ADRs End Slightly Lower; Ericsson, Cheetah Mobile and BBVA Trade Actively

27 Novembro 2018 - 8:56PM

Dow Jones News

International stocks trading in New York closed slightly lower

on Tuesday.

The BNY Mellon index of American depositary receipts fell 0.2%

to 134.49. The European index fell 0.6% to 125.10. The Asian index

increased 0.03% to 156.97. The Latin American index rose 2.6% to

225.57. And the emerging-markets index increased 0.7% to

284.34.

Ericsson AB (ERIC), Cheetah Mobile Inc. (CMCM) and Banco Bilbao

Vizcaya Argentaria S.A. (BBVA) were among those with ADRs that

traded actively.

Ericsson AB (ERIC) said Tuesday that it expects fifth-generation

networks to cover more than 40% of the world's population,

accounting for around 1.5 billion subscriptions to enhanced mobile

broadband by the end of 2024. Ericsson said this will make 5G the

fastest generation of cellular technology to be rolled out on a

global scale, according to its latest Mobility Report. Key drivers

for 5G deployment include increased network capacity and a lower

cost per gigabyte. North America and Northeast Asia are expected to

lead the 5G uptake, with subscriptions in North America expected to

account for 55% of mobile subscriptions by the end of 2024. In

Northeast Asia, the corresponding forecast is above 43%. In Western

Europe, 5G is forecast to account for some 30% of mobile

subscriptions by end of 2024. ADRs of Ericsson fell 2.1% to

$8.25.

On Tuesday, Cheetah Mobile responded to an article issued by

BuzzFeed News regarding attribution of app installations, saying,

"The Company is committed to preventing any SDKs integrated in its

apps from engaging in inappropriate activities and will suspend the

business cooperation with any SDK providers if they are found to be

engaging in fraudulent activities. The Company is dedicated to

complying with all relevant Google policies, GDPR, laws and

regulations." ADRs of Cheetah Mobile fell 32.8% to $5.48.

BBVA faces some regulatory risks in Mexico, Morgan Stanley said

as it cuts its earnings estimates for the Spanish bank and trims

the target price on the stock. The U.S. bank reduced its earnings

forecasts by 3% for next year and 4.6% for 2020. "Similar to

Santander, we assume 10% fee-margin pressure in Mexico to reflect

regulatory risk. We also assume more conservative numbers in the

U.S.," it said. The target price on the stock fell to EUR6.3 from

EUR6.5. ADRs of BBVA fell 3% to $5.52.

(END) Dow Jones Newswires

November 27, 2018 17:41 ET (22:41 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

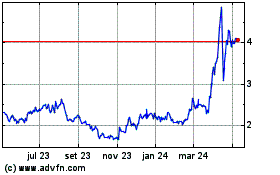

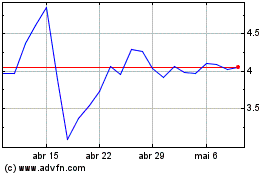

Cheetah Mobile (NYSE:CMCM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Cheetah Mobile (NYSE:CMCM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024