UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No.2)*

Cheetah Mobile Inc.

(Name of Issuer)

Class A ordinary shares

(Title of Class of Securities)

163075 1041

(CUSIP Number)

Sheng Fu

Sheng Global Limited

c/o Cheetah Mobile Inc.

Building No. 11

Wandong Science and Technology Cultural Innovation Park

No.7 Sanjianfangnanli

Chaoyang District

Beijing 100024

People’s Republic of China

+86-10-6292-7779

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

October 12, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d–7 for other parties to whom copies are to be sent.

# This Amendment No.2 amends and supplements the Schedule 13D initially filed on October 10, 2017 (the “Original Schedule 13D”) on behalf of Sheng Fu (“Mr. Fu”) and Sheng Global Limited (“Sheng Global”), as amended by the Amendment No.1 to the Original Schedule 13D filed on March 22, 2022 (together with the Original Schedule 13D, the “Original Filings”), with respect to the Class A ordinary shares, par value $0.000025 per share (“Class A Ordinary Shares”), of Cheetah Mobile Inc., a Cayman Islands company (the “Issuer”). The Class A Ordinary Shares beneficially owned by Mr. Fu and Sheng Global were previously reported on a Schedule 13G filed on February 13, 2015, as amended by amendments thereto.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

1 This is the CUSIP number for the American depositary shares (“ADSs”), each representing fifty Class A Ordinary Shares of the Issuer.

|

|

CUSIP No. 163075 104 |

Page 2 of 7 Pages |

|

|

|

|

1 |

Names of Reporting Persons Sheng Fu |

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

3 |

SEC Use Only |

4 |

Source of Funds (See Instructions) PF, OO |

5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☒ |

6 |

Citizenship or Place of Organization The People’s Republic of China |

Number of Shares Beneficially Owned by Each Reporting Person With: |

7 |

Sole Voting Power 131,735,588 ordinary shares (1) |

8 |

Shared Voting Power 399,445,025 ordinary shares (2) |

9 |

Sole Dispositive Power 131,735,588 ordinary shares (1) |

10 |

Shared Dispositive Power 0 |

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person 531,180,613 ordinary shares (1) |

12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

13 |

Percent of Class Represented by Amount in Row (11) 36.6% (3) |

14 |

Type of Reporting Person (See Instructions) IN |

(1)Includes (i) 25,996,440 Class A Ordinary Shares represented by restricted ADSs and 58,139,278 Class B ordinary shares, par value $0.000025 per share (“Class B Ordinary Shares”) held by Sheng Global, a British Virgin Islands company wholly owned by Mr. Fu, (ii) 4,000,000 Class A Ordinary Shares (represented by restricted ADSs) and 7,300,000 Class B Ordinary Shares beneficially owned by Sheng Global through FaX Vision Corporation, a British Virgin Islands company controlled by Sheng Global, (iii) 585,800 Class B Ordinary Shares that have vested to Mr. Fu under the Issuer’s 2011 Share Award Scheme, (iv) 1,016,210 Class A Ordinary Shares and 2,574,010 Class B Ordinary Shares that have vested to Mr. Fu under the Issuer’s 2013 Equity Incentive Plan, and (v) 32,123,850 Class B Ordinary Shares held by Sheng Global, which are acquired upon vesting of restricted shares to Mr. Fu under the Issuer’s 2023 Share Incentive Plan.

The rights of the holders of Class A Ordinary Shares and Class B Ordinary Shares of the Issuer are identical, except with respect to conversion rights and voting rights. Each Class B Ordinary Share is entitled to ten votes per share, whereas each Class A Ordinary Share is entitled to one vote per share. Each Class B Ordinary Share is convertible at the option of the holder into one Class A Ordinary Share. Class A Ordinary Shares are not convertible into Class B Ordinary Shares under any circumstances.

(2)Represents 399,445,025 Class B Ordinary Shares held by Kingsoft Corporation Limited (“Kingsoft”). Kingsoft has delegated the voting power attached to these shares of the Issuer held by Kingsoft Corporation to Mr. Fu, effective October 1, 2017.

(3)The calculation is based on 1,450,620,585 ordinary shares, consisting of 480,604,900 Class A Ordinary Shares and 970,015,685 Class B Ordinary Shares, outstanding as of March 31, 2023, as disclosed in the Issuer’s annual report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “Commission”) on April 18, 2023, assuming conversion of all Class B Ordinary Shares into the same number of Class A Ordinary Shares.

|

|

CUSIP No. 163075 104 |

Page 4 of 7 Pages |

|

|

|

|

1 |

Names of Reporting Persons Sheng Global Limited |

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

3 |

SEC Use Only |

4 |

Source of Funds (See Instructions) WC, OO |

5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐ |

6 |

Citizenship or Place of Organization British Virgin Islands |

Number of Shares Beneficially Owned by Each Reporting Person With: |

7 |

Sole Voting Power 127,559,568 ordinary shares (1) |

8 |

Shared Voting Power 0 |

9 |

Sole Dispositive Power 127,559,568 ordinary shares (1) |

10 |

Shared Dispositive Power 0 |

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person 127,559,568 ordinary shares (1) |

12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

13 |

Percent of Class Represented by Amount in Row (11) 8.8% (2) |

14 |

Type of Reporting Person (See Instructions) CO |

(1)Includes (i) 25,996,440 Class A Ordinary shares represented by restricted ADSs and 58,139,278 Class B Ordinary Shares held by Sheng Global, (ii) 4,000,000 Class A Ordinary Shares (represented by restricted ADSs) and 7,300,000 Class B Ordinary Shares beneficially owned by Sheng Global through FaX Vision Corporation, which is controlled by Sheng Global, and (iii) 32,123,850 Class B Ordinary Shares held by Sheng Global, which are acquired upon vesting of restricted shares to Mr. Fu under the Issuer’s 2023 Share Incentive Plan.

The rights of the holders of Class A Ordinary Shares and Class B Ordinary Shares of the Issuer are identical, except with respect to conversion rights and voting rights. Each Class B Ordinary Share is entitled to ten votes per share, whereas each Class A Ordinary Share is entitled to one vote per share. Each Class B Ordinary Share is convertible at the option of the holder into one Class A Ordinary Share. Class A Ordinary Shares are not convertible into Class B Ordinary Shares under any circumstances.

(2)The calculation is based on 1,450,620,585 ordinary shares, consisting of 480,604,900 Class A Ordinary Shares and 970,015,685 Class B Ordinary Shares, outstanding as of March 31, 2023, as disclosed in the Issuer’s annual report on Form 20-F filed with the Commission on April 18, 2023, assuming conversion of all Class B Ordinary Shares into the same number of Class A Ordinary Shares.

Introductory Note:

This amendment No.2 to Schedule 13D (this “Amendment No. 2”) amends and supplements the statement on Schedule 13D filed with the Commission on October 10, 2017 (the “Original Schedule 13D”) and the amendment No.1 to the Original Schedule 13D filed with the Commission on March 22, 2022 (collectively, the “Original Filings”) by each of Sheng Fu and Sheng Global Limited (the “Reporting Persons” and each, a “Reporting Person”), with respect to Ordinary Shares, par value $0.000025 per share, of Cheetah Mobile Inc., a company organized under the laws of the Cayman Islands (the “Issuer”), whose principal executive offices are located at Building No. 11, Wandong Science and Technology Cultural Innovation Park, No.7 Sanjianfangnanli, Chaoyang District, Beijing 100024, People’s Republic of China.

Except as provided herein, this Amendment No. 2 does not modify any of the information previously reported on the Original Filings. Capitalized terms used but not defined in this Amendment No. 2 have the meanings ascribed to them in the Original Filings.

Item 1. Security and Issuer.

Item 1 of the Original Filings is hereby amended and restated as follows:

This Schedule 13D relates to the Class A Ordinary Shares of the Issuer, including Class A Ordinary Shares represented by American depositary shares (the “ADSs”), each representing fifty Class A Ordinary Shares, of Cheetah Mobile Inc. (the “Issuer”), an exempted company incorporated with limited liability and existing under the laws of the Cayman Islands. The ADSs are listed on the New York Stock Exchange (“NYSE”) under the symbol “CMCM.” The Issuer has also issued Class B ordinary shares, par value $0.000025 per share (“Class B Ordinary Shares”).

The principal executive offices of the Issuer are located at Building No. 11, Wandong Science and Technology Cultural Innovation Park, No.7 Sanjianfangnanli, Chaoyang District, Beijing 100024, People’s Republic of China.

Item 2. Identity and Background.

The principal business address of Mr. Fu stated in the Original Filings is hereby amended and restated into c/o Cheetah Mobile Inc., Building No. 11, Wandong Science and Technology Cultural Innovation Park, No.7 Sanjianfangnanli, Chaoyang District, Beijing 100024, People’s Republic of China.

The principal business address of Sheng Global stated in the Original Filings is hereby amended and restated into c/o Cheetah Mobile Inc., Building No. 11, Wandong Science and Technology Cultural Innovation Park, No.7 Sanjianfangnanli, Chaoyang District, Beijing 100024, People’s Republic of China.

Item 2 (d), (e) of the Original Filings is hereby amended and restated as follows:

(d), (e) On September 21, 2022, Mr. Fu reached a resolution with the Commission of the investigation relating to the Issuer’s disclosures for fiscal year 2015 regarding its relationship with one of its advertising business partners, Rule 10b5-1 trading plans entered into by certain of its current and former officers and directors and sales of its ADS under those plans in 2015 and 2016. Pursuant to the terms of the settlement, Mr. Fu has consented to the entry of a cease and desist order with the Commission on a “neither admit nor deny” basis that would require him to refrain from violating (i) Section 17(a)(2) and (3) of the Securities Act of 1933, and (ii) Sections 10(b) and 13(a) of the Act and Rules 10b-5, 12b-20, and 13a-1 thereunder. The terms of the settlement between Mr. Fu and the Commission also include payment of a civil money penalty in the amount of $556,580, which was paid, and certain compliance undertakings.

Except as set forth above, during the last five years, none of the Reporting Persons and, to the best knowledge of each Reporting Person, any of the persons listed on Schedule A hereto has been: (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Original Filings is hereby amended by adding the following:

Since April 2023, an aggregate of 32,123,850 Class B Ordinary Shares, granted in the form of restricted shares in 2023, became vested to Mr. Fu under the Issuer’s 2023 Share Incentive Plan. Mr. Fu did not pay any additional consideration for these restricted shares.

Item 5. Interest in Securities of the Issuer.

Item 5 (a)–(b) of the Original Filings is hereby amended and restated as follows:

(a)–(b) The responses of each Reporting Person to Rows (7) through (13), including the footnotes thereto, of the cover pages of this Amendment No.2 are hereby incorporated by reference in this Item 5.

By virtue of the Board Composition Agreement set forth in the Kingsoft Voting Proxy as described herein, Mr. Fu and Kingsoft, who is not a Reporting Person on this Amendment No.2, may be deemed to constitute a “group” within the meaning of Rule 13d-5(b) under the Act. Kingsoft beneficially owns (i) 5,040,877 Class A Ordinary Shares, (ii) 6,759,670 Class A Ordinary Shares represented by ADSs, and (iii) 662,806,049 Class B Ordinary Shares as of March 31, 2023, as disclosed in the Issuer’s annual report on Form 20-F filed with the Commission on April 18, 2023. By virtue of the terms set forth in the Kingsoft Voting Proxy, Mr. Fu may be deemed to share the voting power pertaining to up to 399,445,025 Class B Ordinary Shares beneficially owned by Kingsoft. As a result, Mr. Fu may be deemed to beneficially own an aggregate of 531,180,613 outstanding ordinary shares, which represents approximately 36.6% of the total ordinary shares assuming conversion of all outstanding Class B Ordinary Shares into Class A Ordinary Shares and approximately 49.4% of the voting power of the total outstanding ordinary shares (Class A Ordinary Shares and Class B Ordinary Shares, which vote together). Except as otherwise stated herein, Mr. Fu expressly disclaims any beneficial ownership of the ordinary shares held by Kingsoft.

Except as disclosed in this Amendment No.2 and the Original Filings, none of the Reporting Persons nor, to the best of their knowledge, any of the persons listed in Schedule A hereto, beneficially owns any ordinary shares or has the right to acquire any ordinary shares.

Except as disclosed in this Amendment No.2 and the Original Filings, none of the Reporting Persons nor, to the best of their knowledge, any of the persons listed in Schedule A hereto, presently has the power to vote or to direct the vote or to dispose or direct the disposition of any of the ordinary shares which it may be deemed to beneficially own.

Item 7. Material to be Filed as Exhibits.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: October 12, 2023

|

|

|

|

|

|

/s/ Sheng Fu |

Sheng Fu |

|

Sheng Global Limited |

|

|

By: |

|

/s/ Sheng Fu |

Name: |

|

Sheng Fu |

Title: |

|

Director |

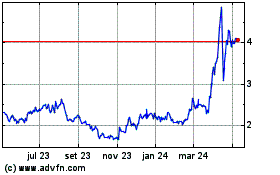

Cheetah Mobile (NYSE:CMCM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

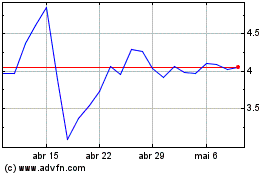

Cheetah Mobile (NYSE:CMCM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024