Coherent Corp. (the “Company” or “Coherent”) (NYSE: COHR), a global

leader in materials, networking, and lasers, today announced that

following a comprehensive search, it has appointed Rob Beard as the

Company’s new Chief Legal and Global Affairs Officer, and Corporate

Secretary, effective today. Rob replaces current Chief Legal

Officer Ron Basso, who is retiring. The Company has also promoted

Marie Batz Martin to Chief Compliance Officer, reporting to

Rob.

Mr. Beard joins Coherent from Mastercard Incorporated

(“Mastercard”), where he was Chief Legal and Global Affairs

Officer. Before Mastercard, Rob spent nearly a decade at Micron

Technology, Inc. (“Micron”), including as General Counsel and

Corporate Secretary, leading Micron’s global legal, intellectual

property, and ethics and compliance functions, and guiding Micron’s

growth through an increasingly complex geopolitical

environment.

“We are pleased to welcome Rob to Coherent’s leadership team,”

said Jim Anderson, Chief Executive Officer. “His broad experience

in the semiconductor industry, international policy experience, and

expertise in business and law make him an excellent partner and

counselor to help us unlock Coherent’s full potential.”

“I am thrilled to join Coherent as its next CLO,” said Mr.

Beard. “It’s an incredible team with a strong culture of innovation

across multiple high-growth markets.”

“I would like to thank Ron Basso for his leadership as

Coherent’s Chief Legal Officer,” said Mr. Anderson. “His experience

and leadership will ensure a smooth transition, and I am grateful

for his commitment and continued dedication to the company.”

About Rob Beard

Rob has more than 20 years of experience in the technology

industry. Before joining Mastercard, Rob spent nearly a decade at

Micron, beginning his career there as the company’s primary M&A

lawyer and for several years partnered closely with Micron’s

corporate development team on a wide range of strategic

opportunities, including significant transactions in Japan, Taiwan,

Europe, China, and Singapore.

Prior to Micron, Rob was corporate counsel at Amazon’s Lab 126

and was an associate at Weil Gotshal & Manges in London, New

York, and Silicon Valley, focusing on M&A and capital markets

transactions, and at Shearman & Sterling in London, where he

focused on debt capital markets transactions. He graduated from the

University of Utah and received his J.D. from the University of

Illinois College of Law, summa cum laude.

About Coherent

Coherent empowers market innovators to define the future through

breakthrough technologies, from materials to systems. We deliver

innovations that resonate with our customers in diversified

applications for the industrial, communications, electronics, and

instrumentation markets. Coherent has research and development,

manufacturing, sales, service, and distribution facilities

worldwide. For more information, please visit us at

coherent.com.

Media Contact:Amy WilsonCorporate

Communications & Investor

Relationscorporate.communications@coherent.com

Forward Looking Statements

The statements contained in this press release

include forward-looking statements relating to future events and

expectations, including statements regarding the Company’s ability

to benefit from the noted executives’ experience and expertise

which is based on certain assumptions and contingencies. The

forward-looking statements are made pursuant to the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995 and relate to the Company’s performance on a going-forward

basis. The forward-looking statements contained herein involve

risks and uncertainties, which could cause actual results,

performance, or trends to differ materially from those expressed in

the forward-looking statements herein or in previous

disclosures.

The Company believes that all forward-looking

statements made by it herein have a reasonable basis, but there can

be no assurance that management’s expectations, beliefs, or

projections as expressed in the forward-looking statements will

actually occur or prove to be correct. In addition to general

industry and global economic conditions, factors that could cause

actual results to differ materially from those discussed in the

forward-looking statements herein include but are not limited to:

(i) the failure of any one or more of the assumptions stated herein

to prove to be correct; (ii) the risks relating to forward-looking

statements and other “Risk Factors” discussed in the Company’s

Annual Report on Form 10-K for the fiscal year ended June 30, 2024,

and additional risk factors that may be identified from time to

time in filings of the Company; (iii) the substantial indebtedness

the Company incurred in connection with its acquisition (the

“Transaction”) of Coherent, Inc., the need to generate sufficient

cash flows to service and repay such debt, and the Company’s

ability to generate sufficient funds to meet its anticipated debt

reduction goals; (iv) the possibility that the Company may not be

able to continue its integration progress and/or take other

restructuring actions, or otherwise be able to achieve expected

synergies, operating efficiencies including greater scale, focus,

resiliency, and lower operating costs, and other benefits within

the expected time frames or at all and ultimately to successfully

fully integrate the operations of Coherent, Inc. with those of the

Company; (v) the possibility that such integration and/or the

restructuring actions may be more difficult, time-consuming, or

costly than expected or that operating costs and business

disruption (including, without limitation, disruptions in

relationships with employees, customers, or suppliers) may be

greater than expected in connection with the Transaction and/or the

restructuring actions; (vi) any unexpected costs, charges, or

expenses resulting from the Transaction and/or the restructuring

actions; (vii) the risk that disruption from the Transaction and/or

the restructuring actions materially and adversely affects the

respective businesses and operations of the Company and Coherent,

Inc.; (viii) potential adverse reactions or changes to business

relationships resulting from the completion of the Transaction

and/or the restructuring actions; (ix) the ability of the Company

to retain and hire key employees; (x) the purchasing patterns of

customers and end users; (xi) the timely release of new products

and acceptance of such new products by the market; (xii) the

introduction of new products by competitors and other competitive

responses; (xiii) the Company’s ability to assimilate other

recently acquired businesses, and realize synergies, cost savings,

and opportunities for growth in connection therewith, together with

the risks, costs, and uncertainties associated with such

acquisitions; (xiv) the Company’s ability to devise and execute

strategies to respond to market conditions; (xv) the risks to

realizing the benefits of investments in R&D and

commercialization of innovations; (xvi) the risks that the

Company’s stock price will not trade in line with industrial

technology leaders; and/or (xvii) the risks of business and

economic disruption related to worldwide health epidemics or

outbreaks that may arise. The Company disclaims any obligation to

update information contained in these forward-looking statements,

whether as a result of new information, future events or

developments, or otherwise.

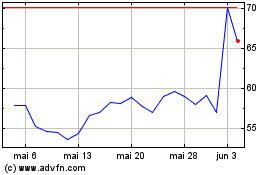

Coherent (NYSE:COHR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Coherent (NYSE:COHR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025