,

Citizens offers a broad range of retail and commercial banking

products and services to individuals, small businesses,

middle-market companies, large corporations and institutions.

Citizens helps its customers reach their potential by listening to

them and by understanding their needs in order to offer tailored

advice, ideas and solutions. In Consumer Banking, Citizens provides

an integrated experience that includes mobile and online banking, a

full-service customer contact center and the convenience of

approximately 3,100 ATMs and approximately 1,000 branches in 14

states and the District of Columbia. Consumer Banking products and

services include a full range of banking, lending, savings, wealth

management and small business offerings. In Commercial Banking,

Citizens offers a broad complement of financial products and

solutions, including lending and leasing, deposit and treasury

management services, foreign exchange, interest rate and commodity

risk management solutions, as well as loan syndication, corporate

finance, merger and acquisition, and debt and equity capital

markets capabilities. More information is available at

www.citizensbank.com or visit us on X (formerly Twitter), LinkedIn

or Facebook.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129074162/en/

Frank Quaratiello 617.543.5810

frank.quaratiello@citizensbank.com

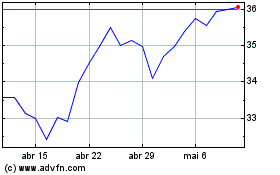

Citizens Financial (NYSE:CFG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

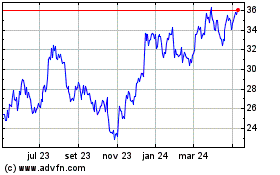

Citizens Financial (NYSE:CFG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025